How to Trade Crypto? A Comprehensive Guide for Beginners

To trade cryptocurrencies, you can follow these steps:

Choose a reputable cryptocurrency exchange platform.

Create an account, complete identity verification, and secure a digital wallet.

Deposit funds into your account, select the cryptocurrencies you want to trade, and execute buy/sell orders based on market analysis.

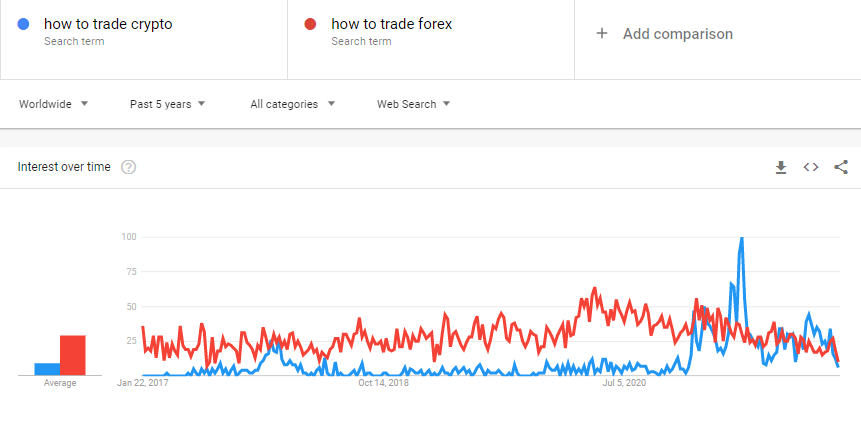

More and more people around the world want to know how to trade cryptocurrencies. Google Trends shows that interest in cryptocurrency trading is already almost the same as Forex trading, although before 2020 there was more interest in fiat currency trading.

Photo: Google Trends

This article is written by a professional cryptocurrency trader and focuses on people who want to start trading cryptocurrencies but don't yet know how. Carefully study the detailed and objective information below and you will understand where and how to start your journey toward successful crypto trading.

Do you need to know blockchain technology to trade cryptocurrencies?

No. Cryptocurrencies are exchange-traded assets whose price is set by the aggregate forces of supply & demand.

Even if you want to establish all the motives that push the price up and down, you won't succeed. Knowing the intricacies of blockchain technology will not give you a decisive advantage in trading cryptocurrencies, just as knowing the technology of gasoline production is not likely to make you a successful trader in the oil futures market right away.

But knowledge is never amiss. The Traders Union recommends that you constantly make an effort to gain a trading advantage in the exchange game. Understanding how does blockchain works will help you interpret network data for on-chain analysis, thereby providing you with the facts to make a more favorable trading decision.

Where does cryptocurrency trading occur?

Every year the number of places where you can trade cryptocurrencies increases. The three most common options are discussed below:

Specialized cryptocurrency exchanges such as Binance, Coinbase.

Centralized exchanges such as the CME exchange trades futures contracts for Bitcoin and Ethereum. Trading in mutual funds (ETFs) based on cryptocurrency assets is becoming more popular.

Forex brokers. They usually offer CFDs on cryptocurrencies, which are instruments linked to Bitcoin and the value of other altcoins.

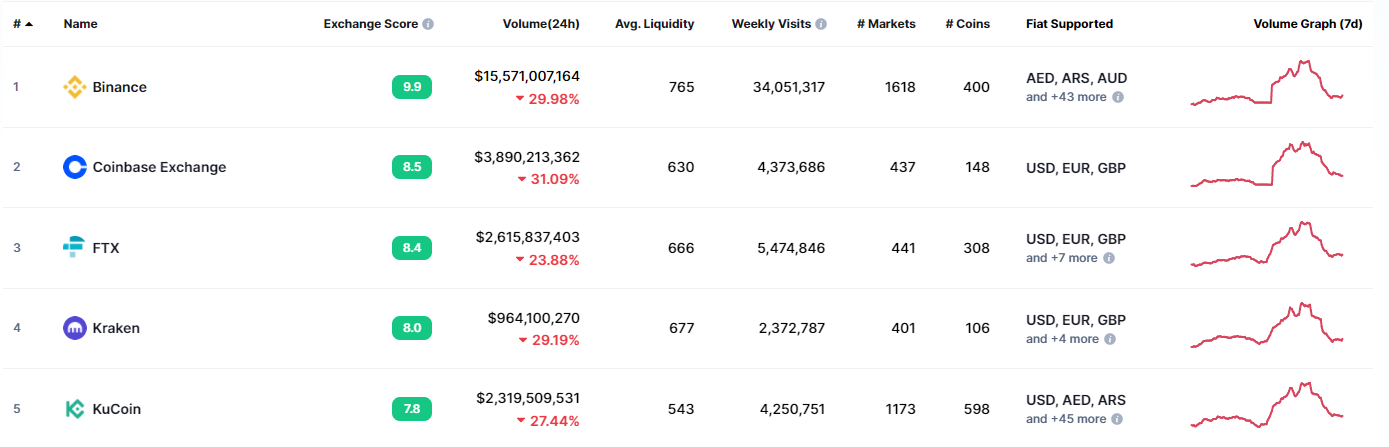

It is prudent to trade cryptocurrencies on specialized exchanges. According to Coinmarketcap, there were over 300 cryptocurrency exchanges in the world at the beginning of 2023, with Binance and Coinbase at the top.

Photo: top crypto exchanges according to Coinmarketcap

The benefits of trading cryptocurrencies through an exchange:

The ability to implement different strategies. You can buy real cryptocurrencies on the spot market, and/or trade short-term speculative futures contracts;

Low commissions;

Rapid account opening;

Anonymity. Although this point can be classified as controversial since some cryptocurrency exchanges under pressure from state regulators require identity verification to remove restrictions on cryptocurrency trading.

Ability to participate in farming and staking;

Performance. Cryptocurrency exchanges support APIs for fast trading. Branded applications are also available to customers.

A wide range of cryptocurrency pairs is available for trading.

There are "sandboxes" for novice traders who have a difficult interface for novice traders and the probability of hacking exchangers shall be considered the disadvantages of the exchanges. But the interface can be studied and adjusted for yourself. Setting two-factor authentication and complex passwords are recommended and do not ignore the other methods of protection offered by the exchanger to protect against hacking.

Below are links to instructions on how a novice trader can open an account on a cryptocurrency exchange.

Two-step guide for how to trade cryptocurrencies

To trade crypto, follow these steps:

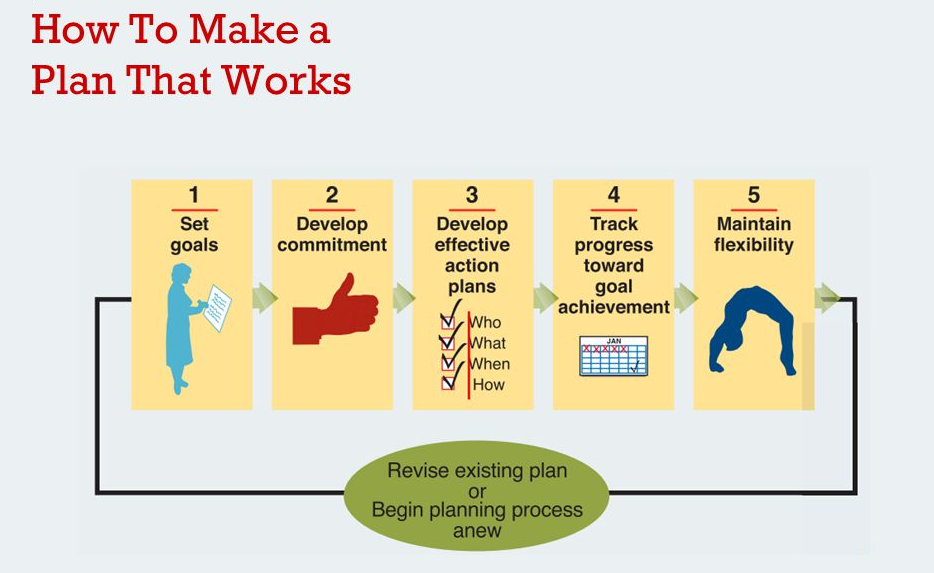

Make a trading plan

Open an account on a cryptocurrency exchange and act according to your plan, checking your mistakes and progressing day by day.

