deposit:

- $1

Trading platform:

- Proprietary platform

Roofstock Review 2024

deposit:

- $1

Trading platform:

- Proprietary platform

- 1:1

- Clients can only trade in real estate or earn money on ready-made real estate portfolios

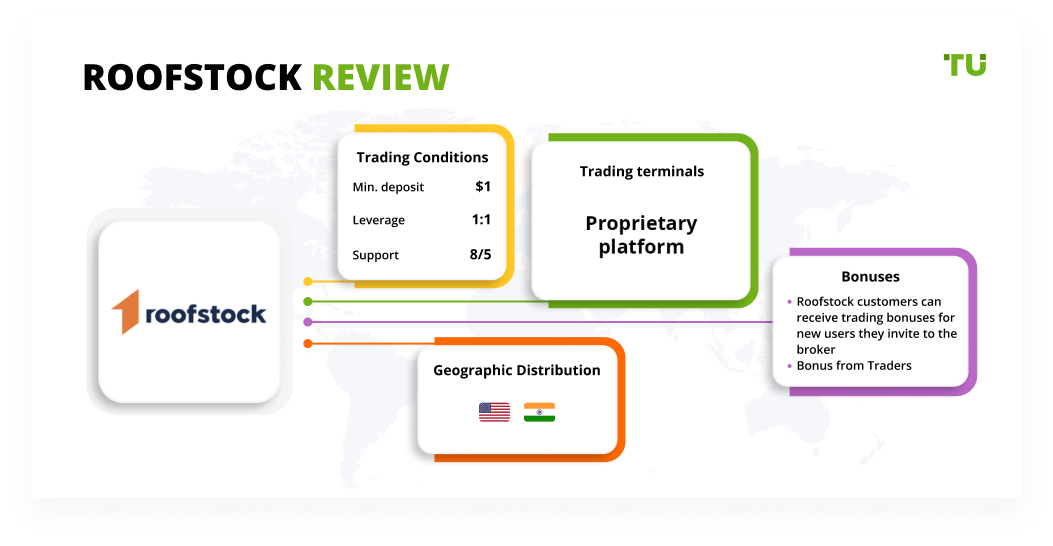

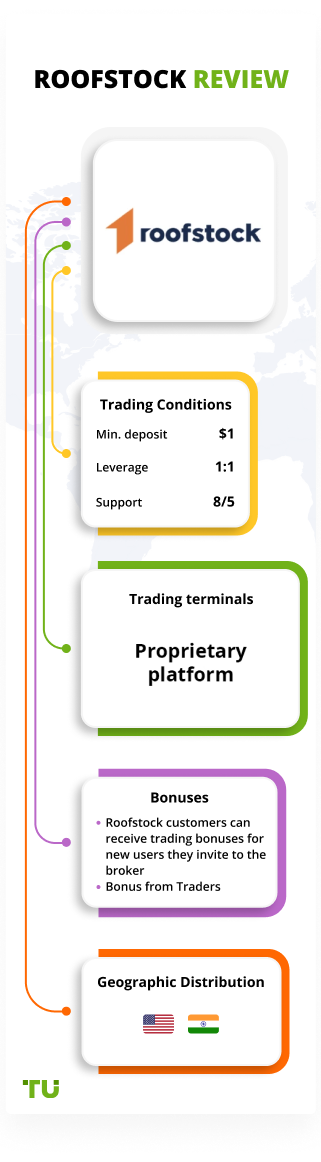

Summary of Roofstock Trading Company

Roofstock is a broker with higher-than-average risk and the TU Overall Score of 4.63 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Roofstock clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. Roofstock ranks 67 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Roofstock is a broker for investors who choose long-term strategies and are ready to invest in US real estate.

Roofstock — a division of Roofstock Realty Llc. — is a broker that specializes in real estate transactions. There are no other trading instruments in the company. A resident of any country can open an account with Roofstock, and in addition to buying real estate, investors can also put up their own plots of land for sale or trade. But it's worth considering that Roofstock offers real estate exclusively from the United States. Roofstock’s trading fees are lower than market fees and additional services are included in the fee. There are no commissions for non-trading operations in the company. Roofstock was mentioned by such publications as Recode, The Wall Street Journal, and Forbes.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | From $0 |

| ⚖️ Leverage: | 1:1 |

| 💱 Spread: | $500 or 5% of the amount when buying real estate, $2,500 or 3% of the amount when selling real estate |

| 🔧 Instruments: | Real estate |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with Roofstock:

- The broker offers a bonus program.

- The commission for trades on real estate at Roofstock is lower than market rates.

- The company does not charge fees for additional services.

- Several ways to contact support.

- Roofstock guarantees a refund if the investor is unhappy with the purchase.

