How to invest in cryptocurrency : a step-by-step guide

Cryptocurrency is not our future, it’s our present. Decentralized digital assets are traded on leading exchanges, and you can use them to pay for in-store purchases and utilities. Therefore, the answer to the question of how to correctly invest in cryptocurrency is important for everyone who wants to be successful and increase their capital.

In this segment, the Traders Union will explain to you how to choose a cryptocurrency for investment, what altcoins are, and highlight the methods of passive earnings on digital assets. Also, the TU experts have prepared an overview of the leading platform for investing in cryptocurrency. For novice investors, there is a separate section with practical tips.

Start trading cryptocurrencies now with Binance!

What are cryptocurrencies?

It is wrong to equate the concepts of “cryptocurrency” and “digital currency” or “digital asset”. Cryptocurrency is a special case of digital currency. Its special feature is that it exists completely autonomously, and it has neither a regulator nor a registrar. In other words, this special status constitutes a decentralized monetary system. All transactions using cryptocurrencies are open and irreversible.

The idea behind cryptocurrency is to create a sustainable digital cash system for remote payment for goods and services. The first successful cryptocurrency was Bitcoin, where information about transactions was combined into blocks, and those, in turn, were combined into a continuous chain called the blockchain. Each subsequent block included the result of processing the previous blocks. Artificial complications solved the problem of confirming the correctness of other people’s operations in the system.

After Bitcoin, cryptocurrencies began to emerge exponentially. Today, there are already thousands of them. All non-Bitcoin cryptocurrencies are referred to as altcoins. They exist as sustainable payment systems and market participants. They can be stored on electronic wallets, exchanged for fiat currencies. Also, you can use them to buy contracts on the exchange, as well as pay for goods, services, and digital assets. Many cryptocurrency exchanges (platforms for working with cryptocurrency) issue proprietary plastic cards for payment in offline stores, and in some regions, utilities can also be paid with cryptocurrency.

Many consumers and traders have started thinking about how to invest in cryptocurrency since Satoshi Nakamoto launched Bitcoin in 2009. This area of the global foreign exchange market is constantly expanding and opens up more and more opportunities for active and passive earnings. You can earn money on cryptocurrency due to its high volatility - quotes are constantly changing, which allows you — with proper forecasting — to buy assets cheaply and sell more expensively.

How to invest in cryptocurrency for beginners

Beginners have many options to invest in cryptocurrency, and the most obvious way has already been mentioned, which is speculative trading on the price difference. The cost of Bitcoin (₿), Ethereum (Ξ), Litecoin (Ł), and other cryptocurrencies changes literally every minute. So does the value of fiat currencies, energy, securities, and other assets. But cryptocurrencies are many times more volatile because they are decentralized and do not have a single regulatory source. Therefore, almost any factor can affect their price.

Most often, cryptocurrencies are traded among themselves on exchanges. For example, Bitcoin to Ethereum (BTC/ETH) or Bitcoin to Tether (BTC/USDT). But some pairs involve cryptocurrency and fiat. Naturally, the most popular such pair is Bitcoin to the US dollar (BTC/USD). Here the answer to the question of how to correctly invest in cryptocurrency is conceptually simple because it is based on the same principles as when trading regular currencies on Forex. That is, the trader uses the methods of technical and fundamental analysis to predict future market prices and conditions.

For example, at the time of this article, Ξ1 costs US$3.935.89. We will proceed from this figure, giving an example. You can see a pattern on the chart and you can predict that the price will rise to US$4.104.47 during the day. Then you buy some amount of Ethereum and then sell it at its peak. The difference between the price of the asset at the time of purchase and the price at the time of sale is your profit.

If you already own a certain amount of cryptocurrency, you may want to start investing passively. That is, to make money not on trading an asset, but on its investment. One of the most popular options is staking. In simple terms, you provide your assets to the blockchain system to keep it running and in return, you receive a fixed percentage of profit.

If you go into details, then new blocks in the blockchain can be created by providing computing power to mine the cryptocurrency. This is the classic mining method to build new blocks during which you do not need calculations, but only existing coins. This is called Proof of Stake (PoS). Based on this, the more coins you transfer, the more your final reward will be.

