6 Best Stock Brokers For Beginners

As a stock trader or investor, choosing the right online stock brokerage is a very challenging decision. The market is filled with tons of options, and choosing the one that meets your financial needs can be very daunting. You need to make sure that the online broker that you choose not only offers a great trading environment but must also be fully regulated. It'll allow you to manage your investment in the best possible way. Moreover, it'll also help you to keep your assets and capital secure in case of any misconduct from the brokerage.

This very article is the product of in-depth and comprehensive research work by the experts of Traders Union. It only contains the best online stock brokers, especially for beginners, for a great stock trading experience in 2024. In our testing, we analyzed and compared all the features and tools that each broker offers thoroughly. From investment offerings and trading platforms to customer services and commissions and fee structure, we took everything into account. So, if you're planning to start your stock trading journey, then consider reading this post till the end to find the best online stock broker for beginners. So, without any further ado, let’s jump right in.

What Is the Best Stock Broker for Beginners?

The best trading platforms make it easy for novice traders and investors to trade stocks seamlessly. For beginners, the fee structure of the stockbrokers is one of the most significant factors to consider. High minimum deposit requirements, as well as high commission percentage, can work as barriers and shut out beginners.

The best stock broker for beginners not only offers low commissions and minimum deposit requirements but also helps beginners with educational and research material to learn more about trading. Each stock broker for beginners that we choose in this list offers a great commission and fee structure and also offers a suitable trading environment that every inexperienced trader can use. So, if you're interested in investing or buying stocks, then read the comparison of all the online brokers carefully. It'll help you to choose the right option to grow your trading account in the shortest possible time.

Top 6 Best Brokers to Start Stock Trading

Here’s our list of the best stock trading brokers that you can use in 2024.

| Position | Broker | Best For |

|---|---|---|

1 |

Best for Stock Trading |

|

2 |

Best for Mobile Trading |

|

3 |

Best for Trading Tools and Research |

|

4 |

Best for Low-Cost Trading |

|

5 |

Best for Investments |

|

6 |

Best for Education |

eToro – Best for Stock Trading

The eToro broker was founded in 2007. The company promotes itself as a social trading platform working with traders from over 140 countries. The broker has several divisions operating under different jurisdictions and licensed by different regulators. For example, eToro (Europe) is licensed by the Cypriot regulator CySEC (109/10) and eToro (UK) is licensed by the British regulator FCA (583263). The broker also has a representative office in Australia and the USA.

👍 Advantages of trading with eToro:

•High level of reliability ensured by the licenses of respected regulatory authorities and participation in the compensation funds.

•Wide selection of assets quoted at stock exchanges in the UK, U.S., Australia and Asia.

•An opportunity to combine active trading with social trading and passive investing.

•Zero-fee trading of a number of stocks.

•Access to ready-made diversified asset portfolios with various risk levels.

•Provision of leverage, educational materials on various markets and user-friendly trading platforms that can run on any device.

•Zero fees for portfolio management, depositing funds and account maintenance.

👎 Disadvantages of eToro:

•High minimum deposit for users of a number of countries.

•No live chat on the website for quick connection to customer support.

eOption – Best for Mobile Trading

The eOption broker (eoption.com) is an American stockbroker headquartered in Glenview, Illinois. It has been operating since 2007 and is a member of FINRA (CRD#: 7297/SEC#: 8-21765) and SIPC. It specializes in options trading and also acts as an intermediary in trades involving the popular securities classes. The company offers low trading commissions, super-fast execution of orders, and modern platforms with an advanced set of analytical tools. In 2020-2021, eOption was recognized as the best options broker by several resources such as Investopedia, The Tokenist, Benzinga, Investormint, and NerdWallet.

👍 Advantages of trading with eOption:

•Low commissions for options trading — $0.10 per contract plus $1.99 per trade.

•No minimum deposit requirements for cash trading accounts opened by US residents.

•FINRA membership and the protection of clients’ funds are available through Securities Investor Protection Corporation (SIPC).

