How to Build an Investment Portfolio in 6 Steps

Creating an investment portfolio begins with the following steps:

-

Set your investment goals.

-

Assess your risk tolerance.

-

Determine your time horizon.

-

Choose your asset allocation.

-

Choose your investments.

-

Monitor and rebalance your portfolio regularly.

The idea of building a stock portfolio can be both exhilarating and daunting, especially for beginners. Many aspire to grow their wealth and secure their financial future but are often hindered by a lack of knowledge or fear of the unknown in the investment landscape. This is where the crucial need for a structured approach to investment comes in.

A well-planned stock portfolio is not just a collection of investments, it's a strategic blueprint for financial success. It's about making informed decisions that align with your financial goals, risk appetite, and time horizon. This article aims to provide the right guidance and understanding, so that anyone can build a solid and potentially quite rewarding stock portfolio.

Start trading stocks right now with eToro!-

How do you start off a portfolio?

First, define your investment goals and risk tolerance, then choose an appropriate asset allocation based on these factors and start investing in a diversified mix of assets.

Best stock brokers 2024

How to start your investment portfolio

Creating an investment portfolio is a vital step towards financial independence and security. While having a diversified investment portfolio has always been a wise choice, in this era marked by fluctuating economies and uncertain financial futures, it's become almost a necessity.

It's about building a foundation that can withstand market volatility while propelling you towards your financial goals. Whether planning for retirement, saving for a major life event, or simply growing your personal wealth, a thoughtfully constructed portfolio can serve as your financial anchor.

It begins with these fundamental steps:

-

Set your investment goals: What are you aiming for? Retirement? A new home? This will be the guide for your investment journey.

-

Assess your risk tolerance: Determine how much risk you're comfortable with to guide your investment choices.

-

Determine your time horizon: The length of time you plan to invest impacts the types of investments you should consider.

-

Choose your asset allocation: This involves spreading your investments across various asset categories to balance risk and return.

-

Choose your investments: Pick specific assets that align with your goals, risk tolerance, and time horizon.

-

Monitor & rebalance your portfolio regularly: Adapt and adjust your portfolio to stay in line with your evolving financial objectives.

Understanding the significance of each step will help you to build a strong and effective investment portfolio that caters to your personal financial needs and aspirations. We’re going to explore each of the steps below.

Step 1: Set your investment goals

The foundational step in sculpting a successful investment portfolio is being crystal clear on your investment goals. These goals act as a compass, guiding your investment decisions and strategies. The nature of your goals can vary widely - from short-term objectives like saving for a vacation or a major purchase, to long-term aspirations such as securing a comfortable retirement or building a legacy.

Understanding your goals requires introspection and practicality. Start by asking yourself key questions, such as:

-

What are you investing for?

-

Is it for a tangible goal like a house down payment or an intangible one like financial security?

-

How soon do you need the funds?

The answers to these questions will shape your investment approach. For instance, short-term goals may necessitate more liquid and less volatile investments, whereas long-term goals can allow for more risk due to having more time to recover from corrections.

It's also crucial to quantify your goals. Setting measurable targets, like saving a specific amount for retirement or a down payment, provides clarity and helps in tracking progress. This step often involves balancing dreams with reality - understanding what's achievable given your financial situation and the time frame.

Moreover, revisiting and adjusting your goals is an integral part of the process. Life's circumstances change, and so may your financial objectives. Regularly assessing your goals ensures that your investment strategy remains aligned with your current needs and future aspirations.

Step 2: Assess your risk tolerance

Risk tolerance is essentially your comfort level with the potential ups and downs in the value of your investments. It's influenced by several factors, including your financial situation, investment experience, and even your emotional response to risk.

-

Begin by examining your financial capacity for risk. Consider your current income, expenses, debts, and emergency funds. Generally, if you have a stable income, little debt, and an emergency fund, you might be able to take on more risk. Conversely, if you are nearing retirement or have significant financial obligations, a conservative approach may be more suitable.

-

Your investment timeline also plays a crucial role. If you have a longer investment horizon, you might be able to tolerate higher risk since you have more time to recover from potential market downturns. Short-term goals usually warrant a more cautious approach, as there’s less time to recoup losses.

-

Another aspect is your personal comfort with risk. Some investors are naturally more risk-averse, experiencing discomfort at the thought of significant fluctuations in their investments. Others may be more risk-tolerant, willing to endure short-term volatility for potential long-term gains.

