deposit:

- $1

Trading platform:

- Fututrade

Moomoo Review 2024

deposit:

- $1

Trading platform:

- Fututrade

- 1:2 for long-term leverage, 1:1.67 for short-term leverage

- Access to margin trading opens when depositing funds starting from $2,500

Summary of Moomoo Trading Company

Moomoo is a moderate-risk broker with the TU Overall Score of 5.71 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Moomoo clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. Moomoo ranks 36 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Moomoo is a trading and investment broker aimed at beginners and experienced investors as well as traders who rely on technical analysis.

Moomoo (moomoo.com) is a California-based broker-dealer and a member of FINRA, SIPC, DTCC, OSS, and NASDAQ. Moomoo Inc. was established in 2018 and is a subsidiary of Futu Holdings Ltd., which is registered with the SEC (0001667858). Moomoo is a member of the LSE and SGX, and is licensed by MAS. The broker offers an intuitive trading platform with professional fundamental and technical analysis tools, as well as interest-free trading in US stocks, ADRs, ETFs, and options. For experienced traders, the platform provides a customizable news feed with audible alerts that allow you to quickly respond to market changes. Users have access to quotations on the exchanges of the USA, China, Hong Kong, and Forex markets. They also have enhanced possibilities for building both standard charts (bars, hollow, full candlesticks, and lines) and multi-charts, including VWAP with different time frames.

| 💰 Account currency: | USD, SGD, HKD |

|---|---|

| 🚀 Minimum deposit: | from 1 USD |

| ⚖️ Leverage: | 1:2 for long-term leverage, 1:1.67 for short-term leverage |

| 💱 Spread: | absent |

| 🔧 Instruments: | Shares, options, ETFs, ADRs |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Moomoo:

- No commission when trading stocks, ETFs, options, and US ADRs.

- Analytical tools include third-party analyst ratings, graphical financial reports, and various charts with over 50 technical indicators.

- No minimum deposit required to open an account.

- All accounts open through a mobile application.

- Active trading community with over 100,000 users.

👎 Disadvantages of Moomoo:

- No chat and phone support.

- Limited investment opportunities. You cannot use cryptocurrency, mutual funds, or bonds.

- Withdrawal of funds only via bank transfer and АСН.

Evaluation of the most influential parameters of Moomoo

Geographic Distribution of Moomoo Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Moomoo

The Moomoo broker only allows open margin trading. The process is completely digital and does not require a minimum deposit. Account verification takes one business day. Having $2,500 on the account allows the client to qualify for opening a margin loan at the cost of securities on the accounts.

If the equity in the investor’s account falls below the requirements set by Moomoo, the broker can sell securities and other assets in any of the user’s accounts to cover the margin deficit. The client neither has the ability to choose which of his assets will be sold nor to extend the timing of the margin requirements. Users of the Moomoo brokerage company have access to second-level market data. They have access to stock quotations (NYSE, Nasdaq), data on transactions made on the exchange in real-time, and more than 50 technical indicators.

The main disadvantages of Moomoo are that clients cannot open joint, corporate, and custodial accounts. There is also no way to trade futures or cryptocurrencies. Deposits and withdrawals are only possible using a bank account and using the ACH. The customer can only contact support by email. In some cases, they have to wait for a response for several days.

Dynamics of Moomoo’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

Moomoo’s clients can invest their funds in over 5,000 stocks, municipal, corporate, and US Treasury bonds, options, ETFs, and ADRs.

Exchange-traded funds (ETFs) and investments at Moomoo

Moomoo users have the option to invest in ETFs. The broker allows you to use different types of ETFs for income generation, speculation, price increases, hedging, or partial risk recovery. Commodity ETFs, Currency ETFs, and Bond ETFs are available to investors. Features of ETF trading on Moomoo are:

-

You can track geographic, industry, commodity, and other ETF parameters.

-

You can set market, limit, and stop orders.

-

ETF trading is carried out without charging a brokerage commission.

-

You can customize and save screeners for ETFs.

-

You can manage the account from any device.

-

24/7 trading on market days.

ETFs are open-ended investment funds that are listed on stock exchanges. They are also trading instruments.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Moomoo’s affiliation program

At the moment, the broker does not offer affiliate programs to users.

