deposit:

- $1000

Trading platform:

- Advanced Trader

- MetaTrader4

- MetaTrader5

- FCA

- FINMA

- DFSA

- MFSA

- MAS

- 0%

deposit:

- $1000

Trading platform:

- Advanced Trader

- MetaTrader4

- MetaTrader5

- FCA

- FINMA

- DFSA

- MFSA

- MAS

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

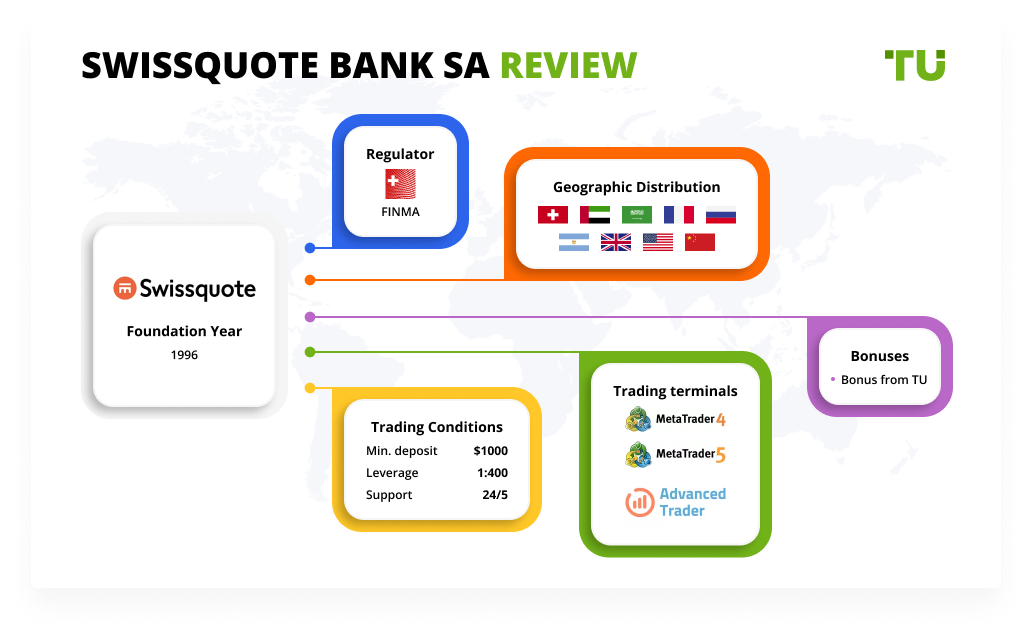

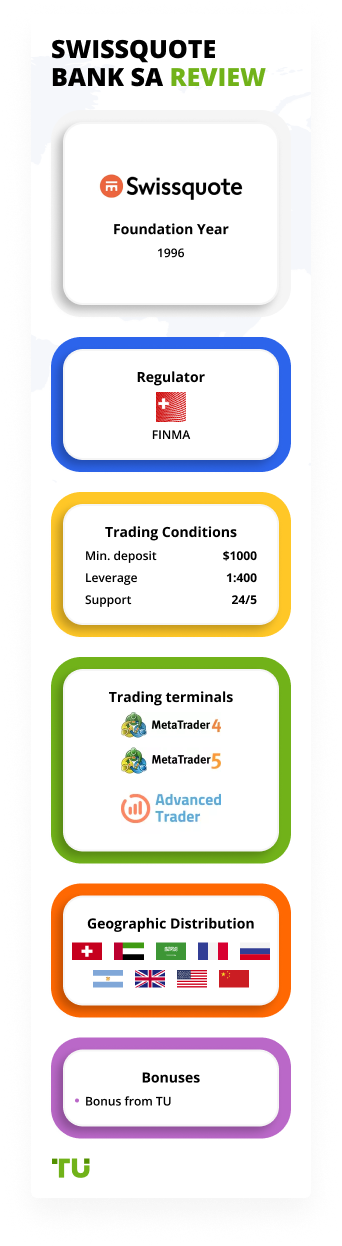

Summary of Swissquote Bank SA Trading Company

Swissquote Bank SA is a moderate-risk broker with the TU Overall Score of 6.78 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Swissquote Bank SA clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. Swissquote Bank SA ranks 44 among 414 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Swissquote is a broker that targets primarily large investors. The company is licensed by the reputable regulator FINMA and that ensures reliable protection of funds and interests of clients or investors in the event of disputes and conflicts. But for ordinary traders, Swissquote is not very convenient due to its unattractive working conditions. Swissquote is worth considering for those looking to invest from $1 million. If you are one of them, send us an email, and we will consult with you separately and help you do everything as quickly and reliably as possible. For ordinary traders, however, Swissquote is significantly inferior to its competitors in all respects.

