SIPC | U.S. Compensation Fund

SIPC is a non-government, non-profit organization that acts as an insurance agent when a broker fails financially. This corporation compensates investors for their losses, including non-residents of the U.S.

The key element of any country’s financial control system is the regulator – a government or non-government organization that supervises all market participants. Its task is to ensure that brokers, investment companies, and other participants operate transparently, observe the law, and do not violate client rights and interests. The SIPC is neither a regulator of broker-dealers nor a government agency. The main purpose of the SIPC is to expedite the recovery and return of a client’s assets and cash during the liquidation of a bankrupt or otherwise failed investment entity. Regulatory functions can be carried out by the central bank or a separate agency that is accountable to executive authorities.

For a broker, holding a license means:

-

Necessity to meet the regulator’s requirements. In some cases, a license restricts the rendering of specific services. For example, CFD trading is limited in the USA and leverage is limited in Europe. On the other hand, the broker can get help from the regulator and advertise its services without restrictions.

-

Authority in the eyes of clients. Traders understand that licensed brokers really exist, are inspected, and are unlikely to deceive its clients.

To protect investor interests, some countries have independent insurance funds – entities that are funded from their members’ contributions. Their function is to compensate for investor money in case of a broker’s bankruptcy. One such entity is SIPC, the U.S. compensation fund.

Description and functions of SIPC

SIPC is a non-government, non-profit organization that acts as an insurance agent when a broker fails financially. This corporation compensates investors for their losses, including non-residents of the U.S.

SIPC’s sole mission is to resolve investors’ issues regarding compensation for money. This corporation has two mechanisms:

-

Recovery of investments in the same form they were made. If an investor bought securities prior to a broker’s bankruptcy, he will receive his funds back in securities.

-

Transfer of accounts to another managing company. Registration with SIPC is mandatory when obtaining a license from the SEC (the U.S. Securities and Exchange Commission). SEC-licensed entities must follow the account segregation rule, i.e., separate their corporate accounts from their clients’ accounts.

Client accounts can be transferred to another company if SIPC does not have sufficient funds to pay out compensation in full. This option is also favorable. The recovery of money through legal action and the assignment of a new managing company may take 6 months or longer, while the transfer takes up to 1 month. By consenting to transfer their accounts to another broker, traders do not freeze their money.

If a broker breaks the account segregation rule and uses client money for its operational activities (in which case the transfer is pointless), SIPC launches the compensation procedure. Its duration depends on the payout amount and the number of harmed investors and can take several years.

To become an SIPC member, a broker has to:

-

Meet the SEC requirements;

-

Be solvent.

SIPC insurance covers funds in client accounts and market assets bought by investors. Registration of securities with the SEC is a mandatory precondition. SIPC does not protect stocks, bonds, or ETFs bought in over-the-counter markets if they are not registered with the SEC.

Official website and available information

Most of the SIPC website’s content is risk minimization rules, advice on avoiding brokerage fraud, frequently asked questions about claims, etc.

Overview of the website:

-

Upper main menu.

-

Information part.

-

Footer.

SIPC Review — Section of the website

SIPC Review — Section of the website

SIPC Review — Section of the website

Main menu structure:

-

About SIPC. Mission, statute and rules, annual report, and more.

-

Cases & Claims. How to file a claim and how soon it will be considered. All open cases and claim FAQs.

-

For Investors. Fraud alerts, protection for investors with multiple accounts, investor FAQs, etc.

-

For Member Firms. Member filing requirements. Guidelines and tools for SIPC member brokerage firms.

-

News & Media. News releases, speeches and testimony, annual reports, etc.

-

Contact Us.

All information on the SIPC website is interesting for investors:

-

For beginner investors – advice on how to protect yourself against fraud and information about possible bubbles and pyramids;

-

For potential investors – a list of SIPC members;

-

For actual investors – a list of investigated cases and SIPC alerts;

-

For investors of failed brokers – claim filing process and tems of consideration.

