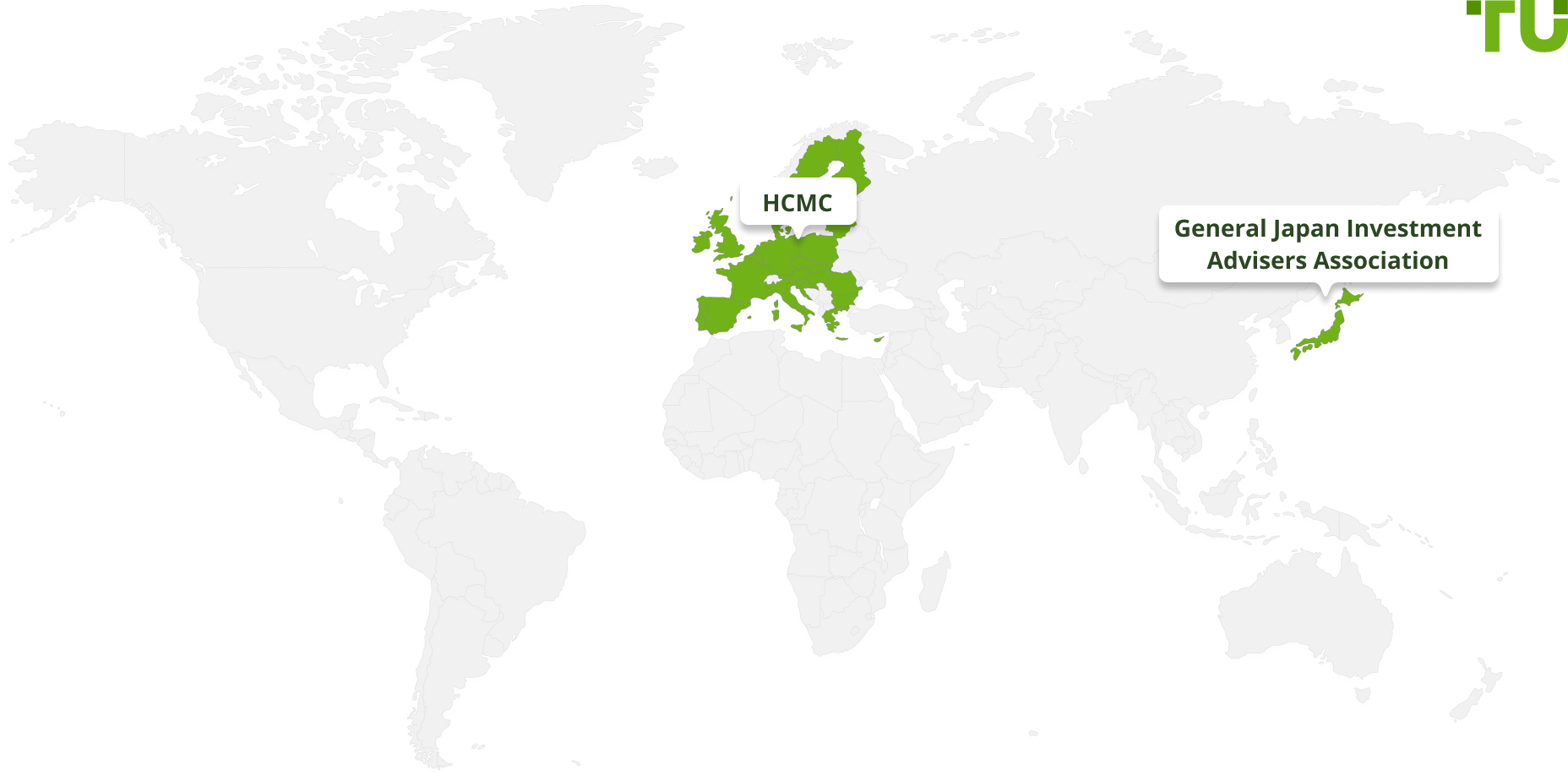

ZuluTrade is a social wealth management platform that was founded in Greece in 2007 and cooperates with over 70 leading European and international brokers as a provider of social and copy trading services. ZuluTrade can be considered a reliable service provider because it is regulated in the EU, by the Hellenic Capital Market Commission (HCMC) and Japan (2014 – No. 1058 Member Associations / General Japan Investment Advisers Association). ZuluTrade is part of the Finvasia Group since 2021.

How to connect to the ZuluTrade social trading platform | Experience of Rinat Gismatullin by TU

Below you will find all the information.

Read the ZuluTrade review from Traders Union expert for all the key information about the platform, such as entry threshold; how to find the best traders to copy; how to copy the trades of the most successful members of the community; and users’ feedback on ZuluTrade.

What does social trading platform mean?

