deposit:

- $5

Trading platform:

- Proprietary web platform

deposit:

- $5

Trading platform:

- Proprietary web platform

- The payout amount varies depending on the traded pair and the user account level

Summary of CloseOption Trading Company

CloseOption is a moderate-risk broker with the TU Overall Score of 6.5 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by CloseOption clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. CloseOption ranks 6 among 21 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

CloseOption is a regulated binary options broker where traders can trade fiat currencies and cryptocurrencies with their own funds. Due to the small size of the minimum deposit, the broker is suitable for beginners. CloseOption will also appeal to experienced traders due to the increased payout rates on VIP accounts.

CloseOption is a binary options broker that was registered in Georgia in 2013 and operates under the supervision of the National Bank of Georgia. It provides its clients with trading in pairs with fiat currencies and cryptocurrencies through a proprietary web platform. CloseOption’s services are used by over 2 million traders worldwide, including the United States. The broker specializes in active options trading but also offers an affiliate program to generate passive income. More than ten payment systems are available to CloseOption clients for depositing and withdrawing funds, with the majority of them allowing fee-free transactions.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | $5 |

| 🔧 Instruments: | Binary options (currency pairs, pairs of fiat and cryptocurrencies) |

👍 Advantages of trading with CloseOption:

- licensed by a reputable financial regulator;

- loyal first deposit of $5;

- size of payments increases as trading volumes increase;

- money prizes for trading with virtual funds;

- many ways to contact technical support that operates 24/7.

👎 Disadvantages of CloseOption:

- a small range of trading assets;

- clients cannot trade with leverage;

- payments on accounts with small deposits are lower than those of competing brokers.

Evaluation of the most influential parameters of CloseOption

Trade with this broker, if:

- You value a low initial deposit requirement. With a loyal first deposit of just $5, this broker offers accessibility to traders with smaller capital.

- You appreciate the incentive of increasing payment sizes as trading volumes increase. As your trading activity grows, the size of your payments also increases, providing potential for higher returns over time.

Do not trade with this broker, if:

- You require the option to trade with leverage. This broker does not offer trading with leverage, which may limit your ability to amplify potential profits or losses.

- You prioritize higher payments on accounts with small deposits. Payments on accounts with small deposits are lower compared to those of competing brokers, which may affect your overall profitability, especially if you have a smaller trading capital.

Geographic Distribution of CloseOption Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of CloseOption

Clients can trade pairs on the CloseOption broker platform not only with the most liquid currencies, such as USD, EUR, GBP, and AUD, but also with JPY, CAD, CHF, NZD, and NOK. Cryptocurrency pairs include ETH/USD, LTC/USD, BCH/USD, and XBT/USD. Because the company does not provide leverage, it is possible to use only personal funds in trades.

CloseOption does not offer a Weekend Trading option, which means that, unlike other brokers, its clients cannot trade on Saturdays and Sundays. As a result, the company seeks to protect the capital of traders, as market volatility typically increases on weekends. CloseOption warns on its website that delays in price processing and its display in the trading platform range from 1000 to 2000 ms. This means that there is a chance of closing a trade with a minor price difference, which can result in both profit and loss.

Creating a user account takes no more than 10 minutes, but the user must pass verification. To do so, he must submit scanned copies of documents proving his identity and place of residence. Authentication of the provided details takes up to two business days. Citizens of countries where trading in binary options and Forex is prohibited at the state level are unable to open an account with CloseOption.

Dynamics of CloseOption’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

CloseOption is a broker for independent binary options trading. It provides no investment solutions, such as copy trading or staking. The only option for receiving passive income is its referral program.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

CloseOption referral program

The affiliate program allows clients to earn money from the trading activity of traders registered on the CloseOption platform through the referral link. The broker offers two plans — “The regular commission plan” and “The revenue share plan”. The partner receives $1-2 for each $100 a referee trades.

The revenue share plan is available to partners who have brought a significant number of referrals to the platform. The conditions of the referral program are available upon request from the company’s client service.

Trading Conditions for CloseOption Users

The percentage of payments from the CloseOption broker is not fixed. It varies according to market volatility, the total number of orders placed for the particular asset, and the user account level. The minimum payout rate is 17% of the bet amount, and the maximum is 95%. Before the expiration of the contract, a trader can buy or sell no more than 25 options. A buy or sell trade order cannot be canceled.

