Forex facts | Currency trading

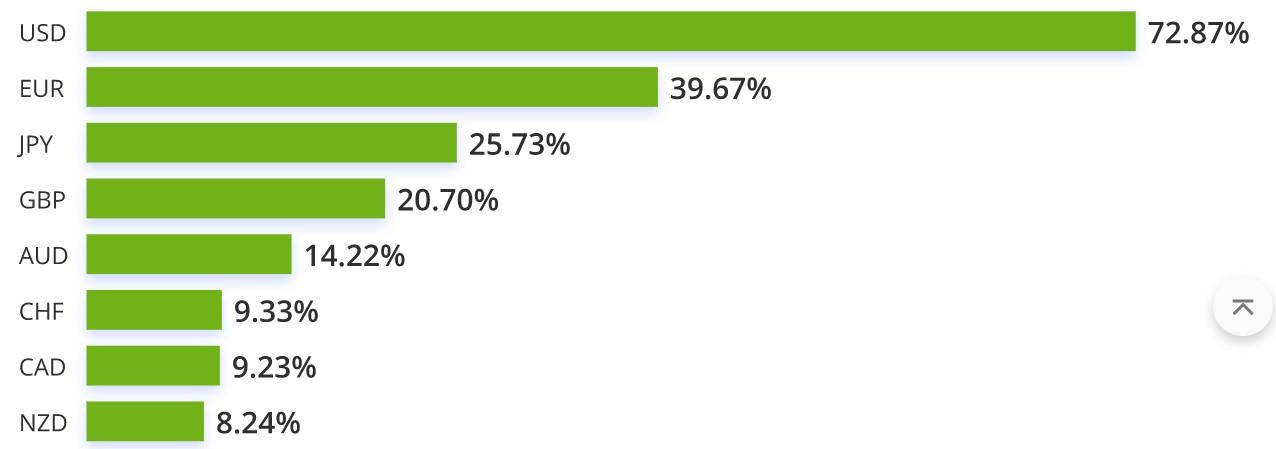

The U.S. dollar is the most heavily traded currency in the Forex market. The USD paired with currencies of developed countries forms 7 instruments, which are traditionally called majors or major pairs. Pairs without the USD are called crosses or cross currencies. Pairs with currencies that are not widely used in global transactions (Polish zloty, South African rand, Norwegian krone) are called exotic pairs.