If you don't have a plan, you're likely acting impulsively, based on emotion. Be warned, gambling leads to losses. Treat cryptocurrency trading as a business to achieve sustainable success.

Photo: How to make a plan that works

Your trading plan should be unique, don’t copy it from the internet.

Answer these questions honestly:

What are your strengths? Take credit for your ability to conduct technical analysis, a high level of discipline, learning capability, analytical mindset, the ability to find the information, work on yourself and by yourself, resistance to stress, command of programming languages (to build algorithmic systems). Any and all advantages are critical to achieving sustainable profits.

What are your weaknesses? Greed, fear, lack of experience in trading may play against you. How will you keep your emotions under control?

How much are you willing to spend? Don't take risks with money you're not willing to lose. How will you limit your risks?

What are your financial goals? Describe your time horizon, indicate how much you want to earn in a month, a year. Set realistic goals, taking into account your age.

What is your strategy? Describe your entry point into the position. What are the criteria for closing the position? Are there any proofs that the strategy will bring you profit (often sellers of strategies are making tricks to artificially inflate its profitability. Unscrupulous dealers are more common in the field of cryptocurrencies than in Forex)?

How will you know if you're ready to trade for real money? Try trading on a demo account first, then trade a minimum lot, gradually increasing the volume. Don't rush into cryptocurrency trading, profitable opportunities appear every day.

How much time are you willing to devote to trading, learning? If you can spare a whole day for trading, then intraday scalping will be an available option. If you are busy for 8 hours at your job and then busy with the house, perhaps investing and holding coins for the long term will be better options for you.

Your choice of strategy for trading cryptocurrencies, as well as your choice of the market: spot or derivatives (futures), depends on your answers to the above questions. On the spot market, you buy real coins, and you can't earn if their price fall, but you can deposit them into a secured digital wallet. Futures are a leveraged speculative market for making money on the rise and fall of the cost of cryptocurrencies. You may also be interested in information how to trade cryptocurrency for a living.

Types of cryptocurrency analysis

There are 3 basic methods for evaluating a potential trade:

On-chain analysis

Technical analysis

Charles Dow formed the basis of technical analysis at the beginning of the 20th century. He founded the Wall Street Journal and published his observations on the stock market in the editorial column.

The basic concepts of technical analysis are:

History repeats itself Prices are based on traders' emotions.

Price takes everything into account. It makes no sense for traders to know which factor changes the price. All influencing factors add up and form the supply and demand matrix, which sometimes balances the price and sometimes forms imbalances.

Market movements occur in different stages. There is a stage of trend (directed price movement), as well as a stage of flat (no trend).

The Dow theory suggests that traders should study the dynamics of volume, price, and their interaction to determine the most likely future direction.

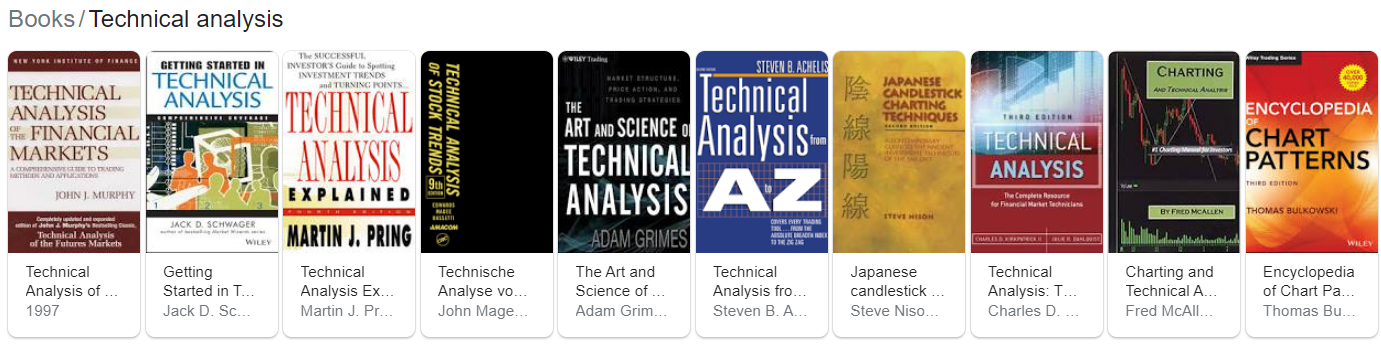

The technical analysis development, the publication of new books, and the growth of the computing power of computers led to the rapid development of the industry.

Photo: Technical analysis books

As a rule, technical analysts use the following methods to assess the market and predict price movements:

technical analysis figures, such as: "head and shoulders", "cup and holder", "double bottom", "triple top", and various types of triangles.

support and resistance levels built according to various methods;

statistics of trade volumes, market profiles, data of buying and selling orders issued

other information of value according to the analysts.

Fundamental analysis

For investing in stocks, fundamental analysis involves working with data from the economy, the labor market, and statements by politicians, financiers, and market influencers (such as Elon Musk, Bill Gates, etc.). Also, you must study the business processes of individual projects and companies.

Fundamental analysis is also applicable in cryptocurrencies. Let's say, by understanding the creation smart contracts, you might conclude that the Ethereum network (the main way to create smart contracts) has significant drawbacks, such as high fees. Then you might see the prospect of investing in relatively new Ethereum competitors, such as Solana.

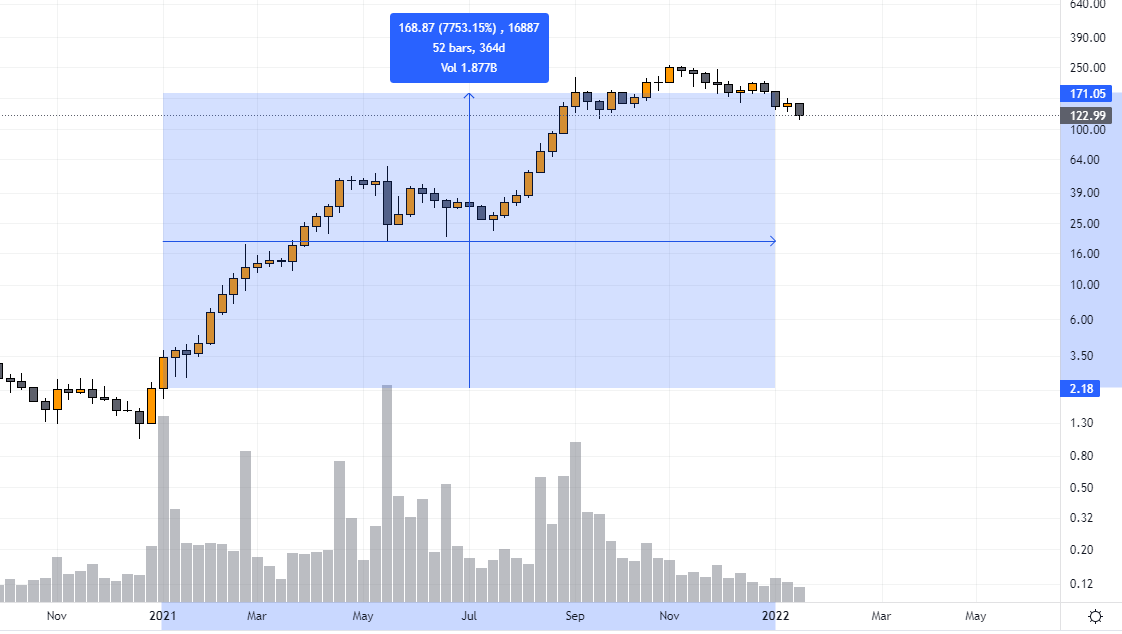

Photo: Solana price chart

You could convert the right fundamental analysis into huge profits, as the SOL/USD exchange rate increased by over 7 thousand percent in 2023.

