deposit:

- $10 000

Trading platform:

- Proprietary platform

SIX Group Review 2024

deposit:

- $10 000

Trading platform:

- Proprietary platform

- 1:1

- Only certified traders are allowed to trade

Summary of SIX Group Trading Company

SIX Group is a moderate-risk broker with the TU Overall Score of 5.35 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by SIX Group clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. SIX Group ranks 43 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

The activities of SIX Group are aimed at cooperation with large traders and financial institutions.

The SIX Swiss Exchange (the SIX Group) consortium was founded in 2008 as a result of the merger of SWX Group, Telekurs Group, and SIS Group. Its main office is located in Zurich (Switzerland). The SIX Group includes more than 120 financial institutions and offers services in securities transactions and financial information processing. The company is an independent and self-regulated member of SER under the supervision of FINMA. The SIX Group offers a wide range of instruments for trading on stock exchanges, as well as the possibility of listing securities.

| 💰 Account currency: | CHF, USD |

|---|---|

| 🚀 Minimum deposit: | 10 000 CHF |

| ⚖️ Leverage: | 1:1 |

| 💱 Spread: | absent |

| 🔧 Instruments: | Shares, bonds, ETFs, ETPs, mutual funds, structured products, indices, cryptocurrencies |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with SIX Group:

- Low trading commissions can be reduced to zero when you pay a subscription fee.

- Proprietary trading platform with a wide selection of interfaces for each strategy.

- Providing listing on the Swiss and other world stock exchanges.

- Instant order execution.

- Financial magazine in paper and digital format.

- The interests of traders in FINMA are represented by the Participants and Surveillance Committee.

👎 Disadvantages of SIX Group:

- High minimum deposit for a private trader.

- Long consideration of the registration application.

- No online chat.

Evaluation of the most influential parameters of SIX Group

Geographic Distribution of SIX Group Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of SIX Group

SIX Group (SIXGroup) acts as a contractor at the stock market and after the client completes a transaction, undertakes obligations to complete all necessary operations. The company offers listing services for the quick admission of bonds and derivatives to stock exchanges for financial institutions wishing to present their own securities on the stock market.

The trading platform, which the SIX Group provides to clients for trading, operates on the X-Stream INET technology, which comprises algorithmic high-frequency trading and instant order execution. The terminal has a large number of interfaces with a wide functionality that the client can customize depending on his trading strategy and financial instruments.

The most serious disadvantages of the SIX Group are that you can deposit and withdraw funds only in USD and CHF, nor is there any online support on the site. The languages of the interfaces of the trading terminal and the company’s website are German and English.

Latest SIX Group News

Dynamics of SIX Group’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

SIX Group offers to invest in stocks, derivatives, certificates, and bonds. The broker’s clients have access to more than 4,500 financial instruments.

Listing — SIX Group’s unique offer for investors

The SIX Group invites its clients to invest in ETFs and sponsored mutual funds. The SIX Group’s passive investments characteristics are:

-

The sponsor acts as a market maker and assumes the risks of purchasing securities.

-

The client can use the listing services.

-

The company guarantees that all products comply with investor protection regulations.

-

The information on trading activity is available online.

The SIX Group carries out the placement of assets of corporate clients and financial institutions on the stock exchange. After the client has provided all necessary financial and legal information, they register securities within a month from the date of the application.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

SIX Group’s affiliate program

There are currently no affiliate programs available on the broker’s website. But the Six Group offers companies active cooperation on the placement of securities on stock exchanges throughout the listing.

Trading Conditions for SIX Group Users

The SIX Group offers its clients access to assets authorized by FINMA, the regulatory agency for stockbrokers and that oversees the activities of brokers. In addition to transactions with securities, traders registered with the company can trade 92 cryptocurrencies and tokens. The proprietary trading platform has 6 interfaces available for comfortable work on an individual trading strategy. The minimum deposit is CHF 10,000. The broker does not support margin trading and therefore does not provide leverage.

$10 000

Minimum

deposit

1:1

Leverage

8/5

Support

| 💻 Trading platform: | Proprietary platform |

|---|---|

| 📊 Accounts: | Standard Account |

| 💰 Account currency: | CHF, USD |

| 💵 Replenishment / Withdrawal: | Wire transfer, Payeer, ACH |

| 🚀 Minimum deposit: | 10 000 CHF |

| ⚖️ Leverage: | 1:1 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | N/A |

| 💱 Spread: | absent |

| 🔧 Instruments: | Shares, bonds, ETFs, ETPs, mutual funds, structured products, indices, cryptocurrencies |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | N/A |

| 📱 Mobile trading: | unavailable |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Only certified traders are allowed to trade |

| 🎁 Contests and bonuses: | unavailable |

SIX Group Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Standard | from $0.5 | No |

Banks transferring funds may charge an additional fee for handling the transfer.

