What Is The Gold And Silver Price Forecast For 2024?

The value of precious metals in 2024 may be influenced to an increased degree by central bank policies and inflation rates, which remain high at the end of 2023.

-

The most bullish forecast is given by analysts at Standard Chartered: in their opinion, the price of gold could reach $2,300 and silver $36.

-

The most bearish forecast is given by analysts of Citibank: in their opinion, the price of gold could be $1,850 dollars, and silver $28.

Precious metals have held a timeless allure as investments, offering security and stability even during economic turmoil. However, with 2024 approaching and economic uncertainty looming, choosing between gold and silver for your portfolio becomes even more important.

Do you want to buy gold or silver? Open an account on Roboforex!-

What to invest in 2024?

Choosing investments for 2024 depends on factors like financial goals, risk tolerance, and market conditions. Diversifying across assets like stocks, bonds, real estate, and precious metals is often recommended for a balanced approach. The widespread expert opinion to invest 5 percent of your capital in gold may still be valid in 2024.

Gold and Silver Price Forecasts for 2024

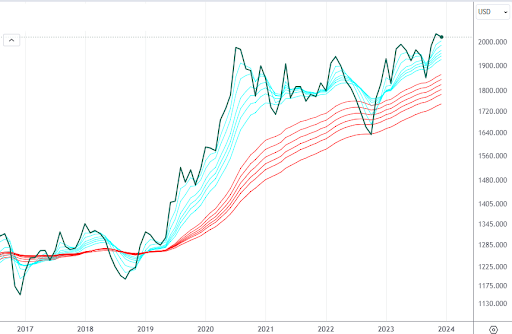

The prices of gold and silver are intricately tied to many factors, including global economic conditions, interest rates, inflation rates, and geopolitical events. To illustrate the trends, consider the chart below:

After a correction in 2022, the bullish trend continued into 2023

Observing the trajectory since 2019, gold has exhibited a consistent upward momentum. However, it's essential to approach price forecasts cautiously, as they represent a spectrum of expert opinions and not guarantees. Actual gold and silver prices may vary significantly from the projected forecasts, emphasizing the dynamic nature of precious metal markets.

Gold Price Forecasts for 2024

In 2024, various experts share their predictions about gold prices, adding an element of intrigue and uncertainty.

-

InvestingHaven: Anticipates $2,200, with a potential climb to $2,500 by 2025.

-

Physical Gold: Foresees a range between $2,000 and $2,200, drawing from consensus forecasts and leading indicators.

-

ABN AMRO: Pegs it at $2,000, relying on the average price.

-

Goldman Sachs: Envisions $2,100, fueled by mounting inflation and geopolitical uncertainties.

-

Bank of America: Suggests $1,950, influenced by a robust US dollar.

-

Commerzbank: Eyes $2,050, factoring in a weaker US dollar and sustained central bank support.

-

Capital Economics: Proposes $2,150, citing robust economic growth and increased gold demand from China and India.

-

Standard Chartered: Projects $2,300, driven by inflation upticks and a weakening US dollar.

-

Citibank: Points to $1,850, considering a strong US dollar and decreasing inflation.

-

World Gold Council: Hovers around $2,000, maintaining a balanced outlook for the global economy.

These forecasts are speculative, and the actual gold price may deviate significantly. But the general agreement is that gold prices could go up in 2024.

What is the silver price forecast for 2024?

As we look forward to 2024, the silver market is tempted with anticipation and uncertainty. Various experts have cast their predictions, each adding a unique perspective to the silver prices.

-

InvestingHaven: Anticipates $34.70, with a potential surge to $48 by mid-2024 or mid-2025.

-

Physical Gold: Positions at $29.50, drawing from average consensus forecasts.

-

Silver Bullion: Aims for $30, depending on boosted demand from industrial and investment sectors.

-

Commerzbank: Sets the target at $32, factoring in a weaker US dollar and sustained central bank support.

-

Capital Economics: Predicts $34, driven by robust economic growth and growing silver demand from China and India.

-

Standard Chartered: Projects $36, rooted in rising inflation expectations and a weakening US dollar.

