Richest Forex Traders - Trading Secrets & Life Stories

Richest Forex traders in the world are:

George Soros has a current net worth of about $8 billion.

Bruce Kovner maintains holdings appraised at nearly $6 billion.

Paul Tudor Jones owns assets estimated at $4.5 to 5 billion.

Joe Lewis is valued at approximately $5 billion.

Stanley Druckenmiller has accumulated wealth nearing $2 billion.

Bill Lipschutz has accrued assets approaching $2 billion.

Andrew J. Krieger owns capital approximating $1.6 billion.

Martin Schwartz possesses assets totaling around $1.5 billion.

The richest Forex traders have amassed significant fortunes by trading in the Forex market. It’s not just plain luck that got them to where they are today. Millionaire Forex traders used a wide range of techniques and planning to become successful in the Forex market. There’s a lot that today’s everyday Forex trader can learn from these major players.

How to learn from the experience of famous billionaires, you will learn in this review.

In this guide, we’ll look into the success stories of Forex’s biggest traders who have made millions off of their efforts. We’ll also look at some techniques that such traders have used to become successful. It’s difficult to achieve a significant financial gain in Forex, so knowing a little bit about major players’ success stories can certainly help the process.

Do you want to start trading Forex? Open an account on Roboforex!Richest Forex Traders - Trading Secrets & Life Stories

Below you will find all the information.

Richest Forex Traders - Trading Secrets & Life Stories

Who is the king of Forex?Top Forex Trader – George Soros

George Soros has a current net worth of about $8 billion.

We can’t have a list of the richest Forex traders without including the famous Hungarian billionaire George Soros. Soros began his trading career while attending school. He developed a very unique strategy that ultimately led to his success – He took highly leveraged positions that were based specifically on how currency rates were moving. In 1992, he used that strategy and held a short position against the U.K. pound during the famous Black Wednesday crisis. He predicted a number of different factors that would leave banks vulnerable, and the trade he made earned him a whopping $1 billion. Soros has continued to accumulate wealth in the nearly thirty years since that fateful day, and currently has a net worth of about $8 billion. Soros is one of the richest Forex traders to ever exist.

George Soros’ advice for beginner Forex traders: “Markets are constantly in a state of uncertainty and flux and money is made by discounting the obvious and betting on the unexpected.”

Second place - Bruce Kovner

Bruce Kovner is one of the richest Forex traders in the world. He’s a renowned American hedge fund manager, billionaire, and philanthropist. As of April 2022, his estimated net worth stood at US$6 billion. Kovner embarked on his trading journey in 1977, utilizing a $3,000 loan secured against his MasterCard to invest in soybean futures contracts. Although his initial investment grew to $40,000, it subsequently decreased to $23,000 before he liquidated his position. This early experience underscored the significance of risk management for Kovner.

Primarily focusing on commodities and futures trading, Kovner has crafted numerous trading strategies throughout his career. These strategies include a "trend following" approach, which capitalizes on existing market trends for profit, and a "contrarian" approach, which involves purchasing undervalued assets. Kovner's trading success can be attributed to his unconventional methods and ability to seize market trends.

Bruce Kovner's advice for Forex traders: "If you personalize losses, you can't trade," He stresses the significance of detaching emotions from losses and maintaining emotional discipline during trading.

Third Place – Paul Tudor Jones

Paul Tudor Jones has a current net worth of about $4.5 to 5 billion.

After graduating from the University of Virginia back in 1976, Jones had many opportunities presented to him. He was even asked to attend Harvard Business School. Jones turned it down, instead opting to work in commodity trading. This choice was a smart one – during the 1987 market crash, Jones made the option to short, making more than $100 million. Since then, he has founded his own investment corporation that focuses on the fluctuations of the currency market’s interest rates. He was also the NYSE’s charimain between 1992 and 1995. He’s still one of the richest Forex traders on the planet, with a new worth of around $4.5 to 5 billion.

Paul Tudor Jones’ advice for beginner Forex traders: “The most important rule is to play great defense, not great offense. Every day, I assume every position I have is wrong. I know where my stop risk points are going to be. I do that so I can define my maximum drawdown. Hopefully, I spend the rest of the day enjoying positions that are going in my direction. If they are going against me, then I have a game plan for getting out.”

Runner Up – Joe Lewis

Joe Lewis has a current net worth of about $5 billion.

This U.K. trader boasts an inspiring rags to riches story. Joe Lewis started working when he was only fifteen years old to help his family’s catering business. After inheriting the business, Lewis sold it and began his journey into currency trading.

