deposit:

- £50

Trading platform:

- Mobile Apps

- Web Trading platform

- SIPC

- FCA

- FSCS

Stake Review 2024

deposit:

- £50

Trading platform:

- Mobile Apps

- Web Trading platform

- 1:1

- Zero brokerage fees, no desktop terminal

Summary of Stake Trading Company

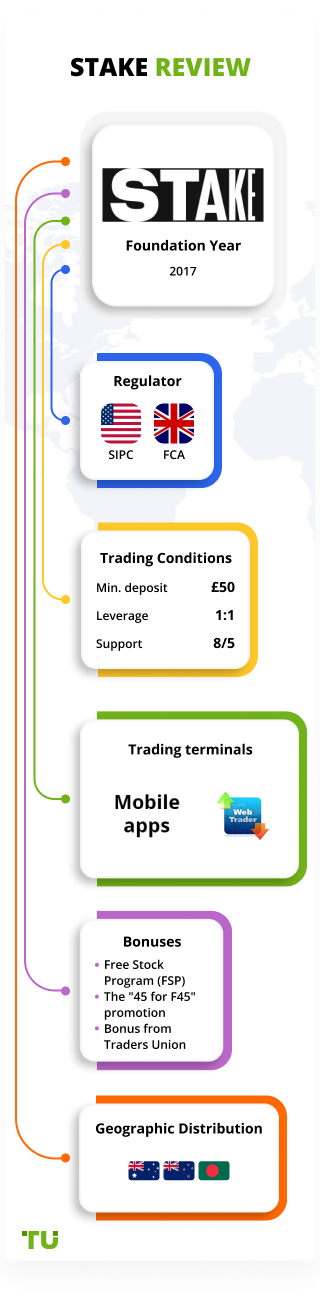

Stake is a moderate-risk broker with the TU Overall Score of 5.02 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Stake clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. Stake ranks 54 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Stake is a broker for investors who are interested in the U.S. stock market but are outside the U.S. and do not need to be trained.

Stake is a broker that has been providing trading services for U.S. securities in the United Kingdom, Australia, New Zealand, and Brazil since 2017. It is regulated by the Financial Conduct Authority (830771) and is licensed for financial services in Australia. Stake offers its clients zero fees on trades in U.S. stocks and ETFs, a convenient and easy-to-use mobile trading app, and investment protection from the FSCS and SIPC. The trading conditions for clients from different countries are similar, but there are slight differences. In this review, the main focus is on the UK branch of Stake.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | From £50 |

| ⚖️ Leverage: | 1:1 |

| 💱 Spread: | Not indicated |

| 🔧 Instruments: | U.S. stocks & ETFs, fractional shares, inverse & leveraged ETFs |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Stake:

- Available minimum deposit size for medium- and long-term strategies.

- Regulation in multiple jurisdictions, including by the FCA.

- Zero trading fees on unlimited trades in stocks, ETFs, and ADRs listed on U.S. exchanges.

- Easy-to-use trading platforms.

- Ability to invest in equities.

- Lightning-fast and fully digital account opening.

- Offers one free stock to every new customer who deposits within 24 hours of account opening.

👎 Disadvantages of Stake:

- Having a GBP to USD (and vice versa) conversion fee for deposits and withdrawals.

- The list of countries whose citizens can become a client of the broker is limited. Registration is not available for U.S. residents.

- There is no online chat and telephone support is not available.

Evaluation of the most influential parameters of Stake

Geographic Distribution of Stake Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Stake

Stake is a newcomer to the stock market, but its reliability is undeniable because it is FCA-regulated and participates in the FSCS scheme. Clearing for it is carried out by the American broker-dealer DriveWealth, which is a member of SIPC and has a FINRA license. Although Stake does not yet have any serious titles and awards, its services are used by more than 330,000 investors from different parts of the world, including Britain and Australia.

The broker does not charge a trading fee but does charge a currency conversion fee. Stake is loyal to newcomers and traders who want to invest in U.S. securities but don't have large sums to do so. The minimum deposit to start trading is just £50. However, for intraday trading, you must have at least $25,000 in your account.