•Access to professional trading platforms such as DAS and Sterling Trader Pro are developed by third-party software developers for the proprietary eOption terminal.

•An affiliate program with high rewards.

•Compensation for commissions for funds or assets from other brokerage firms and institutions transfer.

•Prompt support by phone and online chat in the trading platform during company business hours.

👎 Disadvantages of eOption:

•The narrow range of choice of investment solutions to generate passive income.

•You cannot trade Pink Sheet and Bulletin Board stocks.

•There is no online chat on the company's website.

Ally Bank – Best for Trading Tools and Research

The Ally Bank broker is part of Ally Financial Inc., which is an American holding company. The original company was created in 1919 by the General Motors automobile corporation to conduct activities with its auto parts suppliers and associated automobile dealerships. In 2014, Ally started offering banking products, and since 2017, it has also offered brokerage services. Currently, it operates solely as an online bank and brokerage firm and has no physical branches. It does, however, offer favorable terms of cooperation at consistently competitive rates with professional round-the-clock support. The company's services are used by more than 8.1 million customers globally.

👍 Advantages of trading with Ally Bank:

•It has official licenses for banking, dealer, and brokerage activities from reputable US regulators.

•A wide range of assets is available such as currency pairs, metals, securities, and options.

•There is an opportunity to invest in diversified portfolios for passive profit.

👎 Disadvantages of Ally Bank:

•The company works only with US tax-paying residents.

•On the broker's website, there is no training on trading in various financial markets, nor is there a Forex glossary of terms.

•There are high commissions for withdrawing funds and the company does not compensate customers in any way.

•Only registered users can ask a question in the online chat.

•There is a time-consuming procedure for opening an account, which in some cases takes up to two weeks.

Revolut – Best for Low-Cost Trading

Revolut is a British fintech company that has been providing investors with accounts for trading precious metals, cryptocurrencies, and stocks listed on U.S. exchanges since 2015. The broker offers its clients access to investing in stocks and ETFs on European stock exchanges. For organizations and private clients, the company offers a multi-currency account with the possibility of exchanging currencies at the current inter-bank exchange rate. Revolut is supervised by the Financial Services Authority (FSA).

👍 Advantages of trading with Revolut:

•In addition to stock trades, customers can trade cryptocurrencies and precious metals.

•The broker offers commission-free trading plans.

•The minimum number of shares to buy is 0.00000001.

•There are no minimum deposit requirements.

•Social trading is available, which allows newcomers to the stock market to copy trades of successful traders.

•Communication with the support service via chat is available in the mobile application 24 hours a day.

•There is no fee for opening and maintaining a trading account.

👎 Disadvantages of Revolut:

•Stock trading is currently only available to UK residents.

•Operations in precious metals and cryptocurrencies are not regulated by supervisory authorities.

•The company does not offer fiduciary management of its investment portfolio.

Interactive Brokers – Best for Investments

Interactive Brokers is among the best-known US investment companies, operating since 1977. The broker offers to trade currency pairs, but its basic instruments are stocks, CFD, indices, metals, ETF, futures, and other exchange market assets. The company is regulated by the US Securities and Exchange Commission (SEC), the US Financial Industry Regulatory Authority (FINRA), the UK Financial Regulatory Authority (FCA, 208159), and other international financial regulation commissions. In 2020, the broker was awarded the "Best Online Broker” (Barron's) and "Best Broker for Economical Investments" (NerdWallet) titles and got five stars in the Online Stock Trading for Traders category (Canstar). Also, the broker is popular in other countries. Here you can read reviews of Interactive Brokers in Canada, Singapore, Australia, Hong Kong, Ireland.

👍 Advantages of trading with Interactive Brokers:

•wide range of training materials;

•access to 135 markets in 33 countries;

•a huge subset of trading instruments.

👎 Disadvantages of Interactive Brokers:

•website interface is only partially translated into other languages;

•you have to pay for an inactive account;

•Support service does not work on Saturday and Sunday;

•long and complex registration procedure;

•no cent accounts for novice traders.

