10 Best Cheap Stocks To Buy Under $5

The best stocks to invest under $5 are:

-

Opendoor Technologies (OPEN): Streamlined real estate transactions, rapid revenue growth.

-

Planet Labs (PL): Global Earth observation leader, large satellite constellation.

-

Heron Therapeutics (HRTX): Strategic partnership, strong late-stage pipeline, analyst support.

-

Baytex Energy Corp. (BTE): Free cash flow focus, positive 2024 outlook, financial health.

-

Grupo Aval Acciones y Valores S.A. ADR (AVAL): Resilience, discounted stock with dividend appeal, streamlined structure.

-

Enel Chile SA (ENIC): Renewable energy focus, strong financial performance, market dominance.

-

Accelerate Diagnostics (AXDX): Innovative technology, market growth potential, positive partnerships.

-

Matterport Inc. (MTTR): Innovative spatial data technology, market growth, strategic partnerships.

-

Olaplex Holdings Inc. (OLPX): Patented bond-building technology, strong brand loyalty, international expansion.

-

Luminar Technologies Inc. (LAZR): Industry leadership in LiDAR, strong partnerships, diversification strategy.

In this informative article, TU experts provide a comprehensive analysis of a carefully selected group of stocks priced under $5. The discussion covers a range of sectors, offering insights into each company's strategic positioning, growth prospects, and financial performance. Investors can expect a nuanced exploration of factors influencing the stock market in this budget-friendly segment. From real estate and energy to technology and pharmaceuticals, the experts dissect the unique attributes of each stock, guiding readers through the intricacies of potential investment opportunities.

-

What is the significance of investing in stocks under $5?

Investing in stocks under $5 can offer opportunities for budget-friendly investments, potentially allowing investors with limited capital to diversify their portfolios and seek higher returns.

