deposit:

- $100

Trading platform:

- Mobile application

- Proprietary platform

M1 Finance (M1Finance) Review 2024

deposit:

- $100

Trading platform:

- Mobile application

- Proprietary platform

- No

- Broker specializes in long-term investments

Summary of M1 Finance Trading Company

M1 Finance is a reliable broker with the TU Overall Score of 7.33 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by M1 Finance clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews showed that the broker’s clients are mostly satisfied with the company. M1 Finance ranks 9 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

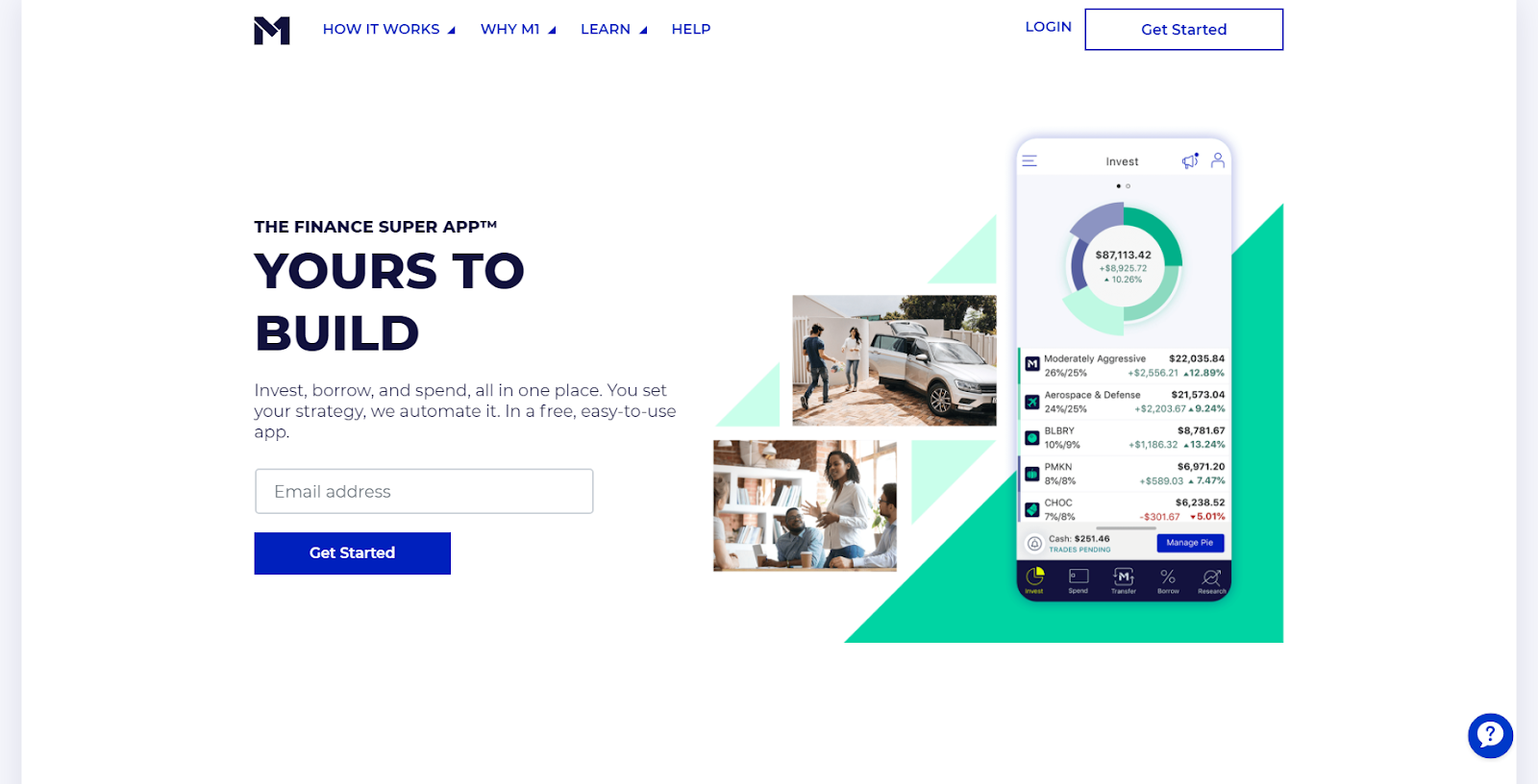

M1 Finance is suitable for traders and investors who prefer long-term trading strategies. The amount of the minimum deposit in the company varies from 100 to 500 dollars, depending on the type of account. For trading, M1 Finance offers an author's terminal. A unique feature of the broker is the presence of a dynamic investment portfolio rebalancing system - Pie, which allows you to distribute investments optimally between segments of the portfolio selected by the client. M1 Finance broker is suitable for both experienced investors and beginners who are ready to invest single-handedly on a long-term basis.

M1 Finance is a subsidiary of M1 Holdings Inc., which provides long-lasting investment services. M1 Finance is registered and regulated by FINRA (Financial Industry Regulatory Authority of the United States, CRD#: 281242/SEC#: 8-69670), and also cooperates with SIPC (Securities Investor Protection Corporation), which guarantees investors comprehensive protection and financial compensation in the event of a financial mishap. The M1 Finance broker provides services exclusively to US residents and offers to choose a trading account with personal or joint access, create a trust and retirement account, and open an account for minors. In addition to investing, M1 Finance clients have access to loan and payment services with a special M1 card.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | $100 for taxable accounts; $500 for retirement accounts |

| ⚖️ Leverage: | No |

| 💱 Spread: | No |

| 🔧 Instruments: | Stocks, ETFs, bonds, Crypto, exchange-traded funds |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with M1 Finance:

- There are no fees for transactions in the company.

- A plethora of ways for customers to reach out to the support team.

- You can test the trading conditions of M1 Finance by creating a login.

- The company's clients have access to automatic portfolio rebalancing.

- You can manage your portfolio both from a personal computer and from mobile devices.

- The company offers accounts with the same trading conditions, but different forms of ownership, as well as retirement accounts and accounts for minors.

