deposit:

- $2500

Trading platform:

- Mobile platforms

- SpeedTrader PRO

- Active Web

- FINRA

- SIPC

SpeedTrader Review 2024

deposit:

- $2500

Trading platform:

- Mobile platforms

- SpeedTrader PRO

- Active Web

- Calculated individually for each client and provided upon request

- Routing for intraday trading

Summary of SpeedTrader Trading Company

SpeedTrader is a moderate-risk broker with the TU Overall Score of 5.83 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by SpeedTrader clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. SpeedTrader ranks 34 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

SpeedTrader strives to cooperate with traders with significant capital reserves who have hands-on experience in trading on the stock markets.

SpeedTrader is a stock market broker that started operations in 1999 under the brand name Mint Global Markets, Inc. The broker is currently regulated by the Financial Industry Regulatory Authority (FINRA, CRD#: 107403/SEC#: 8-53035 ) and is a member of the Securities Investor Protection Corporation (SIPC). SpeedTrader provides online trading platforms with a collection of analytical instruments as well as trading software with direct access to renowned exchanges. The company is headquartered in New York, USA.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | For SpeedTrader Pro — from $10,000, for Active Web — from $2,500, for day trading — from $30,000 |

| ⚖️ Leverage: | Calculated individually for each client and provided upon request |

| 💱 Spread: | No |

| 🔧 Instruments: | Stocks, options, ETF |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with SpeedTrader:

- SIPC insurance coverage and FINRA membership.

- Availability of an affiliate program.

- Proprietary trading platforms.

- Daily update of the list of available assets.

- Online chat for urgent issues.

- Trade routing.

- Optimized web platform.

👎 Disadvantages of SpeedTrader:

- The high minimum deposit for day trading (from $30,000) and a fee for using the trading platform.

- Inability to trade cryptocurrency and Forex instruments.

- Time-limited free demo account.

Evaluation of the most influential parameters of SpeedTrader

Geographic Distribution of SpeedTrader Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of SpeedTrader

The SpeedTrader broker provides clients with two types of accounts, the terms of which provide for several options for commission fees. On the ApexPro account, the trader pays a fee for each share, on the Axos broker, an additional amount is charged from each transaction. All account types have a subscription fee for using the trading platform and routing.

Traders with accounts in SpeedTrader are offered more than 4,500 instruments for trading, a significant selection of charting tools, and indicators for technical analysis. The broker is focused on active clients, therefore a monthly inactivity fee has been introduced. The company has presented a flexible tariff plan that can be customized depending on the trading strategy. Its conditions can be changed once a month.

The main disadvantages of cooperation with SpeedTrader are a high minimum deposit to start day trading, a paid version of the mobile platform, and limited options for deposits and withdrawals of funds. In addition, the company does not convert currencies and only trades in USD.

Dynamics of SpeedTrader’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

SpeedTrader provides direct access to the stock market but is not directly involved in trading. Investors are offered trust management accounts for managing brokers to trading stocks, options, and ETFs. To work with a managed account, a client who does not want to trade on their own must sign an Investment Club Agreement. After filling out the registration form for opening a trust account, a list of certified managers appears on the official website. Based on the accepted agreement, SpeedTrader provides the client with information about the account status and completed transactions in the form of daily reports.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

SpeedTrader’s affiliate program:

-

"Referral program". The current client places a link to the broker's website on various resources like social networks and thematic sites. For each replenishment of the account of the invited referral from $30,000, the partner is paid $100.

The essence of the program is that the partner receives passive income for each account opened and replenished by a client registered after the invitation.

Trading Conditions for SpeedTrader Users

The SpeedTrader broker offers direct market access trading and its conditions are optimal for intraday traders. The company has implemented a routing process — operations to redirect orders to the exchange where the best price for the traded instrument is offered. Leverage is provided individually upon request to technical support. It is possible to customize the tariff plan by the size and type of fee, depending on the chosen strategy.