Cheap stocks to invest under $5

| Stock Name | Stock Ticker | Market Cap | EPS Next 5Y | Forward P/E |

|---|---|---|---|---|

Opendoor Technologies |

OPEN |

$2.04B |

5.20% |

- |

|

Planet Labs |

PL |

$589.89M |

25.00% |

- |

|

Heron Therapeutics |

HRTX |

$325.65M |

47.50% |

- |

|

Baytex Energy Corp. |

BTE |

$1.72B |

18.20% |

4.98 |

|

Grupo Aval Acciones y Valores |

AVAL |

$972.59M |

- |

7.96 |

|

Enel Chile SA |

ENIC |

$4.01B |

- |

6.68 |

|

Accelerate Diagnostics |

AXDX |

$32.74M |

30.00% |

- |

|

Matterport Inc. |

MTTR |

$680.09M |

- |

- |

|

Olaplex Holdings Inc. |

OLPX |

$1.37B |

- |

11.66 |

|

Luminar Technologies Inc. |

LAZR |

$1.17B |

- |

- |

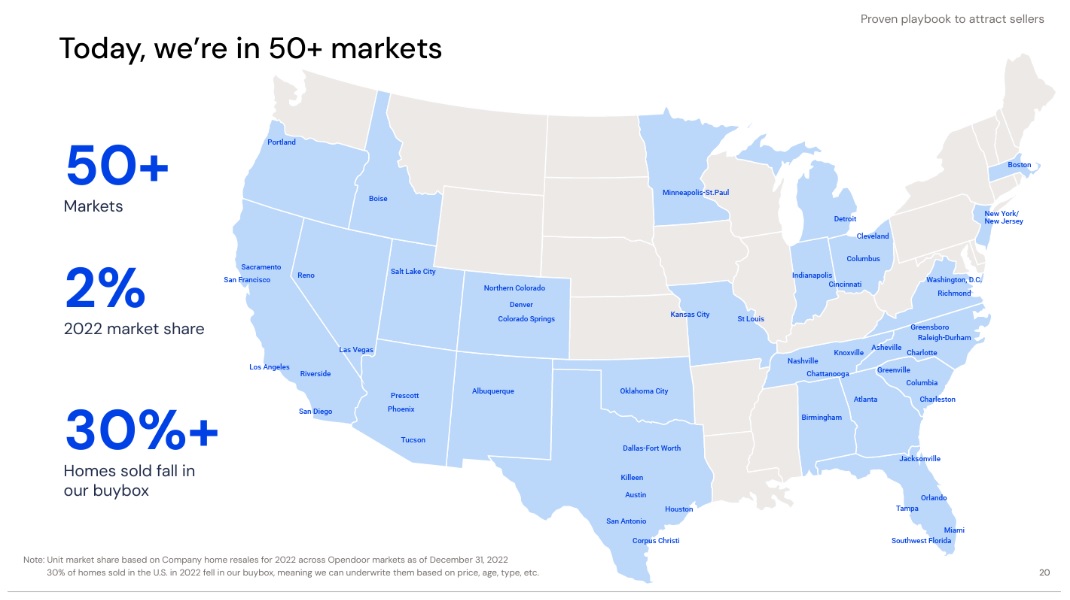

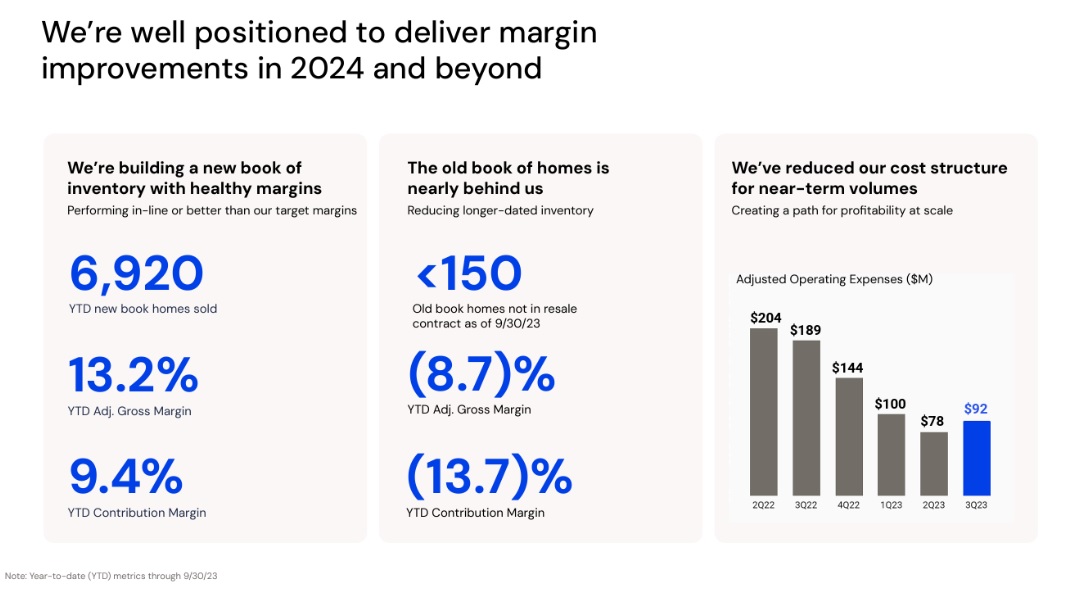

Opendoor Technologies (OPEN)

Investing in Opendoor Technologies (OPEN) in 2024 holds promise for several compelling reasons. Firstly, Opendoor addresses a vital gap in the housing market by offering a seamless platform for direct home transactions, catering to the increasing demand for efficiency and flexibility among consumers. The company's rapid revenue growth, despite its short history, signals strong execution and a growing customer base.

Moreover, Opendoor's improved financial outlook is noteworthy, with expectations of achieving adjusted net income in 2024. This progression towards profitability enhances its investment appeal, attracting investors seeking value beyond immediate earnings. The rise in institutional ownership, exemplified by interest from major institutions like Renaissance Technologies, signifies growing confidence in Opendoor's long-term potential.

