Fear And Greed Index in Crypto Trading

The cryptocurrency market is known for its high volatility and unpredictability. It can be influenced by various factors, such as news, events, regulations, hacks, innovations, and more. However, one of the most powerful drivers of the crypto market is human emotion.

Emotions can affect the decisions and behaviors of traders, investors, and enthusiasts, creating cycles of fear and greed that move the market in extreme ways.

How to use Fear and Greed Index in crypto trading:

-

Incorporate the Fear and Greed Index to guide trading decisions, considering market sentiment and avoiding emotional biases.

-

Implement emotional discipline in trading by avoiding impulsive decisions driven by fear or greed, as highlighted in the article on trading psychology.

-

Consider other market sentiment indexes like Glassnode's Fear and Greed Index, Sentiment Strength Indicator (SSI), and Crypto Volatility Index (CVIX) to gain a comprehensive understanding of market emotions.

-

Familiarize yourself with the factors contributing to the Fear and Greed Index, such as volatility, market momentum, social media, surveys, and Google trends.

Various market sentiment indexes

The fear and greed index is not the only market sentiment index that exists.

-

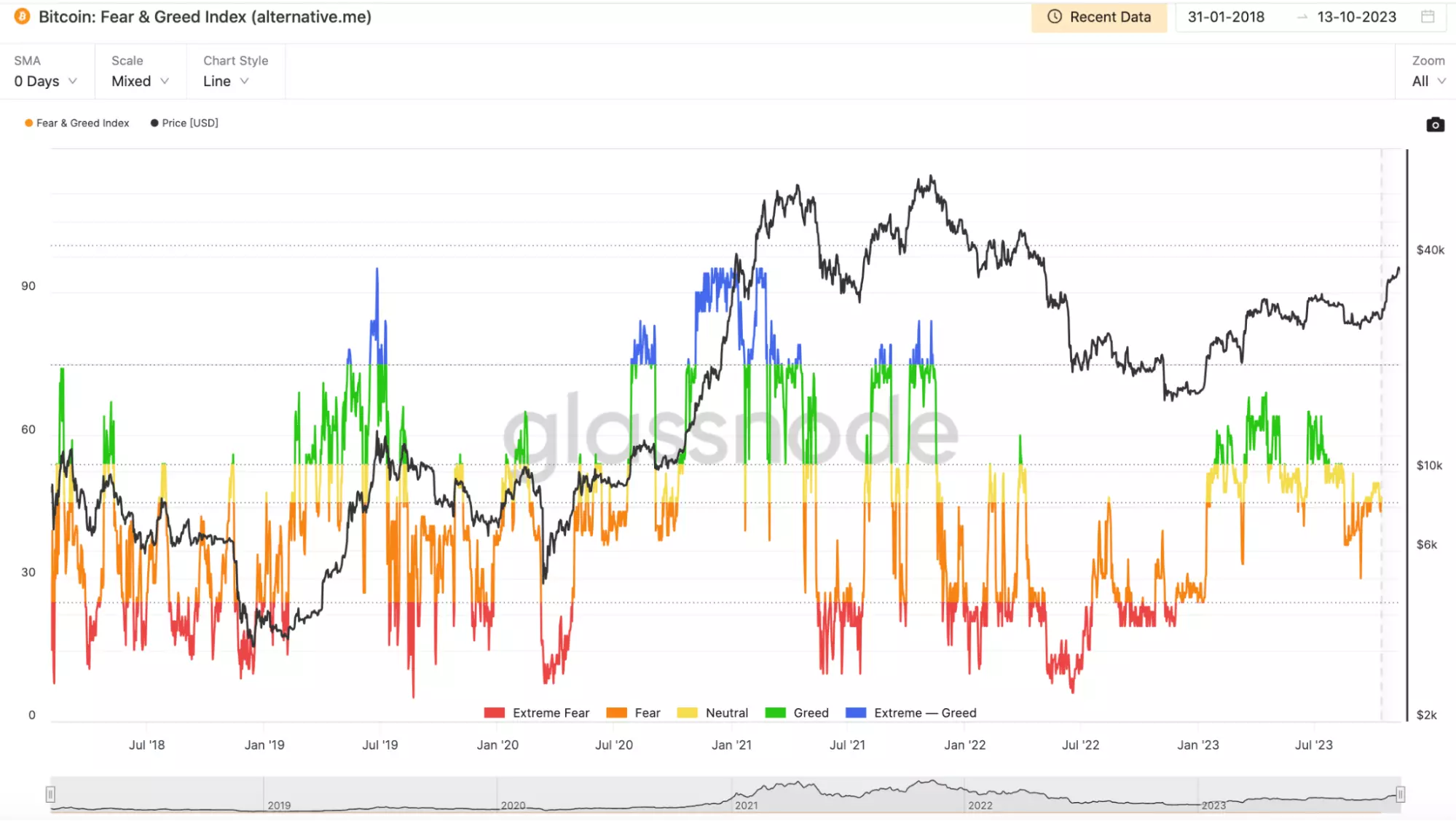

Glassnode's fear and greed index is a popular market sentiment index that is similar to the crypto fear and greed index.

