Commodity Trading Guide: How To Trade Oil On Forex

Forex oil trading involves trading CFDs or derivatives contracts based on the price of Brent crude or West Texas Intermediate (WTI) crude oil. Oil is a complex financial instrument with strong ties to currency prices and global trade, so requires a deep understanding of the market and consideration of a lot of fundamentals. You can trade oil contracts on RoboForex, Pocket Option, Tickmill, Interactive Brokers, and Degiro.

Best Forex broker to trade oil - RoboForex

The top Forex brokers to trade oil are:

-

RoboForex: minimum deposit $10, spread-based oil trading fee

-

Pocket Option: minimum deposit $5, spread-based oil fee

-

Tickmill: minimum deposit $100, сommission in trading oil - minimum $0.85

-

Interactive Brokers: minimum deposit $0, сommission in trading oil - $0.25 to $0.85

-

Degiro: minimum deposit $0, сommission in trading oil - €1 EUR per trade ($1.09 USD)

Some say oil makes the world go round. While that may be an overstatement, oil is certainly one of the core components that fuel modern society, with the so-called “black gold” being perhaps the world’s most important commodity. We use oil to drive our vehicles, to power our homes, and to produce important materials. Entire wars have been fought over oil. Oil's prevalence in everyday life means it inevitably has a huge impact on the global economy, including the foreign exchange market, and vice versa. Much of the world’s trade runs on the petrodollar, and geopolitical events within one region can have a direct impact on currency rates and oil prices in another.

This interconnectedness between currency prices and oil makes oil an appealing option for traders. Pair that with oil’s high volatility, desirable liquidity, and diversification opportunities, and you can see why it's such a highly traded financial asset. In this article, we discuss Forex oil trading, how to trade oil in Forex, and what impacts oil prices.

-

What is the "market price of crude oil"?

This term refers to the spot price of 1 barrel of oil from one of the benchmark crudes that are freely traded on the futures market. Currently, these are the European Brent, the American WTI and the Arabian Dubai Crude.

-

Can you trade oil on Forex?

Yes, you can trade oil on the Forex market using derivatives like CFDs or futures contracts, but not the underlying asset. These instruments allow speculation on oil price movements without owning the physical commodity. The most commonly traded oil contracts in Forex are based on the prices of crude oils like Brent crude or West Texas Intermediate (WTI).

-

What is the prediction for the price of oil?

Traders Union analysts produce daily reports and predictions for the price of oil, giving comprehensive information on the future price dynamics, possible support and resistance levels, and reversal points, which you can check out here: Crude OIL Price forecast for today by Traders Union.

-

Which is better to trade: Forex or commodities?

There is no one-size-fits-all answer as the “better” option depends on individual preferences, risk tolerance, and market conditions. Both are two very different ball games. Forex is centered on currency pairs and offers high liquidity and accessibility, but constant high risk in a 24-hour market. Commodities trading involves tangible assets and offers diversification yet offers less liquidity and is vulnerable to geopolitical and supply-demand factors.

-

Which exchanges trade oil?

You can trade physical oil primarily on commodity exchanges such as the New York Mercantile Exchange (NYMEX) and Chicago Mercantile Exchange CME. The main Forex brokers who trade oil contracts are RoboForex, Pocket Option, Tickmill, Interactive Brokers, and Degiro.

Understanding Forex oil trading

For the uninitiated, hearing about “oil trading” might conjure up images of multinational corporations with vast capital and warehouses full of oil barrels exchanging their resources for cash. However, when traders refer to oil trading, they’re more often than not referring to the practice of trading oil contracts and derivatives, which involves speculating on the price movements of oil without owning the physical commodity. So, unless you have a cargo ship and several warehouses, you’re probably looking at trading oil contracts and not the physical commodity.

You can participate in oil Forex trading by buying and selling derivative contracts, such as futures or Contracts for Difference (CFDs), through Forex brokers. This allows you to capitalize on fluctuations in oil prices without owning the actual oil. Usually, when you trade oil in Forex, they’re a derivative contract based on the price of a specific type of crude oil such as Brent or WTI. These are major benchmarks for global oil prices and are often listed as USD/WTI or BCO/USD .

Which benchmark crudes are traded on the exchange?