On-chain analysis

There are hundreds of types of network characteristics, each providing valuable information in its own way, such as:

Number of active addresses

Number of new addresses

Volume of transactions

Capital flows on cryptocurrency exchanges

By analyzing changes, investors can get signals to make profitable trading decisions. For novice traders, this information can be difficult to understand. It doesn’t provide guaranteed and simple entry points (there are no magic wands), but if you want to become a professional, pay attention to on-chain analytics to gain an advantage over other traders.

Platforms for on-chain analytics:

Glassnode

Cryptoquant

Messari

Dune Analytics

Santiment

This is a shortlist, and there are many other analytical platforms, but unfortunately, they all provide only information of little value for free.

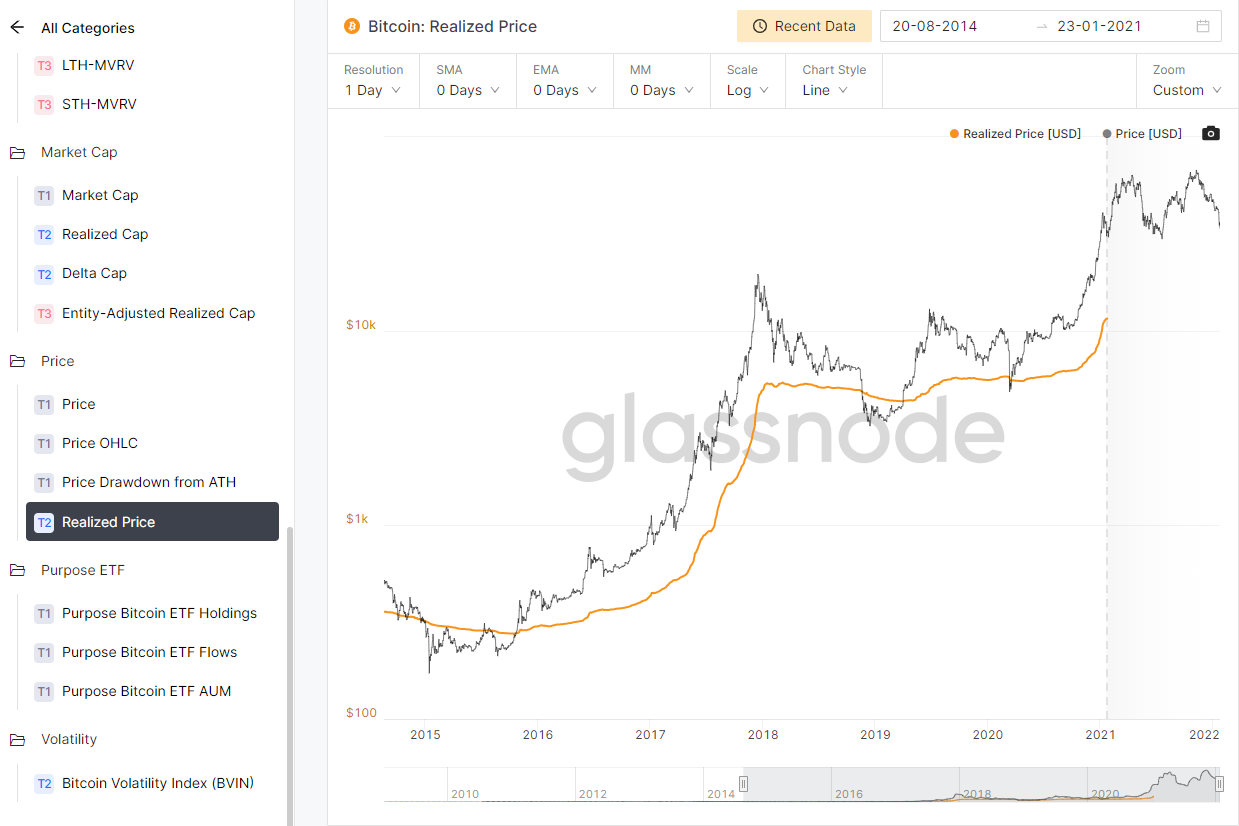

Photo: Bitcoin: Realized Price

And metrics such as Realized Price, for example, will be provided with a time delay or hidden behind an invitation to buy the paid version.

Find below a few strategies on crypto trading for novice traders that are free:

apply to any cryptocurrency exchange,

do not use lagging indicators,

contain descriptions of the advantages and disadvantages, so you can choose the one that suits you best.

Mistakes of novice cryptocurrency traders

But before examining the mistakes by novice crypto traders, accept the 6 unbreakable prohibitions for successful cryptocurrency trading, which are:

You cannot average (increase a losing position).

Do not bet too much, a series of losses should not destroy the account. Control the size of the volume in a trade. Remember that leverage can quickly increase profits as well as expose your account to unreasonable risks.

You can't ignore the importance of a stop loss. A stop loss is a protective order that will automatically close a trade if the price goes against you.

Don’t look for a grail. There are no magic means or signals that guarantee 100% accuracy.

You can't act spontaneously, emotionally, or gamble. It is better to lose money in a casino or buy a lottery ticket. Always treat trading as a business.

You can't ignore the importance of your account safety. Set up two-factor authentication, strong passwords, and other available security methods on your account.

Do not violate these bans, and you will avoid the common novice traders' mistakes.

Crypto trading strategies

Trading strategy based on trends

The trend is always a friend! This is perhaps the most famous proverb among traders. It suggests that traders should look for indicators that mark prevailing price trends. Following trending prices is the best option for novice traders in cryptocurrency trading.

The market can be placed in one of two phases:

The trend stage (imbalance of supply and demand) – upward or downward;

the Flat stage (supply and demand balanced).

The market can be placed in one of two phases:

Caveat

There are studies, such as the Elliott Wave Theory, that state the market is never flat but is always either in an uptrend or in a downtrend.

The idea is to enter a trade when the market moves from a calm (flat) stage to a directional phase. And hold the trade as long as possible to make a profit.

To trade on the trend, you must be able to identify it. To do this, you can use indicators such as Bollinger Bands, Keltner channels, MACD, Market Profile, and others. Also, you can use the analysis figures to identify the beginning of the trend.

