12 Best Robo-Advisors in 2024

Best Robo-Advisor is Empower

Best robo-advisors are:

-

1

Empower - Best for long term investing

-

2

Interactive Advisors - Best Desktop Trading Platform

-

3

E*Trade - Best For The Low Spread Trading

-

4

Wealthfront - Best for receiving passive income

-

5

Schwab Intelligent Portfolios - lowest minimum deposit brokers

For many investors, personally managing an investment portfolio is no simple task. It requires consistently staying on top of market changes and performing thorough research—duties that can be quite time-consuming. Enter robo-advisors, an attractive option for those lacking experience or the hours needed to actively oversee their holdings. By employing algorithms to execute trades, these digital services are able to offer a hands-free approach while still applying fundamental strategies.

In this article, we evaluate some of the top robo advisors currently available. Each platform is assessed based on criteria such as associated fees, minimum account sizes, account features, and investment choices. We explore the distinguishing qualities of each to help investors determine which may be the best fit depending on their budget and risk tolerance.

-

What are the fees for robo-advisors?

Robo-advisor fees typically range from 0.25-0.5% of your total portfolio value annually. Some may charge additional fees for account set-up, ongoing services, or securities trading. Fees vary between providers.

-

Can robo-advisors manage more than retirement accounts?

Yes, while many are best known for retirement services like IRAs, robo-advisors can also manage non-retirement, taxable brokerage accounts.

-

Can I customize my portfolio?

Most robo-advisors allow you to customize your portfolio allocation within pre-determined risk levels. Some offer further customization options.

-

How are assets invested?

Robo-advisors invest your money in low-cost ETFs or mutual funds across asset classes like stocks and bonds based on your risk profile and goals.