👎 Disadvantages of M1 Finance:

- The broker provides a small number of ways to fund a trading account and withdraw earned funds to a personal account.

- Support is closed on weekends.

- There are no programs that allow you to copy transactions of other investors, and there are no automatic trading services.

Evaluation of the most influential parameters of M1 Finance

Geographic Distribution of M1 Finance Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of M1 Finance

M1 Finance is a broker that provides optimal conditions for long-term investment. The company aims to work with US citizens, regardless of their investment experience. Also, M1 Finance offers solutions for active investors who want to independently manage their capital. There are no opportunities for passive investment in the company, the only option to receive additional income for non-trading activities is to participate in an affiliate program. Services for copying transactions, for managed accounts, for using trading robots are not the focus of M1 Finance. To open an account, an investor will need $100, to open a retirement account, an account must be replenished with $500 or more.

The company has developed its proprietary Pie system, which makes the portfolio rebalancing process more understandable and convenient for both novices and professionals. Other advantages of the broker are zero fees, the ability to trade from a mobile device, and financial compensation to investors in case of bankruptcy.

The disadvantages of M1 Finance are the lack of electronic payment systems for conducting transactions, as well as the limited working hours of the support team.

Dynamics of M1 Finance’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

The broker indicates that it is ready to cooperate with traders who want to manage their capital and choose the best deals on the market single-handedly. Hence, M1 Finance works to provide favorable trading conditions specifically for self-investing and does not offer its clients automatic investment programs.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

M1 Finance’s affiliate program

-

Refer a friend. Participation in the program allows the participant of the affiliate program and the invited user to receive $30 for their personal trading account. To do this, an M1 Finance client needs to open a personal trading account, replenish a trading account with the minimum amount following the type of account, and then receive a referral link and share it with friends. For each referred friend who opened an account with the company and replenished it to the required minimum, a bonus will be credited to the partner's account, and the invited client will also receive a financial bonus.