Example

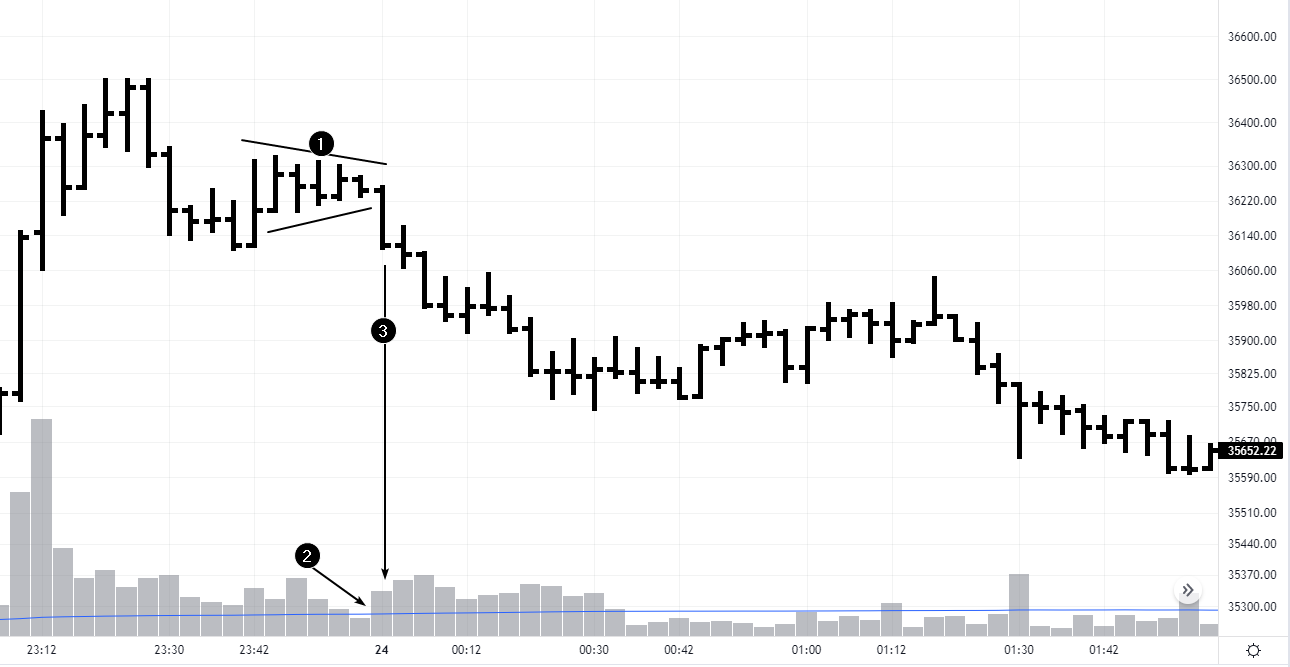

At the end of January 23, 2023 (UTC), Bitcoin was traded around 36250, with a range of bars narrowing (1), to form a triangle. An important characteristic is the declining volumes representing market activity. Fading price swings and declining activity are a sign that the market is in balance.

Photo: Bitcoin price chart

The first bar on January 24 (3) shows a widening spread (the difference between the minimum and the maximum) and increasing volumes. The closing price is at the minimum. This means that there are sellers in the market that pushed the price out of balance with their activity. This is a signal to enter the short position at the beginning of a presumed bearish trend.

On the next bar after number 3, you should try to open a sell trade and immediately set a stop loss for the upper limit of the triangle (1). And then, let the profit grow, dropping the stop-loss first to the no-loss zone, and then protecting the profit accumulated gradually in the direction of the trend.

The size of the trade should not reduce your account amount by more than 2-3% in the event of failure.

Example 2

A deal to buy a cryptocurrency.

Photo: A deal to buy a cryptocurrency

The scheme is similar but reversed.

a narrowing triangle on below-average volumes.

a noticeable effort of buyers to break through the upper line of the triangle.

a rollback on exsiccant volumes, as confirmation of the activation of demand in the market.

a more noticeable effort of buyers, which brought an obvious breakdown.

a rollback on exsiccant volumes allows buying cryptocurrency in the direction of an uptrend that is gaining momentum.

Advantages of the strategy:

It is based on the natural property of the market to be balanced/imbalanced.

Allows you to enter a position at the beginning of a trend and stay in balance with the market sentiment.

You can look for entry points at any timeframe. This allows you to form a long-term portfolio or speculate on intraday rates of cryptocurrencies. It is your choice.

You can trade through a standard interface with a volume indicator without involving additional information sources and software tools.

Cons in the strategy:

Subjectivity. You may see a breakdown where none exist.

Constant tension. Once you notice the balance, focus on the moment when you get out of balance (triangle breakdown).

False breakdowns. When trading cryptocurrencies, you will find that a lot of momentum has the purpose of leading traders into a trap, after which the price reverses to set the trend in the opposite direction.

Trading strategy based on long-term investment

Cryptocurrency traders call this strategy with a slang word HODL formed from the misspelled word HOLD (hold) in the traders' forum. The author of the post said that he does not pay attention to price fluctuations, but simply holds his position.

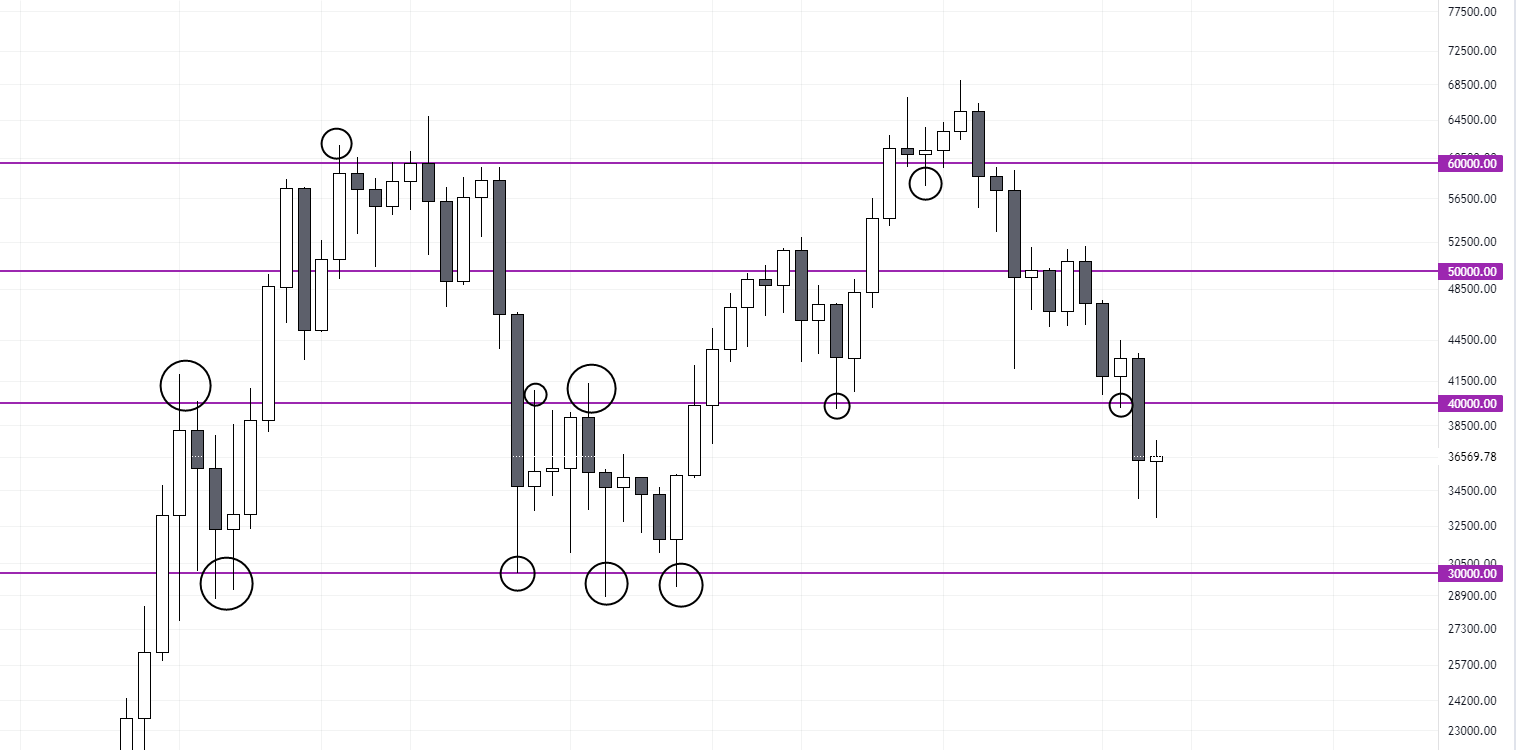

As the weekly chart with the logarithmic price scale shows, the Bitcoin exchange rate is within a long-term upward channel. So in terms of investment horizon, adding Bitcoins to a portfolio near the green zone and holding a position for many years could grow into an amount with a lot of zeros.

