How does Polygon work?

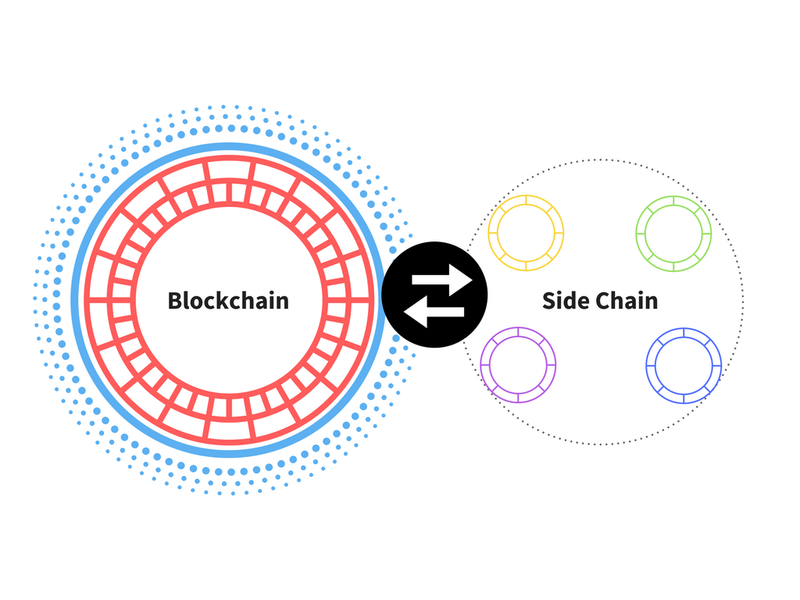

The architecture of Polygon has 4 layers responsible for the security of the system, communication between several blockchains included in the network structure – the Ethereum layer, the security layer, the Polygon layer (consists of several blockchains), and the transaction execution layer. Polygon is unique, as it is the only scaling solution that supports the Ethereum Virtual Machine (EVM).

