Upcoming Stock Splits 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

If you're too busy to read the entire article and want a quick answer, the best commission-free stock broker is Plus500. Why? Here are its key advantages:

- Is legit in your country (Identified as United States

)

- Has a good user satisfaction score

- Diverse investment options

- Instant deposits and fast withdrawals

Stock splits can increase liquidity and availability and can be a bullish signal of corporate confidence. But the strategy of buying a stock before a stock split comes with risks. It can take weeks or months from announcement to stock split, we recommend following the official announcements of the exchanges. Among the expected high-profile stock splits of 2025:

Nvidia (NVDA) Dominant in GPUs and AI, substantial revenue growth, potential stock split.

CrowdStrike (CRWD): Leader in cybersecurity, solid financial performance, possible future split.

Microsoft (MSFT) Historical splits, impressive growth, AI integration, potential 2025 split.

In the financial world, stock splits are maneuvers that often capture the attention of investors, analysts, and the general public alike. A stock split occurs when a company decides to increase the number of its outstanding shares, thereby reducing the price per share without altering the company's overall market capitalization.

This move can make shares more accessible to a broader base of investors and can have various implications for both the company and its shareholders.

What is a stock split?

At its core, a stock split divides the company's existing shares into multiple ones to increase liquidity and make the stock more affordable to small investors. While the total value of the shares remains unchanged, the action is perceived positively in the market, reflecting a company's growth and accessibility. It's a strategy often employed by firms looking to enhance their stock's marketability and attractiveness to a wider audience.

Companies choose to do stock splitting for several reasons, particularly in 2025, where the market dynamics and investor preferences continue to evolve. Here are a few pivotal reasons:

Enhanced Liquidity: Stock splits increase the number of shares available in the market, thus improving liquidity. This makes it easier for investors to buy and sell shares without influencing the stock price too much.

Affordability: By reducing the price per share, companies make their stocks more accessible to retail investors. This inclusivity can broaden their investor base.

Psychological Appeal: Lower-priced shares often appear more attainable to individuals, which can drive demand and potentially increase the stock's price over time.

Benchmarking: Companies may also split their stocks to align with the share prices of their peers in the industry, ensuring they remain competitive and not perceived as overvalued or undervalued based on share price alone.

Signal of Confidence: Executing a stock split can be interpreted as a marketing signal from the company’s management that they believe in the firm's continued growth and performance. It's a way of sharing success with the investors, making the stock even more attractive.

Stock Split on the Nasdaq Exchange in 2025

In 2025, the Nasdaq Exchange continues to facilitate stock splits with precision and regulated oversight, ensuring a seamless transition for both the companies and their investors. The process of a stock split on the Nasdaq involves several key steps:

announcement,

SEC filing,

shareholder notification,

and finally, the execution of the split on the effective date.

For example, on the Nasdaq, when a company like Hemppaco Co., Inc. decides to undergo a stock split, it must first publicly announce its intentions, including the split ratio and the effective date of the split. In this case, Hemppaco announced a 1:10 split, effective on March 13, 2024. This means that for every share held by an investor, they will now hold ten after the split, at a reduced price per share.

This announcement is then followed by a filing with the Securities and Exchange Commission (SEC), where detailed information about the split is provided. Shareholders are informed through official communications, and the company's transfer agent adjusts the share registry to account for the increased number of shares.

On the effective date, the stock begins trading at the adjusted price on Nasdaq, reflecting the new share count but maintaining the company’s pre-split market capitalization.

Which Stocks Will Split in 2025?

As of 2025, a variety of stocks have been slated for splits, indicating a robust interest in this financial strategy.