The comparison table shows the average trading commissions of the SIX Group and other stockbrokers for transactions in shares. But you have to remember that the value specified for the SIX Group is available only to customers who have paid the subscription service fee specified in the offer.

| Broker | Average commission | Level |

| SIX Group | $0.5 | Low |

| Charles Schwab | $11 | High |

| Ally Bank | $4 | Medium |

Detailed Review of SIX Group

SIX Group offers its clients numerous instruments of the stock markets to trade but also post-trading services, such as clearing, settlement, setup, and maintenance of assets. Thanks to the listing, the company’s clients can bring their own assets to the market as quickly as possible.

Achievements of the SIX Group in numbers:

-

The company’s profit for 2020 was 1.4 billion Swiss francs.

-

More than 728 million payment transactions between banks were made.

-

More than 120 banks are co-owners and at the same time the main clients of the SIX Group.

-

The company employs over 3500 employees from 20 countries.

SIX Group is a broker for financial institutions, corporate clients, large traders, and investors

The SIX Group is a company that offers services for trading stocks, certificates, bonds, derivatives, and cryptocurrencies on stock exchanges to clients from 20 countries. Since cooperation is possible only with licensed traders, the broker offers training and gives an international certificate. Experienced traders can take additional courses to improve their professional qualifications with the help of SIX Group.

SIX Group has a proprietary SWXess trading platform that presents six interfaces depending on the set of tools and the strategy that the trader is using. It offers six internet portals for access to e-commerce. If you have to speed up the process of data exchange, you have the ability to plug into an individual access point.

Useful services of the SIX Group:

-

World stock markets news.

-

Economic calendar with upcoming important events and technical information that help you plan and participate in future market events.

-

Subscription to daily notifications about the products the company offers.

-

Review of market activity for the Swiss Market Index and the SMIM index.

-

Red magazine in electronic format with reference information and articles on exchange topics.

Advantages:

The broker provides clearing services, which increases the accuracy of quotes and reduces the execution time of an order to open/close positions.

Listing services allow you to place your own assets on the exchange.

The client can choose the interface of the trading terminal with a certain set of technical indicators, focusing on the specifics of financial instruments and the trading strategy he applies.

After paying the subscription fee, you can use the Alternative Fee structure, a service that adjusts the tariff plan and reduces commission fees.

Access to trades with 92 cryptocurrency pairs.

Intraday trading is available to clients who conduct a large number of transactions in a short period of time.

How to Start Making Profits — Guide for Traders

The SIX Group offers its clients one type of account, however, for an additional monthly fee, you can change the tariffs and expand the list of trading instruments. Margin accounts are not provided.

Account types:

The SIX Group provides an opportunity to test the trading terminal. The operating time of the test mode is unlimited.

The SIX Group is aimed at large investors and licensed traders with a high level of experience, as well as companies that have assets for trading on the stock exchange.

Bonuses Paid by the Broker

At the moment, there is no information about bonus programs on the broker’s website.

Investment Education Online

The SIX Group offers qualified training for traders in various areas. You have to first pass a test for initial knowledge of the principles of exchange trading. Based on the results of the test, they issue you an international license. In addition, the company’s website has a Market Data section, which provides useful information for traders.

After completing the registration procedure, you can work in test mode without the risk of losing your investment.

Security (Protection for Investors)

The SIX Group is one of the largest stockbrokers under the joint management of about 120 banks, which at the same time are the broker’s major clients. This guarantees the transparency of all transactions. The company is part of the Global Reporting System (GRI) and provides monthly reports on its activities.

The broker is self-regulating and all businesses that are part of the SIX Group are authorized by the Swiss Financial Markets Authority (FINMA). In addition, they have a three-level degree of protection against risks, and clients’ funds are kept in segregated accounts of third-party banks, which provides additional guarantees for the safety of investments.

👍 Advantages

- High degree of protection against financial risks

- Keeping clients’ deposits in third-party accounts with the largest banks in Europe

- Transparency of all financial and trade transactions

- The SIX Group financial statements are publicly available

- Corporate governance

👎 Disadvantages

- No insurance policy

- It works only with licensed traders

- Failure to comply with the terms of the offer by the client shall result in the imposition of a fine

Withdrawal Options and Fees

-

To withdraw funds, you must fill out the form on the website or apply by email. Applications are reviewed within 24 hours. There are no restrictions on the withdrawal amount.