There are various tools and questionnaires available to help gauge your risk tolerance. These can provide a useful starting point, but remember, risk tolerance can change over time. Life events, financial changes, and even shifts in the market can influence your risk profile.

Simply put, an honest assessment of your risk tolerance helps you build a portfolio that you’re comfortable with, both financially and emotionally. It’s about finding that balance where your investments are aligned with your goals without causing undue stress or financial strain.

Step 3: Determine Your time horizon

Understanding your time horizon is crucial to crafting an effective stock portfolio. The time horizon refers to the expected timeframe until you need to access your invested funds. Here’s how to approach it:

-

Long vs. short time horizons:

Longer Time Horizon: This typically allows for greater risk tolerance. It is suitable if you won't need to access your funds for many years, like when saving for retirement. With a long time horizon, you can afford to invest in stocks or mutual funds, which despite their volatility, often offer better returns over extended periods.

Shorter Time Horizon: Requires a more conservative approach. If you're saving for a near-term goal, like buying a house in a few years, preserving capital is key. Opt for less volatile investments like bonds or high-yield savings accounts, which offer lower risk and protect your principal from short-term market fluctuations.

-

Consider your financial goals:

For long-term goals (e.g., retirement in 30+ years), a higher allocation in stocks or mutual funds might be appropriate.

For short-term goals (e.g., down payment for a house in three years), prioritize capital preservation with safer investment choices.

-

Diversify based on different time horizons:

Your portfolio should reflect a mix of short, medium, and long-term objectives. This diversification requires balancing higher-risk investments for long-term goals with safer options for immediate needs.

-

Regularly review and adjust:

Your time horizon is not static. It will change as you move closer to your goals.

Regularly revisiting and adjusting your investment strategy is crucial to keeping your portfolio effective and relevant.

By considering these aspects, you can better align your stock portfolio with your specific financial timeline and goals.

Step 4: Choose your asset allocation

Asset allocation is about diversifying your investment portfolio across different asset classes, such as stocks, bonds, and cash. It’s a key strategy for balancing risk and potential returns, tailored to your unique goals, risk tolerance, and time horizon. Here’s how to approach asset allocation:

-

Understanding different asset classes:

Stocks: Offer high potential returns but come with higher risk, especially in the short-term.

Bonds: Generally yield lower returns but are less volatile, adding stability to your portfolio.

Cash or Cash Equivalents (e.g., money market funds): The safest option with the least risk but also the lowest returns.

-

Determining your ideal mix:

Risk-Tolerant, Long-Term Investors: Might prefer a higher percentage of stocks.

Risk-Averse or Short-Term Investors: Should consider more bonds and cash.

-

The importance of rebalancing:

Over time, different assets in your portfolio will appreciate or depreciate at different rates.

This change can shift your asset allocation, altering your portfolio’s risk profile.

Regular rebalancing, which involves adjusting your holdings, helps maintain your desired asset allocation and aligns your portfolio with your strategy.

-

Personalization and flexibility:

There is no universal solution for asset allocation; it should reflect your personal financial situation and goals.

As your life circumstances and goals evolve, so should your asset allocation.

Showing prudence and wisdom when choosing asset allocation lets you effectively balance risk and return in accordance with your personal investment objectives.

Step 5: Choose your investments

After establishing your asset allocation, the next significant step is selecting specific investments within each asset class. This is where you put your investment strategy into action, choosing between individual stocks, bonds, mutual funds, ETFs, or other vehicles that align with your goals, risk tolerance, and time horizon.

| Investment Type | Traits | Considerations |

|---|---|---|

|

Stocks |

● Potential for high returns ● Higher risk, especially short-term |

● Company's financial health ● Industry sector ● Growth potential Diversification across industries and geographies |

|

Bonds |

● Generally offer lower returns ● Less volatile, less risky |

● Range from safer government bonds to riskier corporate bonds ● Maturity date alignment with your time horizon |

|

Mutual Funds/ETFs |

● Diversified portfolio of stocks or other assets |

● Suitable for those uncomfortable picking individual stocks ● Research fund's focus and performance |

|

Cash Options (Savings Accounts, CDs, Money Market Funds) |

● Low-risk ● Lower returns |

● Best for short-term goals or as a safety net ● Consider liquidity needs |

It's important to research the fees and expenses associated with each investment, as these can impact your returns. Low-cost index funds are often a popular choice for their broad market exposure and lower expense ratios.

The investment landscape is constantly evolving. Keep up with market trends and economic indicators, but stay focused on your long-term objectives and be prepared to make adjustments as your goals, risk tolerance, or time horizon change.