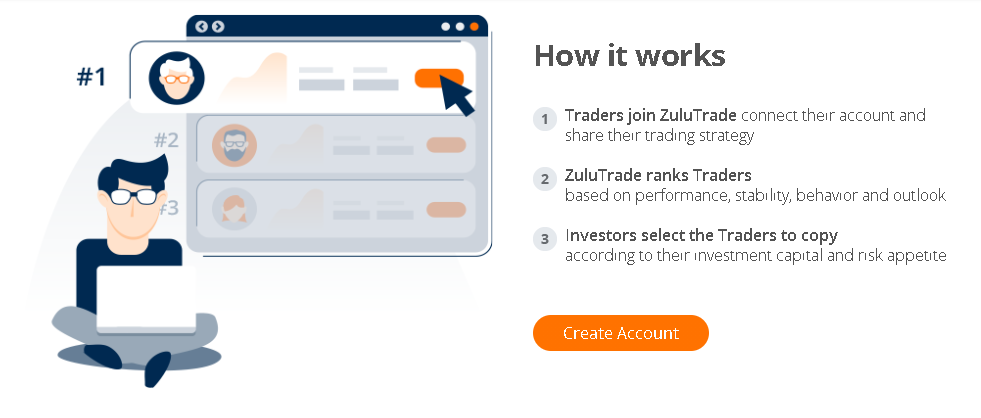

The idea of the ZuluTrade social trading platform is to unite the world's leading traders and ordinary inexperienced investors to make money on a single platform. The platform encompasses how to copy trades and communication and sharing experience and knowledge among online members. In short, it functions as a social network for traders.

The mission of professional traders is to do their thing and make profitable trades. And novice investors can copy them in automatic or semi-automatic mode. After subscribing to the trader-manager, his transactions and orders shall be automatically copied to the investor's account.

Since ZuluTrade is a provider of copy trading platforms, then managers and investors are often clients of different brokers. In total, the provider cooperates with over 70 brokers as of the beginning of 2023. The service is integrated into the popular MT4 and MT5 terminals, as well as the proprietary ZTP platform.

ZuluTrade solves several problems for novice traders at once:

ZuluTrade’s copy trading network at a glance

ZuluTrade copy trading platform review

ZuluTrade has been created as a user-friendly novice-trader platform.

Traders

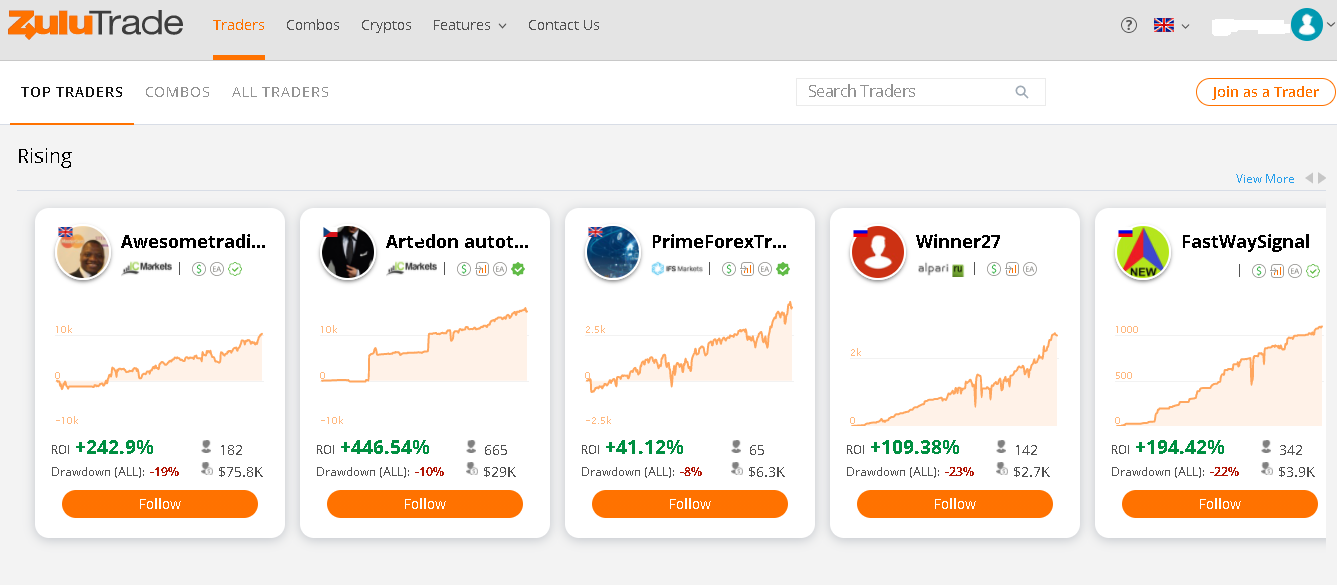

Let's start the review of copy trading on ZuluTrade with the “Traders” section. Here you will find a list of top traders, compiled by the platform's proprietary algorithm that includes:

growth dynamics

applied

management.

The first pages of the traders' profile immediately provide you with valuable information like profitability, maximum drawdown, number of subscribers, and assets under management. There’s also a button to start a subscription.

