deposit:

- $1

Trading platform:

- Web Trading platform

- Sharekhan Mobile

- Sharekhan Mini-mobile

- Trade Tiger (Desktop)

- SEBI

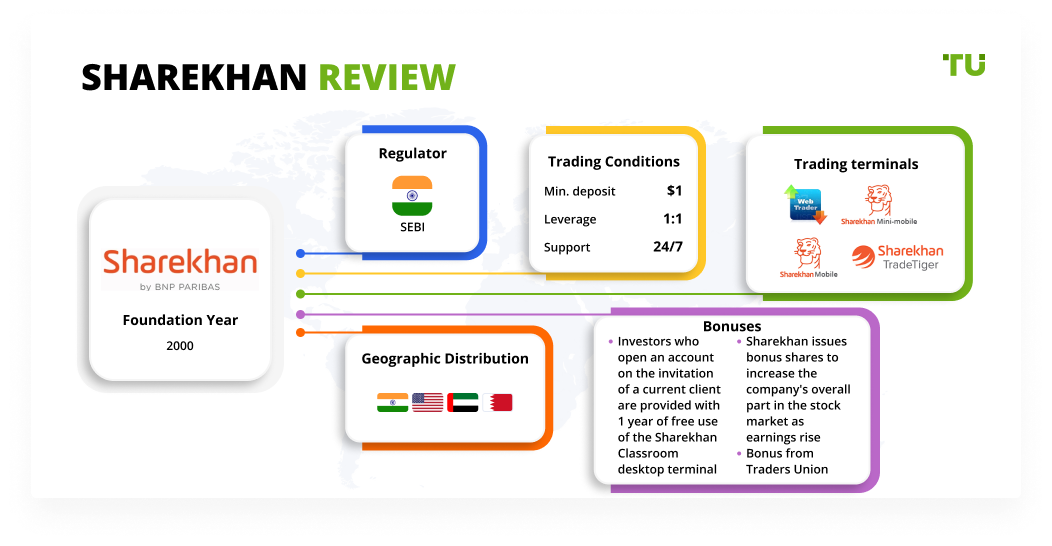

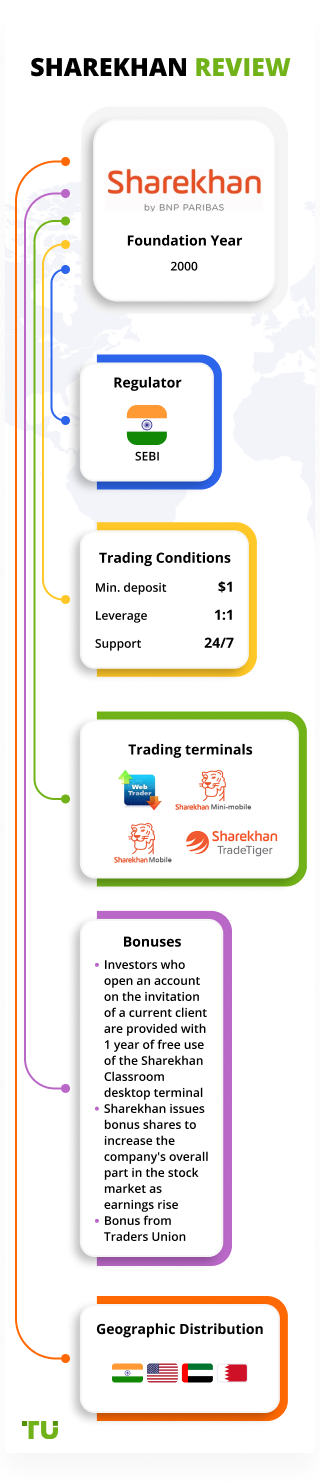

Sharekhan Review 2024

deposit:

- $1

Trading platform:

- Web Trading platform

- Sharekhan Mobile

- Sharekhan Mini-mobile

- Trade Tiger (Desktop)

- Floating

- Extended trading hours available, margin trading supported

Summary of Sharekhan Trading Company

Sharekhan is a moderate-risk broker with the TU Overall Score of 5.2 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Sharekhan clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. Sharekhan ranks 48 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Sharekhan is suitable for experienced traders and newcomers to the stock market.