Trading Conditions for Moomoo Users

Moomoo allows you to trade stocks, ETFs, and options. The broker does not charge a fee for opening a brokerage account. It allows clients to trade on margin with leverage from 1:1.67 to 1:2.

$1

Minimum

deposit

1:2

Leverage

24/5

Support

| 💻 Trading platform: | Fututrade |

|---|---|

| 📊 Accounts: | Demo, individual margin |

| 💰 Account currency: | USD, SGD, HKD |

| 💵 Replenishment / Withdrawal: | Bank account, АСН |

| 🚀 Minimum deposit: | from 1 USD |

| ⚖️ Leverage: | 1:2 for long-term leverage, 1:1.67 for short-term leverage |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No data |

| 💱 Spread: | absent |

| 🔧 Instruments: | Shares, options, ETFs, ADRs |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Access to margin trading opens when depositing funds starting from $2,500 |

| 🎁 Contests and bonuses: | available |

Moomoo Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Individual Margin Account | 6.8% | Yes |

We compared the trading fees of moomoo.com with those of other popular brokers.

| Broker | Average commission | Level |

| Moomoo | $0.04 | Low |

| Charles Schwab | $11 | High |

| Ally Bank | $4 | Medium |

Detailed Review of Moomoo

Moomoo allows its clients to trade shares and ETFs using margin accounts even before a deposit is made to an open account.

Moomoo advantages by the numbers:

-

You can trade US shares, options, and ETFs with a $0 / 0% commission.

-

Insurance coverage for clients is up to USD 500,000.

-

Its trading community has over 100,000 users.

Moomoo is a broker for experienced investors who use a variety of analytical tools that are not easy for beginners to understand.

Moomoo is a broker that allows you to trade American, Chinese, and Hong Kong stocks, options, and ETFs. Clients gain access to NYSE Arcabook, NYSE Open book, and Nasdaq Total View Level 2 quotes. You can open up to 40 different orders at the same time.

The Moomoo platform is available in desktop and mobile versions. It is compatible with Windows and Mac operating systems, as well as Android and iOS mobile operating systems. Synchronization of the platform on various devices provides the user with mobility, allows trading both at home and while moving around the city or when in the countryside.

Moomoo useful services:

-

Option Analysis. An optional profit-and-loss charting tool that allows the user to combine charts and make forecasts for options execution.

-

Single Moomoo. A tool that allows you to build a diagram of the major situation in the options market to determine the maximum and minimum losses and the break-even point.

-

Futu Bull. A set of customizable technical indicators that an investor can use to analyze current market trends.

-

Indicators. There are MACD and RSI oscillators, Bollinger bands, moving averages, and cash flow indices, etc.

-

Economic calendars. They display upcoming reports on business earnings, IPOs, and other financial events.

-

Smart reminders. Automatic notifications about changes to parameters are monitored by the user.

Advantages:

The possibility to trade from various devices.

Access to exchange information in real-time with a stable internet connection.

The possibility to trade from 4:00 to 20:00 ET.

No minimum deposit required to open an account and no charges for providing second-level market data.

How to Start Making Profits — Guide for Traders

Moomoo offers its customers the opportunity to open an individual margin account.

Account types:

Moomoo has a demo account that can be used in both mobile and desktop versions of the terminals.

The broker attracts experienced traders with a variety of analytical tools and allows beginners to get comfortable with the stock market.