Trader’s profile

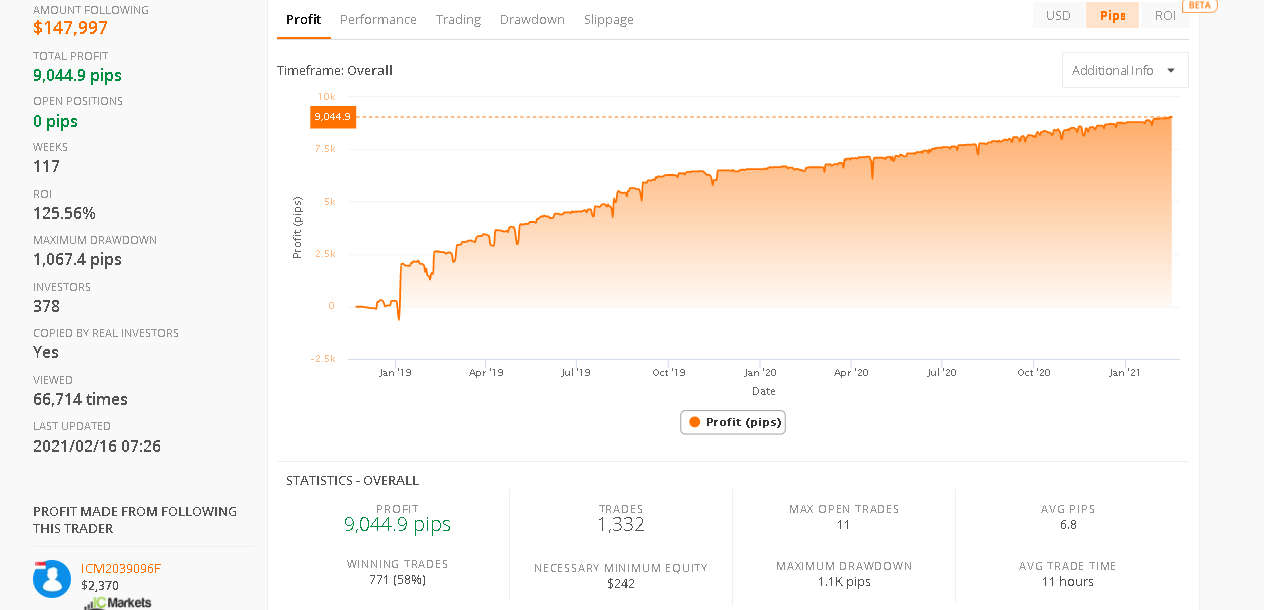

Click on the profile to learn more detailed information about the trader:

-

1Description of the trader's strategy;

-

2Investor’s rating;

-

3The minimum investment amount;

-

4The number of active weeks on the platform;

-

5The number of investors and the amount under management;

-

6Profitability and maximum drawdown in points;

-

7Chart of trade statistics;

-

8History of transactions;

-

9Open positions, etc.

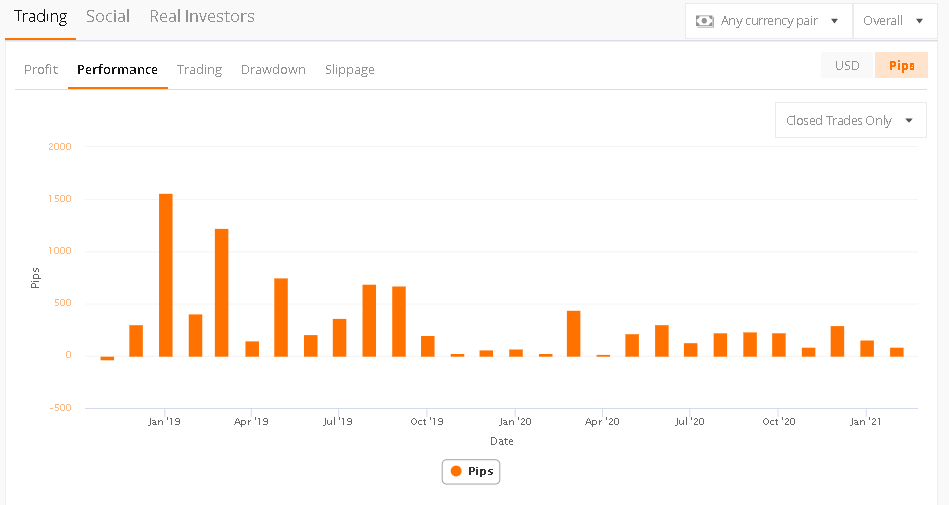

Also in the profile, you can study the performance for the last year by months using diagrams; a diagram of the history of drawdowns and slippages in pips; and the share of currency pairs in the total number of transactions.

