deposit:

- $99

Trading platform:

- MetaTrader4

- ASIC

deposit:

- $99

Trading platform:

- MetaTrader4

- A 15% profit split when trading on a demo account, then a 60-90% profit split

- balance potential: up to $4 million

- favorable referral program

- proprietary mobile app

- Up to 1:100

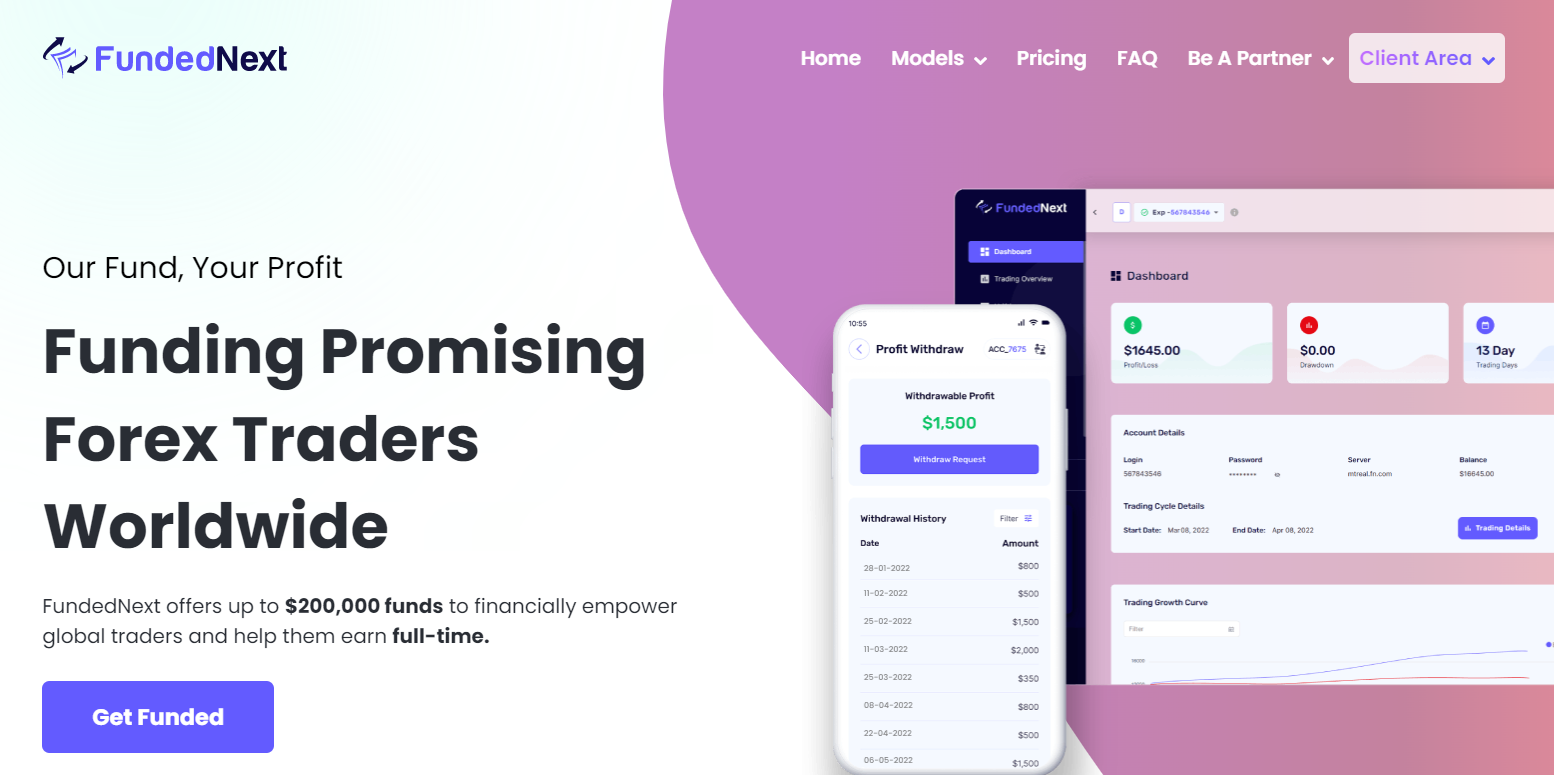

Summary of Funded Next Trading Company

Funded Next is a moderate-risk prop trading firm with the TU Overall Score of 6.15 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Funded Next clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this firm as not all clients are satisfied with the company, according to reviews. Funded Next ranks 11 among 40 companies featured in the TU Rating, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Funded Next is a typical prop firm that cooperates with residents of all countries. The platform offers two funding models and a total of ten plans, giving a trader up to 90% of his net profit. All trading is performed on the popular МТ4 platform. Other trading platforms cannot be used so far, but MT5 will become available soon. Funded Next has a proprietary mobile app, which enables a partner to control his trading activity with a smartphone. On the whole, the company’s conditions are favorable. It works with a proven and reliable broker and therefore can be recommended for cooperation.

Proprietary trading firm Funded Next works with the Eightcap broker (was founded in 2009 and is licensed by the Australian Securities and Investments Commission - ASIC, 391441). The prop (proprietary trading) firm has offices in the UAE, USA, and Southeast Asia and works with residents of all countries. It provides up to $200,000 with a growth potential of up to $4 million. The maximum leverage is 1:100. Funded Next offers 2 account types with 5 plans in each, which allows traders to select the best options. A partner’s profit share is 60%-90%, depending on his performance. The challenges are quite easy. To confirm his qualification, a user trades on a demo account, but the platform pays him 15% of his earnings in real funds. After that, the limits are minimal: at least 10 trading pays per month, up to 5% daily drawdown, and up to 10% overall drawdown. Partners trade on MetaTrader 4 and can use the prop firm’s proprietary mobile app for account control.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | $99 |