Step 6: Monitor & rebalance your portfolio regularly

The final, ongoing step in managing your investment portfolio is regular monitoring and rebalancing. This process serves to maintain the intended asset allocation and risk level of your portfolio, ensuring it stays aligned with your investment goals over time.

Monitoring your portfolio involves regularly reviewing your investments to assess their performance and how they're contributing to your overall goals. It's not just about checking for gains or losses, but understanding how each investment is performing in the context of the current market conditions and your long-term strategy.

Rebalancing is the act of realigning the weightings of your portfolio. Over time, some of your investments may outperform others, leading to an asset allocation that differs from your original plan.

For instance, if your stock investments have done particularly well, they might comprise a larger portion of your portfolio than you initially intended, inadvertently increasing your risk level. Rebalancing involves selling off some of these outperforming assets and using the proceeds to buy more of the underperforming assets, bringing your portfolio back to its target allocation.

This process is not about chasing performance or trying to time the market. It's a disciplined approach to sticking to your investment strategy. How often you should rebalance depends on your individual circumstances and market conditions, but a common approach is to review your portfolio at least annually or when your financial situation changes significantly.

Regular rebalancing helps manage risk, capitalize on buying low and selling high, and keep your investment strategy on track.

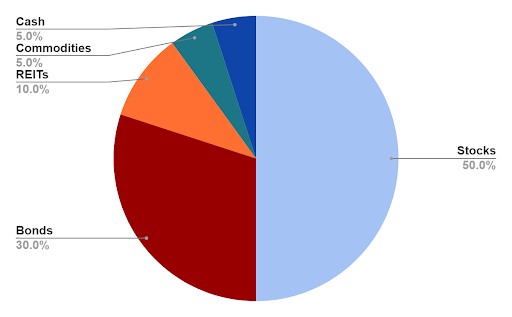

Example of a well diversified portfolio

A well-diversified portfolio is key to managing risk and achieving steady growth over time. Here's an example of how such a portfolio might look for an investor with a moderate risk tolerance and a long-term investment horizon:

Example of a well diversified stock portfolio

-

Stocks (50%): This portion is invested in a mix of individual stocks and stock mutual funds, encompassing various industries and geographies. For instance, 30% in U.S. large-cap stocks, 10% in emerging market stocks, and 10% in European stocks. Stocks offer potential for high returns but come with higher volatility, making them suitable for long-term growth.

-

Bonds (30%): The bond allocation includes a mix of government and corporate bonds. Here, 20% might be in U.S. Treasury bonds for stability and 10% in high-grade corporate bonds for slightly higher yields. Bonds offer lower risk compared to stocks and provide a steady income stream, making them ideal for balancing the portfolio's risk.

-

Real Estate Investment Trusts (REITs) (10%): Investing in REITs provides exposure to real estate, an asset class that often moves independently of stocks and bonds. REITs can offer a combination of income and growth and serve as a hedge against inflation.

-

Commodities (5%): Including commodities like gold or oil can further diversify the portfolio. Commodities often perform well when other assets are struggling, offering a protective hedge in times of market stress.

-

Cash or Cash Equivalents (5%): Keeping a small portion in cash or cash equivalents like money market funds ensures liquidity and safety, which is useful for short-term needs or unexpected expenses.

This diversified portfolio combines growth potential through stocks and REITs, income and stability through bonds, and additional diversification and protection through commodities and cash. The mix of assets is designed to work together to reduce overall risk while still aiming for a reasonable return over the long term.

For more insights on building a diversified investment portfolio, you can refer to our resource, Stock Investing Tips for Beginners.

Conclusion

Building a well-structured stock portfolio is a journey that requires careful planning, an understanding of your financial goals, and a thoughtful approach to risk management. Each step, from setting clear investment goals to regular monitoring and rebalancing, plays a vital role in aligning your portfolio with your financial aspirations.

The key to successful investing lies not in chasing short-term gains but in maintaining a disciplined, diversified approach that can weather market fluctuations and grow your wealth over time. Stay informed, stay focused on your goals, and adapt as your needs and market conditions evolve. With these principles in mind, you're well-equipped to embark on your investment journey.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

3

Diversification

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

-

4

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

5

Volatility

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Tobi Opeyemi Amure is an editor and expert writer with over 7 years of experience. In 2023, Tobi joined the Traders Union team as an editor and fact checker, making sure to deliver trustworthy and reliable content. The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options.

Tobi Opeyemi Amure motto: The journey of a thousand miles begins with a single step.