Photo: HODL strategy

The main thing is not to break the trend, and there are no everlasting trends or impervious supports. This strategy involves buying real coins on the spot market, while the other strategies mentioned in this article are better for trading cryptocurrency futures.

Advantages of the strategy:

Simplicity. Just buy and hold.

There is plenty of time to do the analysis.

Bankruptcy protection. Investing with this strategy offers bankruptcy protection by refusing to buy a leveraged asset. For example, an ADA token costs $1. You have $100. You buy 100 tokens, no leverage is involved. The idea is that sooner or later the development of the Cardano project that issued the ADA token will lead to your investment making a profit. And possible drawdowns will not lead to the liquidation of the position.

Cons in the strategy:

A long waiting period for an entry point at a strong support level.

The portfolio won't grow quickly, it's a position trade that sets long-term goals.

Trading strategy based on market profile

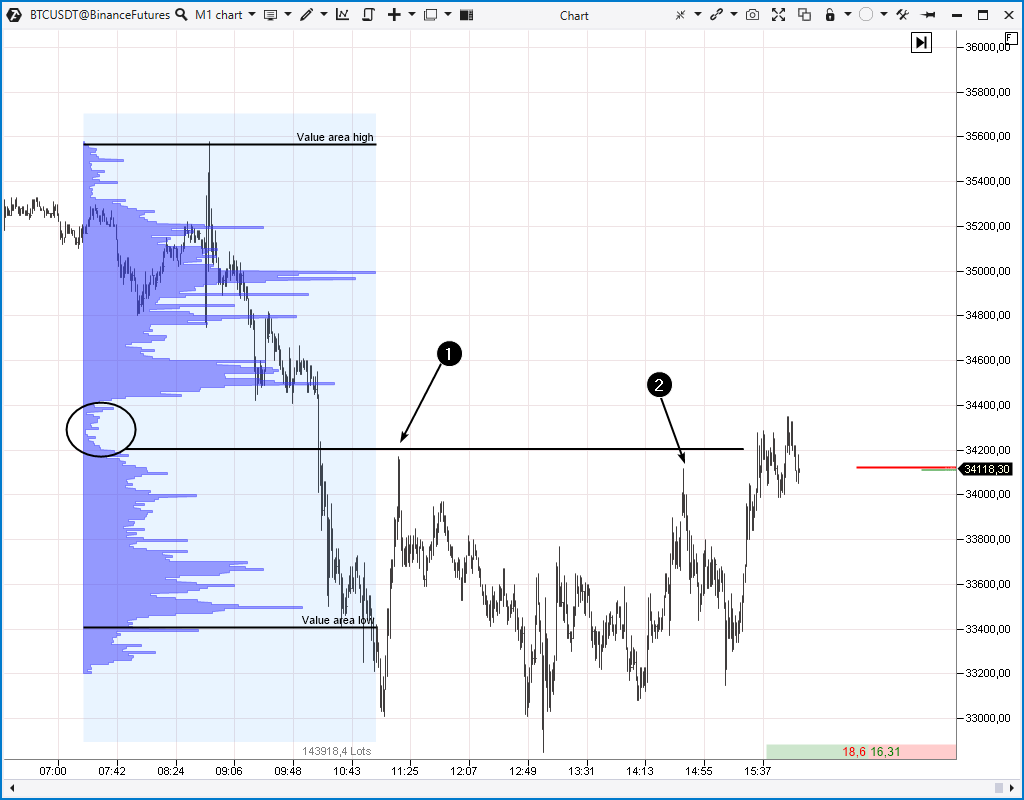

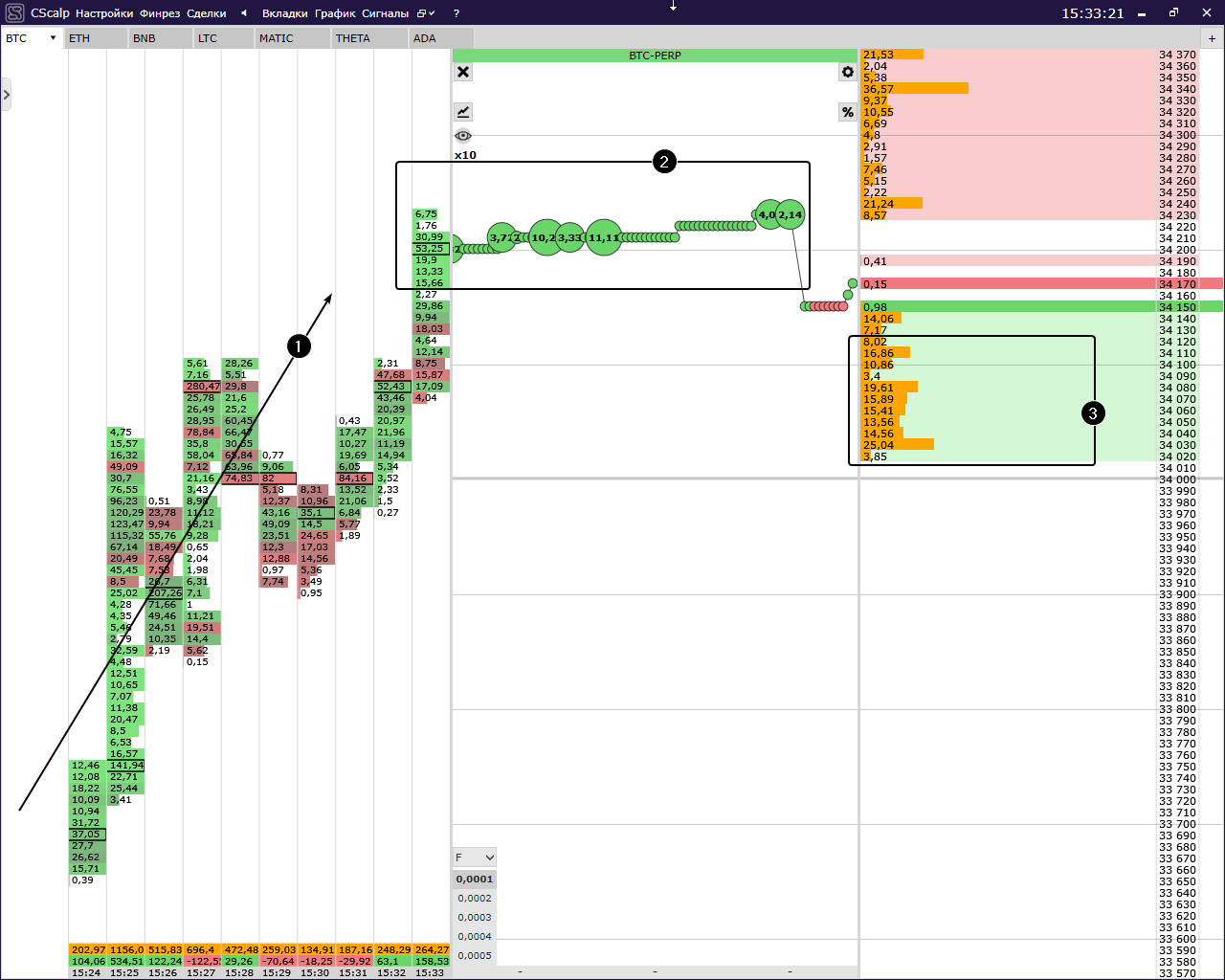

Please study below a screenshot from the ATAS trading and analytical platform. It can be used for free to conduct transactions on cryptocurrency exchanges. This is a more sophisticated platform than CScalp.