| ⚖️ Leverage: | Up to 1:100 |

| 💱 Spread: | No |

| 🔧 Instruments: | Currencies, indices, and commodities |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Funded Next:

- the company cooperates with a broker that holds a license from ASIC and has been providing services for over 13 years;

- after passing a challenge, a trader can get up to $200,000 in his balance and increase this amount by 20 times;

- a partner initially receives 60% of his net profit and then the prop firm leaves him up to 90%;

- at first, payouts are made on request once per month and then, once in 14 days;

- the trading fees are set by Eightcap, but they are lower than if you trade with the broker directly;

- 2 account types, each having 5 plans, differ in the balance provided to a partner after he confirms his qualification;

- a trader takes a challenge on a demo account, where he can only receive a 15% profit share;

- a favorable affiliate program that allows you to earn up to 15% of the referrals’ fees.

👎 Disadvantages of Funded Next:

- no free plans. The minimum fee for a balance of $15,000 is $99;

- the prop firm does not disclose the trading fees until you start trading.

Evaluation of the most influential parameters of Funded Next

Geographic Distribution of Funded Next Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Funded Next

Funded Next has been in business for years. It has physical offices across the world and is one of the leaders in the segment. The platform does not need to be regulated, as it cooperates with Eightcap. This broker first appeared in 2009 and has been successfully developing ever since and consistently expanding its user base. Most importantly, it operates under the aegis of ASIC, one of the leading international regulators.

In terms of features, Funded Next is a typical prop firm, although it definitely has a few competitive advantages. It offers two funding models. In the first one, the challenge has 2 stages and is time limited. In the second one, the challenge has 1 stage and no time limit. Initially, a trader gets 60-80% of the profit, depending on the account type. Later, the profit share can be increased to 90%. A truly unique feature is that after completing a challenge on a demo account, a partner is given 15% of the money earned.

