Illustration Of The Cheat Sheet

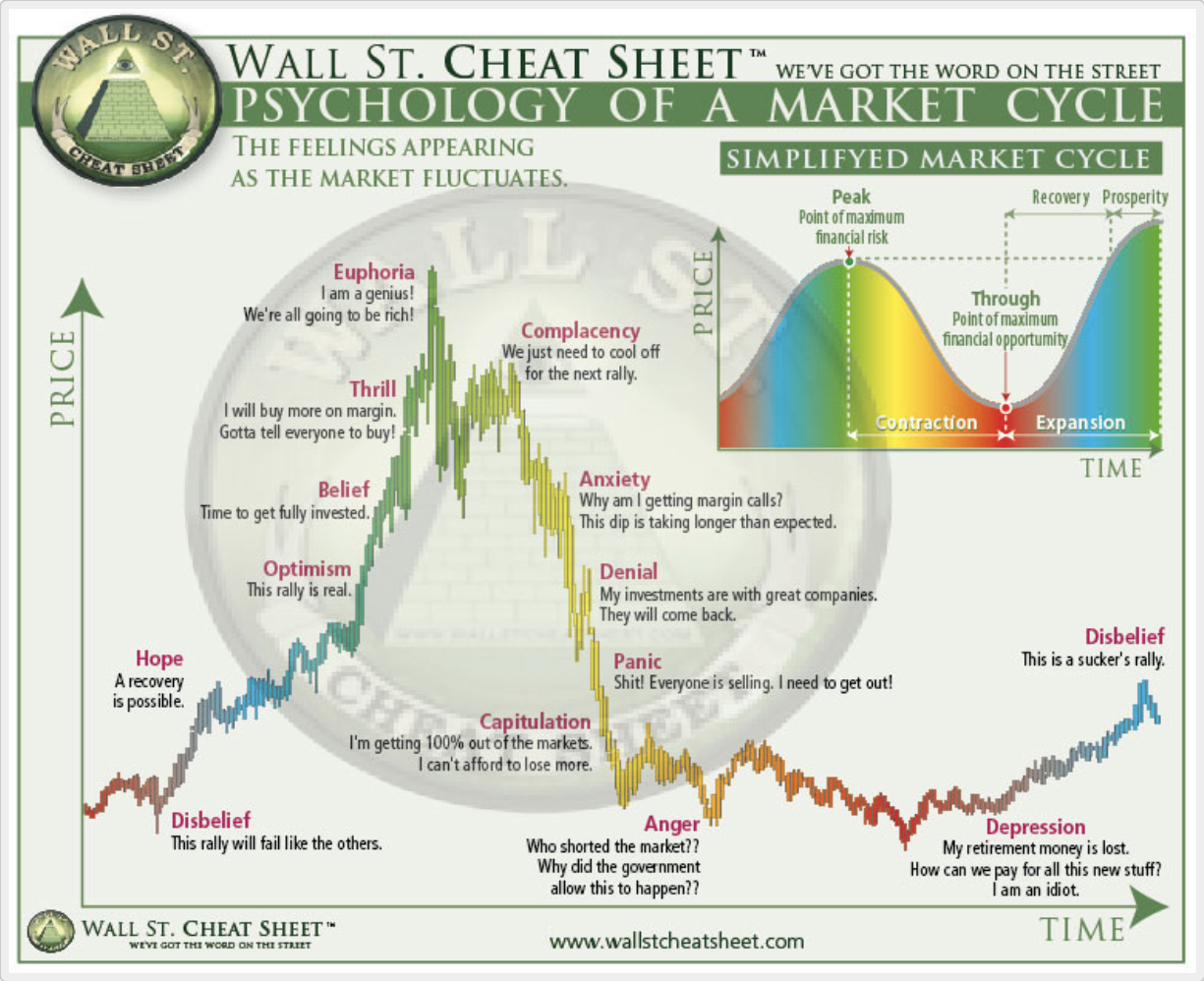

The Cheat Sheet is a simple but powerful diagram that illustrates the different emotions that investors experience during a typical market cycle. It consists of a line that represents the price movement of an asset, such as a stock, a currency, or a cryptocurrency. It also has a set of labels that identify the dominant sentiment at each stage of the cycle.

Have you ever wondered why the stock market moves in cycles? Or wondered why investors often act irrationally and emotionally? If so, you are not alone. Many researchers and experts have tried to explain the psychology behind market fluctuations and investor behavior.

One of the most popular and useful tools to do so is the Wall Street Cheat Sheet.

Description of emotional investing

Emotional investing is the tendency to make investment decisions based on feelings rather than facts. As most traders recognize, emotions can cloud judgments and lead to buying or selling at the wrong time, resulting in losses or missed opportunities. Emotions can also cause us to overreact to market news and events, creating volatility and uncertainty. Emotional investing is influenced by many factors, such as personal biases, herd mentality, greed, fear, optimism, and pessimism.

The Cheat Sheet helps us understand how emotional investing affects market cycles and investor behavior. It shows that emotions are not static, but dynamic and cyclical. They change as the market conditions change, creating feedback loops that enhance or diminish price movements. The Cheat Sheet also shows that emotions are not uniform, but are diverse and sometimes conflicting. Different investors may have different emotions at the same time, creating market divergence and convergence.

The structure of the Wall Street Cheat Sheet

The Cheat Sheet is structured based on two main concepts in analyzing markets: trend and sentiment. Trend is the general direction of the market or an asset over time. It can be upward (bullish), downward (bearish), or sideways (neutral). Sentiment is the collective attitude of investors towards the market or an asset. Sentiment can be positive (optimistic), negative (pessimistic), or mixed (uncertain).