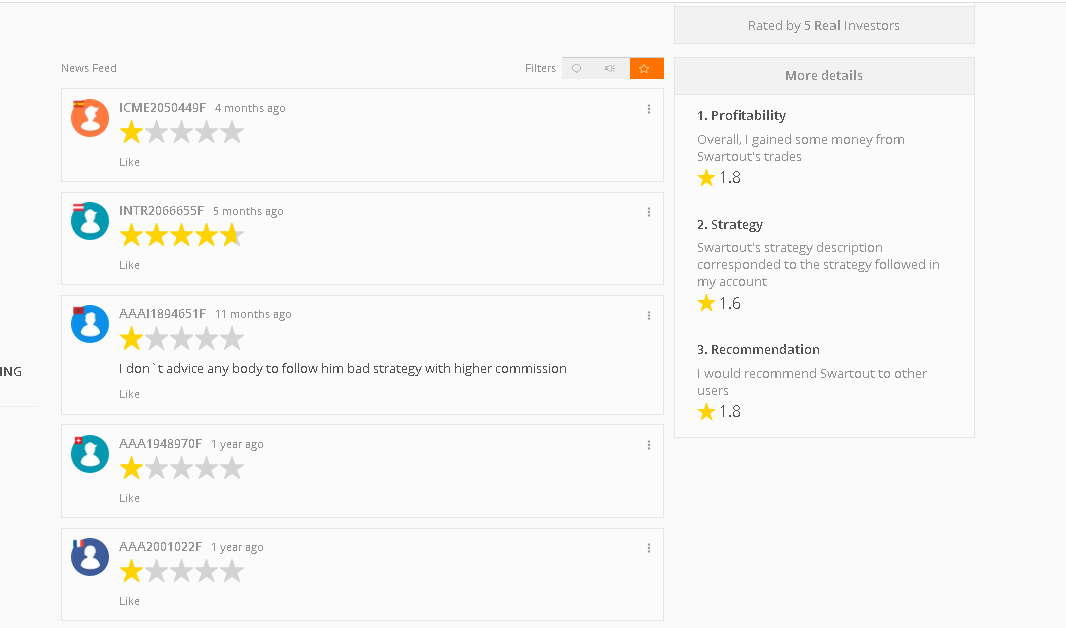

Social

The Social profile page can be very useful when choosing traders, as it allows you to study reviews and personal ratings based on investor ratings. As you can see, the reviews about this signal provider are quite controversial, and the ratings are low, although the performance is average. It gives you pause for thought whether it is worth working with the manager and studying other data.

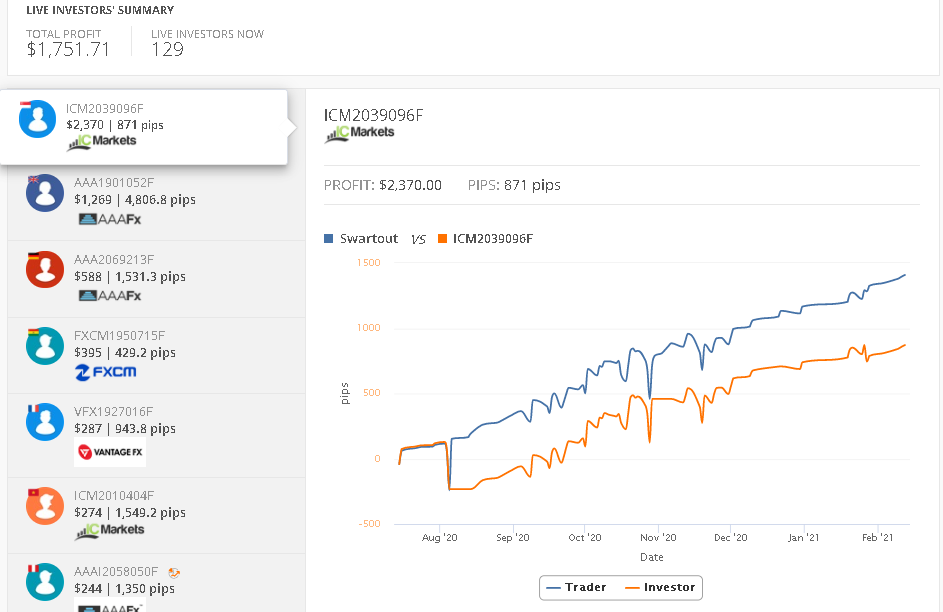

Real Investors

The page shows the list of the trader's subscribers; the dynamics of changes in their number; and the total amount of profit brought by the trader.

