How to Buy Stocks Online In 6 Steps

To buy stock online follow such steps:

Select an online stock broker

Sign up for an account

Deposit funds into your brokerage account

Choose the stocks you want to buy

Place your orders to buy stocks

Monitor your investments

In this article, Traders Union will guide beginners through the process of buying stocks online. Before you start investing in stocks, it's important to choose a well-regulated broker that accepts clients from your country. Once you have the right broker, you can proceed with the following steps to start your stock market journey.

Opening a brokerage account typically takes 10-20 minutes, but some online stock brokers may require account validation, which could take up to one or two working days. During this process, the broker verifies the provided information to ensure compliance with regulatory requirements and security measures.

How to Buy Stocks Online

How to buy shares online

1 Choose an online stock broker

To begin investing in stocks, you need to select an online stock broker. Look for a broker that offers a user-friendly interface, low fees, good customer service, and a wide range of investment options. It is essential to ensure that the broker is regulated and operates within your country's jurisdiction.

For beginners, brokerages with extra benefits such as social trading can be invaluable as they offer opportunities to learn from experienced traders, as well as study best strategies. Additionally, access to comprehensive educational resources, fractional shares trading, and a diverse range of ETF investment options can further empower beginners in making well-informed and diversified investment decisions.

Compare some of the best beginner-friendly stock brokers.

2 Sign up for an account

Once you have chosen a suitable broker, you'll need to sign up for an account. The registration process typically involves providing your personal information, which may include:

Your full name

Address and contact details

Date of birth

Social Security number (or equivalent)

Proof of identification (such as a driver's license or passport)

Employment and material status information is optional

Keep in mind that some brokers might require mandatory verification of your identity and documents.

3 Make your first deposit

To pay for the stocks you want to purchase, you'll need to deposit funds into your brokerage account. Most brokerages offer various funding options, such as bank transfers, credit/debit cards, or wire transfers.

Bank Transfers: Usually free or low-cost, but may take a few days to clear

Credit/Debit Cards: Instant, but may involve additional fees

Wire Transfers: Instant, but may involve additional fees

How much money should I deposit for the first time? TU experts recommend starting with a small amount to understand the stock market and gain practical experience.

4 Choose the stocks you want to buy

With your account funded, it's time to choose the stocks you want to buy. You can use your brokerage's research tools or other financial websites to gather information about potential investments. Take into consideration factors like your budget, risk tolerance, and long-term investment goals when making your decisions.

If you are inclined towards long-term investing, it is essential to focus on conservative trading strategies, prioritize portfolio diversification, and thoroughly understand the businesses of the companies you invest in. On the other hand, if you prefer active trading, consider learning technical analysis or other techniques to make informed decisions and navigate the dynamic nature of the stock market effectively.

5 Place your orders to buy stocks

There are different types of orders you should understand:

Market order executes the buy order at the current market price. It prioritizes execution speed over price, ensuring immediate execution

Market order use case: Investors who want to enter or exit a position quickly, especially in highly liquid stocks.

Limit order sets a specific price at which the investor is willing to buy or sell a stock. It allows investors to control the price at which the trade will execute, offering price protection

Limit order use case: Traders who want to buy or sell at a specific price and are willing to wait for the market to reach that price.

Stop order (stop-loss order) executes the order when the stock reaches a specified price. Stop orders are used to limit potential losses by triggering a sale if the stock's price moves unfavorably

Stop order use case: Traders who want to protect their investments from significant price declines.

6 Monitor your investments

The stock market can be volatile, and the value of your holdings may fluctuate. Stay informed about the companies you've invested in and keep an eye on market trends. Remember that investing is a long-term endeavor, and it's essential to review and adjust your portfolio periodically based on your financial goals and risk tolerance.

By following these steps and staying informed, you can start your journey into the world of online stock investing. Remember that investing involves risks, and it's crucial to do thorough research and seek professional advice if needed. Happy investing!

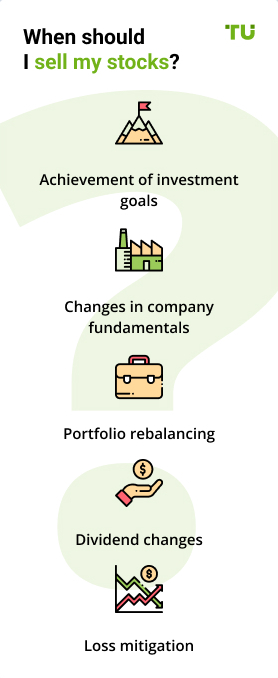

When should I sell my stocks?

