How To Start Generating Passive Income

As per the experts the top 15 Passive Income ideas in stocks and crypto are:

-

1

Stocks for Dividends and Capital Gains – Dual income and stable growth

-

2

Real Estate Investment Trusts (REITs)– Accessible real estate and growing industry

-

3

Investing in Bonds – Steady income, and lower risk

-

4

Robo-Advisors – Tech-driven, low fees, personalized, millennial adoption

-

5

Option Selling in the Options Market – Premium income, risk management, strategic options

-

6

Copy Trading – Time-saving, low barriers, diversification, monitored performance

-

7

Peer-to-Peer (P2P) Lending – Modern borrowing, lower rates, diversification, reputable platforms

-

8

Broker Affiliate Programs – High earnings, low upfront investment, consistent income

-

9

Royalty Trusts – Passive income, natural resources, intellectual property

-

10

AI-Based YouTube Channel – Automated content, reduced costs, growing viewership

-

11

Bitcoin – High returns, decentralized, limited supply

-

12

Crypto Staking – Earn rewards, enhance security, eco-friendly

-

13

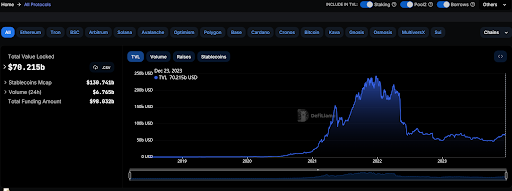

DeFi Lending – High interest, no intermediaries, blockchain automation

-

14

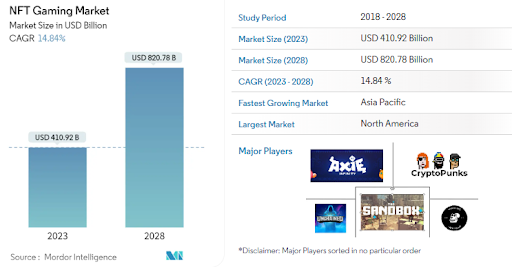

Play-to-Earn Games – Real value through gameplay, NFT ownership

-

15

NFT Rentals – Passive income, broaden market reach, true ownership

In this guide, the experts at TU have explored the top 15 strategies for generating passive income, covering traditional options like stocks and real estate along with newer opportunities in cryptocurrencies. The experts also share insights on managing risks, the impact of AI-driven ventures, and providing a roadmap for investors.

Start trading stocks right now with eToro!-

What is passive income in simple terms?

Passive income is money earned with minimal effort, often through investments or ventures that require little day-to-day involvement.

Securities

Buying stocks and for dividends and capital gains

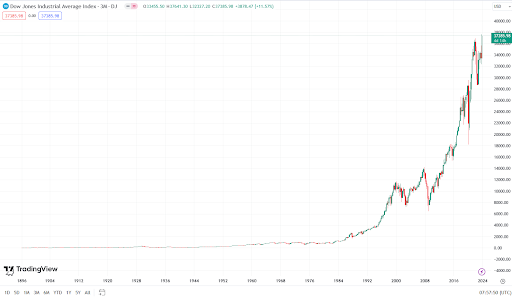

When you're thinking about buying stocks, there are two main ways you can make money: dividends and capital gains. Dividends are like a share of the company's profits that they give to their shareholders. On the flip side, capital gains happen when you sell your investment for a higher price than the original purchase price. The returns of Dow Jones best illustrate the potential of stocks in terms of the latter.

Dow Jones Growth Since Inception

If you want stocks that give you both dividends and the potential for capital gains, here are some things to look at

-

Dividend Yield – This is basically the annual dividend payment divided by the current stock price. You'll want to find companies where this is at least 2%.

-

Dividend Payout Growth Rate – This tells you how fast the company has been increasing its dividend payments over time. Look for companies that have been growing this rate by at least 5%.

-

Dividend Payout Ratio – This is the percentage of the company's earnings that they pay out as dividends. It's good to stick with companies that pay out around 60% of their earnings as dividends.

Also, it's smart to go for companies that have been profitable for a long time and are expected to keep growing their earnings between 5% and 15%. Make sure they're making enough money to cover the dividends they're paying out. And try to avoid companies that have a lot of debt compared to what they own.

