deposit:

- $1

Trading platform:

- WebTrader

- Schwab Mobile

- StreetSmart Edge

- US Securities and Exchange Commission (SEC)

- Financial Services Regulatory Authority (FINRA)

Charles Schwab Review 2025

deposit:

- $1

Trading platform:

- WebTrader

- Schwab Mobile

- StreetSmart Edge

- 1:2 subject to payment of interest on completion of related transactions

- Possibility of purchasing fractional shares within one of proposed investment programs

Summary of Charles Schwab Trading Company

Charles Schwab is a reliable broker with the TU Overall Score of 7.15 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Charles Schwab clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews showed that the broker’s clients are mostly satisfied with the company. Charles Schwab ranks 12 among 149 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Charles Schwab is a real catch for active trading in the American and international securities markets for both beginners and experienced traders.

Charles Schwab is one of the largest companies in the US financial services market. It was founded in 1971 and the main office is located in San Francisco. This broker specializes in banking and brokerage services. A special electronic trading platform has been created for traders and investors. There are no fees for opening and maintaining an account, and there are no minimum deposit requirements. A vast array of built-in tools are available for work: stocks, options, ETFs, bonds, mutual funds, futures, insurance contracts (annuities), and various monetary funds.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | From $1 |

| ⚖️ Leverage: | 1:2 subject to payment of interest on completion of related transactions |

| 💱 Spread: | Brokerage fee from 0 to 1.5 dollars per contract |

| 🔧 Instruments: | Stocks, options, ETFs, bonds, mutual funds, futures,insurance contracts (annuities), and various monetary funds |

| 💹 Margin Call / Stop Out: | No |

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

👍 Advantages of trading with Charles Schwab:

- No minimum deposit is required.

- Working with trading instruments is possible in several ways: via the StreetSmart desktop terminal, a PC browser, and a mobile application.

- Customer support is available 24/7 via online chat.

👎 Disadvantages of Charles Schwab:

- There is no demo account.

- No access to the foreign exchange market.

- Withdrawals are in US dollars only and money is not converted into any other national currency.

Evaluation of the most influential parameters of Charles Schwab

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Charles Schwab

Analysis of Charles Schwab broker’s conditions and its website showed that the company is equally focused on active online trading and investment. You can start on the stock market with a zero deposit, besides, it has its training program, so the broker is a real catch for newbies. The support service is available around the clock.

The Charles Schwab broker offers a slightly different approach to margin trading. Instead of leverage, the size of which is calculated concerning the deposit, a margin lending system is applied. Hence, the client takes out a loan to buy securities and upon completion of the related transactions pays the broker interest at a rate of 8%.

For instance, a client buys shares for $5,000, which allows him to buy the same amount on a loan. After the sale of these securities, he is obliged to repay Charles Schwab a loan of $5,000 + 8% ($400). A trader's net profit is the funds remaining after the sale of assets minus payment of brokerage fees and taxes.

Dynamics of Charles Schwab’s popularity among

Traders Union’s traders, according to 2024 data

Investment Programs, Available Markets, and Products of the Broker

The broker offers mutual funds, exchange-traded (ETF), cash funds, and a special program Schwab Stock Slices for medium and long-term investments. Thus, you can choose a suitable strategy and diversify risks.

Schwab Stock Slices — fractional stock investment portfolios

Participation in Schwab Stock Slices allows any client to purchase a stake in one of the companies whose shares are included in the S&P 500. The size of the minimum investment is $5, even if one share of the company itself is more expensive — it’s the main difference between the offer and the usual purchase of security. Thus, Schwab Stock Slices is micro-share trading. Other features of this program are:

-

The ability to purchase a security in parts of the value per share, a portfolio of various securities.

-

There is no broker commission for basic types of transactions.

-

The portfolio can include fractional shares of 30 different assets.

On schwab.com, clients can actively trade or enjoy passive investment. It is also possible to combine both strategies and thus diversify risks: invest part of the funds in safe stable assets and receive percentage of income; and send the other part of the capital to active trading in more profitable and risky instruments.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Charles Schwab’s affiliate program:

-

Referrals — A trader can join the referrals program by opening a bonus account using the link of an active client of the company and depositing $1000 or more within 45 days, and receive up to $500 on the balance once.

Charles Schwab customers can invite friends and family to the company through referral links. However, there is no monetary reward for those who post the link. Only new clients receive money if the terms of the program are met.

