deposit:

- $1

Trading platform:

- Mobile Apps

- Own platform

- FINRA

- SEC

- SIPC

Passfolio Review 2024

deposit:

- $1

Trading platform:

- Mobile Apps

- Own platform

- Margin trading is available: margin size - 50%, if the share price is higher than USD 5

- Reinvestment of dividends available

Summary of Passfolio Trading Company

Passfolio is a moderate-risk broker with the TU Overall Score of 5.14 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Passfolio clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews. Passfolio ranks 50 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Passfolio is a broker for active traders who choose to trade stocks, cryptocurrencies and ETFs, as well as for investors who choose long-term trading strategies.

Passfolio is an American stockbroker whose trading conditions are suitable for traders and investors of all skill levels. The company is regulated by two independent bodies: the US Financial Services Regulatory Authority (FINRA, CRD#: 299874/SEC#: 8-70262) and the SEC. The Securities Investor Protection Corporation (SIPC) is responsible for the safety of client funds and financial payments in case of unforeseen circumstances. The Passfolio broker gives you the ability to trade stocks, cryptocurrencies, ETFs, REITs and increase portfolio returns with the DRIP investment offer.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | USD 1 |

| ⚖️ Leverage: | Margin trading is available: margin size - 50%, if the share price is higher than USD 5 |

| 💱 Spread: | USD 0.02 for shares worth more than USD 5, 0.5% for trading cryptocurrencies + commission from USD 0.99 to USD 2.99, depending on the order amount |

| 🔧 Instruments: | Stocks, Cryptocurrencies, ETFs, REITs |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Passfolio:

- Low level of the minimum deposit - from $ 1.

- A wide range of payment systems for account replenishment and withdrawal of funds, including local ones.

- The broker offers clients DRIP - an investment program.

- There are no account maintenance fees.

- Passfolio works with traders from 170 countries.

- The company provides for the protection of client funds.

👎 Disadvantages of Passfolio:

- You cannot test the trading conditions of the broker on a demo account.

- The company has few ways to contact support.

- There is little information about trading and the features of various trading instruments in the "Education" section.

Evaluation of the most influential parameters of Passfolio

Geographic Distribution of Passfolio Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Passfolio

Passfolio is an American stockbroker suitable for both active traders and investors. A user with any level of knowledge about trading in the stock markets can open an account since the broker sets a low level of the minimum deposit.

Passfolio offers trading in stocks, cryptocurrencies, exchange-traded funds (ETFs) and REITs - investments in the real estate market, regardless of how much the client plans to invest. The company has a main account, the Standard Plan, which can later be customized with a Passfolio Pro subscription. Subscription provides access to margin trading, dividend reinvestment and allows the trader to use an extended list of orders. Trading commissions for stock trading at Passfolio are minimal, with cryptocurrency trading commissions ranging from $ 0.99 to $ 2.99, and a flat commission of 0.5% is charged.

Since it will take from $ 1 to open an account, Passfolio does not offer users to open a demo account. Detailed information about the current market situation and the news section are also missing.

Dynamics of Passfolio’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

The Passfolio broker not only provides clients with the opportunity to earn income for active trading in stocks, cryptocurrencies and exchange-traded funds but also offers a program for long-term investment and increasing portfolio returns.

DRIP

It is a tool that allows you to automatically reinvest dividends. It is available to users who have subscribed to Passfolio Pro and have activated the DRIP function in their Personal Account.

-

The reinvested position is available in whole and fractional parts.

-

The DRIP system automatically reinvests dividends if a trader has activated such a function.

-

It is impossible to establish the reinvestment of dividends on specific securities or assets.

-

This feature increases the portfolio's profitability and is popular with users who choose a long-term investment.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Passfolio’s affiliate program

-

Referral Program. A trader can receive an additional reward for inviting new users to the company. To do this, you need to open an account with Passfolio, get a referral link in your Personal Account and use it to attract new customers. The trader will receive a bonus for each referral - a random share worth from $ 1 to $ 100. The referral will also receive a bonus share. To receive a reward, a referral must replenish a trading account for at least $ 25 or $ 50 in cryptocurrency. For a year, a referrer can receive shares, the total value of which does not exceed $ 500. Upon reaching the limit, bonus shares will be awarded only to referrals.

The Affiliate Program allows Passfolio traders to generate additional income that does not require trading.

Trading Conditions for Passfolio Users

The Passfolio broker provides an opportunity to engage in active trading, as well as use investment offers to generate passive income in the long term outlook. Trading is carried out in its own Passfolio application, and among the trading instruments are stocks, cryptocurrencies, exchange-traded funds, REITs. The minimum deposit is from $ 1, and for additional functions (reinvesting dividends, access to margin trading, etc.), a trader can buy a subscription to Passfolio Pro. Users can also open an account with shared access: when registering, it is enough to indicate a trusted person who will also have access to your account.

$1

Minimum

deposit

1:1

Leverage

24/7

Support

| 💻 Trading platform: | Own application, mobile application |

|---|---|

| 📊 Accounts: | Standard Plan, Passfolio Pro |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | TED, Nigeria Bank Transfer, ACH, Internal Transfer (US Residents Only), SWIFT International Bank Transfer |

| 🚀 Minimum deposit: | USD 1 |

| ⚖️ Leverage: | Margin trading is available: margin size - 50%, if the share price is higher than USD 5 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | Minimum investment - USD 1 |

| 💱 Spread: | USD 0.02 for shares worth more than USD 5, 0.5% for trading cryptocurrencies + commission from USD 0.99 to USD 2.99, depending on the order amount |

| 🔧 Instruments: | Stocks, Cryptocurrencies, ETFs, REITs |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Reinvestment of dividends available |

| 🎁 Contests and bonuses: | Yes |

Passfolio Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Standard Plan | USD 0,02 per share | Withdrawal via TED - 1.45% + 0.38% + R $ 2, via Nigeria Bank Transfer - 0.5% + NGN 55, via ACH - USD 0.25, via internal transfer - USD 25, via SWIFT - USD 35 ... Withdrawal of cryptocurrency is free |

| Passfolio Pro | USD 0,02 per share | Withdrawal via TED - 1.45% + 0.38% + R $ 2, via Nigeria Bank Transfer - 0.5% + NGN 55, via ACH - USD 0.25, via internal transfer - USD 25, via SWIFT - USD 35 ... Withdrawal of cryptocurrency is free |