The price you see in most Forex trading terminals is the price of the CFD analog of the oil futures contract:

-

West Texas Intermediate (WTI, or Light Sweet Crude Oil) - oil from the fields of Texas, futures traded on the NYMEX. It is the oil that is accumulated in a strategic storage facility in Cushing, Oklahoma, USA, and the statistics of these inventories are considered an important fundamental factor. Ticker options: WTI/USD, XTI/USD, USOIL, CRUD, CL, etc.

-

Brent Crude Oil (Brent Blend, or London Brent), an oil blend from several North Sea fields, is considered the standard for markets in Europe and OPEC countries. Futures are traded on the ICE exchange. Ticker options: UKOIL, BRN/USD, XBR/USD, BZ, CO1, etc.

-

Dubai Crude (or Fateh) - the main export grade for the Gulf countries, futures are traded on the Dubai Mercantile Exchange. Ticker options: DCO, DUB, DCR/USD, etc.

Other oil grades are also traded on the market, but the prices of, for example, Russian Urals and Siberian Light, Iraqi Kirkuk and Basra Light, Norwegian Statfjord, Iran Heavy and Iran Light are calculated on the basis of the main benchmarks. These assets are only offered by some forex brokers.

The spot price is usually higher than the price of the physical asset, so these values differ by about 5-10% in the Forex terminal and in the exchange terminal.

Please note that tickers may differ depending on your broker or trading platform. Be sure to clarify this information before opening trades.

Traders flock to oil trading due to its status as a vital commodity with a global impact, making it one of the more behaviourally unique assets out there. Oil Forex trading provides an avenue for diversifying your portfolio and taking advantage of opportunities arising from the dynamic nature of the oil sector. Trading oil on Forex also involves monitoring global supply and demand factors that impact price movements. All these characteristics make oil an attractive option for traders.

👍 Benefits of Forex Oil Trading

• Liquidity: The Forex market, including oil trading, is highly liquid, ensuring that you can easily enter and exit positions without a significant impact on prices

• Extended Market Hours: The Forex market operates 24 hours a day during the business week, providing flexibility in responding to global events and news that could impact oil prices

• Diversification: Forex oil trading allows you to diversify your portfolios by including commodities alongside traditional currency pairs. This diversification can help manage overall risk

• Leverage Options: Forex brokers offer leverage, allowing you to control larger positions with a relatively small amount of capital. This amplifies potential profits, although it also increases the risk of losses, so be cautious about using leverage

👎 Disadvantages of Trading Oil on Forex

• Not for Beginners: Understanding the factors that influence oil prices can be complex. This complexity requires a thorough understanding of the oil market. Some brokers (like eToro) prevent you from trading oil at all without proven experience

• Complex Fundamental Analysis: Analyzing and interpreting the various fundamental factors affecting oil prices, such as OPEC decisions, inventory reports, and global economic trends, requires in-depth knowledge and ongoing research

• Limited Control Over Market: Traders as a whole have limited control over the broader oil market, which can be influenced by factors beyond their control. Unforeseen events, geopolitical tensions, or natural disasters can impact oil prices, unlike other assets which are more directly influenced by trader activity

• Correlation Risks: Oil prices may not always move in tandem with currency pairs or other assets in your portfolio. This lack of correlation introduces additional complexity and risk if you’re trying to achieve diversification

How to start trading oil in Forex?

To start trading oil on Forex you’ll need a Forex account. There are several steps you can take to get you started trading:

-

Research Forex Brokers: The first thing you should check when selecting a suitable broker is whether they offer oil trading instruments, including popular benchmarks like WTI (West Texas Intermediate) or Brent crude. Once you’ve confirmed that, check that they are regulated by reputable authorities to ensure a secure and transparent trading environment. Consider the broker's leverage offerings as well as the fee structure, including spreads, commissions, and any additional charges associated with oil trading

-

Select Account Type: After settling on a Forex broker, decide which account type you want. As a beginner, you might opt for a demo account to trade with virtual currency. Otherwise, for live trading, decide between a standard or micro account. Micro accounts allow for smaller trading sizes. If you are a practicing Muslim, consider an Islamic account that adheres to Shariah principles, if available. Alternatively, you could open a managed account, in which your capital is managed by an account manager

-

Understand Trading Platform: Once your account is set up, explore and understand the trading platform. Assess its user interface ensuring it’s user-friendly and easy to navigate. Familiarize yourself with the technical analysis tools, order types, and risk management tools. Look for mobile compatibility for trading on the go

-

Start Trading: Begin with small trades, especially if you’re new to oil trading. Gradually increase trade sizes as you gain experience and confidence. Stay informed about market trends, economic developments, and geopolitical events affecting oil prices. Continuously educate yourself and adapt your trading strategy as needed

What is the best Forex broker to trade Oil?