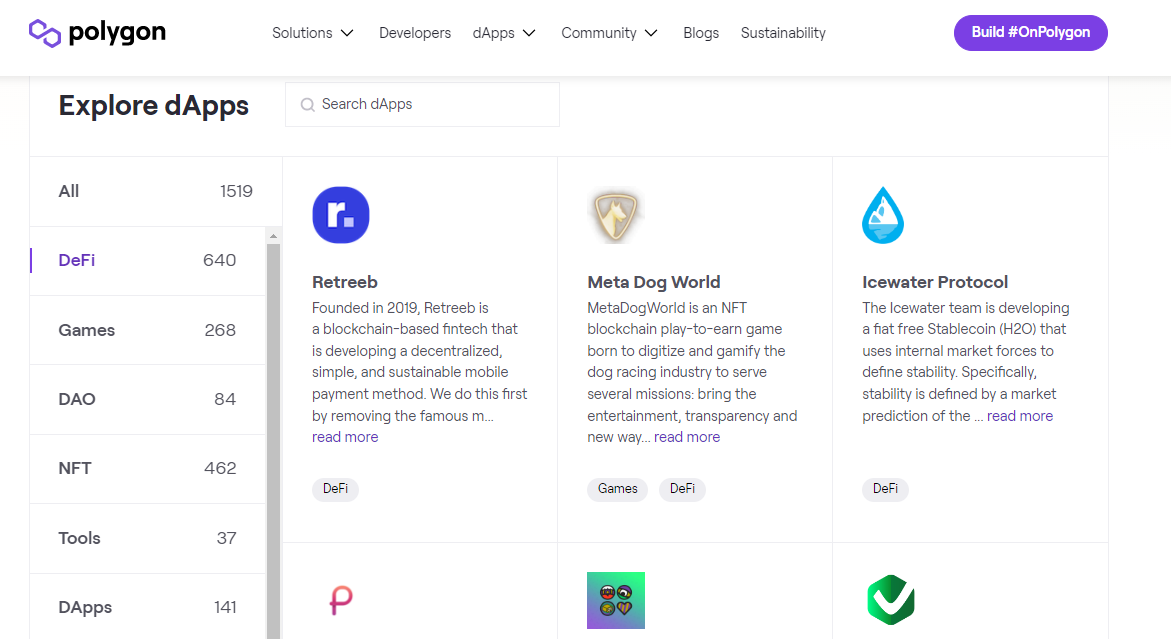

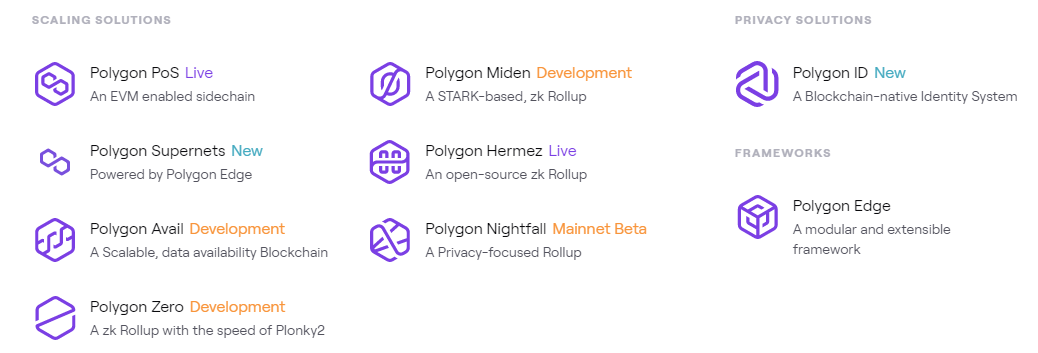

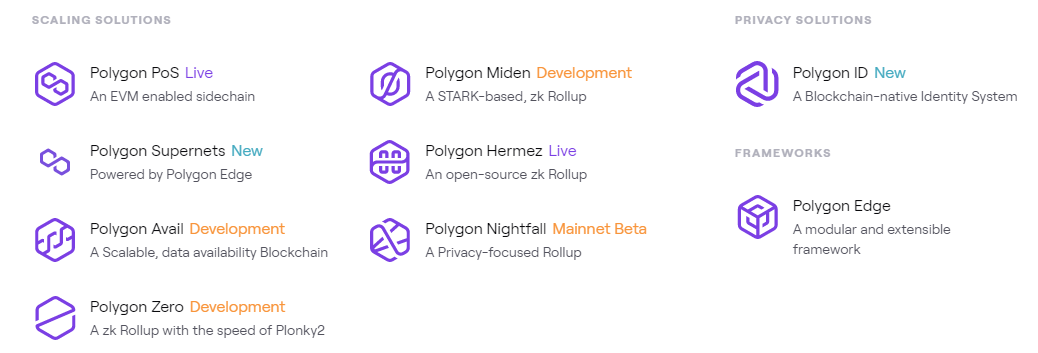

The Polygon ecosystem has the following products:

Products of the Polygon ecosystem

Matic sidechain. It is an add-on, where Ethereum blockchain transactions are processed.

Polygon Hermez. Uses the Ethereum-based ZK-Rollups technology, processing around 2,000 transactions per second. Is not compatible with EVM.

Polygon Zero. It is a layer 2 scaling solution that uses ZK-SNARK technology.

Polygon Miden. Uses the ZK-STARKs technology. It has a low transaction processing speed, but is compatible with the EVM.

Polygon Edge. This is a framework for building layer 2 and sidechain solutions.

Polygon Nightfall. A privacy-focused rollup for corporate clients.

These products are standalone scaling solutions. Any of them can be chosen by the developers as the most suitable one for their project.

How is MATIC created?