1

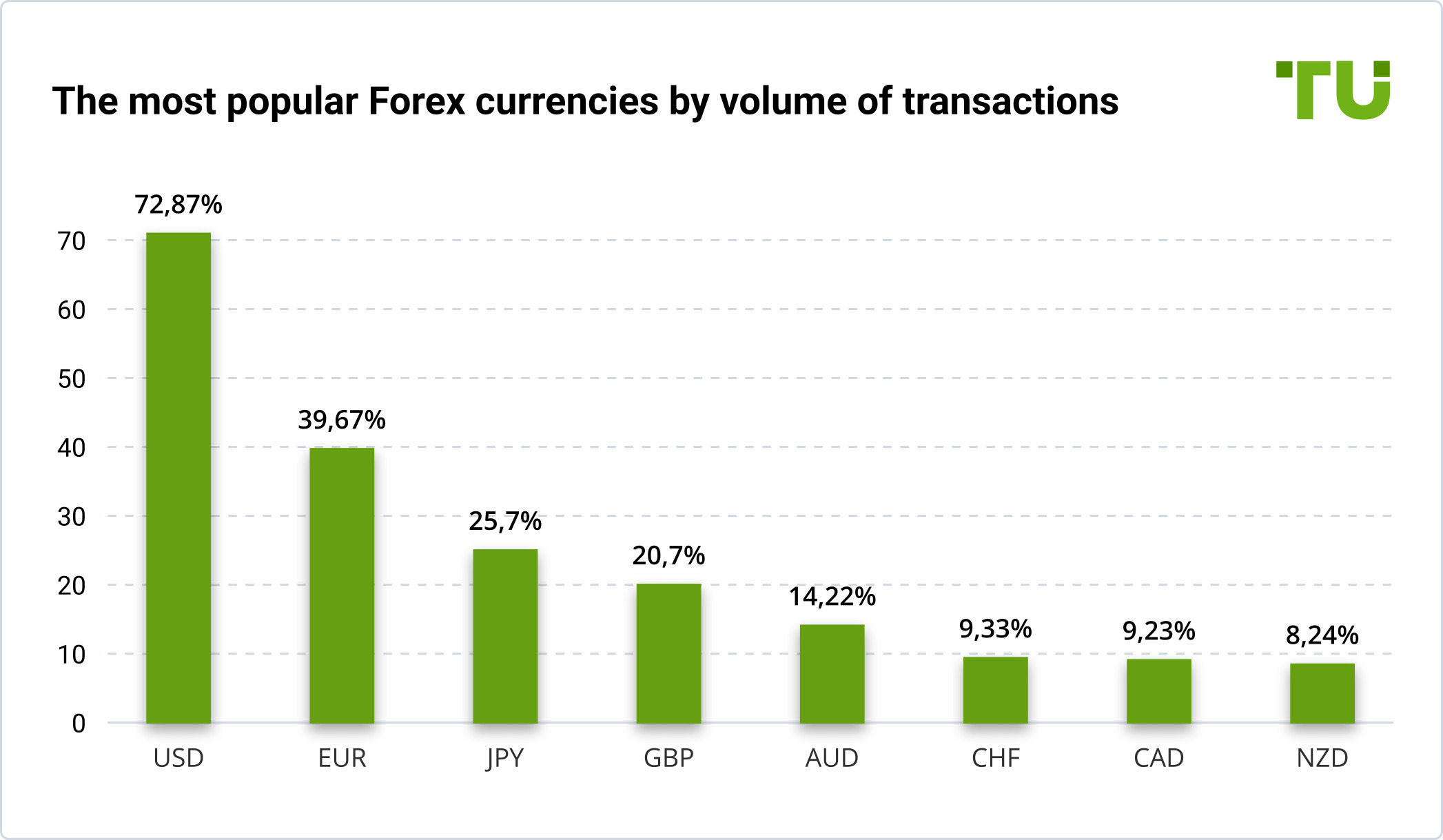

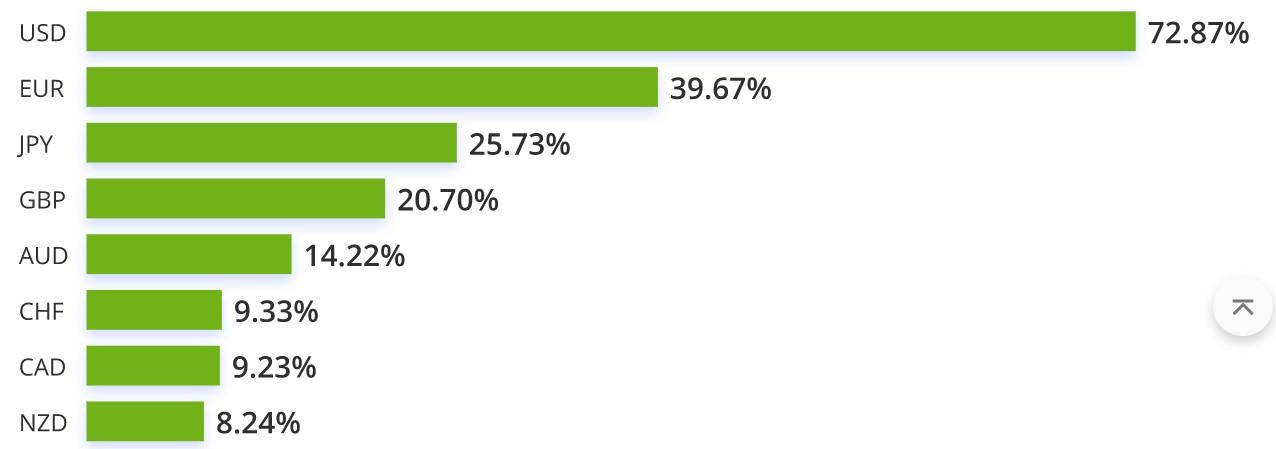

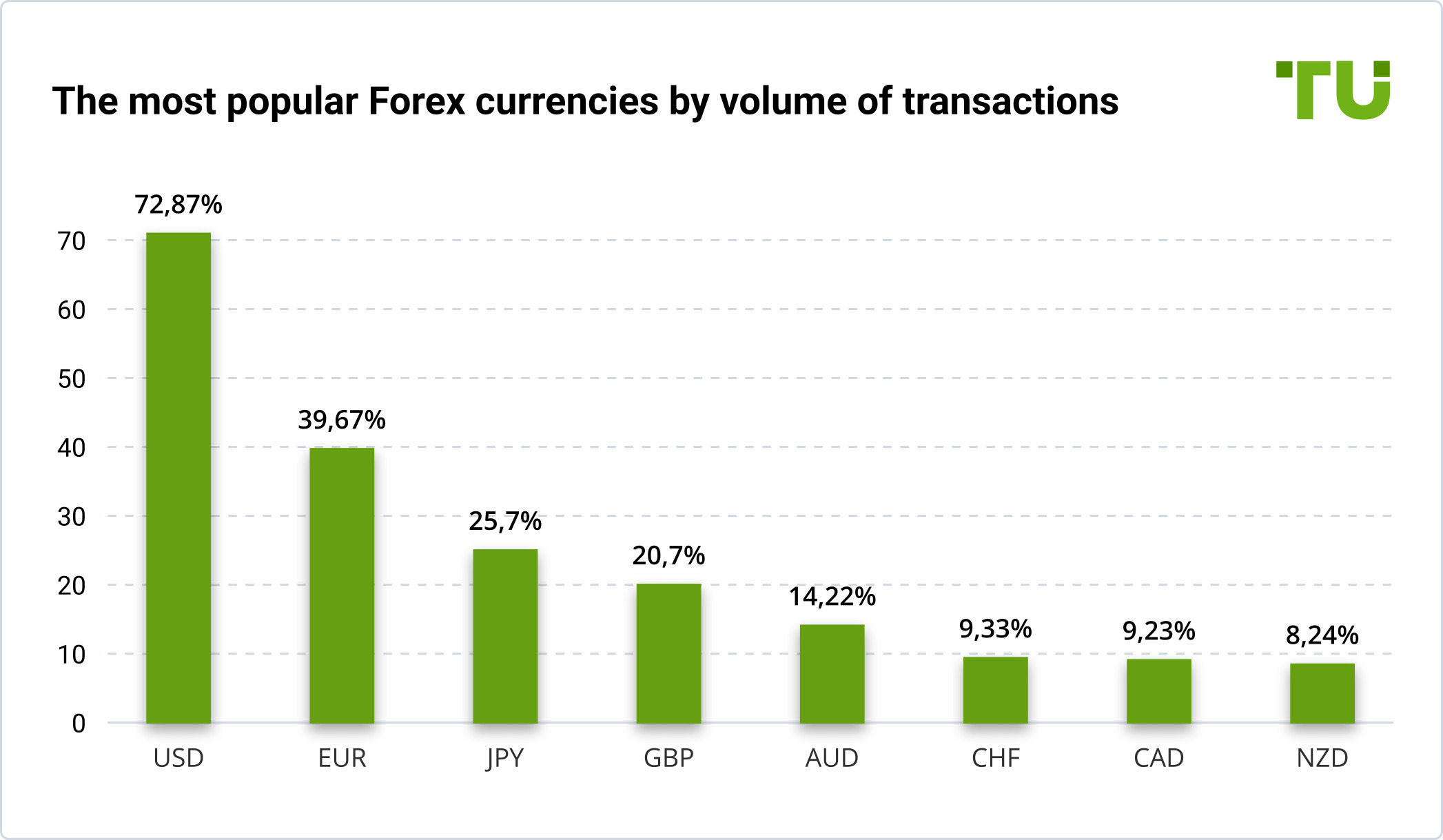

72.87% is the share of the USD in the total trading volume. In the past three years, this indicator has slightly dropped. Last year, the USD share was around 88%. The U.S. dollar is gradually losing its share in the total trading volume, but still remains a confident leader. The order of other currencies hasn’t changed, only their share in the trading volume did. Compared to last year, investor interest towards the euro dropped, with traders switching to Japanese yen. The share of EUR dropped by 7.3% compared to previous year, and JPY share increased by 8.9%.

The share of different currencies in the total trade volume

The most popular Forex currencies by volume of transactions

2

Currencies of developing economies account for 24.5% of all trades in Forex. This indicator is slowly but steadily increasing. This means that investors are gradually moving away from traditional trades in USD and EUR, as the currencies of developing countries can bring a bigger income due to higher volatility.

3

4.3% is the share of Chinese yuan in the total number of trades. Despite the fact that the Chinese economy is a closed one, some traders consider yuan as an alternative to the U.S. dollar, although the statistics include offshore yuan trading.

