deposit:

- from $10 000

Trading platform:

- CQG

- CTS T4

- Blue Trading System

- Onixs directConnect

- ProOpticus

- Stellar Trading System

- Valdi Futures Trader

- Trading Technologies

- Metro Trading Platform

- NFA

- CFTC

- and FINRA

Advantage Futures Review 2024

deposit:

- from $10 000

Trading platform:

- CQG

- CTS T4

- Blue Trading System

- Onixs directConnect

- ProOpticus

- Stellar Trading System

- Valdi Futures Trader

- Trading Technologies

- Metro Trading Platform

- Margin trading is available

- Clients get direct access to such exchanges such as: CME Group, Eurex, ICE Futures Europe, ICE FUTURES U.S., MGEX, CBOE Futures Exchange, Monreal Exchange

Summary of Advantage Futures Trading Company

Advantage Futures is a moderate-risk broker with the TU Overall Score of 5.77 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Advantage Futures clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. Advantage Futures ranks 35 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Advantage Futures is a broker for active participants in the futures markets, and trading conditions are suitable for traders with different levels of expertise.

The Advantage Futures broker (Advantage Futures) is an American brokerage that began its operations in 2003. The company is regulated by three independent bodies: the US National Futures Association (NFA 327359), the US Financial Industry Regulatory Authority (FINRA 39362), and the US Commodity Futures Trading Commission (CFTC). Advantage Futures specializes in futures trading and provides traders with direct access to seven exchanges for derivatives. Experience in trading in the futures market is not obligatory, the broker offers trading platforms for different clients’ needs, and the support service will help each client individually to choose the appropriate options.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | $10,000 |

| ⚖️ Leverage: | Margin trading is available |

| 💱 Spread: | From $0.7 up to $0.99 |

| 🔧 Instruments: | Stock futures, indices, metals, energy, agricultural products, and foreign currencies |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Advantage Futures:

- The broker allows you to kick the tires and get acquainted with trading conditions using a demo account.

- A trader can choose accounts with different forms of ownership.

- The company offers a lightning-fast execution of transactions, so trading at Advantage Futures is suitable for scalpers.

- The company offers low fees, which decreases further with increasing trading volumes.

- Providing traders with direct access to derivatives exchanges.

- Keeping clients’ funds in segregated accounts.

- A vast array of trading platforms for different clients’ needs.

👎 Disadvantages of Advantage Futures:

- Bonuses for trading in the company but contests are not provided.

- High level of minimum deposit.

- The company's clients do not have access to replenishment and withdrawal of funds through electronic payment systems.

Evaluation of the most influential parameters of Advantage Futures

Table of Contents

- Geographic Distribution

- Latest Comments

- Expert Review

- Latest Advantage Futures News

- Analysis of Advantage Futures

- Dynamics of the Popularity

- Investment Programs

- Trading Conditions

- Commissions & Fees

- Detailed Review

- Client Area of Advantage Futures

- User Reviews of Advantage Futures

- FAQs

- TU Recommends

Geographic Distribution of Advantage Futures Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Advantage Futures

Advantage Futures (Advantage Futures LLC) is a broker that specializes in futures trading. The company is suitable for traders with different needs: such as new market participants, professional traders, algorithmic trading, etc. The minimum deposit in the company is pretty high — of $10,000. To register, a user needs to fill out a short online questionnaire accompanied by a specified package of documents that must be sent by snail mail to Advantage Futures address a specified package of documents. A resident of any country can open an account with this broker.

The broker provides its clients with direct access to derivatives exchanges, including CME Group, Eurex, ICE Futures Europe, ICE Futures U.S., MGEX, and others. The broker also offers accounts with different forms of ownership and 9 nine trading platforms adapted to the different needs of traders. The use of advanced technologies in the creation of the trading infrastructure has given the broker the advantage of low latency, high speed of order execution, and data centers guarantee the continuity of the trading process and disaster recovery.

The disadvantages of the broker include a high level of the minimum deposit, a long procedure for opening an account, and the absence of electronic payment systems through which traders could replenish a trading account and withdraw earned funds.

Dynamics of Advantage Futures’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

Advantage Futures offers optimal trading conditions for active futures traders. For this reason, services for copying transactions, trading robots, other methods of automatic trading, and receiving passive income are not available for traders here.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Affiliate program from Advantage Futures:

There is also no opportunity to generate income for referring new clients to Advantage Futures LLC. Instead, the broker provides traders with the opportunity to open a special trading account —called Introduced Account. Thus, the account holder becomes an intermediary to the broker, gets the right to provide financial services, and receives interest for his activities.

