What are Goldbacks?

Goldbacks are banknotes resembling ordinary currency notes, such as dollar bills, but they are overlaid with pure 24-karat gold. This gold “sheeting” is protected by two layers of polymer, which is also used to add artistic elements to the Goldback currency.

There’s an exciting new way to own and invest in gold: an actual gold currency, known as Goldbacks. Goldbacks, created by Goldback Inc. in 2019, are touted as the first practical gold currency. On its website, Goldback.com, the company describes Goldbacks as “the world’s first physical, interchangeable, gold money designed to accommodate even small transactions”.

eToro-best stock brokers with 0 feesHow can I use Goldbacks

One-ounce gold coins, such as the popular American Gold Eagles, can be used as currency. However, with the price of gold sitting around $2,000 per ounce, it’s rather difficult to use Gold Eagles to, for example, pay for $25 worth of groceries. To solve that problem, Goldback Inc. set out to create a form of gold that would exist in small enough quantities that it could easily be used for everyday transactions.

What the creative minds at Goldback came up with was both a very original, and very aesthetically attractive, gold asset – Goldback notes.

Goldbacks are produced by the private mint, Valaurum, a certified gold minter that services a number of governments.

The proprietary minting process used to create the Goldback “sheets” of gold involves an extremely complex, patented vacuuming procedure to ensure that each Goldback note contains the precisely correct amount of gold. 1 Goldback contains 1/1000th of one troy ounce of pure 24-karat gold.

Every minting of Goldbacks has the gold content of each note precisely verified, using:

-

X-rays

-

Fire assay of the gold content

-

Third-party measurements

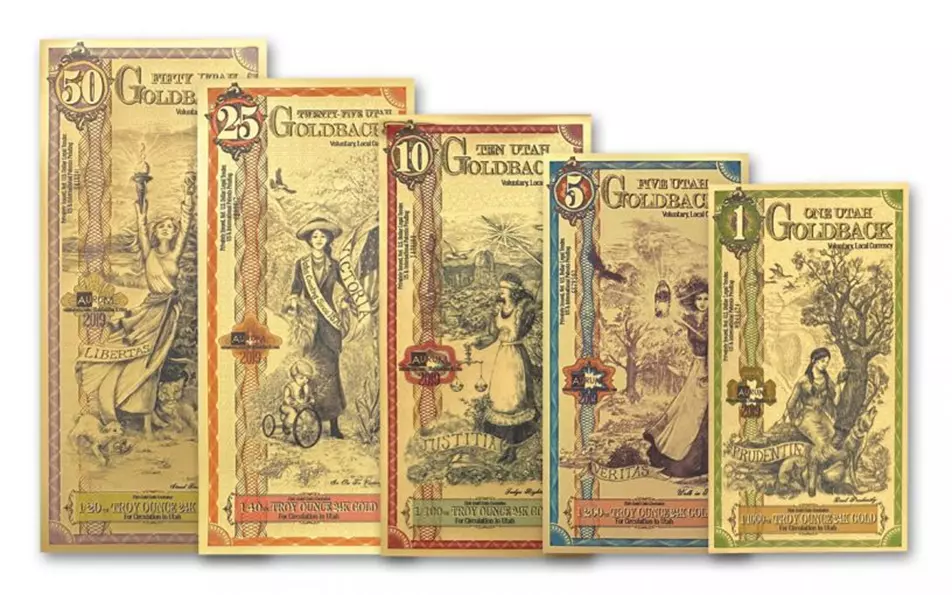

Goldbacks in denominations of 1, 5, 10, 25, and 50 (Source: Goldback.com)

With the current US paper dollar exchange rate for Goldbacks at approximately $4.00 for 1 Goldback, Goldbacks can easily be used to make ordinary, everyday purchases.

The paper dollar exchange rate for any type of gold, as reflected on the world’s currency exchange markets, varies based on multiple economic factors. Goldback Inc. publishes the current Goldback/US dollar exchange rate daily on its website, by averaging the dollar exchange rate for 1 Goldback currently being offered by several online gold dealers.

All denominations of Goldbacks are exchanged at the same proportionate rates. In other words, if 1 Goldback notes are going for $5 US, then 50 Goldback notes would be selling for $250.

Are Goldbacks a good investment?

“Goldbacks are not a promise to pay in gold - they are the gold!” (Benjamin Shaffer, Head of Merchant Services at Goldback Inc.).

Since their creation in 2019, Goldbacks have proven to be one of the best-performing gold investment assets. When Goldbacks first debuted, the US dollar exchange rate was $2.25 for 1 Goldback. With the current 1 Goldback exchange rate at approximately $4.16, in terms of purchasing power, Goldbacks have nearly doubled in just four years. In contrast, over that same time frame, the per ounce price of gold has only increased by about 10% (from approximately $1,800 per ounce to $1,980 per ounce).