-

Citibank: Suggests $28, considering a strong US dollar and diminishing inflation.

-

World Silver Council: Hovers around $30, maintaining a balanced outlook for the global economy.

-

Precious Metals Insights: Points to $32, fueled by escalating demand for silver in the solar and electronics industries.

-

Metals Focus: Positions at $33, reflecting increased investor interest in silver as a safe haven asset.

-

Traders Union: according to gold price forecast XAUUSD can reach 2042.89 in 2024.

These forecasts offer a glimpse into the potential trajectories that silver might take. Whether it's the surge predicted by InvestingHaven or the balanced outlook from the World Silver Council, 2024 holds promise for silver investors.

Risks of investing in gold and silver in 2024

As we enter 2024, considering gold and silver investments is tempting, yet it's crucial to be aware of potential risks.

Volatility:

The value of gold and silver is prone to volatility, indicating significant fluctuations in the short term. Investors should brace themselves for dynamic shifts that can impact the market unpredictably.

Liquidity:

Gold and silver may exhibit lower liquidity than other investment assets, posing quick sell-off challenges when urgent arises. Investors must consider this aspect when crafting their investment strategies.

Storage Costs:

One often overlooked aspect of investing in precious metals is the expense associated with storage. Storing gold and silver can incur significant costs, which investors need to factor into their overall investment calculations.

How to analyze the gold and silver market

A multifaceted approach is essential when analyzing the gold and silver market, considering various factors and technical indicators to spot potential trading opportunities. Here's a breakdown of key points to guide your analysis:

Support and Resistance:

-

Support: Identify price levels where a downward trend may stall or reverse. Look for horizontal lines, trendlines, or moving averages acting as support.

-

Resistance: Pinpoint price levels where an upward trend may encounter resistance. Search for horizontal lines, trendlines, or moving averages acting as resistance.

-

Identify Key Levels: Use chart analysis tools to identify historical support, resistance, and Fibonacci retracement levels.

-

Market Sentiment: Factor in current market sentiment toward gold and silver. Gauge optimism or pessimism, as it can influence price movement near support and resistance levels.

Technical Indicators

-

Moving Averages: Deploy moving averages (MA) to determine trends and potential reversals. Watch for crossovers, like the 50 MA crossing above the 200 MA, indicating a possible uptrend.

-

Momentum Indicators: Employ indicators like the Relative Strength Index (RSI) and Stochastic Oscillator to assess buying and selling pressure. Identify overbought or oversold conditions for potential trend reversals.

-

Volume Indicators: Monitor volume changes alongside price movement. Rising volume on breakouts can confirm a trend, while declining volume may signal indecision.

-

Other Indicators: Consider integrating additional indicators such as Bollinger Bands, MACD, and Stochastic Oscillator for confluence and confirmation of signals.

Combining support and resistance analysis with different technical indicators, this practical approach improves your understanding of the gold and silver market.

Best brokers to trade gold and silver CFDs

Summary

The average view is that the gold price could rise slightly in 2024. However, given the likelihood of Fed rate cuts, gold may not be the most favorable buy of the year. Approach every investment with a clear understanding of the potential risks and rewards involved.

Team that worked on the article

Upendra Goswami is a full-time digital content creator, marketer, and active investor. As a creator, he loves writing about online trading, blockchain, cryptocurrency, and stock trading.

Dwight specializes in risk, corporate finance, alternatives, fintech, general business trends, and financial markets, and he has broad experience managing complex projects. Dwight is an author for the Traders Union website.

Dwight was a financial columnist for The Wall Street Journal and The New York Times during the Great Financial Crisis. He has served as Editor-in-Chief of Worth, a personal finance magazine for the wealthy, and as Editor of Risk, the premiere global publication about derivatives, risk management, and quantitative finance, based in London.

He has also served as Managing Editor at The Economist Group and ran the Americas operations of two British trade publications.

For the last 12 years, Dwight has worked as a freelance writer and editorial project manager, serving clients in the financial technology, banking, broker/dealer, consulting, asset management, and corporate sectors. This has given him considerable experience in idea generation and project management, working collaboratively to help clients meet their goals with little or no supervision.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).