Trading Conditions for Advantage Futures Users

Advantage Futures LLC specializes in futures trading and offers clients from all over the world favorable conditions for trading. The broker provides its clients with direct access to European, American, and international derivatives exchanges, including CME Group, MGEX, Eurex, and others. The minimum fee to start working with a broker is $10,000, regardless of the form of account ownership. There are only two ways to fund your trading account: by bank transfer and by check. A charged fee per contract starts at $0.99 and goes down to $0.07, as the monthly trading volume increases. There are no trading bonuses, as well as contests among traders. Nor is there a welcome bonus.

from $10 000

Minimum

deposit

1:1

Leverage

24/7

Support

| 💻 Trading platform: | Blue Trading System, CTS T4, CQG, Onixs directConnect, ProOpticus, Stellar Trading System, Valdi Futures Trader, Trading Technologies, Metro Trading Platform |

|---|---|

| 📊 Accounts: | Individual Account (U.S. Citizencitizens), Individual Account (Non U.S.non-U.S. Citizencitizens), Corporate Account (U.S. Citizencitizens), Corporate Account (Non U.S.non-U.S. Citizencitizens), Account (U.S. Citizencitizens), LLC Account (Non U.S.non-U.S. Citizencitizens), Partnership Account (U.S. Citizencitizens), Partnership Account (Non U.S.non-U.S. Citizencitizens), Trust Account, Introduced Account, Managed Account |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Bank transfer and check |

| 🚀 Minimum deposit: | $10,000 |

| ⚖️ Leverage: | Margin trading is available |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | Not indicated |

| 💱 Spread: | From $0.7 up to $0.99 |

| 🔧 Instruments: | Stock futures, indices, metals, energy, agricultural products, and foreign currencies |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | None, the broker cooperates with futures exchanges directly |

| 📱 Mobile trading: | Depends on the trading platform which that the trader uses |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Clients get direct access to such exchanges such as: CME Group, Eurex, ICE Futures Europe, ICE FUTURES U.S., MGEX, CBOE Futures Exchange, Monreal Exchange |

| 🎁 Contests and bonuses: | No |

Advantage Futures Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Individual Account (U.S. Citizencitizens) | From $0.99 per contract | No |

| Individual Account (Non U.S.non-U.S. Citizencitizens) | From $0.99 per contract | No |

| Corporate Account (U.S. Citizencitizens) | From $0.99 per contract | No |

| Corporate Account (Non U.S.non-U.S. Citizencitizens) | From $0.99 per contract | No |

| LLC Account (U.S. Citizencitizens) | From $0.99 per contract | No |

| LLC Account (Non U.S.non-U.S. Citizencitizens) | From $0.99 per contract | No |

| Partnership Account (U.S. Citizencitizens) | From $0.99 per contract | No |

| Partnership Account (Non U.S.non-U.S. Citizencitizens) | From $0.7 per contract | No |

| Trust Account | From $0.7 per contract | No |

| Introduced Account | From $0.7 per contract | No |

| Managed Account | From $0.7 per contract | No |

There is no fee for account replenishment, account maintenance, and or other non-trading operations. We compared the fees at Advantage Futures with those that Charles Schwab and Ally charge. As a result of the comparison, each broker was assigned a low, medium, or high medium commission level.

| Broker | Average commission | Level |

| Advantage Futures | $11 | High |

| Charles Schwab | $11 | Medium |

| Ally Bank | $4 | Low |

Detailed Review of Advantage Futures

Advantage Futures LLC is a broker that cooperates with traders from all over the world and offers favorable conditions for futures trading. The company provides clients with direct access to derivatives exchanges and offers futures for foreign currencies, energy, stocks, options, etc., as instruments. Fees for contracts in the company are low, and when the trading volume increases, the fee is further reduced.

Advantage Futures in numbers:

-

The company began providing financial services in 2003.

-

The broker serves clients from 61 countries.

-

$0.07 is the minimum fee per contract, $0.99 is the maximum fee.

-

The broker cooperates with 17 clearing centers.

-

The company's clients have access to the markets 24 hours a day.

-

In 2020, the company processed over 213 million contracts.

Advantage Futures is a broker for active market participants who trade futures

Advantage Futures LLC provides its clients with accounts for personal use or joint trading, as well as access to American, European, and international derivatives exchanges. Among the instruments available to traders are stock futures, indices, agricultural commodities, energy, metals, etc. Investment programs, PAMM accounts, copying services, referral programs, and other ways to generate passive income in the company are absent. However, traders can open a managed trading account and provide management of their capital to a trusted manager, it is also possible to open a representative account, which is issued only for a company, not for an individual.