Trading Conditions for Charles Schwab Users

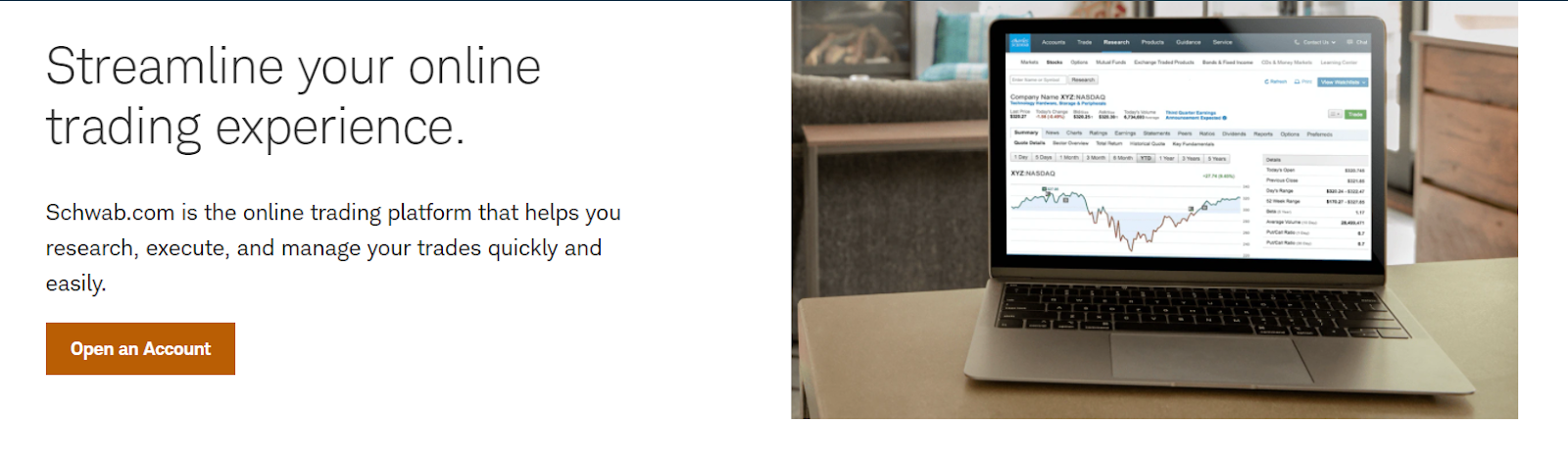

Charles Schwab offers its traders and investors a superb StreetSmart trading platform. Trading is possible through the company's web terminal, in the mobile application, and using the desktop version. Opening an account is available from $1 with no additional service fees. No brokerage fee is charged for US stocks (except for high volume, difficult to execute contracts).

$1

Minimum

deposit

1:2

Leverage

24/7

Support

| 💻 Trading platform: | StreetSmart Edge, Schwab Mobile, Web Trader |

|---|---|

| 📊 Accounts: | Standard brokerage, pension brokerage, investment with the possibility of automated portfolio management |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Bank Transfer, Visa, Mastercard, Check, Walmart and Western Union money transfer |

| 🚀 Minimum deposit: | From $1 |

| ⚖️ Leverage: | 1:2 subject to payment of interest on completion of related transactions |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | $1 or a fractional share of a bond worth from $5 |

| 💱 Spread: | Brokerage fee from 0 to 1.5 dollars per contract |

| 🔧 Instruments: | Stocks, options, ETFs, bonds, mutual funds, futures,insurance contracts (annuities), and various monetary funds |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | Not indicated |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | No |

| ⭐ Trading features: | Possibility of purchasing fractional shares within one of proposed investment programs |

| 🎁 Contests and bonuses: | Welcome bonus from to $100 up to $500 |

Charles Schwab Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Standard brokerage | From $1.5 | Yes |

| Pension brokerage | From $1.5 | Yes |

| Investment | From $30 | Yes |

Swap commissions are not provided for the assets offered by the broker. Our analysts have compared the size of the average spread for all types of accounts of various companies. Below is a comparison chart of Charles Schwab's and popular brokers’ trading fees.

Detailed Review of Charles Schwab

Charles Schwab is one of the oldest brokers in the US financial services market. The company offers its clients fairly loyal trading conditions, as well as free analytics of its experts and third-party specialists. The site has a separate news section. News reports are also available in the trading terminal and through the personal account for registered users. It also contains a large variety of reviews, trading, and investment tips.

Mind-blowing information regarding Charles Schwab in numbers:

-

More than 10 million registered clients.

-

More than 335 branches in the USA, London, and Puerto Rico.

-

More than 4,000 zero-entry funds are available to investors.

Charles Schwab is a regulated broker for traders and investors which allows you to start trading with a minimal investment.

There’s a zero-entry deposit when opening a brokerage account for trading on the stock exchange. Also, there is no maintenance fee. In most cases, no brokerage fee is charged for transactions in US stocks. If we are talking about investing, then it is possible to buy equity shares, starting from $5. With an investment of $1500 or more. The broker makes it possible to form an investment portfolio, which can include up to 30 different securities. A large number of zero-entry investment funds are also offered. StreetSmart trading terminal and its mobile version for all types of accounts are available for free. Investment product consulting costs start as little as $30 per month.

Another crucial broker’s advantage is the ability of traders to use the materials of the company's training center for free with registration in the system. The convenient division into thematic blocks makes the process of acquiring new knowledge convenient and intuitive even for beginners.

Useful services of Charles Schwab:

-

Daily analytics.