Technical analysis for OPEN

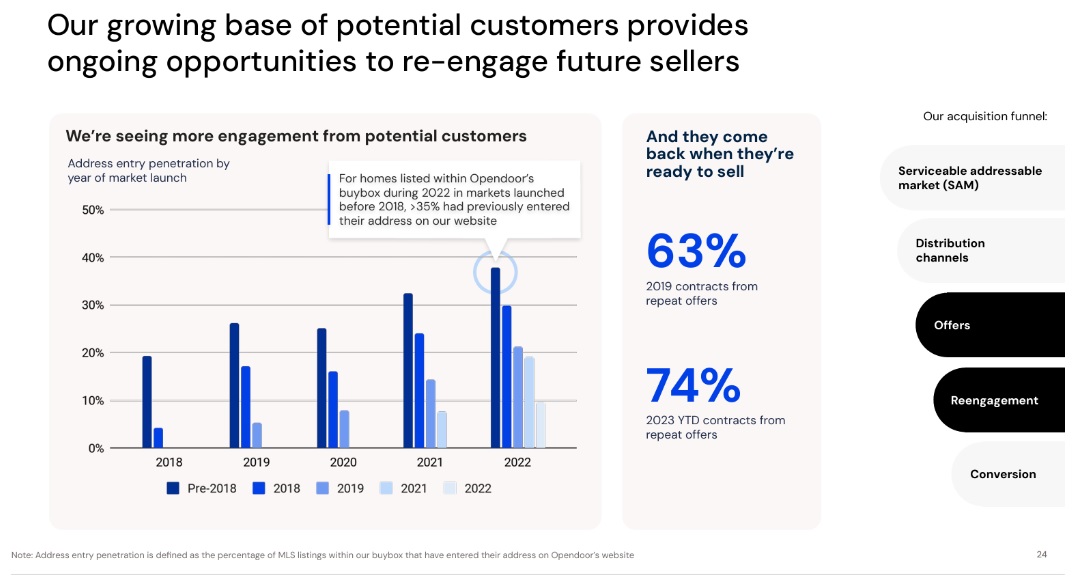

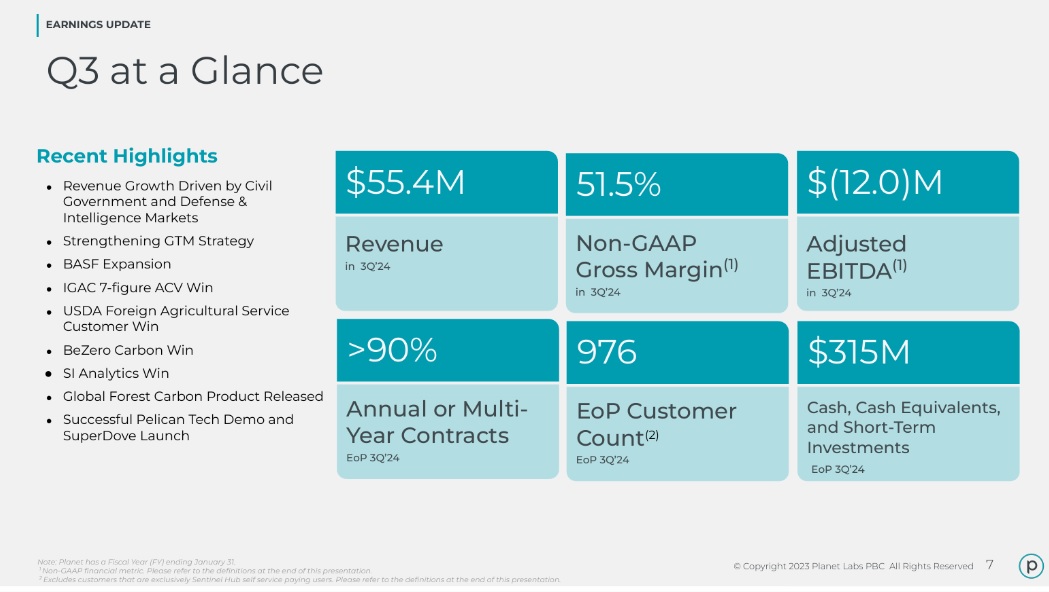

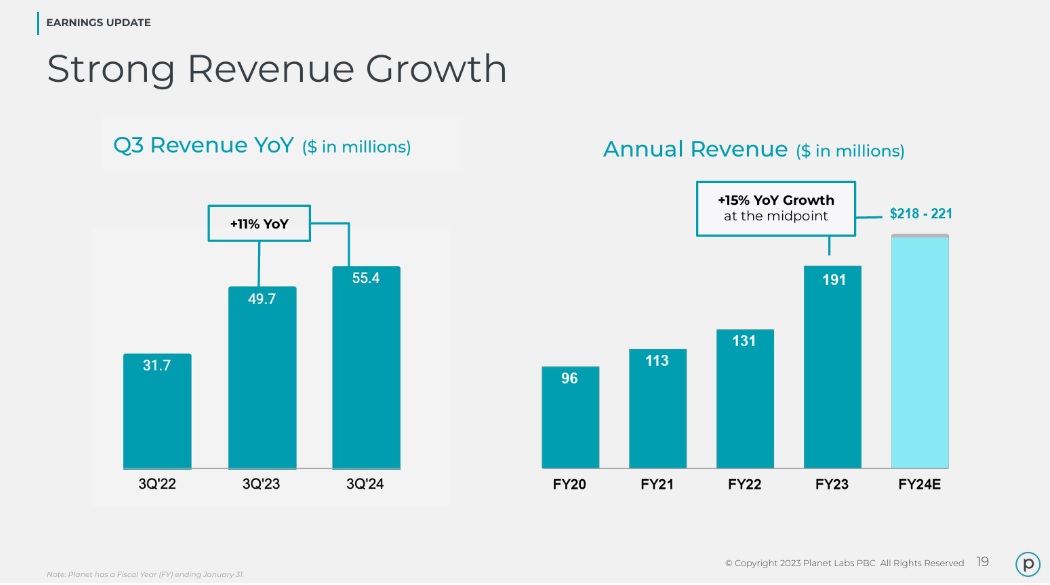

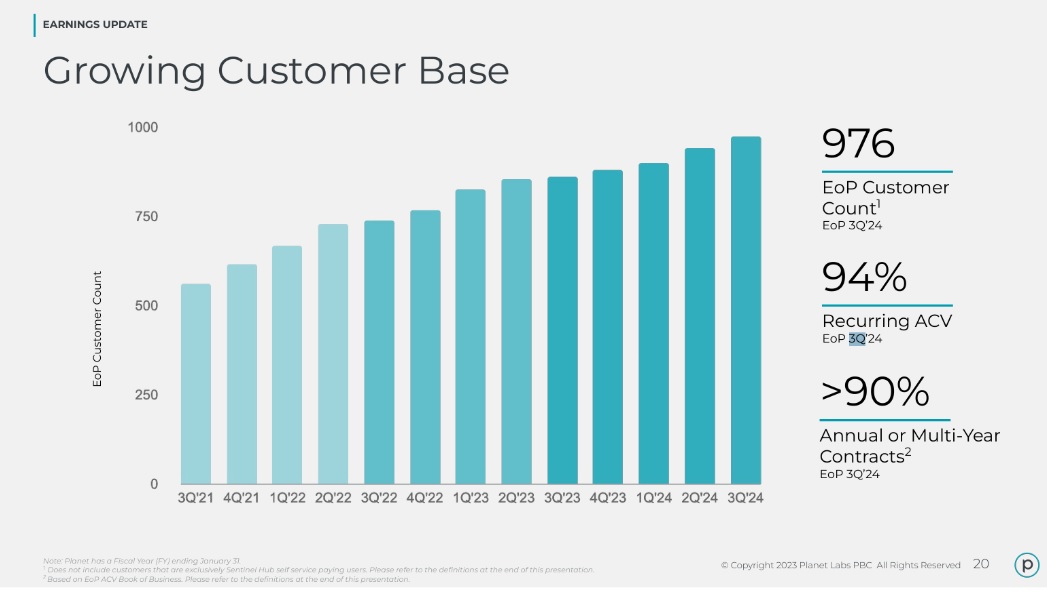

Planet Labs (PL)

Planet Labs (NYSE: PL) stands out as a leader in Earth observation, boasting the largest satellite constellation. With unmatched daily access to detailed global data, the company addresses growing demands in sectors like agriculture and government intelligence. Despite historical stock lows, Planet Labs' strategic importance, financial strength, and focus on profitability make it a compelling investment prospect for 2024.