$5

Minimum

deposit

1:1

Leverage

24/7

Support

| 💻 Trading platform: | Proprietary web platform |

|---|---|

| 📊 Account types: | Real, Contest, and demo |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | PayPal, Perfect Money, WebMoney, Bitcoin, Tether, Ether, Tron, Ripple, Bitcoin Cash, Dash; Visa, MasterCard, or American Express bank cards, and wire transfer |

| 🚀 Minimum deposit: | $5 |

| 📈️ Min Order: | $1 |

| 🔧 Instruments: | Binary options (currency pairs, pairs of fiat and cryptocurrencies) |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| ⭐ Trading features: | The payout amount varies depending on the traded pair and the user account level |

| 🎁 Contests and bonuses: | Yes |

Comparison of CloseOption with other Brokers

| CloseOption | Pocket Option | Binarium | Binary.com | Intrade Bar | Centobot | |

| Trading platform |

Proprietary web platform | MT5, Web, Mobile | Binarium | WebTrader, Mobile | Mobile MT4, WebTrader | RaceOption, Binarycent, Videforex |

| Min deposit | $5 | $5 | $5 | $5 | $10 | $250 |

| Trading instruments |

Binary options (currency pairs, pairs of fiat and cryptocurrencies) | currency | indexes, Currencies, Cryptocurrencies | indexes, Forex, goods, stock, random index | Currency pairs | Binary options (fiat currencies and cryptocurrencies) |

| Signals | No | No | No | No | Yes | No |

| Analytical support |

No | No | No | Yes | Yes | No |

| Training | No | No | No | Yes | Yes | No |

| Additional tools |

No | Copy Trading tool | No | premature closing | No | No |

Broker comparison table of trading instruments

| CloseOption | Pocket Option | Binarium | Binary.com | Intrade Bar | Centobot | |

| Forex | Yes | Yes | Yes | Yes | Yes | No |

| Metalls | No | No | No | Yes | No | No |

| Crypto | Yes | Yes | Yes | No | No | Yes |

| CFD | Yes | No | No | Yes | No | Yes |

| Indexes | No | Yes | Yes | No | No | No |

| Stock | No | No | Yes | No | No | No |

| ETF | No | No | No | No | No | No |

| Options | Yes | Yes | Yes | Yes | Yes | Yes |

CloseOption Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Real | $1 | Yes, when withdrawing via bank transfer |

If the trading account has been inactive for more than three months, a monthly fee of 0.5% of the balance will be charged.

Comparing the fees of various brokers allows traders to determine which of them provides the best conditions. Traders Union analysts performed a comparison of commission fees. The comparison of CloseOption, VideForex, and IQcent is shown below.

| Broker | Average commission | Level |

| CloseOption | $1 | Low |

| VideForex | $5 | Medium |

| IQcent | $7 | High |

Detailed review of CloseOption

CloseOption is a regulated broker suitable for trading traditional put/call binary options. In addition to a trading platform with high payouts, it provides its clients with high-quality education and professional support 24/7. CloseOption accepts deposits and withdrawals via a variety of payment methods, including electronic and crypto wallets. The company’s trading platform works in Opera, Chrome, Mozilla Firefox, Internet Explorer, and Safari browsers and has an intuitive interface and a demo mode for risk-free training.

