deposit:

- $1

Trading platform:

- MultiCharts

- FIX API

- SaxoTraderGO

- SaxoTraderPRO

- TradingView

- DFSA

- FCA

- ASIC

- FINMA

- and SFC

deposit:

- $1

Trading platform:

- MultiCharts

- FIX API

- SaxoTraderGO

- SaxoTraderPRO

- TradingView

- Up to 1:30 for Forex

- Trading fees reduce when trading volumes increase

Summary of Saxo Bank Trading Company

Saxo Bank is a reliable broker with the TU Overall Score of 7.49 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Saxo Bank clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews showed that the broker’s clients are mostly satisfied with the company. Saxo Bank ranks 6 among 79 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Saxo Bank focuses on providing access to trading in various markets that include stocks, bonds, Forex, futures, and options, as well as to mutual funds and ETFs. Moreover, it offers portfolio management tools and analytical data for traders and investors.

Saxo Bank is a large Danish bank established in 1992. It specializes in online investments and trading different financial instruments, including underlying assets, debt instruments, and derivatives. It provides access to organized exchanges of the U.S., Pacific Ocean region, EU, Asia, Africa, and the Middle East, and to Forex and CFD markets. Saxo Bank provides its services to individual and institutional investors, offers a wide choice of account types, proprietary and third-party platforms, and a multi-level fee model that depends on the trading volume. The broker is regulated by DFSA (Danish Financial Supervisory Authority), FCA (Financial Conduct Authority | UK), ASIC (Australian Securities and Investments Commission), FINMA (Swiss Financial Market Supervisory Authority), and SFC (Securities and Futures Commission | Hong Kong).

| 💰 Account currency: | USD, EUR, GBP, AUD, CAD, HKD, etc. |

|---|---|

| 🚀 Minimum deposit: | 1 unit of base currency |

| ⚖️ Leverage: | Up to 1:30 for Forex |

| 💱 Spread: | No |

| 🔧 Instruments: | Stocks, ETFs, ETNs, ETCs, bonds, options, futures, mutual funds, and leveraged instruments for CFDs and Forex |

| 💹 Margin Call / Stop Out: | 100%/75% |

👍 Advantages of trading with Saxo Bank:

- Many representative offices and regulated activities;

- Presence in the market since 1992 and stable financial indicators;

- Huge range of trading instruments;

- Minimum fee for stocks and ETFs is $1;

- Three account levels with different initial deposit requirements, fees, and interest on free funds;

- Diverse investment solutions for traders who prefer passive strategies;

- Electronic platforms for professional investors and novice traders.

👎 Disadvantages of Saxo Bank:

- Trading fees for individual traders with little trading volumes can be higher than those of the broker’s competitors;

- Lower fees are available only upon depositing from €200,000;

- Technical support isn’t available on weekends.

Evaluation of the most influential parameters of Saxo Bank

Geographic Distribution of Saxo Bank Traders

Popularity in

Saxo Bank is a multi-asset broker that provides a high-quality service. It has a well-designed and user-friendly trading platform, supported by great research. The product portfolio includes all asset types and many international markets. It is regulated by multiple top-tier authorities and has a clean regulatory record.

Saxo Bank offers various trading platforms, including the popular MetaTrader 4 and 5, as well as its own web and mobile platforms. It also has social trading through ZuluTrade and DupliTrade. It has a low minimum deposit of $0 and accepts several payment methods. It also has a demo account and a free educational section.

However, Saxo Bank also has some limitations. It has a high minimum balance requirement of €2,000 for the entry-level Classic account, and even higher for the Platinum and VIP accounts. It applies high trading fees for bonds, options, and futures, as well as inactivity and custody fees. Its research and education tools are also basic and not very comprehensive. Its customer support is available only via phone and email, and not 24/7.