This decision paid off. Lewis worked with George Soros during that fateful day in 1992. With his part of the trade, he was able to bring home $1.8 billion. Today, Lewis is worth around $5 billion.

Joe Lewis’ advice for beginner Forex traders: “One of the rewards of your success is the quiet enjoyment of it. Being on the front page of newspapers doesn’t allow that.”

Runner Up – Stanley Druckenmiller

Stanley Druckenmiller has a current net worth of about $2 billion.

Many of the entries on this list are linked to George Soros, and Stanley Druckenmiller is no exception. One of the richest Forex traders alive today, Druckenmiller started out in the economic world by graduating with a degree in economics before working as an oil analyst for a national bank. After just a year in the industry, Druckenmiller went on to launch his own firm called Duquesne Capital Management. He made most of his money managing cash for George Soros for over a decade as the lead portfolio manager of Soros’ Quantum Fund. Now worth about $2 billion, Druckenmiller has taken to philanthropy and has donated over $700 million to charity. Druckenmiller is also well known for offering a lot of advice to Forex traders, mainly in the realm of watching central banks.

Stanley Druckenmiller’s advice for beginner Forex traders: “I like putting all my eggs in one basket and then watching the basket very carefully.”

Runner Up – Bill Lipschutz

Bill Lipschutz has a current net worth of about $2 billion.

One of America’s richest Forex traders, Bill Lipschutz made hundreds of millions of dollars back in the eighties by trading with Salomon Brothers. Originally, Lipschutz developed his love of trading while he was in college. He started out by investing $12,000 he received in inheritance. Today, he has an impressive net worth of around $2 billion. Lipschutz has also been very forthright with advice for Forex traders.

Bill Lipschutz’ advice for beginner Forex traders: “If most traders would learn to sit on their hands 50 percent of the time, they would make a lot more money.”

Runner Up - Andrew J. Krieger

Andrew J. Krieger is a prominent forex trader who gained recognition in the late 1980s. Reportedly, his net worth stands at approximately $2 billion. Krieger's trading approach is characterized by its aggressive nature and his capacity to capitalize on inflated pricing.

Krieger's most notable trade took place in 1987, targeting the overvalued New Zealand dollar, or "kiwi."

Employed as a currency trader at Bankers Trust, Krieger leveraged options to assume a massive short position against the Kiwi, amounting to hundreds of millions of dollars. His sell orders purportedly surpassed New Zealand's entire money supply. The resulting selling pressure, coupled with the currency's limited circulation, led to a sharp decline in the kiwi's value, dropping by 5%, while Krieger generated millions for his employers.

Krieger's trading strategy demanded foresight, unwavering resolve, and precise market entry and exit timing. His ability to pinpoint overvalued currencies and exploit such situations has cemented his legacy and made him one of the best Forex traders in the world, inspiring numerous aspiring traders.

Runner Up - Marty Schwartz

Marty Schwartz, a prosperous trader with an estimated net worth of $1.5 billion, is renowned for his trading strategies and ability to yield consistent returns over extended periods. Schwartz's expertise spans swing trading, day trading, and trend following. He began his career as a financial advisor in the early 1980s before transitioning to trading and subsequently founding his hedge fund, Martec, in the 1990s.

Schwartz successfully managed the fund, generating returns exceeding 20% for several years. Through trading, he transformed a $100,000 portfolio into $2 million in a mere two years. Schwartz emphasizes the crucial role of discipline and patience in trading. He underscores the importance of having a trading plan, a passion for trading, and a drive for success.

He also personally hand-draws his charts on paper, which he believes helps him establish a better connection with his instruments. Additionally, he subscribes to numerous market newsletters, synthesizing the information to develop his own system. Schwartz's exceptional success can be attributed to his discipline, work ethic, and consistent routine.

Marty Schwartz's advice for Forex traders: "The key to trading success is emotional discipline. If intelligence were the key, there would be a lot more people making money trading… I know this will sound like a cliché, but the single most important reason that people lose money in the financial markets is that they don't cut their losses short"

Top 7 Successful Forex Traders You Should KnowCan I Get Rich Trading Forex?

It's important to provide realistic expectations to those looking to dive into the world of currency trading. Forex markets do provide opportunities for profits, but accumulating true wealth solely from Forex is remarkably rare. The sobering statistics show most Forex traders lose money over the long-term, despite the seductive promise of massive gains from news headlines. So going in with the mindset of getting rich quickly is unrealistic.