The Swissquote brokerage firm has been operating in the Forex market since 1996. The company is regulated by the Swiss Financial Markets Authority (FINMA). The company is a member of the Swiss Bankers Association. It has offices in many financial capitals of the world: Zurich, London, Dubai, Hong Kong and is moderately popular among traders. The company falls short in the category of customer service when compared to other top companies and is significantly inferior to popular Forex brokers in many other respects also. This is reflected in its place in the Forex broker ratings. Swissquote has prioritized reliability, while paying less attention to indicators that are important for each trader, such as the size of the minimum deposit, trading conditions, deposit conditions, and its rules on withdrawing funds. The quality of Swissquote Bank's customer support is also at a satisfactory level, but lower than that of the top brokers.

| 💰 Account currency: | EUR, USD, JPY, GBP, CHF, CAD, AUD, TRY, PLN, SEK, NOK, SGD, XGD, HUF, CZK |

|---|---|

| 🚀 Minimum deposit: | From $1,000 |

| ⚖️ Leverage: | Up to 1:400 |

| 💱 Spread: | From 1.1 p |

| 🔧 Instruments: | Currencies, CFD, precious metals, stock indices, bonds, commodities, cryptocurrencies |

| 💹 Margin Call / Stop Out: | 100/30% |

👍 Advantages of trading with Swissquote Bank SA:

- availability of a license from an authoritative regulator;

- a wide range of financial services;

- a large selection of deposit currencies.

👎 Disadvantages of Swissquote Bank SA:

- not very informative and slow working site;

- high spreads and commissions;

- large deposit;

- lack of multilingual support in the live chat;

- few promotions, bonuses, contests, or other special offers;

- a very complicated registration procedure that requires mandatory verification.