To generate trading ideas, Stake provides ratings of securities from experts of independent analytical resources. However, their assortment is limited and the number available to the user directly depends on the type of account opened: for premium accounts, the set of possibilities is much larger. A significant drawback of the broker is the lack of live chat and phone support.

Dynamics of Stake’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

Stake allows you to invest in U.S. stocks, ETFs and ADRs (American Depositary Receipts) but is focused on investors with placement experience who can build a portfolio of assets themselves. Also, its clients can attract referrals and get bonuses in the form of free trading fees.

Dividends — passive income on the U.S. stock market

Dividends are the profits an investor can receive for the securities he or she has purchased. Dividends are paid by the company whose shares were purchased by the investor. They are accrued based on the distribution of net income, that is, the company's income that was generated after all taxes were paid. Rules for receiving dividends through Stake:

-

U.S. companies pay dividends to shareholders monthly, quarterly, semi-annually, and annually. In personal account, an investor can track not only the amount of income accrued but also the taxes withheld on it.

-

Dividends are paid to the brokerage account 2-3 trading days after the date of accrual.

-

In the U.S., a 30% tax is withheld on dividends. However, Stake clients can reduce it to 15% by filling out Form W-8 when they open their account.

Depending on currency exchange rates or foreign tax changes (for example, due to government regulation), distributions to shareholders may increase or decrease. However, the complete cancellation of dividends is extremely rare, so dividend income can be considered stable.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Stake’s affiliate program:

-

The affiliate program allows active clients to receive remuneration for the trading of the attracted referrals. Affiliate payments are made every month, but their amount is not indicated on the website. The number of referrals is not limited.

Affiliates can participate in company events to increase the number of referrals and develop their content creation skills.

Trading Conditions for Stake Users

Stake offers investment in the most popular U.S. asset classes with zero trading fees after depositing £50 or more. At the same time, the broker does not limit the number of trades. Intraday traders can also trade without restrictions, but with an account balance of $25,000. Stake accepts deposits in pounds from clients from Great Britain but converts them into dollars — the account currency, which allows making transactions on the U.S. exchanges.

£50

Minimum

deposit

1:1

Leverage

8/5

Support

| 💻 Trading platform: | Mobile app, web trading platform (Australia and New Zealand clients only) |

|---|---|

| 📊 Accounts: | Standard Account, Stake Black, Limited Purpose Margin Account (LPMA) |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Bank transfer via Open Banking app |

| 🚀 Minimum deposit: | From £50 |

| ⚖️ Leverage: | 1:1 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No |

| 💱 Spread: | Not indicated |

| 🔧 Instruments: | U.S. stocks & ETFs, fractional shares, inverse & leveraged ETFs |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | BATS Global Markets |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Zero brokerage fees, no desktop terminal |

| 🎁 Contests and bonuses: | Yes |

Stake Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Standard Account | From $5.95 | Yes |

| Stake Black | From $5.95 | Yes |

| Limited Purpose Margin Account | From $5.95 | Yes |

Stock transfer fees: from another broker via ACATS is free of charge; for DTC, it’s $15 per position; to another broker via ACATS, it’s $100; for DTC, it’s $15 per position.

We compared the average fee for trading U.S. stocks of three stockbrokers - Stake, Ally, and Charles Schwab. You can view the results of the study in the table below.

| Broker | Average commission | Level |

| Stake | $5.95 | Medium |

| Charles Schwab | $11 | High |

| Ally Bank | $4 | Low |

Detailed Review of Stake

Stake is a broker that offers direct investment in more than 4,500 U.S. stocks and ETFs without being a U.S. citizen. In addition to stocks listed on the major U.S. exchanges, such as the NYSE and Nasdaq, Stake's clients have access to more than 200 ADRs of global companies traded on the U.S. market.

Stake's success in numbers:

-

More than 4 years in the stock markets.

-

Over 330,000 clients.

-

Registrations in 4 jurisdictions.

Stake is the broker for traders from Australia, Europe, South America, and Oceania who want to invest in U.S. securities

Stake is constantly adding new stocks, ETFs, and ADRs to its list of available assets. In addition, its clients can request securities that are not yet available for trading. However, only Elective Professional Investors — non-retail clients who meet certain criteria set by MiFID II can invest in U.S. ETFs from the U.K. In addition, a new listing can be traded through the broker on the day of its IPO, further attracting professional investors.

