Best Cheap Stocks With High Dividends

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Best cheap stocks with high dividends:

AT&T (T) - 4.97% dividend rate

Verizon Communications (VZ) - 4.97% dividend rate

Enterprise Products Partners L.P. - 6.33% dividend rate

Franklin Resources (BEN) - 6.44% dividend rate

Ford Motor (F) - 5.98% dividend rate

FirstEnergy Corporation (FE) - 4.31% dividend rate.

Investing in shares can be a solid way to expand one's fortune and low-priced dividend shares offer a viable starting point for many investors. These stocks not only provide suitable pricing but also the extra perk of dividend payments that can supply an ongoing source of revenue. In this article, we will inspect the top cheap dividend stocks that you can consider adding to your portfolio.

List of best cheap dividend stocks

We have prepared a list of the best cheap dividend stocks, focusing on stocks with an average dividend yield of at least 4%.

| Country | Industry | Dividend rate (%) | |

|---|---|---|---|

| AT&T (T) | USA | Telecommunication | 4.97% |

| Verizon Communications (VZ) | USA | Telecommunication | 4.97% |

| Enterprise Products Partners L.P. | USA | Midstream Energy Services | 6.33% |

| Franklin Resources (BEN) | USA | Investment Management | 6.44% |

| Ford Motor (F) | USA | Automobiles | 5.98% |

| FirstEnergy Corporation (FE) | USA | Utilities | 4.31% |

This list is for informational purposes only and should not be considered investment advice. Before making any investment decisions, consult a certified financial advisor. We recommend verifying the latest market information before proceeding with any investment strategy.

