Top 10 Monthly Dividend Paying Stocks to Watch in 2024

Top commission-free stock broker - eToro

The best 10 monthly dividend paying stocks to invest are:

-

Fortitude Gold (FTCO): Monthly dividends, strong financials, high-grade gold focus

-

Gladstone Capital Corp. (GLAD): High monthly yield, experienced management, debt securities focus

-

Horizon Technology Finance Corp. (HRZN): High yield, tech sector exposure, debt focus

-

Modiv Industrial (MDV): Stable dividend yield, industrial real estate focus, growth potential

-

Main Street Capital Corp. (MAIN): High dividend yield, consistent growth, diversified portfolio

-

Dynex Capital (DX): Impressive dividend yield, low-risk investments, experienced management

-

LTC Properties (LTC): Strategic healthcare real estate, monthly dividends, potential for interest rate-driven rally

-

EPR Properties (EPR): Experiential real estate focus, FFO recovery, balanced portfolio

-

Pennant Park Floating Rate Capital Ltd. (PFLT): Dependable monthly income, senior secured loans, experienced management

-

Diversified Royalty Corp. (DIV): Diverse royalty portfolio, high yield, potential for capital appreciation

In this article, TU experts will delve into the top 10 monthly dividend-paying stocks for potential investors in 2024. The focus will be on providing a comprehensive analysis of each recommended stock, highlighting key factors such as monthly dividend yield, financial performance, growth potential, and the expertise of the management teams. The experts will offer insights into the unique aspects of each stock, guiding investors on the reasons to consider these particular investments.

Additionally, the article will discuss the pros and cons of investing in monthly dividend stocks, offering a balanced perspective on the benefits and potential drawbacks. Practical tips for navigating the monthly dividend stock market in 2024 will also be provided, including considerations related to financial strength, dividend track record, growth potential, and tax implications.

-

What are monthly dividend stocks?

Monthly dividend stocks are investments that pay dividends to shareholders every month, providing a regular income stream.

-

How do monthly dividend stocks differ from traditional stocks?

Monthly dividend stocks distribute earnings on a monthly basis, offering a more frequent payout schedule compared to the typical quarterly dividends of traditional stocks.

-

Why consider monthly dividend stocks for long-term growth?

Monthly dividend stocks provide consistent income, compounding the potential for long-term wealth accumulation and offering stability in a diversified portfolio.

-

What should investors consider before choosing monthly dividend stocks?

Factors such as financial strength, dividend track record, growth potential, and tax implications should be assessed to make informed investment decisions.

Best monthly dividend paying stocks to invest

| Stock Name | Stock Ticker | Dividend Yield | Market Cap (Billion) |

|---|---|---|---|

Fortitude Gold |

FTCO |

8.20% |

1.42 |

Gladstone Capital Corp. |

GLAD |

8.90% |

0.44 |

Horizon Technology Finance Corp. |

HRZN |

7.32% |

0.33 |

Modiv Industrial |

MDV |

4.72% |

2.34 |

Main Street Capital Corp. |

MAIN |

6.08% |

0.4 |

Dynex Capital |

DX |

8.00% |

0.26 |

LTC Properties |

LTC |

5.88% |

4.44 |

EPR Properties |

EPR |

5.40% |

3.46 |

Pennant Park Floating Rate Capital Ltd. |

PFLT |

8.50% |

0.27 |

Diversified Royalty Corp. |

DIV |

7.50% |

0.23 |

1 Fortitude Gold (FTCO)

Investing in Fortitude Gold (FTCO) in 2024 appears promising due to its strong financial performance, debt-free operation, focus on high-grade gold deposits, positive gold market outlook, and experienced management team.

| Aspect | Reason to Invest in FTCO |

|---|---|

Monthly Dividends |

FTCO provides a consistent monthly dividend, offering a forward yield of 7.97%, making it an attractive option for income-seeking investors |

Financial Performance |

The company achieved its 2023 gold production target and maintains a consistently profitable track record, showcasing its operational efficiency and stability |

Debt-Free and Growth-Oriented |

Operating without debt reduces financial risks, and the company actively explores new mining projects, positioning itself for potential future expansion and growth |

High-Grade Gold Deposits |

FTCO focuses on projects with rich gold deposits, potentially leading to efficient production and lower operating costs |

Positive Gold Outlook |

Analysts predict a rise in gold prices in 2024 due to economic uncertainties and inflation. This positive outlook could benefit gold producers like FTCO, potentially leading to higher stock prices |

Experienced Management Team |

The company boasts an experienced management team in the mining industry, enhancing confidence in their ability to navigate challenges and drive future success |

2 Gladstone Capital Corp. (GLAD)

Investing in Gladstone Capital Corp. (GLAD) in 2024 is attractive due to its high monthly dividend yield, experienced management team, focus on relatively stable debt securities, potential for capital appreciation, and the tax advantages associated with its Business Development Company (BDC) classification. The combination of regular income and growth potential makes GLAD a compelling investment option.

| Aspect | Reason to Invest in GLAD |

|---|---|

High Monthly Dividend Yield |

GLAD offers a robust 8.9% annual dividend yield, paid out monthly. This appeals to income-seeking investors desiring regular cash flow |

Experienced Management Team |

Managed by Gladstone Investment Corporation, a well-established firm with a proven track record in the financial services industry |

Focus on Debt Securities |

GLAD primarily invests in senior secured loans and mezzanine debt of established businesses, which are considered less risky than equities |

Potential for Capital Appreciation |

While income is a primary focus, GLAD also invests in equity securities, providing potential for long-term capital appreciation. Investors benefit from both regular dividends and potential stock value growth |

