Trading Computer Setup | Full Guide From a Trader

To have an efficient trading computer, you need to choose the right:

-

CPU - look at speed and efficiency, multi-tasking capability, reliability and performance

-

SSD - the key factors to consider when choosing an SSD include the interface, capacity, and type

-

RAM - consider the number of monitors you use, the trading software you run, and your personal trading style

-

Graphics card - consider the software utilized, the complexity of visualized data, and budget constraints

-

Monitor - consider the resolution, color accuracy, screen size, refresh rate

-

Adapters - consider the electrical performance, safety and compliance, compatibility, etc

For any trader, having a reliable and optimized computer setup is important. Not only can the right equipment enhance your ability to analyze market data and execute trades efficiently, but it can also minimize technical hiccups that could potentially lead to missed opportunities or financial losses. This guide draws upon the practical experience of a trader to offer you key considerations and valuable tips for building or acquiring a trading computer setup that caters to your specific needs and maximizes your trading potential.

-

What kind of PC do I need for trading?

Most traders prefer a PC with a fast processor, ample RAM, and good graphics for smooth trading performance.

-

How do I set up a trading computer?

Choose components based on your trading needs, assemble them carefully, and install trading software.

-

What is the best CPU setup for trading?

A powerful CPU with multiple cores for quick data processing and smooth operation is considered optimal for trading.

-

Is 16GB RAM enough for day trading?

Yes, 16GB RAM is typically sufficient for day trading, but consider more if running multiple applications simultaneously.

How to choose the best trading computer?

Choosing the best trading computer requires considering several factors to ensure it meets the demands of active trading. When I began my trading journey, I initially used a basic laptop with an Intel Core i5 processor, 8GB of RAM, and a 256GB SSD (HDDs are a complete no-go for this use-case in my opinion). However, this setup proved inadequate due to slow performance, limited storage, and inadequate graphics capabilities.

The slow performance of my initial setup, attributed to its weak processor and limited RAM, resulted in frequent lags and freezes, particularly during volatile market conditions. Additionally, the 256GB SSD quickly filled up with accumulated data, making it challenging to maintain an organized trading setup. Moreover, the integrated graphics were insufficient for handling high-resolution charts and real-time data visualizations essential for effective trading.

Consequently, I opted to upgrade to a more powerful and dedicated trading computer, considering key factors such as processor performance, memory and storage capacity, graphics capabilities, and display quality. My current setup is a custom-built trading computer featuring an Intel Core i7-9700K processor, 32GB DDR4 RAM, 1TB NVMe SSD storage, and an NVIDIA GeForce RTX 2080 graphics card.

The Intel Core i7-9700K processor provides significant processing power with its 8 cores and 16 threads, allowing seamless operation of multiple trading applications and data feeds simultaneously without slowdowns.

Intel Core i7-9700K source: amazon.com

Additionally, the ample 32GB RAM and combination of fast M.2 SSD and larger HDD offer sufficient resources to handle large datasets, historical market data, and trading-related files.

32GB RAM source: amazon.com

The NVIDIA GeForce RTX 2080 graphics card ensures excellent performance in rendering high-quality charts and real-time data, facilitating precise market analysis. Furthermore, the 27-inch 1080p 144Hz IPS panel delivers a smooth and responsive viewing experience.

NVIDIA GeForce RTX 2080 source: amazon.com

Best Forex brokers

Choosing the right CPU

When selecting the right CPU for trading, it's essential to consider its impact on your trading activities. The processor plays a crucial role in executing trades swiftly and efficiently, as well as processing data and running trading software smoothly. Here's why choosing the correct CPU is vital and what factors depend on it:

Speed and efficiency

A powerful CPU ensures fast trade execution, especially crucial in volatile markets where split-second decisions can determine profit or loss. The processor's speed directly influences how quickly your trading platform can process data and execute trades.

Multi-tasking capability

The number of cores and threads in a CPU dictates its ability to handle multiple processes simultaneously. More cores allow for better efficiency and enable the CPU to run several programs concurrently, enhancing multitasking capabilities.