M1 Finance – Best for Education

M1 Finance is a subsidiary of M1 Holdings Inc., which provides long-lasting investment services. M1 Finance is registered and regulated by FINRA (Financial Industry Regulatory Authority of the United States, CRD#: 281242/SEC#: 8-69670), and also cooperates with SIPC (Securities Investor Protection Corporation), which guarantees investors comprehensive protection and financial compensation in the event of a financial mishap. The M1 Finance broker provides services exclusively to US residents and offers to choose a trading account with personal or joint access, create a trust and retirement account, and open an account for minors. In addition to investing, M1 Finance clients have access to loan and payment services with a special M1 card.

👍 Advantages of trading with M1 Finance:

•There are no fees for transactions in the company.

•A plethora of ways for customers to reach out to the support team.

•You can test the trading conditions of M1 Finance by creating a login.

•The company's clients have access to automatic portfolio rebalancing.

•You can manage your portfolio both from a personal computer and from mobile devices.

•The company offers accounts with the same trading conditions, but different forms of ownership, as well as retirement accounts and accounts for minors.

👎 Disadvantages of M1 Finance:

•The broker provides a small number of ways to fund a trading account and withdraw earned funds to a personal account.

•Support is closed on weekends.

•There are no programs that allow you to copy transactions of other investors, and there are no automatic trading services.

What Are Usual Stock Trading Costs?

Some online stockbrokers that are available in the market charge commission on performing stock trading. Here’s a list of the most common expenses that, as a trader, you might need to pay.

Annual Fee

Some brokers charge an annual fee which typically costs somewhere between 50 to 75 US dollars. But you can avoid that by choosing the platform that doesn’t charge an annual fee.

Inactivity Fee

Different online brokers who charge inactivity fees have different criteria that can be based on yearly, quarterly, or even monthly cycles. Typically, it can cost you about 10 to 200 US dollars. Except for Interactive brokers, all the other online trading platforms that we mentioned don’t charge an inactivity fee.

Trading Platform Fee

Most online brokers offer more than one trading platform with unique and advanced features. You’ll need to pay a fee to use those platforms, such as Thinkorswim by TD Ameritrade. These specialized platforms can cost you around 50 to over 200 US dollars monthly.

Data Subscriptions and Research

Many online brokers offer paid subscriptions to access experts’ analyses and research data that can cost you 1 to 30 US dollars per month. However, many online brokers offer these features for free, and we recommend you choose the broker with free educational and research material.

Paper Statement Charges

Online brokers offer paper statement services that allow you to receive your financial statement monthly. It typically costs 1 to 2 US dollars on each statement. It’s not advisable to use this service in this era of technology because you can always choose a free email service.

Transfer or Account Closing Fee

Most online brokers charge a fee to close your trading account or on transfer which is typically somewhere between 50 to 75 US dollars.

Important Considerations

As you can see that most of the fees can be avoided or minimized by choosing the right brokerage. But it’s important to note that your primary concern must be the trading environment that a broker offers that must suit your investing and trading style.

You can find all the information on the official websites that brokers offer regarding every type of fee. You can also contact customer services to find out everything you need to know about the brokers’ fee structure. Moreover, a great strategy is to acquire the demo account that almost all the renowned brokers offer. This way, you’ll be able to analyze all the features and tools that a broker offers without risking your real money.

How Much Can I Earn?

The only thing that’s certain in trading is that your profits can never be guaranteed. The ROI (Return on Investment) depends upon multiple factors such as your trading strategy, the performance of the underlying asset, market volatility, and more. Moreover, active investment and trading can help you to increase your profit. But at the same time, this strategy also increases the risk factor that you’ll need to minimize by devising a comprehensive risk management strategy.