At Traders Union, we favor these five brokers for trading crude oil in 2024.

| Forex Broker | Minimum Deposit | Commission in Trading Oil |

|---|---|---|

$10 |

Minimum $0.25 USD |

|

$5 |

No commission |

|

$100 |

Minimum $0.85 |

|

$0 |

$0.25 to $0.85 USD |

|

$0 |

€1 EUR per trade ($1.09 USD) |

You can learn more about these Forex oil brokers in our detailed article: Best Crude Oil Brokers 2024.

What is causing oil prices to go up and down?

As the world’s primary fuel source and due to its intrinsic ties to the US dollar, oil prices are more influenced by global events, geopolitics, and international trade than most tradable assets. This makes Forex oil contracts one of the most complicated trading instruments, as their price is influenced by so many factors. Explaining how oil prices move is no easy feat, but let’s give it a shot.

Certain countries in the world are major oil producers, like Saudi Arabia, the USA, and Russia, and export their excess oil to oil-importing nations like Sweden, Greece, or France, which produce little to no oil. Revenues from oil sales contribute significantly to the economic health of oil-exporting countries, while the economies of importers tend to suffer when oil prices rise. Control over and access to oil resources can cause geopolitical tensions and even lead to conflict.

Oil is predominantly priced in US dollars, and the US dollar is the world’s reserve currency, so changes in oil prices can influence the exchange rates of all currencies. Rising oil prices usually strengthen the currencies of oil-exporting nations but may lead to currency depreciation for oil-importing nations due to higher import costs.

Major oil corporations and multinational companies explore, extract, refine, and distribute oil, often engaging in projects worldwide and forming partnerships with oil-producing nations, which can affect the stock market and currency rates too. On top of this, international organizations like OPEC and the World Petroleum Council (WPC) consist of different nations working together to coordinate oil prices.

Due to the sheer number of major players in the global oil market, you can see why predicting and understanding oil price movements is incredibly complicated. An almost uncountable number of different individual factors can affect oil prices, making it a trading instrument not for the inexperienced. Here are some specific factors that can impact oil prices, with examples:

-

Global Demand and Supply: Changes in global demand for oil can impact prices. Similarly, shifts in oil supply, affected by production levels and geopolitical events, play a significant role. Oil demand plummeted during the COVID pandemic as planes stopped and businesses shuttered, which caused a collapse in oil prices

-

Economic Conditions: Economic indicators such as GDP growth, employment rates, and manufacturing data influence oil prices. Economic expansion typically leads to increased energy consumption and higher oil demand. For example, China’s economy and population have boomed in recent decades, so their oil demand increased almost tenfold since 1999, partially causing higher oil prices

-

OPEC and Non-OPEC Decisions: Decisions made by the Organization of the Petroleum Exporting Countries (OPEC) and non-OPEC nations regarding oil production levels and output quotas can influence supply and, consequently, prices. After the pandemic-driven oil price crash, OPEC had to artificially boost oil prices and cut production by over 9 million barrels per day just to stabilize oil’s value

-

Geopolitical Events: Political instability, conflicts, and geopolitical tensions in major oil-producing regions can disrupt supply chains, leading to fluctuations in oil prices. After Russia invaded Ukraine in February 2022, WTI shot up 52.33% and Brent Crude 56.33%. When the UK and USA bombed Yemen in January 2024 due to Houthi rebel attacks on commercial shipping routes, oil prices climbed 4%. Sadly, war is profitable for oil traders

-

Innovation and Technology: Advances in oil production technology can drive oil supply and lower prices. The expansion of fracking in the USA contributed to a substantial increase in U.S. oil production and subsequent period of oversupply in the global market, which likely contributed to lower prices

These are just some examples of events and factors that influence oil prices. To have a strong grasp on the behavioral characteristics of oil, you need to pay attention to geopolitical events, international organizations, oil-producing corporations, tech companies, the economic indicators of individual nations, and more. This can be a lot for most traders! Luckily, Traders Union has simplified things somewhat, with our predictions for oil prices for 2024-2030, which you can read here: Oil (XBR) price prediction 2024, 2025, 2030.