Tax Advantages (BDC Classification) |

GLAD is classified as a Business Development Company (BDC), offering tax advantages to investors, such as the ability to deduct a portion of received dividends from taxable income |

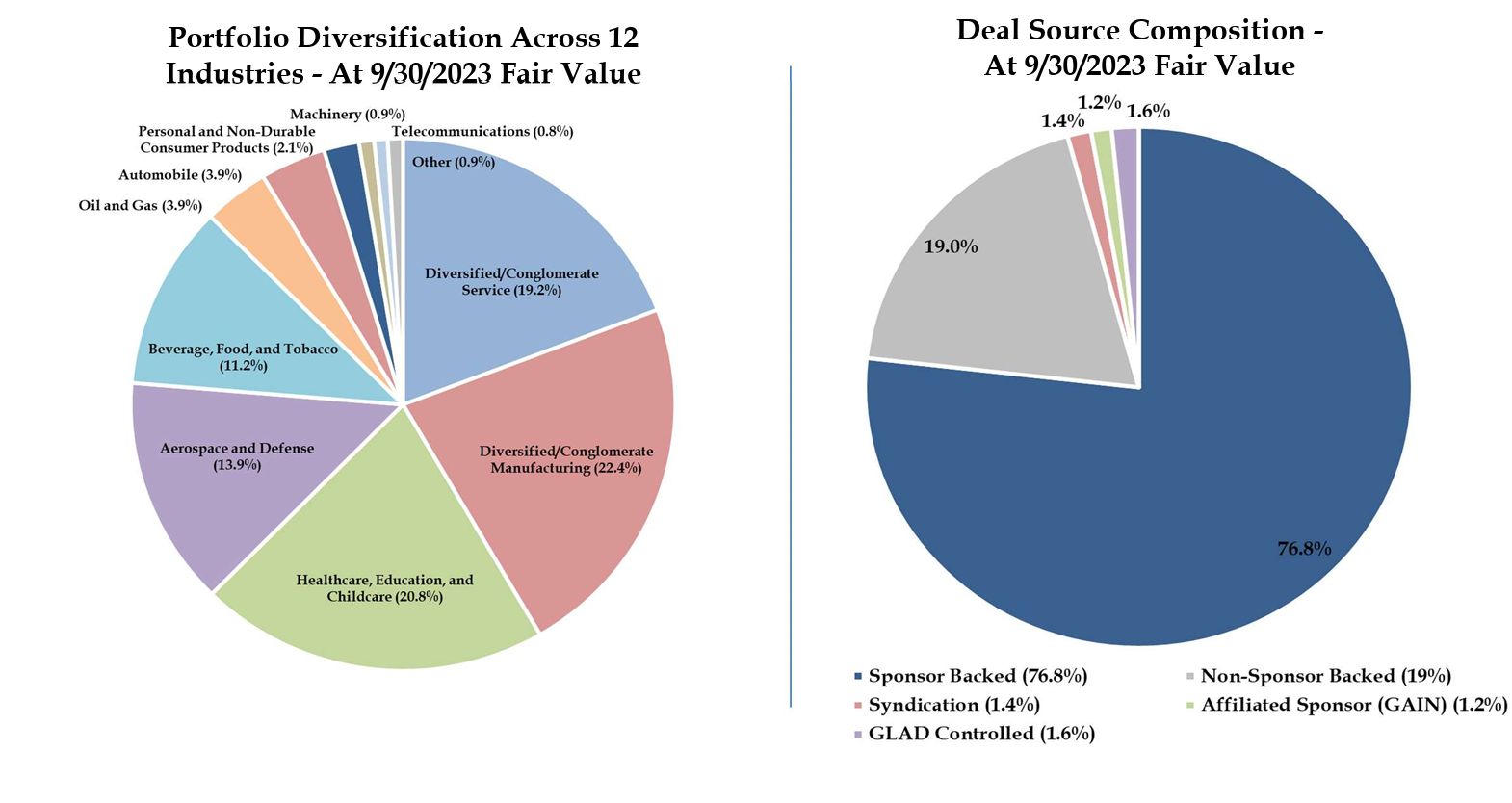

GLAD portfolio diversification

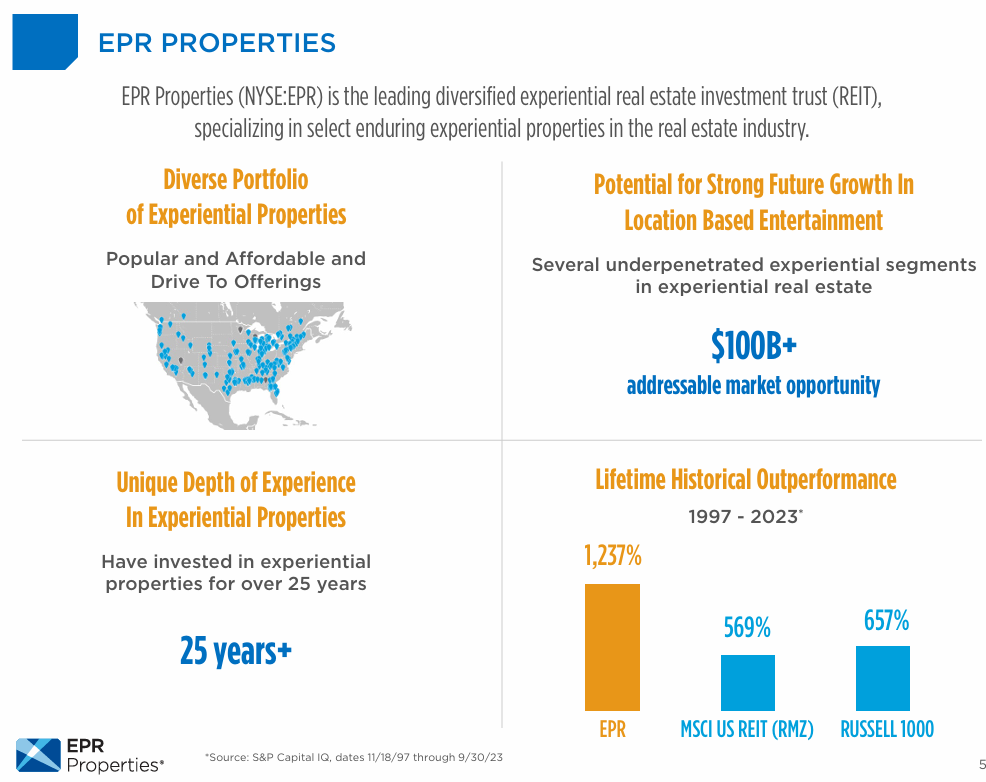

3 EPR Properties (EPR)

EPR Properties, a unique real estate investment trust (REIT), specializes in experiential properties, including theaters, tourist attractions, fitness centers, and more. As of 2024, it stands out as an appealing investment option for several reasons.

Key Factors

-

Strong FFO Recovery

EPR Properties experienced a robust post-pandemic recovery, with funds from operations (FFO) rebounding to pre-pandemic levels. This recovery is indicative of the resilience of the experiential real estate sector and positions EPR for continued growth -

Balanced Portfolio

With a diversified portfolio comprising various experiential properties, EPR has strategically reduced its exposure to the theater segment, adapting to changing consumer trends. This flexibility enhances the REIT's ability to navigate evolving market dynamics -

Stable Monthly Dividend

EPR Properties resumed its monthly dividend payments, currently at $0.275 per share. The dividend coverage ratio of 178% in Q3 2023 indicates a well-supported payout, offering investors a reliable income stream -