Top 12 Robo-Advisors Comparison

| Brokers | Minimum Investment | Management Fee | Key Features |

|---|---|---|---|

Empower |

$100,000 |

0.89% for investments below $1-M, while 0.49% for above it |

1. Unlimited withdrawals and deposit, as well as direct deposit services |

$100 |

Between 0.8% to 1.5% per year |

1. The Socially Responsible Investing tool blocks companies that don’t share the same values as you | |

$0 |

$0 for stocks, $0.65 per contract for Options |

1. Comes with two mobile applications, as well as a desktop version with more robust capabilities |

|

$500 |

0.25% |

1. Extend several promotions like your first $5,000 investment is free from fees |

|

$5,000 |

0% |

1. Various educational resources to expand your knowledge on investing | |

$100 |

0% |

1. Cash management tool that allows you to borrow money for capital | |

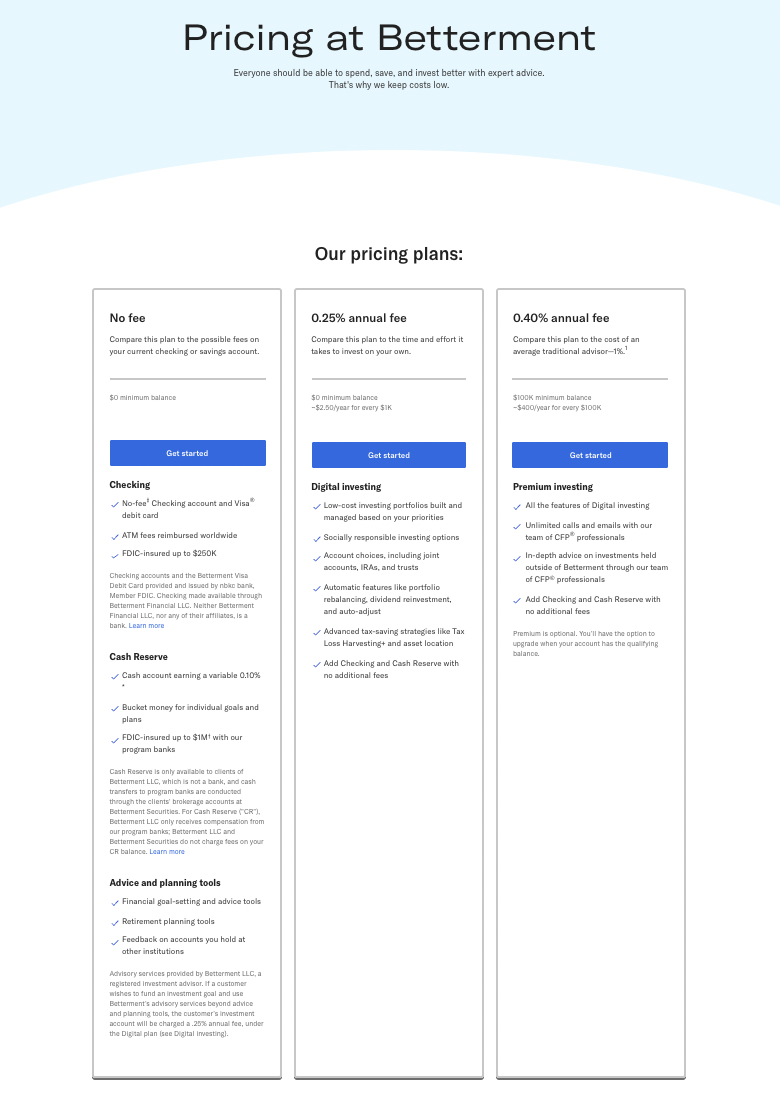

Betterment |

$0 |

0.25% for a digital account and 0.40% for the premium plan |

1. Offers customizable Core, Smart Beta, and Retirement Income for all users

2. Automates deposit based on your preferred schedule |

$0 |

0% |

1. Trading available for cryptocurrency and other digital assets | |

Ellevest |

$0 |

$1 to $9 per month depending on the plan you select |

1. Accounts for women’s unique financial issues like reduction in pay after child-birth or longer life |

Vanguard Digital Advisor |

$3,000 |

0.15% per year |

1. Provides planning for non-retirement investments like starting a college fund or buying a new home |

Acorns Investment |

$0 |

Between $3 to $5 per month, depending on the plan selected |

1. An automated savings tool to take care of your earnings |

Ally Invest Managed Portfolios |

$100 |

0% for a cash managed portfolio |

1. A goal tracker helps you stay updated with your plans and objectives |

Empower

Empower is another of the best robo-advisors available, especially those who can accommodate its high minimum requirement when starting. It offers users all the basic bank-like functions, but also adds several financial planning tools, including tax strategies, cash flow analysis, and retirement planner, among others.

Needless to say, they have one of the most comprehensive list of services available.

Commissions, Assets, and Minimum Amount:

Their minimum requirement to open an account is quite high at $100,000. They make up for it, though, with an affordable management fee of 0.89%. This number decreases further to 0.49% for investments about $1-M.

Empower

Distinguishing Features:

The retirement planning function is really useful, particularly for those considering it in the coming years. It even includes your expected Social Security income received on a monthly basis.

Special Promotions:

Empower has a promo of free wealth management for six months when you sign up and put in at least $250,000.

