deposit:

- $1

Trading platform:

- Mobile application

- Proprietary platform

- IIROC

- CIPF

Qtrade (Q trade) Review 2024

deposit:

- $1

Trading platform:

- Mobile application

- Proprietary platform

- Margin trading is available

- Trading assets with fixed profit is available

Summary of Qtrade Trading Company

Qtrade is a broker with higher-than-average risk and the TU Overall Score of 4.93 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Qtrade clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. Qtrade ranks 57 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Qtrade is a broker that is suitable for novice investors and for professionals. The company created conditions for comfortable active trading, while there are no opportunities for passive investing.

Qtrade is a Canadian stock broker that has been providing financial services in the market for over 20 years. Its operation is overseen by IIROC, and the company is also a member of the Canadian Investor Protection Fund (CIPF), which provides financial insurance for Qtrade clients in case the broker files for bankruptcy. Qtrade specializes in providing access to trading stock exchange assets: stocks, bonds, options, exchange-traded funds (ETFs), mutual funds, and securities. The broker’s trading conditions are designed to suit both professional investors and novice traders. Over the years of operation, the broker received many awards, including Best Online Brokerage (The Globe and Mail), Best Online Brokerage Experience (Surviscor) and Best Independent Online Broker (MoneySense).

| 💰 Account currency: | USD, CAD |

|---|---|

| 🚀 Minimum deposit: | 1$ |

| ⚖️ Leverage: | Margin trading is available |

| 💱 Spread: | Fixed, depends on the type of account and asset |

| 🔧 Instruments: | Stocks, bonds, mutual funds, ETFs, options, IPO, GIC, securities |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Qtrade:

- Before opening a live account, investors can test the broker’s trading conditions on a free demo account.

- The company offers accounts for the clients with different needs, including retirement accounts.

- The broker does not have a minimum deposit requirement: the trader chooses the amount to deposit on the account.

- Qtrade clients can trade using their PC or mobile device, through the Qtrade application.

- The company provides instruments that allow users to assess portfolio effectiveness and possible risks.

- Wide selection of instruments provides for an opportunity to build a diversified portfolio.

- Clients’ equity is protected, as the broker is a member of the Canadian Investor Protection Fund.

👎 Disadvantages of Qtrade:

- Only the residents of Canada, residing in the territory of the country, can open an account on Qtrade.

- The broker does not have featured passive income programs or a partnership program and bonuses for trading.

- Opening an account can take from 2 to 7 days depending on the company’s workload.

Evaluation of the most influential parameters of Qtrade

Geographic Distribution of Qtrade Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Qtrade

Qtrade (Q trade) is a Canadian broker offering conditions for active investing in stocks, mutual and exchange-traded funds, bonds, securities, options and other stock assets. The broker’s conditions are suitable for users with any level of experience: from novice investors to professional traders. Qtrade does not have minimum deposit requirements, while only residents of Canada, residing in the territory of the country, can open an account.

Qtrade offers a wide selection of trading instruments, which allows investors to build portfolios with a high degree of diversification. Using Portfolio Score, investors can evaluate their portfolios based on five criteria. This service also features a simulation that helps the beginners to learn how to create portfolios.

Minimum commission is $0 if the investor is trading free ETFs offered by the broker. The commission is higher for trading other assets.

Dynamics of Qtrade’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

Q trade offers great conditions for investors with different trading strategies, although the broker is focused on working with active users willing to earn profit from trading in the markets. For this reason, there are no passive income programs that imply earning income without taking trading actions. Qtrade also does not have an automated trading feature.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Qtrade’s affiliate program

Q trade does not have a partnership program, which in the majority of cases implies financial or other kinds of bonuses to the trader for referring new clients. The broker does not offer conditions for earning passive income; it is possible to earn a profit only through active trading.

Trading Conditions for Qtrade Users

Trading conditions on Qtrade meet the needs of active investors and also clients who want to open savings accounts. The company provides access to trading stocks, options, securities, bonds, mutual funds and other assets. A trader can open a cash account to perform transactions only using his/her own equity and also use a margin account. However, it is worth noting that the margin applies to trading a limited number of instruments, while an investor with a margin account must meet a number of requirements: have a minimum deposit of USD 2,000 and also amounts to cover short sales, options on indices. Qtrade does not have minimum deposit requirements; the client decides on the amount to deposit. Trading is performed on the broker’s proprietary platform and also via a mobile application.