Real estate investment trusts (REITs)

Investing in real estate has long been considered a reliable way to build wealth, but getting started can be tough due to high entry barriers. Fortunately, there's a more accessible route and that is Real Estate Investment Trusts (REITs). These investments open the door to the real estate market without demanding a huge upfront investment.

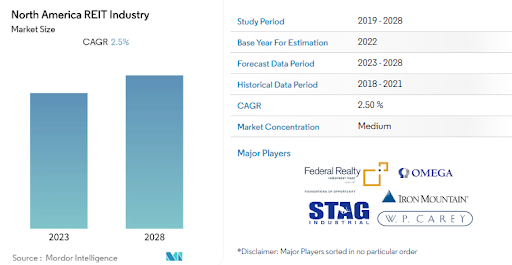

Real Estate Industry Prospects

-

The worldwide Real Estate ETF market is expected to hit $2 trillion by 2027, indicating substantial growth potential.

-

REITs have a track record of outperforming the overall stock market when it comes to total returns.

-

Growing investor interest in alternative investments, particularly real estate, is fueling the demand for Real Estate ETFs.

North America REIT Industry

Taking it a step further, there's Real Estate ETFs (Exchange-Traded Funds). These are like bundles of REITs that you can trade on the stock exchange, making the process even more convenient. They provide immediate diversification, which means your money is spread across various types of properties like apartments, offices, malls, and hotels.

| Type of REIT | Description |

|---|---|

Equity REITs |

Invest directly in real estate ownership, earning income through rental payments. |

Mortgage REITs |

Invest in mortgages and mortgage-backed securities, making money from interest on loan payments. |

Hybrid REITs |

Combine both equity and mortgage investments, providing a balanced income stream. |

Regional REITs |

Concentrate on specific geographical areas, enabling you to target high-growth markets. |

Sector-Specific REITs |

Focus on particular property types, such as healthcare or industrial facilities. |

Diversifying real estate investments reduces risk by spreading money across various properties. Real Estate ETFs offer easy trading, lower entry barriers, and professional management. Choose ETFs aligning with your goals, with low expense ratios, and analyze their historical performance for better decision-making.

On the contrary, these funds still face market ups and downs, even though they're generally less volatile than individual properties. Keep an eye on interest rates when they rise, as it can impact the value and income of Real Estate Investment Trusts (REITs) in the ETF. Additionally, some lesser-known ETFs might not trade as easily due to lower popularity.

Investing in bonds

| Particulars | Key Points |

|---|---|

Core Benefits |

● Bonds balance market ups and downs. |

Expert Tips |

● Choose bonds based on your risk tolerance . |

Risks |

● Rising rates can impact bond values. |

An Overview of bonds

Bonds play the role of reliable workhorses in the investment world, providing a steady income stream and a lower risk profile compared to stocks. Though they may lack the excitement of equities, their stability makes them essential anchors for well-rounded portfolios. The core factor governing this asset class is the United States 10 Year Government Bond Yield.

United States 10 Year Government Bonds Yield Since Inception

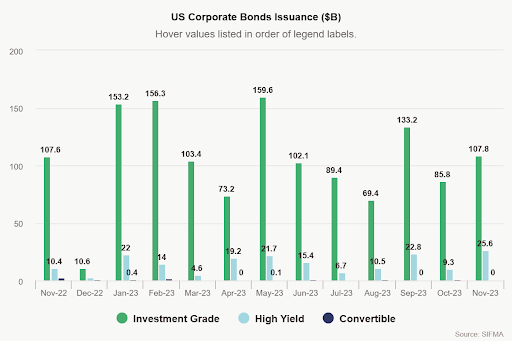

Despite bond prices experiencing fluctuations influenced by changes in interest rates, the entire bond market is projected to reach $131 trillion by 2027. The various types of bonds available cater to a range of risk tolerances and investment objectives.