Knowing when to sell your stocks is crucial for successful investing. It's essential to have a clear strategy and follow a disciplined approach when deciding to sell stocks. Emotional decision-making can lead to impulsive actions that may not align with your long-term investment goals. Regularly reviewing your investment portfolio, staying informed about market trends, and seeking professional advice can help you make informed decisions about when to sell your stocks.

Here are the main reasons to consider selling your stocks:

Achievement of investment goals. If your investment has reached its target price or has met your desired return, it might be a good time to sell and lock in profits to achieve your investment objectives

Changes in company fundamentals. Keep a close eye on the company's financial health, management changes, or shifts in the industry. If there are negative developments that affect the company's long-term prospects, it may be wise to sell your stocks

Portfolio rebalancing. As your investment portfolio evolves over time, some assets may outperform while others underperform. Selling stocks that have become overweight in your portfolio and reallocating funds to rebalance your investments can help manage risk and align with your financial goals

Dividend changes. If you rely on dividend income, significant changes in a company's dividend policy, such as a reduction or suspension of dividends, might prompt you to reevaluate holding the stock. Life events or financial needs

Loss mitigation. If a stock has experienced significant losses and shows no signs of recovery, selling may be a prudent choice to cut losses and reallocate capital to more promising investments

Remember that every investor's situation is unique, and there is no one-size-fits-all answer; thus, it's essential to tailor your selling decisions to your specific financial circumstances and objectives.

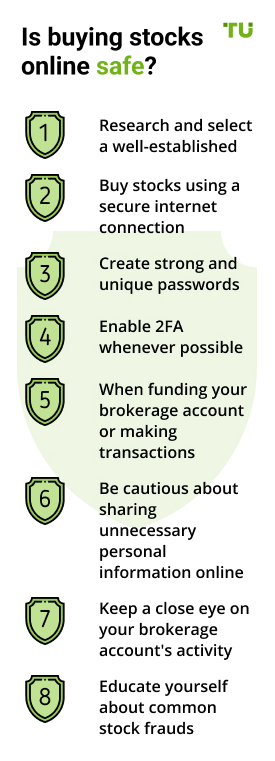

Is buying stocks online safe?

Yes, in general, stock investing is safe, but you should learn some basic safe investing rules that will help protect your money.

1. Research and select a well-established, reputable online brokerage platform with a track record of security and customer satisfaction.

2. Buy stocks using a secure internet connection, preferably your private home network, to reduce the risk of unauthorized access or data interception.

3. Create strong and unique passwords for your brokerage account, incorporating a combination of letters, numbers, and special characters.

4. Enable 2FA whenever possible. This adds an extra layer of security by requiring a second form of verification, such as a code sent to your mobile device, before accessing your account.

5. When funding your brokerage account or making transactions, use secure payment methods such as bank transfers or credit cards. Avoid sharing credit card details directly with third parties.

6. Be cautious about sharing unnecessary personal information online, especially on social media platforms, to minimize the risk of identity theft or fraud.

7. Keep a close eye on your brokerage account's activity. Regularly review statements and transaction history for any unauthorized or suspicious transactions.

8. Educate yourself about common stock frauds and phishing attempts related to stock trading.

By implementing these safety measures, you can significantly enhance the security of your online stock buying activities and safeguard your investments and personal information from potential threats and cyberattacks.

Top 3 stock investing styles

The best stock investing strategies depend on various factors, including your financial goals, available free time, risk tolerance, and market knowledge. Traders Union experts consider the following top three approaches for different types of investors:

Value investing involves fundamental analysis of a company's financial health, earnings potential, and overall market position to identify undervalued stocks that have the potential to deliver solid returns over time. The idea is to buy stocks at a discount to their intrinsic value, making them attractive investments for the long run. Patience is essential in value investing, as it may take time for the market to recognize the true value of the stock

Position trading is a strategy that lies between long-term investing and short-term trading. Traders who adopt this approach typically hold positions for several weeks to months, aiming to capitalize on major price trends. It involves a mix of technical and fundamental analysis to identify potential opportunities and focuses on stocks with strong growth prospects. Position trading requires less active monitoring than day trading or swing trading, making it suitable for individuals with busy schedules

Technical analysis For those interested in actively trading stocks, learning technical analysis techniques can be valuable. Technical analysis involves studying price charts, volume patterns, and other market data to predict future stock price movements. Some common techniques include trend trading (identifying and following trends), pattern trading (recognizing chart patterns), and momentum trading (taking advantage of the stock's strength or weakness). Successful technical analysis requires practice, discipline, and a deep understanding of market dynamics

Should I have a lot of money to buy stocks?