There is also no fee for maintaining a basic account, a monthly subscription for Passfolio Pro costs $ 5, an annual subscription is $ 50. To get an unbiased view of the commission fees at Passfolio, we compared them with the commissions for trading stocks at competing companies - Ally and Charles Schwab. The comparison result is presented in the form of a table:

| Broker | Average commission | Level |

| Passfolio | $0.02 | Low |

| Charles Schwab | $11 | High |

| Ally Bank | $4 | Medium |

Detailed Review of Passfolio

Passfolio is a stockbroker that enables you to profit from self-traded markets and offers long-term investment options. Traders from most countries of the world can open an account with the company, the main condition is that the user must be over 18 years old.

Passfolio in figures:

-

The company has 2 types of accounts: Standard Plan and Passfolio Pro.

-

The support team speaks 3 languages.

-

The company has 3,800 shares and 30 cryptocurrencies available.

-

The fee for stocks with a price above USD 5 is USD 0.02.

-

The broker provides services in 170 countries of the world.

-

Passfolio hit the financial services market in 2018.

-

A cryptocurrency transaction fee is USD 0.

Passfolio is a broker for active traders, investors and passive investing

Passfolio offers trading in stocks, ETFs, cryptocurrencies, as well as a unique REIT trading tool that involves investing in real estate. The broker's clients can invest in large companies even if they have USD 1 on their deposit. Traders who subscribe to Passfolio Pro can trade with margin funds and reinvest dividends to get a higher return on investment in the long term perspective.

The commission for trading stocks is USD 0.02, the fee for trading cryptocurrencies is calculated individually, taking into account the amount of orders, and varies from USD 0.99 to USD 2.99. Trading is carried out in its own Passfolio application, trading from mobile devices is possible.

Useful services of Passfolio investment:

-

Education. This section contains information that may be useful to users wishing to open an account with Passfolio.

-

Roadmap. In this section, clients of the company can write what features they would like to see at Passfolio, or support ideas offered by other traders.

-

Support Center. There are answers to frequently asked questions from traders about the broker, trading at Passfolio, deposits and withdrawals, margin trading, and more.

Advantages:

The broker cooperates with traders from 170 countries.

The company has unique investment instruments - REITs.

Passfolio provides conditions for active trading and long-term investment.

Customer funds are protected by SIPC.

The company has a referral program and a welcome bonus for referrers and referrals.

The broker offers many convenient ways to deposit and withdraw funds, including local payment systems.

How to Start Making Profits — Guide for Traders

The broker offers two main types of accounts. Initially, a trader can open the Standard Plan, then subscribe to Passfolio Pro and gain access to advanced functionality.

Account types:

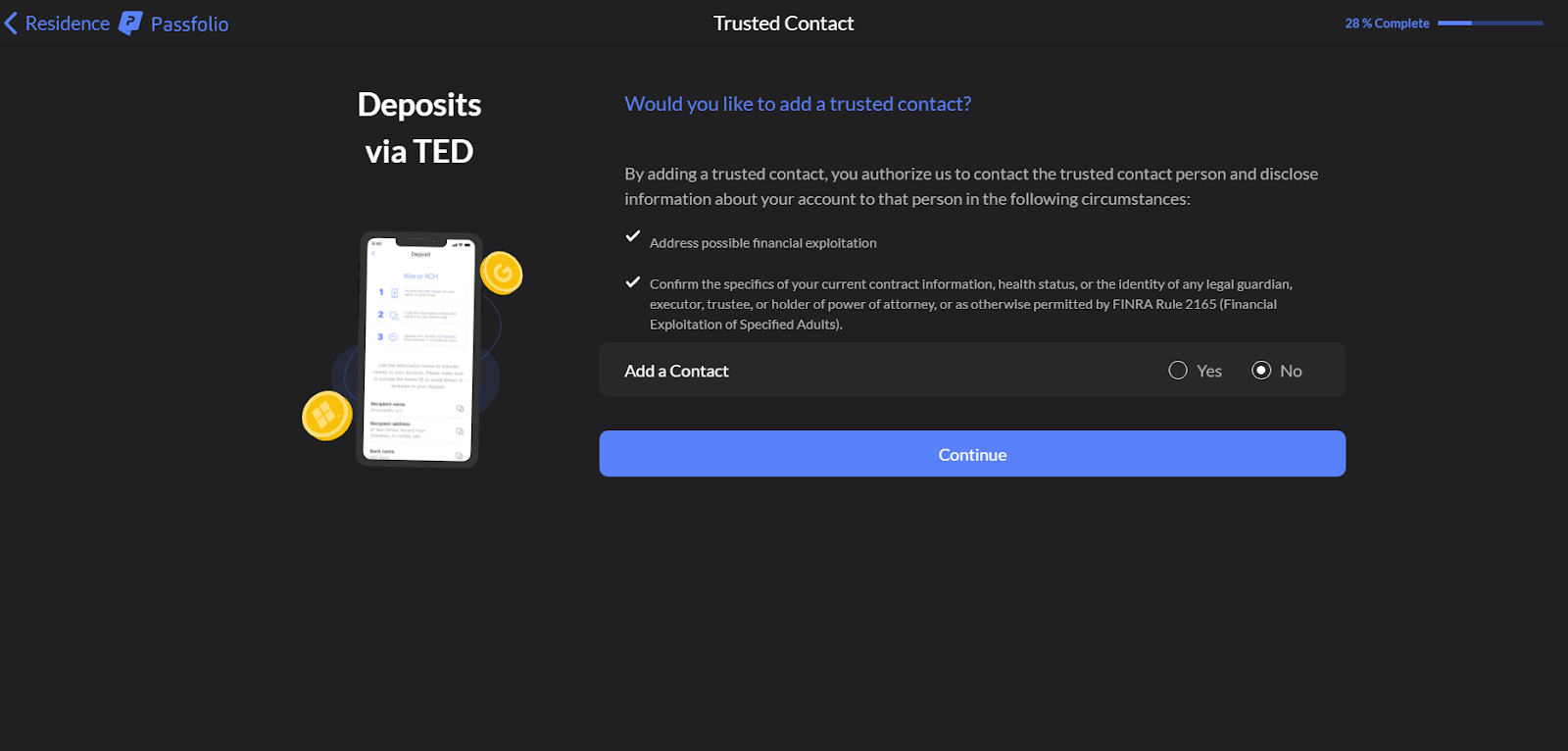

During registration, the user can specify a trusted person - a person who will also have access to trade through the created account.

There is no demo account for checking trading conditions at Passfolio.

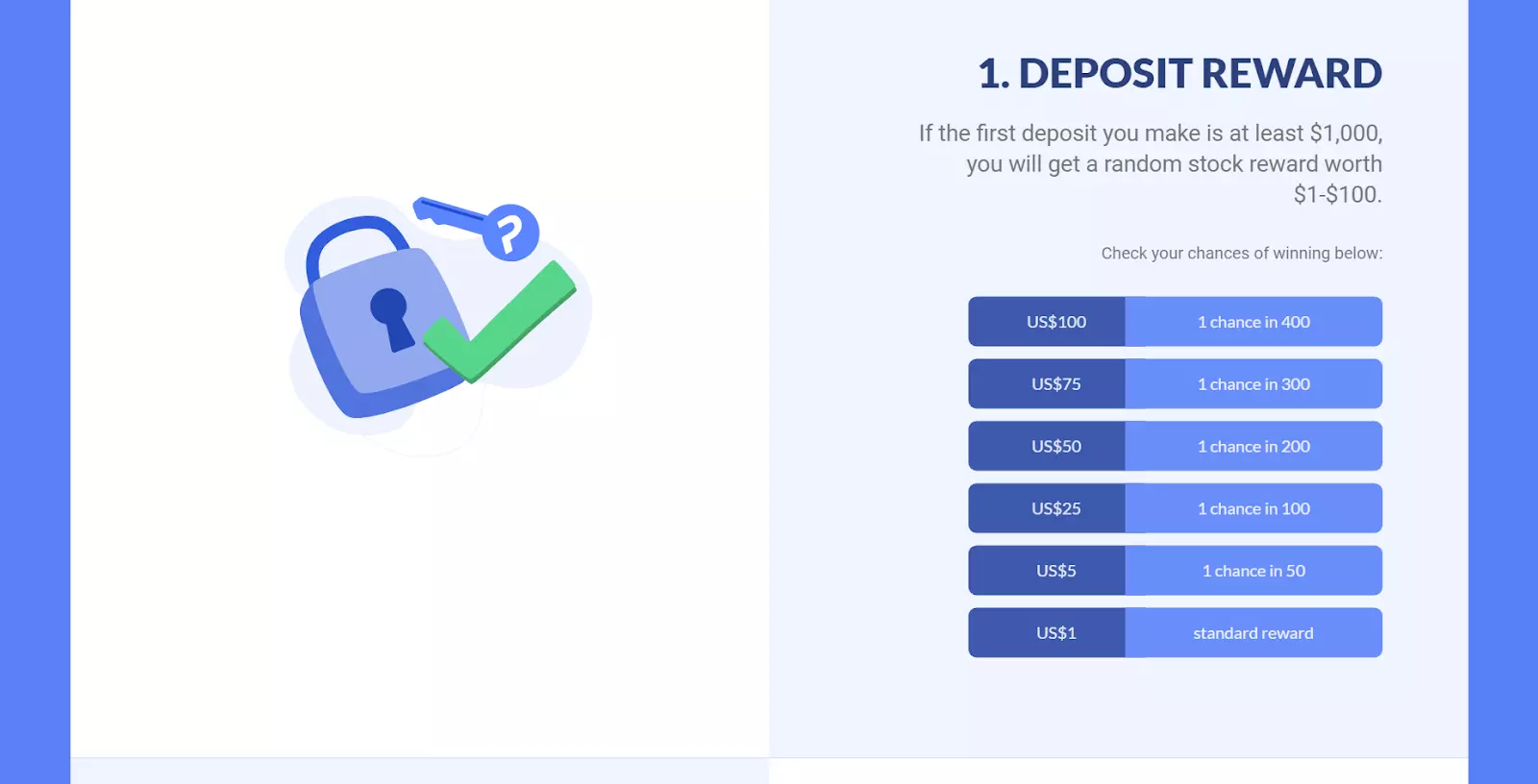

Bonuses Paid by the Broker

Welcome bonus

If a trader deposits his account for the first time for an amount of $ 1000 or more, he can receive a financial bonus in the amount of $ 1 to $ 100. The bonus is awarded randomly.

Investment Education Online

The broker's website contains the "Education" section, which contains information useful for beginners and experienced traders.

The broker does not provide a virtual account where a trader can test his trading skills or check the trading conditions of Passfolio.

