Is it a Good Idea to Invest in a Bear Market?

The answer depends on the type of financial asset you are seeing a bear market in:

-

Stock Indexes: Often rebound over time, presenting long-term buying opportunities

-

Blue Chips: Can also be seen as a lucrative opportunity, especially if the share price declines slower than the index

-

Individual Stocks: Riskier, as they can continue to decline without recovery

-

Gold: Tends to hold value, potentially a safer bet during market downturns

-

Cryptocurrency: Highly volatile; could yield high returns or significant losses

-

Currency: A dangerous venture, as the downtrend may last longer than you think

A bear market, often characterized by a 20% or more decline from recent highs in major stock indices like the S&P 500, represents a significant downturn over a variable period. Understanding the intricacies of such a market is crucial for investors looking to navigate its challenges and opportunities.

Do you want to start trading Forex? Open an account on RoboForex!-

What happens to prices in a bear market?

In a bear market, prices typically decline, often by 20% or more from recent highs, reflecting widespread negative sentiment among investors about the prospects of the market.

-

How long does a bear market usually last?

On average, bear markets last about 10 months, but they can range from a few weeks to several years. The 2008-2009 financial crisis bear market, for example, lasted 18 months.

-

What to buy during a bear market?

Government bonds and defensive stocks historically perform better during a bear market.

-

What is the cause of the bear market?

Various factors can trigger a bear market, including economic recessions, rising interest rates, geopolitical events, and investor panic. Often, it's a combination of these factors that leads to a sustained decline in stock prices.

The bear market: a time to buy or a time to sell?

Bear markets, far from being anomalies, are a consistent feature of the financial landscape, surfacing on average every 3.5 years. These periods are characterized by a decline of 20% or more from recent highs in major stock indices like the S&P 500, indicating a significant shift in market sentiment.

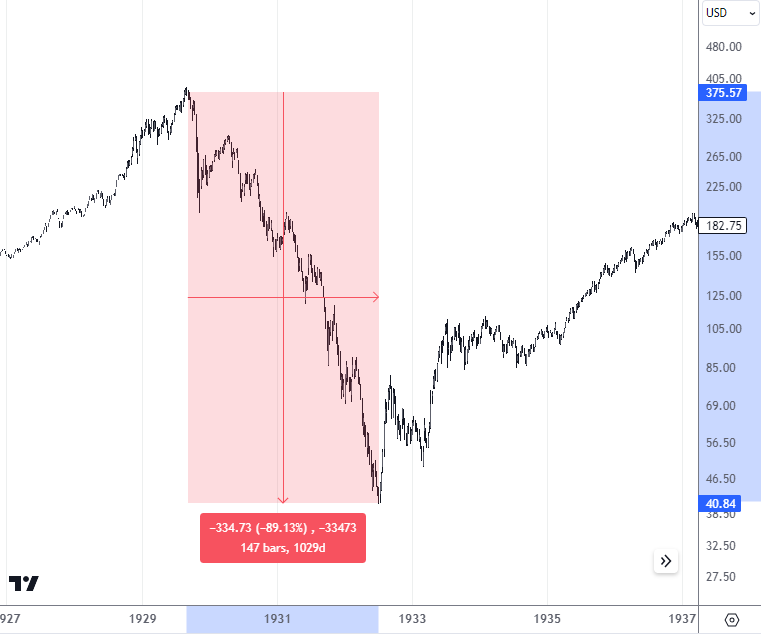

Dow Jones Index

The longest bear market in U.S. history, which spanned from 1929 to 1932, is often cited as the most dramatic, illustrating the extreme market volatility that can occur. Meanwhile, the more recent bear market from February 2020 to June 2023 underscores the ongoing nature of these cycles, reflecting the market's ever-evolving dynamics.

During these challenging times, savvy investors often consider a variety of investment strategies, each presenting unique risks and opportunities. These strategies include:

-

Buying Stock Index: This approach involves investing in a broad market index like the S&P 500 or Dow Jones during a bear market. It's based on the principle that, while markets may fall sharply, they have historically recovered over the long term, offering potential for growth

-

Buying Individual Stock: This strategy is more targeted, focusing on individual stocks that appear undervalued or are poised for a potential rebound. It requires a more hands-on approach, with investors needing to conduct thorough research to identify these opportunities

-

Buying Gold: Many turn to gold as a traditional safe haven during times of economic uncertainty. Gold often holds or increases its value in bear markets, providing a hedge against stock market losses

-

Buying Crypto: Cryptocurrencies represent a newer, highly volatile asset class. Investing in crypto during a bear market can offer substantial rewards but also carries significant risks, given the asset's relative novelty and unpredictability

-

Buying Currency: Currency trading, or Forex, can be especially risky in volatile markets. This strategy involves trading currency pairs and can be influenced by a myriad of global economic factors

Each of these investment paths offers a distinct lens through which to view investing in a bear market. They come with varying degrees of risk and potential for reward, making them suitable for different types of investors with diverse risk tolerances and investment horizons.

Is it good to buy an index fund in a bear market?

Investing in an index fund during a bear market is often seen as a strategic move.