No, you do not need to have a lot of money to buy stocks. The stock market offers investment opportunities for investors with various budgets, and you can start with as little or as much money as you are comfortable investing. Even $100 can be enough to start building a small portfolio with fractional shares!

Top low cost tips for stock investing beginners:

1. Fractional shares allow you to invest in a portion of a single stock rather than buying a whole share. This makes it possible to invest in expensive stocks with only a small amount of money. Review stock brokers with fractional shares.

2. Instead of putting all your money into a single stock, consider diversifying your investments across multiple stocks or exchange-traded funds (ETFs). Diversification helps spread risk and can be achieved even with a modest investment.

3. Adopt a systematic investment plan where you make regular contributions to your investment account. You can begin with a small initial investment and gradually add more funds to your investment account as your financial situation improves.

4. Look for online brokerage platforms that offer low or no-commission trading to minimize transaction costs and maximize your investment amount.

Remember that investing is a long-term endeavor, and even small amounts can grow significantly over time through the power of compounding. As your financial situation improves, you can increase your investments and continue to build your portfolio over time. Learn more how to invest in stocks for beginners with a little money.

Buying stocks vs ETFs

Many beginners face the dilemma of choosing between individual stocks and ETFs. Both options have their merits and drawbacks, and the choice ultimately depends on the investor's risk tolerance, financial goals, investment knowledge, and time commitment. Below, I'll outline the key factors to consider when comparing stocks and ETFs as investments:

| Individual Stocks | Exchange-Traded Funds (ETFs) | |

|---|---|---|

Investment Nature |

Buying shares of individual companies |

Investing in a basket of securities representing an index or sector |

Diversification |

Limited diversification, unless multiple stocks are purchased |

Instant diversification across multiple assets within the ETF |

Risk Exposure |

Exposure to the performance of the individual companies held |

Spread risk across the entire index or sector represented by the ETF |

Management |

Investors manage their stock portfolio independently |

ETFs are managed by professional fund managers |

Transaction Costs |

Each stock purchase incurs transaction fees |

Fewer transaction costs as ETFs are bought/sold like stocks |

Costs |

Can be costlier due to individual transaction fees and potential research costs |

Generally lower expense ratios than mutual funds but involve brokerage fees |

Ease of Trading |

Trading individual stocks may require more research and monitoring |

ETFs offer ease of buying/selling, similar to stocks, and can be traded throughout the day |

Dividends |

Investors receive dividends from individual stocks owned |

ETF dividends are typically reinvested or paid to investors proportionally based on their holdings |

Control and Flexibility |

Investors have control over specific stocks they hold |

Less control over the individual components of the ETF portfolio |

Suitability |

Better suited for experienced investors willing to conduct research and make informed decisions |

Suitable for both beginners and experienced investors seeking diversification with lower costs |

Tax Efficiency |

More tax implications with individual stock trading, especially short-term gains |

Generally more tax-efficient due to lower turnover within the ETF |

Best stock brokers in 2024

Traders Union experts research stock brokers closely to offer the best beginner-friendly options by conducting thorough evaluations and assessments of various brokerage platforms. The focus is on identifying brokers that cater specifically to beginners and provide a user-friendly and supportive environment for those new to the world of investing.

How to buy stocks in countries

Buying shares of top companies

FAQs

How to buy stocks for beginners?

To buy stocks as a beginner, follow these steps:

Open a brokerage account

Provide required personal information

Fund the account

Research stocks you want to buy

Use the broker's platform to place stock orders

Are stocks good for beginners?

Stocks can be suitable for beginners, but consider risk tolerance, conduct research, and start with a small investment. ETFs can offer diversification.

How do I buy stocks on my own?

You can buy stocks on your own by opening a brokerage account and placing orders directly through the broker's trading platform.

Is Tesla stock good to buy?

Investing in Tesla stock depends on your risk tolerance and research. Tesla is a prominent company, but consider its financials and market conditions.

How can I buy Apple stock?

Buy Apple stock by opening a brokerage account, funding it, and placing an order for AAPL shares through the broker's platform.

Can I buy stock without a broker?

No. Buying stocks requires a broker to facilitate the transaction. Brokers provide access to the stock market and handle orders.

Team that worked on the article

Andrey Mastykin is an experienced author, editor, and content strategist who has been with Traders Union since 2020. As an editor, he is meticulous about fact-checking and ensuring the accuracy of all information published on the Traders Union platform. Andrey focuses on educating readers about the potential rewards and risks involved in trading financial markets.

He firmly believes that passive investing is a more suitable strategy for most individuals. Andrey's conservative approach and focus on risk management resonate with many readers, making him a trusted source of financial information.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.