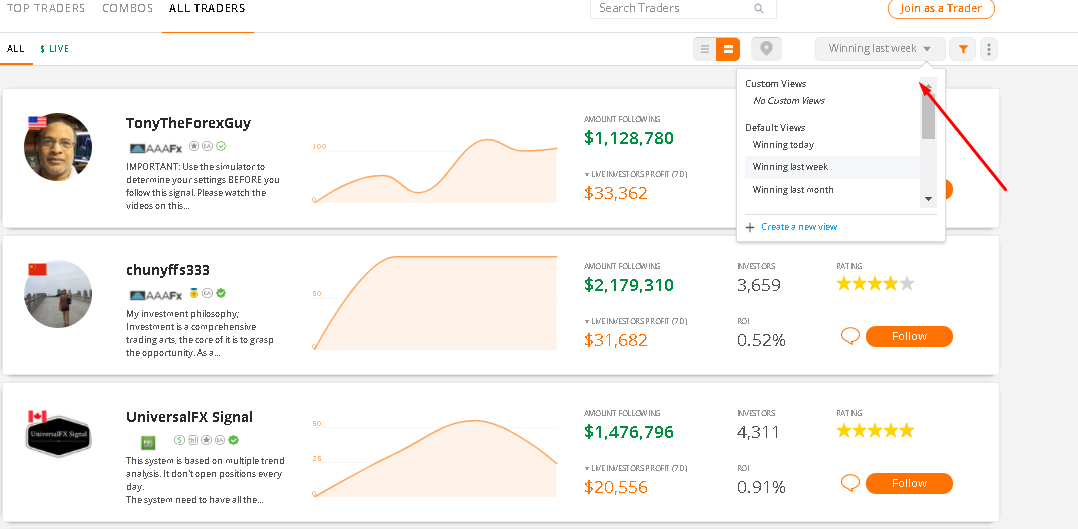

All traders page

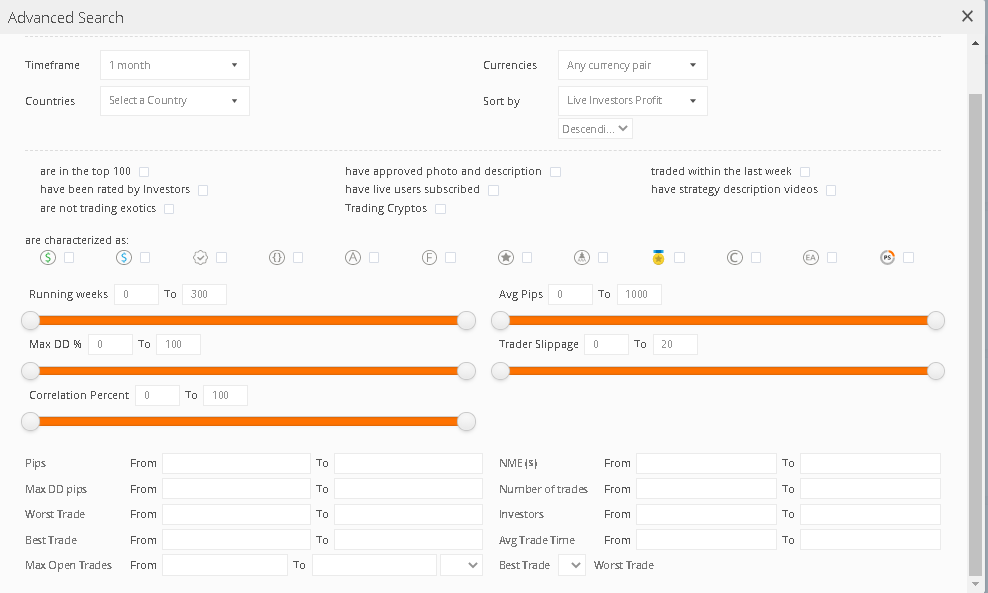

All managers are listed here. They can be selected using basic tools and an advanced filter.

The basic filter allows you to track the best traders over a certain period.

All key parameters for profitability and drawdowns can be entered manually as ranges.

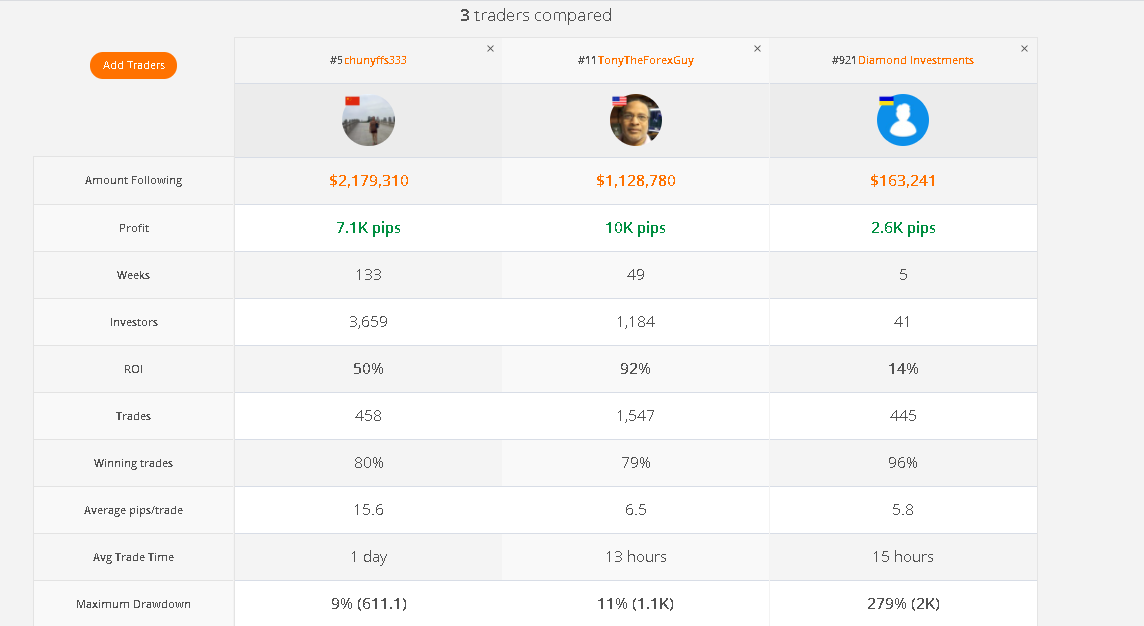

Compare function

The Compare function is quite useful. It allows you to select several profiles you like and the system will automatically compare them by important parameters.

Features section

ZuluTrade has useful features for communication and the exchange of opinions among its online members.

So, on the Social Charts page, traders discuss the latest changes in the market and post their deals, which are displayed on an interactive chart. Here you can select the market you are interested in. For example, the EUR/USD pair, post trades by yourself, follow the transactions of other traders, comment on publications.