Overall, Saxo Bank is a good option for advanced traders who value low fees and fast execution, and who want to use different trading platforms and benefit from social trading. It is also appropriate for traders who want to trade a wide range of instruments, including crypto derivatives. However, it may not be the best choice for beginners, long-term investors, or traders who seek more variety in their products, more competitive fees, more advanced research and education features, or more reliable customer service

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

legender

legender

CA Beauharnois

CA Beauharnois Expert Review of Saxo Bank

Saxo Bank is ahead of its competitors in terms of reliability, the choice of trading assets, and the number of investment solutions. It provides access to various financial instruments, among which are stocks, bonds, currencies, futures, and options. Moreover, Saxo Bank offers services of asset management and trading execution for individual and institutional clients. It is popular due to its trading interface and a high level of technological innovations.

The broker is client-oriented. The more trades traders execute on their accounts, the lower the fees are the next month. There is a three-level fee model. Moreover, Saxo Bank offers individual conditions to traders with a high trading volume. For example, traders who buy/sell over 5,000 futures a month, can request such conditions.

Saxo Bank has developed functional electronic platforms for online trading, however, some financial instruments are not available there. For example, trading orders on certain U.S. and EU bonds can be placed only by phone, email, or live chat. The extra fee for a manual order is $50 or its equivalent in the account currency.

Latest Saxo Bank News

Dynamics of Saxo Bank’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

Saxo Bank is an investment bank, therefore it provides its services to traders interested in passive investment as well as in actively trading securities and derivatives.

Popular investment solutions offered by Saxo Bank

To receive passive income, Saxo Bank clients can use the following options:

-

Saxo Select managed portfolios. The broker offers 7 portfolio types with low-, middle-, and high-risk levels that are managed by professional investors. The minimum investment is €10,000-€30,000 subject to the portfolio type.

-

Mutual funds. Saxo Bank clients can invest in 17,700 mutual funds without fees. It is possible to work with them on the SaxoTraderGO platform adjusted to investors of different levels. The choice of funds varies for different countries.

-

SaxoInvestor. This is a platform for private investors who want to invest in securities for the long term. SaxoInvestor offers a simple and convenient interface, as well as access to analytical tools and market research.

-

Algorithmic orders. Investors can give instructions on transactions with futures to the trading system in advance. These orders can be used for different goals, including the execution of large trades without significant influence on the asset price, arbitrage trading, and the development of automated strategies based on different factors, such as technical analysis, statistical models, and news.

The easiest additional income option is holding funds in a trading account. 0.012%-4.059% per annum is accrued on amounts over €10,000 subject to the account level.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership programs from Saxo Bank

Refer a Friend. The broker gives its partners free loans to attract new clients. These loans can be used to reduce expenses for fees when trading stocks, ETFs, options, bonds, and futures. Fees of referrals, who open accounts following the existing clients’ links, are also partially refunded.

The program is available to residents of 12 countries, including the UK, Czech Republic, Belgium, the Netherlands, Japan, and Australia. Also, Saxo Bank partners with introducing brokers (IBs) worldwide.

Trading Conditions for Saxo Bank Users

Saxo Bank offers over 70,000 trading assets, including securities, derivatives, CFDs on different asset classes, and Forex. In addition to the main account, traders can open 4 sub-accounts in other currencies. Deposits are made in 18 currencies. The broker doesn’t set minimum deposit requirements for the Classic account level, however, there are certain payment rules. For example, bank cards are used to deposit amounts from $1 to $5,000, but not more than $50,000 within 30 days. Trading is available on Saxo Bank's in-house platforms and third-party solutions, including TradingView. Demo modes and mobile apps are available.

$1

Minimum

deposit

1:30

Leverage

24/5

Support

| 💻 Trading platform: | SaxoTraderGO, SaxoTraderPRO, SaxoInvestor, FIX API, TradingView, Dynamic Trend, MultiCharts, Updata, etc. |

|---|---|

| 📊 Accounts: | Saxo (Classic, Platinum, and VIP), Joint, Corporate, Professional, and Portfolio-based margin |

| 💰 Account currency: | USD, EUR, GBP, AUD, CAD, HKD, etc. |

| 💵 Replenishment / Withdrawal: | Bank transfers, bank cards (deposits), and Deposit with Quick Payment (for accounts opened with Danish banks) |

| 🚀 Minimum deposit: | 1 unit of base currency |

| ⚖️ Leverage: | Up to 1:30 for Forex |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 lots for Forex and $1 for securities |