| Reasons to Invest in Planet Labs (2024) | Details |

|---|---|

|

Market Leadership |

Planet Labs boasts the largest constellation of Earth observation satellites, establishing an unparalleled position in the industry. This leadership contributes to the high demand for their daily Earth data across various sectors. |

|

Growing Demand |

Increasing global concerns such as climate change, deforestation, and resource scarcity drive a growing need for Earth observation data. Planet Labs is well-positioned to meet this demand, indicating substantial potential for future growth. |

|

Path to Profitability |

Despite not currently being profitable, Planet Labs has shown progress toward profitability in recent quarters. The company's strategic focus on cost control and operational efficiency suggests a positive trajectory for investors. |

|

Subscription Model Stability |

Planet Labs relies on a recurring subscription-based revenue model. This approach ensures a stable and predictable income stream, contributing to the company's financial sustainability and reducing revenue volatility. |

|

Technological Innovation |

Continuous investment in technological advancements is a key strategy for Planet Labs. Regular satellite launches with improved capabilities highlight their commitment to innovation, securing a competitive edge in Earth observability technology. |

|

Strategic Importance |

Earth observation data is no longer confined to commercial use; it has become crucial for strategic and security purposes. Planet Labs' services play a vital role in providing real-time information, emphasizing their strategic importance. |

Heron Therapeutics (HRTX)

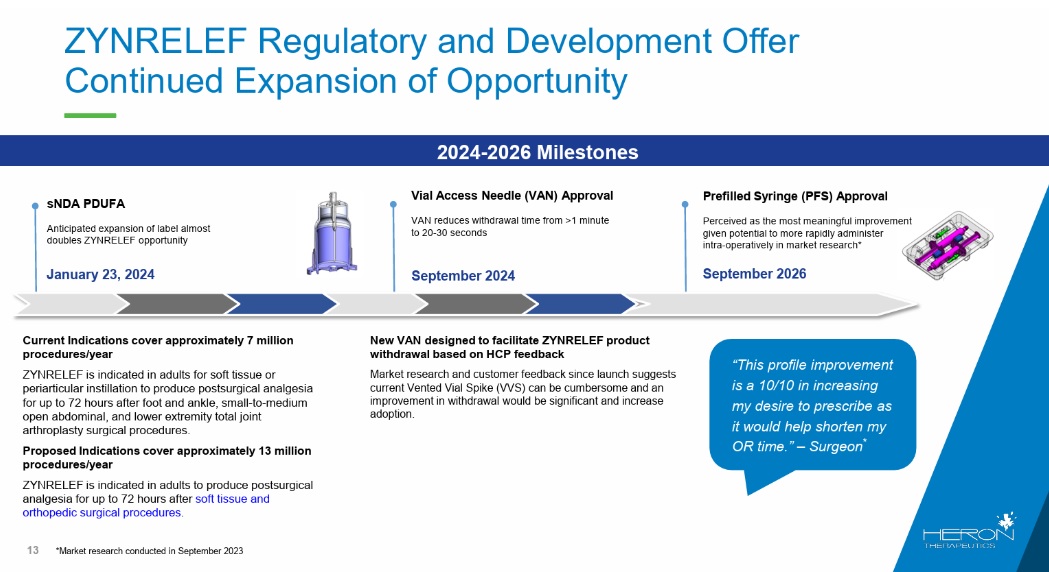

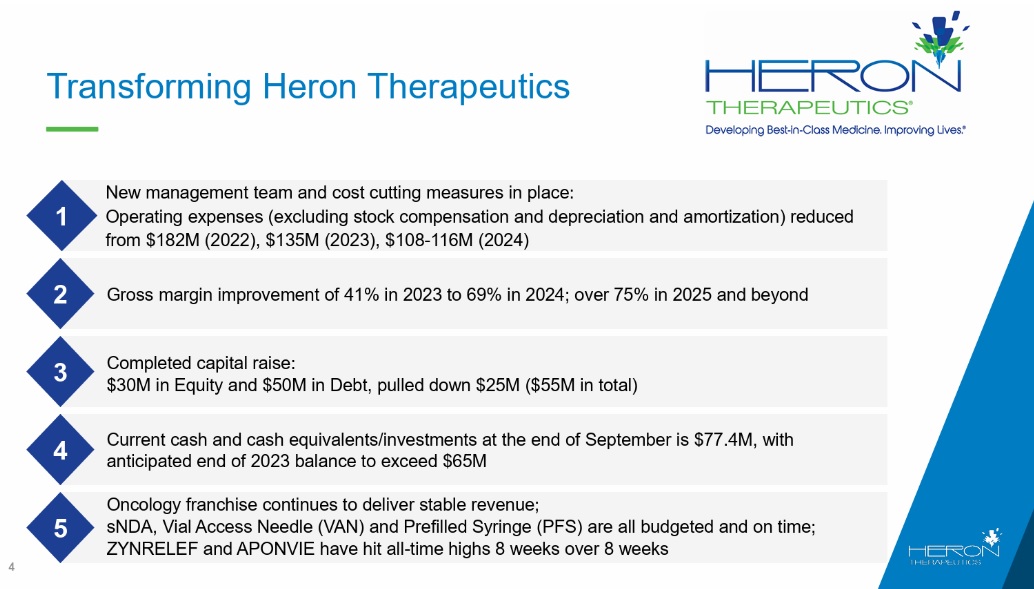

(HRTX) presents an enticing investment opportunity in 2024, primarily attributed to its recent strategic partnership with CrossLink Life Sciences. This five-year distributor collaboration aims to broaden the sales network for ZYNRELEF, an extended-release pain-reducing solution. The phased launch, initially at a regional level followed by a national rollout, involves adding approximately 650 representatives to Heron's sales network within the next year. This targeted expansion, led by CrossLink, the largest private orthopedic distributor in the U.S., focuses on promoting ZYNRELEF for orthopedic indications. The compensation structure, featuring a fixed fee per vial basis, aligns CrossLink's incentives with ZYNRELEF's growth, encouraging proactive promotion.