The minimum deposit to open an account through the SpeedTrader Pro platform is $10,000, and through the Active Web it's $2,500. For day trading, it is required to deposit at least $30,000 on the balance. Regardless of the type of account chosen, a trader can choose a trading platform. The base cost of the available terminals is $25 and $49 per month. Connecting the mobile version costs $30 per month. The broker does not provide access to the foreign exchange market.

$2500

Minimum

deposit

1:1

Leverage

8/5

Support

| 💻 Trading platform: | SpeedTrader PRO, Active Web, Mobile Platform |

|---|---|

| 📊 Accounts: | SpeedTrader PRO, Demo, Axos, ApexPro |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Wire transfer, payments through the automated clearing house (ACH), bank check |

| 🚀 Minimum deposit: | For SpeedTrader Pro — from $10,000, for Active Web — from $2,500, for day trading — from $30,000 |

| ⚖️ Leverage: | Calculated individually for each client and provided upon request |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | From $2 |

| 💱 Spread: | No |

| 🔧 Instruments: | Stocks, options, ETF |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | Not indicated |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Routing for intraday trading |

| 🎁 Contests and bonuses: | Yes |

SpeedTrader Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Axos | From $0.002 | Charged when withdrawing by bank transfer |

| ApexPro | From $0.002 | Charged when withdrawing by bank transfer |

There is also a $30 inactivity fee that is calculated quarterly. Routing fees range from $0 to $0.004 per share. Below is a comparative table of the fees for trades in stocks from SpeedTrader and US brokers that offer similar trading instruments.

| Broker | Average commission | Level |

| SpeedTrader | $0 | Low |

| Charles Schwab | $11 | High |

| Ally Bank | $4 | Medium |

Detailed Review of SpeedTrader

This brokerage offers routing support and direct market access for intraday trading. To optimize commission fees, its clients can customize the tariff plan based on the chosen trading strategy. Trading in the foreign exchange markets is not available.

SpeedTrader facts in numbers:

-

More than 20 years of activity in the stock market.

-

Routing in more than 25 directions.

-

More than 4,500 assets available for trading.

SpeedTrader is a broker for intraday traders with experience in stocks and options

SpeedTrader is a stockbroker that provides flexible conditions for trading stocks and options and direct access to the market. Various charts and popular indicators have been added to conduct qualitative analysis on proprietary platforms. The list of available assets is updated in real-time. To optimize commission costs, it is possible to create an individual tariff plan. The broker only provides margin accounts and cash accounts.

The desktop platform offered by SpeedTrader comprises over 100 keyboard shortcuts. They allow you to build charts, price, and candlestick charts, as well as promptly receive information in real-time. All the important options are available in the settings, which can be accessed directly through the trading platform. Additionally, a web platform is provided that is optimized to increase the speed of data exchange. All functions of the main terminals are supported in the Android mobile application.

Useful SpeedTrader services:

-

Weekly newsletter.

-

Recordings of webinars with training materials.

-

A blog with recommendations from experienced traders.

-

Instructions for using technical indicators.

-

An updated list of available assets.

Advantages:

Availability of proprietary trading platforms adapted to work on all devices with internet access.

Optimized web terminal that does not require installation.

No fees are charged for opening and maintaining an account.

The ability to expand the list of trading instruments.

Connect routing to get the lowest prices for traded stocks and options.

Detailed instructions on the use of indicators used in the terminal.

With an increase in trading volumes, a decrease in restrictions on the number of simultaneously open transactions is available.

How to Start Making Profits — Guide for Traders

SpeedTrader offers its clients two types of margin accounts: Axos and ApexPro. They differ in the size of fees and the number of instruments available for trading. The account type is selected during registration and cannot be changed later. On all accounts, in addition to the main fees, there is a fee for using the trading terminal and the use of routing. By default, the leverage is not set, but if necessary, each client can apply to the technical support service to increase it.