Potential Upside

EPR Properties, currently trading at a forward P/FFO ratio of 9.1X, has the potential for revaluation. Assuming a conservative 5% growth in adjusted FFO in 2024 to $5.40 per share, a fair value calculation suggests a potential upside of around 32%, reaching a fair value closer to $65

EPR Properties

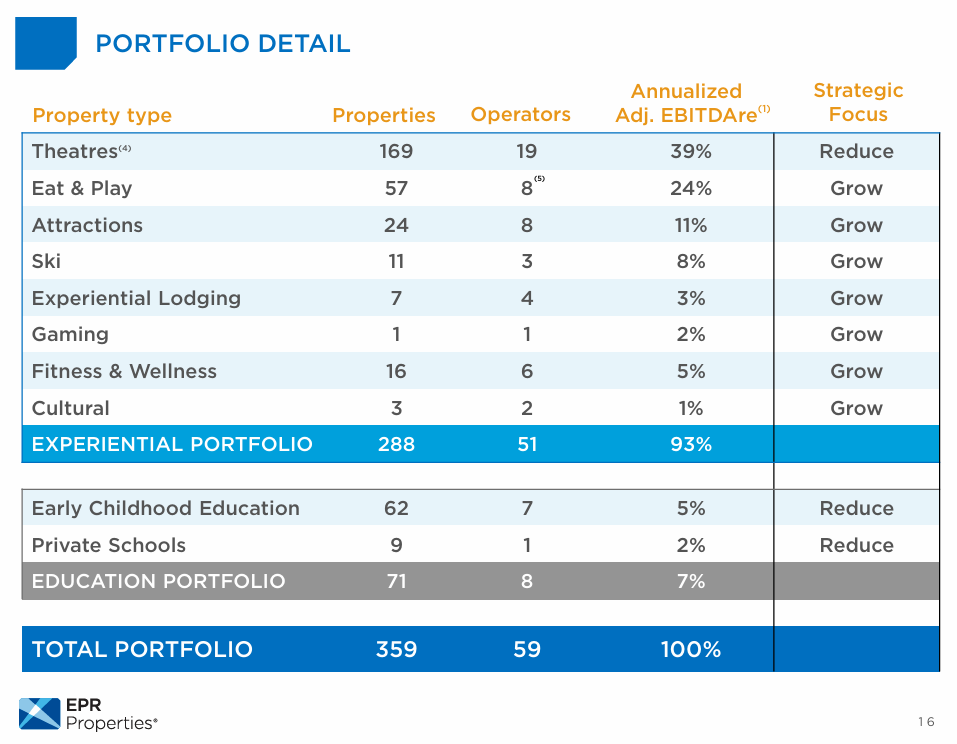

EPR Properties portfolio

4 Horizon Technology Finance Corp. (HRZN)

Investing in Horizon Technology Finance Corp. (HRZN) in 2024 is an attractive opportunity for investors seeking a combination of high yield and exposure to promising sectors.

High Yield

HRZN historically offers attractive yields, with a total annualized yield of 14.4% in 2023. This exceeds returns from many traditional investments, providing a lucrative income stream.

Exposure to High-Growth Tech Sectors

HRZN's portfolio is heavily invested in high-growth sectors like technology and life sciences. This strategic focus provides indirect access to potential long-term capital appreciation as these sectors thrive.

Debt Focus with Secured Loans

HRZN prioritizes debt investments, offering more stability during market downturns compared to equity investments. The focus on secured loans provides additional downside protection, reducing potential losses.