That said, with the right strategies, risk management, and pragmatic outlooks, Forex trading can be a viable way to earn extra income. But it takes a lot of time, effort and discipline to become a consistently profitable trader.

Use proper risk management with stop losses on every trade. Don't risk more than 1-2% of your account on any single trade. Avoid trading with emotions or trying to predict major long-term market movements.

Go in with the mindset of making small, consistent gains over time. Compounding even small daily gains can grow an account substantially over many years. Getting rich quick is unlikely, but building long-term wealth is possible.

Consider getting proper education, using demo accounts to practice, and starting small with real money. Don't quit your job to trade full-time until consistently profitable over a long period. Patience and discipline are key.

In summary, getting rich trading Forex is very difficult, but with the right approach, it can be viable.

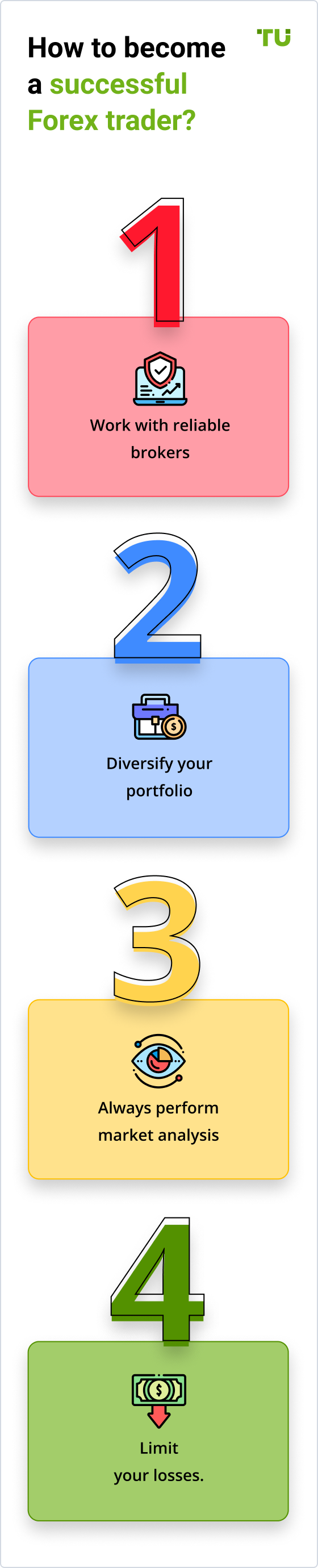

How to Improve Your Forex Trading Performance

Becoming one of the richest Forex traders isn’t easy. However, if you want to improve your overall Forex trading experience.

We recommend using these key best practices and tips:

-

Constantly study the market.

-

Develop and implement a specific risk management strategy for a variety of situations.

-

Keep your emotions in check to avoid making risky decisions that don’t pay off.

-

Create a trading plan and stick to it. The plan you choose depends on your goals and risk tolerance. In Forex, many traders are either day traders or position traders. Each approach should be kept in separate accounts as the decision making process is a little different for each as the time horizons are different.

-

Understand what your goals are. Do you want to make money trading daily? Do you want to make long term gains?

-

Always use a reputable broker and trading platform. We recommend using RoboForex, Admiral Markets, or eToro for Forex trading.

-

Always be clear on the reasons you are entering a trade. What is the technical setup? What fundamental or economic reasons are driving your decision?

-

If you are a systems trader who is using automated trading, always calculate your expectancy in order to determine just how reliable your unique system actually is. The formula for Forex expectancy is: Expectancy = (% Won * Average Win) – (% Loss * Average Loss)

-

Focus on building a positive feedback loop to boost your confidence and to create a cycle of success. Goes hand in hand with consistently tracking your trading performance and metrics. Each evening and on the weekends traders should be reviewing their trades and looking for insights to help improve.

-

Over the weekend when the Forex market is closed, prepare for the following trading week. Take time to study longer term patterns in weekly and monthly charts. Update yourself on news and economic developments that might affect your trading decisions. Make a trading plan for the following week.

-

Before diving into actual trading, take some time to practice trading using practice accounts.

-

Know your limits and don’t trade more than you’re willing to use.

How Much Can I Make in Forex?

The amount of money one can make in Forex trading depends on several factors, including starting capital, trading strategy, and risk appetite. There is no definitive answer to how much one can make, as profits can be highly influenced by market conditions, economic factors, and individual skills.

Forex trading involves speculating on the value of one currency against another, and the potential for profit or loss is inherently unpredictable. A consistent 10% or more monthly return without incurring significant losses is considered a mark of a successful trader. However, it's important to note that such returns are not easily achievable, especially for beginners.