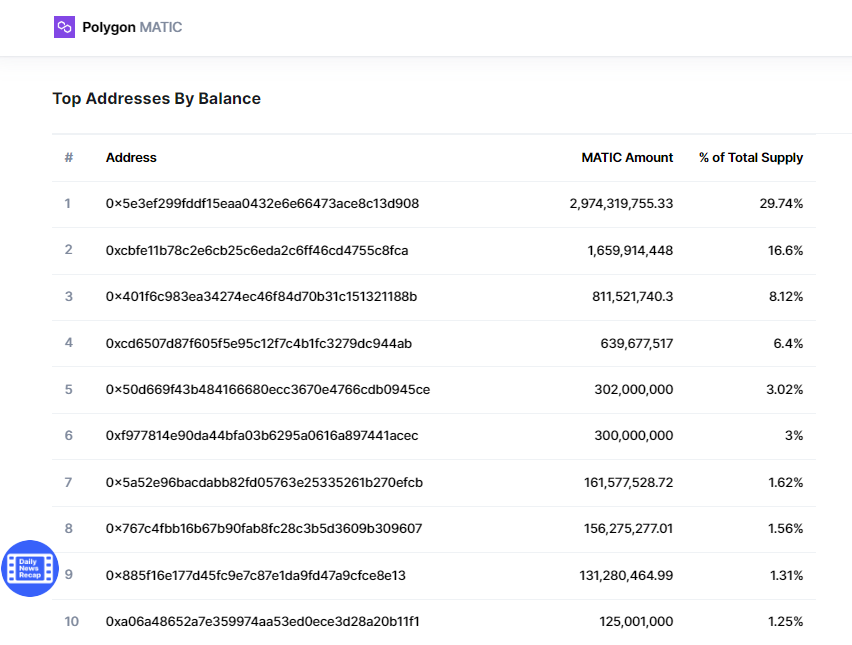

Polygon uses the Proof-of-Stake consensus mechanism for its cryptocurrency MATIC. This means that a full emission of coins was performed at the time of the launch of the platform and mining is impossible. Around 80% of the coins are in free circulation, and 20% of coins are controlled by the developers and put in circulation gradually. Therefore, there are two ways to make money from this cryptocurrency:

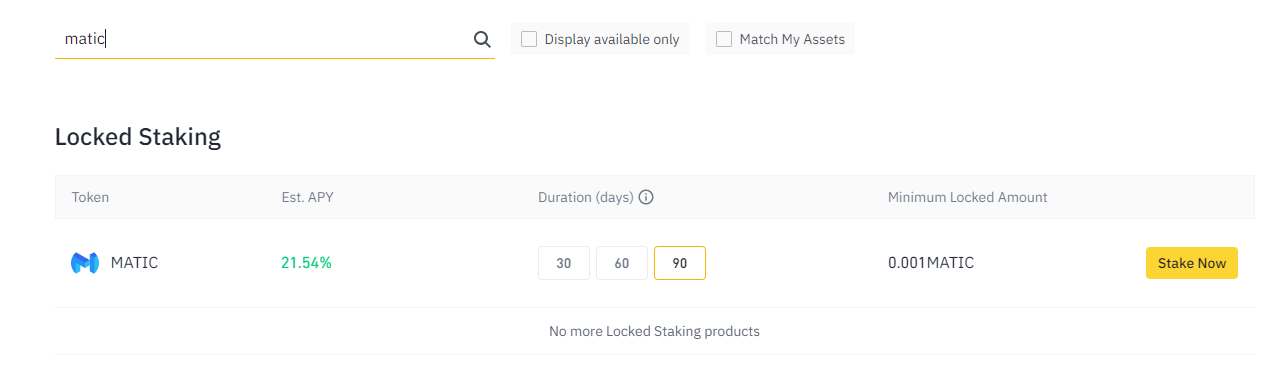

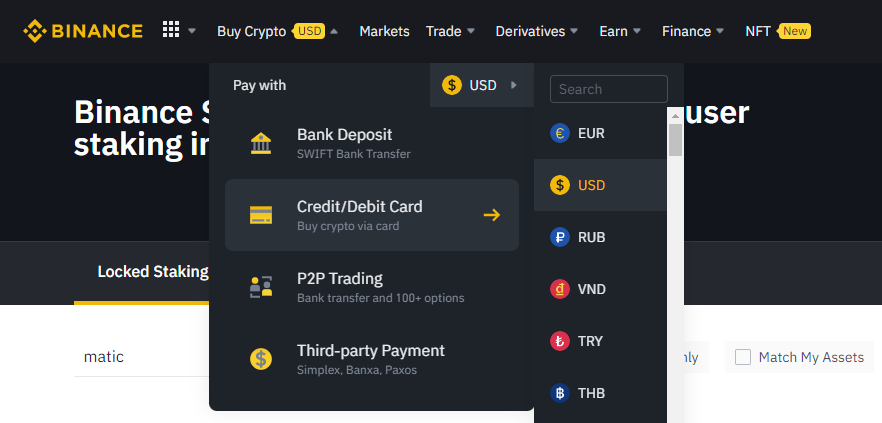

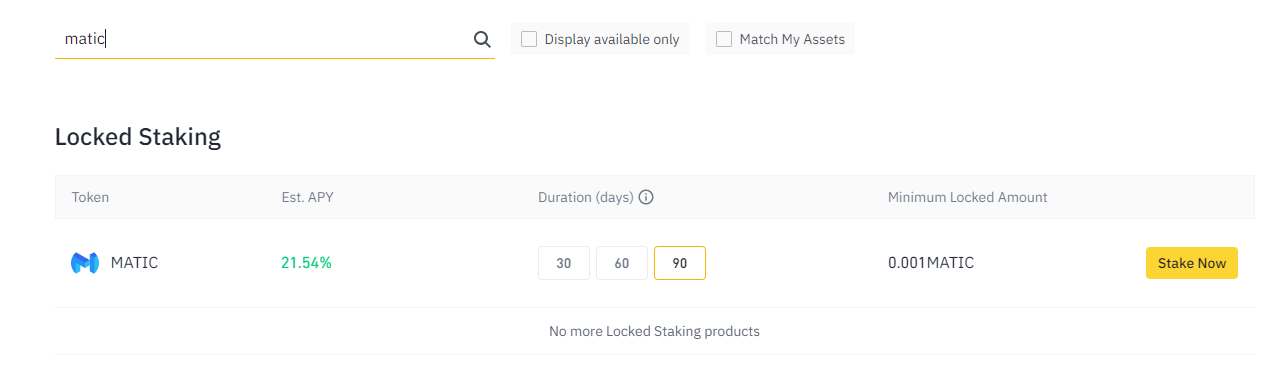

Staking implies that you buy cryptocurrency and ‘freeze’ it in the blockchain, similar to a bank deposit. The frozen coins support the network liquidity and help validators maintain its operation. Staking is supported by some wallets, but the user’s computer must be online around the clock. Staking at exchanges is an alternative option. For example, you register on Binance, pass verification, buy MATIC and activate the staking option.

Staking on Binance

Locking is possible for a period of 30, 60 and 90 days. Early unlocking is categorically not recommended. Estimated APY is around 20% (the annual percentage yield can vary).

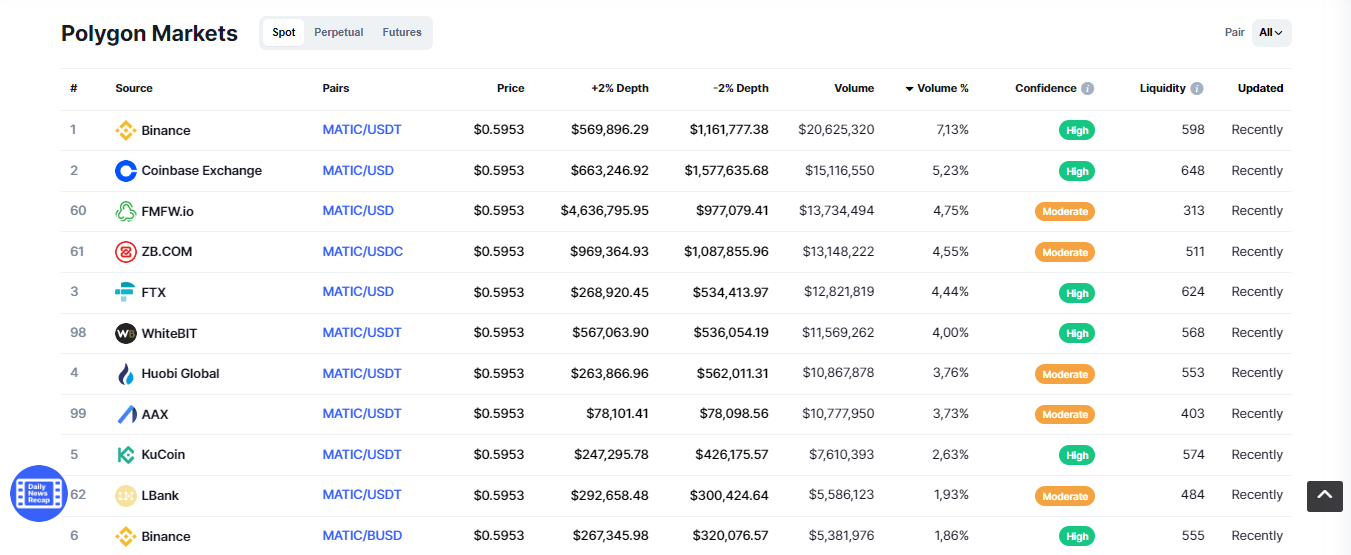

Where MATIC trading is going?