According to one of the most successful and iconic investors of all time, Warren Buffett, index investing by ETF can be a better option for unprofessional investors. Moreover, he says that beginners should consider investing and trading low-cost index funds. It might sound a little intimidating, but the fact of the matter is that index funds are only a stock basket that basically represents a broad market. For example, investing in S&P 500 index fund means that you’ve bought a little part of the biggest 500 US companies which are traded publicly. In other words, it automatically mitigates the overall risk and diversifies your investments.

Here’s a list of the stock indices and most popular shares with one year and average 10-year returns.

| Stocks | 1-year performance | 10-year performance | Risk level |

|---|---|---|---|

S&P 500 Index |

40.25 percent |

14.26 percent |

Average |

Nasdaq Index |

41.65 percent |

19.02 percent |

Average |

FTSE 100 Index |

17.71 percent |

4.40 percent |

Average |

Apple (AAPL) shares |

46.85 percent |

28.09 percent |

High |

Microsoft (MSFT) shares |

33.38 percent |

27.67 percent |

High |

Tesla (TSLA) shares |

240.71 percent |

61.66 percent |

High |

Amazon (AMZN) shares |

23.48 percent |

33.26 percent |

High |

How to Buy Stocks Online. A Beginner's Guide

If buying stocks is intimidating for you and you find it difficult, then consider following the step-by-step guide that we have prepared below.

Step One: Choose the Online Stock Broker

The first and the obvious step that you need to take in order to start your stock buying journey is to choose the right online stock brokerage. It’s the easiest way to buy stocks because other options such as directly buying shares from the company or using a full-service stockbroker can be very cumbersome. Webull is one of the best available options, and we'll use that for our example.

Step Two: Open Your Brokerage Account

The next step after choosing the online broker is to open your trading account. Webull offers a completely free signing up process without any hidden charges or any other catch. You can open your Webull account by going to its official website. Moreover, the brokerage also allows you to claim popular stocks such as SBUX, FB, GOOG, and more if you open your account by depositing 100 US dollars.