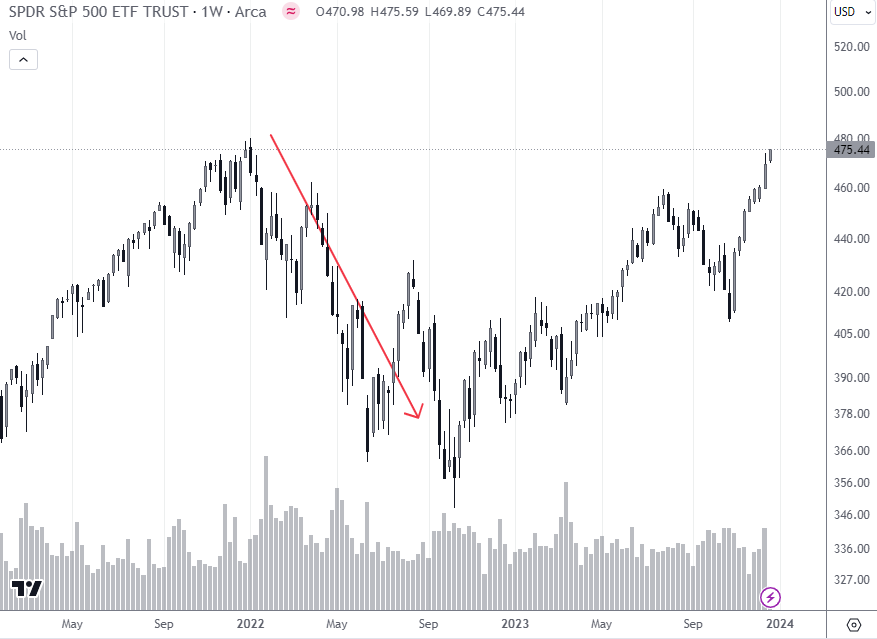

S&P 500 Bear Market

The chart illustrates the cyclicality of the markets: a pronounced downturn followed by recovery. This visual representation underlines the concept that, over time, markets have historically rebounded after a bear phase.

The downturn marked by the red arrow suggests a bear market, characterized by a drop of over 20%. What follows is an upturn, indicating the index's resilience and potential for growth beyond its initial peak. The rationale for buying an index fund in such times is predicated on the principle of diversification inherent in index funds, which typically track a broad market index and are considered less volatile than individual stocks.

Yet, while history often shows a rebound, it doesn't guarantee future results, and recovery may not be immediate. This strategy is best suited for those with a long-term view and a tolerance for interim fluctuations.

Investors should weigh their ability to withstand short-term losses against the potential for long-term gains, as evidenced by the post-downturn ascensions in the provided chart. An informed decision to invest in an index fund during a bear market hinges on one's investment horizon, risk appetite, and financial stability, coupled with historical market trends.

Is it good to buy an individual stock in a bear market?

The prospect of buying an individual stock during a bear market can be risky, as the chart below poignantly illustrates.

CGC Stock Bear Market

The significant downward trend indicated by the red arrow shows a prolonged decline in the stock price of Canopy Growth Corporation, a pattern that is not uncommon for individual stocks during bearish periods.

The danger in buying an individual stock in a bear market lies in the inability to predict the bottom. While the potential for high returns exists if the stock rebounds, the chart reveals the perilous nature of trying to time the market. The continued decline beyond the initial fall demonstrates the risk of further losses.

Unlike index funds, individual stocks do not benefit from the diversification that can mitigate risk. A single company can face challenges that do not affect the broader market, such as management issues, product failures, or sector downturns. These specific risks can lead to continued underperformance, even when the market at large starts to recover.

Thus, purchasing individual stocks during a bear market demands thorough research and a higher tolerance for risk. It's crucial for investors to understand the company's fundamentals, and industry outlook, and to have a clear strategy for managing potential losses.

Best stock brokers 2024

Tips on surviving a bear market

Navigating a bear market requires a blend of strategic planning and mental fortitude. Here are several tips that can help investors weather the storm:

-

Keep a long-term outlook: Bear markets can be disheartening, but history shows that markets have recovered over time. Maintain a vision that extends beyond the current downturn, focusing on the potential for recovery and growth in the long run

-

Rebalance your portfolio: As market conditions change, so should your asset allocation. Rebalancing ensures that your portfolio aligns with your risk tolerance and investment goals, even in a bear market

-

Choose the right stocks: Not all stocks are created equal, especially in a bear market. Focus on stocks with strong fundamentals, such as solid balance sheets and stable cash flows, which are more likely to withstand market pressures

-

Buy the dip and stay the course: If you're already holding a diversified portfolio, consider buying more shares of the same high-quality investments at lower prices. This approach, known as dollar-cost averaging, can potentially lower the average cost per share, positioning you for better returns when the market rebounds

Surviving a bear market is as much about managing your portfolio as it is about managing your emotions. Stick to your investment plan, stay informed, and resist the urge to make impulsive decisions based on short-term market movements. With patience and discipline, investors can not only survive but also thrive in a bear market.