4

3.5% is the share of Hong Kong dollar. In the past year, its share increased by around 1.7%, which indicates that the interest of investors towards Asian markets is growing.

5

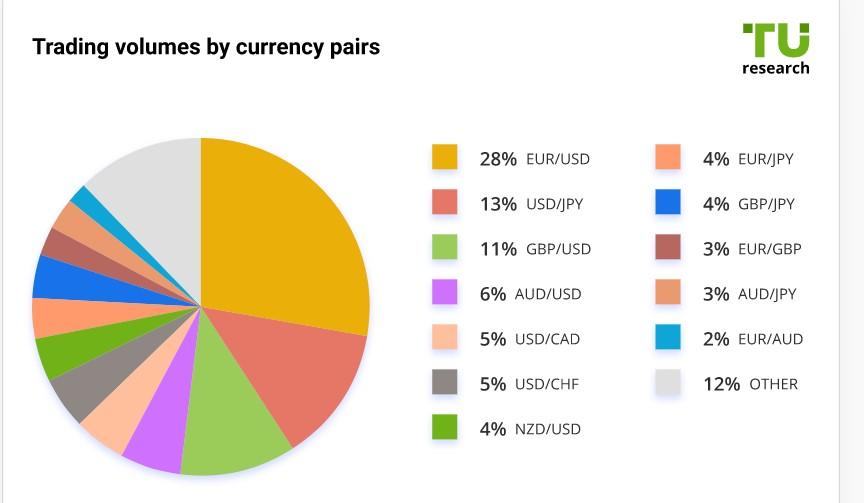

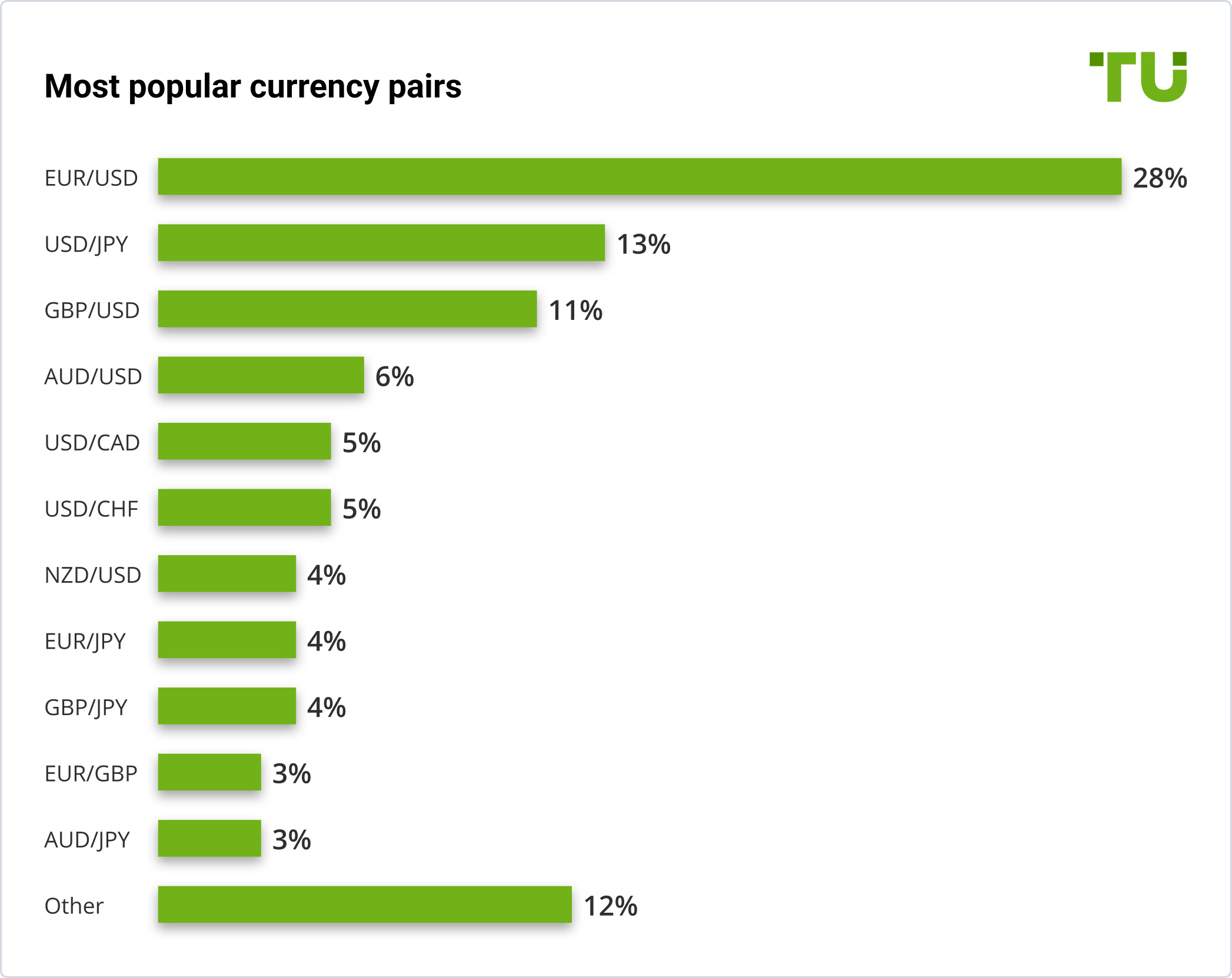