Step Three: Practice Stock Trading

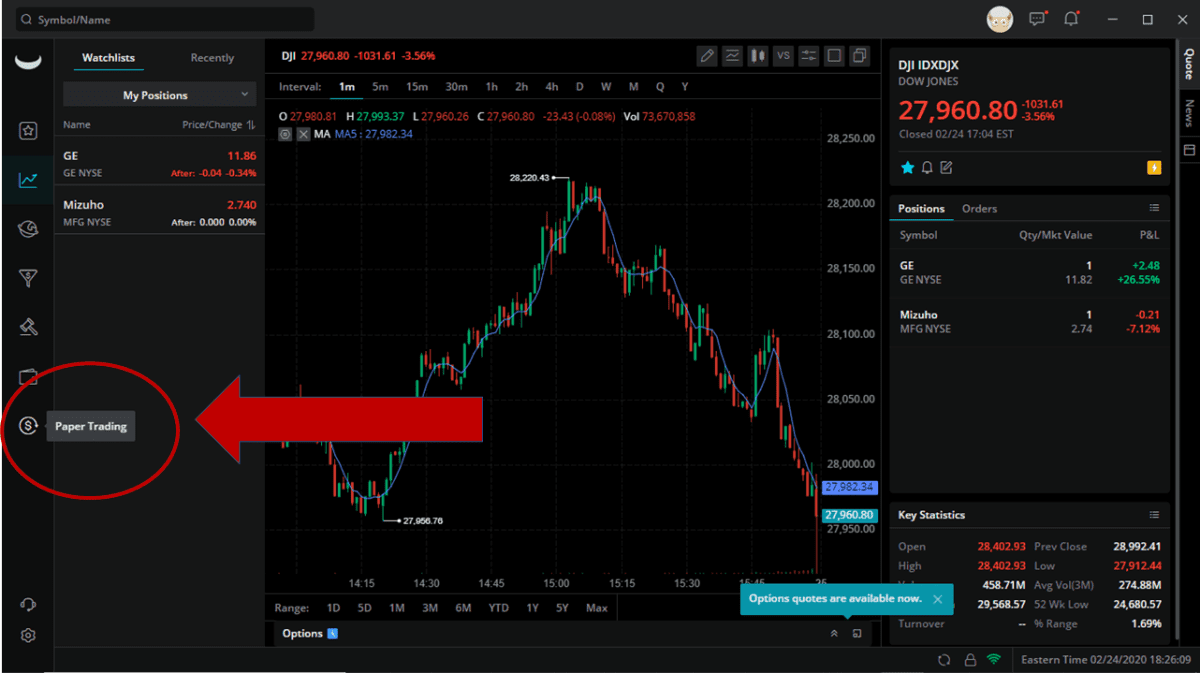

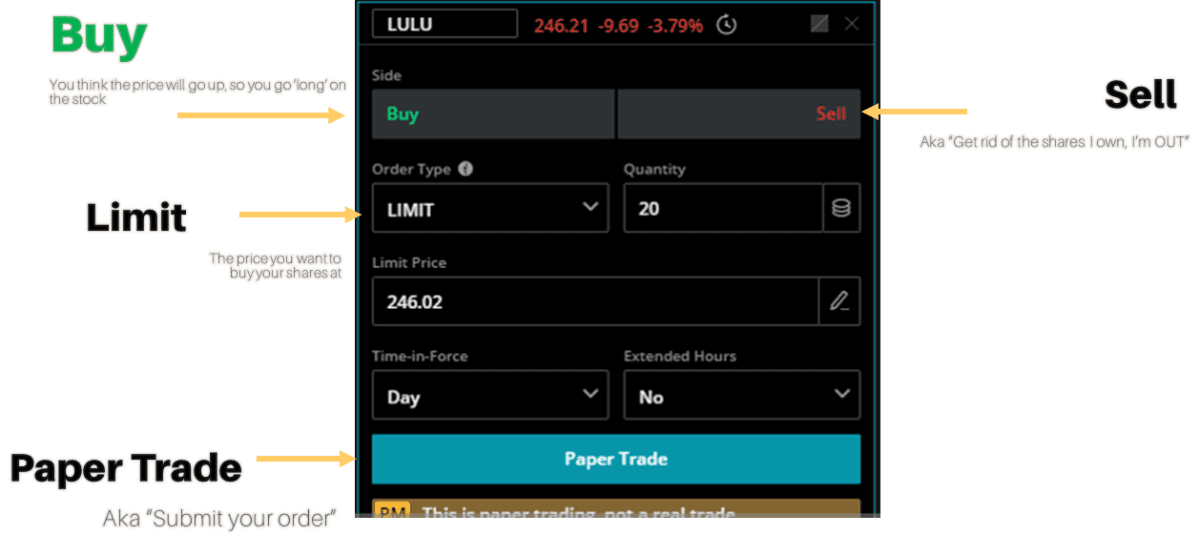

It’s one of the best features that Webull offers, where you can practice the complete trading lifecycle without involving real money. Once your account is set up, you’ll need to open it and click on the “Paper Trading” option (icon with a dollar sign), as shown in the image below.