$1

Minimum

deposit

1:2

Leverage

24/7

Support

| 💻 Trading platform: | Proprietary trading platform, mobile application for iOS and Android |

|---|---|

| 📊 Accounts: | Cash (Individual, Joint, Trust, Estates, Society, Religious organization, Investment Club, Company), Margin, TFSA, RSP (RRSP), LIRA/LRSP, RESP, RIF (RRIF), LIF |

| 💰 Account currency: | USD, CAD |

| 💵 Replenishment / Withdrawal: | Electronic transfer, wire transfer via an account linked to the personal account, personal cheque |

| 🚀 Minimum deposit: | 1$ |

| ⚖️ Leverage: | Margin trading is available |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No data |

| 💱 Spread: | Fixed, depends on the type of account and asset |

| 🔧 Instruments: | Stocks, bonds, mutual funds, ETFs, options, IPO, GIC, securities |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Trading assets with fixed profit is available |

| 🎁 Contests and bonuses: | No |

Qtrade Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Cash | From USD 6.95 | Electronic transfer – free |

| Margin | From USD 6.95 | Electronic transfer – free |

| TFSA | From USD 6.95 | Zero fee |

| RSP (RRSP) | From USD 6.95 | Zero fee |

| LIRA/LRSP | From USD 6.95 | Electronic transfer – free |

| RESP | From USD 6.95 | Electronic transfer – free |

| RIF (RRIF) | From USD 6.95 | Electronic transfer – free |

| LIF | From USD 6.95 | Electronic transfer – free |

Additionally, the broker may charge 1% commission (a minimum of USD 45), if an investor holds a mutual fund for less than 90 days. Account closure fee is USD 100 within the first year only.

We also compared trading commissions charged by Qtrade and its competitors — Charles Schwab and Ally. You can see the results of comparison in the table below.

| Broker | Average commission | Level |

| Qtrade | $6.95 | Medium |

| Charles Schwab | $11 | High |

| Ally Bank | $4 | Low |

Detailed Review of Qtrade

Qtrade is a broker that offers acceptable conditions for investing to the clients from Canada. The company is prepared to work both with professional investors and the beginners and does not have a minimum deposit requirement. With Qtrade, you can trade using your own equity or margin, and also open savings and retirement accounts. Access to trading instruments is granted regardless of the account type an investor decides to open.

Qtrade in figures:

-

The broker offers a list of 100 free ETFs.

-

$0 — minimum deposit.

-

Qtrade received the Best Online Brokerage Award from The Globe and Mail 12 times.

-

The company has been providing financial services for over 20 years.

-

Trial account period is 30 days.

Qtrade is a broker for novice and professional investors who prefer active investing

Qtrade is a company that provides investors with access to trading stocks, mutual funds, bonds, options, securities, ETFs, and GIC. The broker’s clients have access to basic order types, including stop loss, stop limit and stop trailing, and also an instrument that allows them to evaluate an investor's portfolio by five criteria and make it effective and diversified. Q trade offers individual, joint and corporate accounts. The accounts in the name of an underaged person are registered to their parents.

In order to trade, a Qtrade client needs to use the broker’s proprietary platform, which allows them to monitor market situation and be up to date on the latest quotations. Trading from mobile devices is also available – you simply need to install the app for iOS or Android.

Useful services by Qtrade:

-

FAQ. In this section, investors can find answers to frequently asked questions about margin trading, trading conditions, commissions, account opening, etc.

-

Portfolio Score. This is an analytical instrument that will help evaluate your portfolio: its effectiveness, diversification, protection against losses, profitability and level of commissions. Also, novice investors can build virtual portfolios here using a special simulator in order to learn how to properly build portfolios.

-

Weekly Market Pulse. This section features articles based on the results of the previous trading week.

Advantages:

The broker offers different account types, including margin account, cash and retirement accounts.

Investors can build a highly diversified portfolio through investing in different instruments.

Q trade does not have minimum deposit requirements; the client can fund the account for any amount.

The broker’s conditions are suitable for investors with different levels of skills.

Qtrade provides access to free materials for novice investors and professionals.

Users can perform transactions using their personal computer or a smartphone, via a mobile application.