The trading conditions do not differ critically from those at other companies. The only exception is the daily drawdown limit, which most prop firms do not have. Funded Next accepts a loss of not more than 5% of your budget per day, and your overall drawdown must not exceed 10%. Another requirement is to trade at least 10 days in every 30-day trading cycle, but this is a typical rule. Leverage is up to 1:100 and is determined by Eightcap. Note that with Funded Next, you can trade currency pairs, indices, and commodities. Other assets are not available.

No conceptual drawbacks were found during the testing of the company’s features. The relative downsides are that the initial fee is $99 and it’s not refunded. Also, you can trade on MT4 only. On the plus side, Funded Next has a convenient multifeatured mobile app. Based on all the above factors, TU experts recommend this platform to traders who are interested in proprietary trading.

Dynamics of Funded Next’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

Funded Next does not offer investment solutions. Traders cannot earn passively by investing funds in assets but can get bonuses for attracting referrals.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Funded Next’s affiliate program

Every registered user receives a unique code that can be published on any online platform. Anyone who visits the Funded Next website using that code, registers, and pays an initial fee, will bring the code’s owner 10% of the fee. When the number of referrals reaches 30 people, the payout for each next referral rises to 15%. This is the only way partners of Funded Next can earn money, apart from trading.

The conditions of the affiliate program are the same for all regions. Your country of residence does not matter, but there may be restrictions imposed by regional laws.

Trading Conditions for Funded Next Users

Partners of Funded Next can pay the initial fee with a bank card. If you want to use another payment method, see the full list of options in the corresponding menu of your user account. Withdrawal is available via all primary channels: bank cards, bank transfers, electronic wallets, and cryptocurrency wallets. That’s right, the firm’s partners can get payouts in cryptocurrency. Note that leverage size varies. Eightcap provides leverage of up to 1:100, which significantly improves a trader’s profit potential. Technical support can be contacted by email or in a chat. It works 24/7, but does not always respond quickly.

$99

Minimum

deposit

1:100

Leverage

24/7

Support

| 💻 Trading platform: | MetaTrader 4 |

|---|---|

| 📊 Accounts: | Evaluation model and Express model |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Bank card, bank transfer, e-wallet, and crypto wallet |

| 🚀 Minimum deposit: | $99 |

| ⚖️ Leverage: | Up to 1:100 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No |

| 💱 Spread: | No |

| 🔧 Instruments: | Currencies, indices, and commodities |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Unavailable |

| ⭐ Trading features: | A 15% profit split when trading on a demo account, then a 60-90% profit split; balance potential: up to $4 million; favorable referral program; proprietary mobile app |

| 🎁 Contests and bonuses: | Yes |

Comparison of Funded Next to other prop firms

| Funded Next | Topstep | FTMO | Funded Trading Plus | Audacity Capital | TopTier Trader | |

| Trading platform |

MetaTrader4 | Deriv Trader, TSTrader, NinjaTrader, TradingView, Bookmap X-ray, Cunningham Trading Systems, DayTradr, InvestorRT, MotiveWave, MultiCharts, Rithmic R|TRADER Pro, Trade Navigator, Volfix.net | MetaTrader4, MetaTrader5, cTrader | MetaTrader4, MetaTrader5 | MetaTrader4 | MetaTrader4 |

| Min deposit | $99 | $1 | $155 | $119 | $149 | $225 |

| Leverage |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

From 1:1 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:100 |

From 1:1 to 1:100 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0 points | From 0 points | From 0 points | From 0 points |

| Level of margin call / stop out |

No | 1% / 1% | 50% / 50% | No | No | No |

| Execution of orders | N/a | ECN | Instant Execution | Market Execution | No | No |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Prop firms’ comparative table by trading instruments

| Funded Next | Topstep | FTMO | Funded Trading Plus | Audacity Capital | TopTier Trader | |

| Forex | Yes | No | Yes | Yes | Yes | Yes |

| Metalls | No | Yes | Yes | Yes | No | No |

| Crypto | No | No | Yes | Yes | No | Yes |

| CFD | No | No | Yes | Yes | No | Yes |

| Indexes | Yes | No | Yes | Yes | Yes | Yes |

| Stock | No | Yes | Yes | No | No | No |

| ETF | No | No | No | No | No | No |

| Options | No | No | No | No | No | Yes |

Funded Next Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Evaluation model | Determined by the broker | No |