ZuluTrade Automator

The Automator is a useful feature. It is a digital assistant for copying trades on ZuluTrade. You can configure it to perform various automatic actions, for example, to stop trading when a certain income or loss limit is reached. It can also send information via email to alert you to changes in the set parameters. You can set up Automator through your personal account in the Settings section

ZuluGuard allows you to protect your account from severe losses. It stops copying the trader and closes all open positions if the set risk parameters are violated.

Pros and cons of copying traders on ZuluTrade

In conclusion, we highly appreciated the well-designed traders’ profiles and statistics, and there are also useful extra advisors on automation and risk management on the platform.

- Intuitive interface

- Oldest and the first Copy Trading Platform

- Detailed statistics and functions for its comparison

- 70+ online brokers to choose from

- Regulation in the EU by the Hellenic Capital Market Commission (HCMC) and Japan (2014 – No. 1058 Member Associations / General Japan Investment Advisers Association).

- Automation and Risk Control Services - ZuluTrade Automator and ZuluGuard

- More than 90k traders from different countries for investors to choose from

- Convenient functionality for traders to communicate and discuss trades

- Blog and forum are rarely updated

- Advanced filters are ineffective

How to find the right trader to copy on ZuluTrade

There are several ways to search for traders to copy on ZuluTrade. The first method is the simplest and perhaps the most practical. The developers have already collected the most successful traders by different parameters in the Top Traders section, described above. It’s much easier to choose worthy ones among them.

However, please follow these rules:

The second way is to use the advanced ZuluTrade filter in the All Traders section. In practice, however, it doesn’t work very well. For example, (we did not choose the most complicated parameters):

-

1Has been trading on the platform for over a year (this is necessary to assess the stability of the performance);

-

2Ranked among the top 100 traders;

-

3Evaluated by investors;

-

4It has photos and strategy validated.

As a result, the system showed the result, which was that no traders were found for such parameters.

When we tried to adjust the selection of traders by the parameters of the maximum drawdown, the result was the same. So, it's better to use the recommendations of the platform and other participants.

How to start copy trading on ZuluTrade

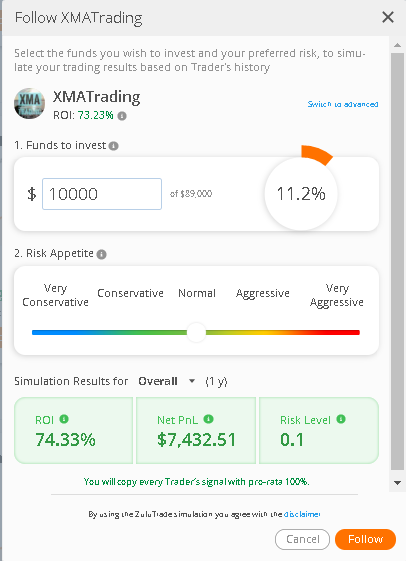

Once you've figured out how to find traders to copy trades on ZuluTrade, it's time to start subscribing and choosing copy options. It is quite simple. Just click the Follow button in the profile of the signal provider.

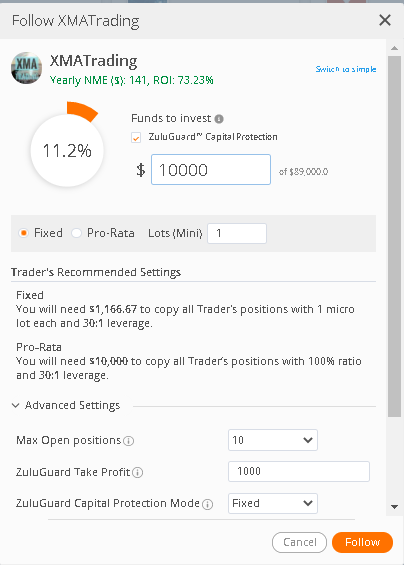

Here you can set the amount by which the trader's transactions shall be copied on your account.

Click on the Switch to Advanced link in the upper right corner of the same window if you want to configure the parameters in more detail. Here you can set the ZuluGuard capital protection parameters, the maximum number of open positions, and set the drawdown level in percentages After attaining such a level, you will receive an email.

Does that sound good? Click Follow.