Account types:

SpeedTrader offers a demo account, and it is enough to indicate your login and email address on the website for a hassle-free registration. The free version is valid for two weeks and is only available through the SpeedTrader PRO platform.

SpeedTrader is aimed at active traders with an intraday trading strategy that requires a fair amount of trading experience in the stock market.

Bonuses Paid by the Broker

After opening an account, a new customer is offered $100 or a month of free services

When providing free use of the trading platform, the client is not exempt from the routing subscription fee.

Investment Education Online

No training is offered on www.speedtrader.com. But the Resources section contains articles on fundamental analysis and how to use technical indicators in trading. It also features video tutorials and webinar recordings from successful traders and leading SpeedTrader analysts.

Working on a demo account makes it possible to test the trading terminal and create a profitable strategy without the risk of losing capital.

Security (Protection for Investors)

SpeedTrader is regulated by FINRA (Financial Industry Regulatory Authority) and the broker is a member of the Securities Investor Protection Corporation (SIPC), a non-governmental organization that protects clients from the bankruptcy of brokers.

The SIPC insurance policy protects securities up to $500,000, but not more than $250,000 for monetary claims. The accounts of Axos are covered by Lloyd's of London's additional coverage of $99.5 million. Through a combination of SIPC coverage and Lloyd's of London insurance, Axos accounts are protected up to $100 million per customer, including up to $1.15 million for cash balances.

👍 Advantages

- Client funds are protected by SIPC and Lloyd's of London insurance coverage

- FINRA regulator considers complaints from traders from anywhere in the world

👎 Disadvantages

- Under the requirements of the regulatory company, there is no choice in the methods of withdrawals

- Each client is obliged to go through thorough verification of personal and payment data

Withdrawal Options and Fees

-

You can withdraw funds using payment via ACN, bank transfer, and bank check (for US citizens only). The daily withdrawal limit for ACN-transfer is $50,000.

-

Payment time via ASN takes from 24 to 48 hours, by bank transfer or check, it can be up to 10 working days.

-

No fee is charged for withdrawing funds via ASN. When withdrawing via bank transfer by US residents, the broker deducts $25 per transaction, for foreign citizens, it is $60. Additionally, a fee for withdrawal may be charged by banks.

-

When requesting a bank check after business hours, the fee is $40.

Customer Support Service

Customer support responds to customer questions Monday through Thursday from 8:00 am to 5:00 pm and Friday from 8:00 am to 4:30 pm EDT.

👍 Advantages

- Online chat available

👎 Disadvantages

- Support is only 24/5

Available communication channels with customer support specialists include:

-

online chat;

-

free phone call;

-

email;

-

fax;

-

messengers for Facebook and Twitter.

Support can be contacted before registering and opening an account by filling out a form at www.speedtrader.com or using any of the above methods.

Contacts

| Foundation date | 1999 |

| Registration address | 1717 Route 6, Carmel, NY 10512 |

| Regulation |

FINRA, SIPC |

| Official site | https://speedtrader.com/ |

| Contacts |

Email:

info@speedtrader.com,

Phone: 1 (800) 874-3039 |

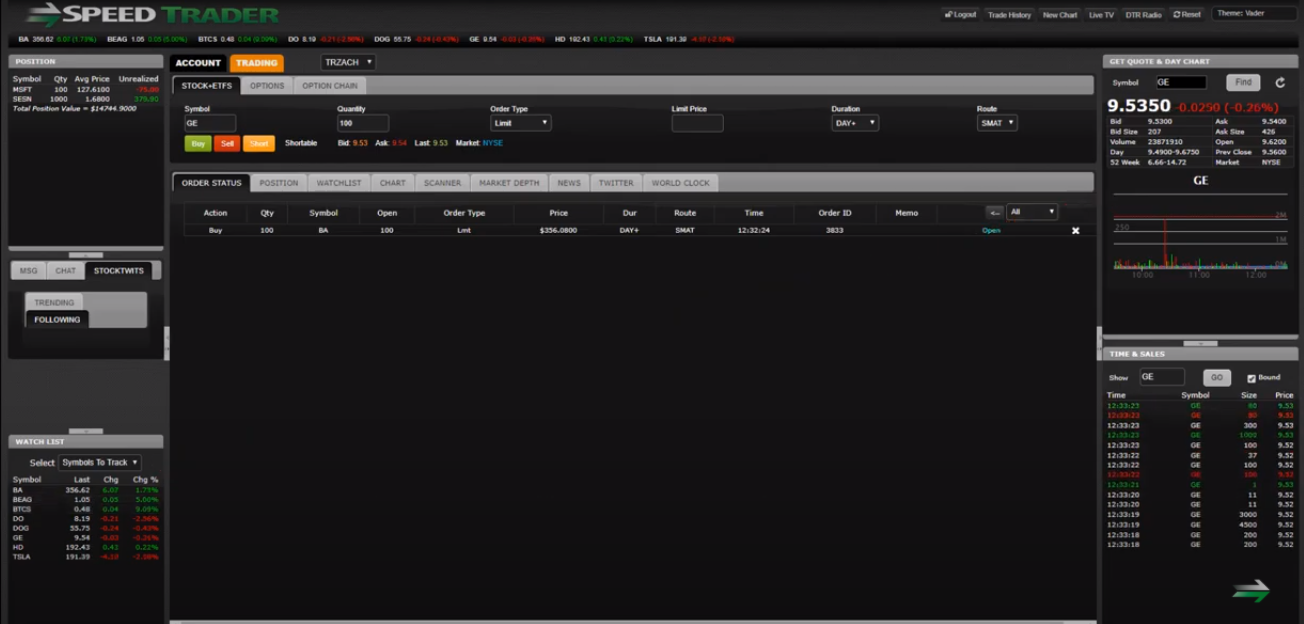

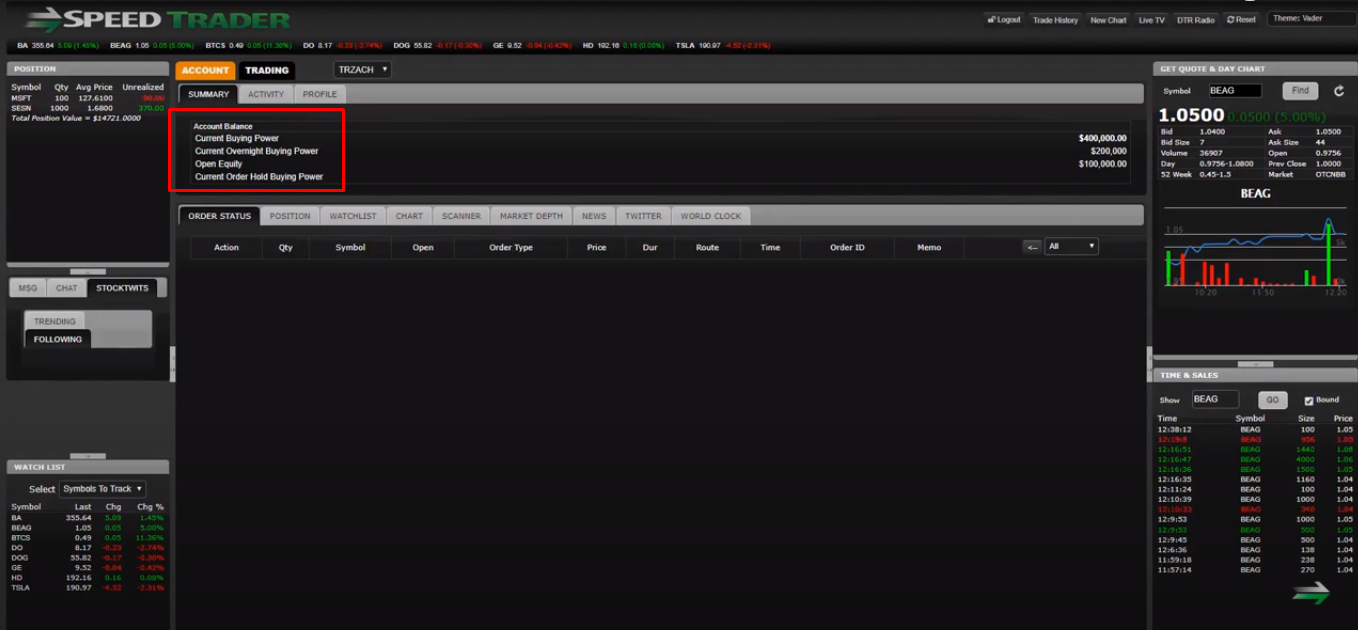

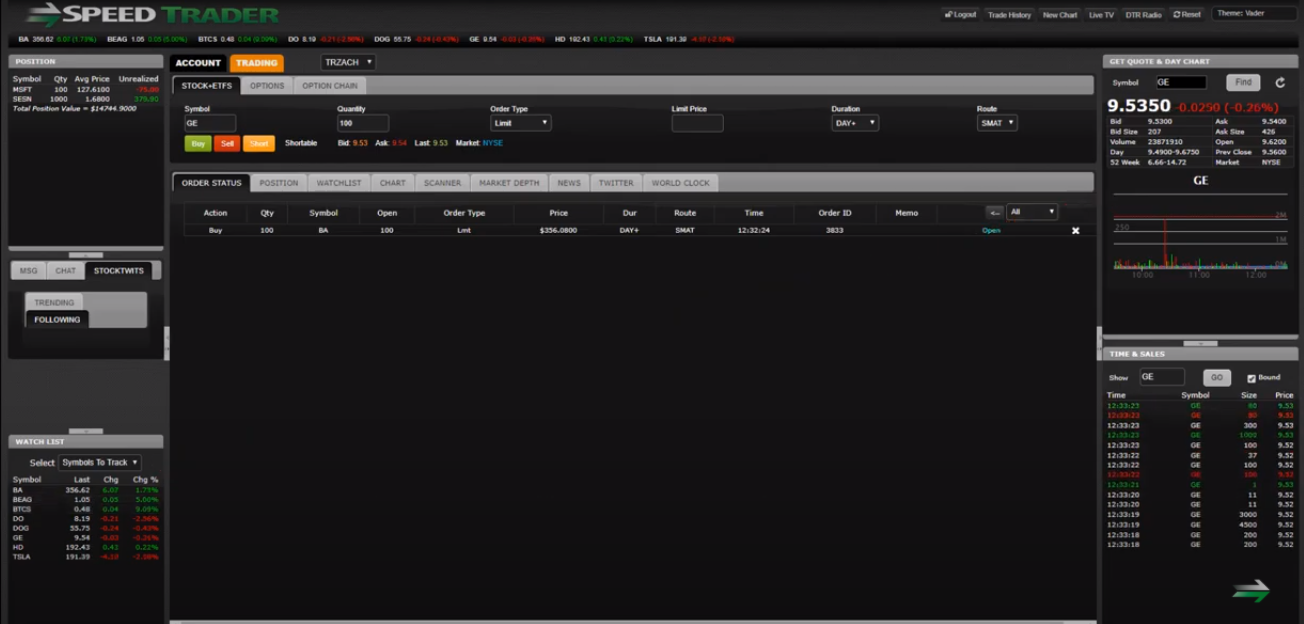

Review of the Personal Cabinet of SpeedTrader

Brief instructions for registering and creating a personal account with a SpeedTrader broker:

Visit the official website of the broker. Click the Open An Account registration button, which is available on any page of the resource.