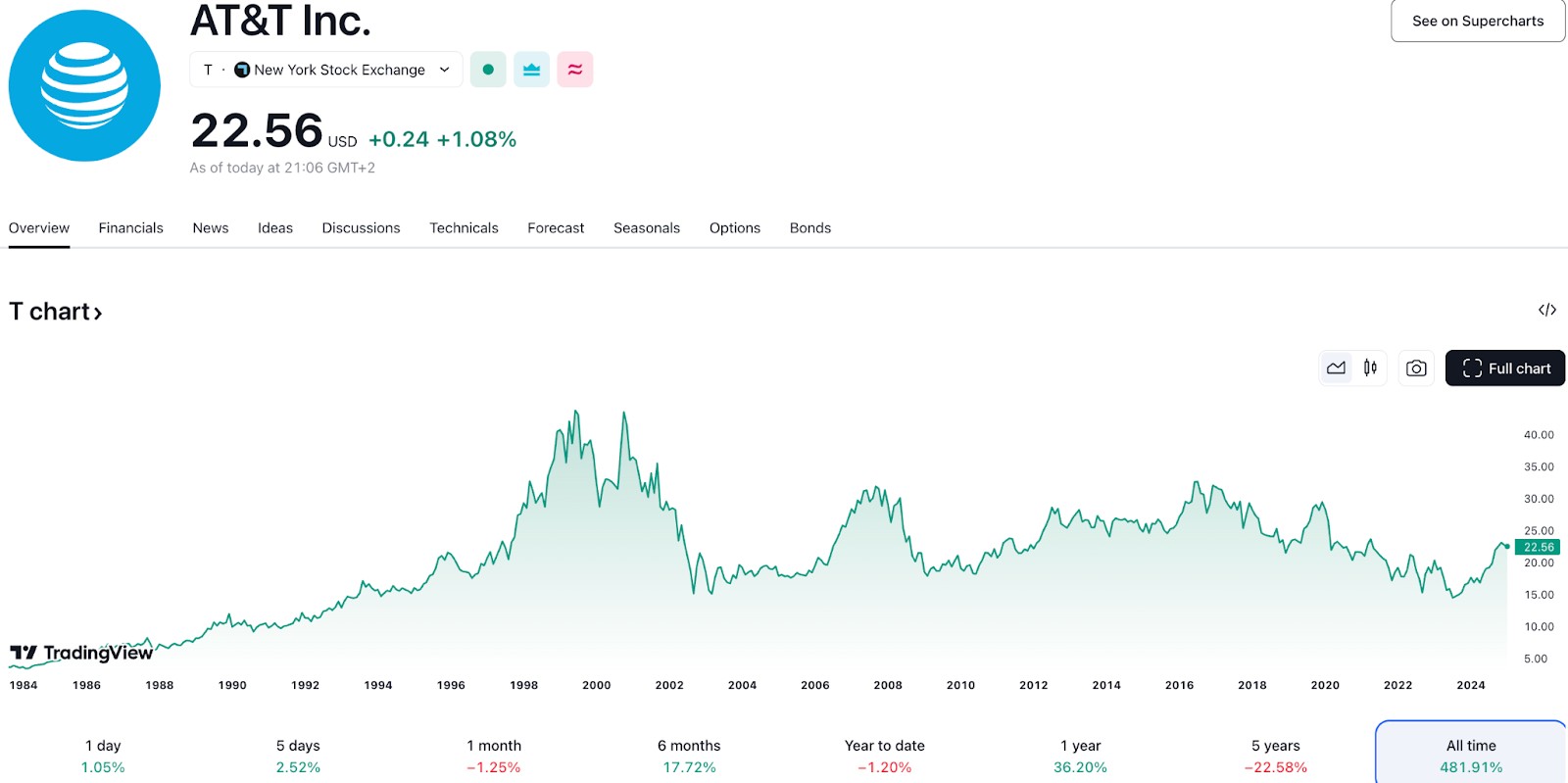

AT&T (T)

Country: USA

Industry: Telecommunication

Dividend Yield: 4.97%

AT&T is a cornerstone in the U.S. telecommunications sector, providing wireless, broadband, and entertainment services to millions of customers. Known for its reliability, the company consistently pays dividends, making it a favorite for income-focused and conservative investors. AT&T is also exploring opportunities in 5G technology and media, which could provide additional growth avenues.