-

Expert materials are available to traders and investors free of charge.

-

Schwab Intelligent Portfolios is a special robot-advisor that helps you to create a diversified portfolio following the parameters set by the investor.

-

Tax Center. Based on the information from the section, the client of the company can perform the necessary tax calculations.

Advantages:

You can start trading on the stock exchange with a zero-entry deposit

There are no fees for maintaining accounts.

Investing is possible.

With a minimum amount of money, you can buy fractional shares of $5 or more.

In addition to working through the StreetSmart desktop and mobile platform, the entire volume of trading operations can be performed through the web terminal and in the personal account on the website.

There is a separate news section, which allows you to receive all the necessary information without searching for it on third-party platforms.

24/7 online support is available via chat on the website or through the trading terminal.

There are no rigid frameworks for traders. You can choose any strategy and timeframe (intraday, medium-term, or long-term trading).

How to Start Making Profits — Guide for Traders

Charles Schwab offers three types of accounts for investment and active trading. Two of them are designed for traders with retirement planning options. The investment account is intended for passive placement of funds.

Account types:

The broker does not have a demo account.

Charles Schwab is suitable for traders and investors at all levels. You can start working in the financial markets here with a minimum investment.

Bonuses Paid by the Broker

Welcome bonus

Accrual of $100-500 when opening a brokerage or retirement account at the invitation of a current client of the company.

Investment Education Online

For training beginners, a special section has been created on schwab.com. It’s the Knowledge Center. Here are the tips of the company's analysts on various aspects of trading and investing, broken down into separate blocks.

There is no opportunity to consolidate the acquired knowledge and practice because this broker does not have a demo account.

Security (Protection for Investors)

The official regulator of schwab.com is the SEC — the US Securities and Exchange Commission (801-29938). The broker is a member of FINRA, the Financial Services Regulatory Authority for the enforcement of trading rules in the securities markets.

In the event of the bankruptcy of Charles Schwab brokerage, the accounts of clients of the company are insured by the SIPC (Securities Investor Protection Corporation) for up to $500,000. If the SIPC limits are depleted, Lloyd's of London will cover the costs of traders and investors in the total amount of up to $600 million.

👍 Advantages

- Reputation of a reliable company with a 50-year history of working in financial markets

- Payment of compensation to customers in case of financial insolvency of the company

- You can file a complaint against a broker with a government regulator

👎 Disadvantages

- Regulated in accordance with the US legal framework — possible difficulties with the consideration of complaints from customers from other countries

- It’s impossible to open an account without providing documents

- The services can be used by traders from a limited list of countries

Withdrawal Options and Fees

-

Withdrawals are carried out only in USD without converting the funds into the client's national currency.

-

The broker does not charge a withdrawal fee, but there is a payment system fee.

-

Withdrawals are available to Visa and Mastercard bank cards, via bank transfer, and through Walmart and Western Union systems.

Customer Support Service

You can contact support specialists for help 24/7.

👍 Advantages

- Availability of online chat

- You can contact by phone

👎 Disadvantages

- Support languages: English, Chinese, Vietnamese and Japanese

- You cannot send a question to email

There are several ways to contact support:

-

via 24/7 online chat;

-

by phones from the "Contact Us" section;

-

with the help of a personal visit to the office of one of the broker's branches;

-

by sending a letter by regular mail.

Remote support options are available both through the broker's website and in your account.

Contacts

| Foundation date | 1971 |

| Registration address | 211 Main St, San Francisco, CA 94105, USA |

| Regulation |

US Securities and Exchange Commission (SEC), Financial Services Regulatory Authority (FINRA) |

| Official site | schwab.com |

| Contacts |

Phone:

800-435-4000

|

Review of the Personal Cabinet of Charles Schwab

You need to open a trading account and create a personal account to start trading on the stock exchange with Charles Schwab, The algorithm of actions is as follows:

Go to schwab.com and select your country of residence from the list. Click the "Open an Account" button, then the "Brokerage services" type:

Fill out the registration form and enter your passport and contact information, social security number, address, and telephone number of your manager, if you are employed. After that, you must provide scanned copies of documents for verification.

The following set of functions is available in your account:

1. Real-time charts and quotes for selected instruments:

2. Access to the web terminal for concluding deals and placing orders:

1. Real-time charts and quotes for selected instruments:

2. Access to the web terminal for concluding deals and placing orders:

The following services are available to traders and investors:

-

Deposit replenishment and withdrawal of funds.

-

Assessment of the potential of instruments based on a custom filter with a set of criteria.

-

Analytics from Charles Schwab experts.

-

Section with news summaries.

-

24/7 support.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the Charles Schwab rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Charles Schwab you need to go to the broker's profile.

How to leave a review about Charles Schwab on the Traders Union website?

To leave a review about Charles Schwab, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Charles Schwab on a non-Traders Union client?

Anyone can leave feedback about Charles Schwab on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

Via eOption's secure website.

Via Wealthsimple's secure website.