The 9 Biggest Risks of Investing in Stocks, and How to Mitigate Them

Top commission-free stock broker - eToro

There are 9 main risks that investors will encounter when investing in stocks:

-

Business Risk: A company’s underperformance lowers stock value

-

Volatility Risk: Large, frequent price movements lead to losses

-

Conservative Risk: An investor misses out on a profit opportunity

-

Horizon Risk: An investment horizon is cut short by unexpected events

-

Political Risk: International or domestic political changes or policies impact stocks

-

Concentration Risk: Too much capital is concentrated in one or few assets

-

Inflation Risk: Inflation erodes real value, or inflation rise causes stock market dip

-

Liquidity Risk: Low trading volume makes it difficult to sell stocks

-

Risk of Inaction: Indecisiveness leads to a lack of action on investments

When it comes to the stock market, there is a shared majority sentiment that the stock market will always grow. If you were to ask an investor, politician, or random person on the street – they’d tell you that generally, the stock market is continuously gaining value, and always will, bar in the event of some global catastrophe. They’d be right as well – the S&P500, for example, has seen new all-time highs 1,176 times since it began in the 1950s.

As long as the world keeps experiencing economic growth, and increased productivity and innovation, the stock market will typically trend upwards over time. This of course makes investing in stocks an attractive option for anybody looking to expand their wealth.

But what about the risks that come with investing in stocks?

If it were as easy as simply investing and getting rich, then everybody with a few dollars to their name would be doing it. Like all investments, investing in the stock market comes with certain risks - though the level of risk differs in other financial markets or investment classes. In this article, we’ll look at 9 of the most common and greatest risks when buying and selling stocks, while offering you guidance on how to mitigate those risks.

-

Is investing in stocks riskier than trading?

Generally, no. With trading, you are trying to profit from short-term movements, whether through intraday movements capturing tiny profits, or swing trading over several days or weeks. This increases risk, as prices tend to move more erratically on shorter timeframes. With investing, a long-term investor would almost always see positive returns, as the stock market has consistently grown over the past several decades.

Which is the greatest risk when investing in stocks?

Investing in the stock market comes with inherent risks, of which there are many. Market volatility, economic downturns, company-specific issues, and unforeseen events can all impact the price of individual stocks and broader health of the stock market. We’ll be looking at 9 of the biggest risks when investing in stocks:

-

Business Risk

-

Volatility Risk

-

Risk of Being Too Conservative

-

Horizon Risk

-

(Macro, Geo) Political Risk

-

Concentration Risk

-

Inflation Risk

-

Liquidity Risk

-

Risk of Inaction

In the meantime, you can read our recommendations for stock brokers here: 6 Best Stock Brokers For Beginners.

Business Risk

When somebody invests in a business, they’re doing so because they believe that the company has value, and will be successful in increasing its value. Similarly, when you buy shares of a company, you hope that the business will run successfully and generate profits so that you see a positive return on your investment.

Unfortunately, 20% of businesses fail within their first two years, 45% by their fifth, and 65% after ten. Even if a company seems like a solid investment with massive growth potential, situations change and its value can decrease, plummet, or in the worst case – it can go bankrupt and its stock gets delisted. If a company experiences financial difficulties, operational inefficiencies, or mismanagement, its overall performance will likely suffer.

High debt levels could erode a company’s profitability or its market perception, leading to lower stock value. A company could be overvalued at the time of investment, only to see its share price corrected and its value decreased. Economic downturns or industry-specific challenges could also lower the value of a particular stock.