Staking, as an investment in cryptocurrency, is more energy-efficient and environmentally friendly than mining because you don’t need powerful graphics cards, processors, and an abundant supply of electrical power. You only need an intermediary service through which you provide your assets within the selected blockchain. Quite a lot of well-known cryptocurrencies operate on the PoS system, for example, Solana, Cardano, Tezos, and Algorand. Ethereum plans to switch to it soon. This means that there is no doubt about the prospects of the method.

Next Big Crypto to Know Before New Bull CycleWhat cryptocurrency to invest in and how to buy Bitcoin

Bitcoin is the correct answer to the first question, but it’s not the only one. Bitcoin was the first successful cryptocurrency. The development of the protocol was completed in 2009, at the same time Satoshi Nakamoto published the code of the client program. The price of Bitcoin is constantly increasing. If at the time of creation it cost a fraction of a cent, then at its peak in 2023 the price reached US$69,000.

In the Russian Federation, the Law on Digital Financial Assets and Digital Currencies is currently in force. According to this law Bitcoin and altcoins are prohibited from being used to pay for goods or services, but they can be an investment facility.

For those who decided to start investing in digital assets, Ethereum (or Ether) can be also very attractive. It is not a payment system like Bitcoin. Ethereum was conceived as a platform for launching decentralized online services. This altcoin appeared in 2014, and today the cost of one Ethereum is ₽290,843.83 (RUB) (~US$3,900.41). It has the second market rank, that is, it follows directly behind Bitcoin. Ethereum has a market dominance rate of 21.07%.

When thinking about which cryptocurrency in which to invest, you don’t have to focus on the market leaders. Many other popular altcoins are profitably traded on exchanges and allow you to earn passively. For example, Cardano (ADA), Ripple (XRP), Dogecoin (Doge,Ð), and Polkadot (DOT). Binance Coin (BNB) is worth mentioning separately. It is the coin of the crypto exchange of the same name, it is not only in demand in the cryptocurrency market, but also gives its holders a discount on commission fees when trading on Binance.

Which cryptocurrency to invest in: Tips for beginners

Tip 1. Look at the popularity of the coin in the blockchain community. If a coin is present on leading cryptocurrency exchanges and reputable publications include news about it in their feeds, it is a promising digital asset.

Tip 2. The in-demand cryptocurrencies are supported by e-wallets. Not every digital asset can be stored on such wallets. But if the asset supports most of the services, it is popular and there will be no problems with moving it between accounts.

Tip 3. Before you start investing, track the quote history of the selected cryptocurrency. This is easy to do by typing the corresponding query into a search engine. If the price of an asset grows in the long term (excluding general drawdowns), you can work with it.

Tip 4. When Ethereum switches to PoS, the emission will decrease by 2.5% and the coin will become profitable for long-term storage. Ether also provides the dApp to work. Beginners need to choose cryptocurrencies that are constantly evolving and are part of large projects.

Tip 5. Take advantage of the Traders Union’s ratings and articles about cryptocurrencies on the portal. Our experts carry out in-depth analyses of the world’s digital assets and provide competent, objective advice.

Top 10 altcoins for investment

Often, the question of which cryptocurrency to invest in is solved by the choice of an altcoin. As was said, altcoins are any cryptocurrency other than Bitcoin. At the moment, there are almost 3,000 altcoins, not every one is promising. The table below shows those that are advantageous to invest in right now.

| Cryptocurrency | Industry | Current price | 1y return | 1m Return | Total score | |

|---|---|---|---|---|---|---|

Cryptocurrency exchange |

603.20$ |

96.93% |

85.77% |

9.5 |

Invest | |

Blockchain platform |

0.75$ |

131.69% |

37.81% |

9.2 |

Invest | |

Payments |

0.00$ |

NaN% |

NaN% |

9 |

Invest | |

Payments |

0.00$ |

NaN% |

NaN% |

8 |

Invest | |

Blockchain platform |

0.00$ |

NaN% |

NaN% |

8 |

Invest | |

Payments |

0.00$ |

NaN% |

NaN% |

7.6 |

Invest | |

Payments |

0.00$ |

NaN% |

NaN% |

7.5 |

Invest | |

Decentralized exchange |

0.00$ |

NaN% |

NaN% |

7.4 |

Invest | |

Blockchain platform/Media |

0.00$ |

NaN% |

NaN% |

7 |

Invest | |

Internet of Things |

0.39$ |

90.86% |

50.15% |

6.9 |

Invest |

Where to buy cryptocurrency for investment?