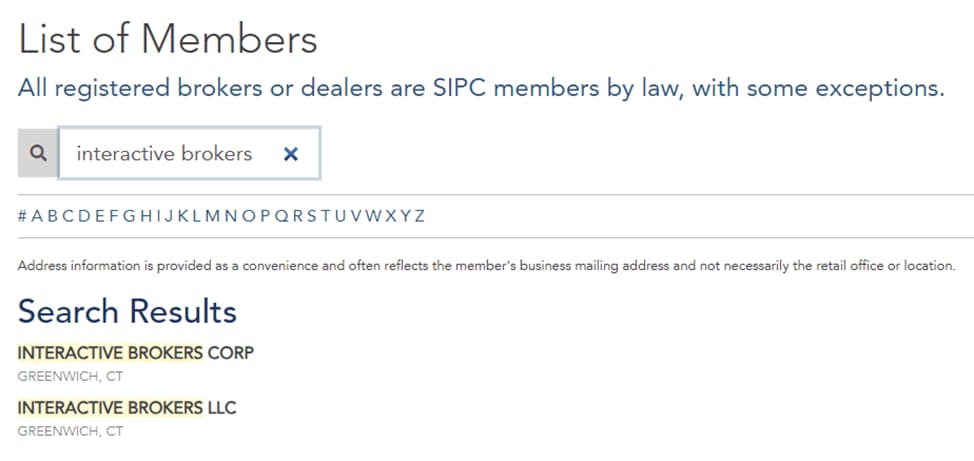

How to confirm that a broker is an SIPC member

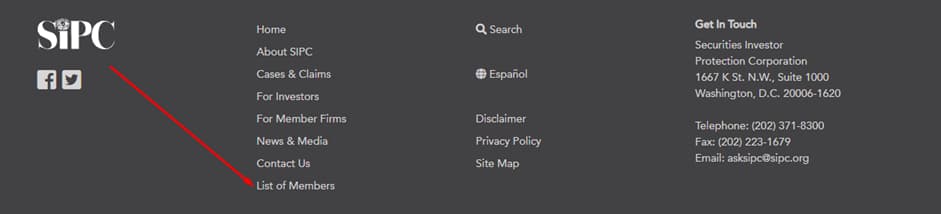

SIPC membership is a mandatory condition to obtain an SEC license. To check if a broker is an SIPC member, you need to:

-

1

Make sure that the broker is a licensed U.S. company. In most cases, this information is in the footer of the broker’s website.

-

2

In the main menu or the footer of the SIPC website, go to “List of Members”.

-

3

Enter the broker’s (or its U.S. branch office’s) legal name in the search box.

SIPC Review — Section of the website

SIPC Review — Section of the website

SIPC Review — Section of the website

SIPC membership is the only information about brokers provided in this section of this corporation’s website.

SIPC’s basic requirements for brokers

Basic requirements to obtain a license:

-

Obtain an SEC license;

-

Make annual contributions to the insurance fund.

Fixed annual contributions from SIPC members are deposited into the SIPC Fund. If the balance becomes lower than $5 billion, the members compensate for the difference at the expense of their revenues (not more than 0.01%). SIPC can get additional funds from external sources, such as U.S. state bonds and a $2.5 billion line of credit with the U.S. Treasury.

SIPC membership | Pros and cons

For an SEC-licensed broker, SIPC membership is mandatory and means additional expenses in the form of contributions to the insurance fund. For a trader, SIPC offers confidence that, in a case of force majeure, he will be able to get at least part of the invested money back. And although regulators are supposed to prevent sudden failures of their licensees, such events happen. Remember the mass bankruptcies in 2008.

Advantages of trading with an SIPC member broker:

-

For beginner investors – advice on how to protect yourself against fraud and information about possible bubbles and pyramids;

The compensation amount is up to $500,000 per client, but not more than $250,000 in cash. The other $250,000 can be returned in securities if the client invested in them.

Disadvantages of trading with an SIPC member broker:

-

1

Complicated paperwork. The trader has to control the following aspects:

- Is the broker an SIPC member? If it isn’t anymore, the trader has almost no chance of getting compensation.

- Is the broker bankrupt? The broker may not be bankrupt but withhold a refund. SIPC does not consider such complaints, referring investors to regulators.

-

2

Compensation may be incomplete. The process becomes more complicated if the broker’s books are unavailable or the broker has violated the law or regulators’ requirements when keeping accounts. In this event, the trader gets all the securities that are registered in his name. Currency and other securities can be allocated proportionally to the investor’s share in profits.

-

3

If securities fall in price by the time compensation is ready to be paid out, traders will incur losses.

SIPC steps in only if the broker fails financially. The paperwork is so complicated that private traders with relatively small capital find it easier to notice brokers’ problems themselves and diversify risks.

SIPC’s jurisdiction

SIPC restores lost assets for non-residents of the U.S. as well. The main requirements are that the broker must have an office in the USA and the securities must be registered with the SEC.

Getting compensation

-

1

Complicated paperwork. The trader has to control the following aspects:

-

2

Complicated paperwork. The trader has to control the following aspects:

- SIPC refers the matter to a court, which appoints a trustee (managing company) to deal with investors.

