Joe Lewis Trading Strategy and Investing Philosophy

Every renowned trader was once a novice and each learned the workings of the markets by burning their hands in it. However, in the end, their experience and learning are more than a gold mine if passed on to those looking to enter Forex trading. Likewise, Joe Lewis’ success story can be a highly effective guide for those looking to begin their trading career or enhance it. This article will holistically analyze the trading tycoon’s forays from a restaurant operator to the controlling owner of one of the biggest football clubs in the world. Readers can expect some key insights on how he successfully conquered each business challenge, the principles of his trading strategy, and how they can be adopted and adapted by today’s traders.

Who is Joe Lewis?

Born on 5 February 1937, Joseph C. Lewis is a renowned British businessman and Forex trader who made the majority of his wealth through Forex trading. He was born in a Jewish family living above a Roman Row pub in Bow, London. He left school at the age of 15 to assist his father in their catering business, Tavistock Banqueting, which was located in Central London. Since then, it has all been uphill for him. Currently, Lewis heads the Bahamas-based private investment organization Tavistock Group, a firm he founded in 1975.

Although Lewis forms part of the elite club of Forex traders that includes the legendary George Soros and Julian H. Robertson Jr., he chooses to live a laid-back and closed lifestyle. You wouldn’t find much of his interaction with the media as he consciously chooses to stay away from the crowds, living in his beachfront mansion that has everything money can buy. He is also an avid collector of modern and contemporary art.

How did Joe Lewis make his money?

After he joined his father’s catering business, Lewis was quick to expand it. He was a natural businessman and was quick to grasp any opportunity presented to him. By selling luxury goods to American tourists, he grew the catering business to a level where selling it would’ve made him millions, and he rightly cashed in on this opportunity too. In 1979, he sold the entire catering business for £30 million, which made him a millionaire even before his trading career was streamlined.

After exiting his catering gig, Lewis moved to the Bahamas with all the money he had earned and went all-in on his Forex trading career. From there, he was quick to multiply his wealth. The biggest spike in his wealth came from his participation in the combined bet against the Bank of England wagered by a group of speculators including George Soros.

According to experts, it is estimated that the crashing out of the pound from the European Exchange Rate Mechanism in 1992 (often termed ‘Black Wednesday’) cost the Bank of England nearly £3.4 billion. Because Lewis and the group of speculators went short on the currency, they made handsome profits on this trade. Analysts’ estimates suggest that the profits earned by Lewis from this trade could be north of a billion dollars and were even higher than what Soros had earned.

The Black Wednesday trade was enough to establish an image of a Forex trading tycoon for Lewis but he didn’t stop there. Three years later, he took a similar short trade, but this time, the victim currency was the Mexican peso. Mexico had accumulated a huge trade deficit by 1994 and this led speculators to bet that the peso, which was visibly lacking support from the Government, would crash. As it turned out, by the beginning of 1995, the peso did crash, and speculators/traders like Joe Lewis amassed huge profits.

Alongside his trading career, Lewis was also consistent in his investment venture Tavistock Group. The firm was constantly investing in private and public companies and the multiple successful investments only increased Lewis’ wealth.

Richest Forex Traders in the World - Top 10 - What Are Their Secrets?What is Joe Lewis’ net worth?

According to Forbes, Joe Lewis has a net worth of around $5.2 billion as of January 2023. This ranks him at #490 in the Forbes World’s Billionaires List 2023. A major chunk of his wealth has resulted from his spectacular Forex trading career while the rest has come from his diversified investments in various assets. The following contribute to his wealth:

He is the founder and owner of the Tavistock Group, a private investment organization that has a portfolio of 200+ assets across 15+ countries. Lewis is famously known for his controlling stake in the Premier League football club, Tottenham Hotspur, and the U.K.-based pub operator Mitchells & Butlers through Tavistock.

He also owns numerous luxurious mansions across the globe. In addition to these, he has invested in a variety of other assets, including luxury hotels, club resorts, restaurants, and an agriculture firm based in Australia.

One of his most talked-about investments is the development of Lake Nona, a high-tech medical city situated near Orlando.

Lewis has an immense liking for modern and contemporary art. His art collection is valued at more than £1 billion. He has put it up for display on his 250-foot yacht, Aviva. The collection includes the work of great artists like Picasso, Modigliani, Lucian Freud, Chagall, and Cézanne, among others.