Security (Protection for Investors)

Passfolio is licensed and regulated by FINRA (US Financial Services Regulatory Authority) and SEC (Securities and Exchange Commission). This means that the broker is under the supervision of two independent bodies and complies with the requirements that regulators put forward to US brokers.

Passfolio also cooperates with SIPC (Securities Investor Protection Corporation). For the trader, this cooperation guarantees capital protection of $ 500,000, of which $ 250,000 is in cash. If Passfolio goes bankrupt, traders' assets will be transferred to another brokerage company as the assets are held in segregated accounts and remain safe. The user's personal account is protected by two-factor authentication.

👍 Advantages

- The broker is regulated by two bodies: FINRA and SEC

- SIPC guarantees protection of client funds and provides compensation

- Client funds are in accounts Passfolio does not have access to

👎 Disadvantages

- The broker does not provide information about the banks he cooperates with

Withdrawal Options and Fees

-

Passfolio customers have access to the following methods of depositing and withdrawing funds: TED, Nigeria Bank Transfer, ACH, internal transfer (for US residents only), international bank transfer SWIFT.

-

The minimum amount a trader can withdraw through TED is USD 5 and Nigeria Bank Transfer is USD 1. There is no minimum withdrawal amount for other payment systems.

-

Passfolio customers can withdraw funds in these cryptocurrencies: BTC, ETH, BCH, LTC or ZEC. There is no commission for deposits and withdrawals in cryptocurrency.

-

The withdrawal time depends on the payment system. For TED and Nigeria Bank Transfer, it is between 10 and 30 minutes if the transaction is made between 7:00 am and 12:30 pm PT Monday through Friday, and there are no transfers on holidays or weekends. An ACH transfer is credited within 1–5 days, but keep in mind that if you replenished a deposit through ACH, you can withdraw funds in at least 30 days. Domestic transfers and international bank transfers by SWIFT are processed within 1-5 business days.

-

Transaction fees depend on the way the trader has used to withdraw funds. For TED, the fee is 0.38% (federal tax), plus an additional 2 reals per transaction and 1.45% for currency conversion. For Nigeria Bank Transfer, the commission is 0.5% + NGN 55 (depending on the current exchange rate). There is a fee of USD 0.25 for ACH transfers, USD 25 for internal transfers. SWIFT assumes the existence of a commission in the amount of USD 35, which are withdrawn from the trader's account at the time of the application for withdrawal of funds.

Customer Support Service

If the user encounters problems during the registration process, replenishment of the account, making trades and other operations, he can contact the broker's support service.

👍 Advantages

- The support team speaks three languages: English, Portuguese, Spanish

👎 Disadvantages

- Few ways to contact support

- The broker does not indicate the working hours of the support service

There are several ways to contact support specialists:

-

fill out the feedback form on the broker's website;

-

write a letter to e-mail.

There is no online chat on the broker's website, but Passfolio representatives are on social networks: Facebook, Twitter, Instagram. LinkedIn, Telegram.

Contacts

| Foundation date | 2016 |

| Registration address | 10th Floor Beaufort House, 15 St Botolph Street, London, EC3A 7QU |

| Regulation |

FINRA, SEC, SIPC |

| Official site | https://www.passfolio.com/ |

| Contacts |

Email:

hello@passfolioapp.com suporte@passfolio.us, |

Review of the Personal Cabinet of Passfolio

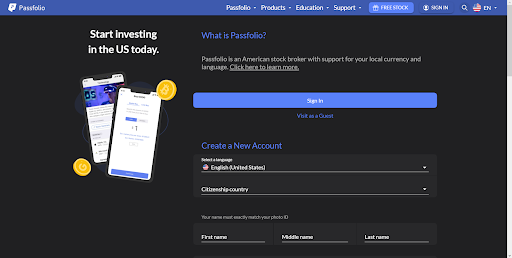

To start trading with Passfolio and take advantage of the benefits of the broker, you need to open an account with the company. How to do this is described in the instructions below.

Go to the broker's official website. To open a trading account, click on the "Sign Up" button located on the main page in the central part of the screen.

Fill out a short form: indicate the language in which you would like to continue the registration, as well as your personal data (name, surname, country of residence, email address and password for the trading account). Then click on the "Create Account" button.

