Top Free Demo (Trial) Accounts of Prop Firms

Best Free Prop Trading Trial Account - TopStep

Best Free Prop Trading Trial Account are:

TopStep - 14 days free trial with $150,000 in virtual funds

FTMO - 14 days free trial with $100,000 in virtual funds

Funded Next - 15% profit split on demo account for the most successful traders

Proprietary trading firms provide traders with infrastructure and capital to implement their strategies independently. However, succeeding as a proprietary trader presents many challenges such as adapting to a firm's requirements and bearing full responsibility for trading performance. Therefore, prop firms often provide demo trading accounts to help evaluable traders get experience using the firm's platform in a risk-free manner.

This article examines some of the top prop trading firms that provide free demo accounts. We analyze the features and conditions of their virtual trading programs to help readers find the best option for developing their skills before transitioning to live trading.

-

What markets can I trade in demo modes?

Prop firm demo platforms generally mirror their live offerings, so traders have access to forex, indices, commodities, stocks and cryptocurrency markets.

-

How are trades executed in demo modes?

Since it's simulated trading, orders are not sent live to markets. However, prices and liquidity on demo platforms closely mimic real exchanges to provide accurate practice.

-

Will demo performance guarantee me funding?

While strong results increase chances, there are no guarantees as fund allocation depends on many factors and availability of open slots. Demos are assessment tools, not automatic funding programs.

-

Do I need trading experience for a demo account?

While experience helps, demos are designed for both beginners and experienced traders alike, allowing everyone the opportunity to learn more about prop firm programs.

What is a prop trading free trial (demo) account?

A prop trading company free trial refers to a trial period offered by proprietary trading firms to potential traders interested in joining their company. Proprietary trading, or prop trading, involves trading financial instruments with a firm's own capital, as opposed to trading on behalf of clients.

During a prop trading company free trial, individuals can experience the trading environment and strategies of the firm without having to commit any initial capital. The trial allows prospective traders to assess whether they are compatible with the firm's trading style and to gauge their own profitability before deciding to become a full-time trader with the company.

Here are the top five benefits of using a prop trading company free trial:

Risk-free Experience

The free trial provides an opportunity to trade with the firm's capital without paying any commissions or fees

Increased Chances of Passing the Evaluation Phase

By gaining experience and demonstrating profitability during the trial period, traders can showcase their skills and prove their ability to meet the evaluation criteria set by the firm, increasing their likelihood of being accepted as a full-time trader

Real-Time Market Exposure

The trial allows traders to access live market data and participate in real-time trading

Professional Guidance and Mentorship

Prop trading firms often provide guidance and mentorship during the trial period. Traders can learn from experienced professionals, receive feedback on their trades, and improve their trading skills through personalized advice

Access to Advanced Tools and Technology

Prop trading companies typically offer traders access to advanced trading tools, software, and technology infrastructure

It's important to note that the specific benefits of a prop trading company free trial may vary among different types of firms.