| Express model | Determined by the broker | No |

Detailed review of Funded Next

Since this proprietary trading firm first appeared in the market, there have been no reports of disputable situations or unresolved conflicts with clients. Cooperation transparency combined with a powerful technological base enables the platform to ensure a steady and dynamic operation. Top-notch traders can get a balance of $4 million under management, while beginners that complete their challenges successfully can count on $200,000. Depending on the account type, a partner of Funded Next receives 60% or 80% of his profit and can raise the ante to 90% later. Considering the 1:100 leverage and 10% maximum drawdown, clients can trade comfortably with minimal restrictions. This is the platform’s main benefit.

Funded Next by the numbers:

-

$99 minimum initial fee;

-

15% profit share from the challenge;

-

up to a 90% profit share in prospect;

-

$4 million maximum trading balance;

-

0% trading fees.

Funded Next offers trading in currency pairs, indices, and commodities

Instruments that a prop firm’s partner can trade depend on the broker. But brokers usually offer more assets than prop firms. Eightcap, which Funded Next cooperates with, allows trading in CFDs and cryptocurrencies, among other things. But the prop firm’s partners get a limited list of assets at their disposal: currency pairs, indices, and commodities. This aspect is explained by cooperation specifics and can hardly be deemed a downside. The vast majority of Funded Next’s partners are satisfied with the list of available assets. You can see the full list in the FAQs section of the platform’s website. Note that this list changes from time to time.

Useful features of Funded Next:

-

No limits on challenges. Besides the fact that the challenge in the express funding model is not time-limited, a trader can restart the challenge any number of times until he achieves the required result.

-

Mobile dashboard. All data on a trader’s account is displayed in his user account, but he can also install a free Funded Next app on his phone to control his trading.

-

Extensive support and presence. Each trader gets a personal manager and access to the economic calendar and blog with educational content. The company has large communities on popular social platforms.

Advantages:

Low entry threshold. The minimum initial fee is just $99, and after passing a challenge, a trader receives an account with a $15,000 balance.

Account options. Funding models differ in challenge rules and partnership conditions. Each model has 5 plans with different account sizes.

Large profit share. It’s important for a trader to receive good and regular payouts. With Funded Next, a partner takes up to 90% of his net profit once in 14 or 30 days.

Comfortable conditions. Due to its cooperation with Eightcap, the prop firm provides up to 1:100 leverage. Restrictions are reasonable: 5% daily drawdown and 10% overall.

Any strategies. The company allows you to use any trading style and even set up advisors.

The platform has an intuitive interface. Registration and trading are not complicated even for beginners who have never cooperated with prop firms before.

Guide on how traders can start earning profits

Choose an account type (funding model) based on your experience and skills. The plan should correspond to your trading style and ambitions. Don’t overestimate yourself. Later, you will be able to grow your balance on any plan, depending on your skills. Getting a 90% profit share is fairly easy, don’t stop at 60-80%. Remember that you can always use leverage up to 1:100. It’s an important tool that enables you to increase profits proportionally, but at the same time, the risk rises as well. The company does not permit losing over 5% of your balance daily or over 10% overall, so monitor your trading results carefully.

Account types (funding models):

You select one of the five plans within an account type. Plans are chosen prior to taking a challenge and differ in the balance that you will get after completing the challenge. The balance can be $15,000-$200,000. Keep in mind that the larger the balance, the higher the initial fee. The minimum fee is $99 and the maximum is $999.

Investment Education Online

Prop firms want their partners to improve their trading skills because the more experienced a trader is, the more he earns and the higher the platform’s profits. Funded Next offers traders several ways to improve their qualifications.