US Corporate Bonds Issuance ($B) for last 12 months

Types of bonds

| Type of bond | Issuer | Risk level | Key features |

|---|---|---|---|

|

Treasury Bonds |

U.S. Government |

Low |

Safest option pays a fixed interest rate with a somewhat lower return |

|

Municipal Bonds |

Local governments |

Low |

Offers tax-free interest for many, focused on specific regions |

|

Corporate Bonds |

Companies |

Moderate to High |

Higher potential return, but there's a risk tied to the company's credit |

|

High-Yield Bonds |

Risky companies or projects |

High |

Attractive interest income, but a notable risk of the issuer defaulting |

|

Zero-Coupon Bonds |

Various issuers |

Moderate |

Sold at a discount, no regular interest, gains realized only at maturity |

Robo-advisors

| Benefits of robo-advisors | Potential risks | Tips |

|---|---|---|

|

Easy investing with low fees |

Limited control over strategies |

Research platforms and their fees |

|

Affordable for all investors |

Focuses solely on portfolio management |

Define your financial goals and risk tolerance |

|

Risk management through diversification |

Vulnerable to technological issues |

Regularly monitor and adjust your investment portfolio |

|

Personalized portfolios for individual goals |

Subject to market volatility |

Start with a manageable investment |

An Overview of robo-advisor investments

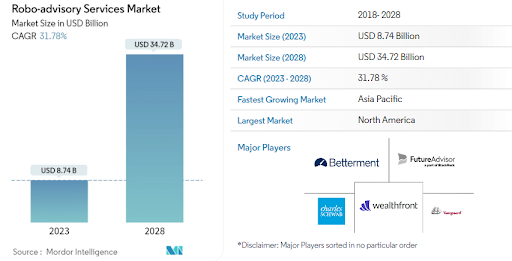

Robo-advisors are transforming how individuals approach investing, by leveraging algorithms to create and manage portfolios based on risk tolerance and financial goals. The market is witnessing a significant shift from traditional investment services to robo-advisory, driven by increased adoption of technology-enabled analytics. It is being propelled by the extensive usage of robo-advisory across retail banking, asset management, and other sectors. Technologies such as artificial intelligence (AI) and machine learning (ML) are key drivers, offering accurate and transparent advisory services. These digital platforms are gaining momentum in the USA, driven by several key factors.

Market Size and Growth

Robo-advisory Market size in USD Billion

The Robo-advisory Services Market is set to surge from USD 8.74 billion in 2023 to USD 34.72 billion by 2028, showcasing a substantial CAGR of 31.78%.

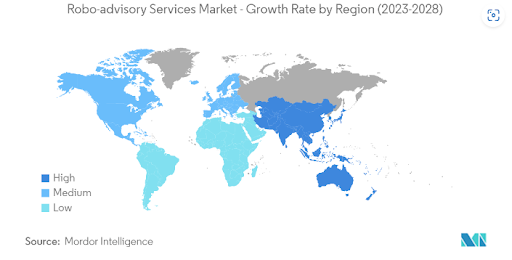

Robo-advisory Market Growth by Region

Accessibility and convenience

Robo-advisors provide low investment minimums, user-friendly interfaces, and automated portfolio management, catering to beginners and those seeking a hands-off approach.

Cost-effectiveness

With significantly lower fees compared to traditional advisors, Robo-advisors, typically charging a percentage of AUM, offer a cost-effective option for investors.

Personalization and automation

These platforms tailor portfolios based on individual goals and risk tolerance, eliminating the need for extensive research and emotional decision-making.

Tech-savvy generation

Millennials and Gen Z, comfortable with technology, are embracing Robo-advisors, contributing to the platforms' popularity.

Options selling

| Benefits of option selling | Risks of option selling | Tips for success with option selling |

|---|---|---|

|

Consistent Income regardless of market direction |

Unlimited Loss Potential if stock moves significantly against you |

Thoroughly research potential losses in different strategies |

|

Capital Preservation with downside protection |

Buyers may exercise their right before expiration |

Begin with small positions and increase gradually |

|

Maximum risk is limited to premium received |

Depending on strategy, you may be assigned the underlying stock |

Match risk tolerance to strategies like covered calls |

|

Flexibility and Diversification with various strategies |

Requires deeper understanding of options mechanics |

Implement stop-loss orders to limit potential losses |

An overview of options selling

In recent years, the options market in the US has been growing rapidly, consistently setting and surpassing previous trading records. Notably, in 2020, the options market outpaced the stock market in terms of trade volume, marking a significant milestone.

