How to stake on Binance

Binance is the biggest crypto exchange in the world with a daily trading volume of nearly $25.5 billion. This makes it the primary and most reliable choice for staking cryptocurrencies. In this review, TU will explore the concept of staking, the Binance staking program, types of staking and rewards offered by Binance and its competitor, as well as offer TU’s analysis.

What is staking?

Simply put, staking means committing your assets for a given period of time in exchange for some reward (generally a percentage return or additional coins). Think of it as a fixed deposit for cryptos. You earn interest on your deposit, but in case the value of the crypto being staked falls, the loss has to be borne by the one who stakes.

Experts suggest that the platform where you stake your cryptos should be reliable enough to eliminate one angle of risk, that is counterparty risk. And for that reason, Binance becomes one of the primary contenders for staking cryptocurrencies. It even offers Annual Percentage Yields (APY) of up to 104.62% on some tokens. Moreover, it supports 100+ currencies for locked staking and has some of the best rewards in the market. Binance offers two types of staking options: Locked Staking and DeFi Staking.

What is Binance locked staking?

This is the basic form of staking. Users have to commit their crypto holdings to Binance for a certain period of time, and once that time period expires, the holdings return to their respective wallets with the additional interest/reward promised in the beginning. Binance provides a guarantee for the coins staked by the users and assumes the responsibility of returning the same number of coins that were staked. Early redemption is allowed but may attract some penalties.

What is Binance DeFi staking?

In this form of staking, users get the chance to be a part of upcoming or in-progress opportunities to invest in Decentralized Finance projects by staking their holdings and providing liquidity to the platforms. A key difference here is that users have the option to invest in “Flexible Lock” duration, which means that they can redeem their holdings freely without any burden of a “fixed” lock-in period.

Binance locked staking rewards and supported tokens

Binance offers locked staking for 100+ tokens including SOL, ADA, BNB, SHIB, and SAND. Based on the token you choose, you’ll have duration options ranging from 21 to 120 days. The rewards are exciting, too, with an Annual Percentage Rate (APR) of 94.6% being offered on AXS and 79.87% being offered in a PancakeSwap (“Cake”). A cake is a Binance Smart Chain-powered tool that allows a trader to swap BEP-20 tokens efficiently and safely and provides a decentralized trading experience combined with liquidity pools. However, each cake-traded token is subject to a minimum staking amount that users must have in order to take part in the staking pool.

Binance DeFi staking rewards and supported tokens

Binance supports 15+ tokens for DeFi staking including BTC, ETH, LTC, and XRP. The majority of them have a flexible deposit option while the APR on them is lower compared to locked staking. DYDX and BUSD offer the highest APR which is nearly 11%. However, DYDX does not have a flexible lock option.

Binance US staking and its supported coins and rewards

Binance US offers its users the option to stake selective tokens and earn APY of up to 14.50%. Users can choose to stake tokens like BNB, SOL, AVAX, ATOM, GRT, LPT, AUDIO, and MATIC. Here’s a brief overview of the APY offered.

| Token | Reward APY |

|---|---|

| BNB | 4.00% |

| SOL | 7.90% |

| AVAX | 6.40% |

| ATOM | 14.50% |

| GRT | 7.70% |

| LPT | 13.00% |

| AUDIO | 12.20% |

| MATIC | 11.40% |

Binance staking rewards vs its competition

Here is a quick comparison of Binance with other popular exchanges that offer staking services.

| APY | Binance | Kraken | Coinbase |

|---|---|---|---|

| BNB | 12.99% | Not offered | Not offered |

| Ethereum 2.0 | Not offered | 4-7% | Not offered |

| Solana | 19.47% | 5-8% | 4.00% |

| ADA | 15.79% | 4-6% | 2.60% |

| AVAX | 29.75% | Not offered | Not offered |

| DOT | 20.98% | 9-12% | Not offered |

How to stake on Binance

Here is a step-by-step guide prepared by TU on how to stake on Binance. Users can follow these steps to get started with staking.