How to purchase cryptocurrency. There are three main options — a cryptocurrency exchange, a P2P exchange service, and a digital asset exchange site. Below is a closer look at each.

Cryptocurrency exchange

A cryptocurrency exchange is a platform for exchanges between cryptocurrencies and sometimes with fiat funds at market quotes. Each of the exchanges has its own trading terminal, usually based on TradingView, with charts and indicators for technical analysis. You can trade through these terminals in a browser from a PC or on a mobile device by downloading the application. Technically, trading on a crypto exchange is carried out in the same way as with a foreign exchange broker (Forex).

For novice traders, cryptocurrency exchanges usually prepare educational guides. Often, they explain spot, margin, and derivatives trading. Top crypto exchanges have services for passive earnings, including staking, as mentioned above. Also, many exchanges offer proprietary multicurrency wallets. For example, Binance has a universal Trust Wallet.

Pros: many assets, a significant palette of purchase and sale options, additional opportunities.

Cons: you need to register and complete verification; most exchanges have a limited selection of fiats

P2P-exchange

The difference between such a service and a crypto exchange is that there is no access to the world market. Resource users create orders to buy or sell one asset for another. In fact, this is not a trade, but an exchange. For example, you want to sell Bitcoin for Ethereum and create an order. If there is another user who has Ethereum and is satisfied with the price, he accepts your terms and buys Bitcoin from you.

P2P digital asset exchange services allow you to exchange cryptocurrencies for fiat funds, and vice versa. They can be beneficial if you urgently need to get one asset at the expense of another. Often, such services provide you a chance to make an exchange at more favorable quotes than those on the market. On the question of how to invest in cryptocurrency, it is convenient if the P2P exchange is integrated into the crypto exchange platform like it is with Binance.

Pros: you set your own terms of the transaction, whereby you can buy/sell an asset more profitably than the market value.

Cons: sometimes it is difficult to find a partner who will agree to your terms; in such a case, the service takes its percentage from each order.

Exchangers

An exchange site is a service where registered users can exchange one digital asset for another or for fiat currency. The keyword here is “exchange”, not sell or buy. Orders are not created here, as it is done on P2P services, the exchange rate is set by the platform itself. Of course, the exchanger will not set prices that are too different from those in the market. Usually, the service commission is included in its rate.

For beginners, the exchanger can be convenient as it does not require long and deep verification, and all transactions go through quickly. The pool of assets is formed from the total amount of funds currently involved in the exchange. Therefore, a popular and proven service makes exchanges quickly and in any direction. But, in general, the activities of such sites are not regulated by a governmental oversight agency, so there is a high risk of getting caught by a scammer.

How to recognize and avoid fraud on crypto exchanges?Pros: no verification is required; fast exchange of many assets in either exchange direction.

Cons: the service can take a high commission, and its activities are not regulated.

What is the best method for buying cryptocurrencies?

In some moments, exchangers can be beneficial. P2P exchange services are in high demand. But the most convenient method is a crypto exchange. Top exchanges are regulated, transparent, and have good technical support. They provide users with multi-currency wallets and various options for depositing and withdrawing funds, including direct payment from a bank card and prompt transfers to it. Plus, they provide additional features, including staking.

Best platform for investment and your personal finance

By now you may already have a general idea of how to correctly invest in cryptocurrency. Choosing a crypto exchange is key because you will trade and stake on its terms. By the sum of the factors, the Traders Union’s experts offer the Binance crypto exchange as a top option. Binance was launched in 2017 and is headquartered in Hong Kong. The exchange works with residents of all countries without regional restrictions. The service is translated into 26 languages, and customer service supports 11 languages.

Key features and benefits: The crypto exchange offers classic and advanced trading, leveraged (margin) trading, and derivatives including futures and options. Fees are below average in the segment of 0.1% for a taker/maker on a spot. There is a built-in P2P exchange service, as well as a fast cryptocurrency purchase service. You can pay directly by credit card, bank transfer, and from other crypto wallets. There are excellent guides for beginners. In terms of passive earnings, the platform has introduced a unique comprehensive Binance Earn solution with different staking options.

Another advantage of Binance is the previously mentioned BNB token. First, it is a popular token that is actively traded. Second, holding it in the account reduces the commission for spot trading by 25% and the commission for trading futures by 10%.

