How To Spot And Invest In Undervalued Stocks

How to start investing in undervalued stock:

-

Fundamental analysis is key in identifying undervalued stocks compared to stocks accurately priced lower

-

Use stock screeners and scanners to find undervalued stocks

-

Assess a company’s financial statements and KPIs to determine whether the stock is a value investment

Whenever I come across a stock that seems to be priced lower than I think it should be, my initial thought is “it’s on sale!”, and I feel immediately compelled to buy it. Undervalued stocks provide ample opportunity for capital appreciation, long-term growth, and some margin of safety. The hard part, however, is determining whether it’s actually undervalued or simply a bad stock. In this article, I’ll be explaining what undervalued stocks are, why they're priced so low, how to spot them, and whether you should invest in them or not.

-

What are undervalued stocks?

Put simply, an undervalued a stock whose market price is currently somehow less than what it ‘should’ be. In other words, the stock is selling cheaper than it could. The term is usually subjective however, as one person might see the stock as undervalued while another would argue that its price accurately reflects its value.

-

Is an undervalued stock good?

That depends on who you ask. On the one hand, an undervalued stock could be seen as being ‘on sale’, selling for cheaper than its actual value. On the other hand, the lower-than-deserved price could reflect poor market sentiment or low company performance, thereby making the stock a potentially bad investment choice.

-

Is it good to buy undervalued dividend stocks?

Buying undervalued dividend-paying stocks can be a sound strategy if you’re looking to invest long-term, providing the opportunity for income and potential capital appreciation. An undervalued stock may offer a higher dividend yield relative to its price. And if the stock price eventually recovers to accurately reflect its intrinsic value, you can benefit from capital gains.

-

Where to buy undervalued stocks?

Publicly traded undervalued stocks can be bought on stock exchanges through a variety of stock brokers. The vast majority of brokers will offer tools and resources to assess individual stocks, so you can determine if they are undervalued. Once you’ve found an undervalued stock on your broker’s platform, you can buy it to take advantage of the perceived price gap. This is known as “value investing”.

How to find undervalued stocks?

Ok, now we get onto the hard part – recognizing and finding undervalued stocks. The process can be pretty time-consuming, as you’ll need to analyze and interpret the fundamental data for the company of each individual stock. To speed up this stage of the process, you can use the various free tools available that list the most undervalued stocks and provide fundamental data for those companies.

To identify undervalued stocks, assess these core financial ratios and metrics of each:

-

Price-to-Earnings (P/E) ratio: This ratio compares a company's current stock price to its earnings per share (EPS). A lower P/E ratio suggests that the stock may be undervalued relative to its earnings potential. It is commonly used to assess the valuation of a stock.

-

Price-to-Book (P/B) ratio: The P/B ratio compares a company's current market price per share to its book value per share. A lower P/B ratio may indicate that the stock is undervalued relative to its assets. It measures the market's valuation of a company's assets.

-

Price-to-Sales (P/S) ratio: The P/S ratio compares a company's market capitalization to its total sales or revenue. A lower P/S ratio suggests that the stock may be undervalued relative to its revenue generation potential. It is used to evaluate a stock's valuation relative to its sales.

-

Debt-to-Equity ratio: This ratio compares a company's total debt to its shareholders' equity. A lower debt-to-equity ratio indicates lower financial leverage and may suggest that the company is undervalued.

-

Dividend yield: Dividend yield measures the annual dividend income received from owning a stock relative to its current market price. A higher dividend yield may indicate that the stock is undervalued, particularly if the dividend payout is stable and sustainable.