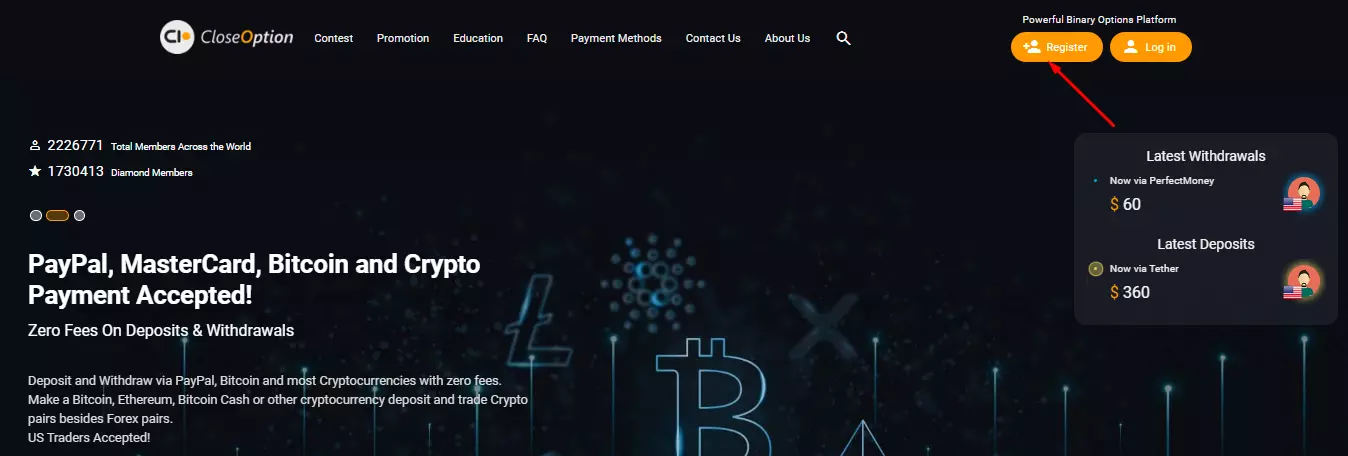

CloseOption by the numbers:

-

Almost 10 years of experience in the Forex and binary options markets.

-

More than 2,200,000 users worldwide.

-

More than 1,700,000 clients with trading volumes exceeding $50,000.

-

The prize pool for trading contests is $3,000 every week.

CloseOption is a binary options broker with variable payout rates

The binary options payout percentage of CloseOption is determined by the market situation, the asset, and the level of the trader’s user account. The level increases or decreases depending on the amount of the deposit. There are 5 levels available on CloseOption. The Cooper level is assigned to accounts with deposits of $0-$1,000; Bronze level is $1,000-$2,000; Silver level is $2,000-$10,000; Gold level is $10,000-$50,000, and the Diamond level is assigned to accounts with deposits of more than $50,000. The maximum payout percentage for the EUR/USD pair, depending on the level, is 76%, 77%, 78%, 79%, and 91%, while the maximum payout percentage for other assets is 75%, 76%, 77%, 78%, and 79%. With a calm market, payouts can reach up to 95%. The minimum rate for all accounts is 17%.

The CloseOption trading platform is accessible via any browser and requires no download. It can be used from a PC, laptop, or smartphone. At the time of this review, CloseOption did not provide any mobile apps.

Useful CloseOption services:

-

Guides for beginners. The company’s website provides detailed instructions on how to use the trading platform, pass verification, select and open an account, and make a deposit.

-

List of countries with restricted access. Traders from the listed countries cannot register with a broker and trade through it. The list is updated when the cooperation conditions change.

-

Trading contests. Trading contests are held every week. The total prize fund is $3,000. To participate in the contest, users need to deposit $5-10. Although trading is done with virtual funds, the top twenty traders receive real money.

Advantages:

fast online registration of the user account;

a wide range of payment systems through which funds can be deposited and withdrawn;

high-quality education materials on trading fiat currency pairs and cryptocurrencies;

availability of a referral program;

increased payments for traders who have deposited more than $1,000 into the account.

The company is well-suited for fast trading because it provides options with 30-second expiration dates.