Now, let's talk about option selling, which is a strategy where an investor sells an option contract to a buyer. In this arrangement, the seller takes on the obligation to either sell or buy the underlying asset at a pre-agreed price if the buyer decides to exercise the option. As compensation for this commitment, the seller receives a premium, which is the price paid by the buyer for the option.

Options sellers employ various strategies to earn money, including the following popular ones:

| Option selling strategies | Concept | Benefits | Risk |

|---|---|---|---|

|

Covered calls |

Sell call options on owned stocks |

Earn premium, limit potential downside |

Forced sale at a potentially lower price if stock rises significantly |

|

Cash-secured Puts |

Sell put options with cash collateral |

Generate income, potential stock ownership at a discount |

Obligation to purchase shares if price falls sharply |

|

Naked puts |

Sell put options without holding stock or collateral |

Potentially high premium income |

Unlimited loss if stock price falls significantly |

|

Straddle/Strangle |

Sell both call and put options on the same stock at different strike prices |

Profit regardless of stock price movement |

Requires higher upfront premium, less profitable in a narrow stock price range |

Best Stock brokers

Alternative investment options

Copy trading

| Benefits of copy trading | Risks of copy trading | Tips for copy trading |

|---|---|---|

|

Time-saving, which means no constant market research |

Performance dependence on chosen trader |

Choose reputable platforms and traders |

|

Low barrier to entry for beginners |

Potential for copying losing trades |

Begin with a small portion of your capital |

|

Diversification potential |

Fees and commissions on copy trading |

Copy multiple traders with different styles |

|

Learning opportunity from successful investors |

Lack of control over investment decisions |

Monitor performance regularly and adjust your portfolio |

An overview of copy trading

Copy trading is an innovative investment strategy that allows you to follow the footsteps of successful investors and replicate their trades to potentially boost your own profits. It's like having a personal investment guide who takes care of making strategic moves on your behalf, offering you a hands-free approach to growing your portfolio.

How copy trading generally works

-

Choose a platform – Select a copy trading platform such as eToro, ZuluTrade or PrimeXBT.

-

Connect to your brokerage account – Link the chosen platform to your existing brokerage account.

-

Select experienced traders – Browse through a list of seasoned investors available on the platform and choose the ones you want to copy.

-

Automatic replication– Once you've chosen your preferred traders, their actions in the market are automatically duplicated in your own investment portfolio. The replication is proportionally adjusted based on the funds you have available.

Types of copy trading

-

Signal-based – Follow specific trade signals generated by algorithms or analysts.

-

Portfolio-based – Copy the entire portfolio of a chosen trader.

-

Hybrid – Combine signal and portfolio-based approaches for greater flexibility.

Peer-to-peer (P2P) lending

| Benefits | Risks | Tips for P2P Lending |

|---|---|---|

|

Potentially lower interest rates than traditional banks, especially for borrowers with good credit. |

Higher interest rates than prime borrowers at banks, potential for default and impact on credit score. |

Choose reputable platforms with strong track records and transparent fees. |

|

Higher potential returns compared to traditional savings accounts. |

Risk of borrower default, potentially leading to financial losses. |

Spread your investments across multiple loans to minimize risk. |

|

Diversification opportunities exist for both borrowers and investors. |

Dependence on platform stability and the regulatory environment. |

Be aware of the potential consequences of default and factor them into your investment decisions. |

An overview of P2P lending

Peer-to-peer (P2P) lending is a modern way for individuals and businesses to borrow and lend money directly, without involving traditional banks. This online system connects borrowers who need loans with investors who are willing to lend their money. The process is like a digital marketplace where borrowers and lenders can find each other.

| How P2P lending works | |

|---|---|

Borrowers |

1. Sign up on the P2P lending platform. |

|

Investors |

1. Explore available loan listings. |

|

Platform |

1. Acts as the intermediary, facilitating the entire process. |

Industry Insights and Findings

| Category | Insights |

|---|---|

Type (Consumer Lending) |

Dominated the market in 2022 with a revenue share of 59.14%. |

Loan Type (Unsecured) |

Dominated the market in 2022 with a revenue share of 65.08%. |

End-User (Business Loans) |

Anticipated to register the fastest CAGR of 22.3% over the forecast period. (2023-2030) |