-

The sentiment strength indicator (SSI) is a unique market sentiment index that tracks the strength of both positive and negative sentiment in the crypto market.

-

The crypto volatility index (CVIX) by BitMEX is a measure of the volatility of the crypto market.

Glassnode’s Fear and Greed Index (source:studio.glassnode.com)

It tracks the sentiment of crypto investors by analyzing a variety of on-chain data, such as transaction activity and network congestion. This index is updated daily and ranges from 0 (extreme fear) to 100 (extreme greed).

Sentiment Strength Indicator (SSI) (source:tlc.thinkorswim.com)

The SSI is calculated using a proprietary machine learning algorithm that analyzes the sentiment of social media posts, such as those from Twitter and Reddit. The algorithm considers the sentiment of the words used in the posts, the number of likes and retweets, and the reputation of the author of the post. The index is updated daily and ranges from -2 (strongly negative) to 2 (strongly positive).

CVIX is calculated using a logarithmic formula that analyzes the daily price changes of Bitcoin over the past 30 days. This formula takes into account the standard deviation of these price changes, effectively measuring the dispersion of Bitcoin's value over the specified period. The index is updated daily and ranges from 0 (low volatility) to 100 (high volatility).

Best cryptocurrency exchanges

Measuring market sentiment is important

Measuring market sentiment is important in trading for several reasons.

First, market sentiment analysis helps define future price movements and helps traders align their investments with these movements. By knowing the prevailing mood of the market, traders can anticipate the possible reactions of other traders and plan entry and exit points accordingly.

Market sentiment helps traders take control of their emotions and make a calculated decision instead of being vulnerable to market volatility. By avoiding panic selling or FOMO buying, traders can reduce their losses and increase their profits.

Market sentiment can help traders identify profitable opportunities that may not be obvious from technical or fundamental analysis. For example, traders can spot oversold or overbought conditions, contrarian signals, or emerging trends by analyzing the sentiment indicators.

Market sentiment can also help traders diversify their portfolio by exposing the trader to different crypto assets and sectors. By following social media and community analytics, traders can discover new projects, innovations, and developments that may have a positive impact on the crypto market.

Market sentiment can also help traders improve their trading skills by challenging their assumptions and biases. By comparing their own views with the views of other traders and experts, they can learn from their perspectives and experiences, and refine their own strategies.

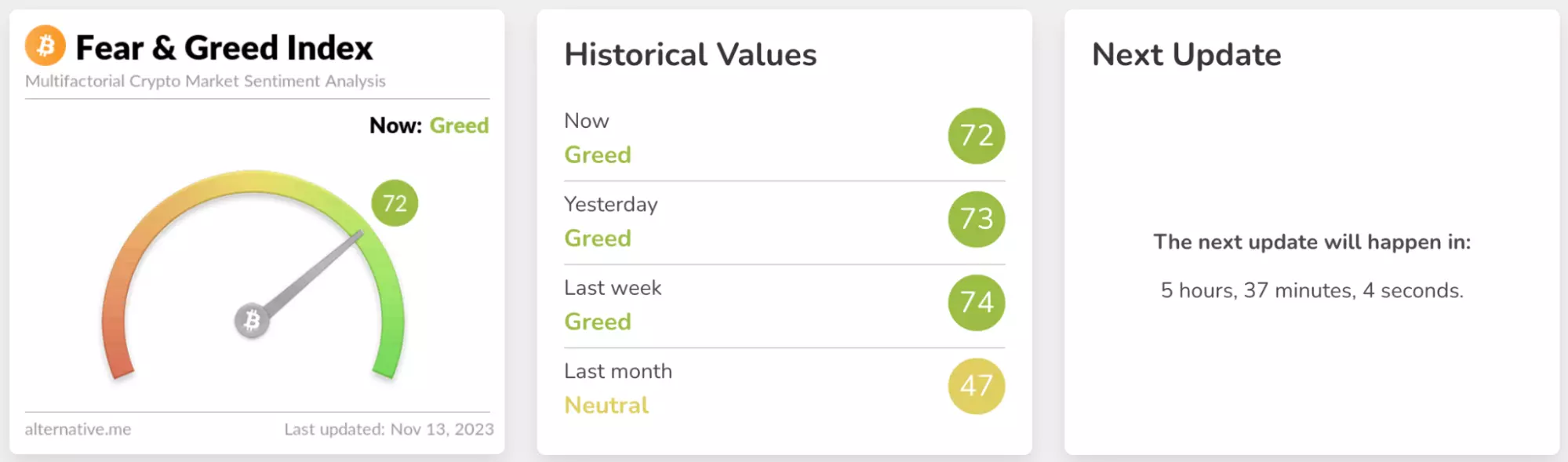

Maintaining the fear and greed index

The fear and greed index is maintained by a team of developers and enthusiasts who are passionate about crypto and blockchain. The team is based in Germany and operates under the name of Alternative.me.