Where to Buy Stocks?Interactive Advisors

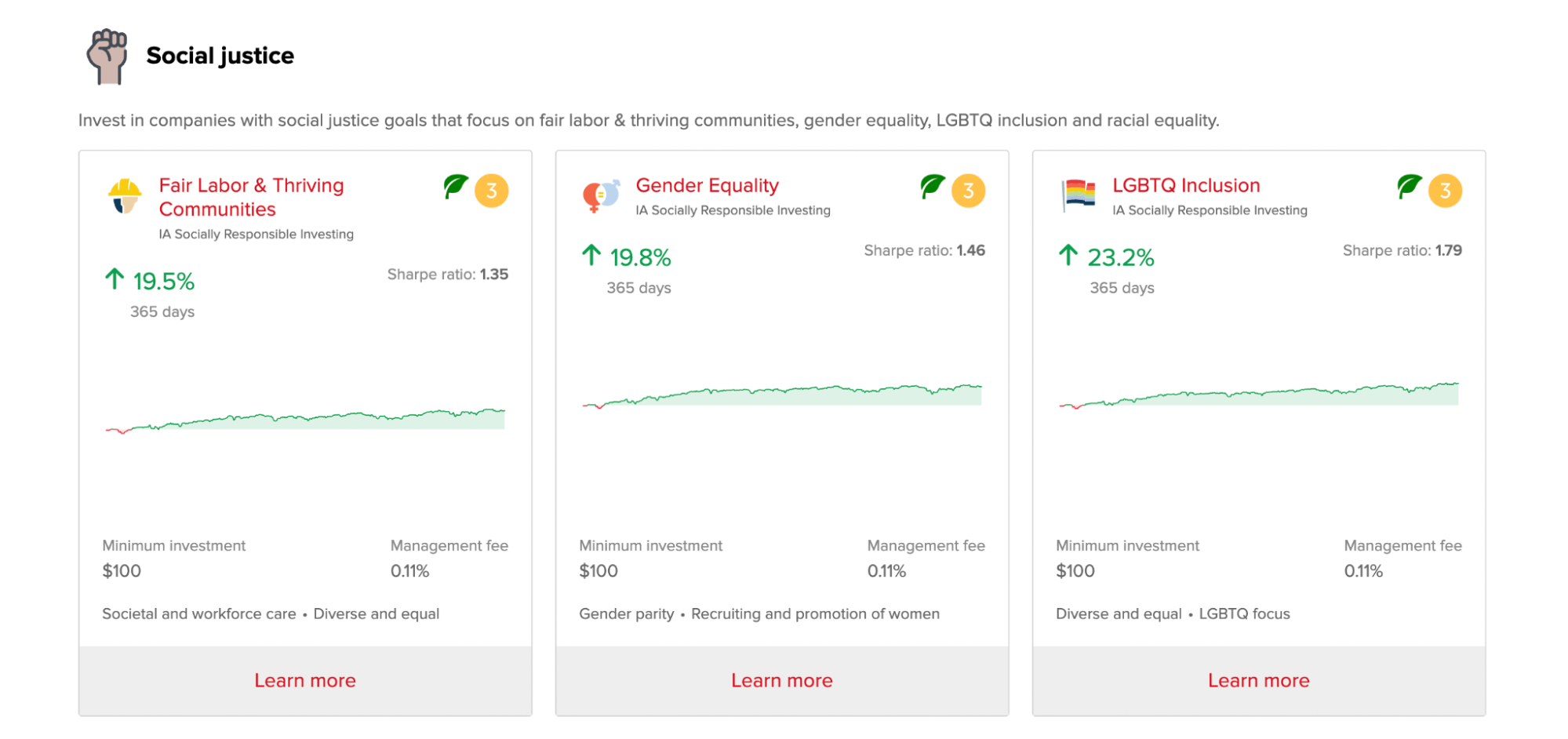

Among the options available today, Interactive Advisors offers one of the widest range of portfolios, which includes stocks and among others. They also extend supplementary services like cash management, goal-setting, as well as a socially responsible investing tool to avoid unethical industries, and prioritize firms that share the same values as you.

Commissions, Assets, and Minimum Amount:

Interactive Advisors charges an annual management fee of portfolios between 0.8% to 1.5%, which is paid on a monthly basis. Thankfully, they have a cost breakdown tool to provide you with an actual estimate.

Furthermore, there is a $100 minimum investment requirement for all new traders. For us, this is a pretty fair amount that balances the risks and rewards of investing.

Distinguishing Features:

What sets them apart from most robo-advisors is their social responsibility function. It’s a really useful tool, particular for individuals with a strong moral compass and choose to boycott controversial companies that are into animal testing, tobacco, alcohol, fossil fuel, and hazardous waste.