Purpose Type (Home Renovation) |

Anticipated to register the fastest CAGR of 22.3% during the forecast period. (2023-2030) |

Region (North America) |

Dominated the market in 2022 with a revenue share of 30.24%. |

Broker affiliate programs

| Benefits | Risks | Tips for success |

|---|---|---|

|

As your audience grows, the potential for high earnings increases. |

Standing out and attracting clients can be challenging. |

Partner with a broker offering competitive commissions and reliable service. |

|

You can earn commissions even when not actively working, creating a steady flow of income. |

Financial market regulations add complexity. |

Focus on audiences interested in financial markets and trading. |

|

Requires minimal upfront investment compared to other businesses. |

Your income relies on successful referrals, with no guarantee of consistent earnings. |

Create valuable content and genuinely engage with your audience. |

An overview of broker affiliate programs

Affiliate programs for brokers are setups that bring together individuals, called affiliates, who promote a broker's services with people who might become clients. The affiliates use different marketing methods to attract potential investors and. When these referred clients sign up and possibly start trading on the broker's platform, the affiliate gets rewarded with a commission, following previously agreed-upon terms.

There are different types of affiliate programs

-

Cost-per-acquisition (CPA) – Affiliates receive a commission for each successful signup they bring in.

-

Revenue sharing – Affiliates earn a percentage of the broker's revenue generated from the trades of the clients they referred.

-

Hybrid model – This combines both CPA and revenue sharing, offering a more flexible structure for affiliates.

The broker affiliate programs market is projected to see a yearly growth of 9.2% from 2023 to 2030. This indicates a steady expansion in the industry over the coming years. Experts have further highlighted in the below table trends and predictions related to this field.

| Trend/Prediction | Description |

|---|---|

1. Regulation Focus |

Regulatory bodies are tightening oversight on forex, affecting affiliate programs. Affiliates may face more requirements, necessitating collaboration with brokers to ensure compliance and reduce risks. |

2. Social/Copy Trading Rise |

Social and copy trading's popularity may lead to tailored affiliate programs. Affiliates could earn successful trades by referring clients, promoting social and copy trading and attracting more traders. |

3. AI/ML Integration |

AI and ML may be integrated into affiliate programs, providing tools for market analysis to enhance affiliate + performance. Brokers may use AI/ML to optimize programs and improve marketing campaign effectiveness. |

4. Emerging Market Expansion |

The forex industry's expansion in emerging markets requires brokers to partner with affiliates familiar with local markets, language, and culture. Customized affiliate programs with localized support may be offered. |

Royalty trusts

Royalty trusts serve as a promising avenue for passive income, capitalizing on the revenue generated by natural resources and intellectual property. These unique investment vehicles grant investors a share in the proceeds from assets like oil wells or music royalties. Operating through legal agreements, royalty trusts provide shareholders with regular income without the active management of underlying assets.

How do Royalty Trusts work?

Ownership – Royalty trusts have legal agreements, called royalty deeds, granting them a share of revenue from specific assets like oil and gas wells, timber land, or intellectual property.

Revenue Sharing – When resources are used or sold, the trust gets a payment based on its ownership. This payment is regularly distributed to shareholders, often in the form of quarterly dividends.

Passive Income – Shareholders enjoy ongoing income without actively managing assets . The trust's management ensures smooth revenue generation and distribution.

| Types of royalty trusts | Description |

|---|---|

|

Natural Resource Trusts |

Focus on resources like oil, gas, timber, and precious metals. Income depends on extraction and market prices. |

|

Intellectual Property Trusts |

Own royalty interests in patents, trademarks, or music. Income from licensing fees and sales royalties. |

|

Hybrid Trusts |

Combine natural resources and intellectual property for diversification and a broader income base. |

AI based Youtube channel

Creating YouTube channels powered by AI can generate passive income by leveraging automated content creation. AI scripts, voiceovers, and video editing reduce manual effort, allowing for consistent uploads. As the channel grows, increased viewership attracts advertisements, contributing to ad revenue. The key lies in setting up the AI tools and letting them run, minimizing hands-on involvement while maximizing the potential for continuous income through engaging content.