All of the broker's clients can make trades in the mobile app. The web platform is currently only available to traders from Australia and New Zealand. The desktop terminal is not provided by Stake. Once registered, traders can improve their security at any time by enabling two-factor authentication with special applications such as Google Authenticator or Authy.

Useful services of Stake:

-

Day trading counter in terminals. It tracks the number of daily trades and notifies the user if he has already made three trades in five days, as well as warns of possible consequences.

-

Trading ideas. Stock ratings are generated by analysts from various research companies.

-

Newsfeed. In terminals, users can view news from third-party news providers, including Bloomberg and CNBC.

Advantages:

The broker offers a wide range of securities listed on U.S. exchanges — more than 4,500 stocks, ETFs and ADRs.

All payments and asset purchases and trades can be made in a mobile app that is compatible with Android and iOS devices.

The company does not withhold trading fees for investing in securities.

The support team responds quickly to email queries and the average response time to a question asked is 10 minutes.

The broker has an affiliate program for passive income.

The number of free trades is not limited. Day trading is allowed but under certain conditions.

How to Start Making Profits — Guide for Traders

Stake offers three types of trading accounts for retail clients: two cash accounts and one margin account with limited capacity. The minimum deposit for all account types is £50. The broker does not currently offer ISA and SIPP accounts, but they are scheduled to launch in 2021.

Account Types:

The broker does not provide a demo account, so new clients do not have the opportunity to practice trading with a virtual deposit. Stake offers non-U.S. residents to trade U.S. securities on favorable terms.

Bonuses Paid by the Broker

Free Stock Program (FSP)

The broker gives one free stock worth up to $150 to new clients who deposit within 24 hours after opening an account. One of the six shares, which are listed on the U.S. stock exchange, is determined at random. To accrue the bonus, funds must be deposited via bank wire transfer through TrueLayer. Most customers receive a share worth less than $10.

The "45 for F45" promotion

The program offers new customers free FXLV (F45 Training Holdings, Inc.) stock worth $45 after depositing via bank wire transfer via TrueLayer. Traders must use promo code F45 when creating a new account. Participation in the "45 for F45" promotion does not cancel the Free Stock Program bonus.

Investment Education Online

There is no tutorial section on Stake's website. There are also no detailed terminal manuals, a dictionary of stock market terms, or their deciphering. General information on trading conditions can be found in the Support section.

The educational information presented on the website may be insufficient to master the basics of stock trading.

Security (Protection for Investors)

Stake is regulated in multiple jurisdictions. The company is registered in the UK as Hellostake Limited (No. 11676409) and regulated by the Financial Conduct Authority (FRN: 830771). In Australia, Stake is an authorized representative of Sanlam Private Wealth Pty Ltd with Australian Financial Services License No. 337927.

Brokerage and execution services in the United States are provided to Stake and its clients by DriveWealth, Llc, a FINRA-registered (CRD#: 165429/SEC#: 8-69161) U.S. broker-dealer that is a member of the Securities Investor Protection Corporation (SIPC). It protects Stake clients who have up to $500,000 (and up to $250,000 in cash) in U.S. securities accounts. Because Stake is an FCA-regulated company, its clients' money is protected by the FSCS for up to £85,000.

👍 Advantages

- SIPC coverage is available to all investors working for the company

- Customers' funds and securities are held at Citibank - one of the largest banks in the world

- Regulatory authorities monitor the broker's compliance with its obligations to clients

👎 Disadvantages

- The ability to deposit and withdraw funds only by bank transfer

- Full verification of personal and payment data is required to open an account

- U.S. traders cannot open an account with a foreign broker to trade U.S. securities

Withdrawal Options and Fees

-

A client of the broker can only withdraw money from their accounts by bank transfer to a local bank account in their name.

-

If the trader's personal bank account is not in U.S. dollars, a conversion fee of 0.5% of the amount (min $2) will be charged if deposited via a direct Stake partner or $5 per transaction if withdrawn using another method.