Webull Platform

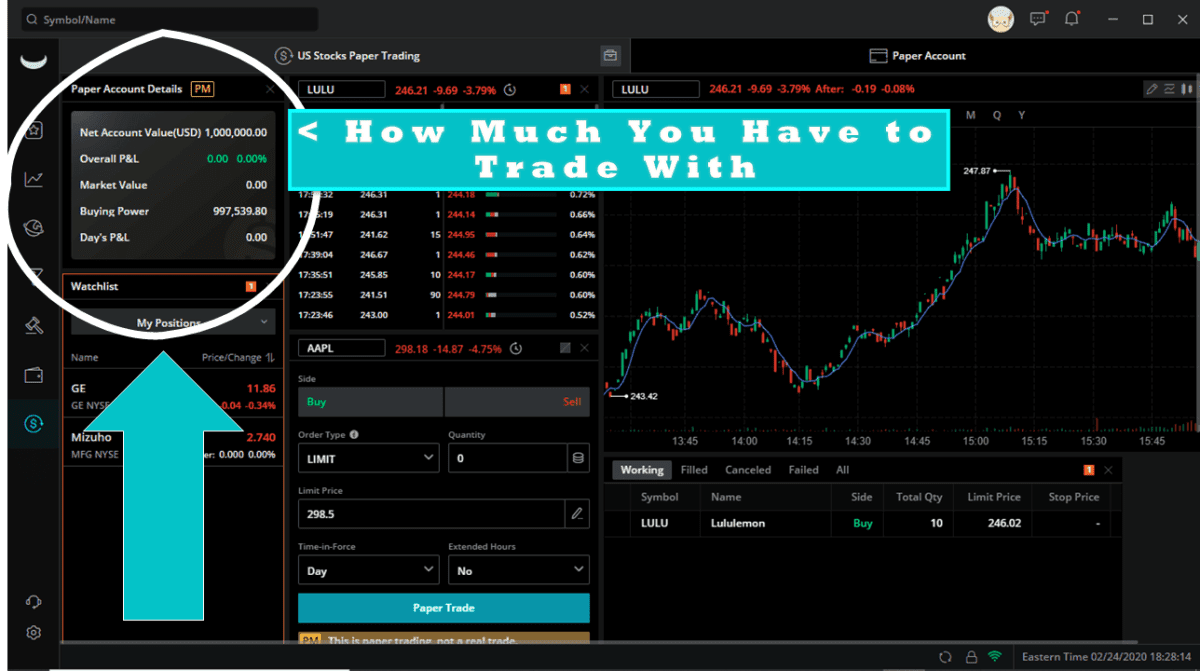

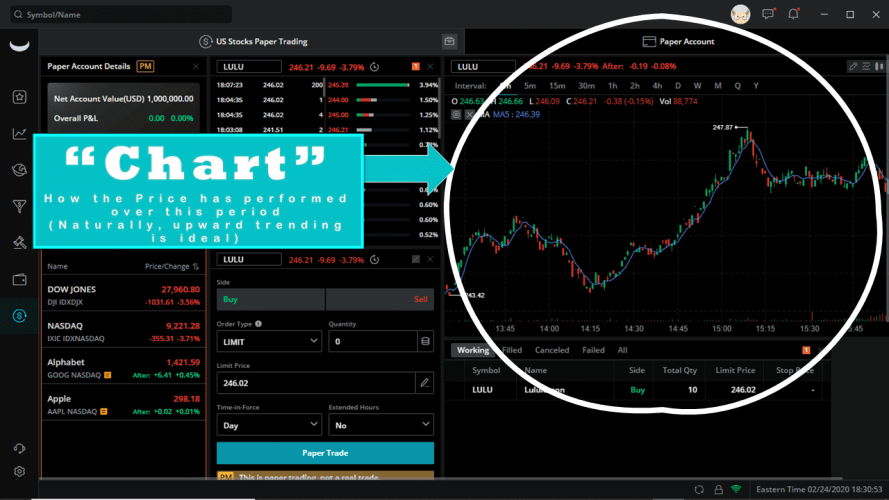

Step Four: Setup Your Trading Account Size

The paper trade option provides you with one million US dollars (dummy data) to test your stock trading skills. We recommend you not to utilize all of it and choose the decent amount that you feel is best. Moreover, it's advisable to use the dummy capital to trade the stocks that you'd actually take into account while trading with real money. In order to set your trading account size, you'll need to click on the "Reset" option. It'll allow you to set the amount that you want to use to start trading.