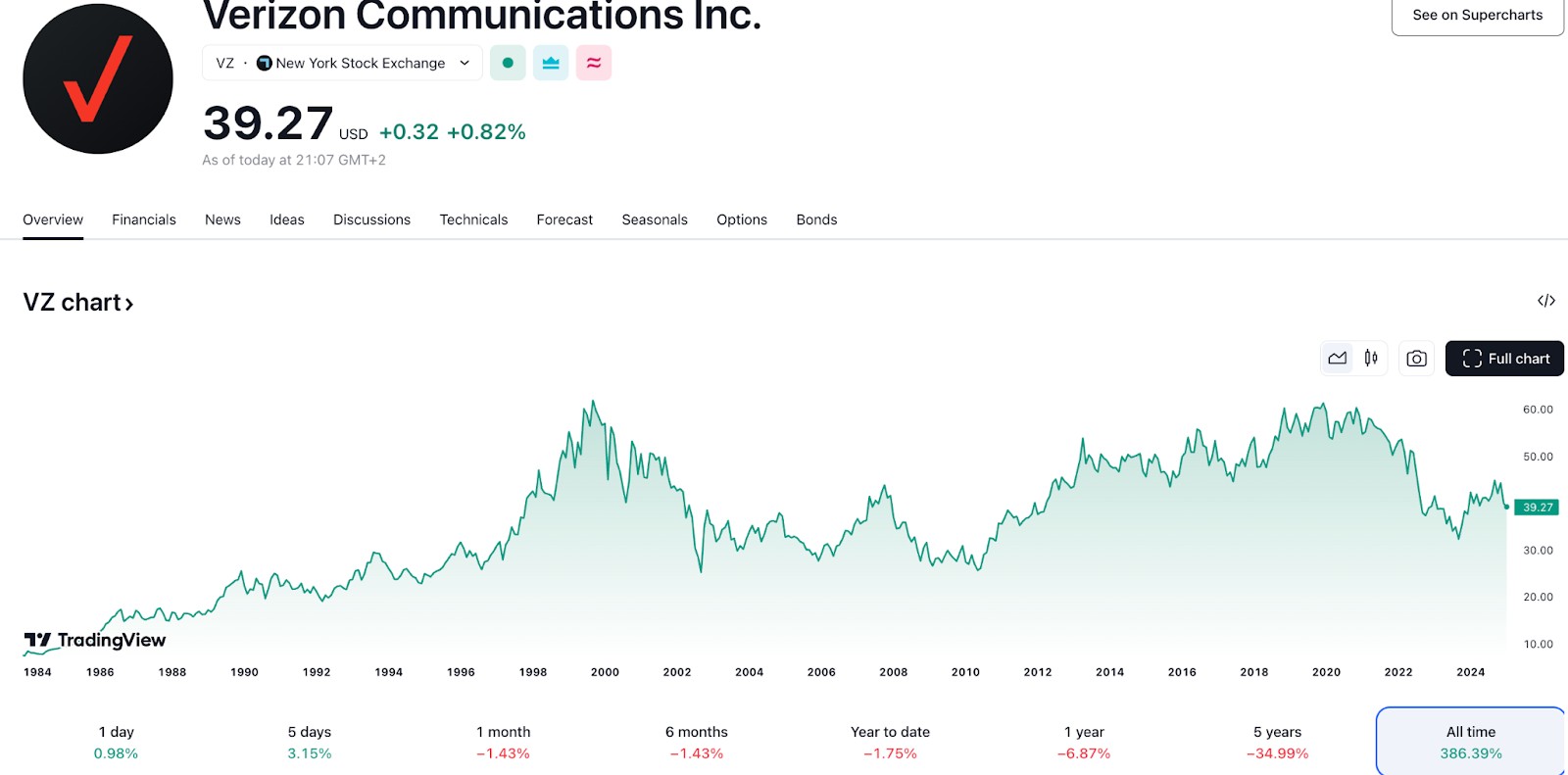

Verizon Communications (VZ)

Country: USA

Industry: Telecommunication

Dividend Yield: 4.97%

Verizon is a major player in the telecommunications industry, offering mobile, broadband, and fiber-optic services. With one of the highest dividend yields in its sector, Verizon is an attractive choice for investors seeking steady income. The company continues to invest heavily in 5G infrastructure, aiming to maintain its competitive edge in the rapidly evolving telecom landscape.