The broker offers traders a choice of 9 nine trading platforms, including platforms for professional participants in the futures markets, as well as for corporate trading, algorithmic trading, and options trading.

Useful Advantage Futures Services:

-

News & Events. This section contains information about news and developments in the field of futures trading, reviews and announcements of seminars, information about updates in the Advantage Futures company.

-

Server Colocation. Broker's clients can host their servers at Advantage Futures LLC datacenters. This feature gives traders an advantage by allowing automated trading systems.

-

Commissions Calculator. This service allows a trader to calculate the size of the commission for trading in a company, using data on the number of contracts that he concluded during the month.

Advantages:

The trader can choose accounts with shared access or for personal use.

The use of ground-breaking technology and redundant data processing centers ensures the accuracy and lightning-fast speed of execution of transactions.

The company provides traders with direct access to derivatives exchanges.

Clients' money is kept in segregated accounts.

All training materials are publicly available, the company periodically conducts free online seminars.

How to Start Making Profits — Guide for Traders

The broker provides clients with trading accounts with the same trading conditions, but different forms of ownership. Also, Advantage Futures offers different accounts for US residents and residents of other countries.

Account types:

To check the broker's trading conditions, as well as your skills in trading futures assets, Advantage Futures LLC offers to use a virtual account. To open it, contact the broker's representatives.

Bonuses Paid by the Broker

Advantage Futures is focused on providing favorable conditions for active trading and does not provide its clients with the opportunity to receive financial and other bonuses for performing trading and non-trading operations.

Investment Education Online

Cooperation with Advantage Futures assumes not only high-quality service and favorable trading conditions, but the broker also provides its clients with educational materials so that they can improve their professionalism and achieve greater success in futures trading.

The broker allows traders to test trading conditions and try out trading strategies without financial risks on a virtual account. To open it, contact the company's employees.

Security (Protection for Investors)

This broker is a subsidiary of Advantage Financial. Advantage Futures is registered in the industry in the United States). As a partner of these regulatory bodies, the broker of the CFTC (US Commodity Futures Trading Commission), NFA (National Futures Association), and FINRA (the Financial Industry Regulatory Authority) duly fulfilled its obligations to them the regulatory agencies, as well as to its clients). The broker does not cooperate with compensation funds, therefore, in the event of the bankruptcy of Advantage Futures, there are no financial payments to traders.

Well-developed trade infrastructure and a high-tech approach are responsible for the smooth processing of data and the security of the personal data of customers.

👍 Advantages

- The company is overseen by three independent bodies regulatory agencies:: NFA, CFTC, and FINRA

- Client funds are not available to the broker as they are kept in separate, segregated accounts

👎 Disadvantages

- Broker doesn’t cooperate with compensation funds

Withdrawal Options and Fees

-

To fund a trading account and withdraw funds, the broker offers two methods: bank transfer and check. Advantage Futures LLC accepts personal checks, cash, and bank checks.

-

Advantage Futures does not provide information on how quickly funds will be credited to the trading account or to the trader's personal account (when withdrawing funds).

-

The broker does not charge clients a fee for financial transactions,; however, the a trading fee may be charged by the bank the trader uses to make the transfer.

Customer Support Service

The broker supports its clients both during the trading process and during the opening of a trading account. If the user has any difficulties or questions, he can always reach out to the support service.

👍 Advantages

- The company offers different phone numbers for solving technical problems, executing transactions through the phone, and questions about transactions

- 24/7 support

👎 Disadvantages

- Few ways to reach out to the sSupport: no callback function, no online chat, no feedback form

Available communication channels with customer support specialists include:

-

write an email to the company;

-

call one of the numbers indicated in the S"Support" section.

The broker's representatives are also on social networks and messengers: such as Twitter, Facebook, Instagram, and LinkedIn.

Contacts

| Foundation date | 1983 |

| Registration address | 231 S. Lasalle St. Suite 1400 Chicago, IL. 60604 |

| Regulation |

NFA, CFTC, and FINRA |

| Official site | advantagefutures.com |

| Contacts |

Email:

contactus@advantagefutures.com,

|

Review of the Personal Cabinet of Advantage Futures

You can start trading with Advantage Futures and take advantage of the company's benefits after opening a trading account. To do this, follow these quick instructions:

Go to the broker's official website. On the main page, on the right side of the screen, you will see the "Open an account" button. To open a trading account, click on it.