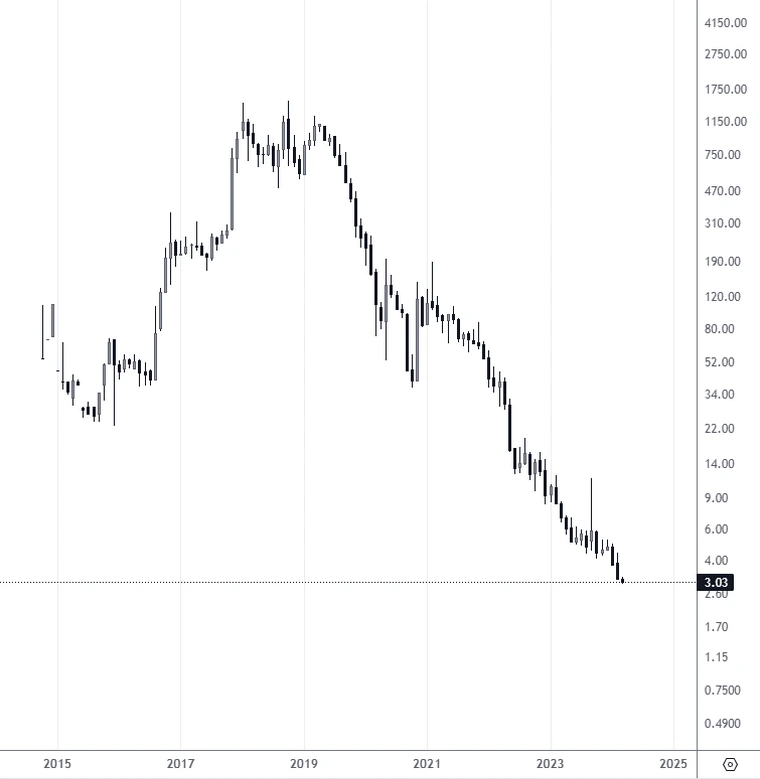

Let’s look at a recent example. Aurora Cannabis Inc (ACB) is a cannabis distribution company that in 2017 was hailed as a growth stock by investors, reaching an all-time high of $1195.20 per share in 2019.

ACB Stock chart

Fast-forward to today, and ACB stock is now worth a paltry $3.03, a decrease of 99.79%. Overspending, low revenue, not meeting earnings expectations, and actual demand falling short of projected demand, all led to a huge valuation decrease for the company.

To mitigate the risk of suffering the same kind of losses seen by ACB investors:

-

Thoroughly research the fundamentals of any company you invest in. Learn about their financial statements, earnings reports, debt levels, dividend history, growth prospects, customer base, valuation metrics, and wider industry trends.

-

Make sure to diversify your portfolio. If you spread your capital across multiple investments, then a major loss on one stock won’t have as large an impact on your overall portfolio. A portfolio of only 5 stocks that incurs a 50% loss on one equals a 10% loss overall, whereas with 25 stocks, a 50% loss on one only sets you back 2% of your overall portfolio.

Market Risk (Volatility Risk)

Volatility in stocks refers to the fluctuation of prices, and the frequency and size of the up and down movements. If you’ve ever looked at a bar chart, you’ve no doubt seen lines, bars, or candles colored in green and red moving up and down, sometimes rapidly and in great lengths. When prices are moving larger distances, and at higher frequencies, volatility is high.

Higher volatility leads to increased risk, as stock prices can experience rapid and unpredictable changes, leading to the sudden loss of capital (or profit opportunities). Even experienced investors may struggle to consistently predict which way a price will move, particularly during times of high volatility. In addition to this, larger and faster fluctuations can lead to emotional and impulsive decision-making based on greed or fear.

Volatility is usually highest right after the market opens, typically for the first 30 minutes to 2 hours, so short-term stock traders should be aware of the additional risk.

To alleviate some of the risk brought on by volatility, adopt a long-term perspective, focusing on the fundamentals of your investments rather than reacting to short-term market movements. If a company has strong fundamentals, it is likely to grow in value over time, even with short-term fluctuations. Don’t allow yourself to react impulsively to short-term fluctuations.

Risk of Being Too Conservative

Have you ever had something you wished you invested in but were too hesitant to, only to see that missed investment turn out to be lucrative? This is a common occurrence with stock investment too.