Money management and psychological training problems are resolved individually. Each partner of the prop firm is given a personal manager who gives advice and recommendations on many issues, as well as monitors the trader’s progress.

Security (Protection for Investors)

Funded Next is officially registered. It is not a financial organization and therefore does not hold a corresponding license. The prop firm’s partner, Eightcap, is licensed by ASIC, regulated, and operates transparently worldwide. Considering that Eightcap has been in business since 2009 and, so far, has never violated the law or failed to fulfill its obligations to its clients. Consequently, the broker can be deemed reliable.

👍 Advantages

- Traders can resort to lawyers at the prop firm and the broker

- Traders can file complaints with ASIC

👎 Disadvantages

- The prop firm is not responsible for traders’ funds. Responsibility rests entirely with the broker

Withdrawal Options and Fees

-

a trader’s first profit is 15% of the funds earned from the challenge (even though challenges are taken on demo accounts);

-

when trading on real accounts, traders get 60-80% of the profit earned and can potentially raise the payouts to 90% (the rest goes to the prop firm);

-

at first, funds can be withdrawn only once in 30 days. Later, withdrawals become available on request once in 14 days;

-

traders can withdraw funds to bank cards, electronic or cryptocurrency wallets, or via bank transfers;

-

profit can be withdrawn in USD or popular cryptocurrencies like BTC or ETH. Automated conversion is available;

-

withdrawal requests are processed within several days.

Customer Support Service

The Funded Next technical support service works 24/7, but may not respond promptly enough, and its available channels do not include a call center.

👍 Advantages

- Tech support can be contacted by unregistered users

- Email and online chat are available around the clock through browsers or the mobile app

👎 Disadvantages

- No call center

- Sometimes you have to wait a while for a response

Funded Next’s traders can contact tech support in three ways:

-

email;

-

a chat on the website or in the app;

-

a form on the website (response will be by email).

The prop firm has official accounts on Facebook, Twitter, Instagram, and YouTube, where relevant information is published. You can also join the company’s Discord or Telegram community. All the links are included in the website’s footer.

Contacts

| Foundation date | 2020 |

| Registration address | United Arab Emirates Office no. 7, AI Robotics HUB, C1 Building, AFZ, Ajman, UAE |

| Regulation |

ASIC |

| Official site | fundednext.com |

| Contacts |

Email:

support@fundednext.com,

|

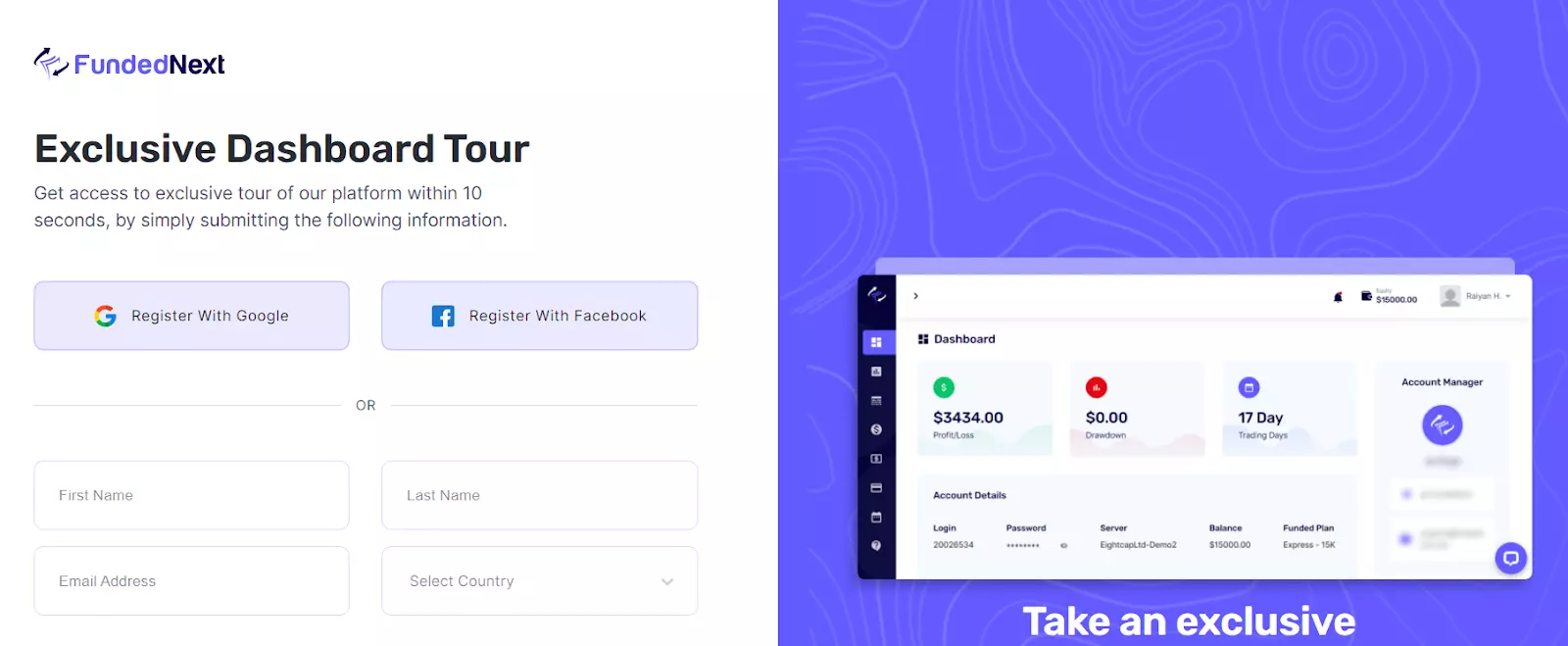

Review of the Personal Cabinet of Funded Next

To start trading with the prop firm’s funds, you have to register. All transactions are made on MT4 through your user account or the mobile app. Although the registration process is simple and the user account is intuitive, TU provides this step-by-step guide to answer your questions.

Go to the Funded Next official website. Click on the “Client Area” button in the top right corner and choose “Register” from the dropdown menu.

You can register with Google or Facebook if you have active accounts on these platforms. Otherwise, include your first and last names, email, and country of residence. Create a password and confirm it. Click “Register”.

Preliminary registration is complete. Sign in with the username and password you provided. You can also use your Google or Facebook account to sign in.