Reliability and performance

Opting for a reliable CPU ensures that your trading platform operates smoothly without lags or delays. Investing in a high-quality processor can improve the overall performance of your trading computer, leading to a more efficient trading experience.

My preferred choice for a trading CPU is the Intel Core i7-13700K. It strikes a balance between performance, speed, and reliability, making it suitable for various trading applications. The i7-13700K boasts excellent single-thread performance, crucial for activities requiring rapid data processing and trade execution.

Alternatives:

-

Consider the Intel Core i9-13900K/KF. With 24 cores and 32 threads, this processor offers even higher performance, ideal for intensive trading activities involving extensive data processing and calculations

-

For a budget-friendly alternative, the AMD Ryzen 5 5600X is worth considering. It provides good performance for trading applications while maintaining a balance between cost-effectiveness and efficiency, making it suitable for traders on a tighter budget

Choosing the right SSD

Selecting the right SSD is crucial for enhancing your trading computer's performance, as it can significantly reduce transmission delays and speed up information processing. The key factors to consider when choosing an SSD include the interface, capacity, and type.

SSD interfaces commonly include M.2, PCI-E, and SATA. If your computer motherboard supports M.2 or has extra PCI-E interfaces, opting for an SSD with an M.2 or PCI-E interface can provide better performance. Otherwise, choosing an SSD with a SATA interface is suitable.

Capacity is another essential consideration. It's advisable to select an SSD with a minimum capacity of 256GB, with a 500GB SSD offering a good balance between price and capacity. If budget permits, a 1TB SSD is also a viable option.

There are two main types of SSDs: SATA interface SSDs and NVMe SSDs. SATA interface SSDs are cheaper but offer lower performance, while NVMe SSDs deliver better performance albeit at a higher cost. Opting for an NVMe SSD is recommended for improved performance in trading activities.

Choosing the right RAM

RAM (Random Access Memory) is a crucial component of a trading computer, as it allows for quick access to data and helps to ensure smooth performance during trading activities. Choosing the right RAM for your trading computer depends on several factors, including the number of monitors you use, the trading software you run, and your personal trading style.

When it comes to choosing the right RAM, there are several options to consider. One good option is the Corsair Vengeance LPX 16GB (2x8GB) DDR4 DRAM 3200MHz, which offers high-speed performance and is compatible with most trading platforms. Another good option is the G.SKILL Ripjaws V Series 16GB (2x8GB) DDR4 DRAM 3000MHz, which is also a reliable choice for traders.

If you're looking for a more expensive option, the Corsair Dominator Platinum RGB 32GB (2x16GB) DDR4 DRAM 3200MHz is a high-performance choice that offers RGB lighting and advanced cooling features. On the other hand, if you're on a tight budget, the Kingston HyperX Fury 8GB (2x4GB) DDR4 DRAM 2400MHz is a more affordable option that still offers reliable performance.

In general, it's recommended to have at least 16GB of RAM for a trading computer, although some traders may prefer 32GB or more depending on their specific needs. Additionally, it's important to ensure that your chosen RAM is compatible with your motherboard and trading platform.

Selecting the appropriate graphics card for trading holds significance as it can greatly influence the performance and speed of your trading software. Responsible for rendering charts, graphs, and other visual data representations, the graphics card plays a vital role in aiding informed trading decisions.

Choosing a graphic card

Several factors dictate the choice of graphics card, including the software utilized, the complexity of visualized data, and budget constraints. Typically, a mid-range graphics card like the NVIDIA GeForce series suffices for trading purposes, offering commendable performance and compatibility with most trading software.

However, for advanced visualization needs such as multiple high-resolution monitors or intricate 3D charts, a more solid graphics card may be necessary. The NVIDIA RTX series, known for its high-performance graphics capabilities, proves fitting for demanding trading applications.

Regarding specific models, the NVIDIA GeForce RTX 3060 Ti emerges as a favored option for trading due to its fast performance and cost-effectiveness, having 8GB of GDDR6 memory, ample for most trading tasks. Alternatively, for those requiring additional memory, the NVIDIA GeForce RTX 3080 presents itself as a pricier yet another good choice, equipped with 10GB of GDDR6X memory.