Evaluation of the most influential parameters of Swissquote Bank SA

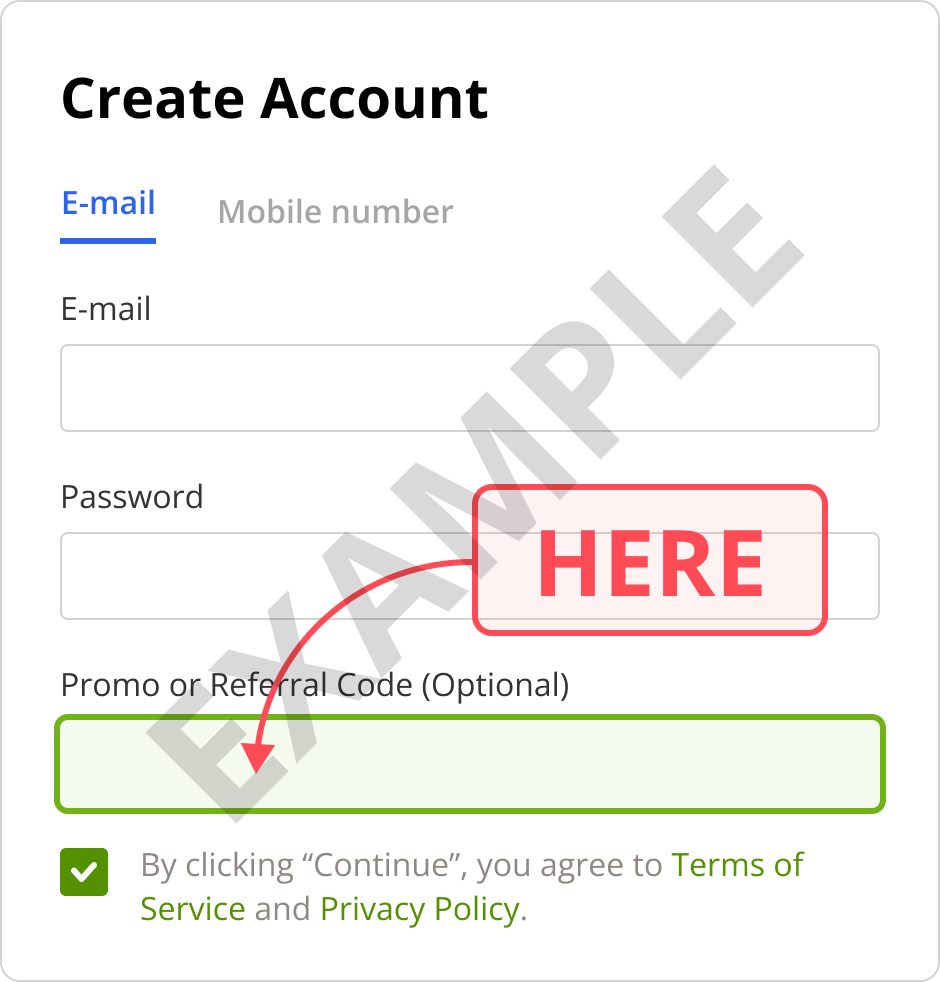

NOTE!

Do not miss a chance to get additional monthly bonuses and payouts for trading at Swissquote Bank SA.

Enter the referral code when you register on the website or Swissquote Bank SA app.

d6d5fe42-5550-43b5-86d7-eeebeb8916a2

*TU may receive partnership reward for registration of the client on the company’s website on a referral link.

Between 70 and 80% of retail investors are losing money when trading forex instruments and CFDs.

Table of Contents

- Geographic Distribution

- Video Review

- Latest Comments

- Expert Review

- Latest Swissquote Bank SA News

- Analysis of Swissquote Bank SA

- Dynamics of the Popularity

- Investment Programs

- Trading Conditions

- Commissions & Fees

- Detailed Review

- Client Area of Swissquote Bank SA

- User Reviews of Swissquote Bank SA

- FAQs

- TU Recommends

Geographic Distribution of Swissquote Bank SA Traders

Popularity in

Video Review of Swissquote Bank SA i

Swissquote Bank, nestled in the financial peaks of Switzerland, offers a diverse panorama of options for trading and investing. Backed by a banking license and regulated by FINMA, it boasts a solid reputation and clean track record. But navigating its terrain requires careful footing, as its appeal varies greatly depending on your experience level.

For seasoned traders, Swissquote is a well-equipped summit. Multiple platforms, including the popular MetaTrader 4 & 5 alongside their own web and mobile solutions, cater to diverse trading styles. Social trading features like ZuluTrade and DupliTrade add a collaborative layer, letting you learn from and mirror the moves of experienced investors. Low minimum deposits (starting at $0) and multiple payment methods make it accessible, while a demo account and free educational resources provide foundational knowledge.

However, beginners beware. The ascent isn't without its treacherous paths. The entry-level Classic account requires a hefty €2,000 minimum balance, which quickly escalates for Platinum and VIP tiers. Fees can be sharp, especially for bonds, options, and futures, and inactivity and custody charges add hidden costs. Research and education tools, though present, lack depth and comprehensiveness, leaving you to navigate the complexities with limited guidance. Customer support, limited to phone and email, also falls short of 24/7 availability, meaning help might not be readily available when the market takes a tumble.

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Swissquote Bank SA

Swissquote a/k/a Swissquote Bank is a Forex broker that has been operating in the financial markets since 1996. During this time, the company was able to earn a good reputation. But in the last few years, Swissquote has received more and more claims from its clients. This has led to a loss of its status as a broker. Swissquote Bank primarily targets large investors and ignores the needs of the average trader. This is evidenced by the lack of accounts for beginners and the large size of the deposit.