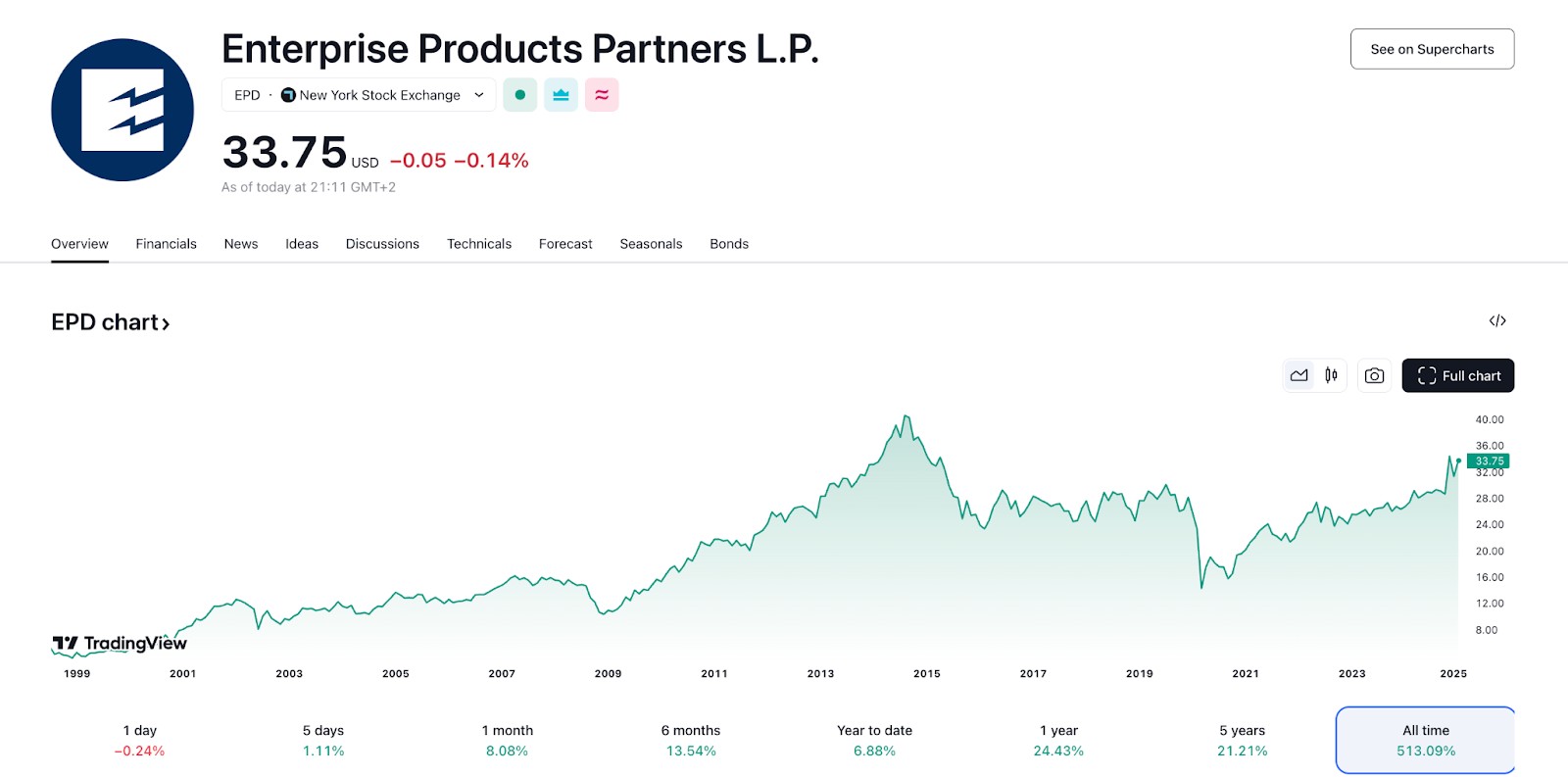

Enterprise Products Partners L.P.

Country: USA

Industry: Midstream Energy Services

Dividend Yield: 6.33%

Enterprise Products Partners is a leader in the midstream energy sector, specializing in the transportation, storage, and processing of natural gas, crude oil, and refined products. The company’s high dividend yield reflects its stable cash flow, backed by long-term contracts. As a master limited partnership (MLP), Enterprise is designed to distribute significant income to its investors, making it a popular pick for dividend-focused portfolios.