To register, click on the "Go" button under the "Download the documents" label.

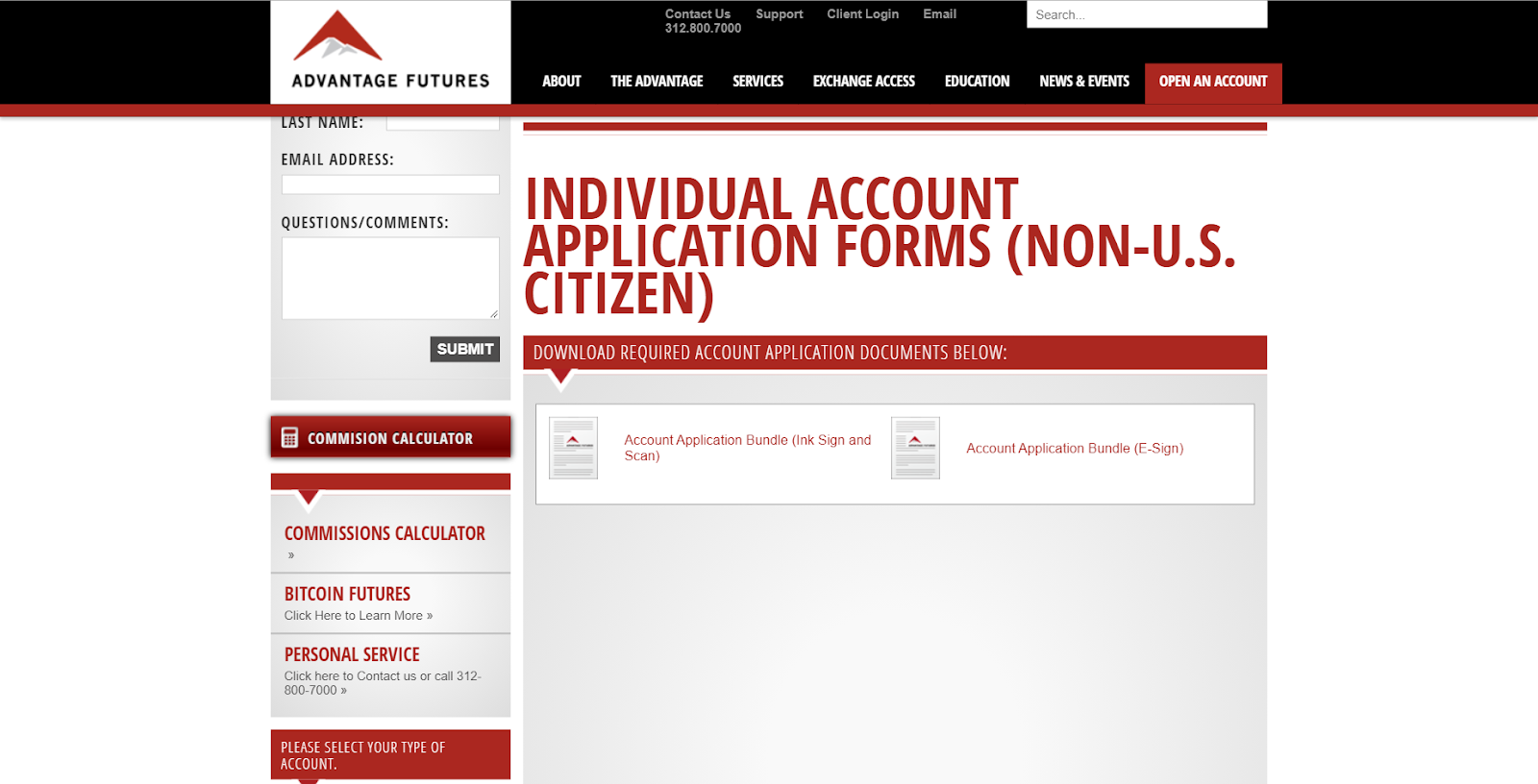

To register, you must send documents by mail to the specified address or by fax, but the broker indicates that some documents are not accepted by fax. Also on this page, you need to select the type of desired trading account.

After selecting the type of account, a page with two or more documents will open, in which the broker indicates which documents must be sent to open an account.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the Advantage Futures rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Advantage Futures you need to go to the broker's profile.

How to leave a review about Advantage Futures on the Traders Union website?

To leave a review about Advantage Futures, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Advantage Futures on a non-Traders Union client?

Anyone can leave feedback about Advantage Futures on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.