The main advantage of the Swissquote broker is its license. You can also note a fairly large selection of trading instruments. When working with Swissquote, traders can use a wide variety of currency pairs (including exotic ones), commodities, stock indices, cryptocurrencies, and a number of other popular assets. Another advantage of Swissquote can be stated with confidence is the presence of an affiliate program, which provides an opportunity for additional earnings, but it, again, is significantly inferior in terms of income generation compared to similar programs of other brokers.

Swissquote, like its numerous competitors, offers a range of standard trading platforms. You can choose from both classic terminals, MetaTrader 4 and 5, and the company's own Advanced Trader.

Latest Swissquote Bank SA News

Dynamics of Swissquote Bank SA’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

Swissquote's automatic Robo-Advisor

The Robo-Advisor service deserves special attention in the Swissquote portfolio. It is an automatic investment manager that creates an individual investment portfolio and monitors it around the clock, constantly optimizing it to maintain the desired level of risk. However, judging by the feedback from investors, technical failures in the operation of this service are often recorded, which sometimes leads to a loss of cash investments.

The service is fully automated and works according to this scheme: the client indicates an acceptable level of risks, selects trading instruments or sectors (optional), and after that, the robot-consultant manages the investments. Its advanced algorithms analyze thousands of securities and generate offers for the ideal portfolio, but in practice, many of these offers turn out to be unprofitable.

Robo-Advisor requires less initial investment than traditional asset management services and is much more cost-effective. At the same time, the risk of losing investments increases much more due to possible algorithmic errors or technical failures. Despite this, Swissquote positions this service as completely transparent, although it does not give full control over investments.

Also, Swissquote provides MAM, LAMM and PAMM systems for the MetaTrader and Advanced Trader trading terminals. PAMM is a classic trust management system, where investors' funds are concentrated in one trading account, which is managed by a trader (account manager). LAMM is a social trading service where the trader is not the account manager, but only opens his trades, which are automatically copied by other investors. MAM can be safely called one of the varieties of LAMM. In this case, transactions are automatically copied to the investor's account, but at the same time, if necessary, he can independently change their volumes, close positions, and make a number of other adjustments. Similar investment programs are provided by more popular brokers. An important difference is the availability of competent managing traders with stable key trading indicators: growth rate, drawdown level, account profitability, etc.

Important!

If you are a large investor and plan on investments over $ 10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Swissquote Bank affiliate program

Swissquote provides an opportunity to generate an additional source of income by attracting new clients. At the same time, the broker offers several cooperation formats. The most popular among them are:

-

Bring a friend. Recommend Swissquote Bank and receive cash bonuses of up to CHF 800 for every customer you refer. To do this, share your affiliate code in your personal account with the users you are referring to Swissquote. It is noteworthy that both the attracted client (referee) and the referrer receive financial rewards. The disadvantage of the program is that bonuses are credited after the referral refills the account. Their bonus depends on the amount of the deposit, but cannot exceed 800 Swiss francs.

-

Introducing Broker Solutions. An excellent opportunity to create your own client base and receive commissions on every transaction made by referred users. The disadvantage of the program is that Swissquote Bank is not very popular among traders due to the lack of loyal trading conditions for beginners. This factor significantly complicates the process of attracting new customers to the company. It is more advisable for a potential partner to work with a popular Forex broker and get more profit from attracting new members due to the flow of clients.

-

CPA Marketing Forex. Traders have the chance to monetize their traffic with a profitable CPA program. The broker guarantees a progressive system for calculating CPA remuneration, provides detailed statistics on attracted clients, makes monthly payments, and provides a number of other benefits. The amount of remuneration for each attracted client can reach US$800. The disadvantage of the program is the reduced interest of traders to the broker, which significantly reduces the chances of getting the desired income.