The screenshot shows how you can find important resistance levels. As you can see, the profile has a bottleneck. It was formed in the area of 34200-34500 when the price was rapidly going down. The "bottleneck" shows the total superiority of the sellers. There were too few buy orders, and therefore this zone remained under the full control of the supply forces.

Photo: Trading strategy based on market profile

Therefore, if the price exceeded level 34200, a shortage of buyers and a reversal downwards could be expected. Knowing this information, the trader had 2 opportunities during the day to open a short position with a favorable risk/reward ratio.

The formation on the far right side of the chart shows that the buyers are back in the market, but they need a lot of effort to overcome the resistance zone of 34200-34500.

Advantages of the strategy:

Justified by data on transaction volumes.

Allows you to find important support and resistance levels.

Works on any timeframe.

Cons in the strategy:

Subjective. You should practice finding narrow profiles on historical data.

Price doesn’t always test the narrow profile zone.

Using a third-party platform can be inconvenient.

Trading strategy based on psychological levels

"Round" levels, which have several zeros at the end, have a psychological effect. As soon as the price crosses a level, it will immediately make headlines in the media.

Example

Let's take the chart of the Bitcoin price on the Coinbase exchange and mark "round" levels of 30ths, 40ths, 50ths, 60ths on the chart.

Photo: trading strategy based on psychological levels

Circular levels or false breakdowns are marked with circles. They are formed due to the psychological effect: when the price breaks through at least a little bit the level of Х0000 dollars for Bitcoin, people think that the impulse is strong enough and the price will continue to move in the same direction and open positions based on their assumptions.

The simultaneous position opening leads to the formation of a local bubble that tends to burst. Moreover, major manipulators are interested in a round level breakout, because that gives them a liquidity flow to optimize their positions.

The round-level piercing trading strategy is uncomplicated and suitable for use by novice cryptocurrency traders.

The plan could be as follows:

wait for the cryptocurrency price to approach the round level;

wait for the price to break the circular level;

insert a stop order that will open a position when the price comes back.

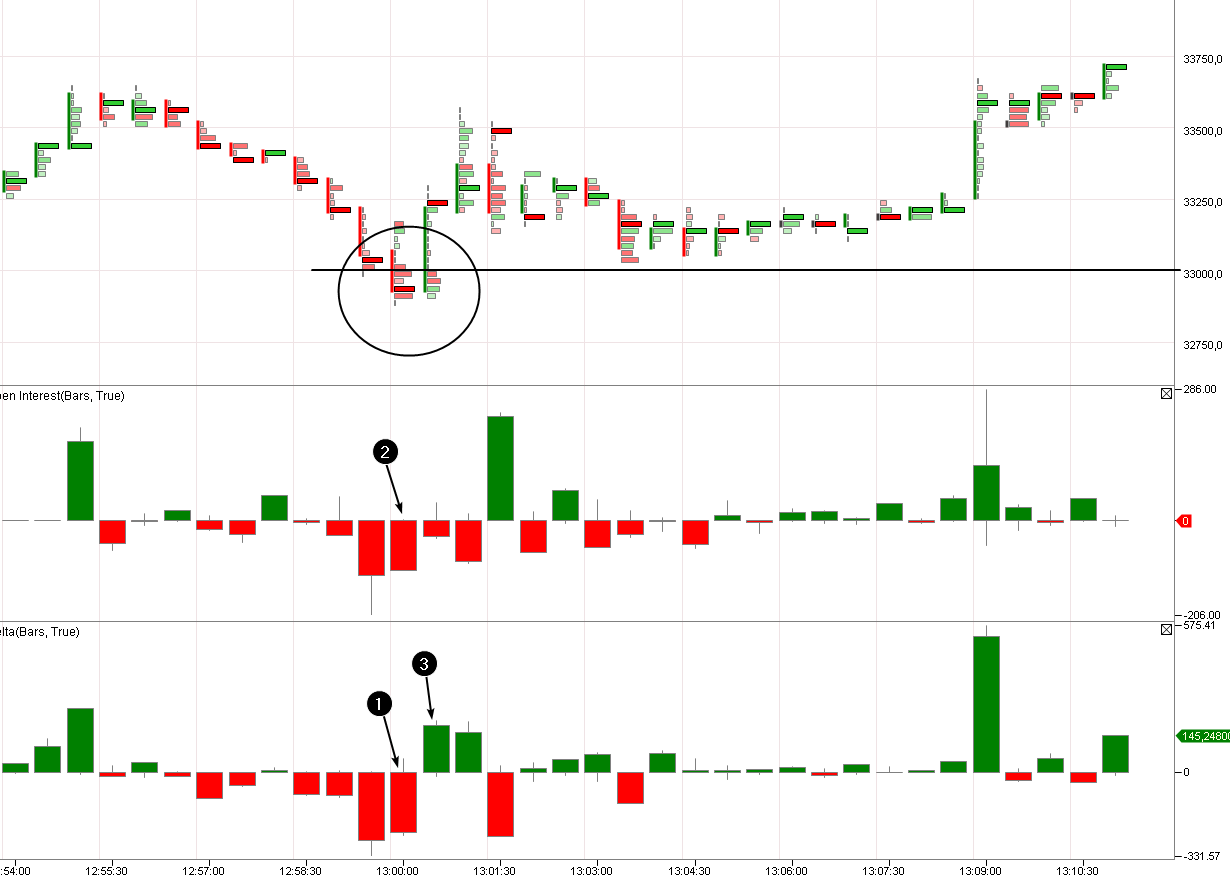

If you want to understand better how the strategy works, study the cluster chart of a professional intraday cryptocurrency trader below. The screenshot shows a false break of the psychological mark of 33000.

Photo: a false break of the psychological mark of 33000

The circle marks the puncture point.

Note that immediately after the puncture there were massive market sales, as shown by the Delta indicator (1). Most likely, it was a buyer closing on a stop-loss, because the Open Interest indicator indicated a decrease (2) in the number of open positions.

Noticing this, you can set the buy-stop order to a level of 33033.

The number 3 on the delta indicator shows a market purchase splash. It has pushed the price above the round level. Your position has opened, so it's time to protect it by setting a stop loss near the puncture minimum, let’s assume, 32880.

The risk is relatively small – 33033-32880 = $153 per Bitcoin. And the reward comes very quickly since the price rises to 33500 in the next minute. As an option, you can take part of the profit to try to hold the remaining position for higher targets.

Advantages of the strategy:

it is based on mob psychology;

it is confirmed by the patterns on the cluster chart;

works at less significant circular levels within the day, and at more significant psychological levels on daily charts

Cons in the strategy:

Although punctures are more common, true level breakdowns are common either. It is extremely difficult to learn to distinguish between them.

Sometimes the punctures are too "deep," which increases the risk.