The new user must fund the account within 30 days, and also keep this amount in the account for a month so that both of you can receive the bonus. The affiliate program does not limit the number of users you can invite. Pension accounts may not participate in the program.

Trading Conditions for M1 Finance Users

M1 Finance is focused on cooperating with investors, regardless of whether they have experience in trading, and provides optimal solutions for convenient work. Simultaneously, the broker highlights that its specialization is a long-term investment and not profit from short positions. Clients have access to accounts with different forms of ownership: in particular, an individual account, a trust account, a joint account, a pension account, and an account intended for minors. The minimum deposit is $100 for taxable accounts and $500 for retirement accounts. Trading is carried out on a platform developed by the broker. A striking feature of cooperation with M1 Finance is the dynamic rebalancing of the portfolio: the Pie system allows you to optimize the investment process and correctly distribute investments between segments.

$100

Minimum

deposit

1:1

Leverage

8/5

Support

| 💻 Trading platform: | Proprietary M1 Finance platform, mobile app for iOS and Android |

|---|---|

| 📊 Accounts: | Individual Brokerage Account, Joint Brokerage Account, Traditional IRA, Roth IRA, Simplified Employee Pension (SEP) IRA, Custodial Account, Trust Account |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Bank transfer; replenishment and withdrawal through a bank card linked to a trading account; ACH |

| 🚀 Minimum deposit: | $100 for taxable accounts; $500 for retirement accounts |

| ⚖️ Leverage: | No |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | Not indicated |

| 💱 Spread: | No |

| 🔧 Instruments: | Stocks, ETFs, bonds, Crypto, exchange-traded funds |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | Not indicated |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Broker specializes in long-term investments |

| 🎁 Contests and bonuses: | Yes |

M1 Finance Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Individual Brokerage Account | From $1 | Transfers to the card linked to the account are free; internal bank transfers cost $25 |

| Joint Brokerage Account | From $1 | Transfers to the card linked to the account are free; internal bank transfers cost $25 |

| Traditional IRA | From $1 | Transfers to the card linked to the account are free; internal bank transfers cost $25 |

| Roth IRA | From $1 | Transfers to the card linked to the account are free; internal bank transfers cost $25 |

| Simplified Employee Pension (SEP) IRA | From $1 | Transfers to the card linked to the account are free; internal bank transfers cost $25 |

| Custodial Account | From $1 | Transfers to the card linked to the account are free; internal bank transfers cost $25 |

| Trust Account | From $1 | Transfers to the card linked to the account are free; internal bank transfers cost $25 |

There is no fee for moving the position to the next day. However, the broker will charge a fee of $20 for 90 days of inactivity on the account. The experts at Traders Union have also compared the fee levels in M1 Finance and those of other popular stockbrokers - Ally and Charles Schwab. Based on the results obtained, TU has compiled a summary table, which is below.

| Broker | Average commission | Level |

| M1 Finance | $1 | Low |

| Charles Schwab | $11 | High |

| Ally Bank | $4 | Medium |

Detailed Review of M1 Finance

M1 Finance is a broker that specializes in long-term investment. The company offers clients a variety of investment instruments, as well as a convenient system for accumulating funds. In particular, M1 Finance offers retirement and underage accounts, as well as the function of automatically crediting funds from a bank account to a trading account, which allows you to increase your investment turnover periodically and automatically. Please note that M1 Finance works exclusively with US residents over 18 years of age.

M1 Finance in numbers:

-

$0 – is the fee for making trade transactions, as well as account replenishment and withdrawal of funds.

-

$30 is a financial bonus that may be earned for each new user invited to the company.

-

$100 - the size of the minimum replenishment to an account after registration.

-

M1 Finance customers can reach out to the support five days a week.

-

Only 1 click is needed to diversify your portfolio.