As mentioned above, there are online tools that you can use to find undervalued stocks. These tools quicken the process, removing the need to trawl through thousands of stocks analyzing each of them one at a time. The tools usually let you access data about each stock or company too. Some of those tools are:

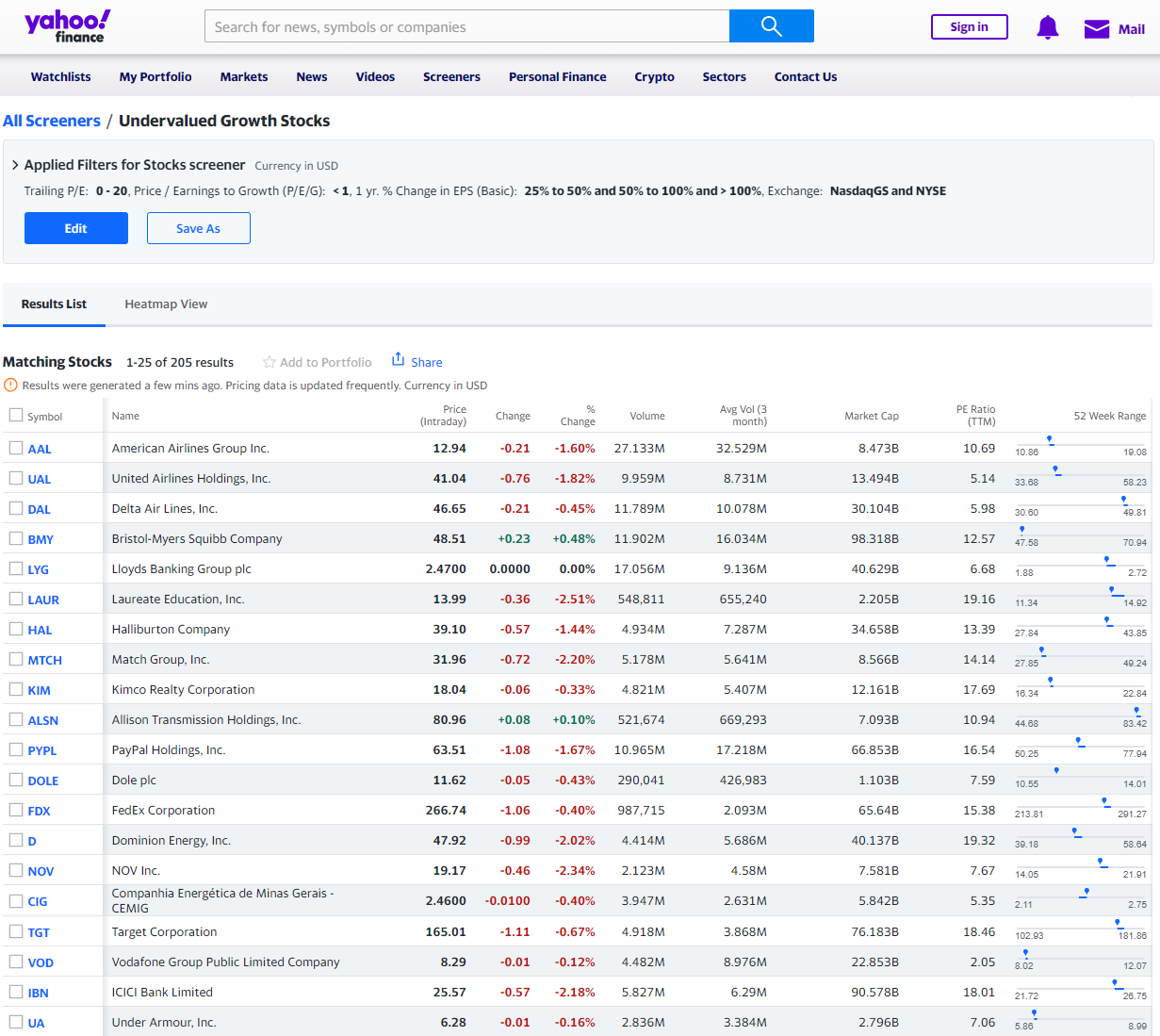

The Yahoo! Finance Undervalued Growth Stock List

Best Stock Brokers

Why do stocks underperform?

At first, it’s important to note that an underperforming stock is not necessarily an undervalued stock. An underperforming stock is one that hasn’t met the expected returns or performance benchmarks over a specific period, and can be underperforming relative to broader market indices, sector peers, or the company's own historical performance. This would mean the underperforming stock is priced correctly, as its actual value is accurately represented in the lower price.