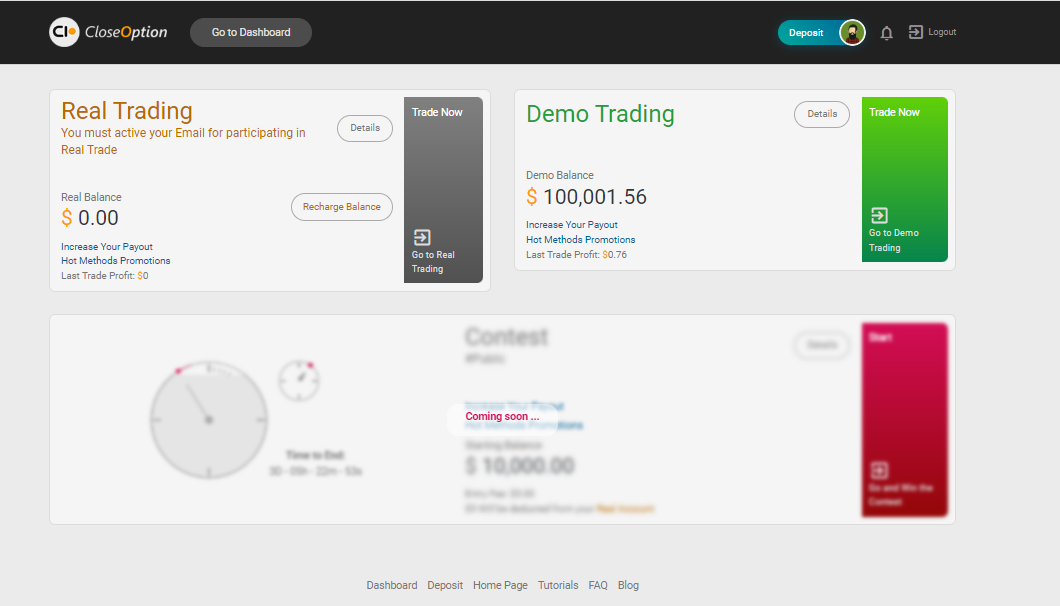

Guide on how traders can start earning profits

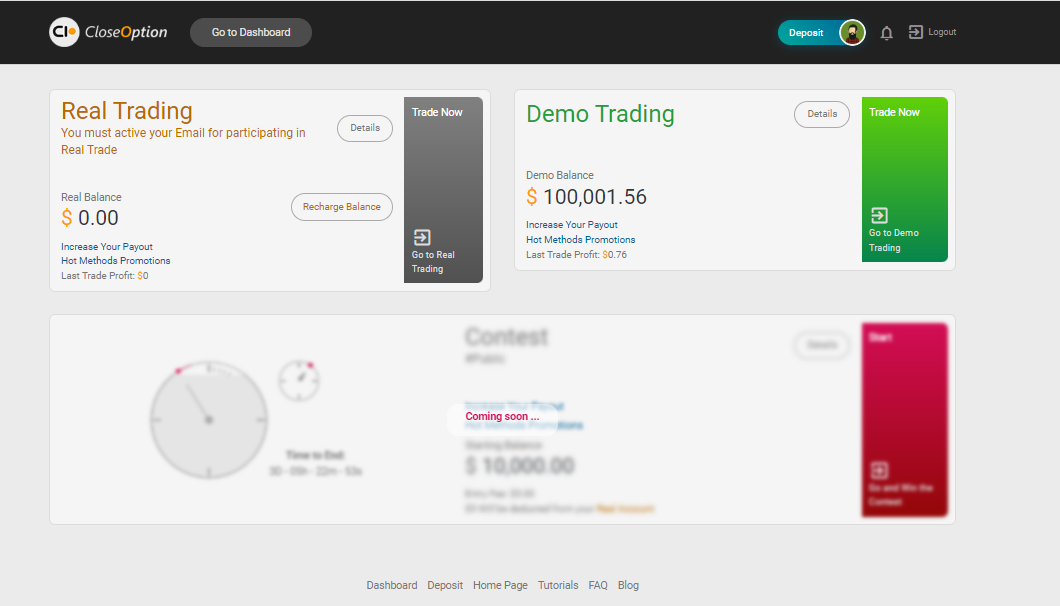

To earn money on the CloseOption platform, it is necessary to open a real account and deposit funds. Next, you must correctly predict the price of assets. A trader can have only one user account on CloseOption. The creation of additional user accounts violates the conditions of the offer, so the broker blocks them.

Account types:

CloseOption also offers a free demo account to practice trading strategies. Profits earned on demo accounts cannot be withdrawn, but losses are zero because trading is done with virtual funds.

The CloseOption broker is unique in that it provides not only a demo account, which is familiar to many traders, but also a contest account, with which clients can win real money for trading with virtual funds. CloseOption Bonuses Explained.

Investment Education Online

On the CloseOption company’s website, education materials are placed in a dedicated Education section. It contains a wealth of information for those new to binary options, Forex, and CFD trading. More about how to buy/sell on CloseOption

The Tutorials section of the website contains practice guides on how to start trading with CloseOption. Another effective education tool is a demo account.

Security (Protection for Investors)

CloseOption is a Georgian company registered under the No. D86708031, so its operations are conducted under Georgian law.