Step 1

Go to: www.binance.com

Binance Website

Step 2

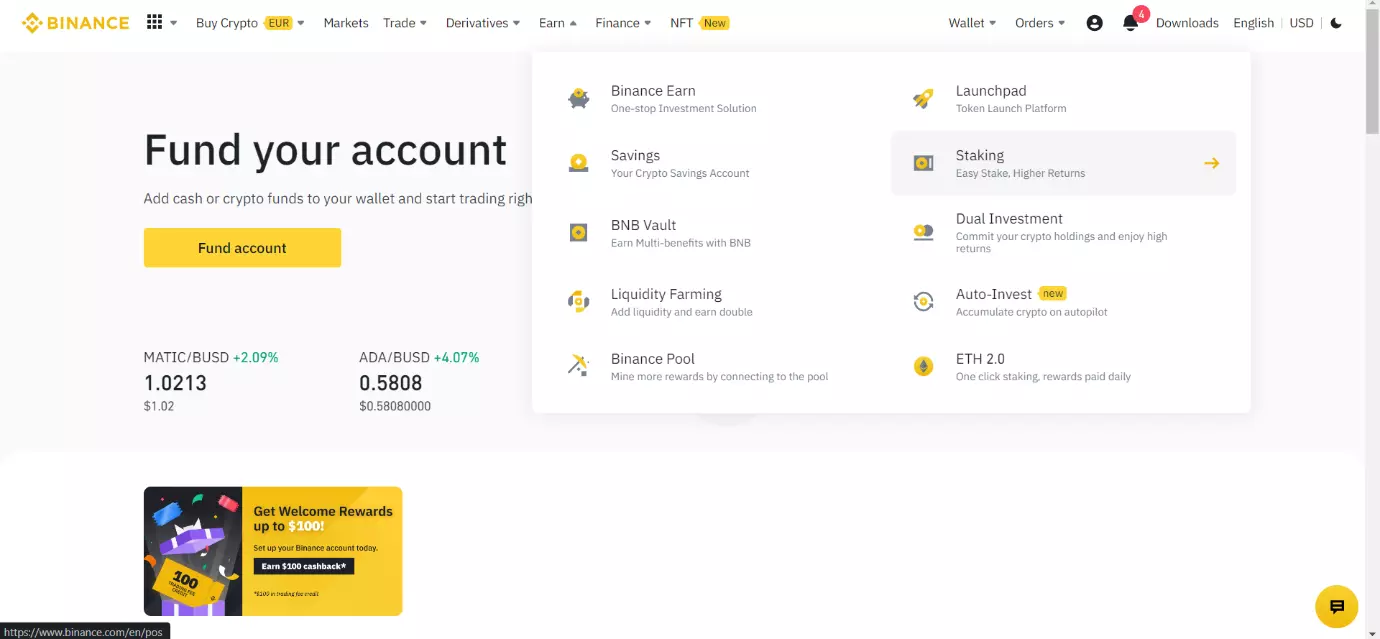

Hover over the “Earn” tab and click on “Staking”.