With over 45 years of experience, CrossLink's established specialty sales organization positions them as a reliable partner. Heron's CEO, Craig Collard, expresses optimism about the collaboration's potential to enhance ZYNRELEF's accessibility, portraying confidence in its ability to deliver substantial value and impact patient lives. Additionally, the mention of potential label expansion and the introduction of a vial-access needle (VAN) for product preparation indicate ongoing product innovation, adding to the investment appeal. Some key reasons toa invest are mentioned below in the table.

| Investment Considerations for2024 | Details |

|---|---|

|

Strong Product Pipeline |

Heron's portfolio, including Zynquista and Apnexia, exhibits robust sales growth. The late-stage pipeline, featuring NETIGAN for PSNV and HTX-019 for acute low back pain, indicates significant market potential, positioning the company for future success. |

|

Improved Financials |

Heron's strategic cost reduction and restructuring efforts have resulted in substantial operational savings. Coupled with successful capital raises, the company has achieved financial stability, making it an attractive option for potential investors. |

|

Analyst Support |

Analyst sentiment is notably optimistic, with a majority recommending buying HRTX stock. The average price target indicates a significant upside, reflecting confidence in Heron's growth prospects as recognized by financial analysts. |

|

Undervalued Potential |

Compared to peer biotech companies with similar pipelines, HRTX appears undervalued. This undervaluation provides an advantageous entry point for investors seeking to capitalize on Heron's growth potential in the pharmaceutical sector. |

|

Strategic Partnerships and Positive Results |

Collaboration with CrossLink Life Sciences expands ZYNRELEF®'s promotional efforts, increasing market reach. Positive Phase 3 results for NETIGAN in PSNV highlight the potential success of Heron's late-stage pipeline, adding value for potential investors. |

|

Efficient Management and Cost Control |

Heron's new management team has successfully implemented cost-cutting measures, enhancing operational efficiency. Reduced operating expenses and improved gross margins underscore the company's commitment to sustainable financial health. |

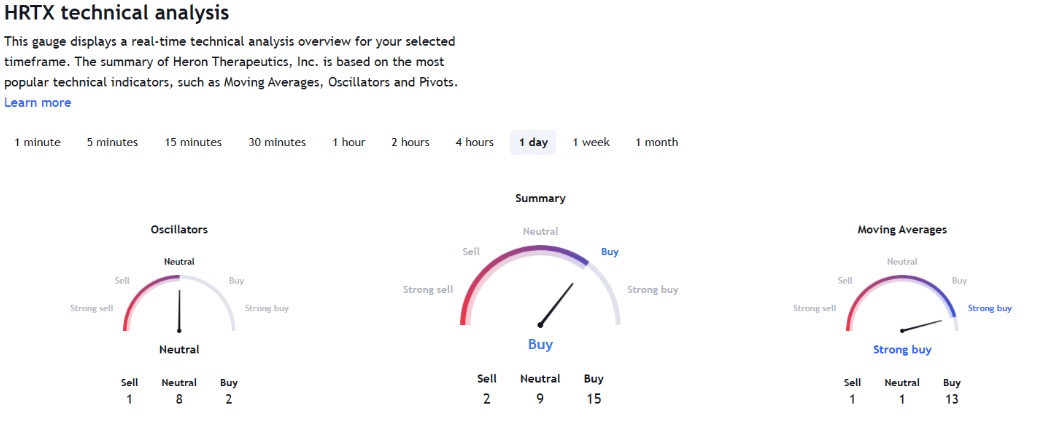

Technical analysis for HRTX

Baytex Energy Corp. (BTE)

Investing in Baytex Energy Corp. (BTE) in 2024 presents an intriguing opportunity, albeit with certain risks inherent to the oil and gas sector. The company's strategic focus on free cash flow, recent financial improvements, and positive 2024 outlook contribute to its investment appeal.

Key factors to consider

-

Free Cash Flow Focus: Baytex prioritizes generating free cash flow, evident in their Q4 2023 projection of around $400 million and a robust $650 million for the entire year.

-

Financial Health: Recent asset sales and debt reduction have bolstered Baytex's financial position, reflected in an improved debt to EBITDA ratio, showcasing the company's commitment to financial discipline.

-

Positive 2024 Outlook: Baytex's 2024 budget emphasizes sustained free cash flow and increased production, particularly in their high-return Eagle Ford assets.

-

Dividend Payment: Shareholders benefit from a quarterly dividend of $0.00225 per share, providing an annualized yield of 2.16%.

With a positive trajectory in free cash flow, production growth, and prudent financial management, Baytex Energy Corp. (BTE) stands as a penny stock worth considering for potential returns in 2024, keeping in mind the inherent volatility of the oil and gas industry.

| Financial Metric | Q3 2023 Value |

|---|---|

|

Production |

150,600 boe/d (85% oil and NGLs), exceeding guidance |

|

Cash Flows from Operating Activities |

$444 million ($0.52 per basic share) |

|

Adjusted Funds Flow |

$582 million ($0.68 per basic share) |

|

Free Cash Flow |

$158 million ($0.19 per basic share) |

|

Exploration and Development Expenditures |

$409 million, consistent with full-year plan |

|

Share Repurchases |

16.8 million common shares repurchased at $5.29/share |

|

Quarterly Cash Dividend |

$0.0225 per share ($0.09 annualized) |

|

Total Debt |

$2.7 billion |

|

Debt-to-EBITDA Ratio |

1.1x (Q3 annualized) |

Grupo Aval Acciones y Valores S.A. ADR (AVAL)