In the registration form that opens, enter your email address and create a password. Next, select the type of account (Axos or ApexPro), enter your personal information such as last name, first name, social security/taxpayer identification number, address (city, country, zip code). It is also necessary to enter information about your employer: his last name, first name, registration address, telephone number, and field of activity.

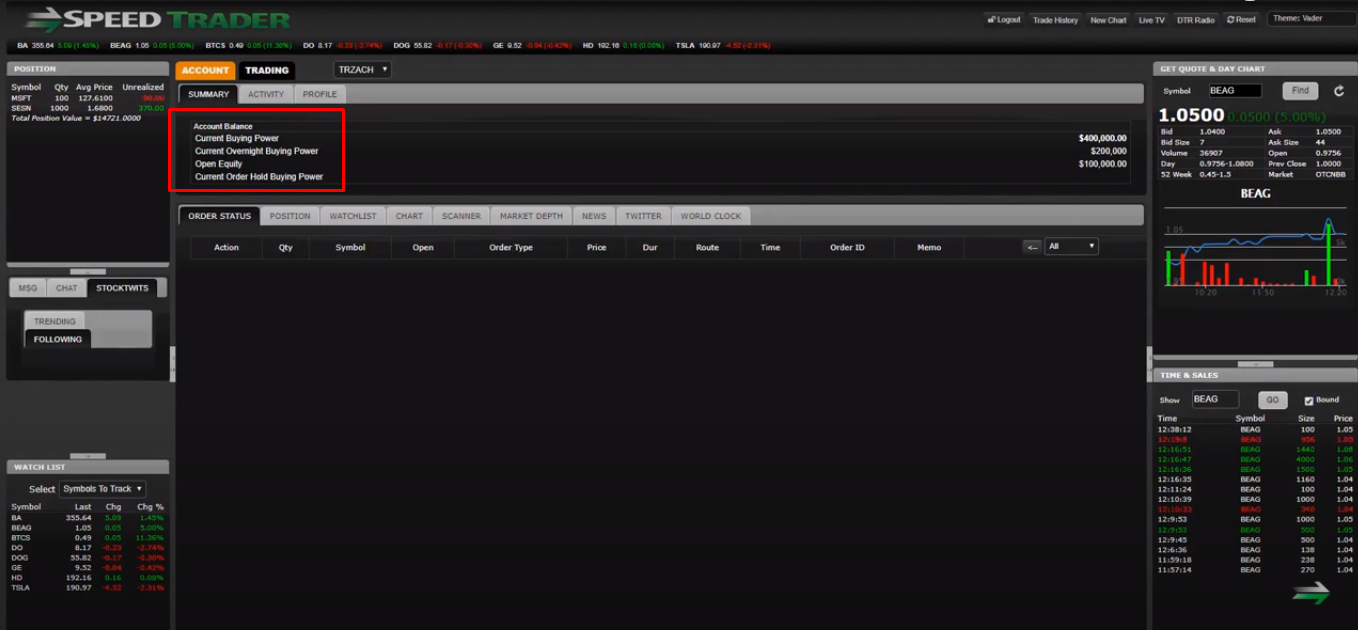

In the personal account, the user can conduct the following actions:

1. Create statistics on open accounts:

2. Trade through the web platform and view information on open and closed orders:

1. Create statistics on open accounts:

2. Trade through the web platform and view information on open and closed orders:

These options are also available in the personal account:

-

Real-time level 2 quotes.

-

Watch lists for user-selected assets.

-

Latest market news, which can be filtered by the name of trading instruments.

-

Integrated stock scanner.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the SpeedTrader rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about SpeedTrader you need to go to the broker's profile.

How to leave a review about SpeedTrader on the Traders Union website?

To leave a review about SpeedTrader, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about SpeedTrader on a non-Traders Union client?

Anyone can leave feedback about SpeedTrader on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.