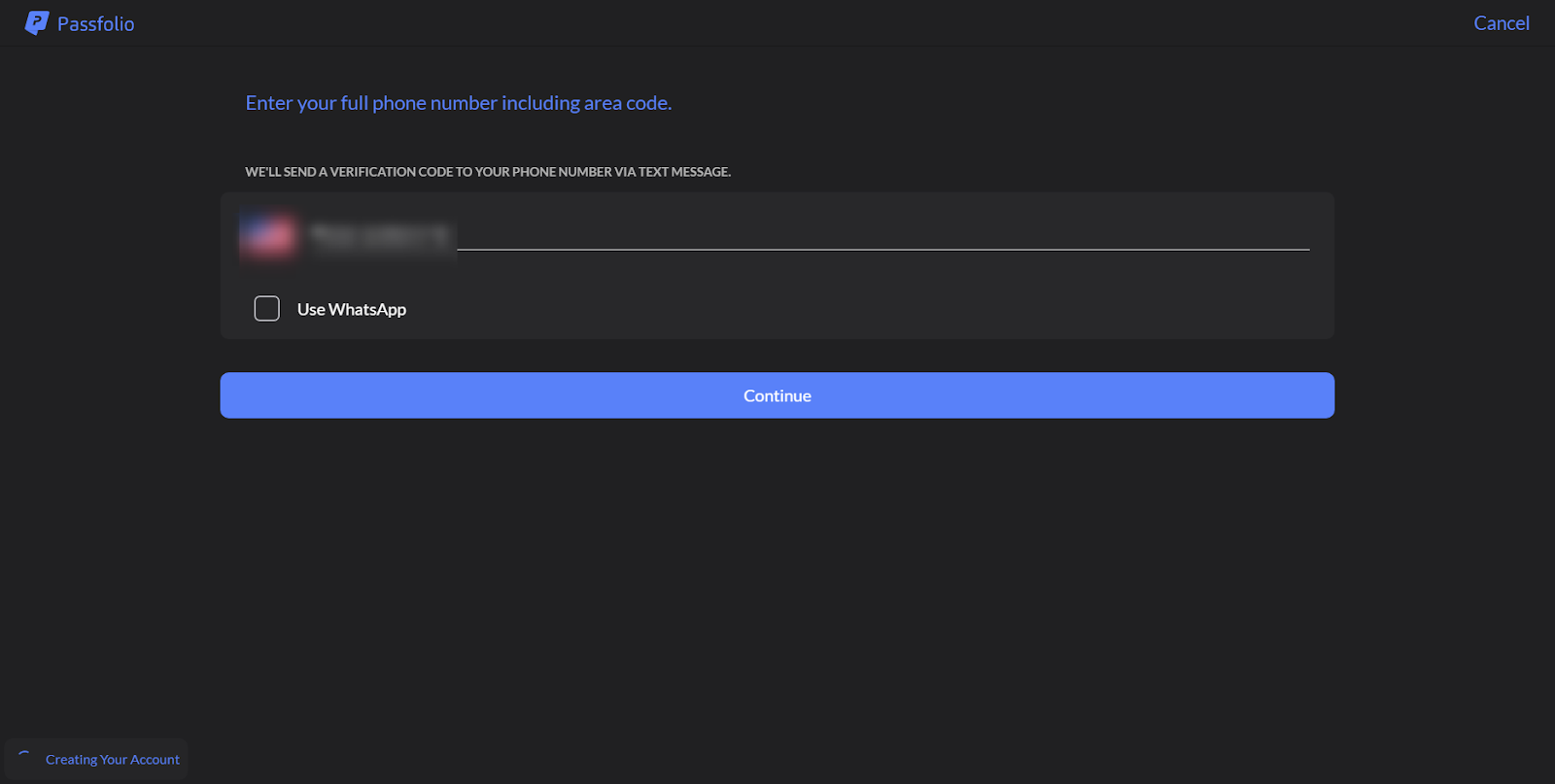

Enter the phone number you can be contacted with. You can also select the "Use WhatsApp Phone Number" option. A code will be sent to your phone number, which must be specified for verification.

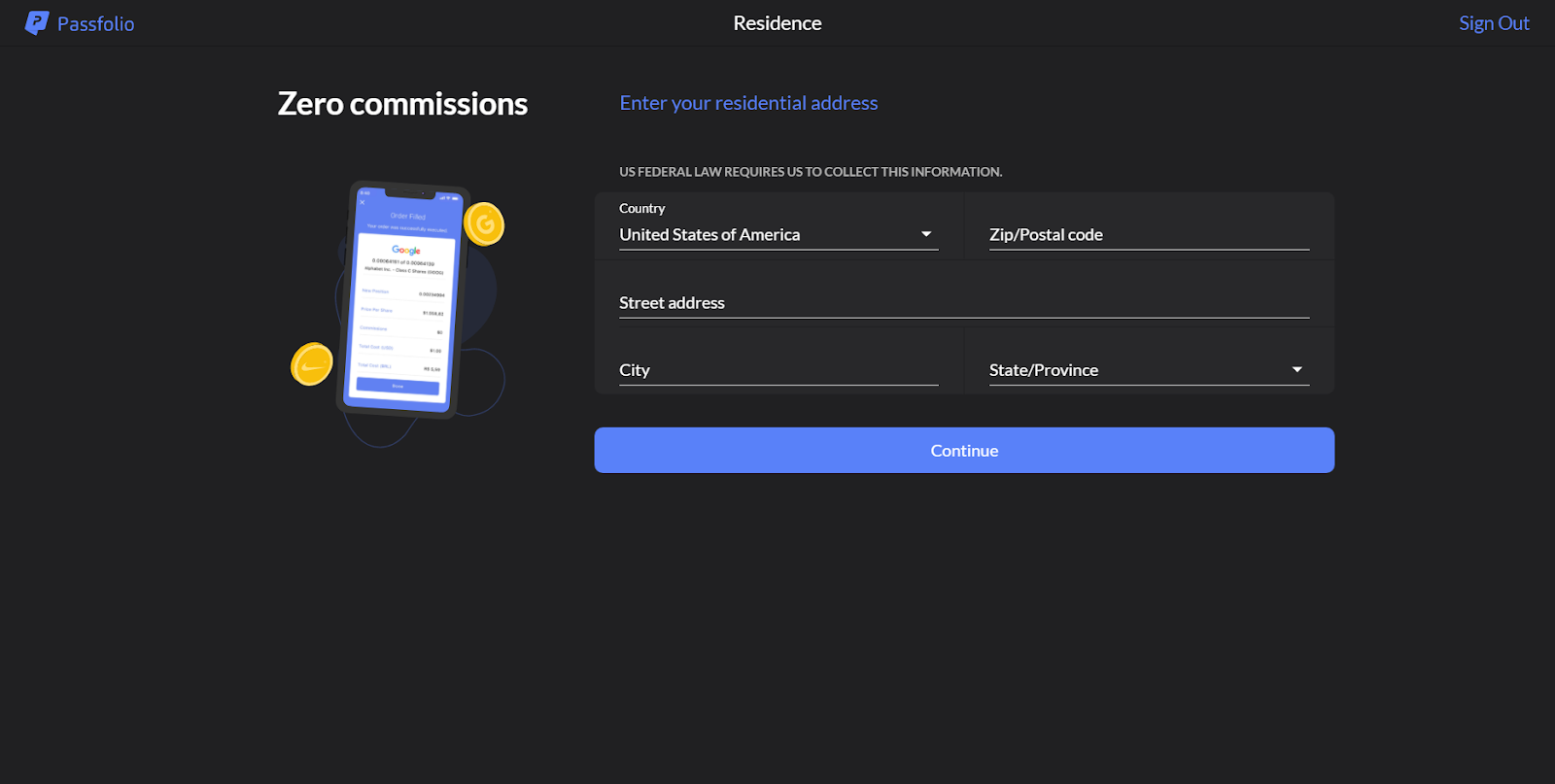

Provide information about your place of residence: country, city, postal code, state.