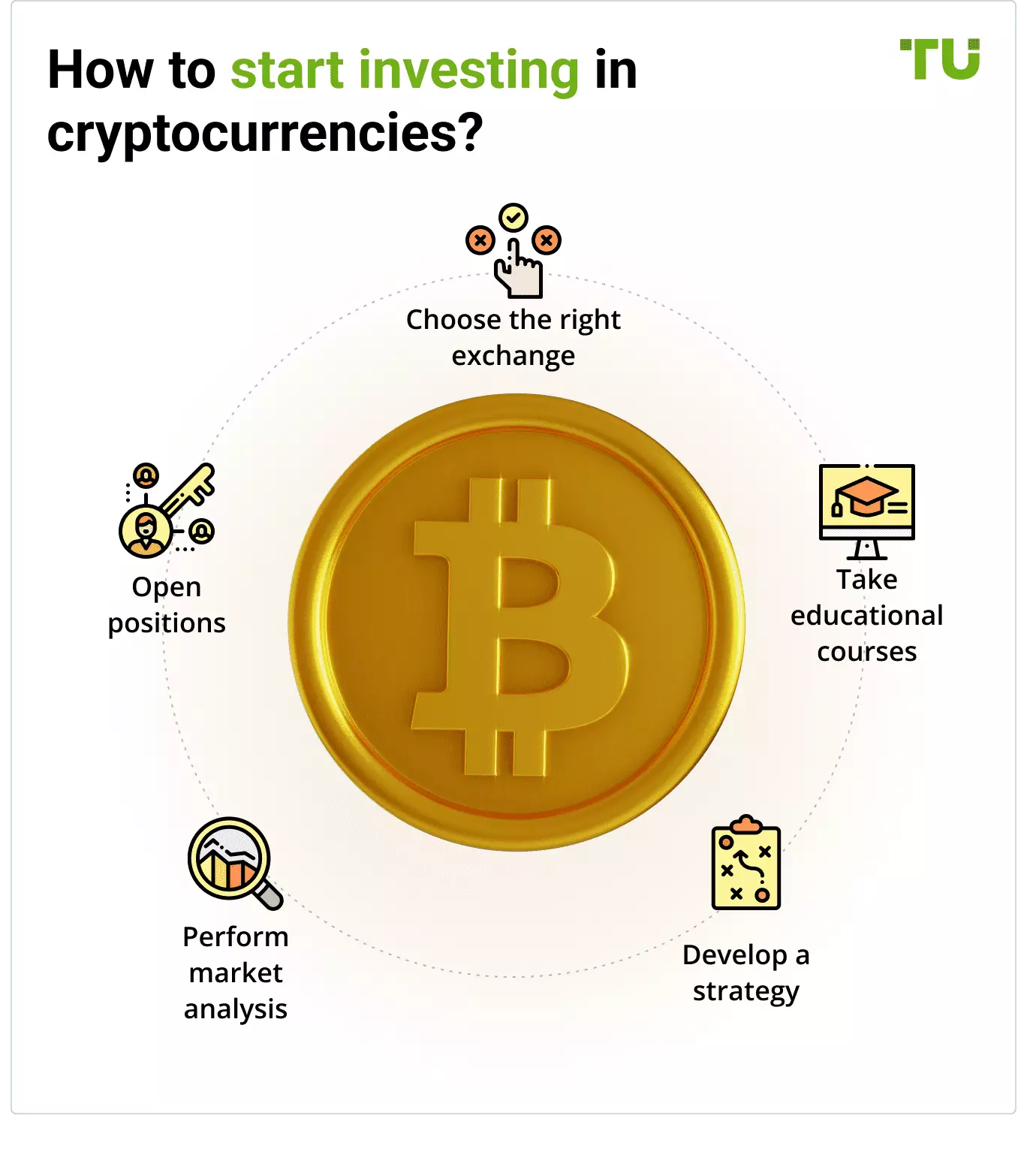

How to invest in crypto currency: step-by-step guide

It’s time to show you how to invest in cryptocurrency. For example, TU will use the Binance crypto exchange to explain to you step by step what you need to do to register, fund your account, analyze the market, and start trading.