-

Withdrawals are available via bank transfer and Payeer system. Clients who use clearing services can additionally withdraw funds via ACH.

-

Withdrawals via ACH take 2-4 business days, and wire transfers take 3 to 5 days. The transfer using the electronic payment system Payeer is carried out instantly.

-

The withdrawal of funds via the broker is free of charge, but the commission may be charged by the receipient’s/sender’s bank or by the payment system.

Customer Support Service

Customer support is available by phone and on weekdays from 8:00 to 17:00 (GMT+2). Support’s languages are German and English.

👍 Advantages

- Many ways to communicate

- Distribution of requests by sections

- Fast processing of requests

- Personal manager

- You can submit a written request to the company’s management

👎 Disadvantages

- No online chat

- Closed on weekends and holidays

Available communication channels with customer support specialists include:

-

a phone call to numbers indicated on the website;

-

filling out the form on the website;

-

contact by email.

The website six-group.com lists the phone numbers of the company’s departments that deal with a particular issue.

Contacts

| Foundation date | 2008 |

| Registration address | Pfingstweidstrasse 110, 8005 Zürich, Switzerland |

| Official site | https://www.six-group.com/en/ |

| Contacts |

Phone:

+41 58 399 2111

|

Review of the Personal Cabinet of SIX Group

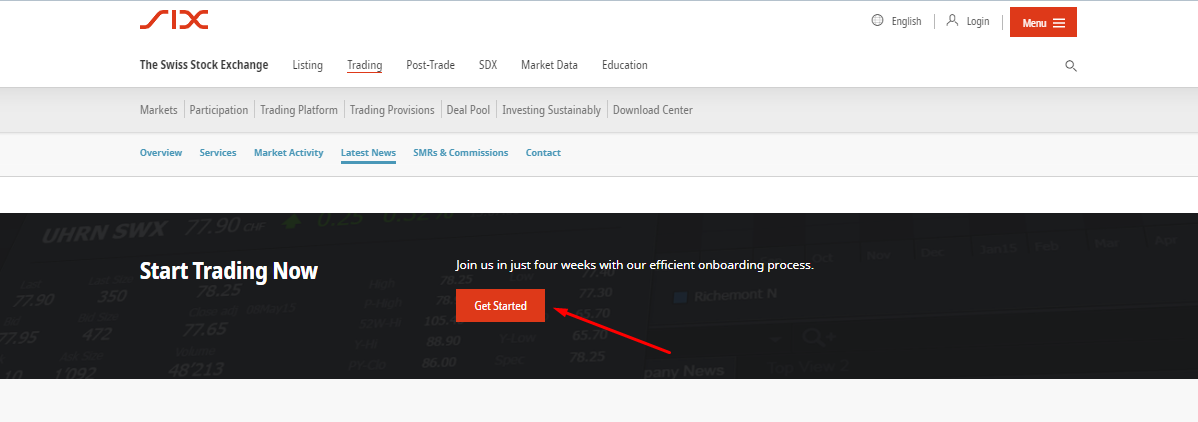

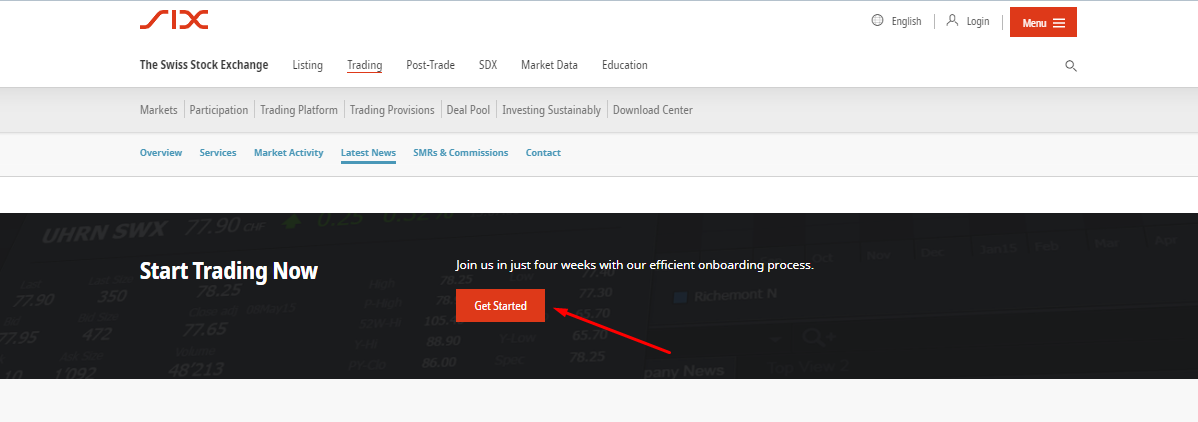

To start trading with the SIX Group you have to:

go to the Trading section and click Get Started on the broker’s official website. After that, in the Participation window, select Onboarding Process Details. The document that opens describes in detail the procedure for registering with the Swiss Stock Exchange. It consists of three stages (Membership Application & FINMA Approval, Technical Setup, and Operational Setup & Testing). The procedure takes four weeks to complete.

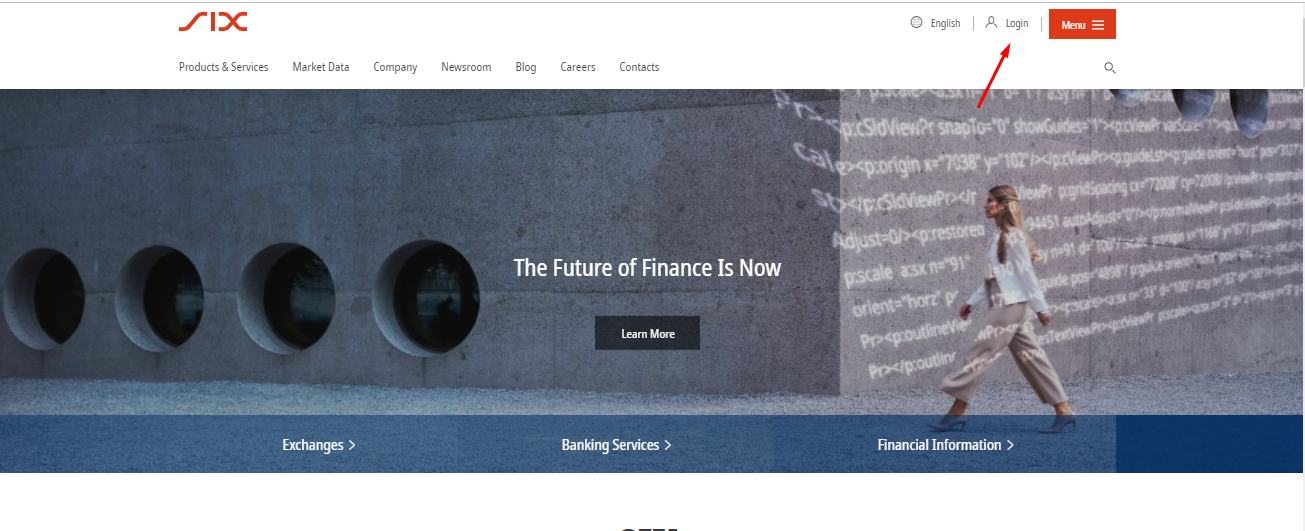

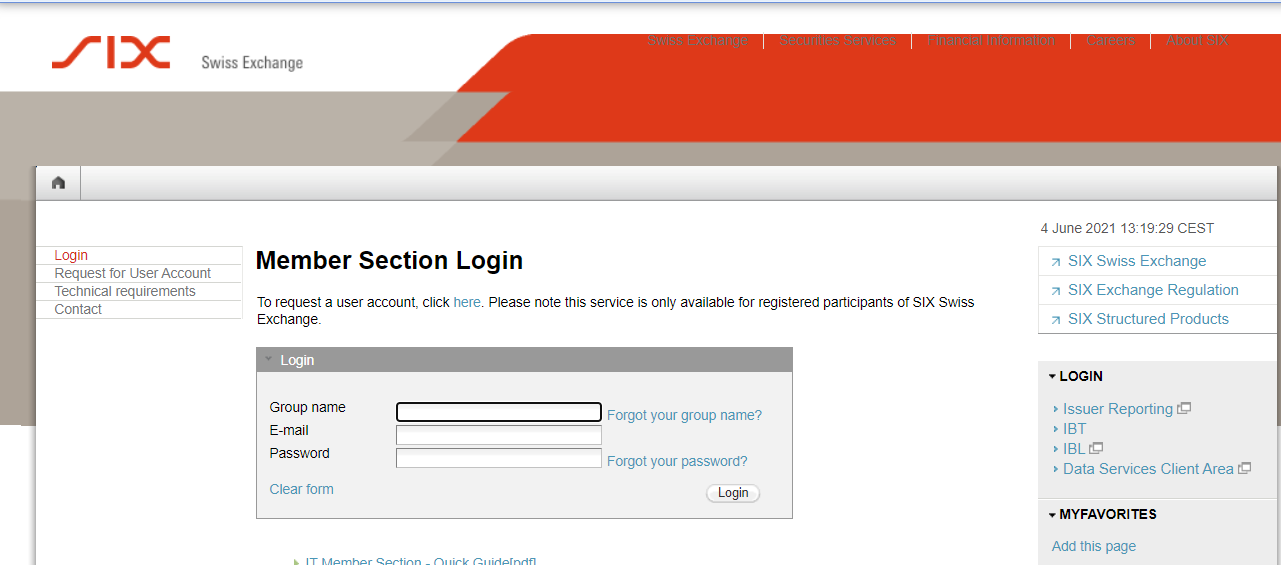

Click Login at the top of the screen and select the Request for User Account section. In the registration form, indicate the name of the company or full name (for retail clients), address, phone number, email. At this stage, you can choose the language of communication — English, German, or French. You also need to come up with a strong password.

To go to the user’s personal account, you need to perform the following steps:

1. Click Login on the main page of the site:

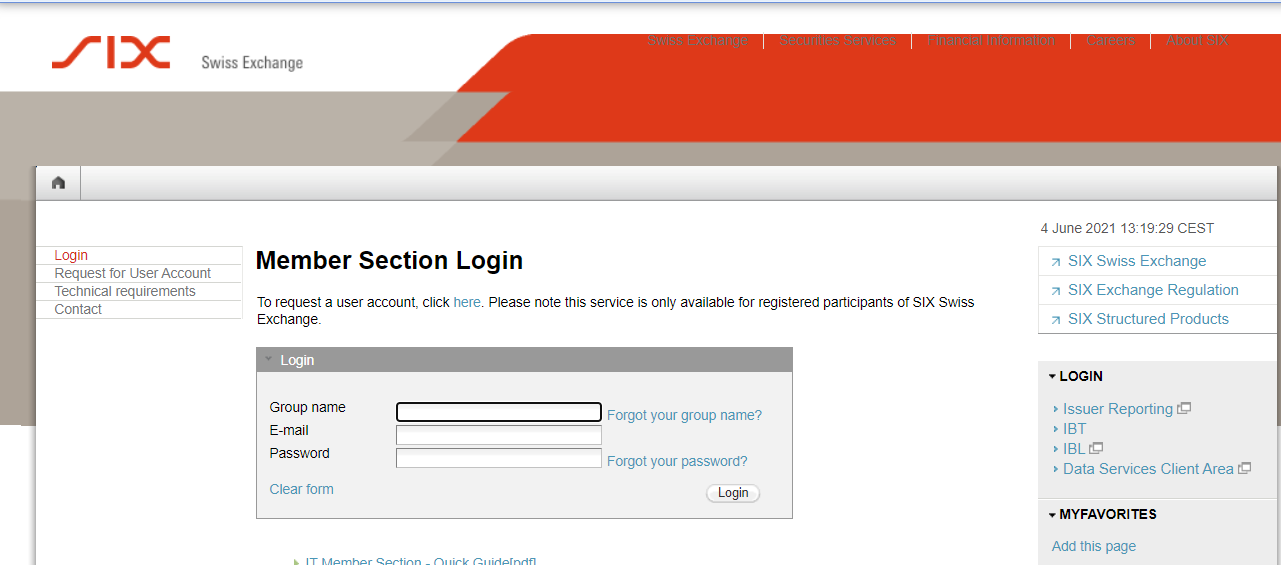

2. In the window that appears, enter the data specified during registration:

1. Click Login on the main page of the site:

2. In the window that appears, enter the data specified during registration:

The following will become available in the SIX Group’s personal account:

-

Trade and financial statistics, history of financial transactions.

-

Account management section.

-

Customer support portal.

-

Broker’s legal documentation.

-

Educational and analytical materials.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the SIX Group rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about SIX Group you need to go to the broker's profile.

How to leave a review about SIX Group on the Traders Union website?

To leave a review about SIX Group, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about SIX Group on a non-Traders Union client?

Anyone can leave feedback about SIX Group on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.