If necessary, you can specify a trusted person who will also have access to your trading account.

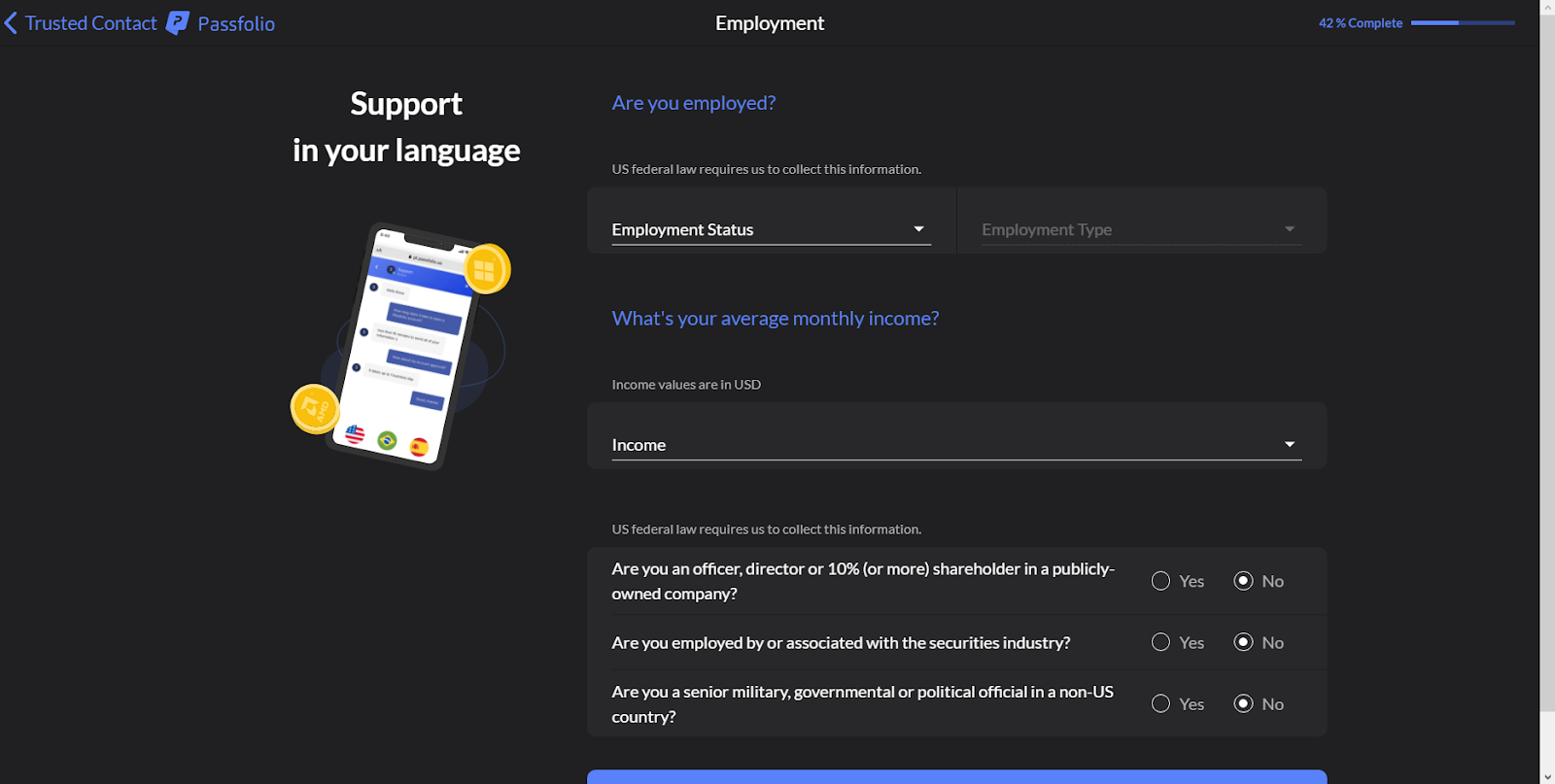

Enter your income details.