Additionally, Goldback Inc. has created a Goldback Leasing Program that offers investors the opportunity to earn interest on their Goldbacks. This leasing program gives holders of Goldbacks the rare opportunity to earn interest on their gold investments - a heretofore virtually unheard of benefit in the world of investing.

The leasing program currently pays 2% to 3.5% annual interest (loaning out larger amounts of Goldbacks gets you a higher interest rate), with interest paid out monthly in the form of Goldbacks. That’s an interest rate that’s considerably higher than what you can expect with most bank savings accounts. And while other ways of owning gold typically involve vault storage fees and insurance premiums, there’s none of that with Goldback Leasing.

Gold has always been the favored “safe haven” investment during times of high inflation and economic uncertainty. But with just a one-ounce gold coin selling for thousands of dollars, opportunities to invest in gold have been rather limited for the average small investor. Goldbacks, which cost as little as just a few dollars, bring gold investing much more easily within the reach of regular people.

Best Investment Brokers

Goldbacks: collectible art

Part of what has made Goldbacks such a high-performing gold investment stems from the work of the very talented artists at Goldback Inc. There are a few gold coins – such as the famous Saint Gaudens Double Eagle $20 coin – that are highly sought after for their design. However, every individual denomination note of Goldbacks, in each Goldback series, is a unique work of art. This has made the collectible value of Goldbacks extremely high.

The creators of Goldbacks decided to go with the Lady Virtues (e.g., Justice, Truth, Prudence, Wisdom) as the theme for the artwork that adorns Goldback notes. Different virtues are featured for each of the five State series of Goldbacks.

Who’s the chief artist responsible for creating the breathtaking Goldback artwork? – Cheri Jensen, co-founder Chris Jensen’s mom.

The Utah Goldbacks Series – (Source:GovMint.com)

Another interesting design feature of Goldbacks is the size and shape of each note. Each higher denomination note is larger in size than smaller denomination notes. Thus, a 5 Goldback note is larger than the 1 Goldback note, but smaller than the 10 Goldback note, which is, in turn, smaller than the 25 Goldback note. Note shapes and sizes also have historical characteristics. The 1 Goldback note is approximately the same shape and size of many early American currency notes. The 25 Goldback denomination mirrors the size and shape of Federal Reserve notes. Finally, the 50 Goldback note is the same size and shape as the Gold Certificates that were in circulation in the US from 1865 until 1933.

The collectible desirability of Goldbacks is attested to by the fact that every state series is often sold in sets that include one note in each of the available denominations – 1, 5, 10, 25, and 50 – and many investors seek to own a complete set of Goldback notes in all of the available series. Demand soars for each new Goldback series as it is unveiled.

Goldbacks quickly became a very popular and widespread way of owning gold, and their popularity has continued to increase exponentially. Average monthly retail sales of Goldbacks have grown from just over $100,000 to more than $1,000,000. In all, there is currently more than $25 million worth of Goldbacks in circulation. And Goldbacks, which started out as a local mint product in the state of Utah, are now bought and sold all around the world. Goldback Inc. and minter Valaurum readily admit that they have a difficult time maintaining production levels sufficient to meet the demand for Goldbacks.

Goldbacks can be purchased at dozens of precious metals dealers’ websites, such as JM Bullion and APMEX. Alpine Gold is one of the few dealers that manages to always keep in stock each denomination of all five currently existing Goldback series – Nevada, New Hampshire, Utah, Wyoming, and South Dakota.

Goldbacks are currently accepted at a rapidly growing list of thousands of businesses in the five US states that have a Goldback note series. The original Utah Goldback series followed passage of the Utah Legal Tender Act, which recognized gold and silver as legal tender in the state.

Goldbacks: the bottom line

There is something that’s just kind of fundamentally cool about holding in your hand what looks like a regular $5 or $10 bill – some denomination of currency – but that is actually a sheet of solid gold. Just think: If you bought a few thousand dollars’ worth, you could wallpaper your bedroom in Goldbacks.

Goldbacks have several characteristics that make them an attractive gold investment:

-

They are easily affordable - anyone can start investing in Goldbacks with just a few dollars

-

The unique artwork of Goldback notes make them a prized collectible

-

Goldbacks are a proven high-performing gold investment – nearly doubling in value in less than five years

Starting to invest in Goldbacks is one excellent way you can diversify your investment portfolio with precious metals, and protect your purchasing power in the current economic environment of high inflation.

Team that worked on the article

Johnathan M. is a U.S.-based writer and investor, a contributor to the Traders Union website. His two primary areas of expertise include finance and investing (specifically, forex and commodity trading) and religion/spirituality/meditation.

His experience includes writing articles for Investopedia.com, being the head writer for the Steve Pomeranz Show, a personal finance radio program on NPR. Johnathan is also an active currency (forex) trader, with over 20 years of investing experience.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.