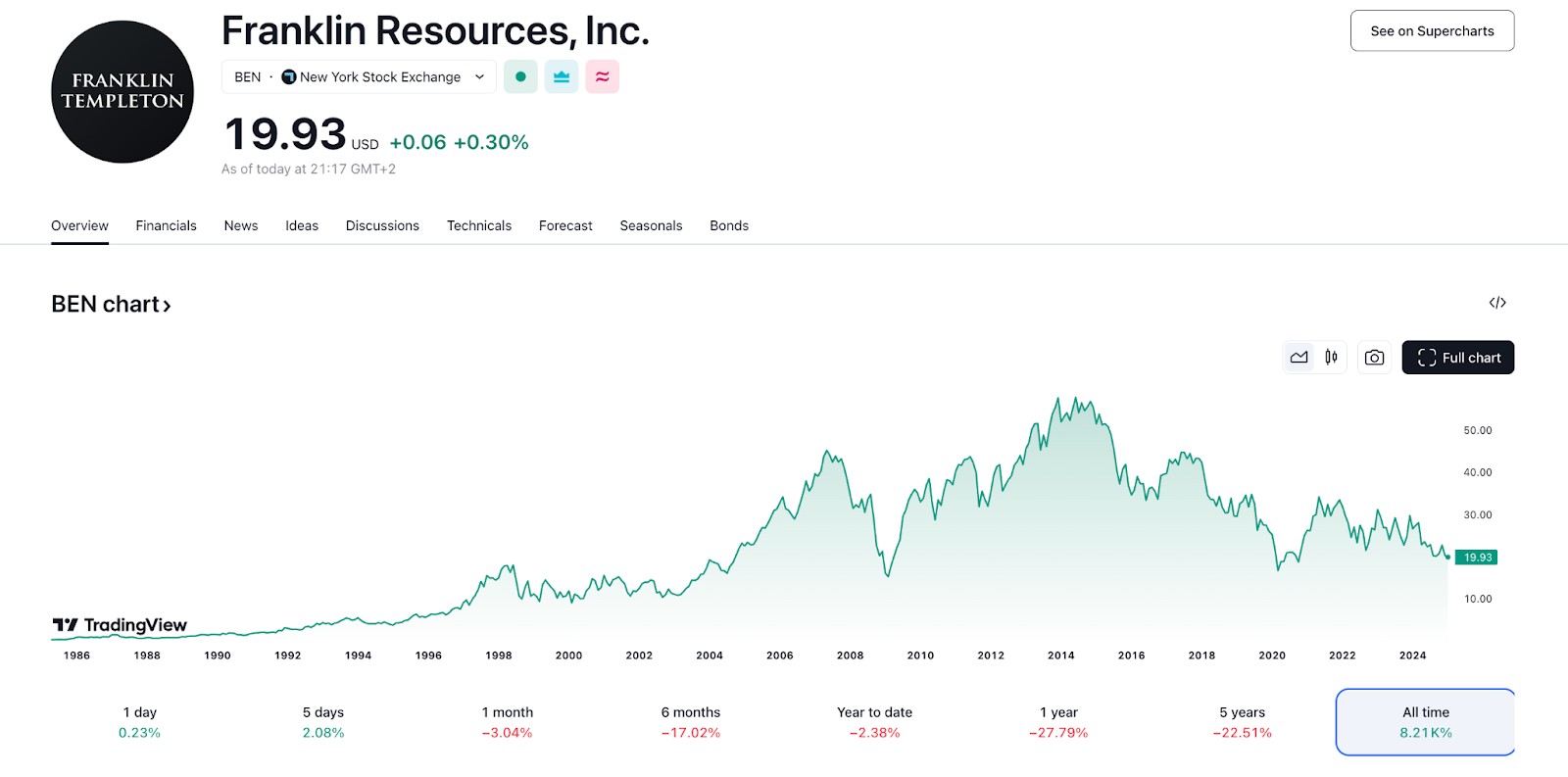

Franklin Resources (BEN)

Country: USA

Industry: Investment Management

Dividend Yield: 6.44%

Franklin Resources, also known as Franklin Templeton, is a globally recognized asset management firm offering a diverse range of investment products. The company has a long history of paying competitive dividends, supported by its robust financial performance. Franklin Resources appeals to investors seeking both income and exposure to the financial services sector.

Ford Motor (F)

Country: USA

Industry: Automobiles

Dividend Yield: 5.98%

Ford is a globally recognized automotive company with a rich history in manufacturing cars, trucks, and SUVs. The company’s strong dividend yield makes it attractive to income-focused investors, while its push into electric vehicles (EVs) signals opportunities for future growth in a competitive and evolving market.