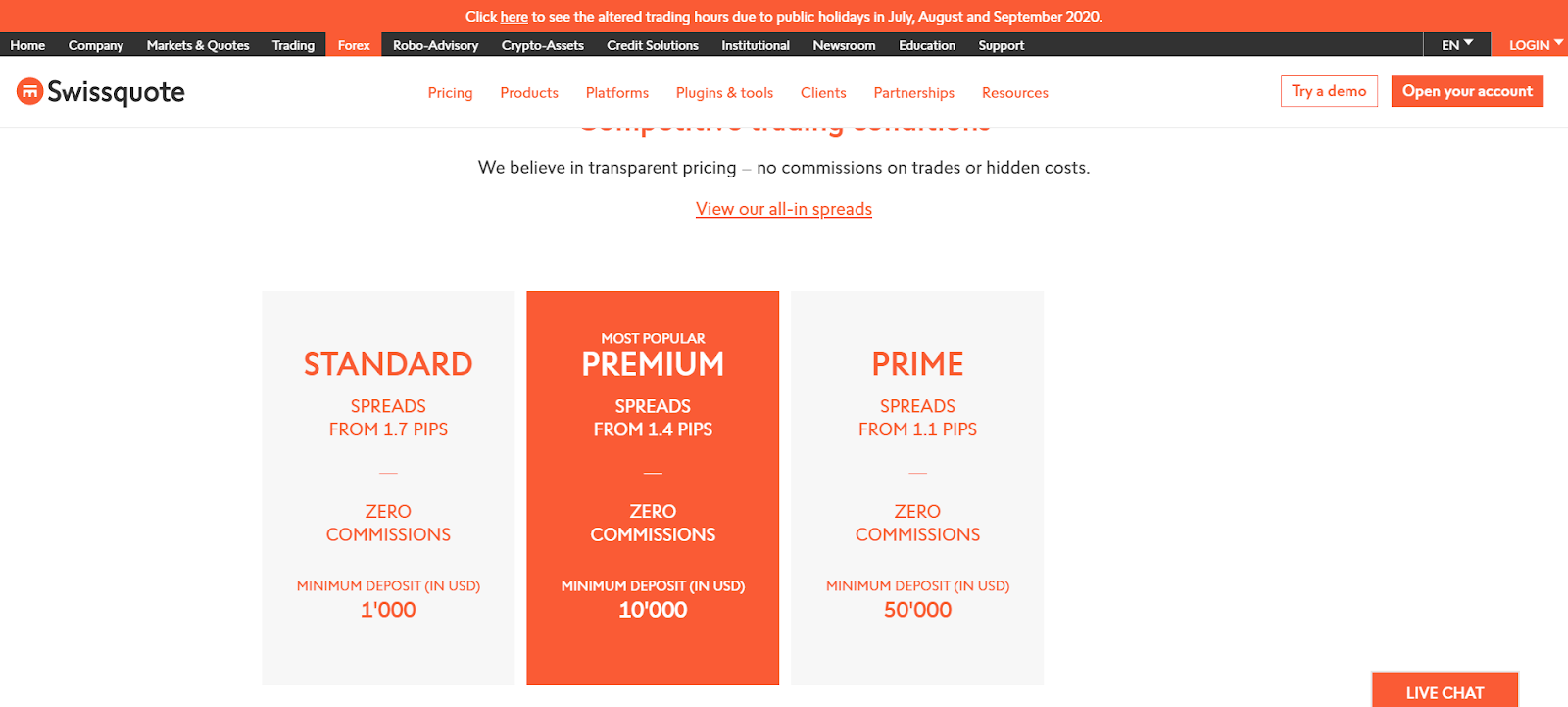

Trading Conditions for Swissquote Bank SA Users

Trading conditions at Swissquote can be hardly called attractive. The size of the deposit is quite high and the maximum leverage is 1:400. On the other hand, it is possible to choose a suitable account currency, thus avoiding conversion costs. Stop Out level is 30%.

$1000

Minimum

deposit

1:400

Leverage

24/5

Support

| 💻 Trading platform: | MetaTrader 4, MetaTrader 5, Advanced Trader |

|---|---|

| 📊 Accounts: | Standard, Premium, Professional, Prime |

| 💰 Account currency: | EUR, USD, JPY, GBP, CHF, CAD, AUD, TRY, PLN, SEK, NOK, SGD, XGD, HUF, CZK |

| 💵 Replenishment / Withdrawal: | eBanking, Visa, Mastercard |

| 🚀 Minimum deposit: | From $1,000 |

| ⚖️ Leverage: | Up to 1:400 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 1.1 p |

| 🔧 Instruments: | Currencies, CFD, precious metals, stock indices, bonds, commodities, cryptocurrencies |