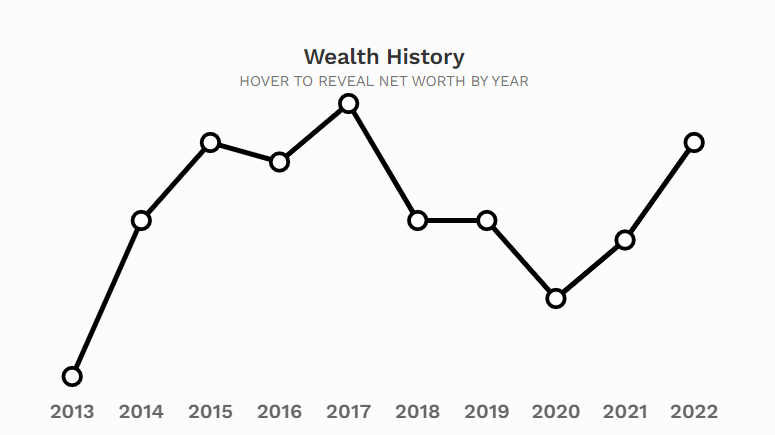

| Joe Lewis’ net worth over the years | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

Year |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2023 |

Net Worth |

$4.2B |

$5B |

$5.4B |

$5.3B |

$5.6B |

$5B |

$5B |

$4.6B |

$4.9B |

$5.4B |

Source: Forbes |

||||||||||

Source: Forbes

What is Joe Lewis’ trading strategy?

Lewis’ trading career can be looked at in two parts with the structural change happening during the Black Wednesday trade. Before that trade, he was regarded as a sensible, methodical trader who took measured risks. He was making or losing millions in each trade back then but once he shifted his strategy to what it is today, his stake rose to billions.

According to experts, the strategy that made him the most money is quite simple: Aggressively short-selling a currency when it’s in a bad place. It is also estimated that he wagers as much as $1.5 billion of his wealth whenever he takes a position against a currency. Both the Black Wednesday trade and the Mexican peso trade were an application of this strategy.

Joe Lewis' advice for novices

The billionaire trader is an intensely private person. His first media interview was not until the 1990s. This explains why there aren’t many ‘Joe Lewis quotes’ on Forex community pages. While Lewis hasn’t outrightly provided any ‘tips’ per se for beginners, experts have analyzed his trading strategy and formulated the following key pointers for beginners:

1. Take risks, but…

Lewis’ trading strategy is aggressive. It is risky to the point that it can hardly be imitated by a normal trader. But it makes sense for someone like him, who would still have $4 billion left even if he loses $1 billion. So as long as the risk is properly calculated, such a decision can hardly be foolish.

2. Position sizing matters

If you look at it, Lewis has made billions of dollars just from two trades. This tells you how big of a role trade conviction and position sizing play when it comes to trading.

3. Bet on liquid currencies

The majority of Lewis’ trades included highly liquid currency pairs, like the pound or the yen. Trading in liquid currencies eliminates liquidity risks, effectively removing an additional burden when executing trades.

4. Know the odds

In an interview with Fortune magazine, Lewis mentioned that being a trader means you’re bound to go wrong at least 3 out of 10 times. Knowing these odds can help you develop the trading psychology of staying in the game for the long run.

5. Not every trade is worth it

Lewis trades even today, but he believes in hitting the nail only on the right opportunities. The market is full of opportunities, so entering only the trades that offer the highest recovery is what makes sense to him.

Best Forex brokers in 2024

Summary

Joe Lewis is a businessman turned Forex trader that has amassed a huge fortune thanks to a few jackpot trades and many winning investments. Contrary to public opinion, he believes in taking aggressive (high-risk) positions if the trade set-up is likely to offer high returns. Beginners can learn from him the art of risk-taking, position sizing, and playing the odds. Those looking to begin their Forex trading journey can choose any of the expert-recommended brokers between eToro and Oanda.

FAQs

What is Black Wednesday?

The term ‘Black Wednesday’ refers to the currency crisis faced by Britain on September 16, 1992, when a collapse in the pound sterling forced the country to withdraw its participation from the European Exchange Rate Mechanism.

What is the Lake Nona Project?

Lake Nona Medical City is a health and life sciences park spread across 650 acres in the Lake Nona region of Orlando, in the State of Florida. Joe Lewis has seeded its development with $100 million worth of gifts and land.

Does Joe Lewis own Tottenham Hotspur?

Joe Lewis’ firm Tavistock Group has a controlling stake in Tottenham Hotspur via the ENIC Group. This makes him the majority owner of the football club.

Has Joe Lewis written any books?

No, Lewis hasn’t authored any books. He has only lived a private lifestyle and made limited interaction with media, and has largely avoided panel discussions, interviews, or opinionizing.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.