- The trustee sends investors guidelines on how to receive compensation.

- Investors apply for compensation, attaching the necessary documents: the agreement with the broker, proof of deposit and transactions, conversations with the broker, etc.

- The trustee considers the claims and determines the compensation amounts. Investors receive compensation in money or securities.

- If an investor is not satisfied with the amount of compensation, he has 1 month to appeal to the court.

Investors have to file all documents within 6 months of the broker’s bankruptcy. The sooner the better. The term can be reduced to 30 days by court order.

SIPC member brokers | How to check on a broker

This section provides information about the brokers that hold an SEC license and are active SIPC members.

-

Don’t have time to monitor regulators’ websites every day?

-

Want to learn in time about the commencement of investigations in relation to brokers?

-

Need current information on all brokers’ licenses and memberships?

Every month, Traders Union analyzes information on regulators’ websites and updates it on its website. There, you will find answers to any questions about brokers’ licenses and memberships.

Reviews of SIPC by complaining investors and traders

This section presents opinions of private traders and analysts that complement the publication by elaborating on the essence and principles of SIPC’s work.

Sergey, trader | Barnaul, Russia

This review lacks one important aspect. SIPC launches the compensation process when the broker officially declares bankruptcy. When exactly this declaration happens is another matter, it’s a separate procedure. However, compensation is only possible if the broker is an SIPC member. Then a trader has 6 months to file a claim.

But companies don’t go bankrupt in 1 day. Understanding that the end is approaching, the broker can withdraw from SIPC in time. In this case, this corporation can use its investor protection program that is valid within 180 days of the moment the broker quits SIPC.

And here I have two questions:

-

If the broker quits SIPC before going bankrupt, then how does the compensation mechanism work? And what happens if more than 180 days pass between these two events?

-

How can traders monitor all this? Should they look through the registers of SIPC and the SEC and court registers every day?

Non-residents who don’t know American laws will have difficulties getting compensation.

Yevgeny, analyst, Moscow

There is one thing about money recovery. Bankruptcy doesn’t happen instantly:

-

First, the broker stops paying out money on various pretexts, stalling for time. The trader spends 1-2 weeks on pointless conversations with the support service and then starts preparing complaints to regulators.

-

The U.S. is a bureaucracy. You have to file complaints with the SEC, Finra, and the authorities of the state in which the broker is registered. Next, you’ve got investigations, requests to send more documents, refusals, etc. In the meantime, the broker becomes bankrupt and a few months may pass before its failure becomes official.

-

SIPC launches the process of compensation through a court only after the broker is declared insolvent. In theory, SIPC says that the whole procedure takes not more than 3 months on the condition that all issues between the broker and the investor are settled. But in fact, compensation can take years and, this whole time, the money will be frozen.

Another problem is that SIPC does not aim to restore the equivalent amount. If you buy 100 Facebook shares and the broker fails, you will get your 100 Facebook shares back. And if they fall in value by the time this miracle happens, you will incur the loss. On the other hand, it’s good if you can recover at least something.

Mikhail, analyst | Blagoveshchensk, Russia

Here’s something to think about. I found this on the internet.

-

In 2019, SIPC had about $3.2 billion in its compensation fund. Even if the amount is $5 billion now, with up to $500,000 protection per client (and “client” can imply an account managed by a full-fledged investment fund), this money will cover payouts for only 10,000 account holders.

-

SIPC pays out compensation only if the broker is officially bankrupt. But regulators are supposed to notice the upcoming failure at an early stage and alert investors in time so that no one needs compensation when the failure actually takes place.

- SIPC refers the matter to a court, which appoints a trustee (managing company) to deal with investors.

- The trustee sends investors guidelines on how to receive compensation.

- Investors apply for compensation, attaching the necessary documents: the agreement with the broker, proof of deposit and transactions, conversations with the broker, etc.

- The trustee considers the claims and determines the compensation amounts. Investors receive compensation in money or securities.

- If an investor is not satisfied with the amount of compensation, he has 1 month to appeal to the court.

-

In 45 years, SIPC has compensated for (or transferred) accounts of 773,000 clients. This is by far not the largest number, considering that hundreds of U.S. brokers have tens of thousands of active traders.

The year 2008 was the hardest for SIPC. The crisis harmed all financial companies at once and SIPC simply didn’t have enough funds for all compensations. That is why, instead of paying out money, this corporation transferred the segregated client accounts to other companies. In particular, this was done with the failed investment bank Lehman Brothers. According to the SIPC website, at that time, 135,000 client accounts amounting to $140 billion were transferred to two other brokers.