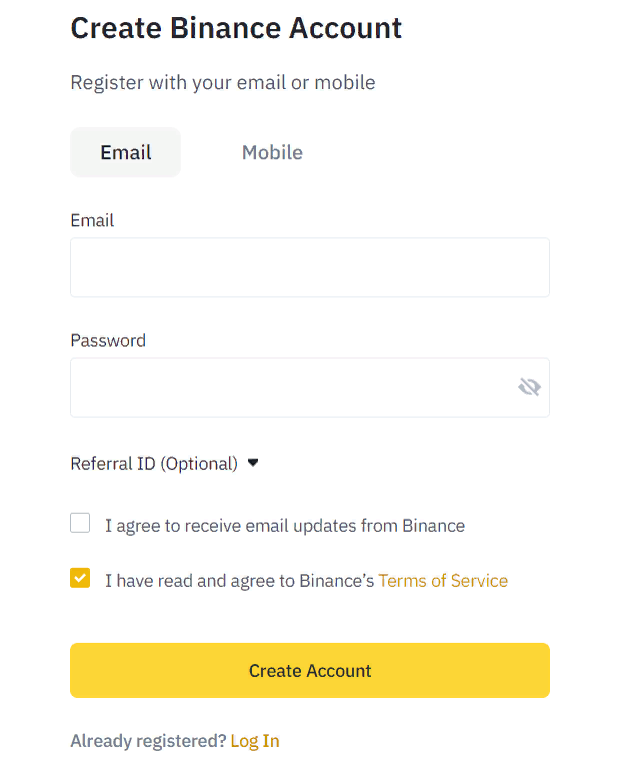

Step1: Registration

Go to the official Binance website; your region will be automatically detected. If it didn’t happen, select a region in the upper right corner. Then click the “Registration” button. Select “Create personal account”, enter your email, and create a password. You will receive a confirmation code by email. Enter it in the appropriate field.

Next, you need to specify your phone number; a verification code will be sent to it. After confirming the number, you will find yourself in your personal account. Note that for some regions, only one confirmation is sufficient — either email or mobile phone. You may also need to go through a simple anti-bot check.