Trading strategy based on scalping

The peculiarity of trading on the cryptocurrency exchange is the ability to connect additional platforms to enhance the convenience and functionality of the standard interface developed by the exchange.

For example, CScalp is a fast and free Windows desktop application to make money on scalping. This is a trading method when trades are held from a few seconds to a few minutes, although you can try to increase the quickly made profit.

CScalp has API connections to major cryptocurrency exchanges, including Binance.

The app divides the workspace into three verticals:

there is the cluster chart, or footprint, or recent trades on the left side;

there is a ticker ribbon or real-time trades in the middle; and

there is the "limit orders glass", or Level II data in the right column.

Photo: CScalp

The chart above shows that the market is in an uptrend, as prices are increasing (1), and the clusters are mostly green (which can be interpreted as the dominance of buyers over sellers).

Therefore, when new buyers (2) appear on the ribbon at the top renewal, it should be considered as a signal to buy. At the same time, there should be significant support (3) at the levels below in the stock market.

Advantages of the strategy:

trader’s experience is key;

potentially rapid growth in profits;

low risk in each transaction;

a large number of sets in each deal;

since scalpers, as a rule, don’t have long-term positions, it positively affects the quality of their sleep.

Flaws in the strategy:

greatly influences the final size of the commissions;

emotional load because of the tendency to experience the negative effects of overtrading.

using a third-party platform can be inconvenient.

Trading strategy based on liquidation indicators

Liquidations can force the close cryptocurrency traders' positions (by stop-losses and/or lack of a margin).

The strategy is based on on-chain data. To trade on it, you will need the Coinglass project charts. They are free (at least at the time of this article's publishing).

The blue circles on the chart below show the moments when cryptocurrency exchanges experienced a particularly large liquidation of positions:

the green bar indicates the liquidation of buyers' cryptocurrency positions;

the red bar indicates the liquidation of sellers' positions.

Photo: Liquidation indicators

As you can see, the price then reverses in the direction of the traders whose positions were liquidated. You may be familiar with that unpleasant feeling when you see that the market is trading the way you planned, but the position has already been closed on a stop loss.

With the Liquidations indicator, you can turn the situation in your favor and open a position where others leave it.

According to Richard Wyckoff: “Look for your money where you lost it”.

Advantages of the strategy:

The strategy is based on changes in the balance of long and short positions, the data is accumulated from various exchanges in real-time.

You can look for liquidations of different scales for intraday trading or during the retention of longer-term positions.

You can track liquidations on various cryptocurrencies.

Flaws in the strategy:

Using a third-party indicator can be inconvenient.

A liquidation splash doesn’t necessarily have to mean only a reversal, it can also be an important level breakout.

Best crypto exchanges for beginners

As was said, open an account on a cryptocurrency exchange to implement cryptocurrency trading strategies. It is recommended that you use two licensed and reliable exchanges such as Binance and Coinbase.

Bybit

Bybit is a cryptocurrency derivative exchange with numerous advanced trading tools. It has gained significant traction in the crypto trading community due to its robust trading features and user-friendly interface. It is a preferred option for novice and experienced traders and is known as one of the most secure exchanges. However, it is unavailable for traders in the United States, Canada, and the United Kingdom.

Advantages of Bybit

The following are the advantages of Bybit:

User-Friendly Interface: It has an intuitive and user-friendly interface accessible to traders of all levels. It also offers comprehensive trading tools and charts for technical analysis, enabling traders to make informed trading decisions.

Advanced Technology: Bybit claims it can handle up to 100,000 transactions per second, a significantly faster rate compared to its competitors. The platform does not experience server downtime, which is a common problem in many exchanges whenever a market change pushes people to trade simultaneously.

Up to 100x Leverage on Crypto: Bybit offers up to 100x leverage on cryptocurrencies. This means you can make a position on $10,000 from a $100 investment. Consequently, traders can profit from leveraged trading as the platform magnifies the potential trading rewards.

Security Measures: The exchange places a strong emphasis on security. Bybit has a track record of keeping its users’ investments safe from cyber threats. It employs industry-standard security protocols that protect traders’ assets.

High Liquidity: Bybit boasts high liquidity, ensuring you can enter and exit positions at the desired price points.

Binance

Binance, the largest cryptocurrency exchange, was founded in 2017 by Changpeng Zhao (or simply CZ), a Canadian programmer originally from China who specializes in developing solutions for high-frequency trading.

According to Coinmarketcap, at the beginning of 2023 on Binance:

trading volume is about $20 billion a day;

over 1,600 markets are available;

You can deposit over 40 fiat currencies.

There is a lot of confusion about licenses — KYC (know your customer), AML (anti-money laundering), and privacy policies — because cryptocurrencies are poorly regulated by states. Therefore, Binance is an exchange that has several structures, each of which is intended for a particular audience, country, and its applicable laws such as Binance Singapore, Binance.US, Binance Jersey, and others.

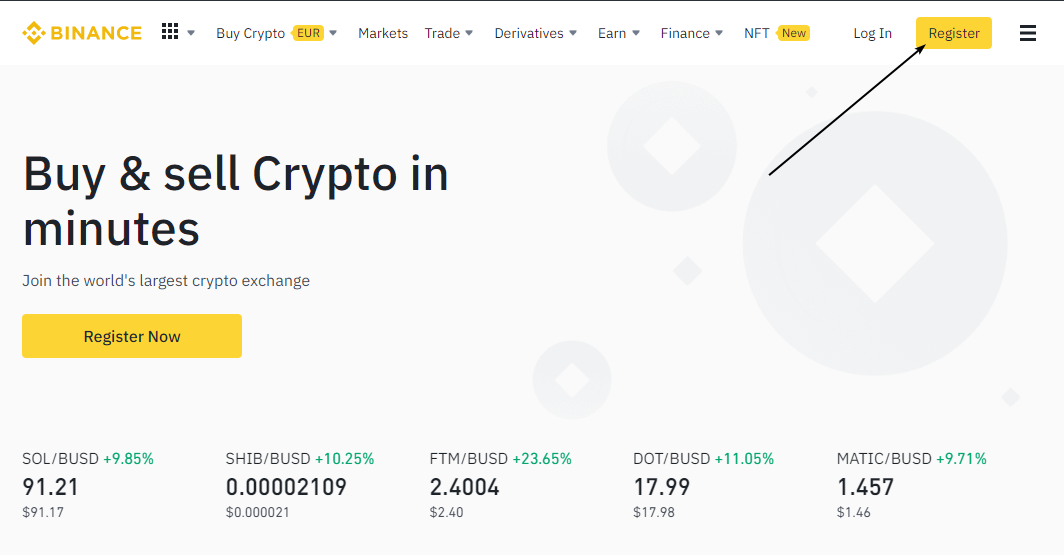

To open a Binance account, visit binance.com and click Register in the upper right corner.

Photo: Binance

The system will determine your location. Be ready; but to use all of the exchange features, you will need to go through the verification procedure.

The detailed procedure for opening an account on Binance is described step by step in this article

The advantages of the Binance exchange:

the largest exchange in terms of trading volume, the number of instruments available, and other characteristics;

licensed in various countries, including the United States;

high liquidity;

low commissions on the futures market;

the ability to connect for trading via API.

Binance has launched its own BNB token as well as its blockchain and the Binance Smart Chain, which has significantly expanded the functionality of the exchange, for example, creating new opportunities for passive income.

Coinbase

Coinbase is the first cryptocurrency exchange with shares listed on Nasdaq (COIN ticker), where shares of Apple, Google, Microsoft, and others are traded.

According to Coinmarketcap at the beginning of 2023 on Coinbase:

trading volume is over $5 billion a day;

over 400 markets are available;

you can replenish your account with USD, GBP, EUR.