An undervalued stock, on the other hand, is one trading at a price below its intrinsic value, suggesting it may have been oversold, and is poised for future appreciation. A stock’s intrinsic value is its true underlying worth, as determined by fundamental analysis and economic factors. So if a stock is trading at a price less than what it’s intrinsically worth, then its market value is less than its intrinsic value, and it’s deemed “undervalued”. That’s when “value investors” come in.

Why some stocks are undervalued? Key factors

Gauging whether a stock is undervalued, rather than simply underperforming, can be challenging. A market value lower than its intrinsic value usually is the result of poor investor or market sentiment, leading to a large selloff of shares, and a price drop larger than there should be. Stocks can be undervalued due to:

-

Mispricing: Market sentiment or investor behavior causes stocks to be underpriced due to due to fear, uncertainty, or speculative trading.

-

Economic Downturns: In economic downturns or recessions, stocks across various sectors may experience price drops, even if their fundamentals remain strong.

-

Market Overreaction: Sometimes, market participants may overreact to news or events, causing stock prices to decline more than is justified.

-

Cyclical Trends: Stocks of companies that operate in cyclical (seasonal) industries may see periods of undervaluation during downturns in their respective business cycles.

-

Regulatory Concerns: Regulatory issues, legal challenges, or compliance problems can lead to negative sentiment toward a company's stock.

-

Poor Performance: Stocks of companies experiencing recent poor performance in terms of earnings, revenue growth, or market share may be undervalued by the market and overlooked by investors.

-

Lack of Awareness: Some stocks may be overlooked by the broader market due to limited analyst coverage, low trading volume, or lack of investor awareness.

Though all of these factors and more can cause a stock to be undervalued, it’s sometimes difficult to pinpoint the exact reason. Let’s look at one example of a stock that is seen by many analysts as currently undervalued, with some sources determining it to be 88% undervalued - Weight Watchers International Inc. (NASDAQ: WW).

WW International Inc. Stock on 4-hour chart

Though the price of WW stock at the time of writing is $1.64, analysts have allocated the stock an intrinsic value of $13.86. Only 7 months ago, the stock was priced close to that, at 13.30 in October 2023. The reason for this sharp price decline was a series of negative quarterly net income reports, beginning in October 2022, as well as the company’s debt load and loss of interest in the company following the release of weight-loss pharmaceuticals. However, analysts estimate that net income will be back in the green this month or in May, making the stock a possible opportunity for capital gain.

To make determinations on whether a stock is undervalued, however, you need to look at the company’s fundamentals and conduct analysis.

Is it good to buy undervalued stocks?

The answer to this really depends on your own trading strategy and risk tolerance, but personally, I seek out undervalued stocks more than I do other types of investment. Undervalued stocks, if accurately assessed, have the potential to significantly increase in value over time as the market recognizes their true worth, which can lead to me generating healthy profits. Additionally, since they’re priced below their intrinsic value, they provide some investment safety, while helping to diversify my portfolio.

But is buying undervalued stocks, or value investing, right for you? Let’s look at some considerations to take into account:

-

Strategy Basics: The basics of the value investing strategy involve seeking out stocks trading below their intrinsic worth, and buying them at a lower price until the market realizes their true worth. You conduct fundamental analysis, looking at financial statements, earnings reports, cash flows, and more, and determining the stock’s intrinsic value.

-

Patience: The strategy requires patience. When you invest in what you perceive to be an undervalued stock, it may take time for the market to recognize the true value of the stock. The price might even go down in the short term. You need to consider the long-term outlook.

-

Diversification: Rather than simply investing in blue chip companies or large companies with strong fundamentals and accurate pricing, value investing diversifies your portfolio. That way you can capitalize on the growth of undervalued stocks while keeping the slower, steadier capital appreciation provided by top-performing stocks.

Let’s look at an example of a successful value investment – this is one you’ve probably heard of. Stock for social media company Meta (NASDAQ:META) had long seen sustained growth since it was publicly listed on May 18, 2012, reaching a peak of $378 in September 2021. However, nearly one year later, META was trading at just $88.09 on November 4th 2022, its lowest price since 2015.