If Qtrade becomes insolvent, its client will receive financial compensation from CIPF.

How to Start Making Profits — Guide for Traders

The broker works with the residents of Canada residing in the territory of the country. The broker does not work with residents of Canada, who moved to live in other countries. Qtrade offers different types of trading accounts, including Cash, Margin, retirement and savings accounts. All accounts imply access to trading assets offered by Qtrade.

Account types:

Before starting to trade on a live account, users can create a trial account to review trading conditions of the company and test different trading strategies without the financial risk. The account is free and is available for a period of 30 days.

Bonuses Paid by the Broker

Qtrade offers great trading conditions and requirements for account opening, which is why there are no financial bonuses for trading and non-trading transactions. There is also no welcome bonus.

Investment Education Online

Q trade provides conditions for experienced investors and for the beginners. There is a section on the broker’s website featuring articles for novice investors that provide knowledge on the topic of investment. More experienced market players can improve their skills using the materials published in the Education section. The information is free and available to Qtrade clients and also to unregistered users.

Investors can test the knowledge obtained from the articles as well as new strategies and Qtrade trading conditions on a trial account without the risk of losing equity.

Security (Protection for Investors)

Qtrade is registered in the territory of Canada and guarantees reliability to its clients. The Investment Industry Regulatory Organization of Canada (IIROC) is the broker’s regulator, which monitors the company’s operation to make sure it provides quality service and fulfills its obligations to the regulator and the clients.

CIPF provides for the protection of the funds. The Canadian Investor Protection Fund will pay financial compensation in the amount of up to USD 1 million to the investors in case Qtrade files for bankruptcy.

The broker also guarantees client data security, including information on financial transactions. For this, Q trade employs a reliable data encryption system and requests that the users use browsers that support 256-bit encryption.

In the event that the client adhered to all security rules, including did not disclose personal data, but encountered unauthorized activity on his/her account, Qtrade undertakes to investigate and compensate the losses in full. The exception is the cases, when an investor intentionally or accidentally provides access to their account to a third party.

👍 Advantages

- Partnership with CIPF guarantees financial compensation in case Qtrade goes bankrupt

- Client personal data is protected

- IIROC controls the activity of the company

👎 Disadvantages

- The broker does not use segregated accounts for holding investor funds

Withdrawal Options and Fees

-

Qtrade offers three methods for making a deposit: electronic transfer, transfer of funds from your bank account or send a personal cheque to the broker.

-

The broker does not specify the timeframe for crediting the funds to the trading account or withdrawing the funds to the personal account. However, we recommend using electronic transfer for faster transactions.

-

If an investor uses RSP/TFSA accounts for withdrawal, the withdrawal fee is not charged. There is no information about the withdrawal fees on other methods of withdrawal.

Customer Support Service

Customer support is a team of broker’s employees a trader can turn for assistance in case of experiencing difficulties with trading, transfer of funds or other transactions. Customer support also replies to all questions a client may have. You can contact customer support from Monday till Friday, from 5:30 am until 5:00 pm PT.

👍 Advantages

- Qtrade provides different methods of contacting customer support

👎 Disadvantages

- No online chat

- No callback option

- Customer support only operates on working days

- The response time may be longer than desired

There are several ways to contact the operators of customer support:

-

Call on a local or toll free number;

-

Write an email;

-

Send a fax.

The broker can also be found on social media: Facebook, Twitter, LinkedIn, YouTube. At the moment, it is impossible to visit the offline offices of the broker.

Contacts

| Foundation date | 1999 |

| Registration address | 1111 West Georgia Street Vancouver, British Columbia, V6E 4T6 |

| Regulation |

IIROC, CIPF |

| Official site | https://www.qtrade.ca/ |

| Contacts |

Email:

info@qtrade.ca,

Phone: 604.484.2627 |

Review of the Personal Cabinet of Qtrade

Only the clients who opened an account with Qtrade can trade with the broker and benefit from its advantages. Below is a step-by-step guide on how to do it:

Access the official website of Qtrade. On the home page, in the upper right corner, you will see the Open an Account button. Click on it in order to open an account.