Activities in the fields of Forex and options trading are permitted under the National Bank of Georgia license No. B 2-08/3647. It was issued in October 2017 and has yet to be recalled by the regulator. Is CloseOption A Safe Broker?.

👍 Advantages

- CloseOption is regulated by a state supervisory authority

- Payments in cryptocurrencies are not prohibited.

- The regulator allows the broker to provide bonuses to clients

👎 Disadvantages

- Documents proving the identity and place of residence of clients are stored on the company’s server in encrypted form

- Broker services are not available in some countries

- Identification and proof of residency are required.

Withdrawal Options and Fees

-

The trader can withdraw funds in the same way he deposited them. Transferring funds to third-party bank cards and electronic wallets is prohibited.

-

The withdrawal process takes up to 3 business days.

-

Minimum withdrawal amount: $1 is for cryptocurrencies, Perfect Money, and WebMoney, $20 is for credit cards, and $500 is for bank transfers.

-

Brokers do not charge fees for cryptocurrency withdrawals or payments made with Perfect Money or WebMoney. Fees for bank transfer withdrawals range from $50 to $100, depending on the amount of the transaction. CloseOption covers fees for withdrawals to bank cards, but the trader pays for currency conversion.

Customer Support Service

Client support is available 24/7.

👍 Advantages

- Live online chat

- Round-the-clock availability

- Support is available in different languages, including English

👎 Disadvantages

- Operators do not always respond quickly

To receive assistance from the CloseOption support team, the client may:

-

call the phone numbers listed in the contacts section, or request a callback;

-

write a message in chat;

-

send a request by email;

-

complete the feedback form by email;

-

create a ticket from the user account.

Users can also reach out to the company’s representatives via Skype, Twitter, and Instagram. Links to the social network profiles are available on the official CloseOption website.

Contacts

| Foundation date | 2013 |

| Registration address | Vake-saburtalo district, Al Kazvegi ave. N41 Apt.N19, Tbilisi, Georgia |

| Official site | https://www.closeoption.com/ |

| Contacts |

Email:

info@CloseOption.com,

Phone: +442032902097, +17068474747 |

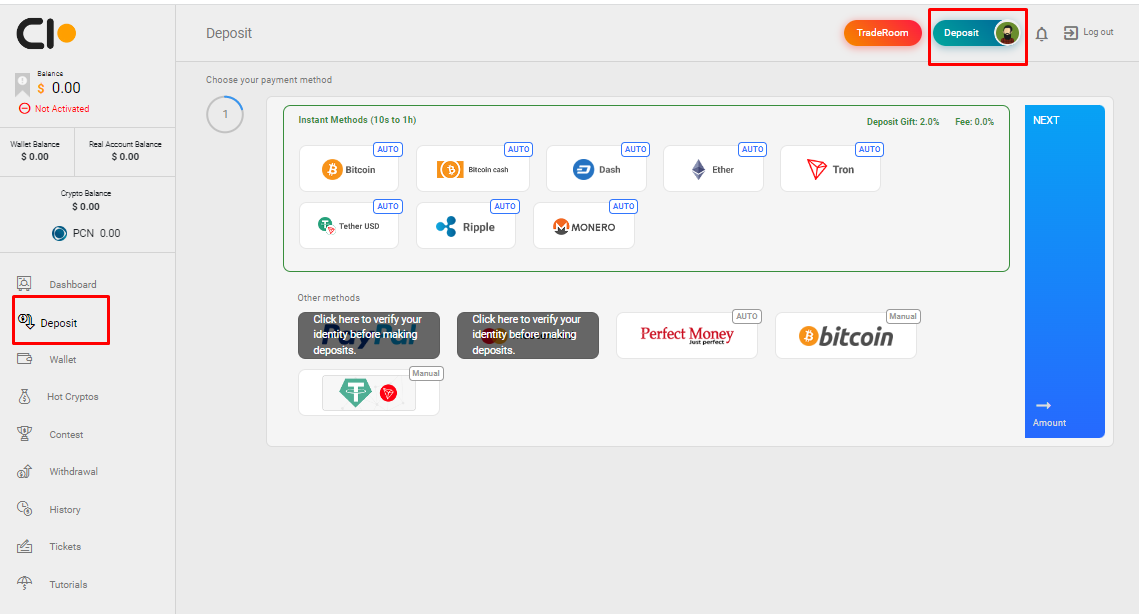

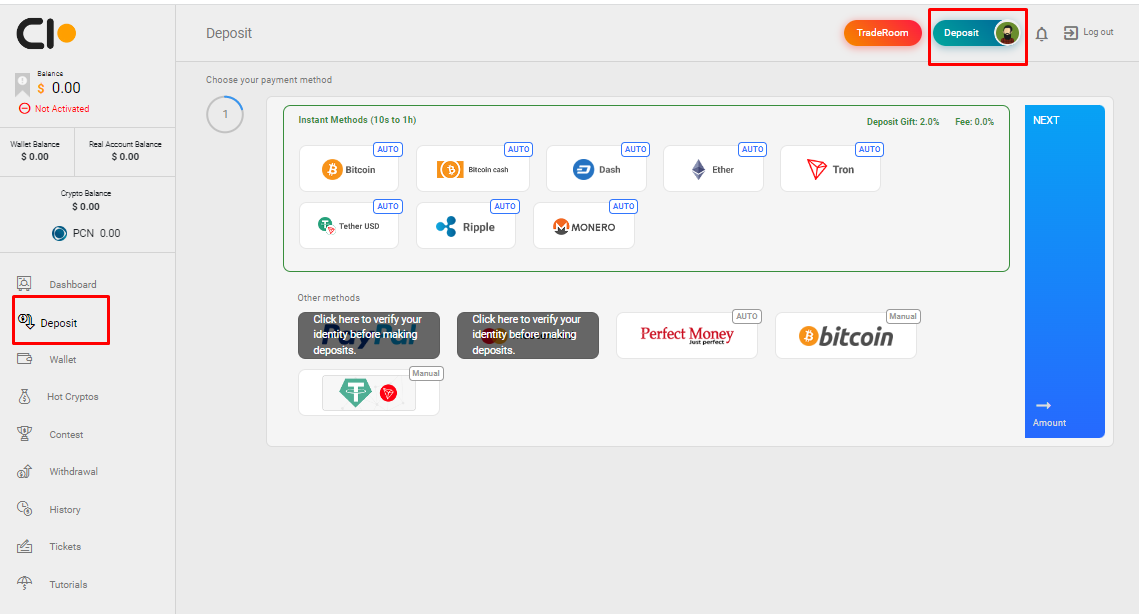

Review of the Personal Cabinet of CloseOption

A user account on the CloseOption website is used to open an account with this broker and make a deposit. The user account also has a button that takes the user to the Trade Room, where he can conduct trades. Following a visit to the CloseOption website, a user should take the following steps:

Find the “Register” button at the top of the screen and press it. It is possible to sign up quickly using your Google or Twitter accounts. If the user does not want to link his social media profiles to CloseOption, he must fill out a special form. He should fill out the form with his first name, last name, nickname, and email address. Also, the trader must create a strong password and choose his country of residence from a drop-down list.

After that, the email must be confirmed by clicking the link provided in the brokerage company’s letter. The user account has now been created. After that, the user must log in with his username and password.

CloseOption user account menu:

1. Available accounts and switching between them:

2. Depositing funds into a real account:

1. Available accounts and switching between them:

2. Depositing funds into a real account:

The user account also allows the user to perform the following actions:

-

move funds to a secure wallet and transfer them to a trading account at any time;

-

submit requests for participation in trade contests;

-

view the history of all trades and transactions;

-

submit requests for the withdrawal of funds;

-

generate statistics on the referral program;

-

send tickets to client support and view the status of previously submitted requests.

Disclaimer:

Your capital is at risk. CFDs are considered complex derivatives and may not be suitable for retail clients. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. The products mentioned here may be affected by changes in currency exchange rates. If you invest in these products, you may lose some or all of your investment, and the value of your investment may fluctuate. You should never invest money that you cannot afford to lose and never trade with borrowed money.

Articles that may help you

FAQs

Do reviews by traders influence the CloseOption rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about CloseOption you need to go to the broker's profile.

How to leave a review about CloseOption on the Traders Union website?

To leave a review about CloseOption, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about CloseOption on a non-Traders Union client?

Anyone can leave feedback about CloseOption on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

62% of retail investor accounts lose money when trading CFDs with this provider.