-

Minimum withdrawal amount: $10.

-

Money will be credited to your bank account within four business days.

-

If there is a suspicion of illegal activity, the broker may block the deposited funds until the circumstances are clarified. In this case, the funds can be inaccessible for withdrawal within 60 days from the date of deposit.

Customer Support Service

Support representatives answer clients' questions by email and only during Stake's business hours.

👍 Advantages

- In-depth and crystal clear responses

- Prompt response time

👎 Disadvantages

- There is no live chat

- Inability to reach out to the support team via phone

- Support is available during company business hours

You can use the following methods to contact email support:

-

Send an email to uksupport@hellostake.com;

-

Click Ask Us in the mobile app or at the bottom of the Support section of the official website.

-

You can also contact support via Stake’s Instagram and LinkedIn social media profiles or Facebook and Twitter messengers.

Contacts

| Foundation date | 2017 |

| Registration address | 85 Great Portland Street, London, W1W 7LT |

| Regulation |

SIPC, FCA, FSCS |

| Official site | https://hellostake.com/ |

| Contacts |

Email:

support@hellostake.com,

|

Review of the Personal Cabinet of Stake

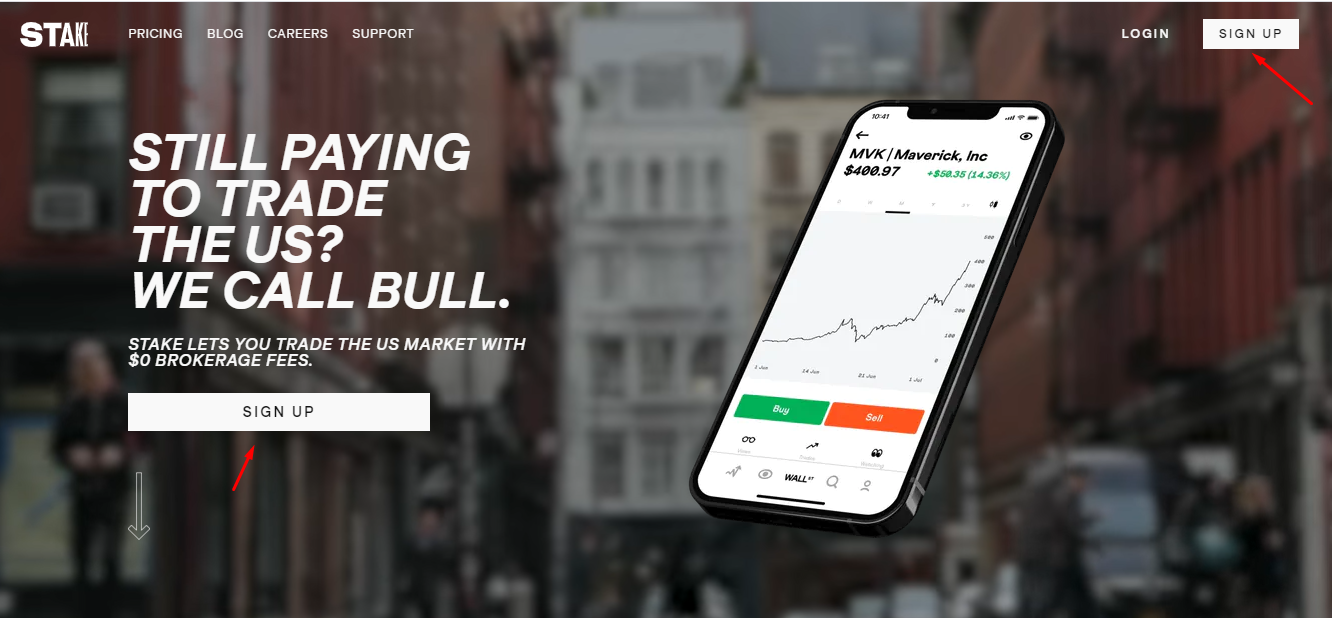

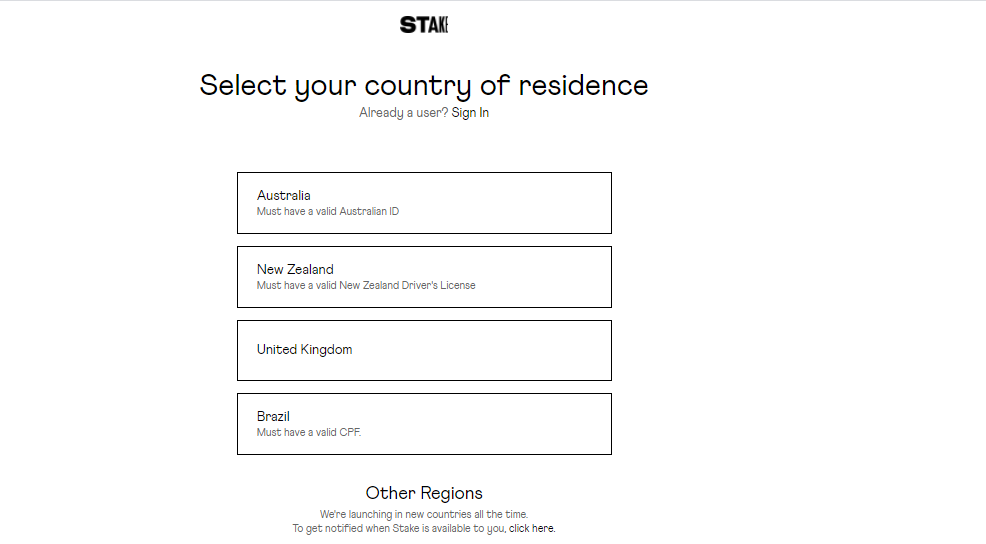

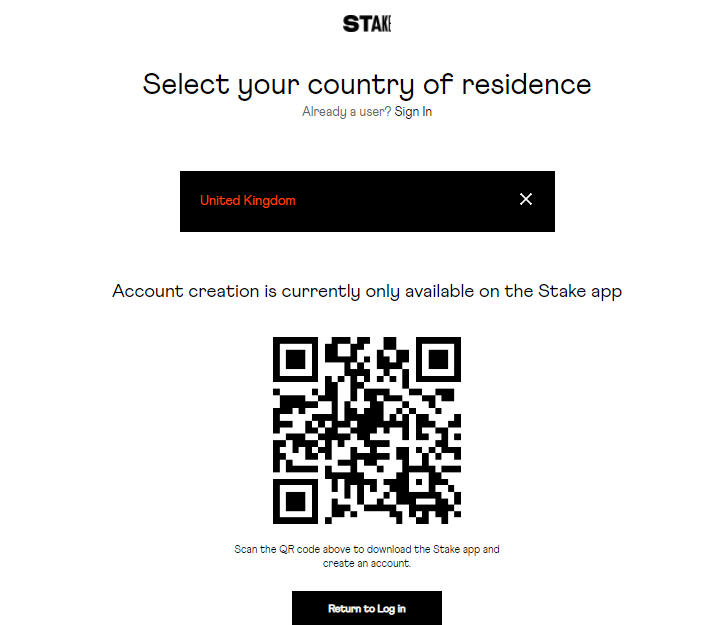

Currently, Australians and New Zealanders can open an account at Stake, and citizens of Great Britain and Brazil can only register via the mobile app. Here is a quick guide on how to set up a Live Account on the Mobile App:

Go to the broker's official website and click Sign Up on its home page.

Select your country of residence:

Follow the on-screen instructions to install the app. Or download the Stake mobile app directly from the Google Play Store or App Store:

Fill in the application to open a brokerage account. You will need to provide your personal information, national insurance, and ID card numbers, and your personal bank account details.

In Stake's personal office, the trader can perform the following actions:

1. Place orders.

2. Tracking price movements.

3. Search for investment instruments by asset name, ticker symbol, and keyword.

1. Place orders.

2. Tracking price movements.

3. Search for investment instruments by asset name, ticker symbol, and keyword.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the Stake rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Stake you need to go to the broker's profile.

How to leave a review about Stake on the Traders Union website?

To leave a review about Stake, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Stake on a non-Traders Union client?

Anyone can leave feedback about Stake on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.