Interactive Advisors

Special Promotions:

The most they offer is low management fees and no minimum investment requirement.

E*Trade

This company began their journey in 2019 as one of the first firms to transition to commission-free trading. One reason for E*Trade’s success is its revolutionary trading platform. They have provided users with two mobile applications and a desktop version. On them, you’ll find various resources to help you trade like an expert.

Commissions, Assets, and Minimum Amount:

E*Trade doesn’t charge a management fee or require a minimum investment amount for basic products like stocks and ETFs. Bonds and Futures, however, have a corresponding fee.

Distinguishing Features:

They offer a wide range of resources, including pre-set scans, analytics from various countries, webinars, online courses, and videos.

Special Promotions:

Cash-back rewards can be availed whenever you open and fund your account. The bonuses will depend on the amount you initially deposit.

Wealthfront

Besides automated trading, Wealthfront allows its users to pay bills through this platform, track expenses, in-app check deposits, and unlimited wire transfers. Its wide range of product offers are also beneficial for those looking to diversify their portfolio.

Wealthfront

Commissions, Assets, and Minimum Amount:

Their minimum amount to start trading is a bit high at $500, which means it is better suited for intermediate traders than beginners. It does make up to this by charging only a standard flat fee of 0.25% for managing your account.

Distinguishing Features:

Wealthfront’s most unique feature is their ability to receive check payments through the mobile app. This way, you don't have to physically deposit it anymore.

Special Promotions:

For new clients, their initial $5,000 investment will be free from any fees.

Schwab Intelligent Portfolios

Generally speaking, Schwab Intelligent Portfolios is an affordable robo-advisor option that won’t sacrifice quality. It provides access to a vast range of asset classes, stemming from its over 50 ETFs. Unfortunately, it lacks a lot of the other services the most firms offer.

Commissions, Assets, and Minimum Amount:

Schwab Intelligent Portfolios has no management fee, but does require an initial investment of $5,000 for the regular account, and $25,000 for the premium version. This is enough to scare away most traders, especially those who prioritize their long-term flexibility.

Distinguishing Features:

Besides their round-the-clock customer service hotline, they also have a tax-loss harvesting tool - as well as other analytics tools - that help you protect your earnings.

Special Promotions:

As of now, sadly, there are no promotions to report.