👎 Disadvantages of Roofstock:

- The broker is not suitable for short-term investment.

- Some of the training materials for investors are fee-based.

- The company does not indicate what methods it uses to protect personal data and customer funds.

Evaluation of the most influential parameters of Roofstock

Geographic Distribution of Roofstock Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Roofstock

Roofstock is a company that offers investors the opportunity to invest in real estate and generate income in the future. The Roofstock broker is suitable for long-term investment, and the client can choose a suitable investment strategy and risk level during the registration and trading process. The Roofstock platform features real estate from different states of the United States.

Opening an account with the company is free, and Roofstock takes a commission only for completed trades: 0.5% for purchases and 3% for sales. This amount includes fees for additional services, so there are no non-trading commissions or hidden fees at Roofstock. A resident of any country can open an account. The company does not request documents for verification, and the investor must provide information about his credit card to make trades. Roofstock provides liquidity to real estate, and, if necessary, buys real estate on its own. Roofstock customers can also get their money back if they are not happy with the property they have bought.

But please note that refunds are only possible if the property has been certified and the refund is requested within 30 days of purchase.

Dynamics of Roofstock’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets, and Products of the Broker

The Roofstock broker is focused on providing investment services. The company welcomes persons to invest in real estate and receive a stable income over time. However, the company does not have any programs, services for copying trades, or other tools for generating completely passive income. At Roofstock, managers take on organizational matters, but the investor decides what to invest in.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Roofstock’s affiliate program:

-

Roofstock Affiliate Program. Investors can generate additional income by spreading information about the Roofstock broker and inviting new clients to the company. Each member of the referral program receives a unique referral link, and for each investor who follows this link and registers with Roofstock, the member will receive a financial bonus of $15. If the invited user buys or sells real estate, then both the referrer and the referee will receive $250 each.

A referral program is a mutually beneficial exchange between a company and an investor — the company gets new customers and the participant gets additional profit. Any Roofstock client can become a member of the affiliate program.

Trading Conditions for Roofstock Users

Roofstock is a broker that offers investors to invest in real estate and earn on further leasing. It is also possible to buy a house for personal use. Trades are made on the broker's own platform. The commission for real estate transactions is 0.5% of the purchase amount, the tax for the sale is 3% and includes the cost of additional services. There is only one trading account at Roofstock and it is for active, live transactions. There is no opportunity to test trading skills on a demo account. Leverage and margin trading are not available. There are no programs for generating passive income where the investor does not have to participate in the trading process. You can get additional passive income at Roofstock only by using the referral program.

$1

Minimum

deposit

1:1

Leverage

8/5

Support

| 💻 Trading platform: | Trading is carried out through the broker's proprietary platform |

|---|---|

| 📊 Accounts: | Active trading (real) account only |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | A bank card is required to make transactions |

| 🚀 Minimum deposit: | From $0 |

| ⚖️ Leverage: | 1:1 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No |

| 💱 Spread: | $500 or 5% of the amount when buying real estate, $2,500 or 3% of the amount when selling real estate |

| 🔧 Instruments: | Real estate |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | No |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Clients can only trade in real estate or earn money on ready-made real estate portfolios |

| 🎁 Contests and bonuses: | There are bonuses |

Roofstock Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Real account | $500 or 0.5% of the trade amount | No |

The broker does not charge additional fees for its services, including certification, marketing plans, consultations, etc.

Roofstock's trading fees were also matched against stockbrokers Ally Bank and Charles Schwab. As a result of the analysis, each of the companies received a low or high level of trading commission.

| Broker | Average commission | Level |

| Roofstock | $0.5 | Low |

| Charles Schwab | $11 | High |

| Ally Bank | $4 | Medium |

Detailed Review of Roofstock

The founders of the company set themselves the task of making real estate investing affordable. As a result, you can buy, sell, rent, or invest in real estate on the Roofstock platform. A client from anywhere in the world can become a real estate investor, but it is worth considering that all properties presented on Roofstock are located in the United States.

Roofstock by the numbers:

-

For 6 years, the broker Roofstock has carried out transactions worth more than $3 billion.

-

The purchase commission is only 0.5%, while the minimum market commission is 0.6%.

-

The average Roofstock rating in Google Reviews is 4.9/5.

-

If the investor is no

Roofstock is a broker for active investors in real estate with long-term strategies

Roofstock is a non-standard stockbroker. The main and only tool of its clients is real estate. The broker does not offer leverage or margin trading and is ready to cooperate with investors who want to invest for the long term. Roofstock is not suitable for short-term investments or for generating passive income. There are no programs for passive earnings at Roofstock, and the broker offers the only financial bonus for inviting new clients to the company and their trading. Roofstock is open to cooperation with investors, regardless of whether they have experience. The company provides training materials, investment courses, and offers consulting services.