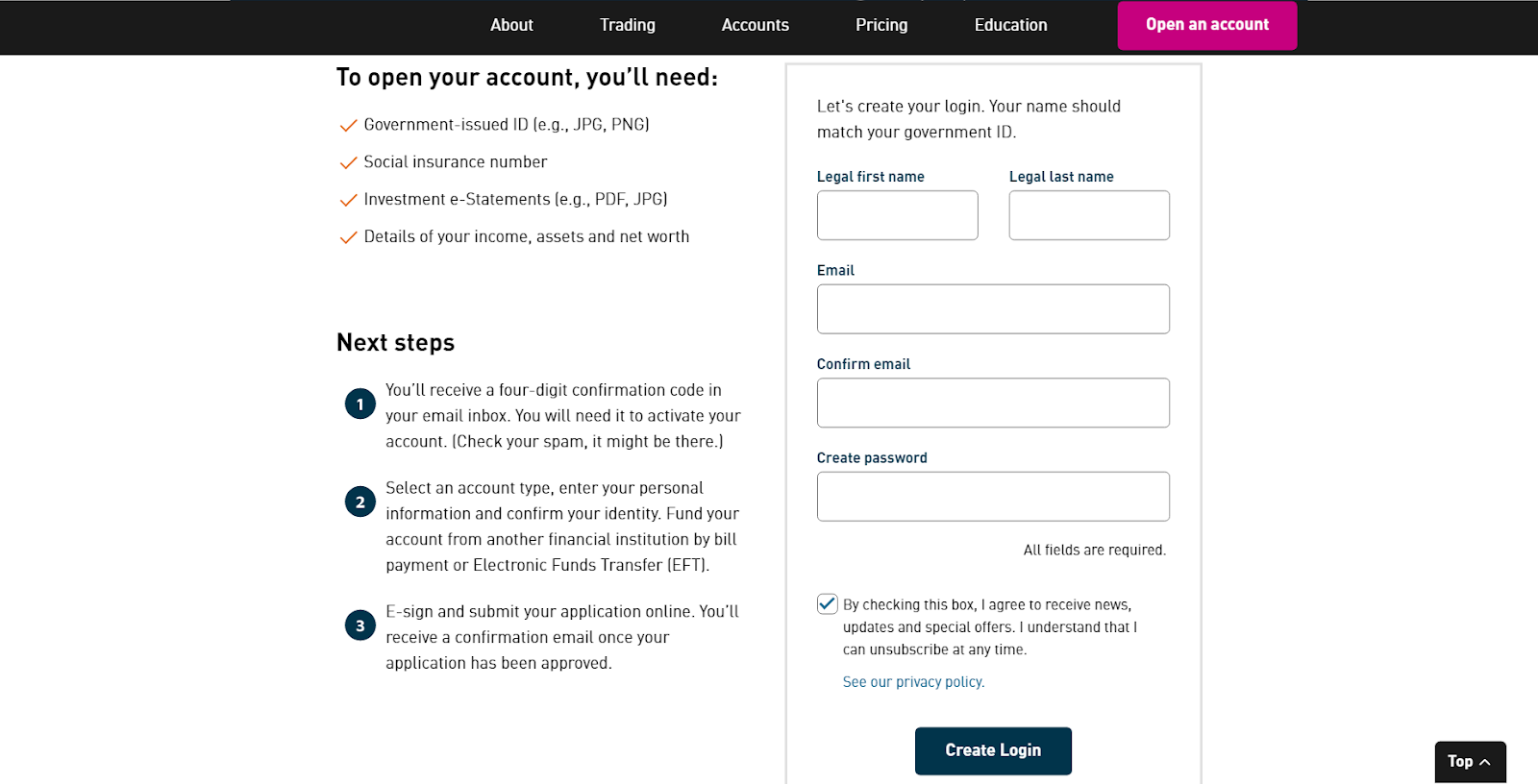

Read the information in the left column: it specifies all documents you will need for opening an account and also a short guideline on the registration procedure. Next, fill out the questionnaire on the right: provide First Name, Last Name, Email, Confirm Email, and create a password you will use to access your Personal Account on Qtrade.