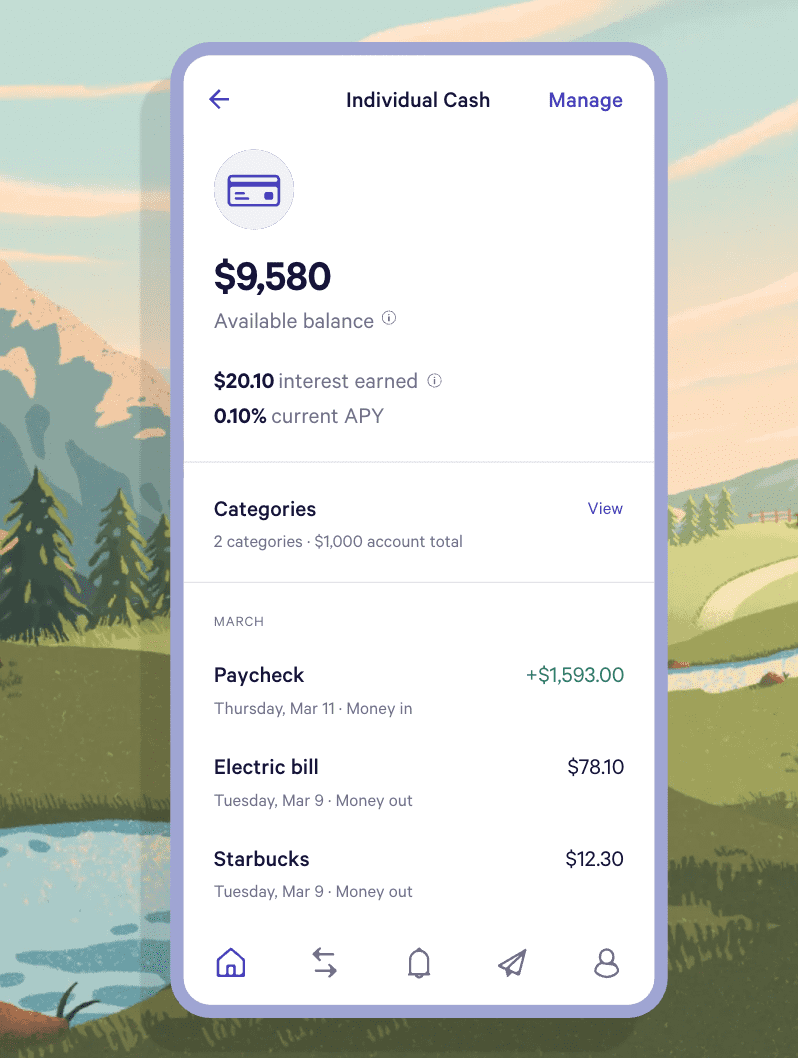

M1 Finance

The range of services that they extend to their customers is very helpful. This includes M1 Borrow, which allows users to lend up to 35% of their fund balance. There are also auto-deposit and withdrawal functions that can be linked to external accounts. Finally, M1 Finance operates like a bank, too, extending credit card and cash flow options to all its clients.

Commissions, Assets, and Minimum Amount:

M1 Finance has no management fee, but requires a $100 minimum deposit to start trading. Nevertheless, interested users can choose to upgrade the system they use by paying an annual subscription fee of $125.

Distinguishing Features:

They have more than 80 different tailored portfolios to serve as your guide when trading. For beginners, this is crucial to help them build a solid strategy.

Special Promotions:

Like most robo-advisors, M1 Finance has several cash-back promotions when opening and depositing money to your account.

How to get free stocks?Betterment

Betterment

Betterment is one of the largest robo-advisors, managing approximately $27-billion in assets. Likewise, they offer a wide range of services, too, which includes bank-like functions such as making real-time transfers, a debit card, and an option to open a checking account. These can be automated as well.

Commissions, Assets, and Minimum Amount:

This firm has two major plans; digital and premium. The first has no minimum amount requirement, but charges an annual fee of 0.25%. On the other hand, the premium plan requires a $100,000 minimum, and has an annual fee of 0.4%. You can choose which one you prefer depending on how serious you are in investing.

Distinguishing Features:

The tax-loss harvesting tools helps users reduce their potential tax payments, while maximizing profits.

Special Promotions:

Betterment has offered to waive their management fees, depending on the initial amount invested. These vary in terms of length, and can be viewed on their website.

How to start investing with little money?Sofi Invest

Due to its low fees and user-friendly features, Sofi Invest is an ideal choice for newbies with zero experience. Their robo-advisor portfolios have been built by certified financial planners, which you can select depending on your risk appetite and existing budget. This even includes up to 17 types of cryptocurrency.

Sofi Invest

Commissions, Assets, and Minimum Amount:

There is neither a minimum investment amount, nor any management fees being charged, except for crypto investments, which has a 1.25% surcharge. Not bad, especially since this is a relatively new venture that holds a lot of risk.

Distinguishing Features:

Sofi Invest provides complete access to its team of financial advisors, helping you prepare for retirement or increase your portfolio exponentially, at no additional charge. Visit their website for more details on this.

Special Promotions:

They offer a welcome bonus for your first-time crypto purchase. Additionally, Sofi Invest has a referral program and an active investment promotion, each with its corresponding perks.

Ellevest

Ellevest

What most people don’t realize is women face a very different set of financial obstacles. Aside from the monetary repercussions felt after giving birth, based on statistics, they also tend to live longer. This means that maximizing their savings becomes even more important.