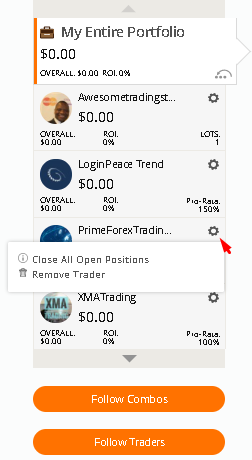

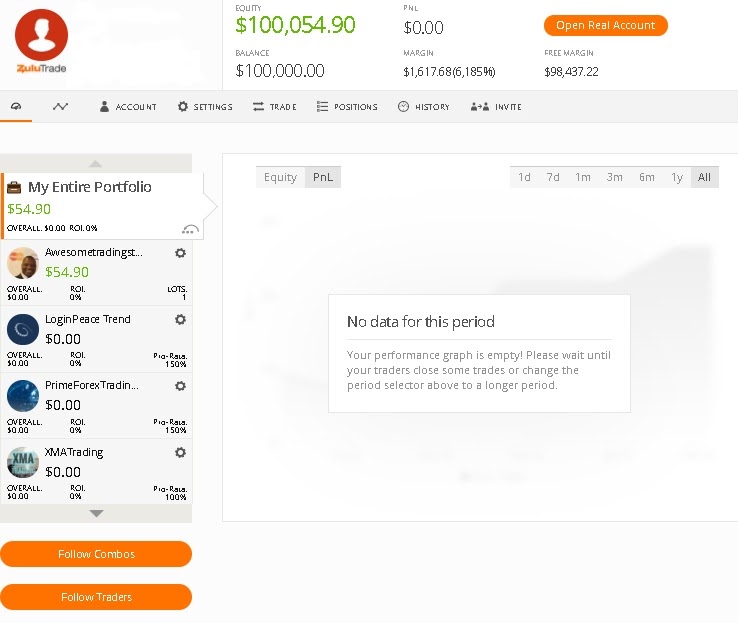

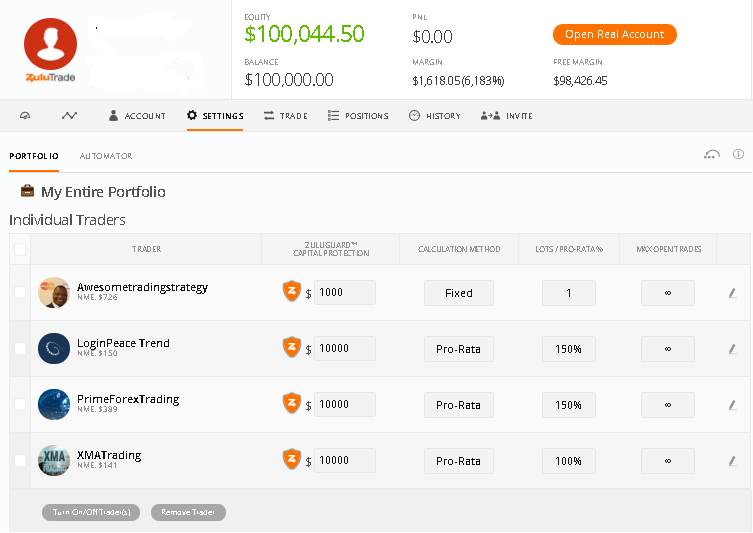

You can track the traders’ results in your personal account. Find the list of traders you are copying to ZuluTrade in ‘My Entire Portfolio’. By clicking on the icon next to the trader's photo, you can remove it from the subscription or close all transactions. When the trading history is sufficient, the overall statistics of the portfolio and each trader you copy will appear immediately.

The Guide on opening an account on ZuluTrade

You can test a lot of Many ZuluTrade functions even without opening an account, but we recommend using the demo first to explore your personal account and learn how to copy trades.

Enter the login and password. You can also manually select the account currency, the leverage is from 1:1 to 1:1.000, and the number of funds for testing from $3,000 to $1 million.

You will get an email to confirm the action. After clicking on the link, you are ready to start copying traders on ZuluTrade. Now the personal account is opened for you and you will be offered to view the instructions on your personal account or get straight to the point.

Personal account

The personal account at ZuluTrade is very functional. Here you will find the panels with the main account parameters and copying statistics.

In the account parameters, include your personal data; also in the Settings parameters, you can configure Automator and advanced copying settings for each trader-manager.

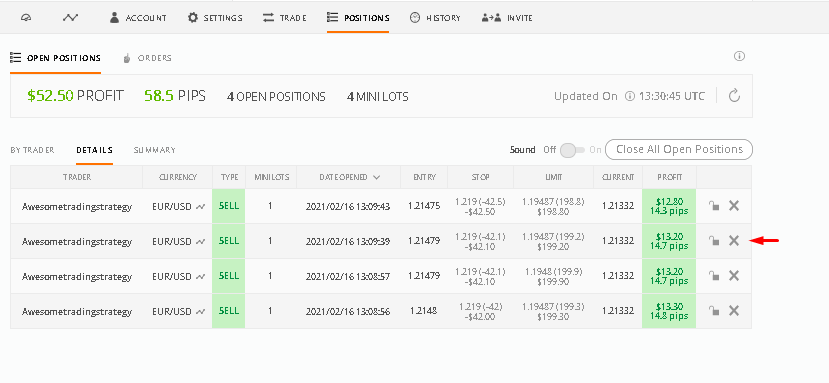

Check all open orders and the history of transactions in the Positions parameters. Here you can independently close any open transaction.