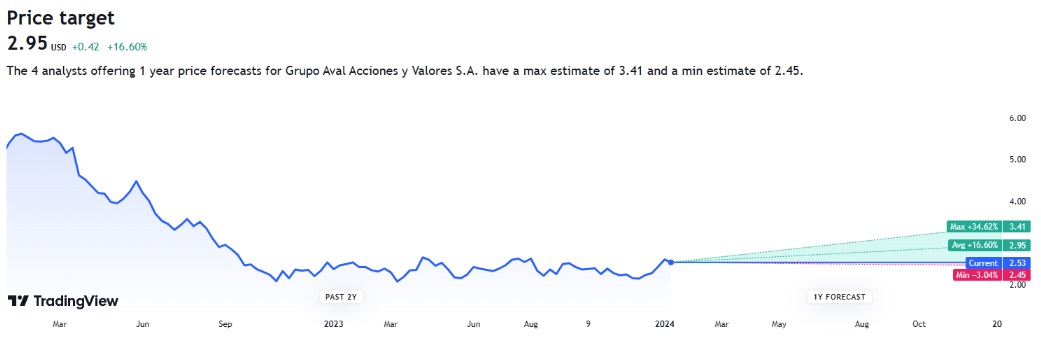

AVAL presents some compelling reasons to invest in 2024, which are mentioned in the below table.

| Reasons to Invest | Details |

|---|---|

|

Resilience Amid Challenges |

Despite economic downturns and political shifts, AVAL has shown resilience, with stock prices surging recently. |

|

Discounted Stock with Dividend Appeal |

AVAL shares trade at a significant discount to book value, offering an 8.4% dividend yield, which is attractive for income investors. |

|

Streamlined Corporate Structure |

The successful sale of the Banco de Bogotá stake reflects a strategic focus on simplification and generating additional liquidity. |

|

Strong Financial Metrics |

Q3 2023 results exceeded expectations, boasting positive revenue growth and earnings improvement across diversified financial services. |

|

Favorable Valuation Metrics |

Relatively low P/E and P/B ratios compared to peers suggest potential undervaluation and room for future price appreciation. |

|

Market Dominance and Leadership |

AVAL's leading position in Colombia's financial sector provides stability, and its experienced leadership adds confidence for investors. |

Technical analysis for AVAL

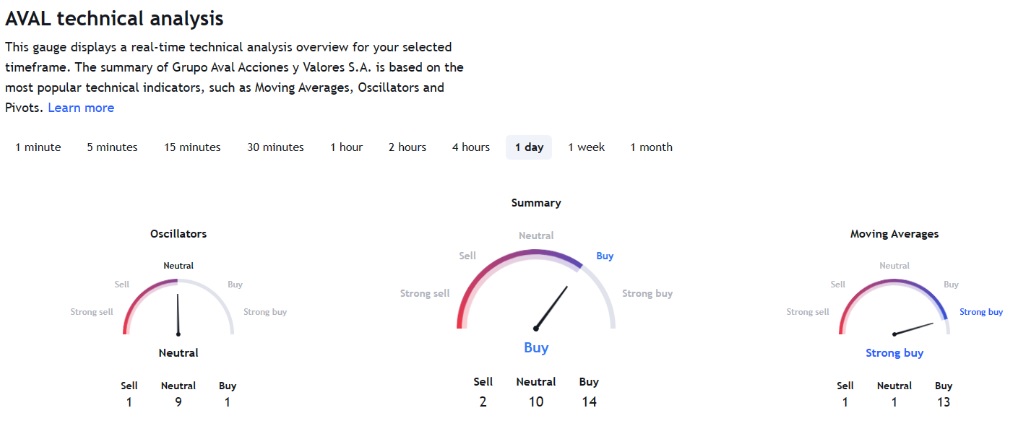

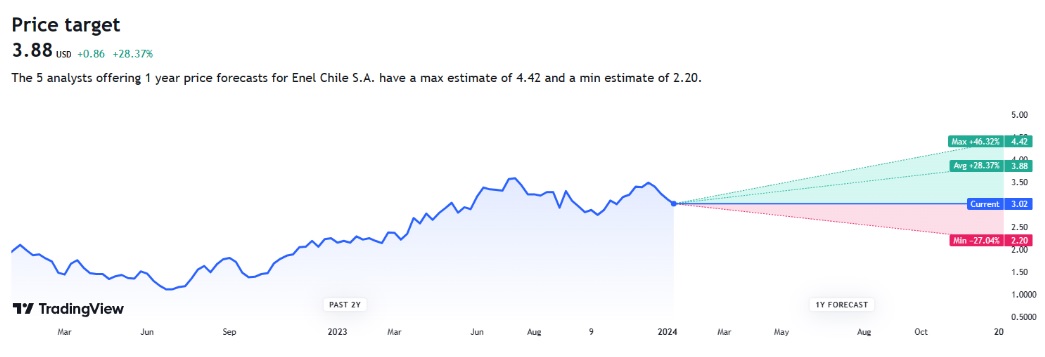

Enel Chile SA (ENIC)

Enel Chile SA (ENIC) operates as a prominent player in the energy sector, particularly within the Chilean market. As part of the larger Enel Group and predominantly owned by the Italian company Enel SpA, ENIC holds a significant stake in Enel Generación Chile and owns Enel Green Power. The company plays a crucial role in Chile's energy landscape, with a diversified portfolio that includes a majority share in hydro and renewable energy sources.