The Sharekhan broker was founded in 2000, and it is a subsidiary of the financial conglomerate BNP Paribas, which is regulated by the Securities and Exchange Board of India (SEBI, INZ000171337). Sharekhan was one of the first Indian brokers to offer Indian citizens and overseas residents a wide range of investment solutions, including stocks, futures, and options trades, as well as portfolio management and stock exchange training. Today, more than two million traders and investors worldwide cooperate with Sharekhan.

| 💰 Account currency: | INR |

|---|---|

| 🚀 Minimum deposit: | From INR 1 |

| ⚖️ Leverage: | Floating |

| 💱 Spread: | No |

| 🔧 Instruments: | Stocks, bonds, options, futures, currency derivatives, commodity, mutual funds, IPO |

| 💹 Margin Call / Stop Out: | No |

Evaluation of the most influential parameters of Sharekhan

Geographic Distribution of Sharekhan Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Sharekhan

Sharekhan does not have a minimum deposit requirement. It provides investors with no experience with ready-made professionally selected portfolios, financial advice, full-time and online training. When making trades on all instruments for quick data exchange and conducting transactions at a more favorable price, clearing can be connected.

The Sharekhan broker provides an opportunity to make secure trades over the phone through the Dial-N-Trade service. You can make a trade on any of the three toll-free phones, and there is no limit on the number of orders that can be placed using this method. If necessary, a company specialist is ready to advise on technical and financial aspects, and for additional security, all telephone conversations are recorded.

After subscribing for a free offer to daily reports, fundamental and technical research of the company's analysts becomes available. For those who have mobile devices with low internet speeds, a mini-application has been developed to receive data in 2G format. The main disadvantage of a broker is that its commission fees are not fixed amounts, but a percentage of the trade amount, which increases the cost of transactions.

Dynamics of Sharekhan’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

Sharekhan offers investors a wide range of financial instruments including stocks, options, and futures. The company's specialists provide financial advice and can form an investment portfolio based on research conducted on all significant fundamental and technical indicators.

Demat account - a profitable offer for investors

Sharekhan customers can attach a Demat account to their main trading account. It is a digitized investment portfolio of assets consisting of securities certificates. The broker acts as a depository for converting investments into electronic format and carrying out transactions in the exchange market.

Demat account advantages and features:

-

Dematerializing shares into certificates increases their availability and ease of circulation.

-

Unlike the paper format, the risk of loss, theft, or counterfeiting of shares is eliminated.

-

Asset management is simplified as it is possible to change the linked bank account, phone number, and other details for each share with the click of a button.

-

Operations can be performed in odd lots.

-

Stamp duty is eliminated and transaction fees are reduced.

-

Time for transactions and investment management is reduced, which makes trading more efficient.

Investments in Demat provide additional security guarantees since when registering an account, the investor receives a unique identifier for his portfolio. The broker does not impose requirements on the size of the investment of funds for creating Demat, and information on operations is displayed in the personal account in real-time.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Sharekhan’s affiliate program

-

Referral program. Within a year after the referral is connected, the broker pays the affiliate 15% of the commission fees from his trade.

Sharekhan offers an affiliate program, for participation in which you need to enter the phone number specified during registration in a special section of the site and click a button to generate a unique link. The referral link can be shared on any available resource.

Trading Conditions for Sharekhan Users

Sharekhan provides a wide range of financial instruments for work with the ability to place market orders around the clock. Up to 5 Demat accounts can be linked to the main trading account to convert securities into electronic format with automatic payment of dividends to the linked bank account. The broker enables margin trading with the provision of a loan for operations with securities of international markets without requirements for the minimum amount of the deposit.