When selecting a graphics card, it's imperative to consider its compatibility with trading software and the unique requirements of your trading setup. Additionally, ensuring compatibility with your computer's motherboard and power supply is equally crucial.

Choosing the right monitor

Choosing the right monitor for trading is crucial as it directly impacts your efficiency, productivity, and potentially even your profitability as a trader. The monitor plays a significant role in providing you with clear and detailed visuals of market data, charts, and indicators, allowing you to make informed trading decisions swiftly and accurately.

The importance of choosing the right monitor for trading lies in several key factors:

-

Resolution (safeguarding the eyes)

-

Color accuracy (for the aesthetics)

-

Screen size (bigger isn’t always better)

-

Refresh rate (extremely important for high frequency trading)

-

Adjustability (because your requirements are bound to change overtime)

In my setup, I prefer a 27-inch monitor with a solid all-round performance like the Dell UltraSharp U2722D. This monitor provides a good balance of size, resolution, and color accuracy, making it suitable for trading activities. It offers a comfortable viewing experience and allows me to display multiple charts and indicators effectively.

As for alternatives, you can consider options like the LG UltraGear 27GL83A-B, which is another solid choice with high-quality features. While slightly more expensive, it offers excellent image quality and performance, catering to traders who prioritize visual clarity and color accuracy.

Choosing the right adapters

Choosing the right adapters is crucial for ensuring the proper power supply to your trading computer setup, which directly impacts its performance and reliability. The choice of adapters can influence the efficiency, safety, and functionality of your trading system, making it essential to select the most suitable options for your specific needs.

The importance of choosing the right adapters lies in several key factors:

Electrical performance

Adapters with the correct specifications ensure that your trading computer receives the required power without any issues, preventing potential damage to the components and ensuring stable operation.

Safety and compliance

Selecting adapters with the appropriate safety certifications is vital to ensure compliance with industry standards and regulations. This helps in maintaining a safe trading environment and prevents any electrical hazards.

Compatibility

Adapters need to be compatible with your trading computer and other devices to ensure seamless connectivity and operation. Choosing the right connectors and specifications is essential for a hassle-free setup.

Efficiency and reliability

Opting for adapters with high efficiency ratings ensures that they operate optimally, reducing energy consumption and heat generation. This contributes to the overall reliability and longevity of your trading system.

In my setup, I prefer using adapters with safety certifications and high efficiency ratings to ensure both safety and energy efficiency. One good option is the Astrodyne TDI adapters, which offer a range of safety certifications suitable for various applications. These adapters provide reliable performance and comply with industry standards, ensuring a safe and efficient power supply to my trading computer.

For alternatives, you can consider more premium adapters like Mean Well or TDK-Lambda, which offer advanced features and higher efficiency but come at a slightly higher price point.

On the other hand, more budget-friendly options like Belker or SoulBay adapters can be suitable for basic setups, although they may lack some of the advanced features and certifications of higher-end adapters.

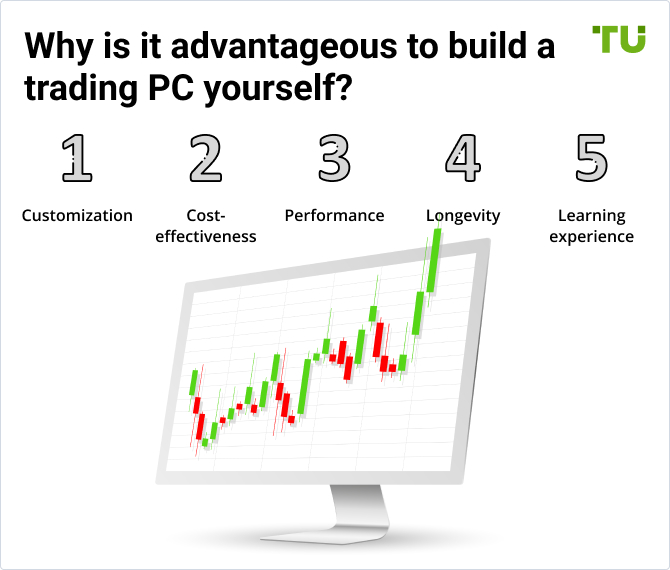

Why is it advantageous to build a trading PC yourself?