Staking

Step 3

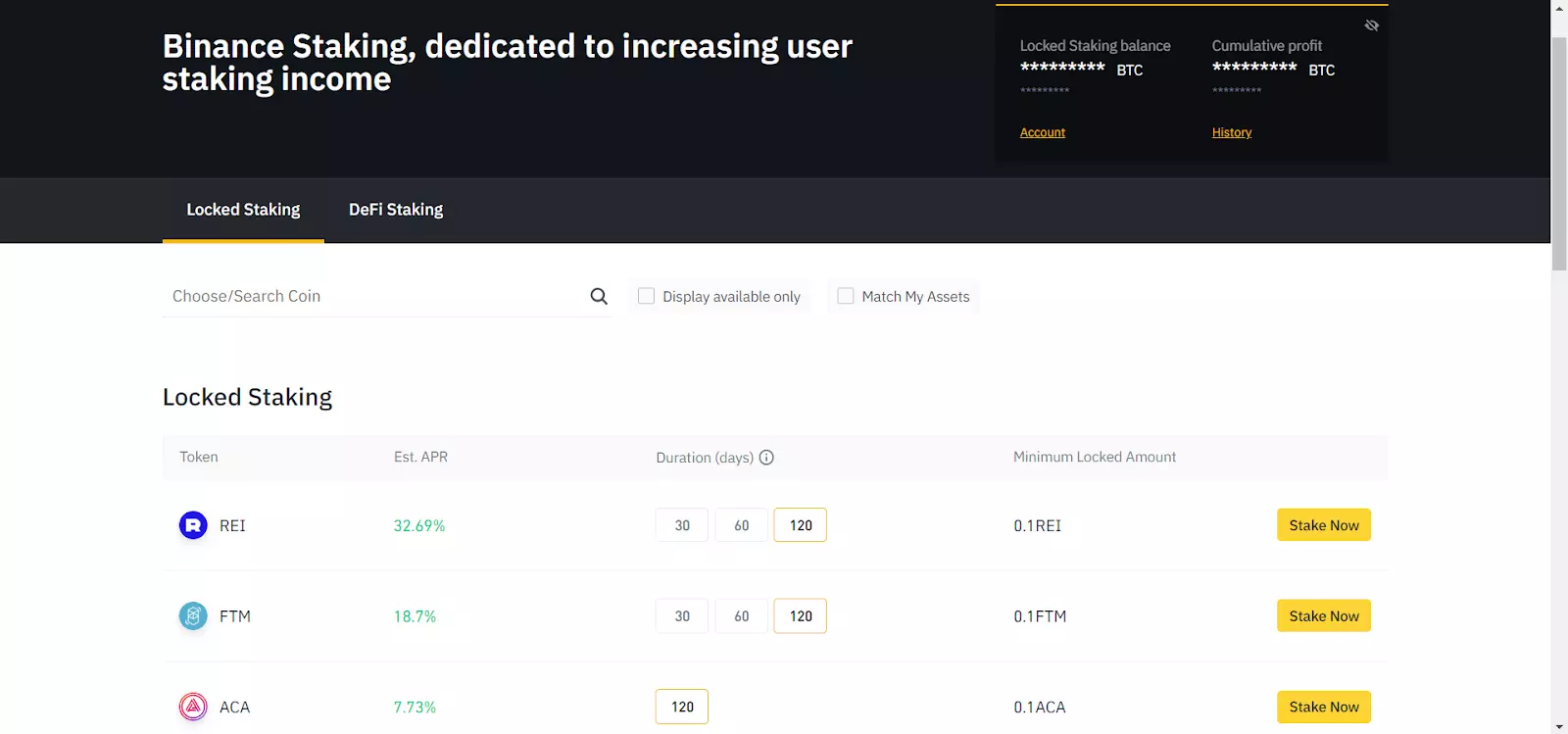

Select/Search for the token you want to stake, decide on the duration, and click on “Stake Now”.