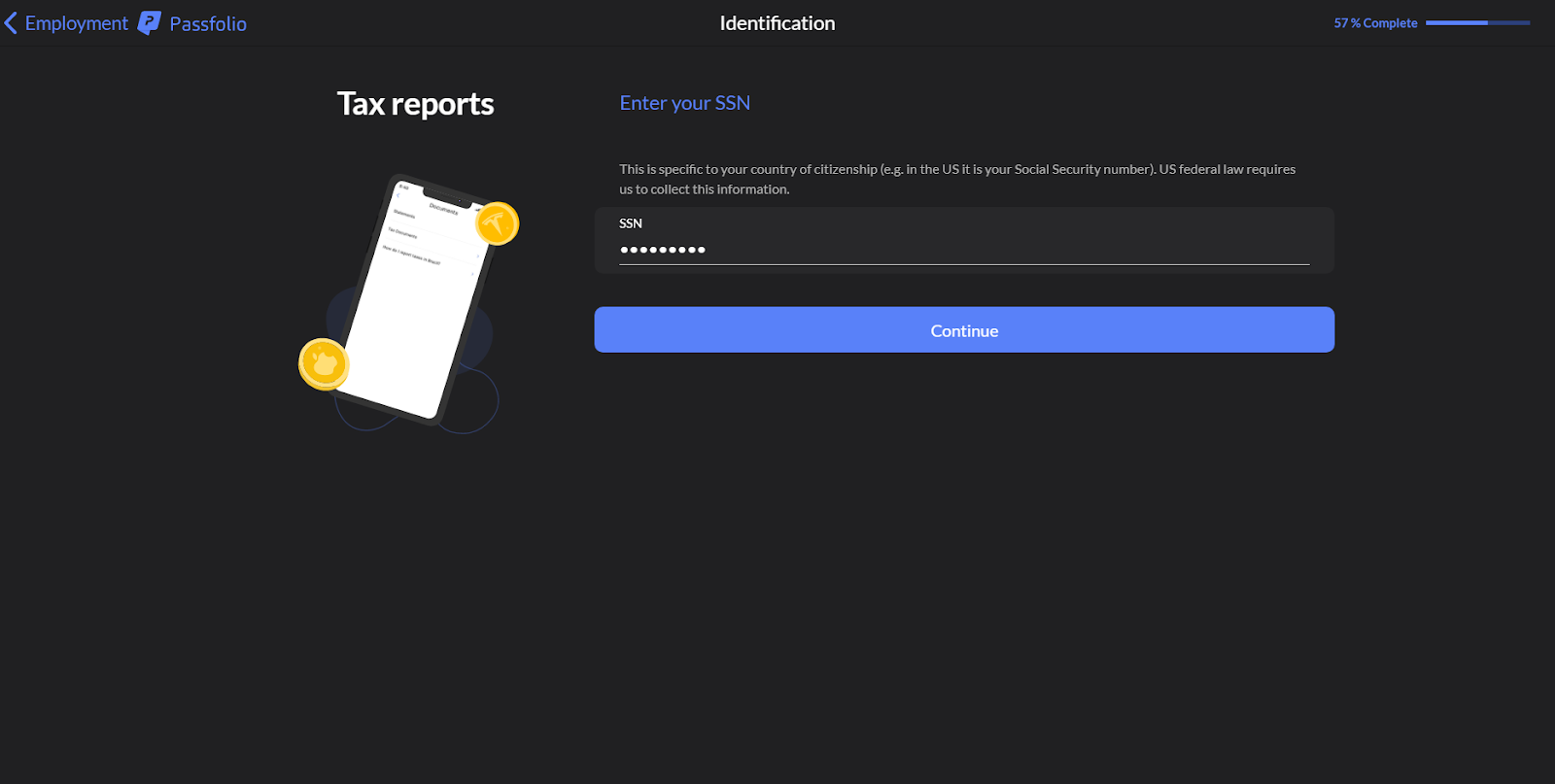

Enter your SSN (Social Security Number) details.