| 💹 Margin Call / Stop Out: | 100/30% |

| 🏛 Liquidity provider: | 17 liquidity providers including UBS Bank, Integral, Prime XM, OneZero, FxCubic, Gold-I and cTrader |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Instant Execution, Market Execution, Spot, Market Best |

| ⭐ Trading features: | A large selection of currency pairs; Including exotic and minor ones; Cryptocurrencies. |

| 🎁 Contests and bonuses: | NO |

Comparison of Swissquote Bank SA with other Brokers

| Swissquote Bank SA | RoboForex | Pocket Option | Exness | Eightcap | Octa | |

| Trading platform |

MT4, MobileTrading, WebTrader, Advanced Trader | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5 | MetaTrader4, MetaTrader5 |

| Min deposit | $1000 | $10 | $5 | $10 | $100 | $25 |

| Leverage |

From 1:1 to 1:400 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 1.4 point | From 0 points | From 1.2 point | From 1 point | From 0 points | From 0.6 points |

| Level of margin call / stop out |

1% / 100% | 60% / 40% | 30% / 50% | No / 60% | 80% / 50% | 25% / 15% |

| Execution of orders | Instant Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Broker comparison table of trading instruments

| Swissquote Bank SA | RoboForex | Pocket Option | Exness | Eightcap | Octa | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes | Yes | Yes |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | Yes | Yes | Yes |

| ETF | No | Yes | No | No | No | No |

| Options | No | No | No | No | No | No |

Swissquote Bank SA Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Standard | From $17 | Yes |

| Premium | From $14 | Yes |

| Professional | Individual | Yes |

| Prime | From $11 | Yes |

Also, a comparative analysis of trading commissions in Swissquote Bank with the indicators of competitors was carried out. Based on this analysis, each broker was assigned a level according to the specified criterion - from low to high.

| Broker | Average commission | Level |

| Swissquote Bank SA | $17 | High |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | Medium |

Detailed Review of Swissquote

Swissquote Bank is an international company focused on cooperation with large European traders. The main disadvantage of the broker is the lack of loyal trading conditions for novice traders. Swissquote aims to work with large investors. Swissquote Bank is trying to implement new technologies. The broker's average execution speed is 27 ms, which is a very good indicator. Swissquote offers a standard set of trading instruments that does not cover all possible trading directions, which is why traders cannot implement non-standard trading strategies. Swissquote provides traders with the opportunity to make money trading cryptocurrencies.

A few facts about Swissquote that will be of interest to clients choosing this broker:

-

more than 320 thousand clients;

-

more than 24 years on the market;

-

15 deposit currencies;

-

CHF 32.2 billion in company assets.

Swissquote meets the best Swiss traditions

Swissquote is one of the top brokers in terms of reliability, but at the same time, Swissquote is inferior to many of its competitors due to the increased complexity of the client's identity and account verification procedures. The company offers several types of accounts. A professional trading account deserves special attention. Most of the trading conditions are determined on an individual basis.

Traders are provided with access to the most popular trading terminals: MetaTrader 4 and MetaTrader 5. Also, clients have access to the proprietary Advanced Trader platform, which features a fully customizable interface, automatic pattern detection, and a wide selection of order types. But some reviews say that technical failures are recorded on the platform when there is a heavy workload or Advanced Trader.

Swissquote Services:

-

Autochartist. A popular market scanner that provides automated trading alerts, volatility analysis, event impact analysis, price range forecast, execution statistics. Thanks to filters, as well as individual search queries, traders have the opportunity to adapt the instruments to their own trading style;

-

Trading Central. An excellent instrument for recognizing chart patterns that allow you to build trading strategies and identify opportunities for opening profitable positions online;

-

FIX API. Financial information exchange protocol is an international standard for online trading. It is designed to ensure active interaction between market participants. The Swissquote API can connect to the trader's trading platform and exchange trading information with the company's server based on the FIX 4.4 protocol. With this service, a trader can independently configure access to real-time quotes, as well as historical data, and place orders via secure communication channels.

Advantages:

good selection of educational materials;

a moderate choice of trading instruments, including cryptocurrencies;

availability of an affiliate program;

free analytics;

own trading platform.