Top 3 prop trading demo (trial) accounts

| Company | Trial Period (Days) | Virtual Funds | Trading Assets |

|---|---|---|---|

|

14 |

Assets for copy trading

$150,000 |

Regulator

Futures, forex, cryptocurrencies |

|

|

14 |

Assets for copy trading

$100,000 |

Regulator

Forex, commodities, indices, cryptocurrencies |

|

|

10 |

Assets for copy trading

$50,000 |

Regulator

Forex, commodities, indices |

Topstep Practice Account

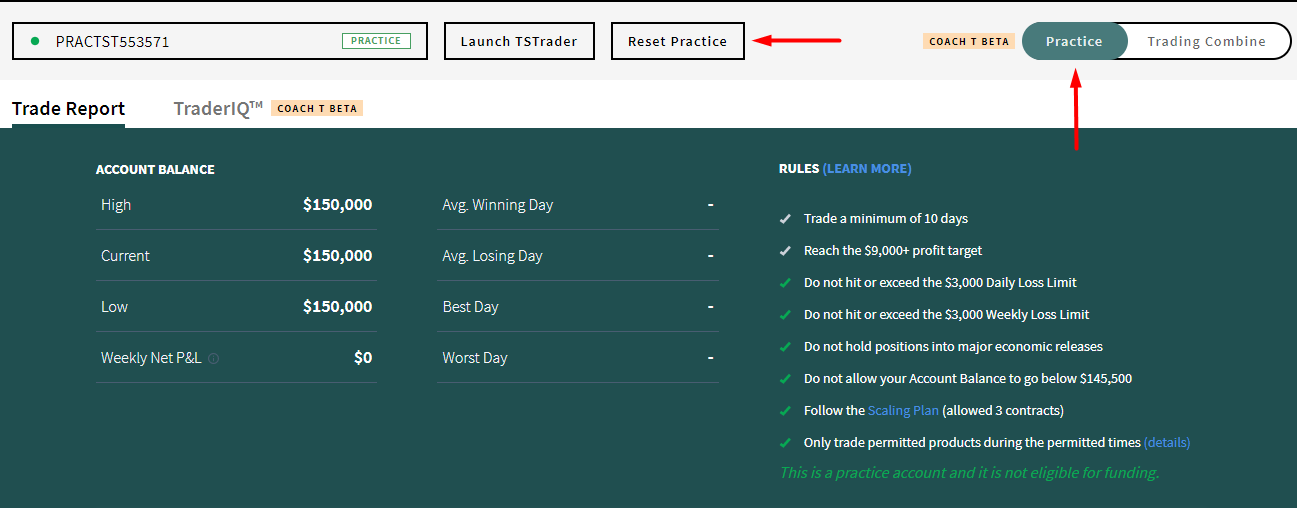

Topstep is one of the best Forex prop trading firms that provides traders with a 14-day free trial period, offering $150,000 in virtual funds to practice their trading strategies. During the trial, traders are expected to achieve performance-based goals and exhibit effective risk control measures. The trial covers various trading assets such as futures, forex, and cryptocurrencies.

Traders can familiarize themselves with Topstep's proprietary trading platform, test their strategies, and gain valuable experience in a risk-free environment. Successful traders during the trial may have the opportunity to progress to funded accounts with Topstep, enabling them to trade with real capital while benefiting from the company's resources and support.

Topstep

FTMO Free Trial

The FTMO free trial offers traders a 14-day opportunity to experience their trading environment with $100,000 in virtual funds. Traders participating in the trial are required to meet a strict profit target and demonstrate a disciplined approach to risk management. During this period, traders can trade a diverse range of assets including forex, commodities, indices, and cryptocurrencies. The trial allows traders to assess the platform's features, execution speed, and reliability while refining their trading strategies. The FTMO free trial serves as a valuable stepping stone for traders looking to showcase their skills and potentially qualify for funded trading accounts with the company.

Funded Next Demo

The trading skills of the individuals are highly valued by Funded Next. If they can achieve a 25% growth in their respective accounts within a 10-day period while strictly adhering to all the rules, such as the 5% daily loss limit, 10% overall loss limit, and maintaining consistency, they will qualify for a real trading account. Additionally, upon meeting these criteria, they will have the option to immediately request a 15% profit withdrawal.

How to find the best prop trading free demo?

Here is a brief four-step guide to help you find the best prop firm demo account:

Research and Evaluate

Begin by conducting thorough research on different prop trading firms that offer demo accounts. Look for reputable firms with positive reviews and a track record of supporting traders. Evaluate their demo account offerings, considering factors such as trading platforms, available markets, trading tools, and educational resources

Review Terms and Conditions

Carefully review the terms and conditions of each prop firm's demo account. Pay attention to factors such as the duration of the demo period, funding levels, risk management rules, profit withdrawal policies

Assess Trading Conditions

Examine the trading conditions provided by the prop firm, including access to real-time market data, order execution speeds, available trading instruments, and risk management features. A reliable demo account should closely simulate the live trading environment, allowing you to test strategies and adapt to real market conditions

Seek Recommendations and Feedback

Reach out to other traders or join trading communities to gather recommendations and feedback about prop firms and their demo accounts. Learning from the experiences of others can help you identify firms that offer high-quality demo accounts with helpful support and a transparent trading environment

By following these steps, you can effectively compare different prop firm demo accounts and choose the one that best suits your needs, providing a valuable learning experience and preparing you for future trading opportunities.