Bernard Madoff’s pyramid was a similar story. Although his fund was registered with SIPC, it turned out to be a pyramid from which there was nothing to transfer. SIPC couldn’t restore all funds. Payouts still continue. So, to some extent, SIPC protects investors against pyramids, but quick payouts within 6 months are not made. And inflation is not taken into account either.

Vyacheslav, trader | Zaporizhzhia, Ukraine

SIPC is a unique entity. It is notable for its independence, which I see as an advantage compared to similar organizations. For example:

-

Some European regulators have their own insurance funds, but they provide up to 15,000-20,000 USD/EUR coverage. For an average investor, this is not much. For a manager, it’s nothing. These insurance funds are mere divisions of regulators, which means conflicts of interest are possible, as it is the regulator that makes decisions about compensation. And since such regulators as CySEC (the Cyprus Securities and Exchange Commission, whose Investor Compensation Fund is essentially a pocket fund) seek to increase the volume of transactions in their countries and don’t want to pay compensation, they can easily take the broker’s side.

-

The Financial Commission. Its compensation fund guarantees up to €20,000 coverage per account. This unique organization has branch offices in Europe and Asia. Among its founders are СЕОs of AutoChartist and Forex Magnates. Alas, the Commission cannot operate in the USA.

For those who want to protect their investments on NYSE or Nasdaq exchanges, SIPC is the only option.

Kiril, novice trader, St. Petersburg

How do I check if securities are registered with the SEC? Suppose a broker offers me to buy shares of a crypto ETF (hypothetically, when they are fully launched). How do I make sure that this ETF is not a pyramid? Check it on the SEC website? How? By the issuer’s name? But there can be several issuances.

Expert’s assessment

SIPC is a U.S. compensation fund with which all SEC-licensed brokers must register. This corporation is not a financial regulator. It does not consider disputes between brokers and traders, does not protect their rights, and does not audit brokers. SIPC’s mission is to restore investors’ assets in the event of a broker’s failure.

What you need to know about SIPC:

-

SIPC only protects investments in stocks and debt securities. Investments in options, futures, and Forex are not protected.

-

Non-residents of the U.S. are also eligible for compensation on the condition that their broker has an SEC license and is an SIPC member.

SIPC works exclusively to restore money and only if the broker has been officially declared bankrupt.

Conclusion

SIPC is an analog of an insurance fund that can help recover at least part of lost money when a broker fails. Help can consist of actual compensation or the transfer of segregated accounts to other managing companies.

About the author of this review

Oleg Tkachenko, author and analyst at TU

Oleg Tkachenko has been TU’s financial analyst and economic observer since 2016. During this time, he has prepared more than 100 reviews of financial companies and analytic articles on technical and fundamental analysis, as well as developed over 10 trading systems. Oleg’s motto is to help everyone come all the way from a novice trader to a professional.

FAQs

What is SIPC?

SIPC is a non-government U.S. corporation that specializes in recovering investors’ assets when a broker fails financially. The insurance fund is formed from SIPC members’ contributions, investments in state bonds, and a line of credit with the U.S. Treasury. If client accounts remain intact after the broker’s failure, SIPC transfers them to another broker. If the account segregation principle was broken, SIPC launches the compensation procedure. Investments can be returned in the form of securities or money.

What do I get from trading with SIPC member brokers?

-

For brokers, it is traders’ trust, to provide help from state authorities, and improve ratings.

-

For traders, it is the confidence that a broker is legitimate and not a financial pyramid; protection by the regulator; and compensation of deposits in case of a broker’s bankruptcy. Conditions apply.

SIPC is additional insurance for traders. However, this corporation does not protect from mistaken investing or devaluation of assets.

How to check if a broker is an SIPC member?

There are two options:

-

For brokers, it is traders’ trust, to provide help from state authorities, and improve ratings.

-

For traders, it is the confidence that a broker is legitimate and not a financial pyramid; protection by the regulator; and compensation of deposits in case of a broker’s bankruptcy. Conditions apply.

Information about broker’s licenses/memberships and alerts from regulators are updated on TU’s website every month.

How to apply for compensation?

-

After the broker is declared bankrupt, notify this corporation in a free form that you hold an account with the broker. SIPC sends all investors a step-by-step guide and a claim form.

-

Contact TU’s legal service which will help you file the claim and confirm your investments.

Registration with Traders Union and its legal assistance are free.

Glossary for novice traders

-

1

SIPC

SIPC is a nonprofit corporation created by an act of Congress to protect the clients of brokerage firms that are forced into bankruptcy.

-

2

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

3

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

4

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

5

CFD

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).