Ellevest is one of the few robo-advisors that include gender differences in their algorithm. Add in its other services like goal-setting and consultations with trusted financial advisors, and you instantly have a platform that’s pretty comprehensive.

Commissions, Assets, and Minimum Amount:

If you’re planning to use the private wealth account, you won’t have to worry about reaching a minimum amount when starting. They do, however, charge a small management fee ranging from $1 to $9 per month.

Distinguishing Features:

Being given access to different training modules, calculators, and analytics tools will help you understand all the key information before making a decision.

Special Promotions:

Currently, they do not offer any special promotions to would-be users.

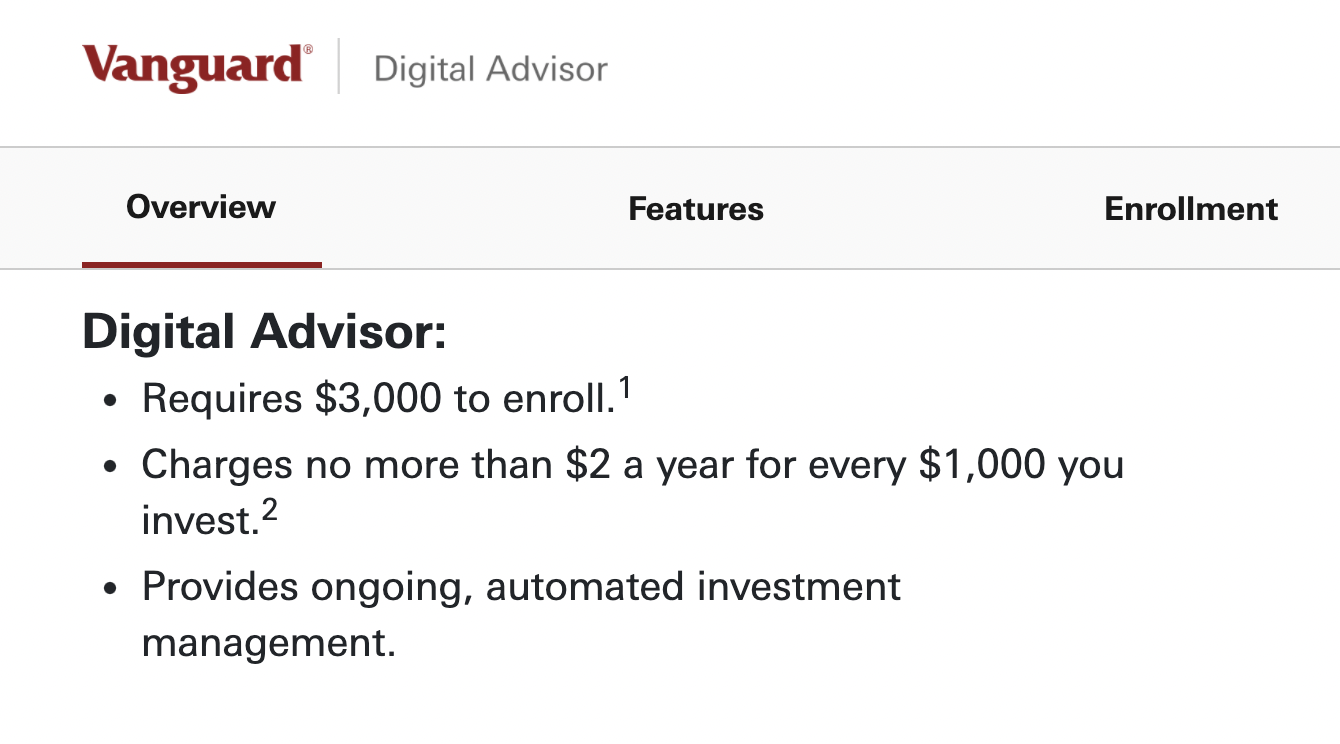

Vanguard Digital Advisor

The Vanguard Group, a conglomerate that manages Vanguard Digital Advisor, was established in 1970, has one of the largest portfolios of mutual funds. About fifty years later, they launched their fully-automated investing service.