Roofstock trades are carried out on the broker's proprietary web platform, and investors do not need to install additional software. Trading from mobile devices is not available, but clients can enter their personal accounts through a browser from any device. There is no fee to use the Roofstock platform, and real property data is updated daily.

Useful services of Roofstock investment:

-

Tools and calculators. Investors can use special calculators for free to calculate the rent.

-

FAQs. This section contains answers to frequently asked questions from investors about the Roofstock company and the specifics of real estate trading on this platform.

-

Knowledge Center. This section provides investors with basic information on how to invest capital wisely and introduces the basics of investing in real estate. It includes a glossary of terms and articles about real estate investing in different states of the USA.

Advantages:

Roofstock clients can either buy real estate or list their own property for sale.

The broker guarantees that the purchased land will be leased.

The company offers different investment styles and different levels of risk.

Roofstock has certified properties.

The broker's website has a training base that is necessary for beginners at the beginning of their investment journey.

Investors can contact support by mail, phone, or visit the broker's offline office.

How to Start Making Profits — Guide for Traders

Roofstock offers a single account type that allows clients from different countries to conduct real estate transactions. To open an account, you do not need to provide documents for verification or wait for confirmation from the broker.

Account types:

The specificity of the Roofstock broker does not allow testing different trading strategies or testing trading skills in a virtual account.

Roofstock works with clients from different countries, but the platform represents real estate exclusively within the United States.

Bonuses Paid by the Broker

Roofstock customers can receive trading bonuses for new users they invite to the broker

If a new client followed the investor's referral link and bought or sold real estate, both the investor and the new client of the broker will receive a financial reward of USD 250 each.

Investment Education Online

Roofstock is ready to work with both experienced investors and those who have never invested before. In a special section, the broker has collected information that may be useful to novice investors. There are also paid investment courses at Roofstock.

There is no ability to test your skills on a virtual demo account at Roofstock.

Security (Protection for Investors)

The Roofstock broker is unique and has special terms and conditions because it offers its clients to invest exclusively in real estate. For this reason, the company cannot be regulated by standard regulatory bodies such as the Securities and Exchange Commission.

Roofstock guarantees the security of customers' personal data and uses special features to encrypt information in its work. The company is also interested in ensuring that the trade satisfies its customers, therefore, if necessary, the investor can apply for a refund if the purchased property did not meet his expectations. This can be done within 30 days from the date of purchase. Refunds can be requested no more than once every 180 days.

👍 Advantages

- The broker guarantees a refund within 30 days

- The company is officially registered and licensed

👎 Disadvantages

- The broker is not regulated by any US authority

- The company does not provide information on how to encrypt confidential customer data

Withdrawal Options and Fees

-

The Roofstock broker needs the investor's credit card information to make a trade. If the trade is confirmed, then the broker takes a commission from the card.

-

The amount of the commission depends on whether you are buying or selling real estate.

-

The broker does not request documents for identity verification. Credit card information serves as a guarantee that the investor is ready to make the trade.

Customer Support Service

Clients of Roofstock, faced with problems or questions that they did not find an answer to on the site, can contact the company's employees.

👍 Advantages

- Investors have several ways to contact support

- Broker clients can request a callback from an expert

- Investors and potential clients can visit the real office of the company

👎 Disadvantages

- No online chat

- The broker does not indicate the working hours of the support service

This broker provides the following communication channels for its clients:

-

call one of the numbers provided;

-

fill out the feedback form on the broker's website;

-

write a letter to: support@roofstock.com;

-

visit the offline office of the Roofstock broker;

-

visit its online messenger services at Facebook, LinkedIn, or Twitter.

Contacts

| Foundation date | 2015 |

| Registration address | 2001 Broadway, Suite 400 Oakland, CA 94612 |

| Official site | https://www.roofstock.com/ |

| Contacts |

Email:

support@roofstock.com,

Phone: (800) 466-4116 |

Review of the Personal Cabinet of Roofstock

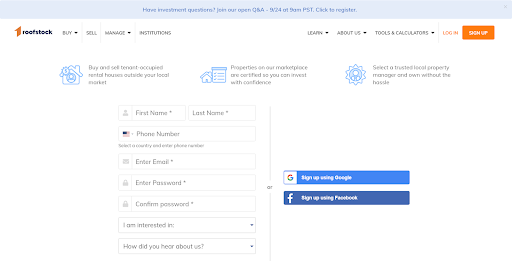

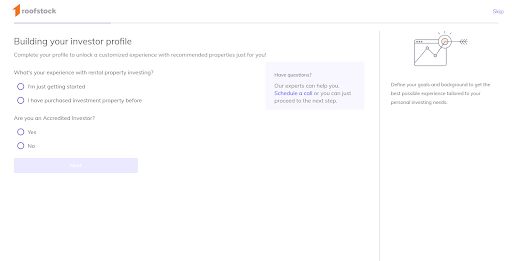

Access to the services and functionality of the Roofstock broker can be obtained only by opening an account with the company. To do this, follow these step-by-step instructions:

Visit the broker's official website. To open a new trading account on the main page, click on the "Sign Up" button located in the upper right corner.