The recently released YouTube Culture & Trends Report for 2023 brings attention to a notable trend where 60% of Gen Z is receptive to content created by artificial intelligence (AI). Additionally, a significant 82% of this demographic actively engages in curating and generating content that aligns with their preferences. This signifies a noteworthy shift in content consumption and creation patterns.

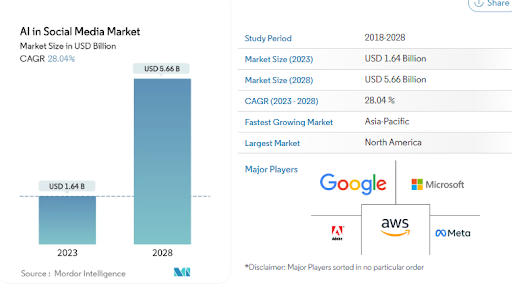

AI in Social Media market

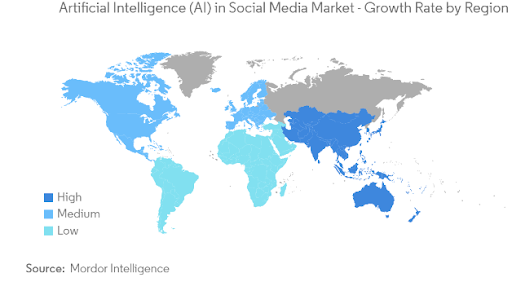

AI in Social Media Market – By Region

How does it work?

AI-enhanced scriptwriting and voiceover

-

Employing advanced AI software to analyze viewer preferences, data trends, and create engaging scripts narrated in natural-sounding voices.

-

Significantly reducing production costs by eliminating the need for human writers and voice actors.

Automated video editing and animation

-

Utilizing AI tools to seamlessly edit footage, integrate compelling visuals, and generate animations, transforming raw content into polished videos.

-

Streamlining the video production process and saving valuable time and resources without the need for manual editing.

Targeted content optimization

-

Leveraging AI algorithms to analyze audience demographics, engagement metrics, and search trends for optimizing titles, descriptions, and thumbnails.

-

Maximizing content discoverability to increase reach, viewership, and subsequently enhance ad revenue and channel growth.

Crypto market

Bitcoin

Bitcoin is a type of digital money that exists online. It's unique because no banks are in charge of it; it functions like money on the internet. There's only a limited amount of Bitcoin available, which can make it valuable. People buy Bitcoin, hoping its value will increase over time. But, just like a rollercoaster, the price can go up and down a lot. So, think of it as a bit of a chance on the future of money – it's not a guaranteed way to make cash, but some investors find it interesting to be a part of this new financial domain.

Start trading cryptocurrencies with ByBitExperts have discussed below the factors supporting bitcoin investment:

| Factors supporting Bitcoin investment | Description |

|---|---|

Bitcoin Halving (Supply Scarcity) |

Scheduled in 2024, the halving event historically triggers price surges by reducing new coin supply, intensifying scarcity. Investors anticipate significant returns. |

Potential Bitcoin ETF Approval |

SEC approval of a Bitcoin ETF could open the door for mainstream investors, injecting substantial capital into Bitcoin. It enhances accessibility, transparency, and acknowledges cryptocurrency legitimacy. |

Regulatory Clarity and Approval |

Expected advancements in crypto legislation in 2024, particularly in the U.S., can provide clearer rules and protections for Bitcoin investors. Regulatory clarity may attract large institutions, boosting demand. |

Rising Demand from Multiple Spot Bitcoin ETFs |

Anticipated SEC approval of spot Bitcoin ETFs can bring billions in additional demand, making Bitcoin more investable for institutions. ETFs raise awareness, provide regulatory clarity, and gain backing from major financial institutions. |

Bitcoin Halving in April 2024 |

The halving reduces downward price pressure by halving miners' daily supply. This event, coupled with a decrease in liquid supply, increases scarcity, making Bitcoin potentially the scarcest asset globally. |

FASB's Adoption of Fair-Value Accounting |

FASB's decision allows companies to hold Bitcoin on their balance sheet at market price, recognizing unrealized gains. This legitimizes Bitcoin as an asset class, making it more attractive for companies and potentially boosting investment. |