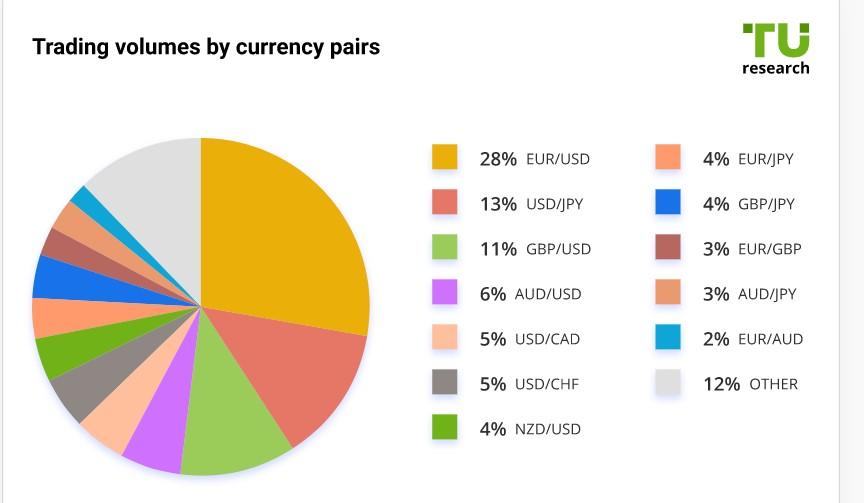

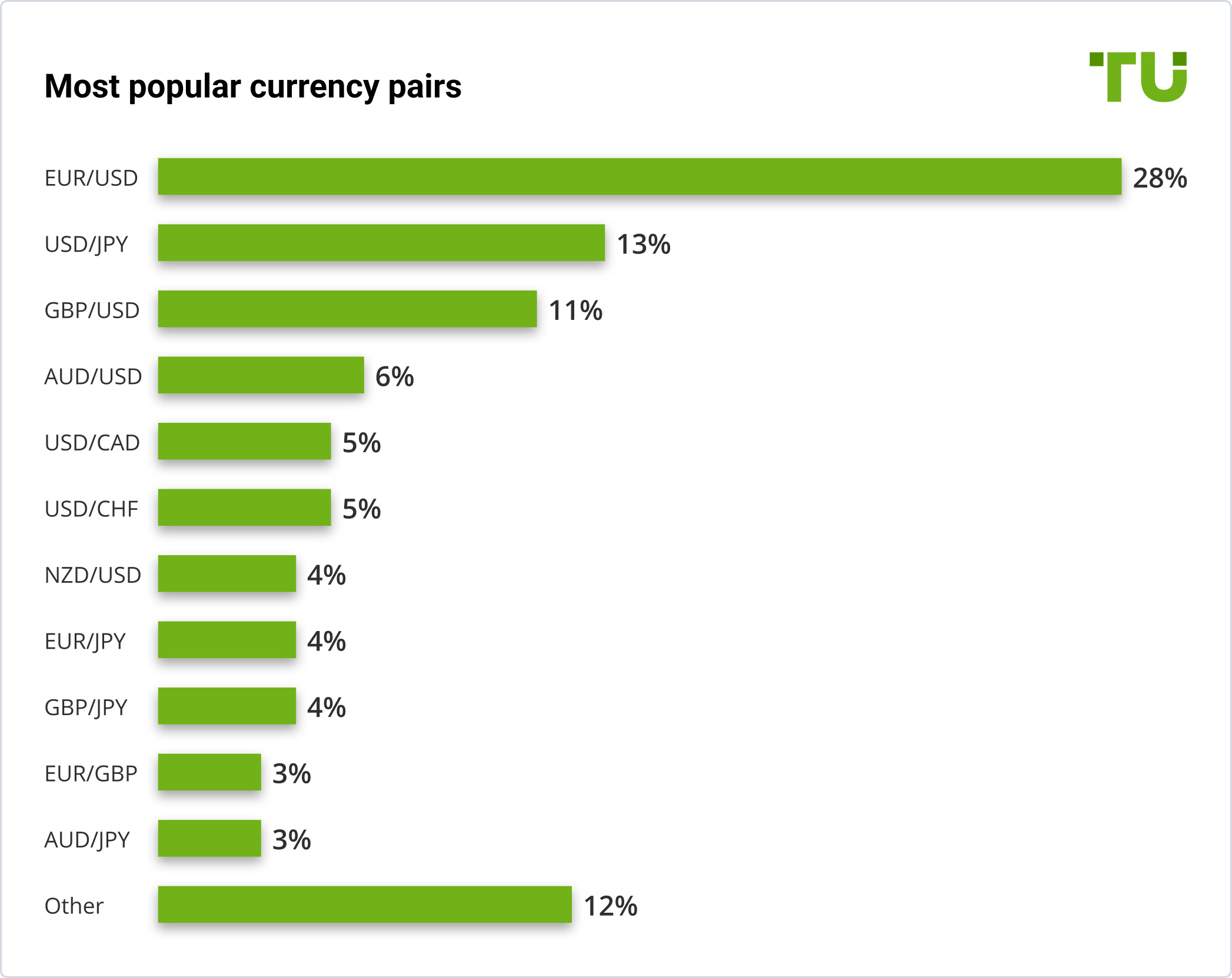

EUR/USD is the most popular currency pair. It accounts for around 28% of all trades in the Forex market. There are also crosses in the Top 10, but they are mostly used by professional traders.