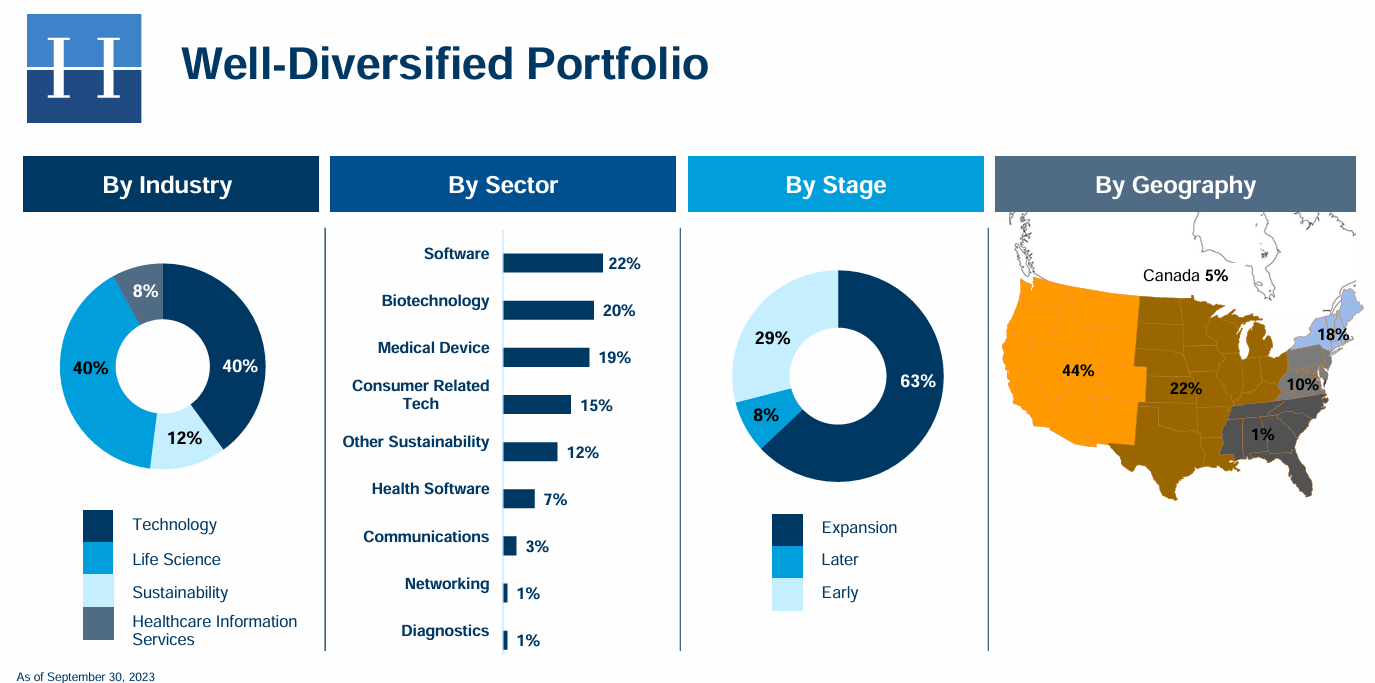

Geographic Diversification

HRZN exhibits excellent geographic diversification which minimizes regional risk and enhances stability.

| Region | Percentage of Investments |

|---|---|

Western U.S. |

38% |

Midwest |

29% |

East Coast |

28% |

Canada |

8% |

Experienced Management Team

Affiliated with Monroe Capital, HRZN benefits from the expertise of a well-established investment firm with a proven track record in debt financing and venture capital. The experienced management enhances confidence in the investment strategy.

Monthly Distributions

HRZN provides predictable monthly distributions, ensuring a consistent income stream for investors. This reliable cash flow is particularly appealing for income-focused investors looking for regular returns.

Horizon Technology Finance Corp. portfolio

5 Modiv Industrial (MDV)

Investing in Modiv Industrial (MDV) in 2024 presents a compelling opportunity for a well-rounded real estate investment. MDV, a Real Estate Investment Trust (REIT) based in Reno, NV, specializes in single-tenant net-lease industrial properties across the U.S.

| Aspect | Reason to Invest in MDV |

|---|---|

Strong Dividend Yield |

MDV offers a high annual dividend yield of around 9.58 cents per share paid out monthly, providing consistent and attractive income for investors |

Focus on Industrial Real Estate |

MDV strategically invests in industrial properties, including warehouses and distribution centers. The current high demand in this sector, driven by e-commerce growth and supply chain disruptions, ensures stable tenants and long-term leases, contributing to predictable income streams |

Growth Potential |

MDV actively pursues property acquisitions and development, expanding its portfolio. With a focus on high-growth markets and strategic partnerships, MDV has the potential to increase its dividend payouts in the future |

Experienced Management Team |

The company is led by a management team with extensive experience in the real estate industry. Their proven track record of successful acquisitions and portfolio management instills confidence in MDV's ability to navigate the market and deliver returns to investors |

Defensive Characteristics |

Industrial real estate, the primary focus of MDV, tends to perform well during economic downturns. The essential nature of storage and distribution needs for companies provides a defensive quality to MDV's portfolio, offering stability even in challenging economic times |

Potential for Dividend Increase |

With the expectation of considerable growth in funds from operations (from $1.08 to $1.73 per share), there is the possibility of a significant dividend increase, making MDV more appealing to income-focused investors |

6 Main Street Capital Corp. (MAIN)

Main Street Capital Corp. (MAIN) stands out as an investment option in 2024 due to its high dividend yield, consistent dividend growth, solid financial performance, and diversified portfolio.

| Key Factors | Reasons to Consider MAIN |

|---|---|

High Dividend Yield |

MAIN offers an attractive 6.6% dividend yield, providing investors with a steady income stream. This is particularly appealing for those seeking regular payouts and income generation from their investments |

Consistent Dividend Growth |

MAIN has a strong track record of consistently increasing its monthly dividends for 17 consecutive quarters. This commitment to enhancing shareholder value suggests stability and the potential for future dividend hikes |