M1 Finance is a self-trading broker

The M1 Finance broker is an ideal option for those who are ready to invest single-handedly. Clients are not offered consulting services, services for automatic conclusion of transactions, or investment programs in which the investor can participate exclusively, materially, and transfer responsibility for capital management to a third party. To make investing simple and understandable for everyone, the company has developed its Pie system, which allows you to track portfolio returns and rebalance the portfolio in one click.

Trading operations are carried out on the broker's own platform. The company also offers mobile applications for iOS and Android, so that the user can manage the portfolio from a convenient device and place. There is no payment for using the application and trading platform on a PC.

Useful M1 Finance services:

-

Borrow. The company provides an opportunity not only to invest but also to arrange loans with a low interest rate.

-

Spend. Another huge plus of the M1 Finance broker is that clients can pay with a card issued by the broker. This card allows you to replenish your trading account without fees, as well as pay for purchases wherever Visa cards are accepted.

-

The Investor's Mindset. This is a monthly newsletter with useful information for investors. The broker also offers to subscribe to Mini Mindset and receive newsletters every week.

-

Newsroom. In this section, customers can read the latest mentions of the company in the press, as well as read press releases.

Advantages:

No fee for making trading operations.

The company provides account types for different forms of ownership.

You can conveniently contact the support team by phone call or in text format.

Holders of all types of accounts (except for the retirement account) can participate in the referral program and receive a financial bonus.

The broker offers a proprietary Pie system that can be used to optimize the investment process.

How to Start Making Profits — Guide for Traders

M1 Finance is focused on cooperating with investors who want to manage their funds single-handedly. The broker has personal accounts as well as joint, retirement, trust, and underage accounts. Any US resident over the age of 18 can open an account with M1 Finance.

Account types:

The opportunity to test the trading conditions of the company and new trading strategies on a virtual account, without the risk of losing capital, is at your elbow. To do this, just create a log-in.

Bonuses Paid by the Broker

A welcome bonus is available for M1 Finance clients

To receive it, a trader must open a trading account with the company and replenish it for an amount over $1,000 within 14 days from the date of opening. The financial bonus will be credited to the trader's account within 1-2 weeks. the welcome bonus is only available if the customer has opened a taxable account.

Investment Education Online

The M1 Finance broker is ready to cooperate with investors regardless of their experience in the field of investment, however, there are practically no materials onsite that can help clients develop their skills and monitor the current state of affairs in the field of investment.

M1 Finance allows clients to test their newly gained knowledge on a virtual account that avoids financial risks.

Security (Protection for Investors)

The M1 Finance broker is supervised by FINRA (US Financial Industry Regulatory Authority), and the broker is also a partner of SIPC (Securities Investor Protection Corporation).

Cooperation with SIPC guarantees investors financial protection in case M1 Finance suffers a financial collapse. In particular, the broker's clients can count on financial compensation in the amount of up to $250,000. The total amount of available insurance is $500,000 per client.

👍 Advantages

- The broker cooperates with a compensation fund, which guarantees payments to investors in the event of bankruptcy of M1 Finance

- The FINRA regulator ensures that the broker fulfills its obligations to the regulator and clients

- Disputes between the broker and the client are resolved by an independent body - FINRA

👎 Disadvantages

- Customer funds are not held in segregated accounts

- The broker does not provide information about the security of the client's account in the network space

Withdrawal Options and Fees

-

M1 Finance customers have the ability to fund and withdraw funds via bank transfer, ACH, and a bank card linked to their account. The user can apply for a withdrawal via his personal account, in the appropriate section.

-

The timing of crediting funds to a deposit depends on the account to which the user transfers funds. Thus, replenishment of an expense account takes 2-3 business days, and depositing funds to taxable and retirement accounts is possible within 1 business day.

-

Withdrawals are also carried out depending on what type of account the client is transferring funds from. Thus, withdrawal to an external bank account takes on average from 2 to 4 business days, withdrawal of funds from a taxable or retirement account to an external bank account takes from 3 to 5 business days.