Photo:

Photo: Coinbase

The advantages of the Coinbase exchange:

operating since 2023 and regulated in the United States;

integration with companies and services in the U.S;

accounts can be opened by citizens of 100 countries, excluding citizens of China and Russia;

over 70 million customers and over 2,500 employees at the beginning of 2023;

the ability to connect for trading via API.

opportunities for passive income.

Coinbase and Coinbase Pro are two related but different exchanges. The first one is better for novice traders. If you are wondering how to trade crypto with a $100, read the Traders Union article.

FAQs

How much money do I need to start trading cryptocurrencies?

Previously, cryptocurrency exchanges could set limits on the minimum deposit. But with the growth of competition, the main restrictions have been lifted. Nevertheless, you may meet a ban on transactions that are too small. This is how exchanges struggle to maintain free resources in their systems. For example, Binance blocks cryptocurrency futures buy/sell transactions under $5 to avoid "obstruction" of its capacity. The barrier is easy to overcome, even for a novice trader. You can buy 0.001 of a BTC/USDT contract. If Bitcoin falls in price by $1,000, you will lose only $1 + a small commission percentage. It's not much of a risk to try Bitcoin trading, don't you agree?

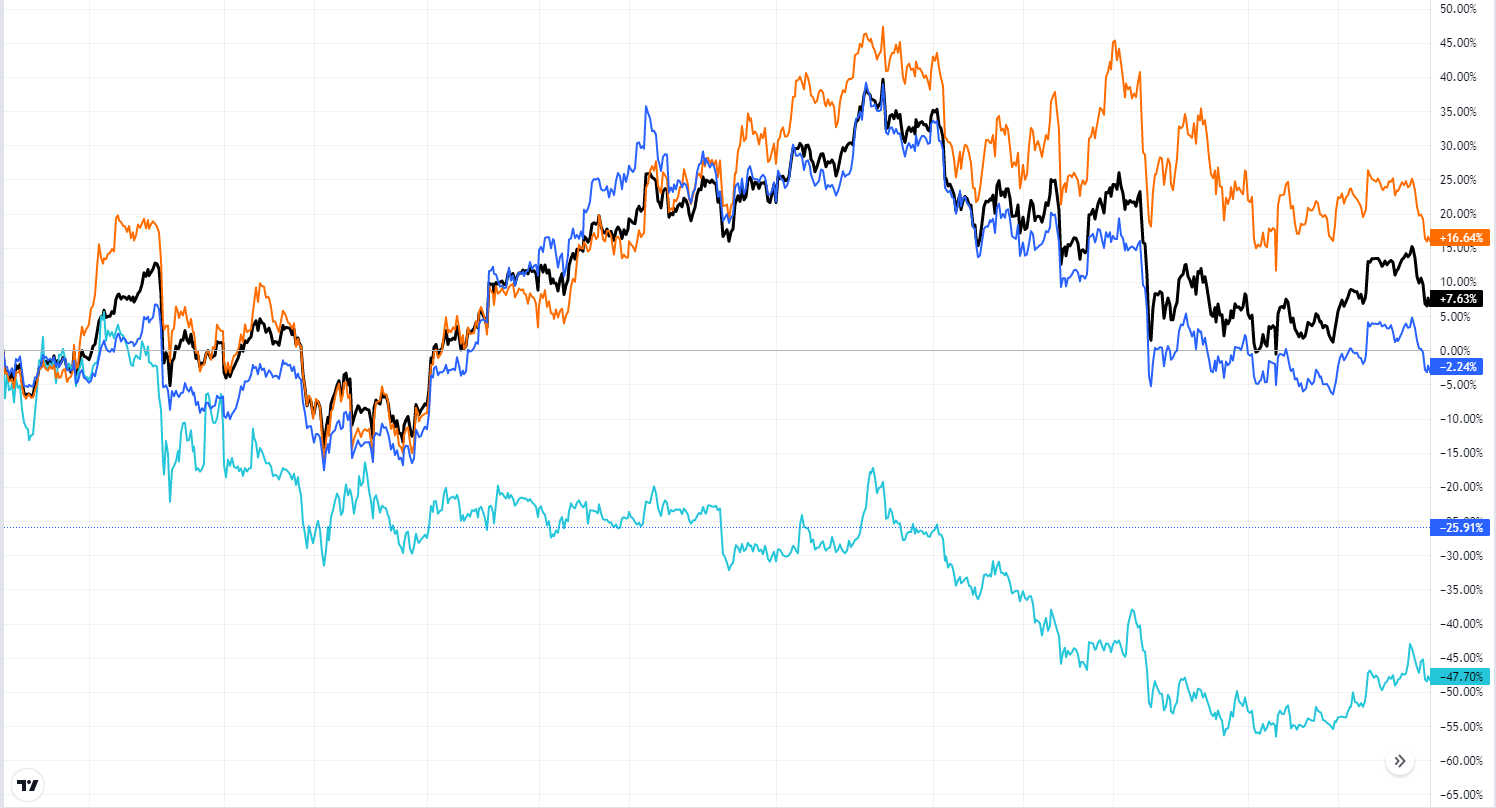

Which cryptocurrency is better for trading – Bitcoin, Ethereum, or other altcoin?

There cannot be a single correct answer to this question. Try this comparative analysis.

For example, you added the price dynamics of Bitcoin (blue line), Ethereum (orange line), Cardano (turquoise line), and the cryptocurrency index (black line) to the chart. Obviously, Cardano works weaker than other cryptocurrency assets. Therefore, it would be logical to look for another asset for investment. At the same time, you should not chase the leaders of the day, because quite often you will get into purchases at the top of the market when the formation of the stock market bubble is completed.

What indicators are better to use when trading cryptocurrencies?

You should use indicators that will help you to:

reduce losses,

hold the winning position longer,

determine the direction of the trend,

get an advantage in cryptocurrency trading.

There is no best indicator, or there wouldn't be so many of them. Try to avoid lagging indicators, or those that overdraw, or those whose signals suspiciously give frequent profits. No indicator is capable of giving a signal in the cryptocurrency market that is guaranteed to make a profit.

Pay attention to volume indicators, such as market profiles, deltas (the difference between ask and bid trades), on-chain metrics, order flow indicators, market participant position indicators, activity indicators in the order glass, and other tools that display the real trading process.

How to trade on pumps and dumps?

A good rule is to never gamble. Pumps and dumps have become common in cryptocurrency markets since such practices are carefully pursued in centralized markets. Pumps are sudden, unreasonable rises in the price of a cryptocurrency, while dumps are its subsequent inevitable falls.

Pumps can occur:

as a result of collusion. When a group of traders conspires to buy one little-known cryptocurrency at a time. Its price increases because its market is very illiquid. The price rise attracts new buyers. When the inflow of buyers is depleted, a crash occurs. As a rule, only those who bought the asset first and managed to sell it in time to late buyers win.

on the backdrop of hyped news. For example, creators created the Squid token, which quickly got popular on the background of the popularity of the "Squid Game" series, and then it collapsed dramatically. Or let’s remember the story of the Grimace token. It was created within minutes of McDonald's response to Elon Musk's tweeted suggestion. Grimace rose by 261,000% within a few hours, and then also decreased.

Team that worked on the article

Ivan is a financial expert and analyst specializing in Forex, crypto, and stock trading. He prefers conservative trading strategies with low and medium risks, as well as medium-term and long-term investments. He has been working with financial markets for 8 years. Ivan prepares text materials for novice traders. He specializes in reviews and assessment of brokers, analyzing their reliability, trading conditions, and features.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.