What's the best strategy for trading oil?

There’s no best strategy due to the complexity of oil and depending on your trading style and strategy, but there are several approaches that may be better suited to you:

-

Technical Analysis: Use price charts and technical indicators to analyze historical price movements and identify potential trends. Identify key support and resistance levels on charts to help you make informed decisions about entry and exit points. Analyzing candlestick patterns can also provide insights into market sentiment and potential trend reversals

-

Fundamental Analysis: Understanding global supply and demand dynamics is crucial. Factors like geopolitical events, OPEC decisions, and economic indicators can impact oil prices, as discussed in the previous section. Monitoring oil inventories and production data, as well as macroeconomic Indicators such as GDP growth and industrial output, helps assess the fundamental health of the market

-

Sentiment Analysis: Traders analyze news and events to gauge market sentiment. Geopolitical tensions, economic reports, or unexpected events can impact oil prices. Monitoring sentiment indicators, such as positioning data or sentiment surveys, helps understand the overall market mood

It’s also important to implement stringent risk management into your strategy, including position sizing, stop-loss orders, and diversification. Determine the size of each trade you enter based on risk tolerance and account size and avoid overcommitting to a single trade. Diversifying across different instruments or asset classes can mitigate risk. Set stop-loss orders to limit potential losses, as this helps control risk and can prevent significant drawdowns.

Whichever strategy or approach you use in trading Forex oil, it’s important that you set realistic goals. Clearly define your objectives, whether they are short-term gains, long-term growth, or income generation. Assess the risk-reward ratio for each trade, ensuring that potential profits justify the assumed risks. Be adaptable and willing to adjust strategies based on changing market conditions, as what works in one market phase may need modification in another. Applying these tips to your goal setting should make your trading easier to monitor.

What is the best time of day to trade oil on Forex?

The Forex market is open 24 hours a day, from Sunday night to Friday night depending on where you’re located. This means you can trade oil contracts on Forex markets almost any time. However, traders need sleep. You can decide which hours are more suited to your trading style based on market volatility throughout the day.

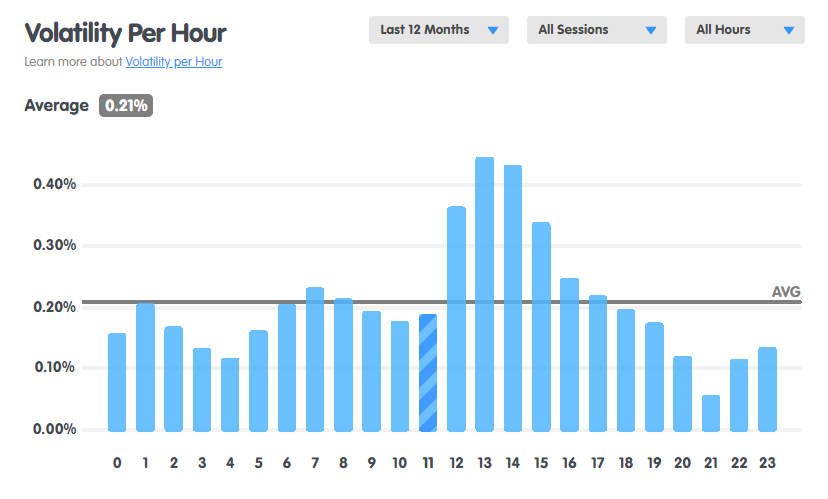

For oil trading, the average volatility is 0.21%. This means that throughout the day, the typical or usual level of price fluctuations or variability observed in Forex oil prices is 0.21%. Levels below 0.21% are considered low volatility and above are high. If you want to capitalize on higher price fluctuations, the optimal time for trading Forex oil is from 12 PM to 6 PM (UTC). The periods of lowest volatility are from 2 AM to 6 AM and 7 PM to 1 AM.

Figure 1 Forex oil volatility through the day (Source: babypips.com)

For a more detailed explanation of the best time to trade oil on Forex, see: Timing Matters: Best Time to Trade Oil on Forex.