In the 1970s, Steve Jobs approached his first boss Nolan Bushnell while working at Atari, and offered Bushnell a third of his company Apple Computers in exchange for $50,000 capital. Bushnell declined, and you probably know what happened to Apple – hint: it’s now worth $2.78 trillion. Talk about a missed opportunity!

To avoid ending up like Nolan Bushnell, fretting over a missed golden opportunity, try to diversify your portfolio. By balancing your portfolio using a mix of asset classes, you maximize the odds of one of your investments seeing huge growth. Research a stock thoroughly to assess its growth prospects, and look at wider trends within the company’s industry.

Horizon Risk

Horizon risk in stock investing refers to the potential threat to your investment horizon, i.e. the amount of time you had planned to invest for. Let’s say you set out to invest for 20 years to plan for your retirement, only to have an unexpected life event or sudden financial need force you to withdraw your invested capital.

The possibility of this happening adds a layer of risk to stock investing. For example, if a person had invested in the NASDAQ Composite (IXIC) in March 2019 with a plan to invest for five years, they’d have made 111.14% profit by February 2024. However, if an unpredictable event had forced them to sell their assets during the pandemic stock market slump, or the periods of high US inflation in 2022, they’d have either lost capital, or seen much lower returns.

There’s no way to stop unforeseeable events from happening, but you can mitigate the risk they bring. Firstly, make sure to have an emergency fund for the things that life throws at you. Secondly, only invest disposable capital that you can afford to lose and don’t need to live, so that you don’t have to sell investments during tough times. Lastly, maintain flexibility in your investment plans by setting financial goals rather than time-based ones.

Political Risk

People often say that money has too much power in politics, but the relationship works both ways. Politics, both domestic and global, often has a direct influence on the performance of the stock market. Shifts in government policy can impact industries and specific companies, as can regulatory change. Political unrest and instability within a country tend to send ripples through their respective stock markets. Even elections and shifting of political power affect how the stock market behaves, with average S&P500 returns fluctuating by several percentage points based on whether the Democrats or Republicans are running the USA.

One way to reduce political risk is by diversifying your stock investments across international stock exchanges. You could invest in the US, UK, European, and Japanese stock exchanges for instance, so that political events in one country don’t influence your entire portfolio. On top of that, stay informed on global political trends and events, to help you better understand how they’ll affect your investments and know if you need to cash them in.

Concentration Risk

Concentration risk, or ‘overexposure’ refers to having too much of your capital focused on a single investment or sector. If you only invested in pharmaceutical stocks for example, you might have seen large gains during the pandemic, but then dips afterwards. It’s not sustainable to put all of your capital into stocks in one sector, as any wider industry trends can impact your whole portfolio. Similarly, concentrating too much capital on one or few assets means that any losses incurred will have a stronger impact on your overall portfolio.

The key to avoiding overexposure is to diversify across different sectors and asset classes. An ideal number of assets to have in your portfolio is somewhere between 20-30. Additionally, try investing in multiple sectors and even various asset classes, so that an industry downturn doesn’t affect your bottom line too much.

Inflation Risk

Inflation erodes the real return on investments. With inflation, the actual value of money decreases over time, impacting the purchasing power it has. Over the past 10 years, average inflation in the US has been 1.88%, meaning that the price of goods has gone up by roughly that amount each year. That also means that if you had invested, your money would have lost on average 1.88% of its real value each year.

Additionally, interest rate changes tend to harm stock prices, as central banks increase the cost of borrowing for companies. Inflation also leads to higher prices for consumers, and in turn, decreased spending, which can impact a company’s bottom line and their stock performance.

To offset the effects inflation has on your stock investment, you should be aiming for your investments to grow by at the very least 2% per year. Inflation rates in recent years have been higher than average, so it’s crucial now more than ever to invest in stocks that have a history of outpacing inflation. Pay attention to interest rate announcements from the Fed or relevant central bank.