-

When withdrawing funds from a taxable or retirement account, you should also take into account the existence of a settlement period: two more business days must elapse from the date of the transaction.

-

The broker does not set a fee for withdrawing funds or replenishing a deposit if the client makes a transaction through a bank account linked to the account. An Internal wire transfer fee is $25.

Customer Support Service

If an M1 Finance customer has problems or questions, he can contact the support service. The service is available during the working week - from Monday to Friday inclusive.

👍 Advantages

- The client can conveniently contact the employees of the company

- The support team responds in writing within one business day

👎 Disadvantages

- You can call the broker during the strictly set hours: from 9 to 16 EET

- Support is closed on weekends

Available communication channels with customer support specialists include:

-

write a message to the support chat on the broker's website;

-

call the number indicated in the sections labeled "Help" or "Contact Us";

-

fill out the feedback form on the broker's website.

-

Also, the broker's representatives are on social networks such as: Facebook, Instagram, Twitter, and LinkedIn.

Contacts

| Foundation date | 2013 |

| Registration address | 200 N LaSalle St., Ste. 800; Chicago, IL 60601 |

| Official site | m1finance.com |

| Contacts |

Email:

support@m1finance.com,

Phone: (312) 600-2883 |

Review of the Personal Cabinet of M1 Finance

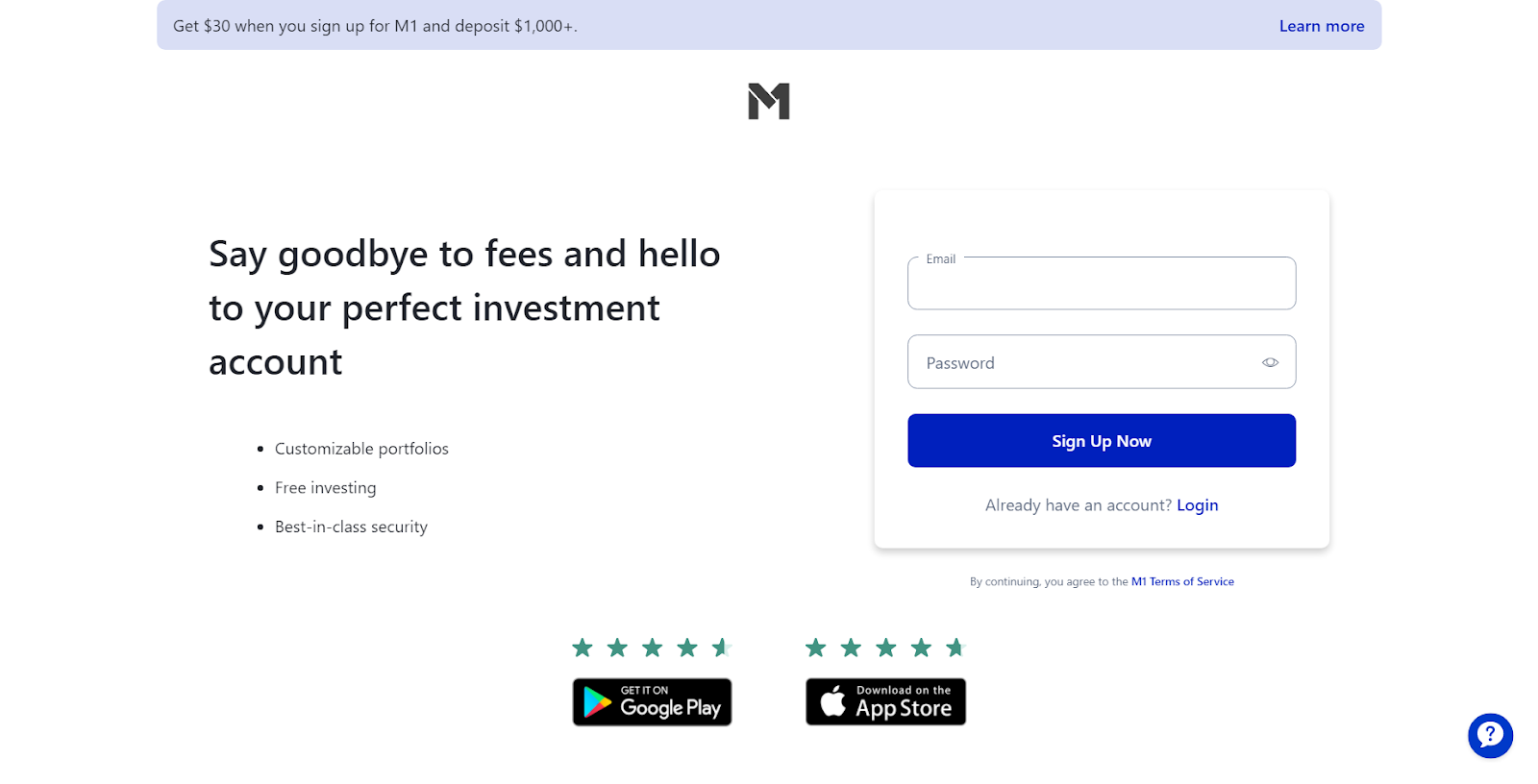

To start trading with M1 Finance, an investor needs to open a personal trading account with a broker. Simply follow the step-by-step instructions below:

Go to the broker's official website. To open an account with M1 Finance, click on the Get Started button located in the upper right corner of the screen.