Is there a prop firm without an evaluation fee?

Yes, there are prop trading firms that do not charge an evaluation fee, but traders usually need to meet some strict criteria. These conditions typically include challenging criteria such as high profit targets (15% and more), strict drawdown limits, trading volume requirements, time restrictions (10-30 days), and adherence to risk management guidelines.

Common Mistakes of Demo Trading

While demo accounts provide a valuable opportunity to learn trading skills risk-free, it's easy for traders to develop bad habits if they don't approach the virtual platform correctly. Here are some common mistakes traders make with demo accounts that they should aim to avoid:

Overtrading - With no real money at stake, some traders fall into the trap of taking an excessive number of trades thinking there are no consequences. This creates unrealistic performance results and bad risk habits.

Unrealistic targets - Setting profit targets that could never be consistently met with real money, like 50% monthly returns, is counterproductive. Demos should mirror realistic live expectations.

Ignoring money management - Good risk habits like sticking to position size limits and stop-losses are often not followed in demo mode since losses don't matter. But these skills are essential for real trading.

Changing strategies often - Constantly switching or over optimizing strategies based on short-term demo performance doesn't allow strategies to be robustly backtested. Stick to a single approach.

Not reviewing trades - It's easy to skip trade analysis in a demo but reviewing wins and losses is important for improvement. Take notes as with real trading.

Relying on historical data only - Backtesting on past price action alone without ongoing updates can result in strategies not working as intended in current markets.

The key is to use demo accounts as closely as possible to simulate real trading and avoid creating unrealistic expectations that won't translate once funds are involved. Demo trading requires discipline as much as live trading.

Expert Opinion

Unfortunately, not many prop firms offer demo accounts, although this option provides traders with an undeniable advantage and increases the chances of passing the challenge later. Choosing the right prop firm with a demo account allows beginners to familiarize themselves with the platform's functionality, tools, and requirements. In addition, risk-free preparation helps improve trading skills and make informed decisions for minimal drawdowns during actual trading. Most importantly, it's a real opportunity to assess whether the trading style offered by the prop firm suits you or if you should look for another option.

Methodology for compiling our ratings of prop firms

Traders Union applies a rigorous methodology to evaluate prop companies using over 100 quantitative and qualitative criteria. Multiple parameters are given individual scores that feed into an overall rating.

Key aspects of the assessment include:

Trader Testimonials and Reviews. Collecting and analyzing feedback from existing and past traders to understand their experiences with the firm.

Trading instruments. Companies are evaluated on the range of assets offered, as well as the breadth and depth of available markets.

Challenges and Evaluation Process. Analyzing the firm's challenge system, account types, evaluation criteria, and the process for granting funding.

Profit Split. Reviewing the profit split structure and terms, scaling plans, and how the firm handles profit distributions.

Trading Conditions. Examining leverage, execution speeds, commissions, and other trading costs associated with the firm.

Platform and Technology. Assessing the firm's proprietary trading platform or third-party platforms it supports, including ease of use, functionality, and stability.

Education and Support. Quality and availability of training materials, webinars, and one-on-one coaching.

Team that worked on the article

Andrey Mastykin is an experienced author, editor, and content strategist who has been with Traders Union since 2020. As an editor, he is meticulous about fact-checking and ensuring the accuracy of all information published on the Traders Union platform. Andrey focuses on educating readers about the potential rewards and risks involved in trading financial markets.

He firmly believes that passive investing is a more suitable strategy for most individuals. Andrey's conservative approach and focus on risk management resonate with many readers, making him a trusted source of financial information.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).