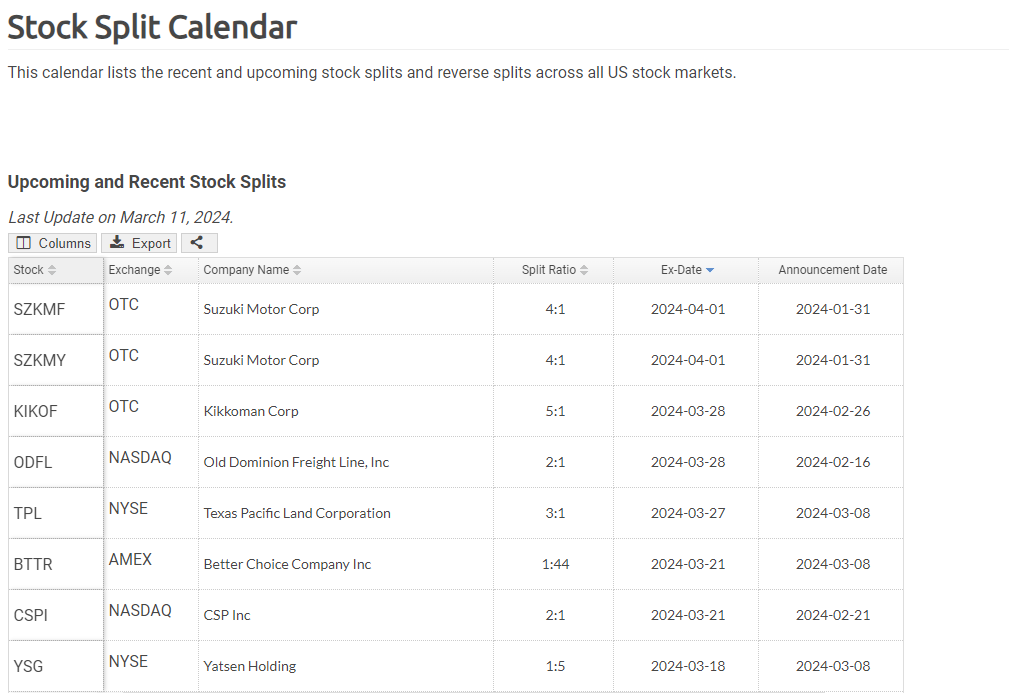

A stock split calendar, a vital tool for investors and analysts, details upcoming and recent stock splits across all US stock markets. This calendar is continuously updated with the latest information, capturing key details such as the stock symbol, the exchange on which it's listed, the company name, the split ratio, the ex-date, and the date of announcement.

For instance, Old Dominion Freight Line, Inc., listed on the NASDAQ, has announced a 2:1 stock split, with an ex-date set for March 28, 2024. Such a move can signify the company's robust performance and its strategy to make its shares more accessible. On the NYSE, Texas Pacific Land Corporation has disclosed a 3:1 split, echoing a similar confidence in accessibility and growth.

Stock Split Calendar

Stock Split CalendarThe expert use of calendars that aggregate this information from exchanges about stock splitsensures that investors have the knowledge at their fingertips, enabling them to make informed decisions without missing out on critical market movements.

Best Stock Brokers

Is it good to buy shares before a split?

The conventional wisdom suggests that buying shares before a stock split can be beneficial, as stock prices may rise due to the split announcement and ensuing excitement. However, this isn't a guaranteed outcome. Let's explore some real-world examples.

Tesla (TSLA) Stock Split Example

Tesla's stock split announcement was a cause for fervor among investors, creating a pre-split price increase as many rushed to capitalize on the anticipated rise in value post-split.

TSLA share price declined after the split

TSLA share price declined after the splitHowever, after the actual split occurred, the excitement dissipated, and the price corrected, aligning more closely with the company’s fundamentals rather than the speculative frenzy. While there may be a temporary appreciation in stock value before a split due to FOMO (fear of missing out), it doesn't necessarily translate into long-term gains.

Amazon (AMZN) Stock Split Example

Similarly, Amazon's 20:1 stock split generated substantial buzz. Before the split, share prices saw an uptrend, likely fueled by predictions of increased demand from smaller investors.

AMZN share price has fallen sharply since the split

AMZN share price has fallen sharply since the splitNonetheless, after the split, the initial exuberance cooled, which might be attributed to the realization that while shares were more affordable, the intrinsic value of the company had not changed.

NVIDIA (NVDA) Stock Split Example

NVIDIA's 4:1 split tells another side of the stock split story. Leading up to the split, NVIDIA experienced a significant price surge, which might be attributed to its strong financial performance and growth prospects in the tech industry.

NVDA share price rose after the split

NVDA share price rose after the splitHowever, post-split, the stock's price showed a degree of volatility but maintained a general upward trajectory, indicating that a stock split combined with solid company performance can sustain investor interest over time.

While buying shares before a stock split might seem advantageous during the pre-split hype, investorsshould be cautious. The post-split performance is dependent on a multitude of factors including overall market sentiment, company performance, and macroeconomic conditions. As such, a stock split alone should not be the sole determinant of an investment decision.

Which Stocks Are Expected to Split in 2025?

As we scan the horizon of 2025, tech behemoths Nvidia (NVDA), CrowdStrike Holdings (CRWD) and Microsoft (MSFT) are on the roster for anticipated stock splits.