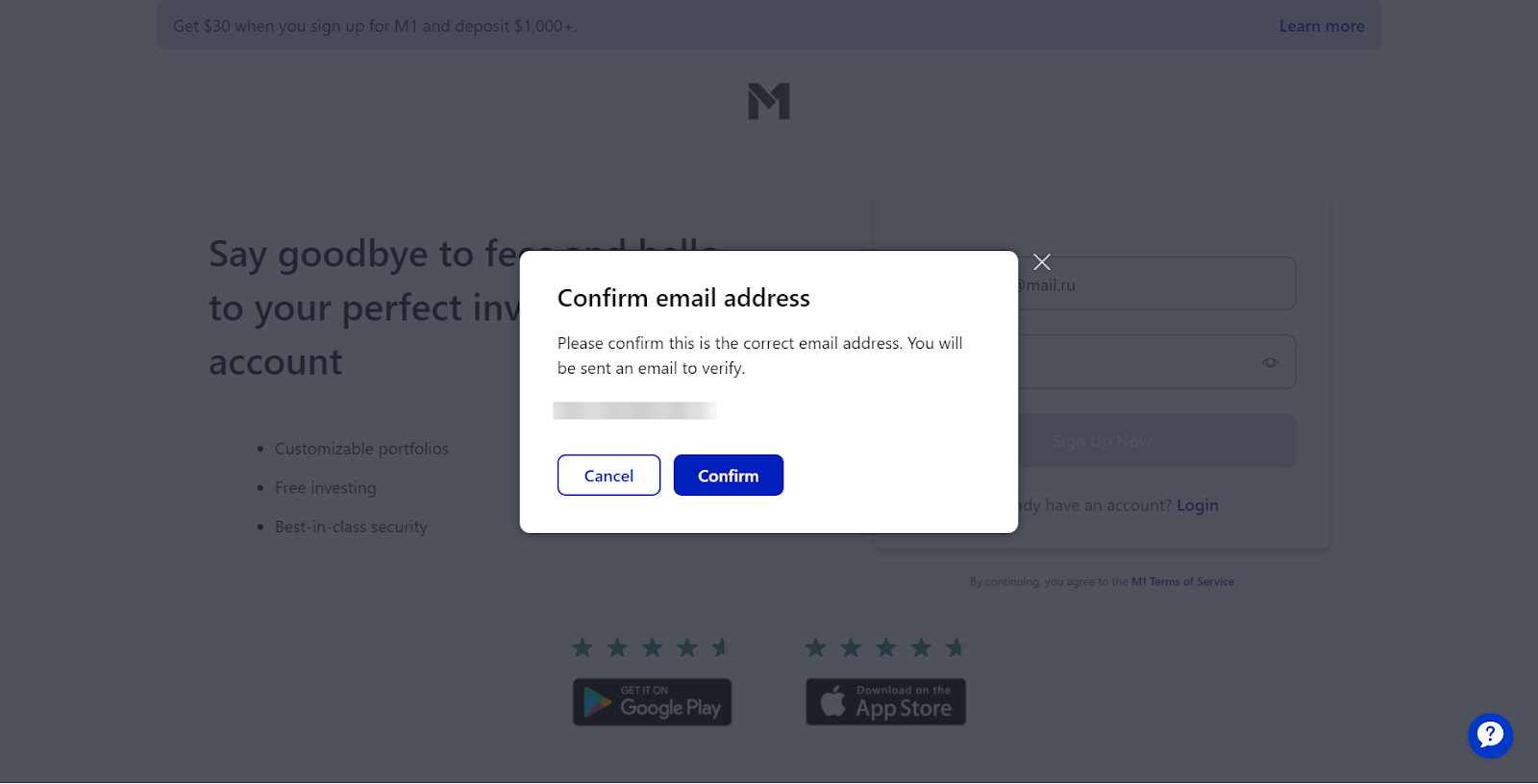

Fill out a short registration form: enter your email and create a password, then click on the "Sign Up Now" button to continue.

Please confirm that the email address you provided is correct. If the address is correct, click on the "Confirm" button, to change the address, select "Cancel".