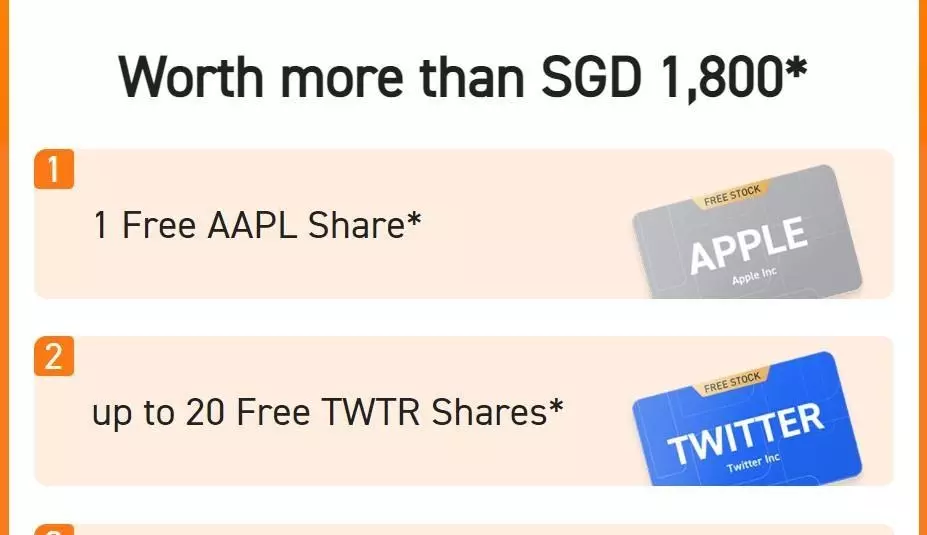

Bonuses Paid by the Broker

When opening a brokerage account, the trader has a chance for free shares

After depositing $100, the user gets 1 free share worth from $8 to $1,000. When depositing $5,000, a Moomoo client has a chance to receive an additional 2 free shares worth from $8 to $1,000. The shares provided by the broker are randomly selected. With moomoo.com, the probability distribution is the following: a $100 deposit gives you a 97.7% chance of getting a share worth between $8 and $13.

The chance of getting stocks worth between $13 and $1,000 is 1:50. If you have a deposit of $5,000, the chance to get 2 shares at a price from $8 to $13 is 97.7%. The chance of getting shares in the price range from $13 to $1,000 is 1:50. The moomoo.com customer has a 1 in 100 chance of receiving shares of Tesla, Netflix, Apple, or Microsoft.

Investment Education Online

The broker’s website does not contain a training section, but information useful for clients is available in the Help Center. In the News section, clients have access to current stock news (7x24), political and economic news affecting the markets (Highlights), and the Financial Calendar.

Security (Protection for Investors)

Moomoo is a subsidiary of Futu Holdings Ltd., a broker-dealer, with insurance of $500,000. It is registered with the Securities and Exchange Commission (SEC). It is also a member of the Financial Industry Regulatory Authority (FINRA), and is licensed by the Monetary Authority of Singapore (MAS). The company is part of the Securities Investor Protection Corporation (SIPC).

Moomoo has additional insurance from Interactive Brokers LLC. It does not cover the fall in the value of securities, but it protects the company from bankruptcy.

👍 Advantages

- Clients of Futu Inc. are insured for up to $500,000 (including $250,000 in the event of a cash claim)

- Claims arising from the trader against the broker can be considered by the regulatory authorities of the United States and Singapore.

👎 Disadvantages

- No negative balance protection

- There is no Better Business Bureau profile where users can leave comments about Moomoo

Withdrawal Options and Fees

-

Moomoo’s clients can withdraw funds using ACH or bank transfer. According to Moomoo’s support service, withdrawals through ACH are possible without commission. The process takes from 3 to 5 business days.

-

It is also possible to withdraw funds by bank transfer. Moomoo charges a fee of $20 from American clients and $25 from traders from other countries. The broker warns that for making a bank transfer, additional fees of $30-50 within the United States and $50-70 for non-US residents.

-

The broker makes withdrawals in US dollars. If the client needs to withdraw money in a different currency, he can use the conversion service. Moomoo has restrictions on the number of transactions. For example, the client cannot withdraw more than $10,000 at a time.

Customer Support Service

The broker has an assistance service that the trader can contact by email. Waiting for a response takes from 1 to 3 days.

👍 Advantages

- Email support with fast response to customer inquiries

👎 Disadvantages

- No way to contact support in real-time by phone or chat

Assistance service’s emails:

-

cs@fututrade.com — for US clients;

-

clientservice@futusg.com — for Singapore clients.

To organize effective assistance, Moomoo support recommends attaching a screen image to the message as well as specify the Moomoo identifier.