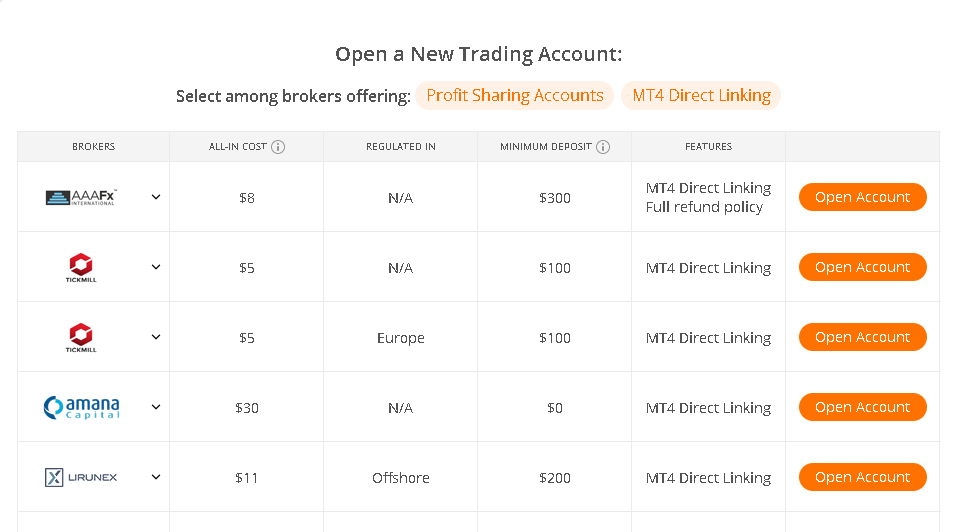

Opening a real account

When opening a real account, you will also need to link your ZuluTrade account with a brokerage account on the MT4 or ZTP terminal. If you already have a brokerage account, go to the technical details. If you don’t have an account, Zulu will offer you to open an account with one of the partner brokers.

ZuluTrade account types

As we already mentioned, ZuluTrade has 1 account type.

ZuluTrade Account

Top 10 brokers working with ZuluTrade:

| Brokers | Minimum deposit | Regulators | Platform | |

|---|---|---|---|---|

| 1 | Fxview | $5 | CySEC | MT4, MT5, ActTrader |

| 2 | AAAFx | $10 | HCMC, FSCA | MT4, MT5, ActTrader |

| 3 | Swissquote | $2,000 | FCA | MT4 |

| 4 | IC Markets | $200 | ASIC | MT4 |

| 5 | EverFX | $250 | CySEC, CIMA | MT4 |

| 6 | Weltrade | $100 | IFSC | MT4 |

| 7 | Axi | $200 | ASIC | MT4 |

| 8 | Oanda | $0 | CFTC | MT4 |

| 9 | InstaForex | $1 | CySEC, FSC | MT4 |

| 10 | Alpari (UK) | $1 | The Financial Commission | MT4/MT5 |

Can I make money by copying traders on ZuluTrade?

It is desirable to form a portfolio of subscriptions to several traders, set the parameters of risk management and capital protection in ZuluGuard to increase the chances of good returns.

What are ZuluTrade fees?

Commission fees on ZuluTrade depend on the broker through which you are connected to ZuluTrade.

Is ZuluTrade social wealth management platform safe?

Yes, we believe the ZuluTrade platform is safe as it is regulated by two reputable regulatory authorities as an investment advisor:

The company is part of a holding that also includes an EU-regulated AAAFX broker.

Has ZuluTrade won any awards?

ZuluTrade has won the following awards in recent years:

Best Social Trading Solution – UF Awards 2022

Best Social Wealth Management Platform at Forex Expo Dubai in October 2022

Best Social Trading Solution Award at iFX EXPO Dubai 2023

Summary

According to the review, the social trading platform ZuluTrade is among the largest copy trading services. Reliable regulation, an intuitive interface, and several useful extra services are to its benefit. ZuluTrade can be seen as a tool for getting extra income, learning from experience, and communicating within the trading community.

However, some peculiarities indicate that ZuluTrade is subordinate to the leader in the social trading platforms ranking, which is eToro. The choice of managers on ZuluTrade is smaller, and the filter for detailed customization of the search is ineffective.

Expert review

Just a while ago it seemed that ZuluTrade could compete with eToro for the pinnacle of copy trading services. However, the company has lost the lead and is now inferior in most parameters.

Yes, it is quite possible to make money on ZuluTrade and there are many examples of this. But it also depends on the brokers’ terms. While the parent broker AAAFX has acceptable fees, in many other cases the increased spread can “eat up” a significant part of your income.

ZuluTrade social trading platform reviews

Jordan Clapton, 29, Trenton

I’ve copied trades to ZuluTrade via AvaTrade. The selection of managers is worse than on eToro, but there are excellent professionals that any eToro trader could envy. I’ve been working with 3-4 traders whose strategies I understand well for over a year. There have never been deep drawdowns and I managed to earn about 5-6% per month.

Ulysses Clifford, 42, New York

What I really like at ZuluTrade is that there is always a choice of brokers to work with. I gained experience here watching the pros and studying their trades. After some time of copying, I switched to independent trading and I’m already thinking about whether I should become a manager.

Dan Peterson, 57, Boston

I’m disappointed in ZuluTrade. It seems like the trader's profitability is huge, and as soon as you start copying, it turns out that the commission eats up most of the profit. Also, traders screw up and allow drawdowns. It just got under my skin. In my mind, it is better to buy an index and wait for what happens. Especially now, when everything is going well even without managers.

FAQ

Which brokers work with ZuluTrade?

In total, the company cooperates with over 30 brokers. Such well-known brokers as AvaTrade, IC Markets, and Tickmill are among them. Visit the ZuluTrade social trading platform website for a complete list of partners.

What are the average profit margins on ZuluTrade?

This broker doesn’t provide such data. Moreover, the profitability of traders in the past doesn’t guarantee the replication of the results in the future. When starting work, you should consider that you can both make good money and also lose.

What are the alternatives to ZuluTrade?

Read more about the rating of social trading platforms in the article on our portal. Today, according to our experts, eToro is the leader among such services.