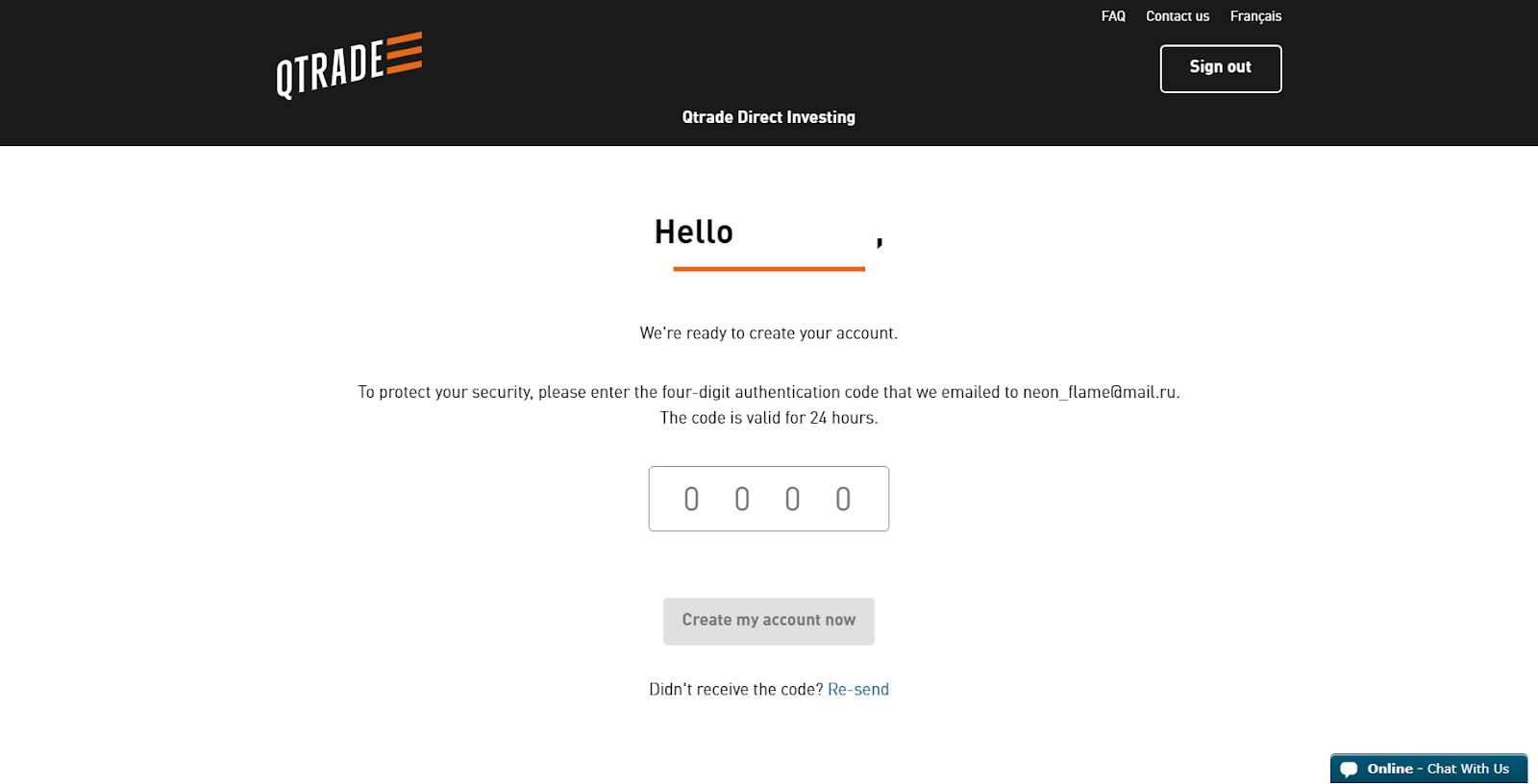

After you fill out the questionnaire, the broker will send you a letter to your email with a unique four-digit code. Enter it in the box on the page below. If you didn’t receive the code, check your Spam folder or click on Resend button to receive it again.

Next, select the account type you want to open, specify personal data and verify your account providing documents that confirm your identity. Fund the account for any amount, place an electronic signature and send the document to Qtrade. In 2-7 days, depending on the broker’s workload, you will receive a letter with approval or denial of your application for account opening.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the Qtrade rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Qtrade you need to go to the broker's profile.

How to leave a review about Qtrade on the Traders Union website?

To leave a review about Qtrade, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Qtrade on a non-Traders Union client?

Anyone can leave feedback about Qtrade on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.