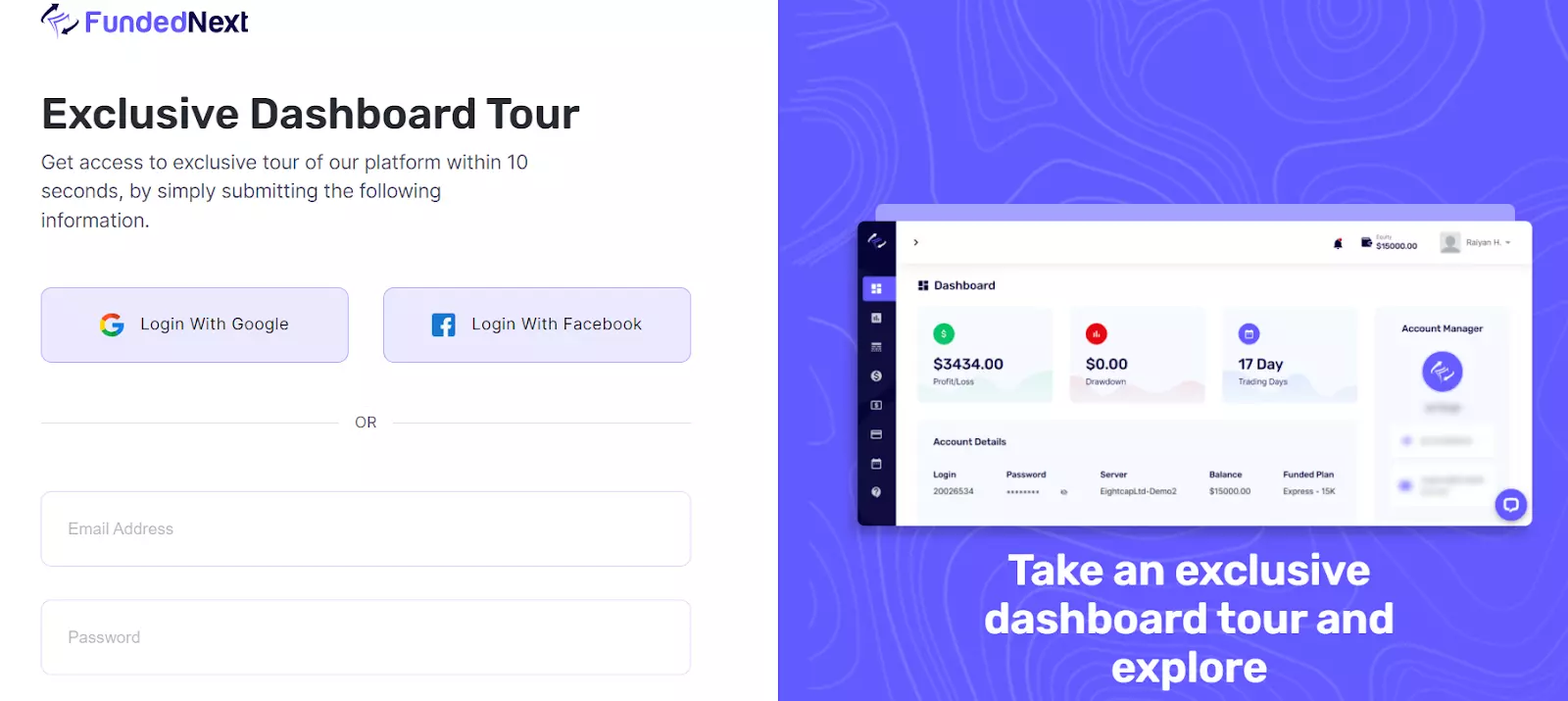

Now you are looking at your dashboard. In the top right corner, click on your name and choose “My profile” from the dropdown menu. Enter the data to meet the verification parameters.

On the left-hand menu, click the “Get funded” button. Select an account type and plan that meet your needs. On the right, you can see basic information about the plan you selected and the fee amount. Click “Buy now”.

Include the details of the bank card, which you want to use to pay the initial fee. On the right, there are buttons for alternative payment methods. After entering the required data, tick the box to accept the prop firm’s terms of service (you can view them by following the links). Click the “Confirm payment” button.

The platform will notify you when the initial fee arrives. From that moment, you can start a challenge. Your progress will be displayed on the dashboard. You can trade on MetaTrader 4, where you need to enter your Eightcap account number provided to you by Funded Next.

Funded Next user account features:

-

dashboard displays data on a trader’s accounts and basic information about his financial activity.

-

trading review includes challenge data and will later display trading details;

-

service section enables you to download and install various calculators, platform indicators, and educational content;

-

withdrawal menu shows your current balance available for withdrawal. Here you can form payout requests;

-

billing menu shows all bills a trader wrote out to the platform and their current status;

-

news calendar includes the economic calendar and coverage of special events by the prop firm’s financial experts;

-

in the Help section, a trader can select a question and get an automated answer with detailed instructions.

Disclaimer:

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Articles that may help you

FAQs

How do client reviews impact Funded Next rating?

Any review can raise or lower the rating of any company in the Forex prop firms rating. To read reviews about Funded Next you need to go to the company's profile.

How can I leave a review about Funded Next on the Traders Union website?

To leave a review about Funded Next , you need to register on the Traders Union website.

Can I leave a comment about Funded Next if I am not a Traders Union client?

Anyone can post a comment about Funded Next in any review about the company.

Traders Union Recommends: Choose the Best!