Solid Financial Performance |

The company's financials exhibit a robust 81.6% profit margin and impressive year-over-year quarterly sales growth of 25.2% as of January 2024. This solid performance indicates profitability and a promising growth trajectory |

Diversified Portfolio |

MAIN invests in a diversified portfolio across various industries, including manufacturing, communications, technology, healthcare, and retail. This diversification helps spread risk and provides exposure to potential high-growth opportunities |

Additional Insights

-

MAIN's strategy involves a mix of both equity and debt investments, making it somewhat more volatile than BDCs focused solely on debt. However, this strategy also offers superior potential for capital appreciation

-

The company typically invests in lower-middle-market U.S. companies generating $10 million to $1.5 billion in revenue, with investments ranging from $3 million to $75 million

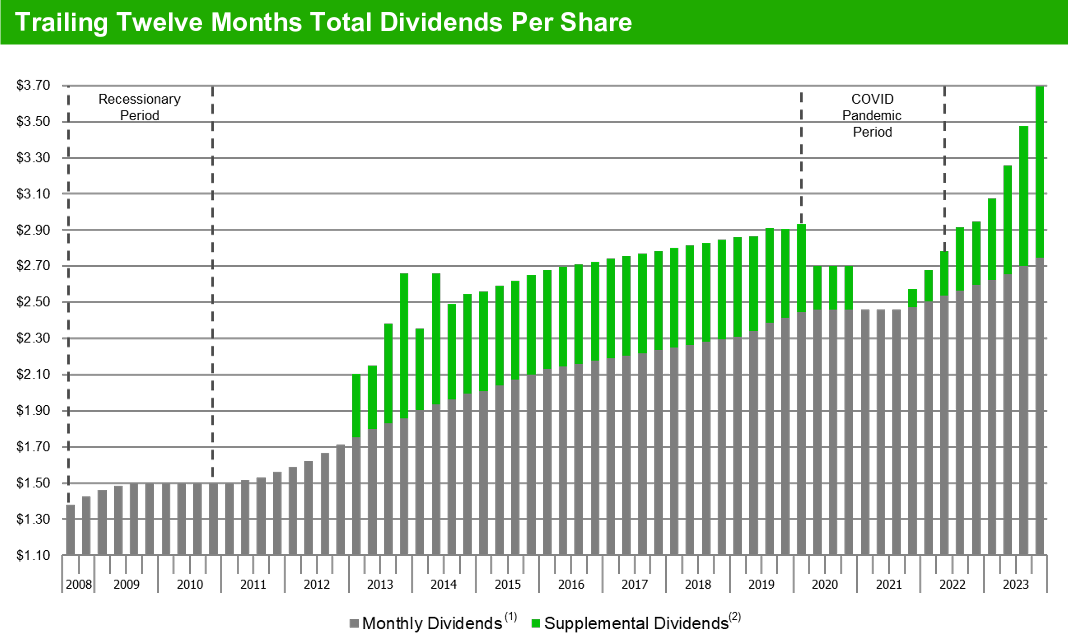

Charts total dividends

7 Dynex Capital (DX)

Dynex Capital (DX) stands out as an investment option in 2024 due to several compelling reasons.

| Key Reasons to Consider DX | Why Invest in Dynex Capital (DX) |

|---|---|

High Dividend Yield |

DX offers an impressive monthly dividend yield of around 9.6%, significantly higher than the average S&P 500 yield |

Focus on Low-Risk Investments |

DX primarily invests in agency Mortgage-Backed Securities (MBS), which are backed by the U.S. government. These are generally considered low-risk investments, providing stability and predictability to the company's income stream |

Potential for Capital Appreciation |

While DX focuses on generating income, its investments in non-agency MBS and Commercial MBS (CMBS) also provide potential for capital appreciation. If the housing market performs well, these investments could yield higher returns |

Positive Earnings Performance |

DX recently exceeded analyst expectations for both net income and core earnings per share in its Q4 and full-year 2023 earnings reports. This positive financial performance signals the company's resilience and ability to weather challenges |

Dividend Increase |

The company declared a monthly dividend of $0.13 per share, reflecting a 5% increase from previous quarters |

8 LTC Properties (LTC)

As per the experts, several factors make LTC an attractive investment choice for 2024.

Strong Industry Outlook

LTC stands to benefit from the "graying of America," reflecting the increasing percentage of Americans aged 65 or over. This demographic trend points to sustained demand growth for elder care services, positioning LTC favorably in a sector with promising long-term growth prospects.

Solid Occupancy Rate

LTC has demonstrated resilience and tenant attractiveness by maintaining consistently high occupancy rates above 90%, even throughout the challenges posed by the pandemic.

Conservative Leverage

LTC maintains a conservative financial profile with a debt-to-equity ratio of around 0.54. This conservative leverage approach strikes a balance between risk and return, enhancing the financial stability of the company and instilling confidence in investors.

Monthly Dividend Payouts

LTC Properties is known for its monthly dividend payouts, providing investors with a steady and predictable income stream. The forward yield of 7.1% on an annual basis makes it an attractive option for income-focused investors, especially in an environment where interest rates may influence the performance of REITs.

Potential for Interest Rate-Driven Rally

Like many REITs, LTC Properties could experience a rally if interest rates move lower in the coming year. Lower interest rates tend to make dividend-yielding stocks, such as LTC, more appealing to investors, potentially driving share prices higher.