How to Start Making Profits — Guide for Traders

Swissquote offers four account types for professional traders. They differ in the size of the minimum deposit, the type/level of the spread, and the minimum trade size.

Important! Swissquote is a company that does not provide trading accounts for novice traders, which exposes the inexperienced trader to great risks.

Bonuses Paid by the Broker

Swissquote does not offer any bonuses or special offers, nor does it offer promotions.

Investment Education Online

Information

Videos, e-books, and training webinars are available on the Swissquote website.

All these instruments can be tested only on a real trading account before use, which is a disadvantage and may result in losses.

Security (Protection for Investors)

Information

Swissquote Bank is regulated by the Swiss Financial Market Supervisory Authority (FINMA).

FINMA — a reliable government regulator that checks the activities of its licensees, and also controls their work.

👍 Advantages

- Licensed by a reputable government regulator

👎 Disadvantages

- The broker solves all controversial issues independently, the regulator does not accept claims from traders

Withdrawal Options and Fees

-

Swissquote allows withdrawals of funds only at the specific request of the client and does not have electronic systems in the list of methods. The commission for withdrawing money depends on the region to which the transfer is made, as well as on the selected withdrawal method.

-

There are two options for depositing and withdrawing money: bank transfer and bank cards (Visa and Mastercard).

-

When withdrawing to Visa and Mastercard bank cards, crediting occurs instantly or within two hours from Monday to Friday from 8:00 to 22:00 CET.

-

Withdrawal and replenishment currencies: AED, AUD, CAD, CZK, DKK, HKD, HUF, ILS, JPY, MXN, NOK, NZD, PLN, RUB, SEK, SGD, THB, TRY, ZAR, EUR, USD, CHF и GBP.

Customer Support Service

Information

The broker's customer support service works only from Monday to Friday.

👍 Advantages

- The ability to hold an online meeting

- There are online chat and telephone support

- Multilingual support (English, Arabic, Spanish, Italian, Chinese, German, Russian, Serbian, Slovak, French)

👎 Disadvantages

- Closed on weekends

- The phone line often does not answer or answers after a long waiting time

- Long response time across all communication channels. If there is a problem, then it takes a long time to resolve

- Email responses are sent within 2-3 days. Often managers do not delve into the essence of the issue and answer with standard phrases

There are several ways to contact Customer support:

-

via phone numbers indicated on the website;

-

by email;

-

via chat on the broker's website;

-

using the feedback form;

-

make an application for an online meeting.

Contacts

| Foundation date | 1996 |

| Registration address | Löwenstrasse 62, P.O. Box 2017, 8021 Zürich |

| Regulation |

FCA, FINMA, DFSA, MFSA, MAS Licence number: 562170, F001438, 57936, 201906194G |

| Official site | swissquote.com |

| Contacts |

Email:

fx@swissquote.com,

Phone: +41 44 825 87 77, +41 44 825 88 88 |

Review of the Personal Cabinet of Swissquote

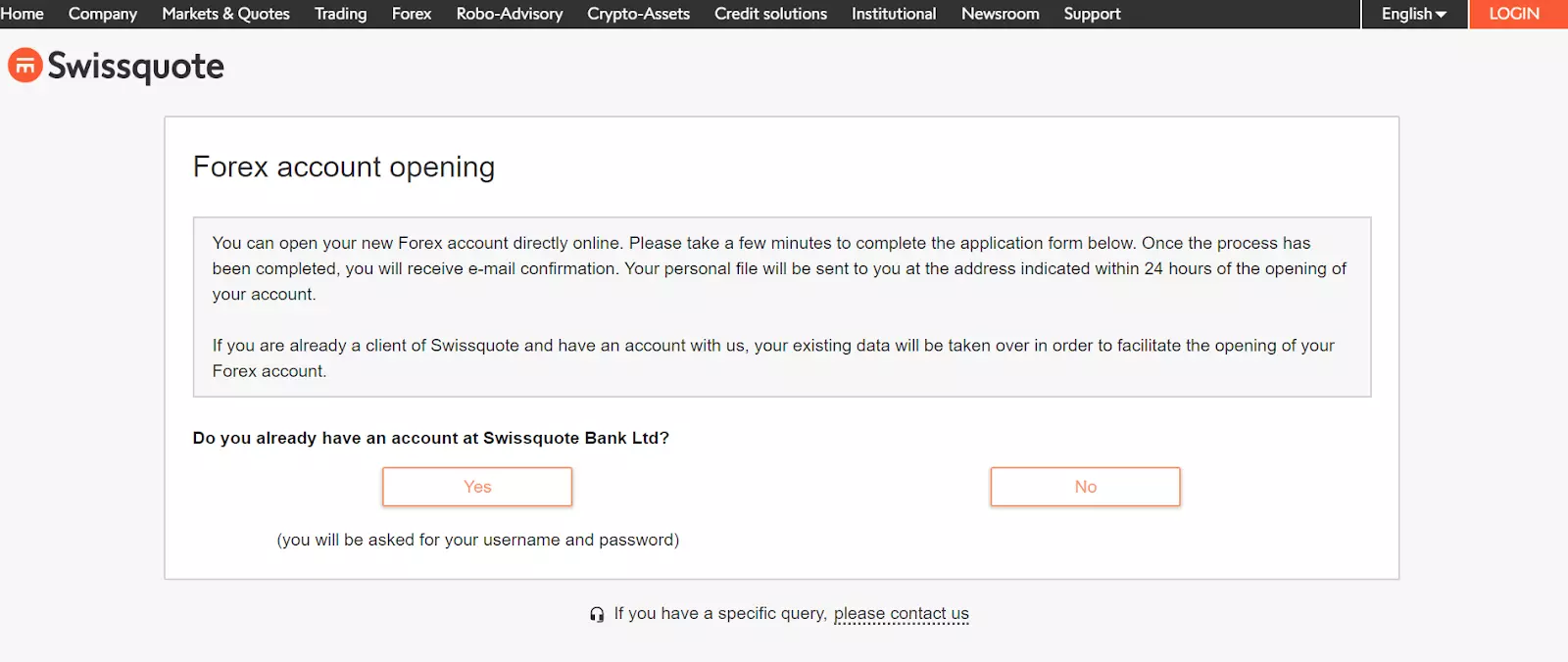

To start making money with Swissquote, you need to:

Go through the lengthy registration process on the Traders Union website by entering your email address. Then follow the affiliate link to the website of the brokerage company and press the "Start trading" button.

Choose a suitable account type.

Indicate if you already have an account with this company.

Go through verification, indicating gender, last name and first name, marital status, date of birth, country of residence and address, email, and mobile phone. It is necessary to fill out a client profile with the entry of financial data. Access to the trading account will be provided only after passing the verification procedure via video communication or sending documents to the company's office.

The following functions are available in your Swissquote account:

-

Account replenishment and withdrawal.

-

Viewing statistics on bonus funds.

-

Possibility to contact support.

-

News section.

Registration on the Swissquote website takes a long time. The broker requests all sorts of personal data at once. Requires confirmation of the client's contact information, his or her identity and complete detailed financial statements. In order to start trading, you need to go through a complex and lengthy verification procedure, including sending personal documents to the company's office.

Disclaimer:

Your capital is at risk. Between 70 and 80% of retail investors are losing money when trading forex instruments and CFDs. Trading foreign exchange, spot precious metals and any other product on the Forex platform involves significant risk of loss and may not be suitable for all investors. Prior to opening an account with Swissquote, consider your level of experience, investment objectives, assets, income and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not speculate, invest or hedge with capital you cannot afford to lose, that is borrowed or urgently needed or necessary for personal or family subsistence. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Find out how Swissquote Bank SA stacks up against other brokers.

See related articles in our country selection:

Articles that may help you

FAQs

Do reviews by traders influence the Swissquote Bank SA rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Swissquote Bank SA you need to go to the broker's profile.

How to leave a review about Swissquote Bank SA on the Traders Union website?

To leave a review about Swissquote Bank SA, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Swissquote Bank SA on a non-Traders Union client?

Anyone can leave feedback about Swissquote Bank SA on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.