Sharp decline in META's share price

Why did this happen? There are several reasons. A reported loss of one million daily active users in December 2021, CEO Mark Zuckerberg’s redirection of billions in company funding into his Reality Labs VR Technology segment, and an iOS privacy update affecting Meta’s ads on Apple devices, all contributed to a huge stock plummet. But anyone who knew Meta’s fundamentals well, and knew the potential the company had, saw this as a value investment opportunity.

Since its 2022 low of $88.09, Meta stock has increased by a whopping 393% to its current price of $434! So any value investor who saw how undervalued Meta stock was and invested, would have multiplied their investment by about 5 times by now. However, opportunities like that are hard to come by. After all, it’s not every day that shares of one of the largest and most powerful companies in the world drop to less than a third of their initial value.

Should you invest in undervalued stocks?

Let’s for a minute consider the Market Efficiency Hypothesis. It’s a theory in finance that essentially says stock market prices always accurately reflect an asset’s true value, and all factors are accounted for in a price. If you’re a believer in market efficiency, then it would be impossible for a stock to be undervalued – its price would always be accurate ("fair").

However, if you believe that you can beat the market and pinpoint stocks that are priced lower than their intrinsic value, then you should invest in undervalued stocks. The opportunity for growth in value investing makes it a hard strategy to ignore. You just have to make sure you do your due diligence in analyzing the fundamentals of each stock. But before you go scouring the internet for undervalued investment opportunities, take these factors into account:

-

Bull Market: In a bull market, undervalued stocks may represent hidden gems that have yet to be recognized by the market. They can offer potential for growth as the wider market continues to rise.

-

Bear Market: During a bear market, undervalued stocks can act as a defensive strategy. Their lower prices relative to their intrinsic value may offer more resilience against market downturns, potentially limiting losses compared to overvalued stocks.

-

Rebalancing: Including undervalued stocks in a portfolio can contribute to risk management and diversification, particularly when used during rebalancing.

-

Long-term, Short-term: Short-term value investing may not fully capture the value proposition of the stocks, as price changes take time. Investing in undervalued stocks is better suited to long-term strategies.

Furthermore, you should weigh up the benefits and drawbacks of pursuing the value investing strategy. I’ve already covered some of them in this article, so I’ll keep this brief.

What are the advantages of undervalued stocks?

-

Capital appreciation potential: As undervalued stocks are priced lower than their intrinsic value, they have the potential for significant growth as the market recognizes their true value.

-

Income generation: Some undervalued stocks pay dividends, providing a source of passive income.

-

Margin of safety: Since these stocks are trading below their intrinsic value, there is less downside risk compared to those with higher valuations.

-

Contrarian opportunity: Value investing involves taking a contrarian approach. Contrarian investors believe market inefficiencies and investor psychology lead to mispricing, leading to profit opportunities.

-

Long-term potential: Undervalued stocks may offer compelling long-term investment potential.

-

Diversification benefits: Including undervalued stocks in a diversified investment portfolio can help reduce overall portfolio risk since they often behave differently from the broader market.

What are the disadvantages of undervalued stocks?

-

Uncertain timing: The process of market correction and price appreciation for undervalued stocks can be slow and unpredictable. Patience is required.

-

Continued underperformance: Despite being perceived as undervalued, stocks could remain undervalued or even continue to decline further in price.

-

Value traps: Some stocks may appear undervalued but fail to appreciate in price due to fundamental weaknesses. This creates the risk of falling into value traps, where apparent bargains turn out to be value-destructive investments.

-

Liquidity concerns: Undervalued stocks, particularly those of smaller companies or those trading on less liquid exchanges, may have limited trading volume and liquidity.

-

Market efficiency: The Market Efficiency Hypothesis proposes that market prices are always accurate and reflect true value, which would nullify the concept of undervalued stocks.

Can beginners invest in undervalued stocks?

Personally, I would not recommend attempting to invest in undervalued stocks for total novices. If you don’t know what you’re doing, you’re more than likely to simply end up investing in a bad stock.