Currently, they still consider themselves in the pilot stage. But they do allow traders to withdraw, deposit, and calculate their debt without any issues. These may seem limited now, though they are expected to introduce more updates.

Vanguard Digital Advisor

Commissions, Assets, and Minimum Amount:

Their fees are approximately 0.15% per year. However, they do require a minimum deposit of $3,000.

Distinguishing Features:

Vanguard Digital Advisor’s financial planning capabilities is what makes them so unique. They help individuals plan for retirement or to anticipate any upcoming expenditures. Several tools are likewise present to help you through this process.

Special Promotions:

No promotions to report as of now.

Acorns Investment

Acorns Investment

Compared to other robo-advisors, Acorns Investment’s services are a bit limited. They offer only the basic functions. However, because of its budget-friendly prices, they have become a popular robo-advisor in today’s market.

They do provide automatic rebalancing when fluctuations in the economy occur, or there are sudden shifts in your portfolio.

Commissions, Assets, and Minimum Amount:

Monthly fees range from $3 to $5 without requiring a minimum amount when opening an account.

Distinguishing Features:

Two features instantly come to mind when speaking about Acorns Investment. First is a savings tool that automatically reinvests spare change. Then, there’s a built-in job finder powered by ZipRecruiter for those seeking new career opportunities.

Special Promotions:

Apart from a $10 sign-up bonus, they also have several cash-back rewards programs for all loyal customers at over 350 retail partners.

Ally Invest Managed Portfolios

Customers of Ally Bank may diversify their assets by opening an account with Ally Invest Managed Portfolios. This way, you’ll have a one-stop-shop that holds your entire portfolio. In terms of services, you can make one-time deposits, set up monthly transfers, and withdrawals whenever you need it.

Ally Invest Managed Portfolios

Commissions, Assets, and Minimum Amount:

They don’t charge a management fee, but do require a minimum amount of $100 before opening an account. Just remember that this platform requires that 30% of your assets be held in cash.

Distinguishing Features:

The goal tracking function is really helpful to make sure you are up-to-speed with all your financial objectives. Sames goes for the wealth-forecasting tool.

Special Promotions:

No promotions are available at this time.

Best stocks to invest in right nowWhat is a Robo-Advisory Service?

This is a digital tool that provides financial advice with little-to-no human interaction. For many investment companies, this is their solution to serving a wider number of people, while only using up minimal resources.

Are Robo-Advisors Safe? Are they Legit?

Even though this technology is still relatively new, several traders are beginning to fully trust this practice. After all, the advice it gives is based on empirical data, practices of existing individuals, and their respective portfolios.

In any case, most companies will still provide the option to speak to an actual human. So when you encounter any issues, someone would always be ready to help.

How do Robo-Advisors Work?

Robo-Advisors are run by algorithms, which are based upon a person’s character, risk appetite, goals, objectives, and other personal information. They use this to know where and how much to invest, or even gauge whether a particular deal will be good for you.

To increase its overall credibility, robo-advisors include several pre-screened portfolios and actual input from seasoned financial planners.

Summary

Robo-advisors are one of the most useful tools introduced when investing. Besides their ease-of-access, they also provide practical tips that beginners will find very useful. It definitely serves as a guide when learning the ropes of growing your portfolio.

But just like any business transaction, earning a profit is never assured. So when choosing what platform to utilize, make sure to do your due diligence first, read up on reviews, and select the one that matches your current needs.

This will only help increase the likelihood of success.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Robo-Advisor

A Robo-Advisor is a digital platform using automated algorithms to provide investment advice and manage portfolios on behalf of clients, often with lower fees than traditional advisors.

-

3

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

-

4

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

5

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).