The most successful traders can earn hundreds of percent per annum, but this level of success is not the norm. In fact, the majority of beginners tend to lose money in the highly volatile and complex Forex market. The key to success lies in developing a solid trading strategy, honing one's skills, and managing risk effectively.

It is crucial to approach Forex trading with realistic expectations and an understanding of the risks involved. Developing a strong foundation in technical and fundamental analysis, as well as adopting a disciplined approach to money management, can help increase the likelihood of success in the long run.

Remember that consistent, modest gains are generally more sustainable than large, erratic profits. Patience, continuous learning, and perseverance are essential qualities for those looking to excel in the world of Forex trading.

How Much Can You Make Trading ForexHow Can I Attract Money For Forex Trading?

There are several ways to attract money for Forex trading, depending on your preferences, experience, and financial situation. Here are some common methods:

Invest Your Own Money

The most straightforward way to start trading is by using your own personal capital. This approach allows you to maintain full control of your trading decisions and the profits you generate. However, it also means that you are solely responsible for any losses incurred.

Find an Investor

Another option is to seek out an investor who is willing to provide you with capital in exchange for a share of the profits. This may be a friend, family member, or an individual who shares your interest in Forex trading. Keep in mind that working with an investor requires building trust and demonstrating a solid trading strategy.

Join a Prop Trading Firm

A prop (proprietary) trading firm, such as Fidelcrest or SurgeTrader, allows you to trade using the firm's capital. These firms often have rigorous selection processes, including trading evaluations and interviews. Once you become a prop trader, you'll be provided with a funded account, and in return, the firm will take a percentage of your profits. Some prop firms offer funding up to $1 million and allow traders to keep up to 90% of their profits.

Working with a prop firm can be a good option for those who have demonstrated trading skills but lack the capital to trade independently. It also offers the advantage of being able to leverage the firm's resources, such as advanced trading tools and access to experienced traders for guidance and mentorship. However, it is essential to carefully research any prop firm you are considering joining to ensure that it aligns with your trading goals and values.

E8 Funding is the best prop trading firm according to TU prop firms ratingTop 3 Forex Brokers

Trading with a Forex broker can be highly beneficial, especially for new Forex traders.

Expert Opinion

Stories of successful traders are motivating, although many believe they can't reach such a level. But is it bad if you achieve even a tenth of what George Soros or Paul Tudor Jones achieved? Behind every successful trader are months, years of practical experience, and dozens of books read. Everyone makes mistakes, but why not learn from them, improving your skills every day? If they could do it, then you can do it too. Be patient, work on self-improvement, learn, believe in your abilities, and you'll succeed!

Best Forex Traders by Countries

FAQs

Do forex traders get rich?

Forex trading can make you rich, but to be successful you need to find a good broker and gain a lot of hands-on experience. The road to wealth can be difficult.

Who is the highest earning forex trader?

One of the richest Forex traders is George Soros. His fortune is estimated at 8.6 billion dollars.

How much is the richest forex trader worth?

The average monthly earnings of Forex traders are $260,000 (90%), $153,500 (75%), $53,500 (25%).

Can Day Trading forex make you rich?

Yes, you can get rich day trading, but it's hard. Most people fail if they don't have enough experience and knowledge.

How did George Soros become one of the richest Forex traders?

George Soros created a unique strategy for trading in the Forex market. Specifically, he took highly-leveraged positions based on the movement of different currency rates.

What makes Forex so special?

Forex differs from stocks and options in that it involves unregulated currency trading. Forex isn’t regulated or controlled by a governing entity, and there are no clearing houses. There is also no arbitration panel available. Forex traders instead trade with one another via credit agreements. Forex is the most liquid market in the world.

Is it possible to become one of the Forex millionaires?

It’s absolutely possible. However, Forex is unregulated and very volatile. Many traders end up losing money. However, some have found success in trading Forex, many of which have become millionaires or even billionaires.

When is the Forex market open?

Unlike the stock market, the Forex market is open twenty-four hours per day from Sunday to Friday, 5:00p, EST. The fact that the Forex market is open for so long makes it an ideal market for day traders.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Bruce Powers is an expert trader and technical analyst with over 20 years of experience in Forex, commodities, ETFs, cryptocurrencies and other assets. He is an active trader, technical and fundamental analyst, media commentator, educator and a writer. As an author for Traders Union, he contributes his deep analytical skills, expertise and understanding of the global economy and financial markets to provide market analysis and insights. Powers is also a frequent guest on business TV news shows.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.