Pros and cons of buying during bear markets

Investing during bear markets can be a double-edged sword. Pros and cons are laid out below, which should help with your decision-making:

👍 Pros

• Lower Prices: Stocks can be purchased at lower prices, providing a greater margin of safety and the potential for higher returns in the long term

• Opportunity for Value: Bear markets can offer opportunities to buy undervalued stocks that have been oversold

• Historical Recovery: Historically, markets have rebounded from bear phases, which can reward patient investors

• Dollar-Cost Averaging: Regular investments during a downturn can lower the average cost per share over time

👎 Cons

• Market Timing Challenges: Predicting the market bottom is difficult, making it risky to invest at any point during a bear market

• Potential for Further Declines: There's always a risk that the market may continue to fall, leading to greater losses

• Liquidity Concerns: In a bear market, it may be more difficult to sell your investments without taking a significant loss

• Emotional Stress: The volatility and uncertainty can lead to emotional decision-making, potentially resulting in poor investment choices

Investors should weigh these pros and cons carefully, considering their financial situations, investment goals, and risk tolerance before making decisions during a bear market.

Is it good to buy Bitcoin in a bear market?

Buying Bitcoin in a bear market presents a unique set of considerations. The chart below indicates a period where Bitcoin underwent a significant decline, marked by the red arrow, before entering a recovery phase that led to new highs.

BTC/USD

In the context of the chart, an investor who bought Bitcoin during the downturn and held onto it through the recovery phase would have seen substantial gains. This pattern suggests that bear markets can offer buying opportunities for those who are patient and willing to endure volatility.

However, the risks are noteworthy. The cryptocurrency market is known for its high volatility, and while the chart shows a recovery, it does not capture the interim price swings that could have resulted in substantial losses for investors who couldn’t afford to hold long-term. Additionally, Bitcoin and other cryptocurrencies are subject to regulatory risks, technological challenges, and market sentiment that can cause rapid price changes.

Investors considering buying Bitcoin in a bear market should assess their risk tolerance and investment horizon. The decision to buy should be made with the understanding that while there is the potential for high returns, the path to those returns may be rocky, and the investment could experience significant drops in value before any recovery.

Is it good to buy gold in a bear market?

When equities fall, investors often turn to gold as a safe haven, and the historical performance depicted in the chart provides insight into this strategy. The red arrow indicates a period of decline in the value of the SPDR Gold Trust, a proxy for gold prices, followed by a recovery and stabilization.

GLD price

Gold is traditionally viewed as a store of value during times of economic uncertainty. As the chart suggests, after the initial decline, gold prices tend to stabilize and can even increase, offering a hedge against inflation and currency devaluation. Its reputation as a safe asset may provide a cushion against the volatility of bear markets.

The recovery phase in the chart illustrates gold's potential to retain value when other assets are declining. While not immune to fluctuations, gold often has an inverse relationship with stocks and can serve as a portfolio diversifier.

However, gold does not yield dividends or interest, and its holding costs can impact overall returns. The decision to buy gold should align with an investor's overall strategy and risk tolerance. Additionally, while gold has historically performed well in the long term, it can take a long time for a full recovery to take place, and investors in gold need to have patience in mind.

Is it good to buy currency in a bear market?

The prospect of buying currency in a bear market can be complex and risky, as demonstrated by the chart for the British Pound against the U.S. Dollar. The red arrow marks a sharp decline in the value of the pound, indicative of the volatility inherent in the Forex market during turbulent economic times.

GBP/USD

Currencies can be extremely volatile during bear markets, as investors flee to safety and central banks may intervene in the market.

Buying currency in a bear market could be advantageous if one can accurately predict currency movements. However, this requires a sophisticated understanding of global economics, interest rates, and geopolitical events. For the average investor, this level of complexity adds significant risk to currency trading.

The potential for loss is significant, as the chart shows no immediate rebound after the sharp decline. The prolonged nature of currency trends can result in sustained losses if the market does not move in the anticipated direction.

Purchasing currency in a bear market is often best left to professional traders who can manage the risk and have the resources to weather potential losses. For many investors, the dangers presented by the high volatility and the unpredictable nature of Forex markets may outweigh the potential benefits.

Summary

Warren Buffett's maxim to "be fearful when others are greedy and to be greedy only when others are fearful" aptly encapsulates the cautious yet opportunistic approach required in bear markets. These periods, marked by widespread pessimism, can offer attractive buying opportunities for those with the acumen to discern value amidst the decline.

However, the risks are palpable, and the balance between fear and greed must be carefully managed. Bear markets are not for the faint-hearted, and the courage to act when others hesitate can be rewarding, provided it is underpinned by wisdom and a strong investment strategy.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Bear market

A bear market is a period of time in which an investment asset, such as stocks, bonds, or commodities, experiences a decline in price for an extended period of time.

-

3

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

4

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

5

Index

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Tobi Opeyemi Amure is an editor and expert writer with over 7 years of experience. In 2023, Tobi joined the Traders Union team as an editor and fact checker, making sure to deliver trustworthy and reliable content. The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options.

Tobi Opeyemi Amure motto: The journey of a thousand miles begins with a single step.