Liquidity Risk

When we talk about liquidity in trading/investing, we’re generally referring to how fast a buy or sell order can be carried out. If a stock is bought and sold multiple times per second, it’s highly liquid, and a transaction can be easily executed. Typically, low liquidity makes it harder to buy or sell an asset and is the result of too few market participants. Real estate, for example, is classed as a highly illiquid asset, as it can take months or years to sell a house.

Let’s say you wanted to buy $1000 of NVIDIA shares. As this is a relatively low sum of money, and thousands of NVIDIA shares are traded per second, a buy order should be executed immediately. The same is true if you wanted to sell those shares. Now, if you were selling $1,000,000 worth of low-volume stock (one with a daily average trading volume of 1,000 shares or less), it may take much longer to find a buyer. The risk is introduced here, as the value of the stocks could decrease in the time it takes to execute the trade (slippage).

The above example is an extreme one, but slippage and low liquidity should be considered in all stock trades. To avoid the impact of low liquidity, focus your investment on stocks with high trading volumes. Most trading platforms allow you to see trading volume, so add this to your chart analysis and avoid investing in low-liquidity stocks.

Risk of inaction

The risk of inaction in stocks refers to the potential negative impact on your investment portfolio when you fail to take necessary actions, make decisions, or seize available opportunities despite having the means and intentions to invest. Similarly to the risk of being too conservative, this occurs when you are indecisive about or afraid of an investment, and miss an opportunity to make a profit.

To avoid the risk of inaction, set clear investment goals with a clear roadmap. Educate yourself on the stock market to boost your confidence in spotting opportunities. Stay informed with relevant market news, important events, and emerging trends. Staying on top of new developments makes it less likely you’ll miss a golden opportunity.

Best stock brokers

Additional tips to reduce risks when investing in stocks

In addition to all of the advice offered on tackling the 9 major causes of risk in stock investing, here are some extra pro tips for reducing stock risk, with articles to help you apply them.

-

Robo Advisors: Robo advisors are automated investment platforms that use algorithms to create and manage a diversified portfolio based on your risk tolerance and financial goals. They provide a hands-off approach to investing, so consider using one to help manage your risk.

-

Demo Accounts: Demo accounts let you practice trading without risking any real money. They’re useful for testing your bold strategies while gaining invaluable experience in a risk-free, simulated trading environment.

-

ETFs: Exchange-Traded Funds (ETFs) are index funds that track a basket of securities managed by professionals. They offer diversified exposure to various assets and are often managed by fund managers with expertise in the market, which helps to reduce certain types of risk. For inspiration on which ETFs to invest in, see: What ETF to buy now.

-

Dividends: Stocks with consistent and high-dividend payouts can provide a steady income stream, which helps to boost your investment returns. Dividend-paying stocks are also often associated with more stable companies, reducing some risk. Check out our list of 20 dividend-paying stocks for under $40: Best Cheap Stocks With High Dividends.

Conclusion

Investing in the stock market is one of the riskier asset classes out there, but it also provides tonnes of opportunities. Stock market risk comes from the often-unpredictable nature of the economy, and the performance of individual companies within it. International and domestic political developments can have a big impact on stocks, and inflation can cause price changes that are hard to foresee. A major hurdle to overcome is the emotional turmoil that comes with stock investing, whether it’s fear leading to missing out on opportunities, being too conservative, or reacting impulsively to high volatility.

The best way to decrease the risks inherent in stock investment is to diversify your portfolio across many stocks or even asset classes, and not concentrate too much capital on one sector or asset. Stay updated with market trends and news relevant to your investments. Learn as much as you can before putting your money into stocks. If you play your cards right, you could successfully profit from one of the most lucrative financial markets out there.

Team that worked on the article

Jason Law is a freelance writer and journalist and a Traders Union website contributor. While his main areas of expertise are currently finance and investing, he’s also a generalist writer covering news, current events, and travel.

Jason’s experience includes being an editor for South24 News and writing for the Vietnam Times newspaper. He is also an avid investor and an active stock and cryptocurrency trader with several years of experience.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.