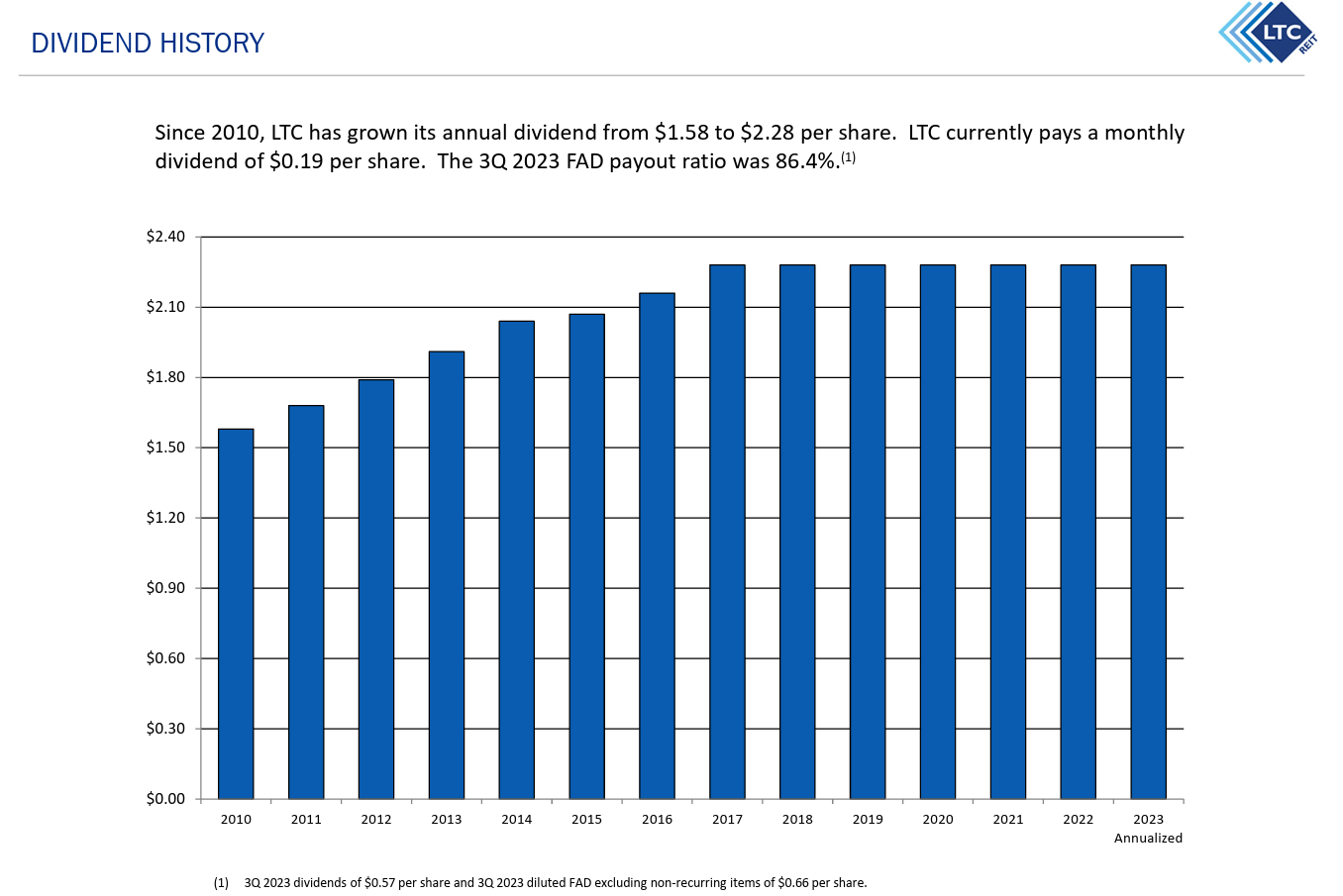

LTC dividend history

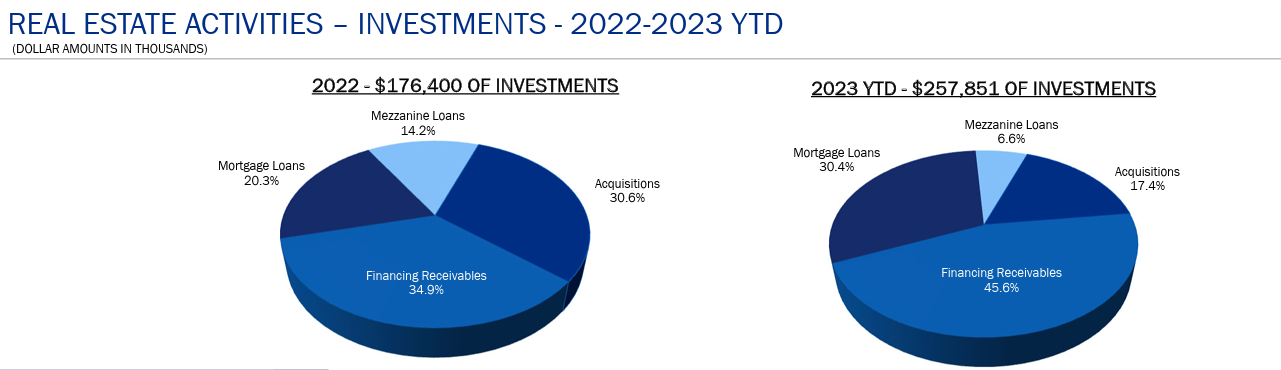

LTC real estate activities

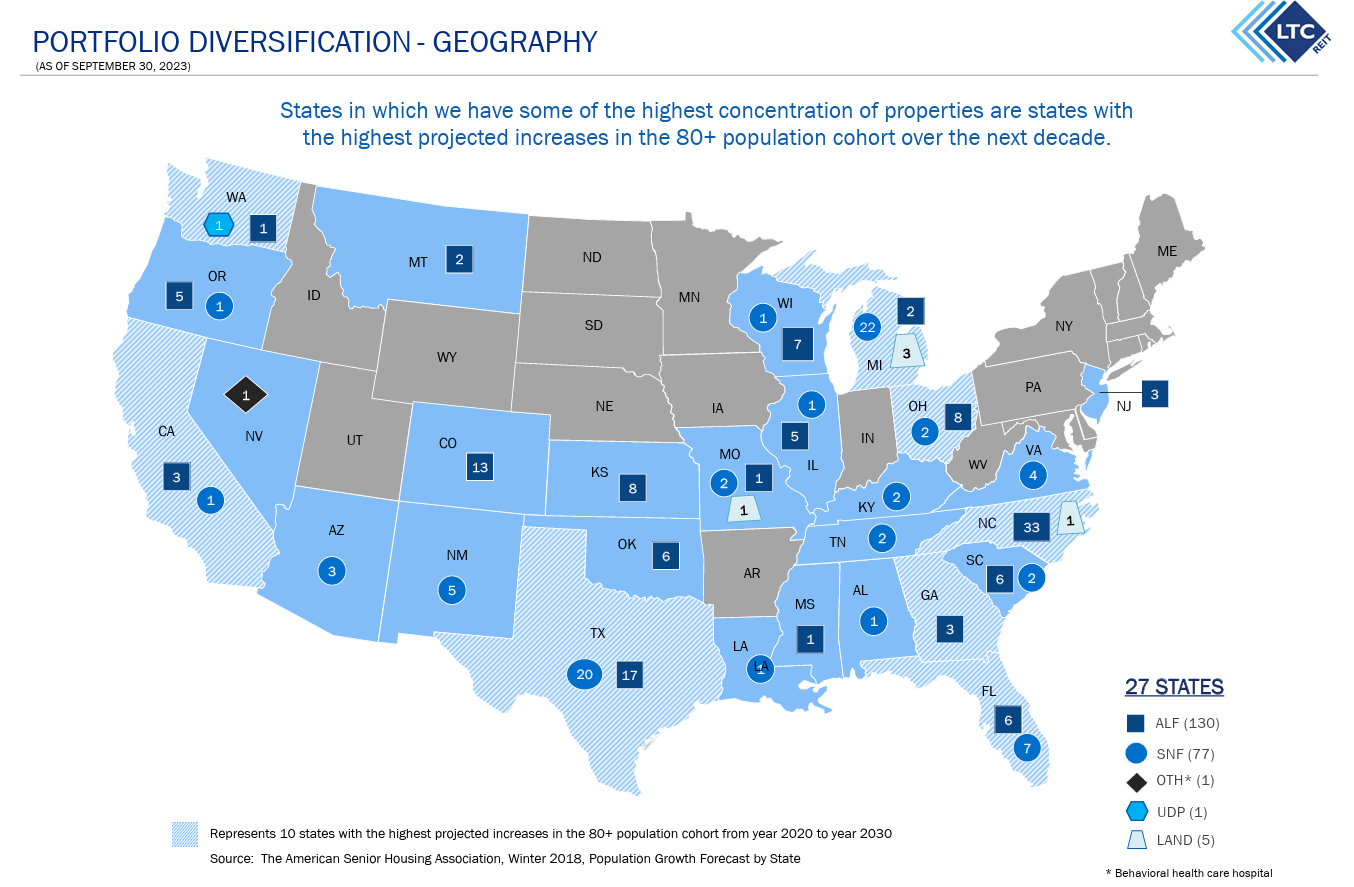

LTC portfolio diversification - geography

9 Pennant Park Floating Rate Capital Ltd. (PFLT)

The table below outlines compelling reasons to consider investing in Pennant Park Floating Rate Capital Ltd. (PFLT) in 2024, showcasing its attractive monthly dividend yield, focus on stable senior secured loans, experienced management team, and a strong track record of consistent returns and profitability.

| Reasons to Invest in PFLT in 2024 | Details |

|---|---|

Dependable Monthly Income Yield |

PFLT offers a consistent monthly income yield of around 10%, providing a reliable and attractive source of income for investors |

Focus on Floating-Rate Loans |

The company's emphasis on originating floating-rate loans adds a layer of stability as the interest adjusts based on benchmarks like three-month LIBOR. Floating-rate securities tend to be less volatile than their fixed-rate counterparts |

Preservation of Capital |

PFLT's commitment to preserving capital for shareholders highlights a risk-conscious approach, aiming for stability and long-term value |

Attractive Monthly Dividend Yield |

With a high monthly dividend yield of approximately 8.8%, PFLT stands out as an appealing choice for income-seeking investors, especially in a low-interest environment |

Focus on Senior Secured Loans |

The majority of PFLT's investments in senior secured first-lien loans to mid-sized companies enhance stability and income predictability, mitigating risks associated with unsecured loans or equities |

Recent Positive Developments |

PFLT declared its January 2024 monthly distribution of $0.1025 per share, payable on February 1st. The company released its Q1 2024 earnings report on February 7th, exceeding analyst expectations for net income and core earnings per share |