| Reasons to invest | Details |

|---|---|

|

Renewable Energy Focus |

ENIC plans to increase its renewable energy capacity to nearly 80% by 2026, aligning with the global push for clean energy. The company added 0.4 GW of new renewable capacity in Q3, reaching a total of 6.7 GW. |

|

Financial Performance |

Strong Q3 2023 financial results showcase robust performance, with a notable 87% YoY increase in net income to $336 million and a 60% increase in EBITDA to $783 million. Earnings per share (EPS) rose by 69.19% to $0.19. |

|

Market Dominance |

ENIC is the largest electricity distributor and generator in Chile, positioning itself as a key player in a growing market. Chile's anticipated economic growth further supports the company's market dominance. |

|

Dividend Payouts |

ENIC has a history of consistent dividend payouts, making it an appealing choice for income-seeking investors. The reliable dividends provide a steady stream of income. |

|

Strategic Expansion Plans |

The company is set to expand its battery and energy storage capacity by 700 MW, investing an estimated $0.6 billion. This strategic move aligns with the increasing demand for energy storage solutions. |

|

Advocacy for Regulatory Reform |

ENIC is actively advocating for regulatory and remuneration reforms in Chile's distribution segment to support extensive electrification. This proactive approach positions the company for future growth. |

|

Stable Economic Outlook in Chile |

Chile's stable economic outlook and projected growth provide a favorable environment for ENIC's operations. The company's dominant position in the market positions it well to capitalize on increased demand for electricity. |

Technical analysis for ENIC

Accelerate Diagnostics (AXDX)

Investing in Accelerate Diagnostics (AXDX) in 2024 offers a compelling opportunity, supported by several positive factors:

-

Innovative Technology: AXDX's Accelerate PhenoTest System, designed for rapid identification and antibiotic susceptibility testing, stands out as innovative. This technology addresses the critical need for quicker and more accurate diagnostic solutions, particularly in life-threatening conditions like sepsis.

-

Market Growth Potential: With the global rapid diagnostics market projected to surpass $28 billion by 2027, AXDX is positioned to tap into this growth. The demand for swift and precise testing solutions aligns with the company's focus on infectious diseases and antibiotic resistance.

-

Positive Partnerships: AXDX's strategic partnerships with healthcare providers and distributors enhance its market presence and revenue potential. Collaborations with research institutions underscore the company's commitment to advancing its technology, contributing to its long-term viability.

-

Recent Milestones: AXDX's achievements in 2023, including FDA clearance for the expanded Accelerate PhenoTest PLUS panel and increased sales momentum, signify positive momentum. These milestones suggest a trajectory toward commercial success and market acceptance.

Latest developments

| Date | News & Analysis |

|---|---|

|

January 10, 2024 |

AXDX collaborates with a leading European hospital system to pilot the Accelerate PhenoTest System in critical care units, expanding its market presence. |

|

December 5, 2023 |

AXDX presents positive data on its next-generation rapid sepsis testing technology at a major medical conference, validating ongoing innovation and pipeline potential. |

Some more key reasons to invest are discussed in the below table.

| Key Information | Details |

|---|---|

|

Latest Results (Preliminary) |

Preliminary results for 2023 show $12.1M revenue, impacted by a challenging capital sales environment. Cash and equivalents at year-end: $13.4M. |

|

Operational Progress |

Advancing the next-gen Accelerate WaveTM for Antimicrobial Susceptibility Testing, with clinical trials planned for Q2 2024. |

|

Product Offerings |

Accelerate PhenoTest System aids rapid diagnosis of infections; Wave expected to set a new standard for same-shift, susceptibility testing. |

|

Market Potential |

The global rapid diagnostics market, projected to exceed $28B by 2027, aligns with AXDX's focus on infectious diseases and antibiotic resistance. |

|

Partnerships/Collaborations |

Collaborations with healthcare providers, distributors, and Bruker Corporation for the Accelerate ArcTM system. |

|

Forward-Looking Statements |

AXDX acknowledges its forward-looking nature, cautioning investors about potential risks and uncertainties, including economic volatility and regulatory approvals. |

Technical analysis for AXDX

Matterport Inc. (MTTR)

Matterport Inc. (MTTR) presents a compelling investment opportunity in 2024, driven by its innovative spatial data technology. Despite market fluctuations and post-metaverse excitement, Matterport's unique position in creating 3D digital twins of physical spaces sets it apart. Key factors supporting investment include

| Factor | Details |

|---|---|

|

Advanced Technology |

Matterport's 3D capture technology provides unparalleled detail,with immersive virtual experiences, especially in real estate marketing. |

|

Market Growth |

The global 3D mapping market is projected to reach $8 billion by 2027. Matterport is well-positioned for significant market capture, utilizing its diversified customer base and recurring revenue model. |

|

Strategic Partnerships |

Collaborations with industry leaders such as Google and Adobe enhance Matterport's market reach and open up potential applications in various sectors. |

|

Recent Innovations |

The introduction of high-density scanning for the Pro3 camera showcases continuous innovation, catering to diverse industries, including construction. |

|

Awards Recognition |

ColumnVMatterport's sponsorship and judging of the 2023 Digital Twin Awards underscore its impact, with over 35 billion square feet captured to date.alue2 |