Webull Trading Account

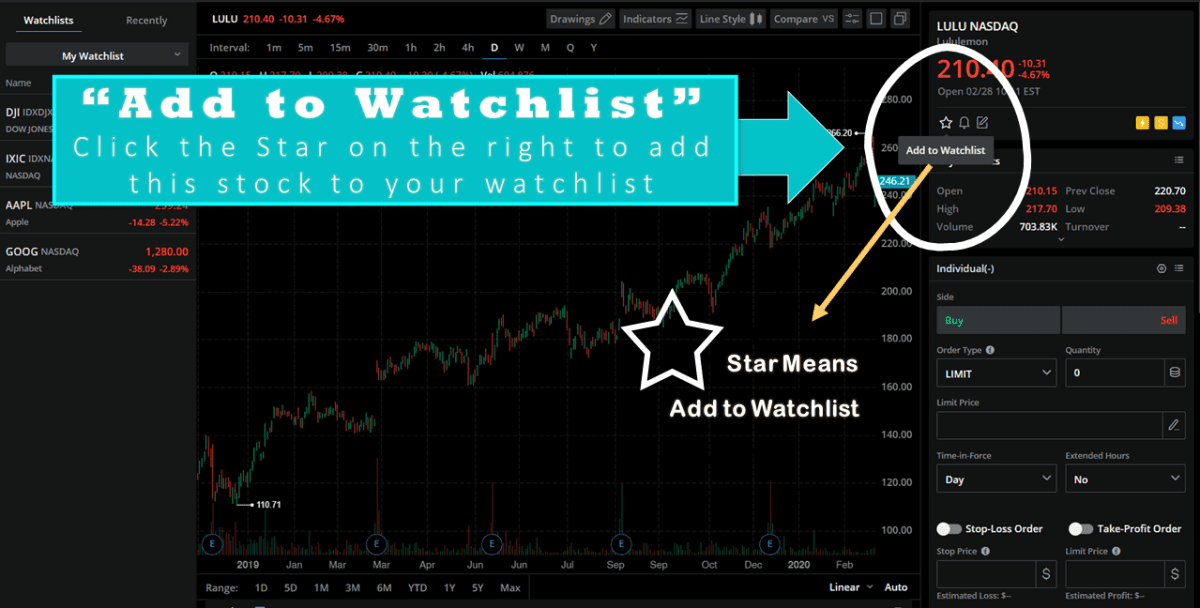

Step Five: Create a Watchlist

Webull offers all the major stocks such as Apple, Microsoft, Amazon, Tesla, and more. Creating a watchlist of the stocks you're interested in comes in handy to follow their market performance.

In order to find a certain stock, you’ll need to search it by writing its name in the search bar available in the top right corner. Then you’ll need to click on the “Star” icon available on the right side.