Trading volumes by currency pairs

The most popular currency pairs

6

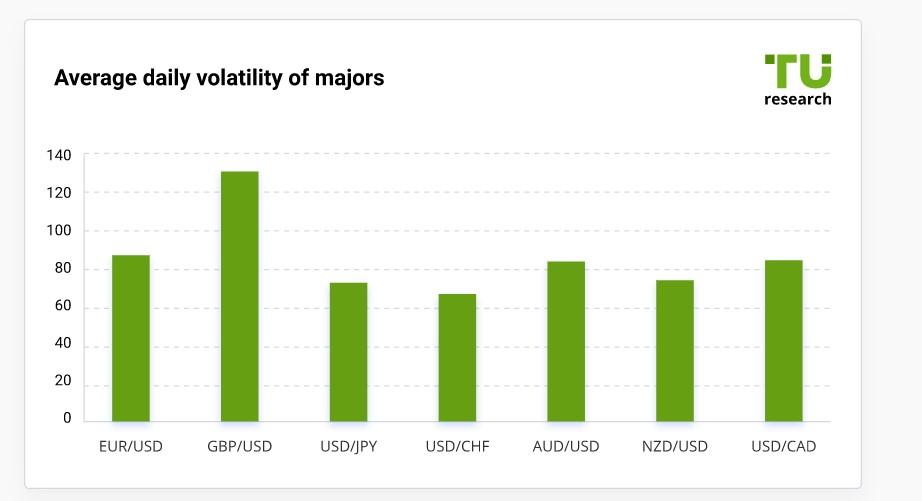

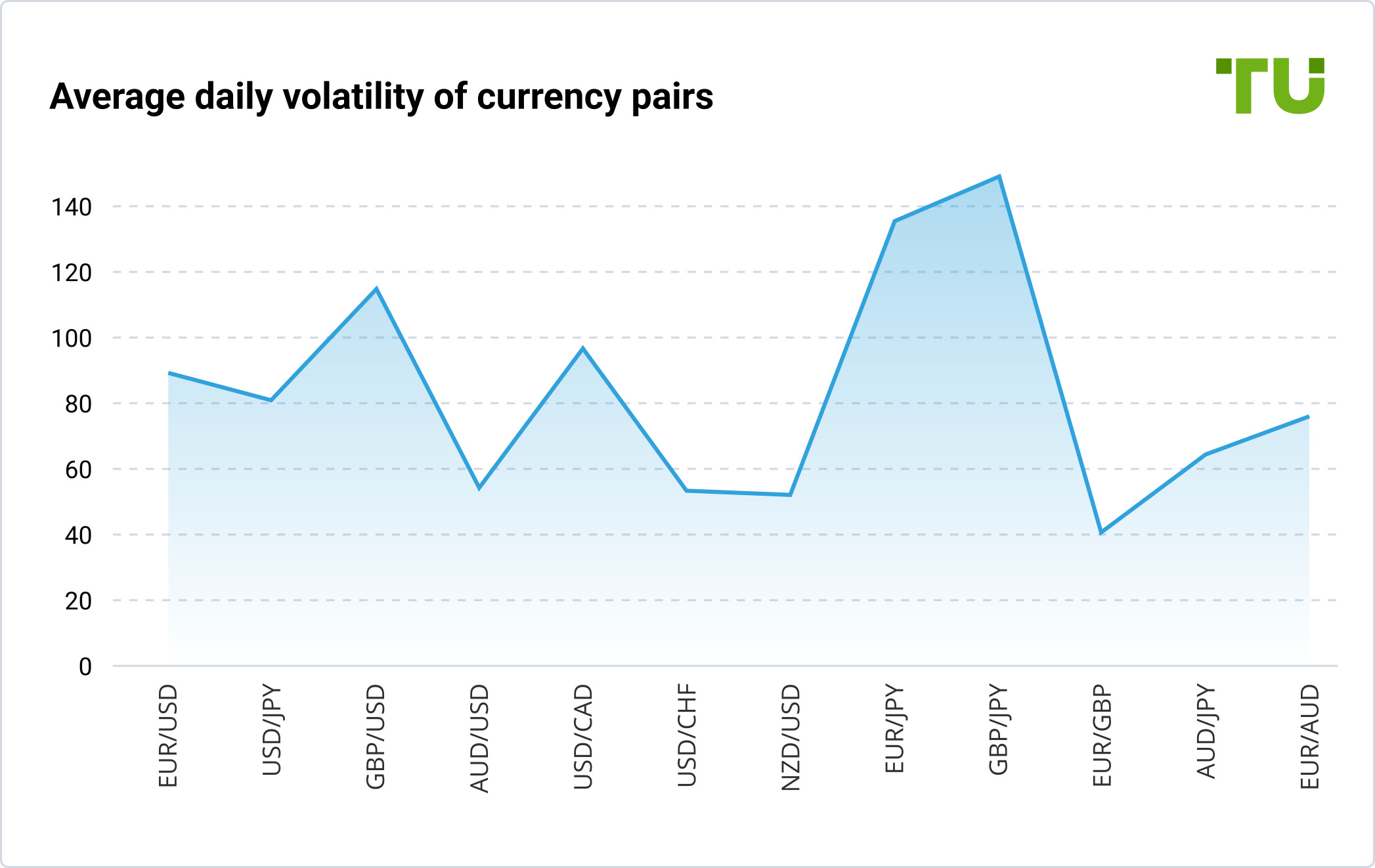

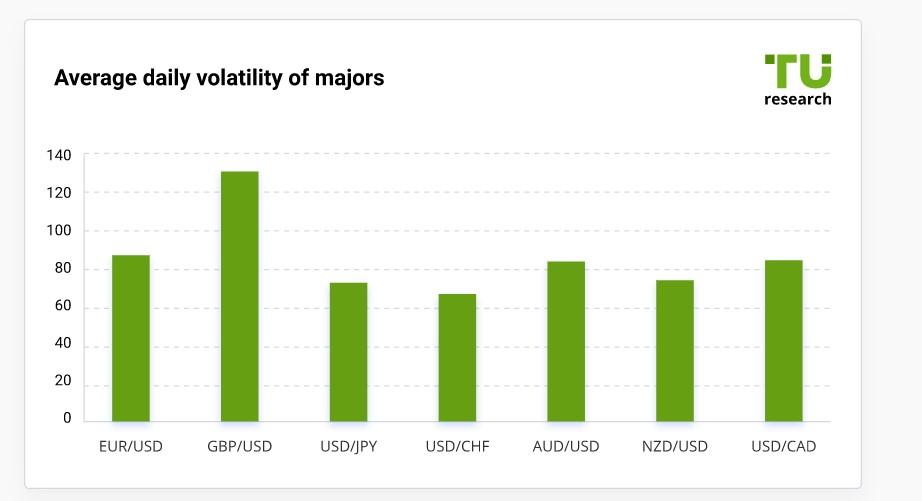

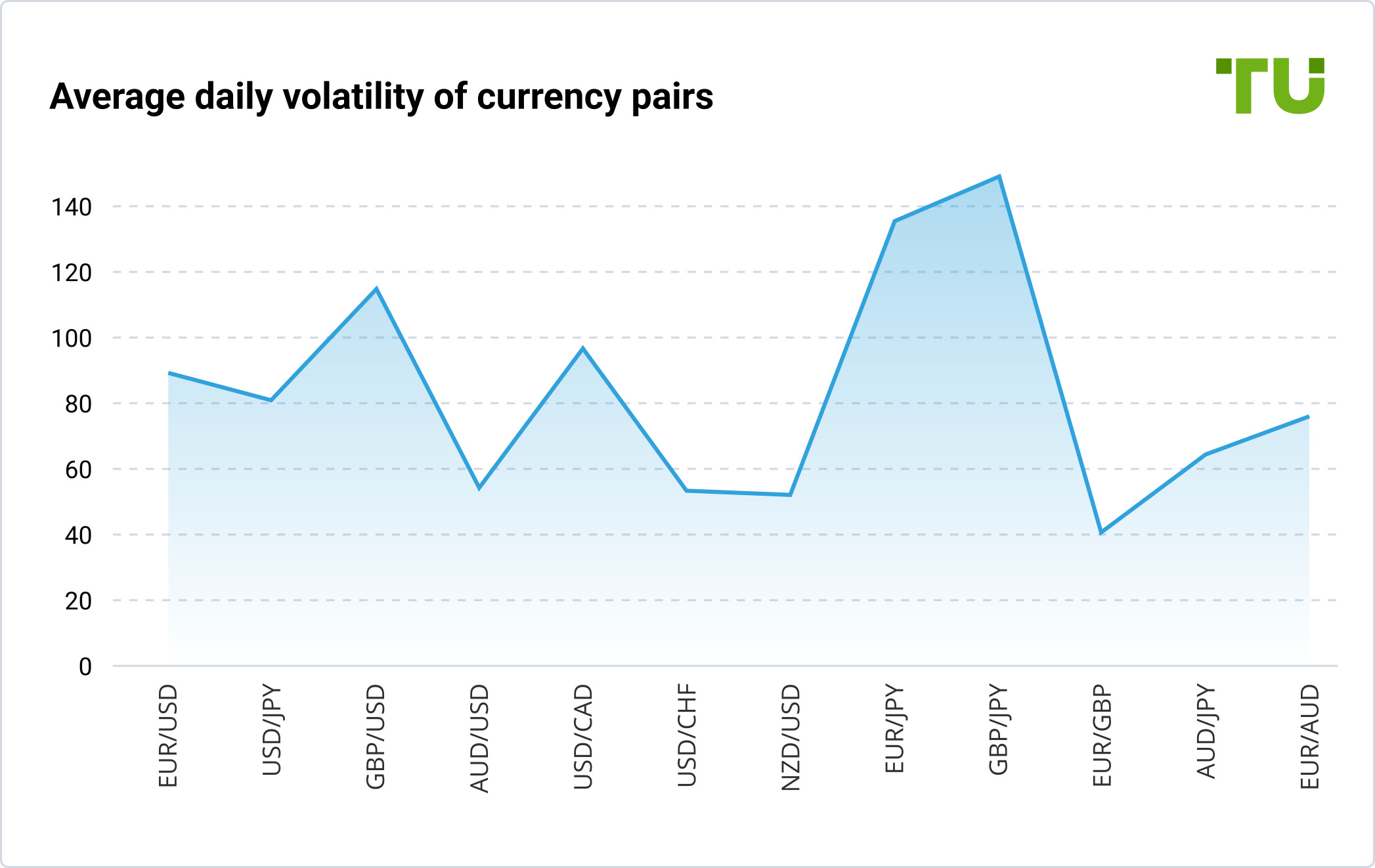

80-90 pips is the average daily volatility of the EUR/USD pair. In terms of this indicator, the pair is somewhere in the middle. However, relatively high volatility does not scare novice traders away, as they still choose EUR/USD instead of more predictable and less volatile AUD/USD or USD/CHF.

Average daily volatility of majors

Average daily volatility of currency pairs

7

GBP/NZD, EUR/CAD, EUR/NZD, GBP/AUD are the most volatile pairs among crosses. The average daily volatility of these pairs ranges within 170-230 pips. CAD/CHF and NZD/JPY are the crosses with relatively low volatility (lower than 80 pips). The higher the volatility, the more money you can make trading in both directions, but the more difficult it is to predict the price. Such pairs are more suitable for scalping, while the pairs with moderate volatility are good for trend trading strategies.

8

From 0 pips is the narrowest spread in forex. Spread is the difference between the sell and the buy price of the currency pair in pips. However, on ECN accounts of some brokers, the difference is so small it can be dismissed. Major pairs with high liquidity have the smallest spread, and the exotic pairs with high liquidity have the highest spread. At the time of news release, spread may increase due to disruption of the demand and supply balance.