1. Nvidia: Dominating the Tech SceneNvidia: Dominating the Tech Scene

Nvidia’s mastery in accelerated computing is unmatched. Dominating the graphics processor industry and leading in AI computing, Nvidia's GPUs are pivotal in workstations and machine learning. Its innovations, such as the DGX Cloud platform, propel Nvidia's AI-as-a-service, showing the company’s prowess in melding hardware, software, and cloud services.

Financial growth is stellar, with a third-quarter revenue leap of 206% to $18.1 billion. Nvidia sits on the cusp of a vast AI market, potentially worth $1 trillion. Analysts are bullish, forecasting an annual earnings growth of 81% over five years. The market's growth indicators, combined with Nvidia’s strategic position, make a stock split a prudent forecast for the company.

2. CrowdStrike: Securing Digital Frontiers

In cybersecurity, CrowdStrike carves its niche with an array of applications aimed at streamlining complex digital defense systems. The company's expertise in AI-driven security solutions has catapulted it to a commanding position in endpoint and cloud security.

The third quarter showed a 35% revenue increase to $786 million, illustrating resilience and growth even amidst economic challenges. With a projection of 30% sales growth annually for five years, CrowdStrike's trajectory is set for expansion. Its broadening product portfolio, including the new Charlotte AI, and a foothold in high-demand cybersecurity markets, signal CrowdStrike as a prime candidate for a future stock split.

3. Microsoft (MSFT): Poised for Potential Split

With a current share price of $415 and a history of nine splits, Microsoft (MSFT) is a likely candidate for another stock split. Since its last split in 2003, MSFT has soared 1,560%, outperforming the broad market index. The company's impressive growth is propelled by its integration of AI across its services, with Azure AI being adopted by numerous Fortune 500 companies.

Microsoft's robust financials are evident in its $3.1 trillion valuation and $81 billion cash reserve, alongside a 33% profit increase year-over-year. This tech titan, firing on all cylinders, may very well consider a stock split to make its shares more accessible, continuing its legacy of growth and investor confidence.

Between the declaration and execution of stock splits lies a period ranging from weeks to months. Tracking these splits requires vigilance and reliable resources, as they can have significant implications for investment strategies. For those invested in the tech sector's pulsating rhythm, staying informed through dedicated platforms is crucial to capture these pivotal moments in 2025.

AlexSmith, stock expert from theTradersUnion team, advises taking advantage of TradingView, which marks the dates of stock splits on charts to study the price behavior after the split.

Conclusion

Business sharks are well aware that stock splits give shareholders the perception that their wealth has increased. Split stocks are the result of strong behavior: a company would not decide to split unless the stock had already grown in value prior to the split to a level that investors might consider "too high." Split stocks typically experience rapid growth accompanied by strong momentum.

Another reason for splits is the desire to increase the number of stocks available for trading. Institutionalists try to avoid stocks with low trading volume because opening and closing large positions can significantly affect the price. The more shares outstanding, the less the price is affected by large-customer trades.

The anticipation around stock splits serves as a barometer of a company's growth and investor sentiment. For those eyeing Nvidia and CrowdStrike, potential splits may not only reflect corporate confidence but could also recalibrate share accessibility. Investors should weave these developments into their strategies with discernment.

Ultimately, while stock splits symbolize a company’s success, astute investors will weigh these events against the backdrop of market trends and the companies' fundamental strengths. The journey through the investment landscape, marked by such milestones, demands both keen observation and strategic foresight.

FAQs

What is a stock split announcement?

A stock split announcement is a public statement by a company that it intends to increase the number of its outstanding shares, which usually results in a reduction of the stock price while maintaining the same market capitalization.

What happens when a stock splits?

When a stock splits, each existing share is divided into multiple shares, increasing the total number of shares and decreasing the price per share. For example, in a 2-for-1 split, an investor who owns 100 shares before the split will own 200 shares at half the price each after the split.

Is a split good for a stock?

A split can be beneficial for a stock as it can make shares more affordable for small investors, potentially increase the stock's liquidity, and often reflects positively on the company's growth prospects, but it doesn’t inherently change the company’s fundamental value.

What does a 1:10 stock split mean?

A 1:10 stock split means that for every one share an investor holds, they will receive ten shares after the split, reducing the price per share by a factor of ten while keeping the total value of their shares the same.

Related Articles

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

FOMO in trading refers to the fear that traders or investors experience when they worry about missing out on a potentially profitable trading opportunity in the financial markets.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

SIPC is a nonprofit corporation created by an act of Congress to protect the clients of brokerage firms that are forced into bankruptcy.

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Algorithmic trading is an advanced method that relies on advanced coding and formulas based on a mathematical model. However, compared to traditional trading methods, the process differs by being automated.