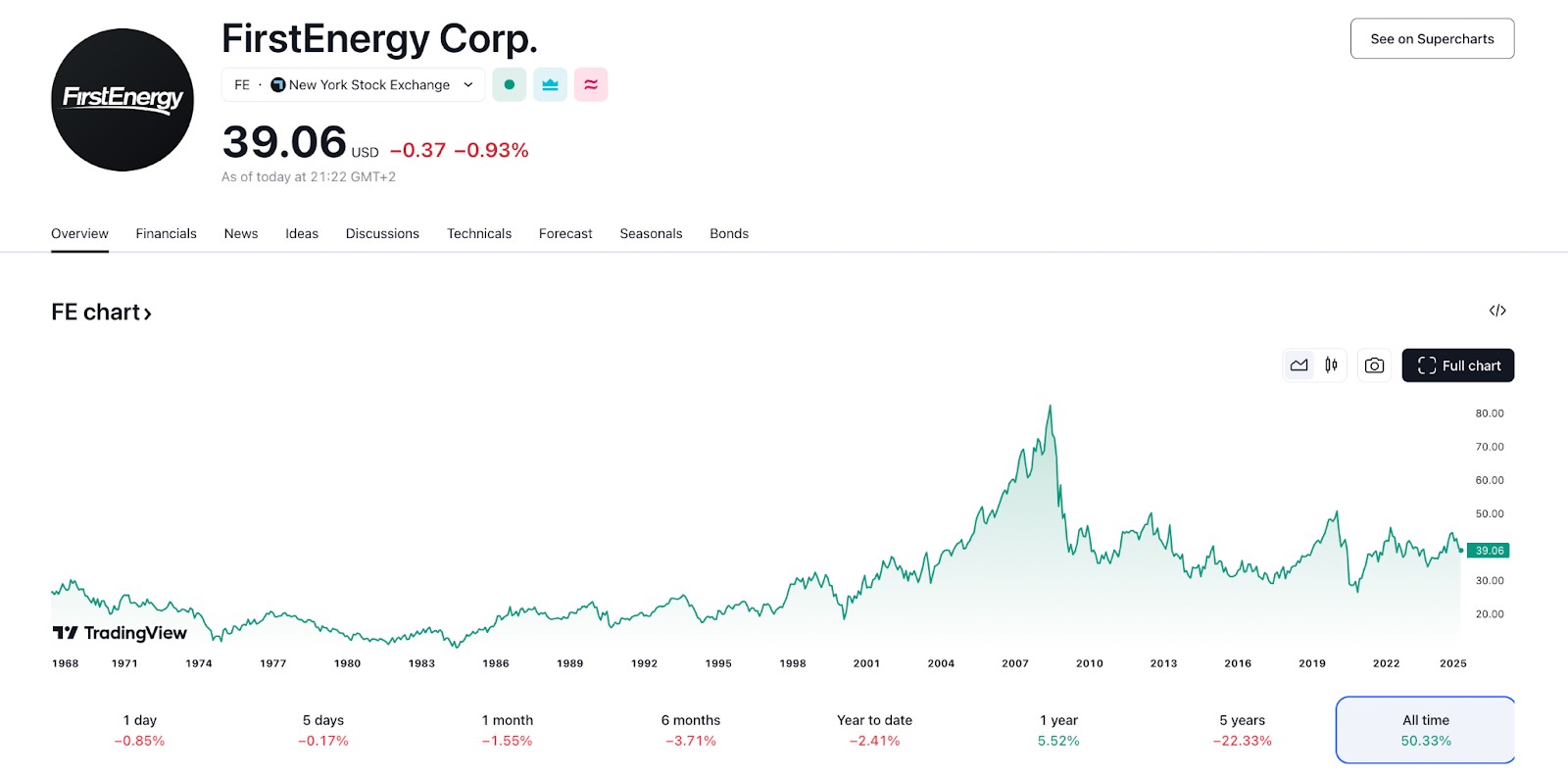

FirstEnergy Corporation (FE)

Country: USA

Industry: Utilities

Dividend Yield: 4.31%

FirstEnergy provides electricity to millions of customers across the U.S., with a focus on reliable and affordable energy delivery. The company’s consistent dividend payments make it a stable choice for investors seeking income from the utilities sector.