9

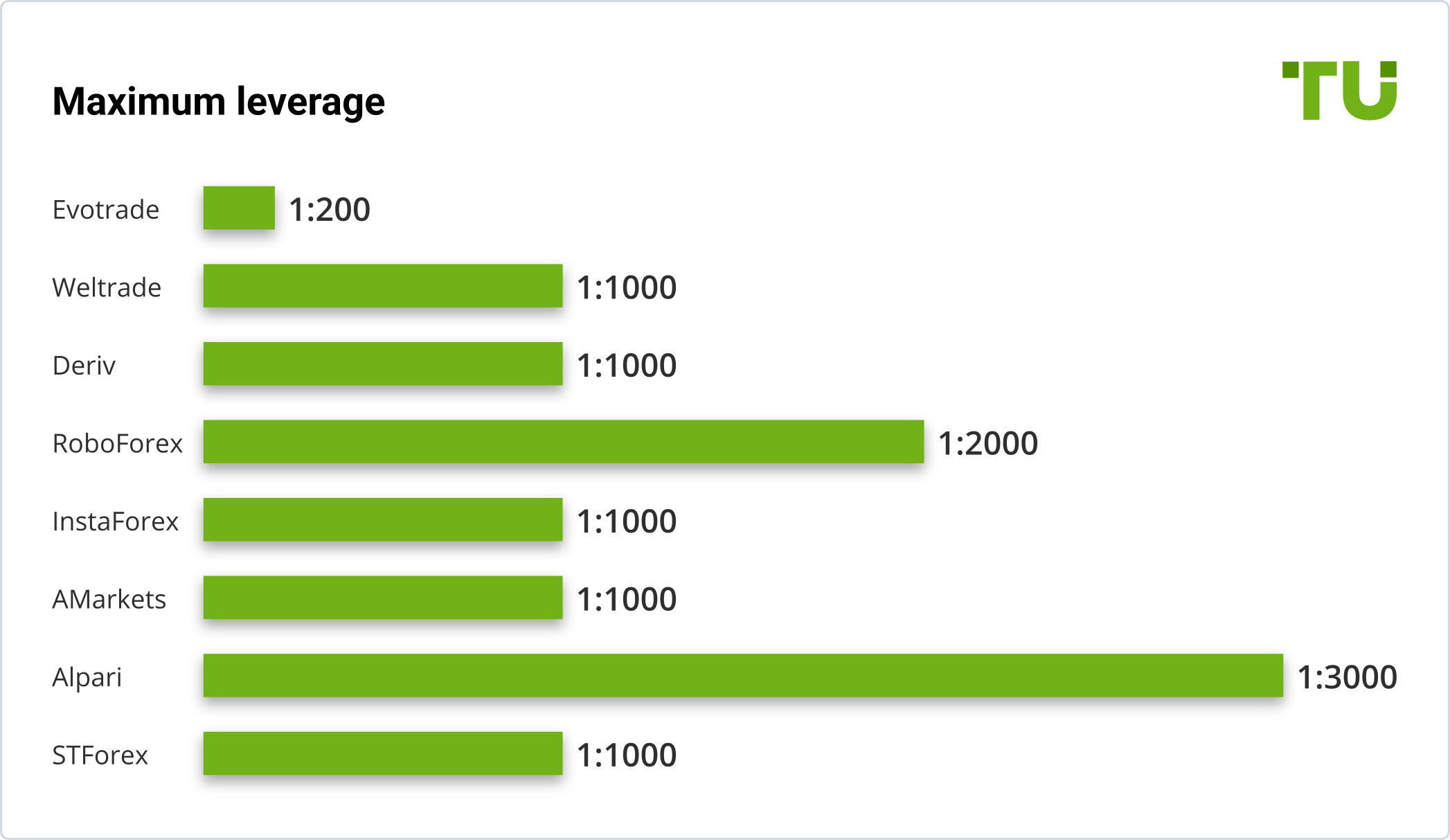

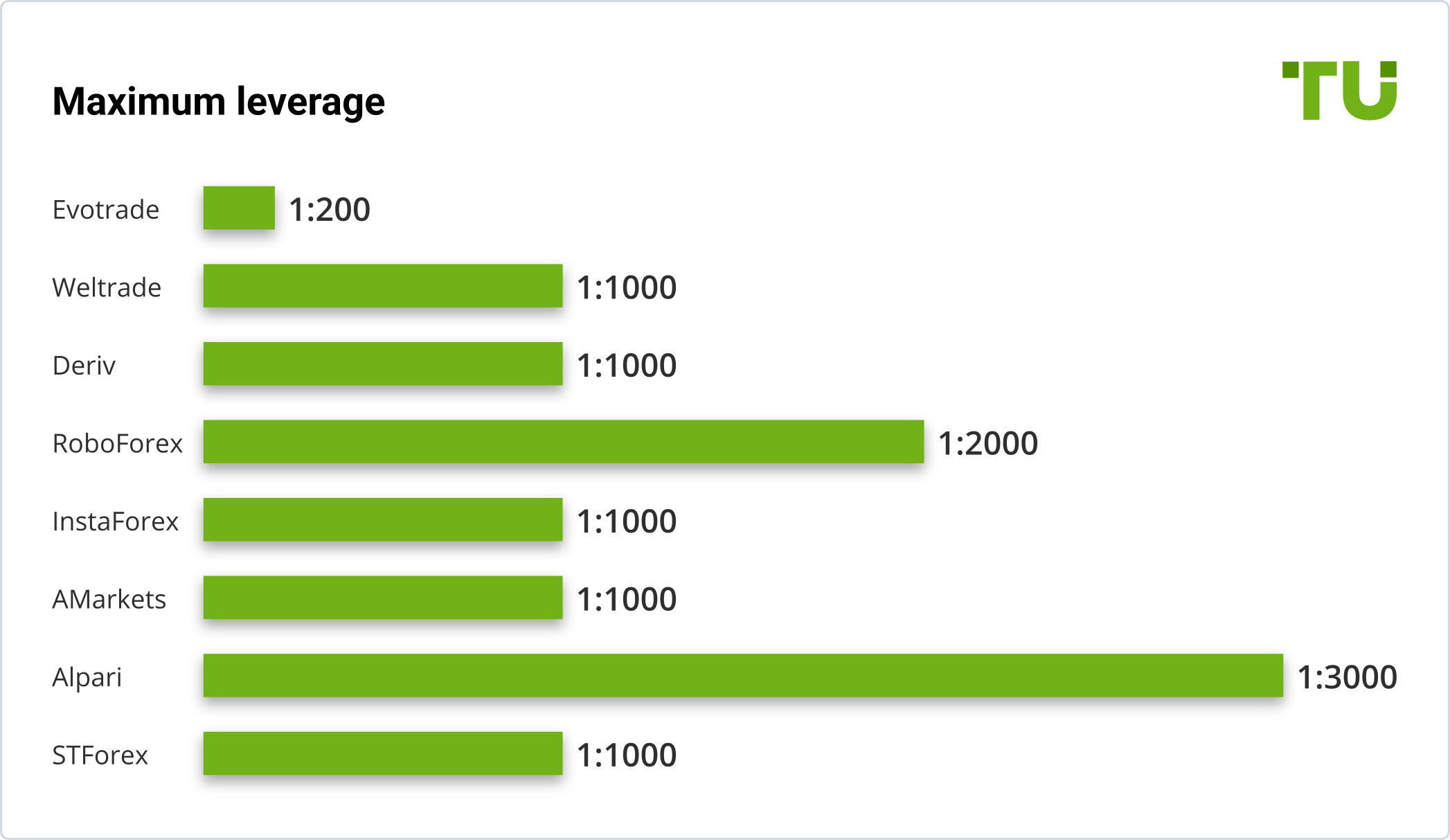

Up to 1:3000 is the leverage offered by brokers. Leverage is the use of borrowed funds to increase the volume of trades. Leverage depends on the broker, chosen asset and regulator. Brokers with the license of a reputable regulator limit the leverage provided to novice traders to 1:20-1:50.

Comparison of available leverage with different brokers

Forex market by countries

The UK is the Forex leader by trading volume. The country’s share is slightly over 40%. The U.S. accounts for around 16%. Despite the fact that the Japanese yen is in the major pairs, the Japanese are not particularly active in trading. Japan accounts for 4.5% of the global currency trading volume.

1

USA. The EUR/USD pair accounts for around 27% of the daily trading volume. USD/GBP is second with 13%, USD/JPY is third with 11%. The Canadian dollar is in fourth place.

2

UK. The EUR/USD pair accounts for 28% of the daily trading volume. The USD/GBP pair accounts for 13% of the trading volume, behind the USD/JPY pair, which accounts for 16% of the trading volume.

3

Australia. The USD/AUD pair accounts for around 47% of the daily trading volume; EUR/USD accounts for only 15% and USD/JPY is third with 10%.

4

Japan. 38.9% of trades are performed with the Japanese yen, and about the same percentage with the USD (38%). The euro accounts for only 9% of transactions.

Cryptocurrencies on Forex

Cryptocurrencies are a relatively young, but very profitable instrument that can now also be found on Forex. Each cryptocurrency is a startup with a unique idea and its implementation. Cryptocurrency volatility averages 1-2% per day, but there are often days and weeks, when traders can use a strong movement from 5% or higher to make a good profit.

1

There are over 21,600 cryptocurrencies listed on CoinMarketCap. Around 80% of them are potential scams or projects that are practically not supported by developers. The total market cap is USD 1 trillion at BTC price at around USD 20,000.

2

Forex brokers offer more than 30 cryptocurrency pairs as CFDs. In most cases, these are the popular coins, including ВТС, ЕТН, XRP, LTC, BCH in the pair with USD.

3

There are 43 million crypto traders in the world. This is four times more than currency traders. This figure, however, includes CFD traders, exchange traders and miners.