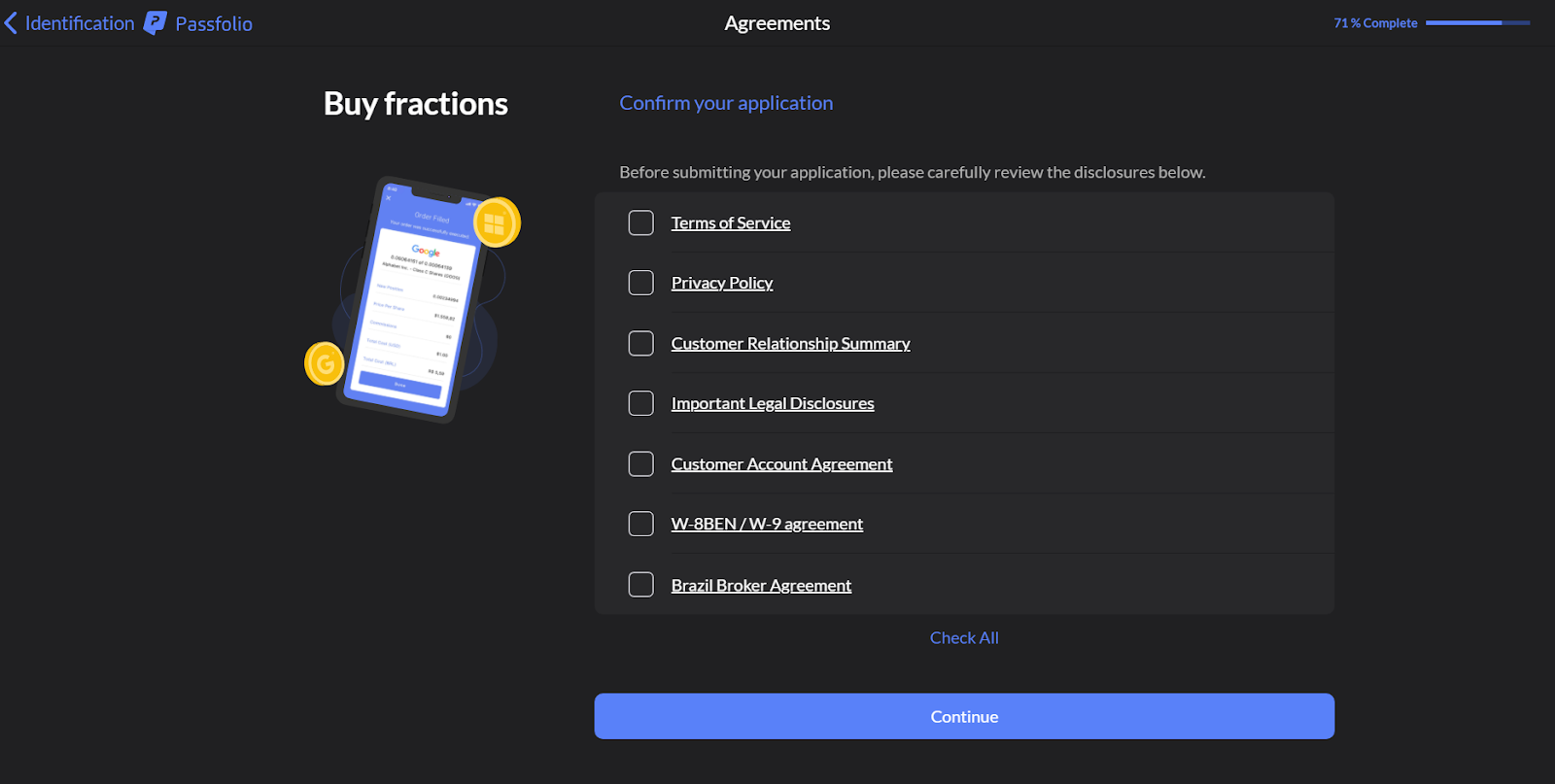

Review the documents and agreements that are applied at Passfolio.

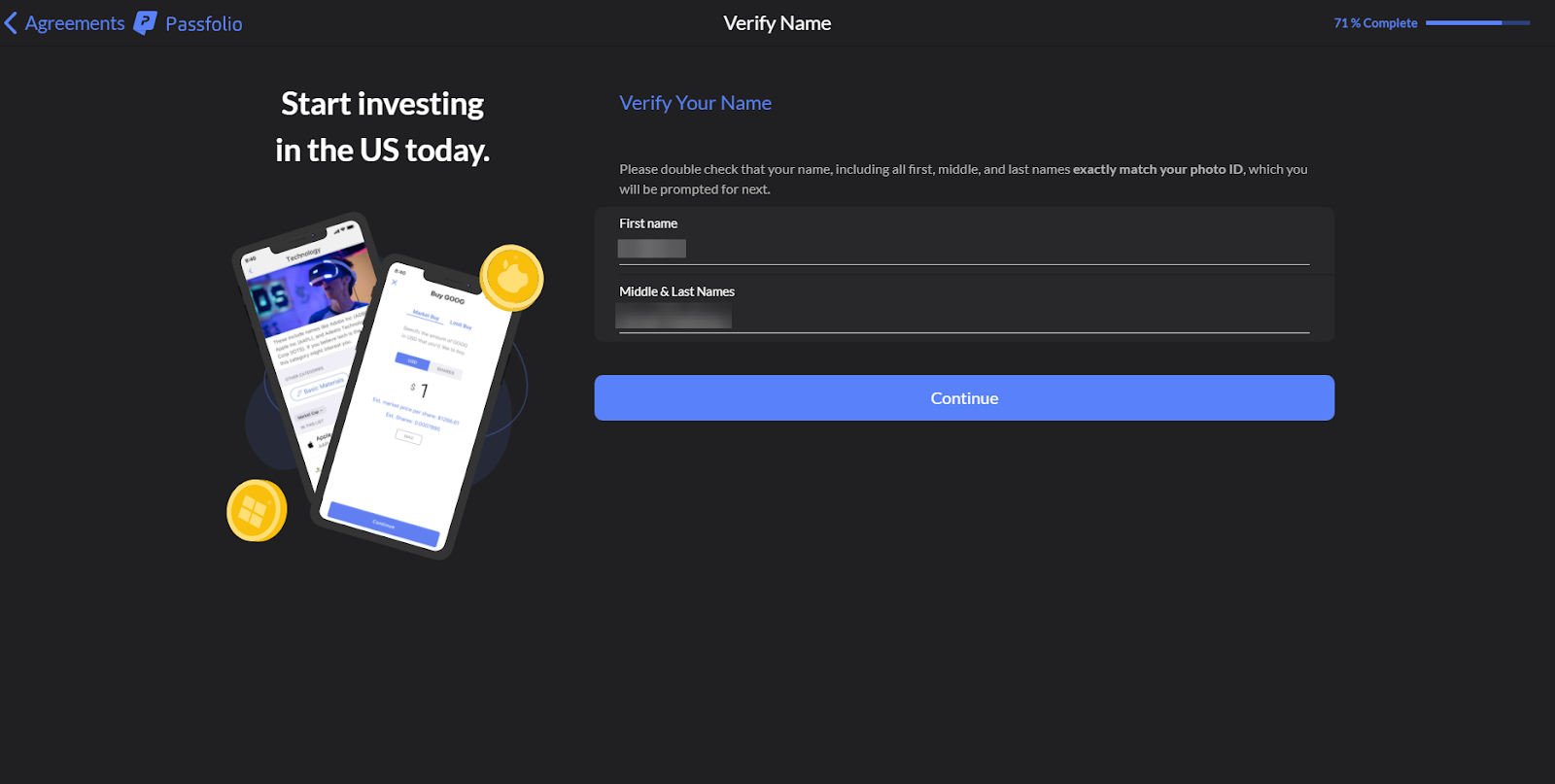

Please confirm the given name and surname.

Additionally, the following sections are available in the Personal Account:

-

History of trading operations.

-

Financial transaction history.

-

Customer support section.

-

Account settings and data editing block.

-

Additional informational sections.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the Passfolio rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Passfolio you need to go to the broker's profile.

How to leave a review about Passfolio on the Traders Union website?

To leave a review about Passfolio, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Passfolio on a non-Traders Union client?

Anyone can leave feedback about Passfolio on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.