Fill out the form with your personal data such as your first name, last name, phone number, email address. Create a login password and confirm it. Choose the type of activity that suits you, such as you want to buy or sell real estate, or act as an agent of a Roofstock broker. You can also use your existing Google and Facebook accounts to register.

Indicate if you have investment experience if you are an accredited investor.

Select the amount you are willing to invest and the period during which you want to make a trade.

Specify the preferred region of the United States (North, South, West, East) for your real estate activities.

Choose the risk tolerance that suits you (low, moderate, high) and an investment strategy focused on income, balance, or growth.

Indicate if you agree to deal with properties that have not been verified and certified by the Roofstock broker, highly depreciated properties, properties in need of renovation and located in unattractive regions.

After filling in all the fields and answering all the broker's questions, you will be taken to your personal account.

The functions of the personal account:

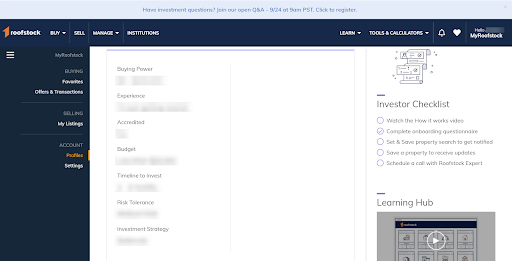

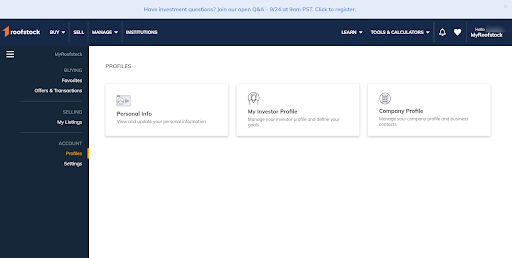

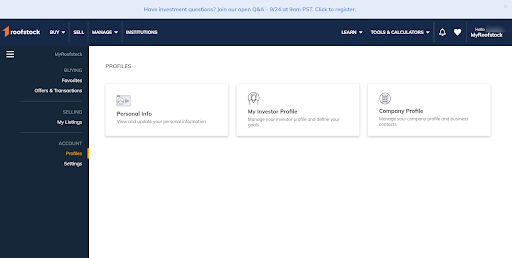

1. Profile settings. Here you can change your personal data, adjust your preferences for real estate transactions and choose a different investment strategy.

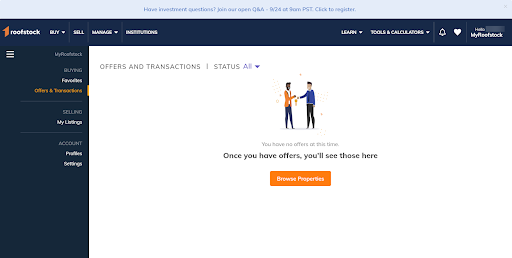

2. Offers and Transactions. In this section, you can track what trades you have made.

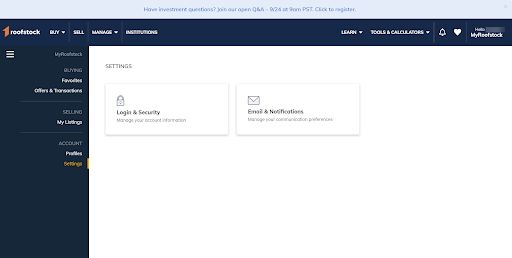

3. Settings. Here you can change security settings, manage emails and notifications from the Roofstock broker.

1. Profile settings. Here you can change your personal data, adjust your preferences for real estate transactions and choose a different investment strategy.

2. Offers and Transactions. In this section, you can track what trades you have made.

3. Settings. Here you can change security settings, manage emails and notifications from the Roofstock broker.

Also in the personal account, the investor has access to:

-

Learn. A section that contains answers to frequently asked questions (FAQs) and all the information an investor needs to work with the Roofstock broker.

-

Tools & Calculators. The broker offers built-in finance and lease calculators.

Read also about other stock brokers:

Articles that may help you

FAQs

Do reviews by traders influence the Roofstock rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Roofstock you need to go to the broker's profile.

How to leave a review about Roofstock on the Traders Union website?

To leave a review about Roofstock, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Roofstock on a non-Traders Union client?

Anyone can leave feedback about Roofstock on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.