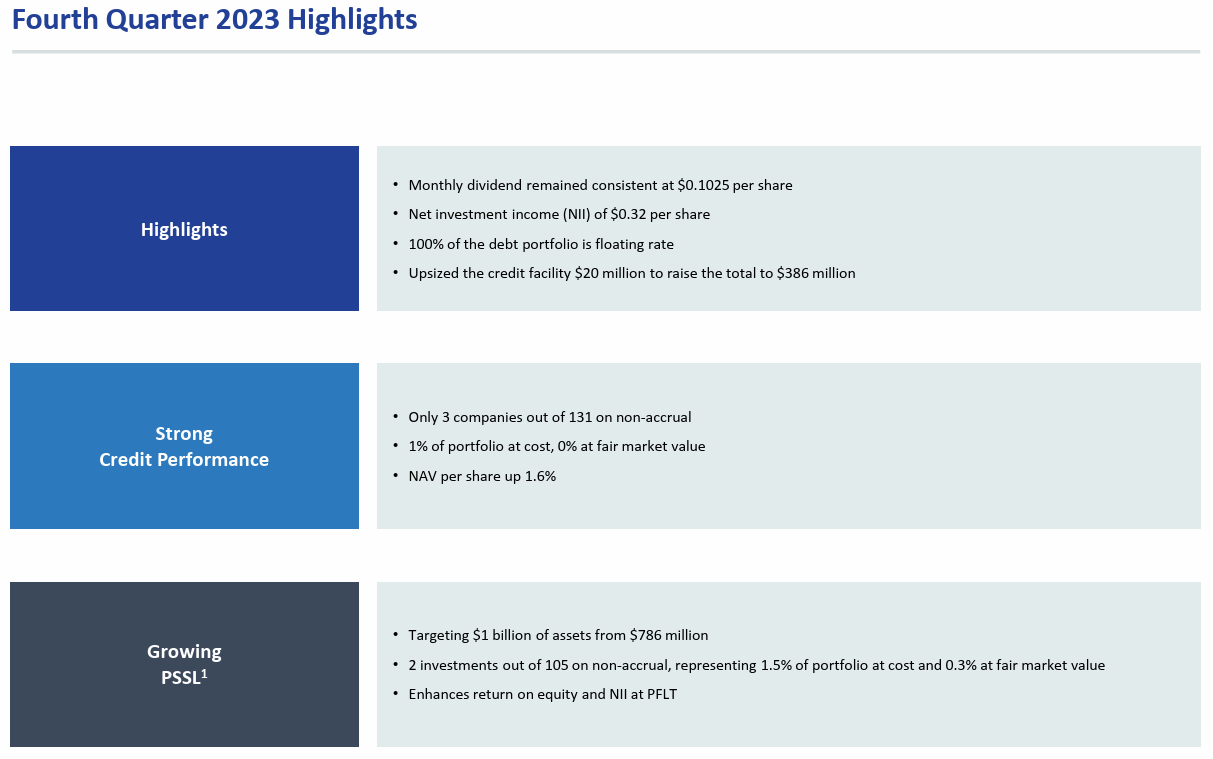

Pennant Park Floating Rate Capital Ltd. - highlights

10 Diversified Royalty Corp. (DIV)

Investing in Diversified Royalty Corp. (DIV) in 2024 is a strategic choice backed by several compelling factors:

-

Diversification Across Sectors

DIV's portfolio spans various sectors such as food & beverage, retail, and automotive services. This diversification strategy mitigates risks associated with investing in a single company or industry, providing a well-rounded and resilient investment -

High Dividend Yield

DIV currently boasts an impressive dividend yield of around 7.5%, which is notably higher than the average yield of the S&P 500. This makes DIV an attractive option for investors seeking regular income, especially in a low-interest environment -

Potential for Capital Appreciation

While DIV's primary focus is on generating income through royalties, the underlying businesses in its portfolio also hold potential for growth. This dual benefit provides investors with the opportunity for capital appreciation over time -

Diverse Royalty Portfolio

DIV owns royalties for well-known trademarks such as Mr. Lube + Tires, AIR MILES®, Sutton, Mr. Mikes, Nurse Next Door, Oxford Learning Centres, Stratus Building Solutions, and BarBurrito -

Dividend Policy and Growth Plans

DIV's objective is to acquire predictable and growing royalty streams. As of January 3, 2024, DIV announced a cash dividend of $0.02042 per common share for the period of January 1, 2024, to January 31, 2024. This dividend, equivalent to $0.245 per common share on an annualized basis, reflects DIV's commitment to delivering returns to its shareholders

Best Stock brokers

Pros and Cons of Investing in monthly dividend paying stocks

| Pros of Monthly Dividend Stocks | Cons of Monthly Dividend Stocks |

|---|---|

Regular Income: Provides a predictable income stream |

Lower Total Returns: Historically, many underperform stocks reinvesting earnings |

Compounding: Reinvesting dividends can aid investment growth |

Tax Implications: Dividends are taxed as ordinary income, potentially at higher rates |

Focus on Mature Companies: Often represents stable, established firms |

Sustainability Risk: Companies may cut dividends in financial difficulties |

Psychological Benefit: Regular dividends can boost investor morale |

Limited Growth Potential: Emphasizing payouts over reinvesting may restrict stock appreciation |

Tips for investing in monthly dividend paying stocks in 2024

| Investment Considerations | Description |

|---|---|

Financial Strength |

Look for companies with a strong history of profitability, robust cash flow, and manageable debt levels. Be cautious of high payout ratios, which may indicate unsustainable dividends |

Dividend Track Record |

Prioritize companies with a consistent track record of paying and ideally increasing dividends, showcasing a commitment to shareholder rewards |

Growth Potential |

Assess companies for growth prospects beyond immediate income. Analyze industry standing, competition, and future plans, as these can influence future dividend increases |

Dividend Yield |

Avoid chasing excessively high yields, which may signal unsustainable dividends. Compare yields with similar companies in the sector for a realistic assessment |

Tax Implications |

Understand the tax implications of monthly dividends based on your income bracket and location, ensuring compliance with tax regulations |

Liquidity |

Mitigate risk by diversifying your portfolio across various companies and sectors, preventing over-reliance on a single investment |

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Tobi Opeyemi Amure is an editor and expert writer with over 7 years of experience. In 2023, Tobi joined the Traders Union team as an editor and fact checker, making sure to deliver trustworthy and reliable content. The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options.

Tobi Opeyemi Amure motto: The journey of a thousand miles begins with a single step.