Building a trading PC yourself has several advantages, including:

Customization

Building your own trading PC allows you to customize it to your specific needs and preferences, including the choice of components, the number of monitors, and the operating system. This level of customization can lead to a more efficient and productive trading environment.

Cost-effectiveness

Building your own trading PC can be more cost-effective than buying a pre-built one, as you can choose components that fit your budget and avoid paying for features that you don't need.

Performance

A self-built trading PC can offer better performance than a pre-built one, as you can choose high-quality components that are optimized for trading activities. This can lead to faster trade execution, smoother multitasking, and better visual quality.

Longevity

A self-built trading PC can have a longer lifespan than a pre-built one, as you can choose components that are durable and easily upgradable. This can save you money in the long run, as you won't need to replace the entire system as often.

Learning experience

Building your own trading PC can be a rewarding learning experience, as you can gain knowledge about computer hardware and software, as well as the trading industry.

The main things to consider before trading PC setup

Budget

Determine your budget carefully. Trading computers come in a range of prices, so it's essential to define your needs and allocate a realistic budget accordingly. Remember, you can still build a powerful trading machine without breaking the bank.

Functionality

Assess your trading style and the tasks your computer will need to perform. Day traders requiring constant monitoring and fast execution will need a more robust machine compared to long-term investors who check in periodically. Identifying your needs upfront ensures you choose a setup that aligns with your requirements.

Operating system

While most trading platforms are optimized for Windows, if you prefer using a Mac, you'll need to consider workarounds like Boot Camp or emulation software. However, keep in mind that these solutions may add complexity to your setup.

Cooling

Running multiple applications and data feeds can generate heat, potentially affecting your system's performance. To counter this, TU expert Mikhail Vnuchkov suggests that the case you choose provides adequate airflow, and consider investing in CPU coolers capable of handling the workload. Reliability is very important for your trading PC, so don't overlook the importance of proper cooling solutions.

How to put it all together?

Putting together a trading PC requires a certain level of technical knowledge and expertise. If you have the necessary skills and experience, you can assemble a computer yourself. This can be a rewarding and cost-effective approach, as you can select the components that best meet your needs and budget, and you can ensure that the setup is optimized for your specific trading activities.

However, if you lack the necessary knowledge and experience, it's best to turn to professionals for help. There are many computer assembly services available that can help you build a custom trading PC based on your specific needs and budget. These services can provide you with a turnkey solution, including installation, configuration, and testing, ensuring that your trading PC is ready to use right out of the box.

Expert opinion

In my expert opinion, for novice traders embarking on their trading PC setup journey, prioritizing simplicity and reliability is important. Opt for a user-friendly operating system like Windows, which is well-supported by most trading platforms, to streamline your setup process and minimize potential complications. Additionally, consider investing in a quality uninterruptible power supply (UPS) to safeguard against unexpected power outages, ensuring uninterrupted trading sessions and protecting your valuable data.

Conclusion

In conclusion, when setting up your trading computer, each component plays a crucial role in ensuring optimal performance and reliability. By carefully considering factors such as CPU, SSD, RAM, graphics card, monitor setup, and adapters, you can create a tailored trading PC that meets your specific needs and preferences. Prioritize functionality, compatibility, and cost-effectiveness to maximize efficiency and productivity in your trading activities. Remember, investing in quality components and paying attention to ergonomic considerations can significantly enhance your overall trading experience. With the right setup in place, you'll be well-equipped to navigate the markets with confidence and success.

Glossary for novice traders

-

1

Trading system

A trading system is a set of rules and algorithms that a trader uses to make trading decisions. It can be based on fundamental analysis, technical analysis, or a combination of both.

-

2

BaFin

BaFin is the Federal Financial Supervisory Authority of Germany. Along with the German Federal Bank and the Ministry of Finance, this government regulator ensures that licensees abide by eurozone laws.

-

3

CFD

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.

-

4

Index

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

-

5

Volatility

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).