$1

Minimum

deposit

1:1

Leverage

24/7

Support

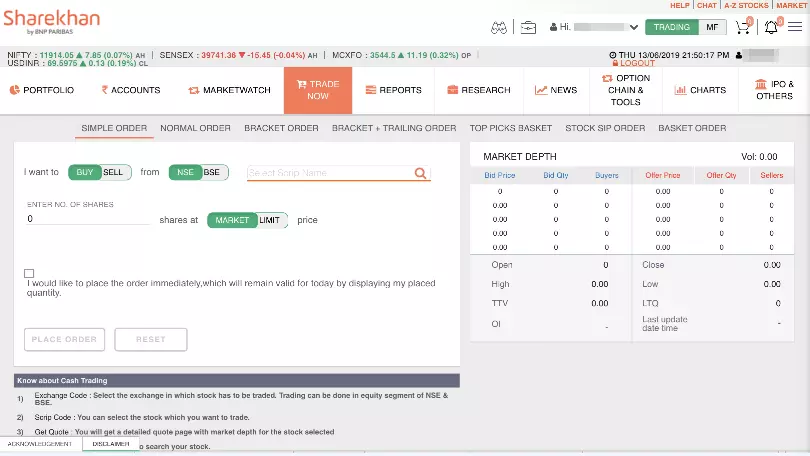

| 💻 Trading platform: | Sharekhan Mobile, Sharekhan Mini-mobile, Trade Tiger (desktop platform), web trading platform |

|---|---|

| 📊 Accounts: |

Demat Accounts: Regular Demat Account, Repatriable Demat Account, Non-repatriable Demat Account Trading Accounts: Equity Trading Account, Commodity Trading Account, Discount Broking Account, Full-Service Trading Account, 2-in-1 Account, 3-in-1 Account, Online Trading Account, Offline Trading Account PMS Account |

| 💰 Account currency: | INR |

| 💵 Replenishment / Withdrawal: | Bank transfer |

| 🚀 Minimum deposit: | From INR 1 |

| ⚖️ Leverage: | Floating |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No data |

| 💱 Spread: | No |

| 🔧 Instruments: | Stocks, bonds, options, futures, currency derivatives, commodity, mutual funds, IPO |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Extended trading hours available, margin trading supported |

| 🎁 Contests and bonuses: | Yes |

Sharekhan Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Trading Account | From $0.2 | No |

For the dematerialization of securities in a Demat account, a fee of INR 5 per certificate is applied. Using the data obtained, the experts made a comparison with brokers Ally and Charles Schwab, which offer similar services on the stock market. The analysts have compared the size of the trading commission for trading stocks. The comparative results are shown in the table below

| Broker | Average commission | Level |

| Sharekhan | $0.2 | Low |

| Charles Schwab | $11 | High |

| Ally Bank | $4 | Medium |

Detailed Review of Sharekhan

Sharekhan is one of the largest companies in India providing the opportunity for online trading in the stock markets. The broker's services can be used by corporate and individual traders and investors. Sharekhan offers many investment options, and its website provides traders with research, market data, analytics, and breaking news.

Sharekhan achievements by the numbers:

-

More than 20 years of experience in the stock market.

-

153 branches in India and abroad.

-

More than 2 million clients worldwide.

-

Over 400,000 trades are conducted each daily.

Sharekhan is a broker that provides a full range of services to support trading in the stock market

The broker offers clients trading in stocks, options, commodities, futures, bonds, foreign exchange derivatives, mutual funds, and IPOs with the ability to link up to five Demat accounts to their trading transactions. The broker is listed on the largest Indian stock exchanges, NSE and BSE, where clearing is at the best prices. The company employs a team of experts in fundamental and technical market analysis, which provides clients with research results in the form of daily reports. A personal financial manager works with each client.

Sharekhan offers a WEB trading platform and a Trade Tiger stationary terminal. There are two versions of mobile applications available, one of which is designed for devices with internet speed limits up to 2G. All platforms provide tools for advanced market analysis, it is possible to place pre-orders. All clients get access to news and research in real-time. More than 30 indicators are provided for technical analysis based on your own strategies, and you can trade directly from charts.

Useful services of Sharekhan investment:

-

Market statistics. A section on the website with market data categorized by segment, market cap, and price range.

-

Must do trades. A smart chart of trades is recommended for position traders and passive investors.

-

OAlert. Automatic order notification system, which eliminates the need for continuous monitoring of the market to select the moment of the transaction.

-

Sharekhan Research. Research tables on short and medium-term targets for traders and investors.

Advantages:

A large selection of software for the convenience of trading.

A variety of tariff plans allowing you to reduce brokerage fees.

No commission fees for deposit/withdrawal of funds.

Trade Dial-N-Trade by phone with the possibility of obtaining expert advice.

Support for clearing services through NSE Clearing Limited (NCL).