Registration with Binance

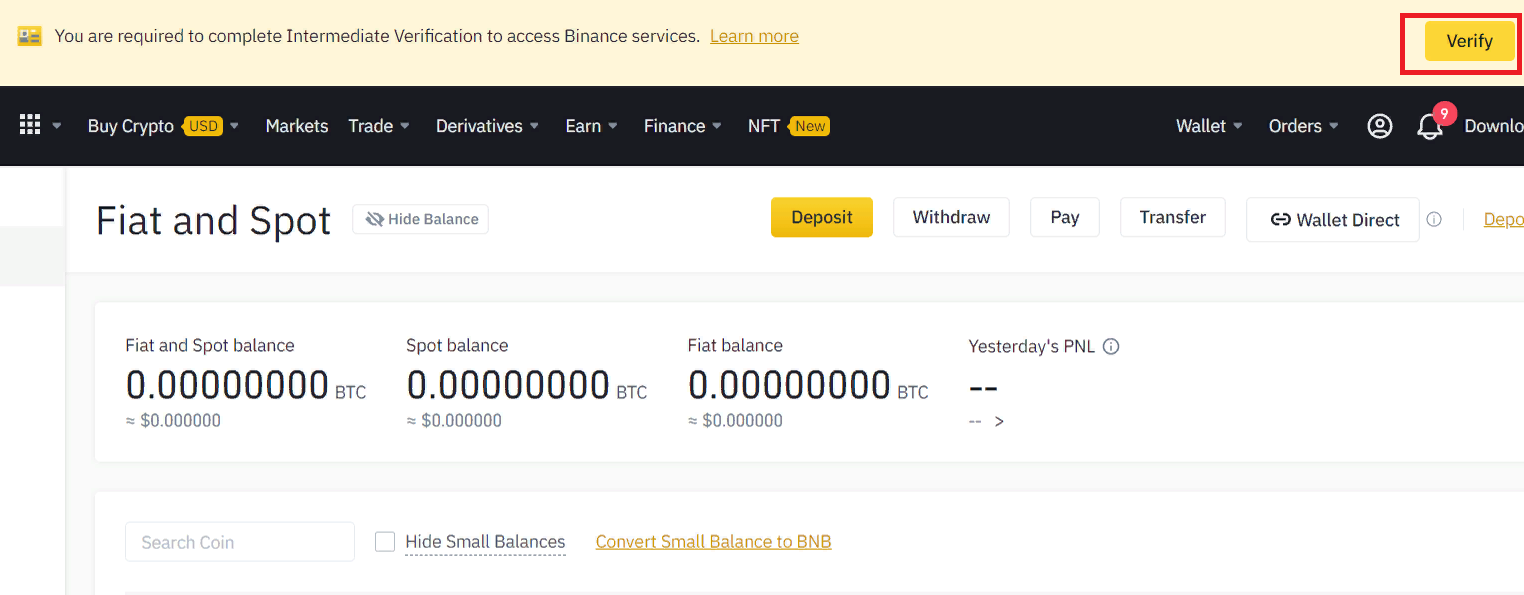

Step 2: Verification

At the top of your personal account, you will see a notification that you need to verify your personal data. You can go to the verification menu from this notification or by clicking on your account icon in the upper right corner and selecting the “Security” section, and then the “Verification” subsection. Use the type of verification that is optimal for you (they differ in the complexity of confirmation and the final limits on the input/output of fiat), click “Start” and follow the instructions on the screen. You will need to provide scans of identity documents.

Verification with Binance

Step 3: Funding your account

In the upper right corner, hover over the “Wallet” section, select the “Wallet overview” subsection, or directly select “Fiat and Spot”. Then press the “Enter” button and indicate what you will enter — either fiat or cryptocurrency. For example, click “Enter in Fiat”, specify the currency, amount, and transfer method, such as from a Visa/MC bank card. Immediately you will see the amount of the commission for the transaction. Click “Proceed” and follow the instructions on the screen. You will be redirected to the payment service.

Step 4: Market analysis

Hover your cursor over the “Trade” section, click on the subsection you are interested in, such as, “Classic Trade”. You will find yourself in a terminal where you can select any asset available for trading, for example, a pair of ETH/BTC. On the screen, you will see a chart with a choice of intervals and indicators for technical analysis. You will also have the archive of transactions. At the bottom of the screen, there is a feature for displaying your transactions on the exchange.

Use technical analysis tools to predict quotes (for example, identify patterns on a chart). Methods of fundamental analysis will also help you such as viewing current news. Make transactions in the trading terminal based on forecasting within your trading strategy. By the way, you can download it to your mobile gadget by hovering over the “Applications” in the upper right corner of the screen. Scan the QR code, download the app and follow the onscreen instructions.

Step 5: Purchase cryptocurrency

To open a transaction to purchase the selected cryptocurrency, go to the bottom of the trading terminal. Select the terms of purchase and click “Buy”. You can also purchase cryptocurrency through the P2P exchange service by going to the section of the same name on the website.

Passive income through Binance Earn

Now that you know how to buy cryptocurrency on Binance, you can start investing through the Binance Earn service. To go to it, click on the “Earn” button located in the top menu. Binance Earn is a convenient passive earning method for beginners.

The “Earn” menu contains all digital assets from which you can make money by lending them to blockchain systems. Note that you must have an appropriate asset on your account. You will be given the opportunity, if necessary, to buy the appropriate asset on the exchange, and exchange it for an existing one. Or you can purchase it through a P2P exchange or pay directly from a bank card.

Binance Earn offers three types of deposits - guaranteed (low income, low risk), high yield (high income, high risk), and auto investing according to an individual plan with an adaptive level of income and risk. For each type, there are detailed explanations. For any asset, you can see the period of the deposit, its spot price, and the estimated income in annual interest. To start investing, click “Start Staking” opposite the selected asset, and the system will provide you with information on the existing conditions. Next, you need to select the amount you want to invest and activate cooperation.

How much can you earn by investing in cryptocurrency?

When you know how to properly invest in cryptocurrencies, it’s fair to ask the operative question: How profitable and promising are cryptocurrencies as an investment? Let’s look at specific numbers. For example, the price of Ethereum in 2023 rose from less than $1,000 to $4,800 at its peak.

These are idealized conditions dictated by the general progress of the cryptocurrency environment at this stage, but the example perfectly shows that there is no upper bar here. Good option: Starting with $500, you can earn up to $1,000 per month in six months. Bad option: Almost immediately break even. It all depends on your analytical skills and the success of the chosen strategy.

On staking from Binance, the guaranteed option of depositing in BNB now gives 7.28% per annum. The high yield SANTOS/BTC pool has an increased risk, but the annual return is 86.99%.

All of the above suggests that you can really earn a lot on digital assets if you “catch a wave”.

The best evidence of this is the richest crypto billionaires in the world list. Each of them decided to invest in cryptocurrencies at some point and made successful choices.