Pro-Bitcoin Regulatory Developments |

Initiatives like the Satoshi Action Fund aiming to pass pro-Bitcoin regulations in multiple U.S. states can enhance institutional confidence, spur entrepreneurship, and increase demand for Bitcoin. |

Fundamental Strength– Adoption and Security |

Increasing adoption, reflected in record-high addresses with Bitcoin holdings, and a rising hashrate exceeding 500 EH/s, showcase Bitcoin's fundamental strength and secure network status. |

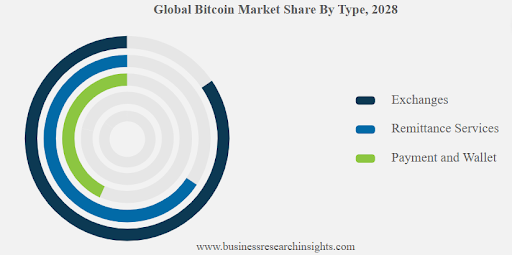

Global Bitcoin Market Share by Type, 2028

| Grand View Research Report | Details (Bitcoin) |

|---|---|

Market size value in 2022 |

USD 20.63 billion |

|

Revenue forecast in 2030 |

USD 132.91 billion |

|

Growth rate |

CAGR of 26.2% from 2022 to 2030 |

Crypto staking

Crypto staking allows you to earn interest on your digital assets. When you stake your cryptocurrency, you're essentially helping secure the blockchain network and, in return, receiving rewards.

Experts have discussed below how Crypto staking works:

| Aspect | Explanation |

|---|---|

|

Proof of Stake (PoS) |

Certain blockchains, like Ethereum or Cardano, use Proof of Stake (PoS) consensus. Unlike Bitcoin's Proof of Work, PoS relies on validators who lock up a certain amount of cryptocurrency as collateral. |

|

Earning Rewards |

Owners of stakable cryptocurrencies can earn rewards by staking a portion of their holdings. The staked crypto is used to validate transactions, and in return, contributors receive more of the same cryptocurrency as a reward over time. |

|

Network Security |

Staking is vital for blockchain security. Validators (those staking coins) are motivated to act honestly; otherwise, they risk losing their staked coins. This incentivizes a secure and honest network environment. |

|

Decentralization |

Staking encourages decentralization by enabling anyone to participate in the validation process. This prevents a single entity from controlling the entire network, enhancing overall security. |

|

Energy Efficiency |

Unlike traditional mining (as in Bitcoin), staking is considered more energy-efficient. It doesn't require extensive computing power, making it an eco-friendly alternative for blockchain operations. |

How to stake your crypto?

-

Get PoS Crypto – Choose a cryptocurrency that supports staking. Ethereum, Cardano, and others are popular choices.

-

Transfer to a Wallet – Set up a wallet that supports staking. Transfer your chosen cryptocurrency to this wallet. Make sure to use a secure wallet recommended by the blockchain's official website.

-

Begin Staking – Follow the network-specific instructions for staking. This might involve delegating your coins to a validator node, running a validator node yourself, or using staking services provided by some exchanges.

Top 5 Cryptocurrencies by staking market cap

| Asset | Price(USD) | Reward(%) | Staking Market Cap (USD, Million) | Staking Ratio (%) |

|---|---|---|---|---|

Ethereum |

1,925.74 |

4.99 |

41,403.84 |

17.59 |

Solana |

27.43 |

7.19 |

10,650.40 |

70.39 |

Cardano |

0.32 |

3.12 |

7,116.94 |

62.85 |

BNB Chain |

243.61 |

2.21 |

5,482.51 |

14.5 |

Avalanche |

14.53 |

1.16 |

3,855.17 |

62.36 |

Staking Industry Research and Insights

Decentralized finance (DeFi) lending

Decentralized Finance (DeFi) lending is a revolutionary financial service within the cryptocurrency space that enables investors to lend their digital assets to borrowers through decentralized platforms. In this innovative ecosystem, individuals can earn regular interest payments on their crypto holdings, akin to traditional savings accounts, but with notably higher interest rates. Unlike traditional finance, DeFi lending operates on blockchain technology, particularly on platforms like Ethereum, leveraging smart contracts to automate and secure lending processes.