Select/Search for the token you want to stake

Step 4

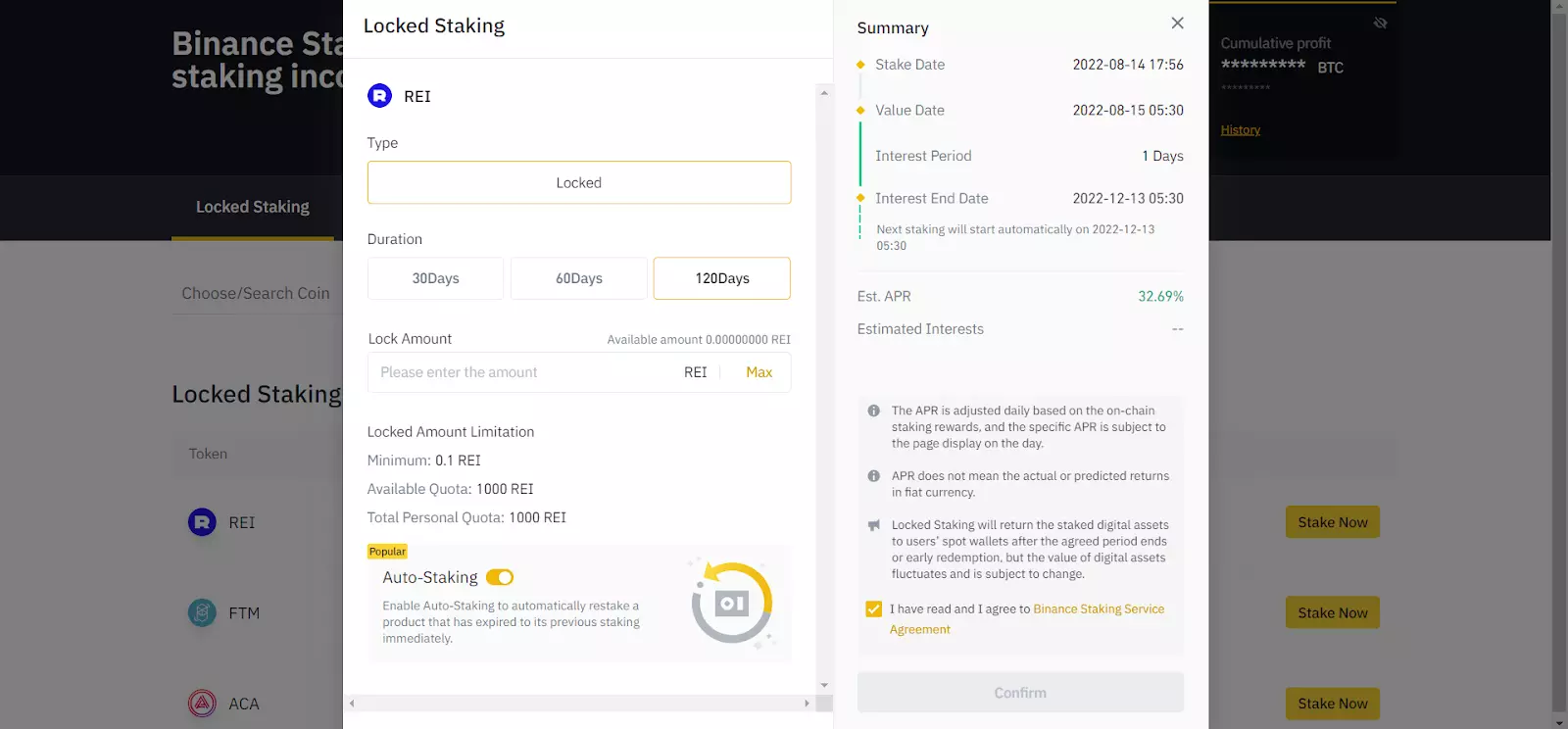

Re-select the duration and enter the amount you want to stake. Make sure it’s above the minimum staking requirements. If you want Binance to auto-stake the assets once they are redeemed, check the “Auto-Staking” option. Then, go through the Binance Staking Service Agreement, and once you’ve read it and agree, click on the “I have read and I agree” checkbox. Re-check all the information once again and click on “Confirm” to finalize the transaction. And that’s it, your coins are now staked!

Locked Staking

FAQs

Can I lose money when staking my assets?

Yes, if there is an adverse price movement in the assets staked, you can face capital loss.

Is Binance safe for staking?

Yes, as per the experts, out of all the crypto exchanges that offer staking services, Binance is the biggest and most trustworthy

What is APY?

APY is the percentage value of annualized interest earned on the assets that you have staked.

What is APR?

APR is the annualized interest rate that is offered by the platforms that wish to invite users to their staking program.

Team that worked on the article

Ivan is a financial expert and analyst specializing in Forex, crypto, and stock trading. He prefers conservative trading strategies with low and medium risks, as well as medium-term and long-term investments. He has been working with financial markets for 8 years. Ivan prepares text materials for novice traders. He specializes in reviews and assessment of brokers, analyzing their reliability, trading conditions, and features.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).