What are dividend stocks?

Dividend stocks are shares of companies that pay part of their profits to investors, usually as cash or additional stock. These payments provide a steady income stream, making dividend stocks popular, especially during inflationary periods when they can hedge against rising prices.

Not all stocks pay dividends, but those that do are typically more stable, with consistent earnings. This makes them appealing to retirees and income-focused investors. Investors seeking regular income and reduced risk often favor dividend-paying stocks, as they tend to be less volatile than non-dividend-paying stocks. Consider exploring promising dividend stocks for steady returns and long-term growth potential.

How to choose dividend stocks?

Selecting dividend stocks requires evaluating financial health and dividend reliability. Here’s a streamlined guide with examples:

Check dividend history and yield

Look for stocks with a history of consistent dividends. For example, if a company pays a semi-annual dividend of $2.50 ($5 annually) and its stock price is $100, its dividend yield is:

DY = $5.00 / $100.00 = 5%

Compare yields to industry averages. A higher yield may signal strong returns but can also indicate risk if the yield is unusually high.

Assess financial health

Evaluate revenue growth, profitability, and cash flow. For instance, a company generating steady annual revenue increases while controlling expenses is a good sign. If its revenue outpaces expenses, the business is more likely to sustain and grow dividends.

Compare industry peers

Compare a stock’s financials and dividend yield with similar companies. For example, if two energy companies offer 4% and 6% yields, investigate why the higher-yielding stock pays more. It could be due to financial instability or aggressive payout strategies.

Other items to consider include:

What is the industry outlook in which the company operates?

What is the quality of the management in place? Does management have a history of making shrewd strategic decisions?

How does the stock’s valuation compare to its peers?

How does this stock fit within an existing investment portfolio?

Are dividend stocks under $40 a good idea?

Dividend stocks under $40 can be a smart addition to a diversified portfolio, but their value depends on market conditions and investment goals. Companies either reinvest profits into growth or distribute them as dividends. While dividends provide income, reinvestment can fuel long-term capital appreciation. Look for companies with consistent dividend payouts, manageable payout ratios (generally below 60–70%), and strong fundamentals.

Importance of dividend stocks

Historical performance. From 1930 to 2017, dividends contributed 40% of the S&P 500’s total returns. During tough market periods like the 1970s and 2000s, dividends accounted for over half of market gains.

Income during volatility. Dividend-paying stocks provide steady income even in bear markets, unlike growth stocks that rely solely on price appreciation.

Compounding effect. Reinvested dividends purchase more shares, increasing returns over time, especially when stock prices are low.

Risks could include market volatility and lower dividend reliability in comparison to well-known, more expensive stocks, but benefits include the potential for high yields and ease of portfolio diversification.

Proven outperformance

From 1972 to 2017, dividend-paying stocks returned an average of 9.25% annually, outperforming the S&P 500's 7.5% and non-dividend-paying stocks’ 2.5%. Consistent dividend growers have historically delivered stronger returns, making dividend stocks a compelling long-term investment choice.

Why do some firms skip dividends?

The key causes of dividend skipping by some firms are:

Tax implications. Dividends are taxed as ordinary income, while capital gains often have lower tax rates.

Stock buybacks. Companies may repurchase shares, boosting share value and earnings per share (EPS).

Debt reduction. Paying down debt can enhance credit ratings and reduce interest costs.

How many stocks should I buy?

Investment experts suggest holding 10 to 30 dividend-paying stocks across various industries for proper diversification. A diversified portfolio can provide steady income and long-term growth, making dividend stocks a reliable investment choice. This strategy helps balance risk and potential returns.

Key tips for dividend stock investing

Diversify across sectors. Spread investments across different industries to reduce risk.

Research thoroughly. Evaluate a company's financial health, dividend history, and growth potential.