Investors participating in DeFi lending deposit their cryptocurrency as collateral, usually at least 1.5 to 3 times the value of the loan. This collateral is held in smart contracts until the borrower repays the loan. One of the key advantages is the absence of intermediaries, which allows for quicker and more accessible borrowing and lending without the need for extensive checks.

The US DeFi lending market is one of the largest globally, reaching an estimated $70.2 billion in total value locked (TVL) as of December 2023. Analysts are optimistic about the trajectory, forecasting that the US DeFi lending market is poised to hit a substantial $250 billion by 2025. This projection reflects an impressive Compound Annual Growth Rate (CAGR) of over 80%.

Play-to-Earn (P2E)

Play-to-Earn (P2E) blockchain games introduce an innovative way to invest by allowing players to earn valuable cryptocurrency and digital assets through gameplay.

In P2E games, assets like characters, weapons, and land are represented as Non-Fungible Tokens (NFTs), ensuring unique ownership. Players can actively earn tokens by engaging in various in-game activities, from slaying monsters to strategic gameplay.

Additionally, there are passive income opportunities, such as renting out virtual land or staking earned tokens for interest. P2E games offer gamers and investors alike a chance to monetize skills and time, presenting a promising source of passive income in the evolving landscape of blockchain gaming.

NFT Gaming Market Size

Popular Play-to-earn games

| Popular P2E Blockchain Games | Description |

|---|---|

|

Axie Infinity |

A game where players battle and collect fantasy creatures, earning cryptocurrency as they progress. |

|

The Sandbox |

A blockchain gaming metaverse that empowers users to generate, share, and monetize their gaming experiences. |

|

BloodLoop |

An MMO-FPS game featuring a decentralized economy for players to engage with. |

|

Orivium |

A strategy game in which players own territories, contributing to the overall gaming experience. |

|

Fractalians |

A mobile multiplayer cooperative Action Role-Playing Game (ARPG) offering an immersive gaming experience. |

NFT rentals

NFT rental is a passive income avenue where NFT owners lend their digital assets for a fee. Users pay to temporarily use or display the NFT, creating a continuous income stream for the owner. It allows individuals to monetize their NFTs when not in personal use, offering a hands-free way to earn from their digital investments.

Types of NFT rentals

| Types of NFT rentals | Description |

|---|---|

Collateral Renting |

Renter offers collateral (cryptocurrency or NFTs) to acquire the NFT. Owner retains collateral in case of loss or damage to the NFT. |

Collateral-less Renting |

No collateral required, but a high rent may be charged to protect the original owner's interest. |

Time-based Renting |

Rent charged only for the duration the NFT is used, suitable for those needing the NFT for a short period. |

Subscription-based Renting |

Renter pays a recurring fee (monthly or annually) for regular use of the NFT, providing an economical option for frequent users. |

Royalty-based Renting |

Renter pays a royalty in addition to the rent, enhancing passive income for NFT holders. Similar to royalties earned on NFT sales, but applicable during the renting period. |

How NFT rentals work?

| How NFT Rentals Work | Description |

|---|---|

|

You Own the NFT |

As the owner, you have complete control and ownership of your NFT. You can use it, hold onto it for potential value appreciation, or choose to rent it out to others. |

|

Rental Platforms |

Utilize dedicated platforms like NFTfi, DopeFinance, and ReNFT to list your NFTs for rent. Specify the duration, price, and any specific requirements for potential renters. |

|

Renters and Their Needs |

Players seeking temporary access to specific NFTs for reasons like in-game challenges, tournaments, or exploration can browse rental listings and select ones that align with their needs. |

|

Earning Passive Income |

When your NFT is rented, you receive an agreed-upon fee in cryptocurrency, introducing a passive income stream to your digital portfolio. Rental fees vary, ranging from a few dollars to thousands daily. |

Best cryptocurrency exchanges

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Bitcoin

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

-

3

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

-

4

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

5

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Tobi Opeyemi Amure is an editor and expert writer with over 7 years of experience. In 2023, Tobi joined the Traders Union team as an editor and fact checker, making sure to deliver trustworthy and reliable content. The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options.

Tobi Opeyemi Amure motto: The journey of a thousand miles begins with a single step.