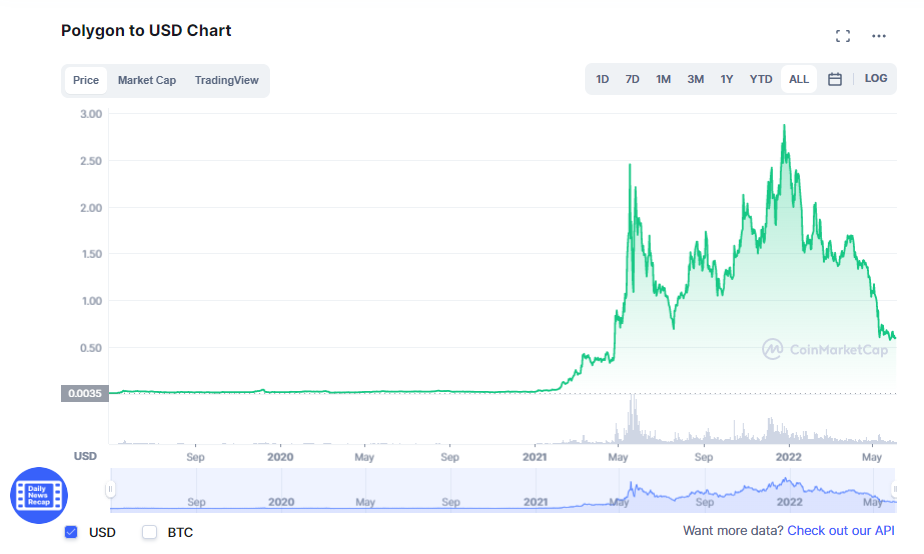

Analysts believe that the platform’s rebranding and the change of its functionality became one of the drivers of the explosive growth in 2021. Investor interest coincided with the interest of cryptocurrency exchanges that started to add the coin to their listing. Following the chain reaction, this provided even more worth to the coin in the eyes of investors. For example, adding MATIC to the listing of Upbit, one of the largest South Korean exchanges on October 15 caused the price of the altcoin to spike by 25% in just one day.

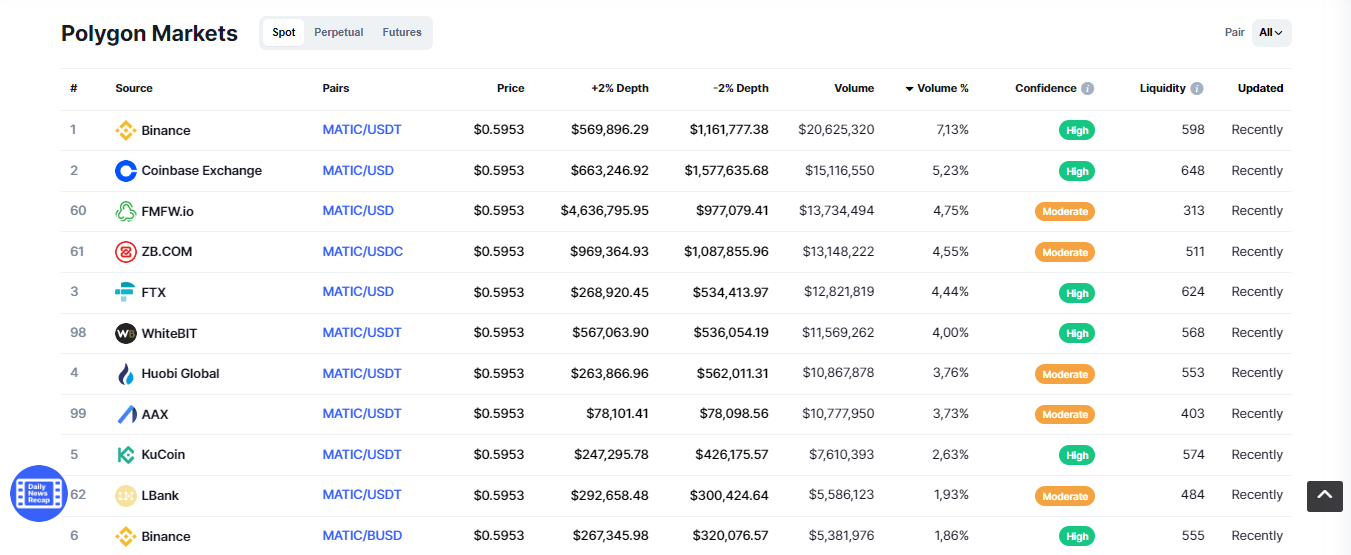

MATIC is currently supported by more than 150 local and global cryptocurrency exchanges. Free conversion speaks for complete trust and popularity of the coin, which is available at the exchanges in pairs with stablecoins USDT, USDC, USD, fiat currencies USD, GBP and other currencies and also Bitcoin. A relatively equal distribution of the trading volumes among the major exchanges is another factor in favor of MATIC. This points to the absence of manipulative schemes of market makers, who artificially overstate quotes with high trading volume. Binance accounts for the highest trading volume at around 13-15%, followed by Coinbase with around 6-7%.

Largest Polygon markets