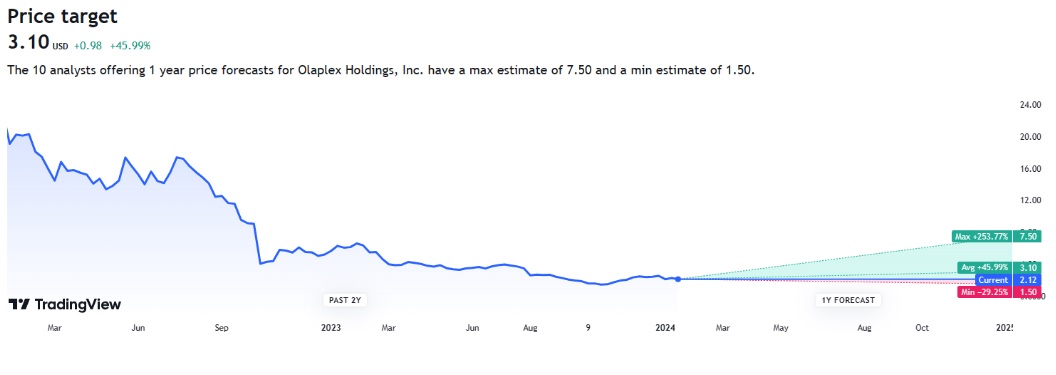

Olaplex Holdings Inc. (OLPX)

Olaplex Holdings Inc. (OLPX) presents a compelling investment opportunity in 2024 due to its innovative haircare technology and strategic initiatives. Known for its patented bond-building technology, Olaplex's unique bis-aminoguanidine technology targets and restores broken disulfide bonds in hair, setting it apart from traditional hair care products. The company enjoys strong brand loyalty among both professional hair stylists and consumers, fostering predictable revenue and long-term growth potential.

With diversified distribution channels, including professional salons, specialty retailers, and e-commerce, Olaplex ensures revenue streams from various avenues. The company's international expansion further positions it for substantial growth beyond its existing markets.

Recent leadership changes, such as the appointment of Amanda Baldwin as CEO, bring deep expertise in building prestige brands, enhancing Olaplex's potential for brand development. Despite a recent decline in net sales, Olaplex demonstrates resilience, with positive brand impressions and growth in online sales.

Technical analysis for OLPX

Luminar Technologies Inc. (LAZR)

Investing in Luminar Technologies Inc. (LAZR) in 2024 presents an intriguing opportunity in the rapidly evolving landscape of autonomous vehicles and advanced driver-assistance systems (ADAS). Some key reasons to invest are:

| Aspect | Investment Consideration |

|---|---|

|

1. Industry Leadership |

Luminar is a frontrunner in LiDAR technology, excelling in range, resolution, and perception accuracy. This positions them favorably in the competitive LiDAR market. |

|

2. Strong Partnerships |

Major collaborations with Volvo Cars, Mercedes-Benz, and Geely ensure sustained demand for Luminar's technology in upcoming vehicle productions. |

|

3. Market Expansion |

The autonomous vehicle (AV) and ADAS market is projected to exceed $1 trillion by 2030, providing a substantial growth opportunity for Luminar. |

|

4. Diversification Strategy |

Luminar is diversifying beyond LiDAR into software and chip development, aiming to become a comprehensive provider of hardware and software for autonomous driving solutions. |

|

5. Recent Technological Advances |

Successful demonstrations of advanced autonomous driving features like Automatic Emergency Steering at CES 2024 highlight Luminar's technological prowess and progress. |

| Financial Metrics | Outlook/Guidance |

|---|---|

|

Revenue Growth (2023) |

~$75 million (85% YoY growth) |

|

Gross Margin (Q4’23) |

Expected to reach positive on a non-GAAP basis. |

|

Cash & Liquidity (End of 2023) |

Expects to end 2023 with a balance of >$300 million. |

|

Free Cash Flow (Q4’23) |

Targeting a 50% reduction relative to Q1/Q2 levels. |

Best Stock brokers

Is it good to invest in cheap stocks under $5

Investing in stocks priced below $5 carries inherent risks due to higher volatility and potential financial challenges faced by these companies. The low stock price may attract investors, but it often reflects the speculative nature of these investments. Thoroughly assess the company's financial health, market conditions, and overall stability before considering such stocks.

Many low-priced stocks lack comprehensive information, making it challenging to accurately gauge their prospects. Diversification is crucial to mitigate risk; avoid concentrating all investments in stocks under $5.

Consulting with a financial advisor is advisable, as they can provide personalized guidance based on your financial goals and risk tolerance. In conclusion, while there may be opportunities for gains, exercising caution and conducting thorough research are essential when considering investments in stocks priced below $5.

Factors to consider before investing in cheap stocks under $5

| Factor | Explanation |

|---|---|

Financial Health |

Assess the company's financial stability, including revenue and debt. |

Market Conditions |

Consider overall market trends and economic conditions affecting the stock. |

Company Stability |

Evaluate the company's stability and potential for long-term success. |

Volatility |

Recognize that low-priced stocks often have higher price volatility. |

Business Model |

Understand the company's core operations and how it generates revenue. |

Industry Trends |

Be aware of trends and challenges in the industry the company operates in. |

News and Events |

Stay informed about recent news, events, or announcements related to the company. |

Short-term vs. Long-term |

Determine if your investment strategy aligns with short-term gains or long-term growth. |

Diversification |

Avoid concentrating all investments in low-priced stocks; diversify your portfolio. |

Professional Advice |

Consult with a financial advisor for personalized guidance and risk assessment. |

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

3

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

4

Volatility

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

-

5

Diversification

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Tobi Opeyemi Amure is an editor and expert writer with over 7 years of experience. In 2023, Tobi joined the Traders Union team as an editor and fact checker, making sure to deliver trustworthy and reliable content. The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options.

Tobi Opeyemi Amure motto: The journey of a thousand miles begins with a single step.