However, if you’re confident in your ability to read a company’s core fundamentals and determine if it has more intrinsic value than it’s currently priced at, then it can be a great avenue for investment. If you’re not well-versed in fundamental analysis, you simply need to put in the time and effort to educate yourself. With enough perseverance and dedication, you can become an expert in spotting undervalued stocks.

Some additional tips and considerations for you to follow:

-

Educate Yourself: Before diving into undervalued stocks, you should understand basic investing principles, valuation methods, and financial analysis techniques. Take the time to learn about fundamental analysis and how to interpret financial statements.

-

Start Small: Begin with only a small percentage of your portfolio allocated to undervalued stocks. This way, you can gain experience and test your investment thesis without exposing yourself to excessive risk.

-

Long-Term Perspective: Adopt a long-term investment horizon when investing in undervalued stocks. Market corrections and price adjustments may take time to materialize. Avoid the temptation to make short-term trades based on fluctuations.

-

Diversify Your Portfolio: Diversification is essential to mitigate risk. Spread your investments across different industries, sectors, and asset classes.

-

Thorough Research: Conduct comprehensive research before investing in a stock you believe is undervalued. Analyze financial statements, evaluate key performance indicators, and assess the company's competitive position within its industry.

Some of the common pitfalls in identifying undervalued stocks, which you should avoid, are:

-

Value Traps: Don’t invest in companies that appear undervalued based solely on traditional metrics but still have underlying issues that prevent them from realizing their full potential. Conduct thorough fundamental analysis to assess the quality of the business.

-

Ignoring Quality: Don't overlook the quality of the company's management, competitive position, and growth prospects.

-

Overleveraging: Avoid using excessive leverage to invest in undervalued stocks, as it can amplify losses and increase the risk of financial ruin. Stick to a disciplined investment strategy.

-

Ignoring Red Flags: Pay attention to warning signs such as deteriorating financial metrics, accounting irregularities, or management integrity issues. Conduct thorough due diligence and investigate any red flags before investing in a company.

As a last note, you should be aware of the qualitative factors that also play a significant role in value investing. These include management quality, industry position, and competitive advantage.

-

Management Quality: Assessing company management is essential for value investing. Strong company leadership with a proven track record of sound decision-making and effective capital allocation can create long-term value, while poor management practices hinder a company’s growth prospects.

-

Industry Position: Evaluating a company’s position within its industry provides valuable insight. Companies that operate in growing industries with favorable long-term trends are more likely to generate sustainable returns. Consider industry trends, competitive forces, and barriers to entry when determining upside potential.

-

Competitive Advantage: Lastly, assessing a company’s competitive advantage is crucial. An advantage allows a company to maintain its market share, defend against competitors, and generate superior returns. Whether it's through proprietary technology, brand recognition, economies of scale, or other factors, companies with a sustainable competitive advantage are better positioned to create lasting value.

Expert Opinion

The reality is that anyone can invest in the stock market. One doesn’t need to personify the Wolf of Wall Street to start investing. It’s a misconception that a massive bank account is necessary to begin investing. Even with little initial investment, investing in stocks can yield some excellent returns.

Summary

Though value investing can seem a little daunting, with perseverance, self-education, and thorough research, it can be done by most investors. Just make sure you’re doing dilligent research on a company’s fundamentals, assessing its financial statements. Use core fundamental data to distinguish between undervalued stocks and accurately low-priced stocks. Before investing real capital, practice your strategy on a demo account to see how it pans out. Then, start investing in undervalued stocks with small amounts. If successful, you should be ready to expand the strategy.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

3

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

4

Diversification

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

-

5

Fundamental Analysis

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.

Team that worked on the article

Jason Law is a freelance writer and journalist and a Traders Union website contributor. While his main areas of expertise are currently finance and investing, he’s also a generalist writer covering news, current events, and travel.

Jason’s experience includes being an editor for South24 News and writing for the Vietnam Times newspaper. He is also an avid investor and an active stock and cryptocurrency trader with several years of experience.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).