Contacts

| Foundation date | 2018 |

| Registration address | 720 University Ave, Suite 100, Palo Alto, CA 94301, US |

| Official site | Moomoo.com |

| Contacts |

Email:

cs@fututrade.com,

|

Review of the Personal Cabinet of Moomoo

It’s easy to start trading with Moomoo. Follow the following algorithm:

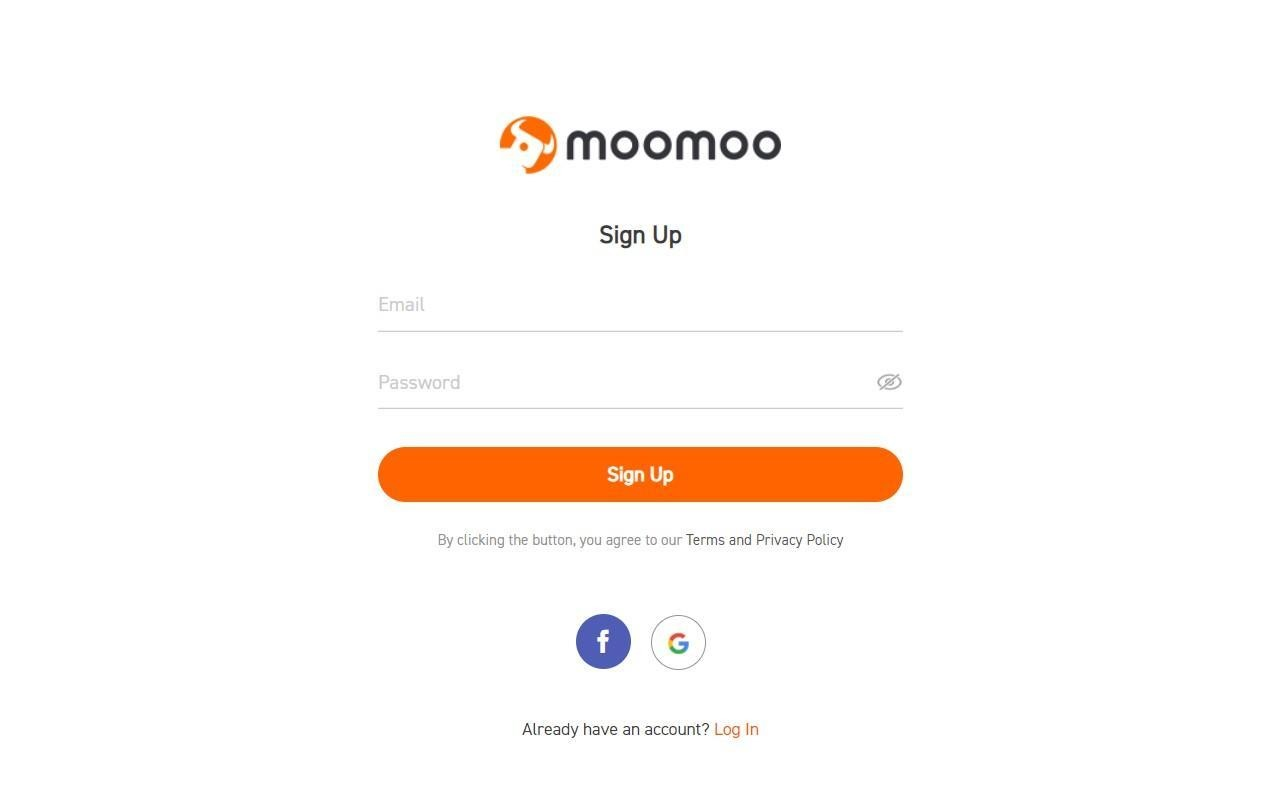

Open the official website Moomoo.com. On the main page, click the “Open Account” or “Get Started” buttons.

After that, you will see a form where you have to enter your email and password, and then confirm them. The system will ask you to enter your US Social Security number, and then confirm your phone number and residential address. You can provide a bank statement/utility bill/certificate of house rent as a document for checking registration.

In Moomoo’s personal account, traders can:

1. Deposit and withdraw funds in SGD, USD, or HKD.

2. Use tools for tracking market quotations, and exchange rates on the US, Singapore, Hong Kong exchanges.

1. Deposit and withdraw funds in SGD, USD, or HKD.

2. Use tools for tracking market quotations, and exchange rates on the US, Singapore, Hong Kong exchanges.

Also in the personal account, the user can:

-

Divide the workspace of the screen into several parts to simultaneously see information about the company and its assets, as well as diagrams for effective decision-making.

-

Set up notifications about events that are necessary for successful trading to receive sound notifications about any changes in the monitored parameters.

-

Use technical indicators simultaneously or by choice.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the Moomoo rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Moomoo you need to go to the broker's profile.

How to leave a review about Moomoo on the Traders Union website?

To leave a review about Moomoo, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Moomoo on a non-Traders Union client?

Anyone can leave feedback about Moomoo on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.