Are there any risks in crypto currencies?

You decided which cryptocurrency to invest in, found an exchange with favorable conditions (for example, Binance), and developed your own strategy. But this does not provide any particular guarantees. Observing the rules of money management, diversifying your investment portfolio using the stop limit and additional functions of the trading terminal, you can reduce the risk, but not eliminate it completely.

Cryptocurrencies are extremely volatile, sometimes their quotes change unpredictably. Of course, with experience, you will learn to identify even less obvious patterns and predict trends accurately. But even being a “pundit” of the direction of the market or asset, you cannot always win. You will still lose several bets. This is how the market works.

Staking also has its own risks such as the so-called scam projects. These are fraudulent firms that collect funds from investors and then simply disappear. Staking exchanges scrupulously weed out unreliable partners, but they also cannot completely eliminate risks for investors. Therefore, when deciding to start investing in digital assets, you must be risk-tolerant yet try to minimize risks by all means available to you.

How to correctly invest in cryptocurrency: 5 tips from an expert

Rule 1 – Fortune favors those who are prepared. Read a couple of books on stock trading, such as Benjamin Graham’s The Intelligent Investor. Take some online courses, study an array of guides. You do not need financial education, but you must master the basics of technical and fundamental analysis in order to trade successfully.

Rule 2 – Do not violate the principles of money management. Let us immediately indicate that in trading you cannot use funds you cannot risk losing at the current moment. In the process itself, on average, the rate should be about 2-5% of the deposit amount. There are other principles of money management, they are universal and excellent in reducing risks. Be sure to study them.

Rule 3 – Appeal to reason rather than to feelings. A successful investor is stress-resistant. If you have a hard time with emotional moments (you react aggressively and thoughtlessly), you need to practice and not allow momentary feelings to impact your decisions. Otherwise, failure is guaranteed even with the most successful strategy.

Rule 4 – Diversify your portfolio. The easiest way to reduce your risk is to trade in multiple cryptocurrencies. Then an erroneous forecast with one asset will be leveled by successful forecasts in other directions. If you are stacking, invest in several projects, not just one.

Rule 5 – Perfect yourself. There are no universal strategies. Therefore, your strategy must be flexible. Constantly monitor the market, learn from colleagues, communicate with other traders in the community, immerse yourself in guides. Even passive investing is active to a certain extent.

Summary

Now you know how to select a promising cryptocurrency, how to start investing, and what is needed to be successful. Technically, there is no difficulty, whether it is active trading on the exchange, P2P exchange, or staking. However, this area needs to be studied while being prepared to take risks. Then you can earn and even make investing your main source of income.

FAQs

Why is it advantageous to invest in crypto?

Digital assets are as much a part of our financial life as a bank card in our pocket. Cryptocurrencies are volatile, so they allow you to make good money on the price difference. You can also earn income from staking, a more environmentally friendly version of traditional mining.

What are the best platforms for investing in crypto?

An exchange site and a P2P exchange service make it possible to buy cryptocurrency, but you can start investing only with an exchange. The exchange allows you to trade with market quotes, it offers different options for diversifying risks and passive income.

Why is Binance the top choice for beginners?

Let’s note right away it’s the top choice not only for beginners. It is one of the leading cryptocurrency exchanges in the world. It offers spot and margin trading, and derivatives. It has a proprietary P2P exchange service, proprietary currency wallet, and many staking programs. Without exaggeration, Binance provides everything you need to make a successful investment in cryptocurrency.

What risks do you need to know?

Cryptocurrencies are highly volatile digital assets, the prices of which are constantly changing and sometimes difficult to predict. You must be prepared for the fact that you will sometimes make mistakes in forecasts, and this will bring financial losses at a specific stage. In the field of staking, there is a danger of running into scammers. The risk will always be with you, a successful investor has to tolerate it well. He must make his way through the thorns to the stars of success (and profit).

Team that worked on the article

Upendra Goswami is a full-time digital content creator, marketer, and active investor. As a creator, he loves writing about online trading, blockchain, cryptocurrency, and stock trading.

Professionally, he has been a marketing professional running his agency for three years now. His agency helps finance projects to grow with the help of internet technologies. Upendra Goswami is an active investor and enthusiast of stocks and cryptocurrency.

Knows about

trading, blockchain, cryptocurrency, stock trading

Alumnus of

JECRC UDML College of Engineering, Jaipur

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.