The team states that their mission is to provide an alternative perspective on the crypto market and to help investors make better decisions.

The index is updated daily and can be accessed.

The Fear and Greed Index (source: alternative.me)

This index is based on the idea that fear and greed are the two main emotions that govern the crypto market. When this market is fearful, people tend to sell their crypto assets, causing the prices to drop.

When the market is greedy, people tend to buy more crypto assets, causing the prices to rise. These emotions can also create opportunities for savvy traders who can exploit the market inefficiencies and take advantage of the price swings.

Computing the fear and greed index

The fear and greed index is computed by using a weighted average of five different factors. Each factor has a different contribution to the index and is based on a different data source. These five factors are summarized below.

-

Volatility. This factor compares the current volatility and maximum drawdowns of Bitcoin with the average values of the last 30 and 90 days. A high volatility indicates a fearful market, while a low volatility indicates a greedy market. This factor contributes 25% to the index.

-

Market momentum/volume. This factor measures the current volume and market momentum of Bitcoin and compares them with the average values of the last 30 and 90 days. A high buying volume and positive market momentum indicate a greedy market, while a low buying volume and negative market momentum indicate a fearful market. This factor also contributes 25% to the index.

-

Social media. This factor analyzes the emotions and sentiments of crypto-related posts on X and Reddit. A high number of positive posts and interactions indicate a greedy market, while a high number of negative posts and interactions indicate a fearful market. This factor contributes 15% to the index.

-

Surveys. This factor collects the opinions of crypto investors and experts through online surveys. A high percentage of bullish responses indicate a greedy market, while a high percentage of bearish responses indicate a fearful market. This factor also contributes 15% to the index.

-

Google trends. This factor tracks the search volume of crypto-related keywords on Google. A high search volume indicates a high public interest and a greedy market, while a low search volume indicates a low public interest and a fearful market. This factor contributes 10% to the index.

Using the fear and greed index in crypto trading

The fear and greed index can help traders to identify the market cycles, trends, and reversals, and to adjust their trading strategies accordingly.

For example, the index can help traders to follow the classic rule of buying low and selling high. When the index is low, it indicates that the market is fearful and undervalued, which can be a good time to buy. When the index is high, it indicates that the market is greedy and overvalued, which can be a good time to sell.

The index can also help traders to adopt a contrarian approach and go against the crowd. When the index is low, it indicates that the market is pessimistic and bearish, which can be a good time to go long. When the index is high, it indicates that the market is optimistic and bullish, which can be a good time to go short.

The index can also help traders to manage their risk and exposure. When the index is low, it indicates that the market is volatile and risky, which can be a good time to reduce the position size and use stop-loss orders. When the index is high, it indicates that the market is stable and confident, which can be a good time to increase the position size and use take-profit orders.

The index can also help traders to follow the trend and ride the momentum. When the index is low, it indicates that the market is in a downtrend and facing resistance, which can be a good time to short the market or wait for a breakout. When the index is high, it indicates that the market is in an uptrend and facing support, which can be a good time to long the market or wait for a pullback.

The index can also help traders to exploit the market swings and capture the price movements. When the index is low, it indicates that the market is oversold and due for a correction, which can be a good time to buy the dip and sell the rally. When the index is high, it indicates that the market is overbought and due for a reversal, which can be a good time to sell the peak and buy the bottom.

Conclusion

The fear and greed index is a useful tool that can help crypto traders measure the sentiment of the crypto market and make better trading decisions. By using the index, traders can avoid emotional biases and follow rational strategies. The index can also help traders to adapt to different market conditions and scenarios, and to optimize their trading performance. However, the index is not a magic bullet that can guarantee success. Traders should always do their own research and analysis, and use the index as a guide, not a rule.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Index

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

-

3

Fear And Greed Index

The fear and greed index is a tool that measures the sentiment of the crypto market based on various indicators. It assigns a value between 0 and 100, where 0 represents extreme fear while 100 represents extreme greed. The index can help investors avoid emotional overreactions and make rational decisions.

-

4

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

5

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Team that worked on the article

Thomas Wettermann is an experienced writer and a contributor to the Traders Union website. Over the last 30 years, he has written posts, articles, tutorials, and publications on several different high tech, health, and financial technologies, including FinTech, Forex trading, cryptocurrencies, metaverses, blockchain, NFTs and more. He is also an active Discord and Crypto Twitter user and content producer.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).