The broker offers face-to-face and online training in the basics of trading and advanced courses for experienced traders.

For clients who have an investment of over five million Indian rupees, the company's specialists offer services for the preparation and maintenance of an investment portfolio.

How to Start Making Profits — Guide for Traders

Sharekhan offers its clients a single trading account with the possibility of margin trading on all available financial instruments. Opening an account is free. There are no minimum deposit requirements. Passive investors can connect a PMS Account to transfer capital under management.

Account types:

The Sharekhan broker does not provide a demo account for trial trading without financial risks.

The company focuses not only on experienced participants in exchange trading, therefore, but it also offers a complete training course or trust management for beginners.

Bonuses Paid by the Broker

Investors who open an account on the invitation of a current client are provided with 1 year of free use of the Sharekhan Classroom desktop terminal

Referrals also get access to Sharekhan Classroom professional training and research on more than 180 tools in various market segments.

Sharekhan issues bonus shares to increase the company's overall part in the stock market as earnings rise

For each security in the investor's portfolio, the client automatically receives one bonus share. An increase in the number of shares is not always accompanied by a fall in value, but even if this happens, the price decrease is compensated by the quantity.

Investment Education Online

In 2010, Sharekhan opened the Online Trading Academy, which offers investment training and short-term position trading on stock exchanges. Six brick-and-mortar training centers have been opened; online training is also available. In addition, self-paced articles and videos are available in the Knowledge Center section of the site.

In the Knowledge Center section, there is a premium branch for experienced market participants, where they can deepen their knowledge of stock trading and learn new technical indicators.

Security (Protection for Investors)

The Sharekhan broker is part of the BNP Paribas group of companies and is regulated by the Securities and Exchange Board of India.

The company has been providing services on the stock markets for over 20 years and fulfills all obligations to its clients. Sharekhan is listed on major Indian exchanges such as NSE, BSE, MSEI, and MCX under number INZ000171337.

👍 Advantages

- There is a possibility of filing a complaint with a supervisory authority

- Password protection of a transaction request

- The existence of a session control manager as well as systems of internet scanners against malicious activity and intrusion detection when trying to hack an account

👎 Disadvantages

- No insurance

- Segregated accounts are not provided for the safety of client funds

- The regulator does not allow the use of electronic payment systems

Withdrawal Options and Fees

-

Withdrawal of funds is carried out by bank transfer to the account specified during registration.

-

The transfer is carried out on the day of application submission if it was made in the personal account before 14:00 hours. Otherwise, the withdrawal is made the next day.

-

Withdrawals from Sharekhan are free, but the receiving bank may charge additional fees.

Customer Support Service

Sharekhan's account managers are ready to provide support 24/7.

👍 Advantages

- Work 24/7

- There is an online chat

- Callbacks are available

- The site has a list of answers to the FAQs

- Personal manager provided

👎 Disadvantages

- There are no ready-made forms for filling out applications

- Online chat is available only to registered users

- No address for a written appeal

This broker provides the following communication channels for existing clients and potential investors:

-

contact by email;

-

online chat on the broker's website;

-

phones call to the specified numbers.

The company also has profiles on social networks such as Facebook, Twitter, and Youtube.

Contacts

| Foundation date | 1992 |

| Registration address | 4th Floor, D Wing, Jolly Board Towers, I Think Techno Campus, Mumbai, Maharashtra 400042, India |

| Regulation |

SEBI |

| Official site | https://www.sharekhan.com/ |

| Contacts |

Email:

igc@sharekhan.com,

|

Review of the Personal Cabinet of Sharekhan

To start cooperation with Sharekhan, you need to open a trading account. This can be done in two ways:

In the lower area of the main page of the site, open an online chat and fill out the registration form.

At the top of the page, click the Open An Account button. A form to complete the registration will open. Complete it.