Check payout ratios. Avoid stocks with extremely high payout ratios, which may signal limited growth reinvestment.

Why is it important to time the purchase of dividend stocks?

Timing matters when purchasing dividend stocks due to the ex-dividend date. If you buy a stock on or after this date, you won’t receive the next dividend payout.

Key dates to remember

Ex-dividend date. The cutoff date to qualify for the next dividend. Buying on or after this date disqualifies you from the payout.

Record date. The date when a company checks its shareholder records to determine dividend eligibility.

Example: If a company sets March 1st as its record date and February 25th as its ex-dividend date, only investors holding the stock before February 25th will receive the dividend. Purchases made on or after February 25th won’t qualify for the payout.

To time your dividend stock purchase correctly, you would need a stock broker that has timely execution capabilities. We have prepared a list of top stock brokers below to help you filter out the best options:

| Demo | Account min. | Interest rate | Basic stock/ETF fee | Min. stock/ETF fee | Inactivity fee | Deposit fee, % | Withdrawal fee | Open an account | |

|---|---|---|---|---|---|---|---|---|---|

| Yes | No | No | $3 per trade | $3 per trade | $50 | No | $25 for wire transfers out | Open an account Via eOption's secure website. |

|

| No | No | 1 | Zero Fees | Zero Fees | No inactivity fees | No | No charge | Open an account Via Wealthsimple's secure website. |

|

| No | No | No | Zero Fees | Zero Fees | No | No | $25 | Study review | |

| No | No | 0,15-1 | Standard, Plus, Premium, and Metal Plans: 0.25% of the order amount. Ultra Plan: 0.12% of the order amount. | £1.00 in the UK, €1.00 in the Eurozone | Not specified | No | No charge up to a limit | Study review | |

| Yes | No | 4,83 | 0-0,0035% | $1,00 | No | No | No | Open an account Your capital is at risk. |

It’s important to focus on dividends that are here to stay, not just the yield

For those new to investing, it’s important to focus on dividends that are here to stay, not just the yield. Some stocks might seem tempting because of their high yields, but if the company's financials aren't solid, it could be a risky bet. Look for companies with solid earnings and a moderate payout ratio. This means the company is more likely to keep paying you. Companies with good cash flow and a steady dividend history are a better bet for consistent returns.

Additionally, think about sectors and market conditions when choosing stocks. Some industries, like utilities and real estate, tend to pay higher dividends, but growth might be limited. On the other hand, tech and healthcare companies might offer lower dividends but more room for growth. Look for stocks that are temporarily undervalued — they offer a chance for growth too. These stocks can give you income while also growing your investment over the long term.

Conclusion

Cheap dividend stocks can be valuable if they align with an investor's financial goals, risk tolerance, and strategy. While dividend payments aren’t guaranteed — companies can cut or suspend them — a well-chosen dividend growth stock can provide a steady, compounding income stream.

FAQs

Should I focus only on the dividend yield when evaluating cheap stocks?

No, focusing solely on dividend yield can be misleading. A very high yield might indicate financial distress or an unsustainable dividend. Consider other factors, such as the company’s payout ratio, cash flow, debt levels, and growth potential.

What are cheap dividend stocks?

Cheap dividend stocks refer to shares of companies that trade at relatively low prices (often measured by their price-to-earnings ratio or absolute stock price) but offer high dividend yields. These stocks allow investors to earn steady income while potentially benefiting from stock price appreciation.

Are cheap dividend stocks worth buying?

Yes. High-paying, cheap dividend stocks provide a regular source of income. Dividend stocks also tend to be more established and less volatile than non-dividend-paying stocks.

Can dividends make you rich?

Over the long run, dividends can make someone rich. However, relying solely on dividends to achieve financial wealth might not be the most prudent investment strategy, since dividends are only one source of investment returns.

Related Articles

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

Xetra is a German Stock Exchange trading system that the Frankfurt Stock Exchange operates. Deutsche Börse is the parent company of the Frankfurt Stock Exchange.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.