What is an example of oil trading?

Let’s use an example to demonstrate trading WTI Crude Oil using a Contract for Difference (CFD) on a Forex platform.

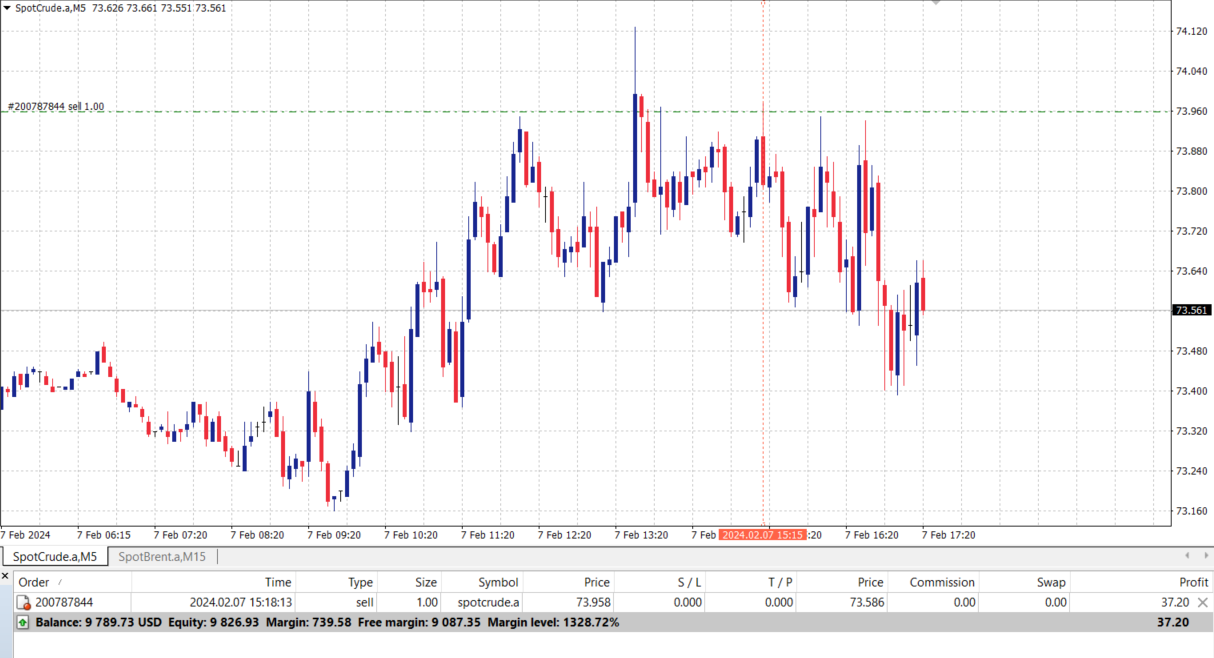

An example of oil trading

The price action between 13:00 and 14:00 points to the activation of sellers, who pushed the price down sharply after it surpassed the $74 per barrel level. In fact, it indicates a bearish engulfing pattern where the bulls' attempt fails completely.

Under such conditions, it is reasonable to assume that the level of $74 will work as resistance intraday, and a trader may try to short as close to the resistance level as possible, setting a stop loss above it.

The chart shows an open sell trade from the price of 73.958 with the volume of 1 lot. To open it, the Forex broker needed to block a margin of $739.58. At the moment, shown on the screenshot, the trade brings 37.20 profit (about 5.03% of the blocked margin).

This oil trading example shows the potential of how much you can earn. However, on the other hand, trading always involves the risk of loss. So it’s important to do your own research.

Conclusion

Whether engaging in oil trading in Forex, it's essential for beginners to conduct thorough market analysis, understand the risks involved, and implement robust risk management strategies. Make sure to stay up-to-date on geopolitical events, international policies, OPEC developments, and any other influential factors in the oil trade.

Team that worked on the article

Jason Law is a freelance writer and journalist and a Traders Union website contributor. While his main areas of expertise are currently finance and investing, he’s also a generalist writer covering news, current events, and travel.

Jason’s experience includes being an editor for South24 News and writing for the Vietnam Times newspaper. He is also an avid investor and an active stock and cryptocurrency trader with several years of experience.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).