The following options are available in the Sharekhan personal account:

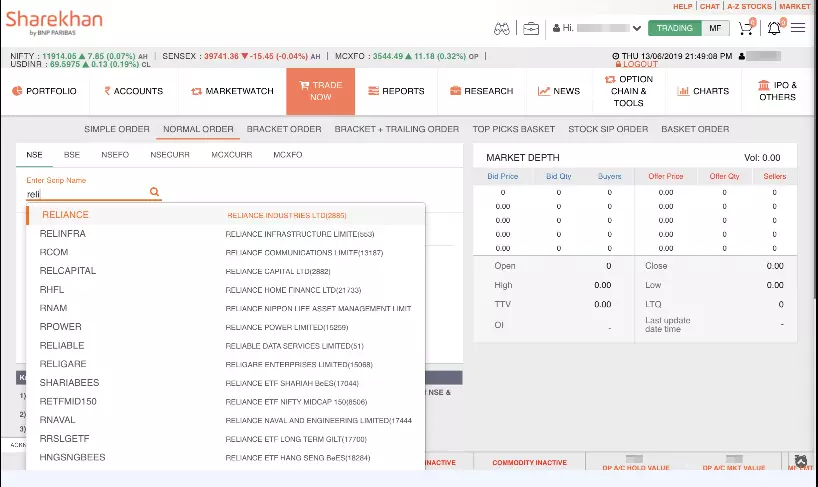

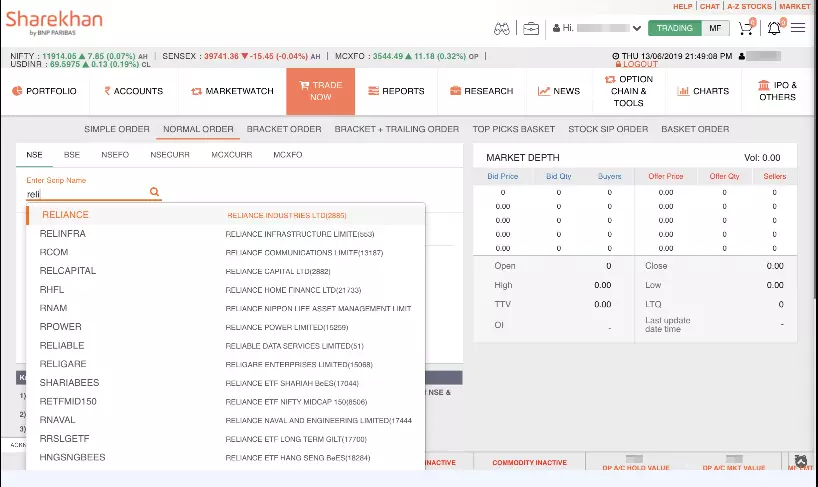

1. Convenient and fast asset search:

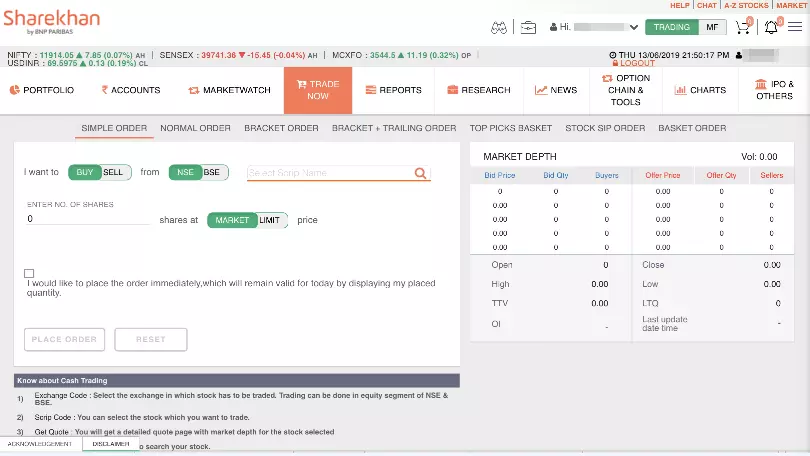

2. Trading via the web terminal:

1. Convenient and fast asset search:

2. Trading via the web terminal:

Also in the personal account, there are sections that allow you to perform the following actions:

-

View the number of bonus shares accrued.

-

Customize alerts and notifications about the prices of securities from the "Favorites" section.

-

Read company and market news, reports on board meetings, and annual meetings.

-

Generate a detailed report on active portfolios.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the Sharekhan rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Sharekhan you need to go to the broker's profile.

How to leave a review about Sharekhan on the Traders Union website?

To leave a review about Sharekhan, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Sharekhan on a non-Traders Union client?

Anyone can leave feedback about Sharekhan on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.