The Cheat Sheet shows how trends and sentiment interact and influence one another during a market cycle. It also shows how trend and sentiment affect investor behavior and decision-making. For example, when the trend is upward and the sentiment is positive, investors tend to buy more and push prices higher. When the trend is downward and the sentiment is negative, investors tend to sell more and push prices lower.

The Cheat Sheet also shows how trends and sentiment change over time due to various factors. These factors may include things like supply and demand, news and events, technical analysis, and fundamental analysis. These factors can create triggers or catalysts that cause trend reversals or sentiment shifts. For example, when supply exceeds demand, prices may fall and trigger a bearish trend reversal. Alternatively, when news or events create positive expectations, sentiment may rise and trigger a bullish sentiment shift.

Best stock brokers

The Cheat Sheet various stages

Generally speaking, the Cheat Sheet depicts four main phases of a market cycle: accumulation, markup, distribution, and markdown. Each phase corresponds to a different level of investor confidence and activity. Let us take a closer look at each phase and the corresponding emotions that help drive each of these phases.

Wall Street Cheat Sheet

The Cheat Sheet divides each phase of a market cycle into several stages based on the dominant emotion that investors experience during each particular stage. These investor stages are summarized below.

-

Disbelief. This is the first stage of the accumulation phase. This is where prices start to rise after a prolonged downtrend. Most investors are still skeptical and doubtful about the new trend, as they have been burned by previous losses. These investors think that the rise is temporary and will soon reverse

-

Hope. This is the second stage of the accumulation phase, where prices continue to rise and break previous highs. Some investors start to become hopeful and interested in the new trend. That is, they see signs of recovery and growth. They think that maybe things are getting better

-

Optimism. This is the first stage of the markup phase, where prices surge higher rapidly. Many investors become optimistic and confident about the new trend, as they see strong momentum and performance. They think that things are going well

-

Belief. This is the second stage of the markup phase, where prices consolidate after a sharp rise. Most investors believe in the new trend firmly, as they see solid support and stability. They think that things will continue to go well

-

Thrill. This is the third stage of the markup phase, where prices break out of consolidation and resume their upward movement. Some investors feel thrilled and excited about the new trend, as they see generous profits and opportunities. They think that things are going great

-

Euphoria. This is the fourth and final stage of the markup phase, where prices reach their peak and become extremely overvalued. A few investors feel euphoric and ecstatic about the new trend, as they see strong returns and potential. They think that things are perfect and nothing can go wrong

-

Complacency. This is the first stage of the distribution phase, where prices start to fall after reaching their peak. Most investors are still complacent and satisfied with the new trend, as they have made a lot of money and expect to make a lot more. They think that the fall is temporary and will soon recover

-

Anxiety. This is the second stage of the distribution phase, where prices continue to fall and surpass previous lows. Some investors start to feel anxious and nervous about the new trend, as they see signs of weakness and decline. They think that maybe things are getting worse

-

Denial. This is the third stage of the distribution phase, where prices plunge lower rapidly. Many investors are in denial and refuse to accept the new trend, as they have lost a lot of money and hope. They think that things are not that bad and will soon improve

-

Panic. This is the first stage of the markdown phase, where prices crash lower violently. Most investors feel panic and fear about the new trend, as they see massive losses and risks. They think that things are terrible and need to get out

-

Anger. This is the second stage of the markdown phase, where prices consolidate after a sharp fall. Some investors feel anger and resentment about the new trend, as they have been betrayed by previous expectations and promises. They think that things are unfair and someone is to blame

-

Depression. This is the third stage of the markdown phase, where prices break out of consolidation and resume their downward movement. Many investors feel depression and despair about the new trend, as they have lost everything and have no future. They think that things are hopeless and nothing can help

-

Disbelief. This is the fourth and final stage of the markdown phase, where prices reach their bottom and become extremely undervalued. A few investors feel disbelief and shock about the new trend, as they have witnessed a complete reversal and collapse. They think that things are impossible and nothing makes sense

Using the Wall Street Cheat Sheet to enhance trades

A trader can use the Cheat Sheet to gauge the market sentiment and align their trading decisions with the prevailing trend.

For example, during the disbelief phase, when most traders are skeptical and pessimistic about the new trend, a trader can look for signs of accumulation and breakout to enter early and capture the potential upside.

During the hope phase, when traders start to become hopeful and interested in the market, a trader can add to their position and ride the momentum. And during the optimism phase, when traders become more confident and optimistic about the market, a trader can monitor the price action and indicators for signs of divergence and exhaustion.

And then finally, during the euphoria phase, when traders become overly excited and greedy about the market, a trader can start to take profits and reduce their exposure. Alternatively, traders may even reverse their position and anticipate a trend reversal. By using the Wall Street Cheat Sheet, a trader can avoid emotional biases and trade more rationally and profitably.

Conclusion

The Cheat Sheet is a powerful tool that can help traders understand investor behavior and market cycles. It can also help to identify the current phase and stage of a market cycle, as well as the dominant emotion that drives the present cycle. It can also help traders avoid emotional investing and make rational decisions based on facts rather than feelings. By using the Cheat Sheet, traders can learn from their mistakes, improve their performance, and achieve their targeted trading goals.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

3

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

4

Options trading

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

-

5

SIPC

SIPC is a nonprofit corporation created by an act of Congress to protect the clients of brokerage firms that are forced into bankruptcy.

Team that worked on the article

Thomas Wettermann is an experienced writer and a contributor to the Traders Union website. Over the last 30 years, he has written posts, articles, tutorials, and publications on several different high tech, health, and financial technologies, including FinTech, Forex trading, cryptocurrencies, metaverses, blockchain, NFTs and more. He is also an active Discord and Crypto Twitter user and content producer.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).