4

15.3 million traders in the U.S., 11.3 million traders in Europe. Asia has the highest number of miners, but U.S. exchange markets have derivative cryptocurrency products, which means that formally, the U.S. is the leader.

The advantage of trading cryptocurrency CFDs in the Forex market is that you can open not only long, but also short positions, there is leverage and there is no need to open a cryptocurrency wallet.

What is Forex and how does it work?

Forex is a foreign currency exchange market, where dozens of currencies are bought and sold. Traders invest in currency pairs, the price of which changes depending on demand and supply. If a trader’s forecast of the future price is correct, he/she earns a profit in the amount of the difference between the prices at the moment of position opening and closing.

Forex glossary:

-

Broker is a legal entity acting as an intermediary between a trader and the financial market. Brokers provide technical instruments for execution of trades and are technical executors of orders placed by traders. Brokers redirect traders’ orders to buy or sell an asset to the liquidity provider or ECN platforms.

-

Liquidity provider is an institutional bank or another legal entity acting as a counterparty to clients’ transactions.

-

ECN platform is a platform connecting buyers and sellers on Forex. Examples of ECN platforms are Integral, Currenex.

-

Spread is the difference between the buy and sell price of an asset, which also includes the markup, which serves as the fee charged by the broker.

-

Swap, also known as rollover fee, is the fee traders pay to keep their position overnight. If swap is positive, the fee is credited to their account. The carry trade strategy is built on this.

-

Order is an offer on the trading platform to open a trade. There are market orders (instant execution), and pending orders (triggered once the price reaches a specified level). There are also Stop-Loss orders (closing a position at a specific loss), Take Profit (closing a position at a specific profit).

-

Technical analysis is a set of tools for forecasting prices based on the analysis of statistical patterns in the past. Chart analysis is a part of technical analysis, which envisages drawing support/resistance levels, and patterns, i.e. candlestick formations with psychological basis.

-

Fundamental analysis is a set of tools for forecasting prices based on macro and micro economic indicators. News trading strategy is based on this type of analysis.

-

Pip is the smallest unit measurement of the price change of an asset.

-

Pip value is the value of one point expressed in currency, which depends on the volume of the position, lot, asset. The calculation formula for the pip value is different for different assets. For example, for the EUR/USD pair, the pip value is 10 cents at 4-digit quotes for a 0.01 lot.

-

Volatility is a measure of the speed and amplitude of the price change over a fixed period of time. For example, if the price of asset A changed by 60 pips, and the price of asset B changed by 100 pips in one day, asset B is more volatile.

There is manual and automated trading. Manual trading means that a trader looks for signals and independently opens and closes positions. Automated trading means that the trades are opened by a robot (expert advisor), which has the algorithm of manual trading written in its code. Using EAs saves time and excludes the human factor.

Foreign exchange market participants

Below, you will learn about the main participants of the Forex market and their roles.

| Participant |

Role |

Broker |

Financial middleman between the buyer and the seller of a currency or a different asset |

Trader |

An individual or a legal entity that buys or sells currencies or a different asset |

Liquidity provider |

A market participant provides an opportunity to buy or sell an asset in the shortest possible time at the best price. These are mostly institutional banks that are counterparties to the transaction |

ECN system |

A virtual platform that connects buyers and sellers of currencies |

Market maker |

A major market player that can influence the quotes of an asset through large buy/sell orders |

Can you make money on Forex?

85% traders lose their money in the first month of trading and the majority of them quit trading in the first year, according to statistics. There are several reasons of why this happens:

Lack of understanding of what trading is. Trading seems like an exciting game for beginners, where they can earn money within a few clicks based on mathematical probability. Beginners don’t know the fundamentals of trading, don’t understand what impacts prices and are not aware of the rules of risk management.

Lack of goals, action plans, strategies, i.e. lack of understanding of what a person wants to achieve and when. Where there is no algorithm of actions, there is no result.

Lack of mathematical skills. These skills are required for the calculation of pip value, stop orders or take profit orders. Novice traders think they can earn money on Forex quickly, the amount equal to at least average salary at another job. What they don’t take into account is the large deposit they must have for that and high risks. Here’s a small example: if the pip value for the EUR/USD pair is 10 cents at the minimum lot of 0.01, and the average volatility is 80, a trader will only earn USD 8 per day. That’s in an ideal world. The calculation is conditional, because positions can be opened in both directions. However, it does not include unprofitable trades and the fact that signals don’t appear every minute.

Lack of the desire to grow and develop. As soon as a novice trader realizes that Forex actually implies hard work, he/she gives up. Forex requires continuous development of skills, knowledge and experience: analysis of new strategies, testing of new instruments, monitoring fundamental news, communicating on forums, etc.

Lack of intelligence, perseverance, and emotion. How do you choose a reliable broker and not a scam? How do you calm down, when you’ve lost real money? What are your actions in the event of a force majeure? Many beginners don’t have answers to these questions.

It is true that you can make money on Forex. However, you have to understand that before you can achieve that you will need to spend months practicing and training on a demo account. You must be prepared to risk real money; you need to dedicate a lot of time to trading. If you want to earn, you must learn every minute. Test strategies, analyze mistakes, believe in yourself and don’t give up!

Forex market cap and forex market daily turnover

Forex trading volume is several times higher than the turnover of stocks at NASDAQ and the global GDP. In 2019-2021, the global GDP ranged within USD 90-95 trillion, the global stock market cap exceeded USD 100 trillion, while the Forex market cap was around USD 2.409 quadrillion. Forex daily turnover is USD 6.6 trillion, stock market daily turnover is around USD 1 trillion.

Best time to trade forex

Forex is open 24 hours, except for weekends and holidays. Trading takes place around the clock, but the intensity of trading activity depends on the asset and the time of day. For example, the EUR/USD pair is most heavily traded during European and American sessions, and JPY is most actively traded during the Asian session. That’s why you determine the best time for you to trade depending on your trading strategy.

Best Forex Currency Pairs

Currency pairs are chosen based on the trading strategy. Here are some tips:

Use a volatility calculator. Pairs with low volatility are more suitable for position and trend trading. Highly volatile pairs are good for scalping and high-risk strategies.

Evaluate fundamental factors. For example, the EUR/USD pair is harder to predict than the AUD/USD pair, because more factors impact the price of the former.

Exotic pairs are more suitable for long-term strategies due to low liquidity and lack of fundamental information.

Choose pairs with no sharp or sudden price movements, and where trend lines, support/resistance level and pattern formation are clearly visible.