Webull’s Watchlist

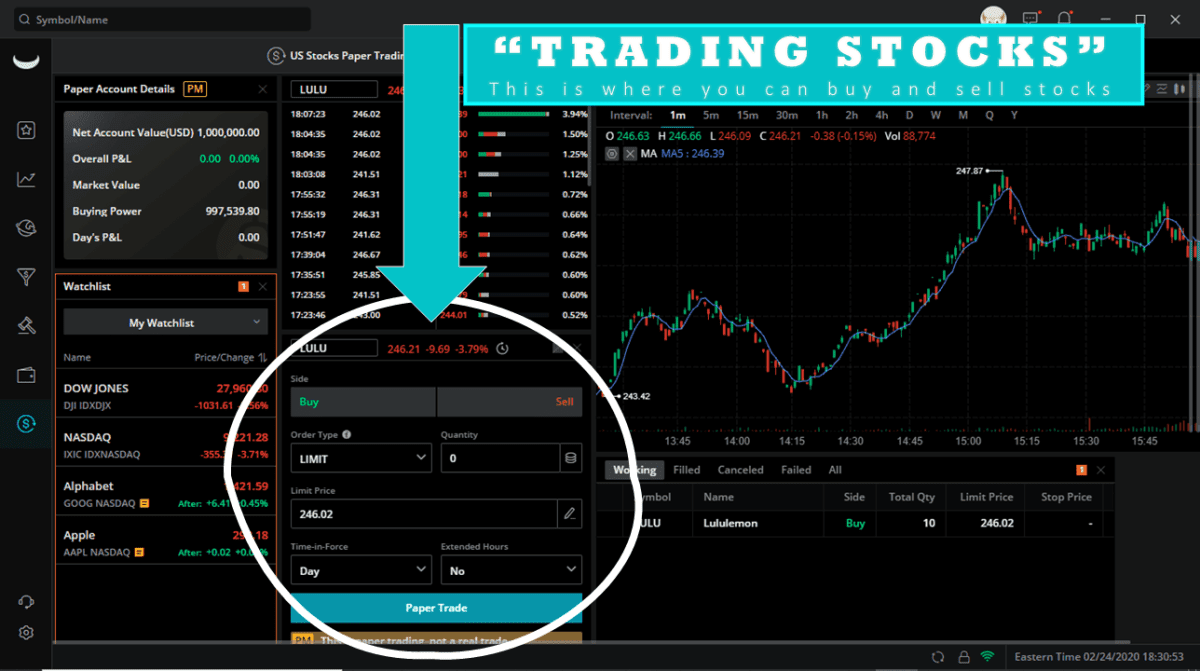

Step Six: Buy Stocks

You can easily buy the stock by clicking on the buy button once it has reached the price point that you provided to the system.

Buying Stocks in Webull

Buying Stocks in Webull

After that, you’ll need to follow the charts regularly in order to find out the stock’s market performance. You can also learn about the history of your selected stock whenever you want by using the intervals.

Webull’s Trading Chart

Methodology

For this Traders Union guide of the "best online stock brokers for beginners," hundreds of data points were collected by the platform's experts. Not only did we test the trading environment of each broker in real-time, but we also checked their customer service multiple times. Moreover, our experts analyzed each and every feature, tool, and technical indicator carefully to create this review. It makes Traders Union a reliable and one of the biggest independent databases providing authentic information about all the popular online brokers.

Because of our robust and in-depth data collection and validation method, the annual human error rate is negligible (about 0.01 percent). In simple words, we provide quality data that you can use and trust. Lastly, you can find the best options on the Traders Union website to start your online trading journey regardless of your expertise and requirements.

Summary

One of the most important factors that you must keep in mind is that you can't get rich overnight by stock trading. It requires time, effort, and most importantly, the right selection of the platform. Moreover, many novice traders fall victim to scam brokers and trading scams because of attractive deals and features that scammers put online. That’s why it’s critical to choose an online brokerage that’s fully regulated by world-famous financial and regulatory bodies.

All the brokers mentioned in this list are not only low-cost, but they're also highly regulated by renowned authorities. It means you can choose any listed option that suits your unique needs with the necessary peace of mind that your money is in safe hands.

Best Stock Brokers For Beginners by Countries

FAQs

How much amount do I need to open my brokerage trading account?

Some online brokers ask you to deposit several hundred or even thousands of US dollars to open your trading account. However, in order to open your fully functional trading account with the best online stock brokers that we have mentioned, you won’t need to deposit a single penny.

What is the paper trading account?

A paper trading account is a term used for a specialized account type that you can use to practice trading without risking your real money. It provides you with the real market data that you can use to determine how your real money would have performed in the same scenario.

What financial information do I need to open my online trading account?

According to most financial and regulatory bodies, brokers must know their customers. That’s why you’ll need to provide the broker you choose with extensive information that usually includes:

Net worth

Annual income

Investing experience (mostly in years)

Investment goals

Risk tolerance

What online broker should I choose?

The type of broker you should choose entirely depends upon your investment needs and financial goals. For example, if you're a beginner and looking for a stockbroker, then you'll need to choose a low-cost broker that allows you to access stock markets safely.

Team that worked on the article

Andrey Mastykin is an experienced author, editor, and content strategist who has been with Traders Union since 2020. As an editor, he is meticulous about fact-checking and ensuring the accuracy of all information published on the Traders Union platform. Andrey focuses on educating readers about the potential rewards and risks involved in trading financial markets.

He firmly believes that passive investing is a more suitable strategy for most individuals. Andrey's conservative approach and focus on risk management resonate with many readers, making him a trusted source of financial information.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.