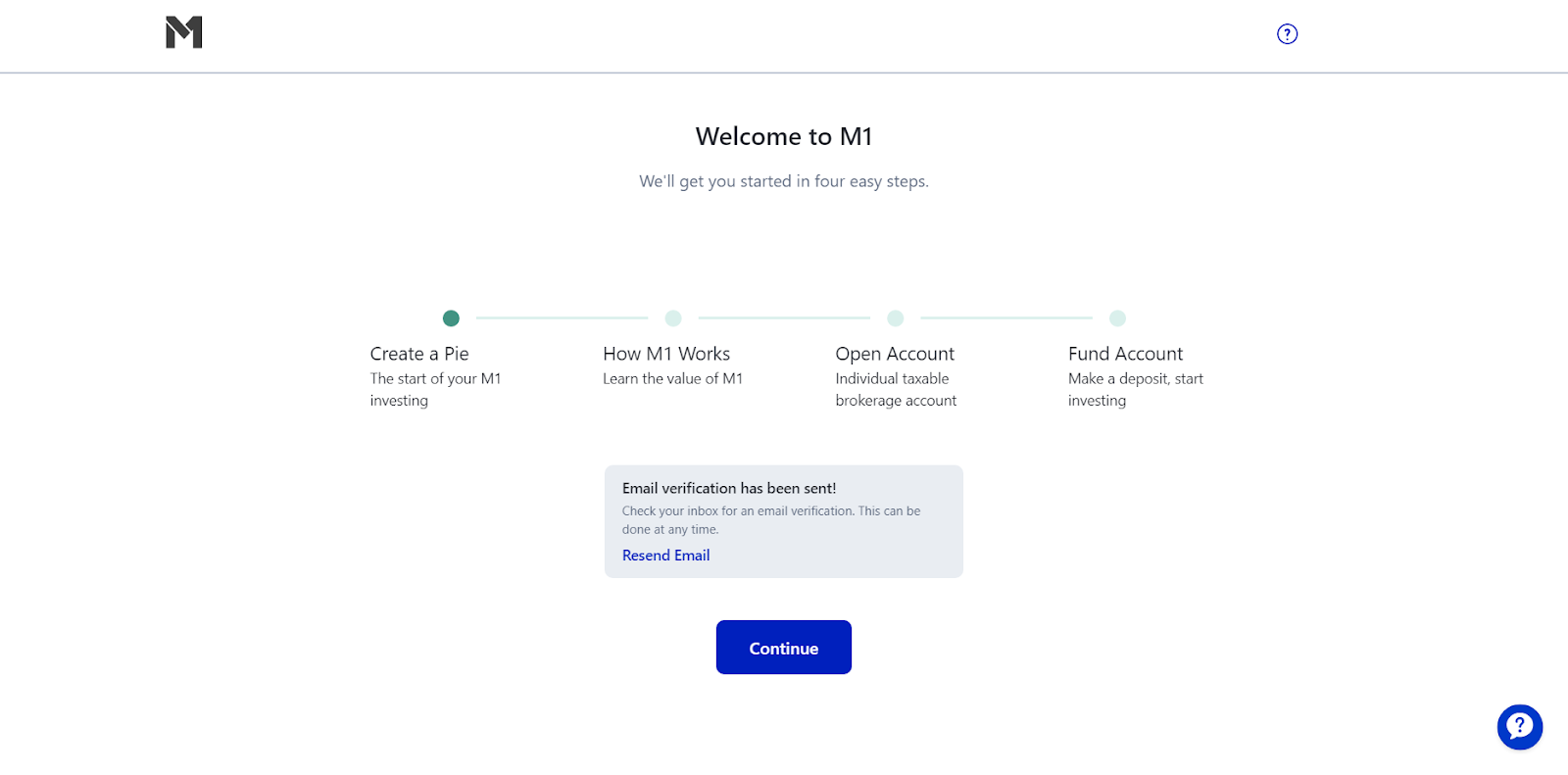

Then follow the 4 easy steps to complete the procedure for opening an account with M1 Finance. On this page, you can familiarize yourself with them and click Continue to complete the process.

Read on for a quick summary of what Pie is and what it is for, then click Continue.

Choose at least three investment instruments that interest you. If necessary, use the search to find the assets you need. Click Continue to proceed.

The instruments you choose will total 100% of your initial portfolio. In the future, you can add other investment instruments to your portfolio. Click Continue to advance.

Then you can see how much your investment in the selected instruments will turn into in 5 years.

The broker sums it up: Pies, like the one you just created, will always be part of your portfolio. Thus, you can control and optimize the investment process. The Pie that you created during registration will be saved by the broker and you can include it in your portfolio.

The next step is to get acquainted with the principles of M1 Finance.

Information about the work of the smart M1 system, which allows you to automatically rebalance your portfolio.

How the portfolio is rebalanced without investor intervention.

Brief instructions for creating new orders.

M1 Finance has created a platform where clients can invest, borrow and spend simultaneously.

You can also choose the M1 Plus tariff, which offers special conditions for cooperation with a broker. The first year of using the tariff is free, in the future, the client will be charged an annual fee of $125. To select this tariff, click on the "Upgrade For Free Year of M1 Plus" button; to skip this step now and return to it later, if necessary, click on the "Skip For Now" button.

The next step is to open a trading account.

Enter your mobile phone number to verify your account, and choose a verification method: a call to your number or a text SMS.

Enter the code that came to your number to open the account.

After registration in the personal account of the broker, the following sections will become available:

-

Financial portal, where you can make deposits and withdrawals and control all financial transactions.

-

The section where you can download the broker's software.

-

Analytics and news portal.

-

Trading portal with statistics and history of transactions.

-

Support.

Disclaimer:

Your capital is at risk. Via M1 Finance's secure website. Your capital is at risk.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the M1 Finance rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about M1 Finance you need to go to the broker's profile.

How to leave a review about M1 Finance on the Traders Union website?

To leave a review about M1 Finance, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about M1 Finance on a non-Traders Union client?

Anyone can leave feedback about M1 Finance on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.