| 💱 Spread: | No |

| 🔧 Instruments: | Stocks, ETFs, ETNs, ETCs, bonds, options, futures, mutual funds, and leveraged instruments for CFDs and Forex |

| 💹 Margin Call / Stop Out: | 100%/75% |

| 🏛 Liquidity provider: | Commerzbank, Barclays, JP Morgan, Credit Agricole, HSBC, Lloyds, etc. |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market |

| ⭐ Trading features: | Trading fees reduce when trading volumes increase |

| 🎁 Contests and bonuses: | Yes |

Saxo Bank Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Classic | 0.08% but not less than $1 | Fees for bank transfers |

| Platinum | 0.05% but not less than $1 | Fees for bank transfers |

| VIP | 0.03% but not less than $1 | Fees for bank transfers |

Also, there are fees for conversion, custody of stocks, ETFs/ETCs, and bonds, as well as for providing statements by email. EU residents also pay a 25% value-added tax on the received income.

The average fee for a small trading volume is $1. This is a low indicator, as it is illustrated in the table below.

| Broker | Average commission | Level |

| Saxo Bank | $1 | Low |

| Fidelity | $2 | Medium |

| Charles Schwab | $11 | High |

Detailed review of Saxo Bank

Saxo Bank is a multi-regulated broker and an investment bank used by traders from Europe, Asia, and Australia to execute over 260,000 trades daily. Liquidity providers are the largest and the most reputable companies. The broker is trusted by investors, which is confirmed by data on client assets; the total amount is over $100 billion as of 2022.

Saxo Bank by the numbers:

-

Regulation in 15 jurisdictions;

-

Over 1 million clients from 170 countries;

-

Daily trading volume is over $17 billion;

-

110+ industry awards;

-

Offices are located in 15 countries.

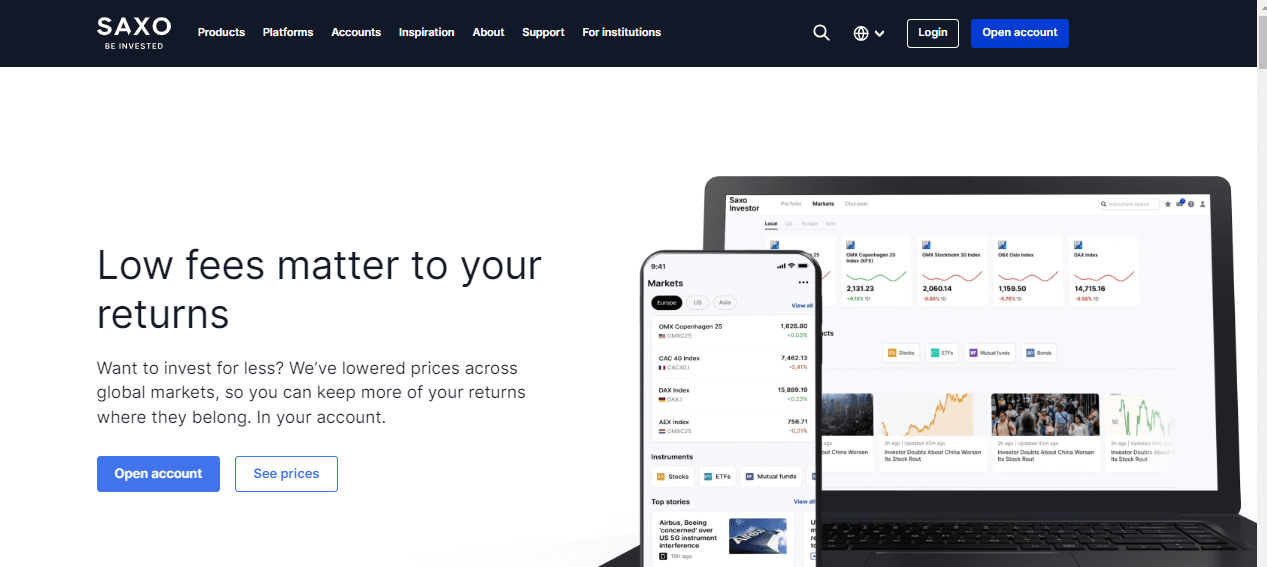

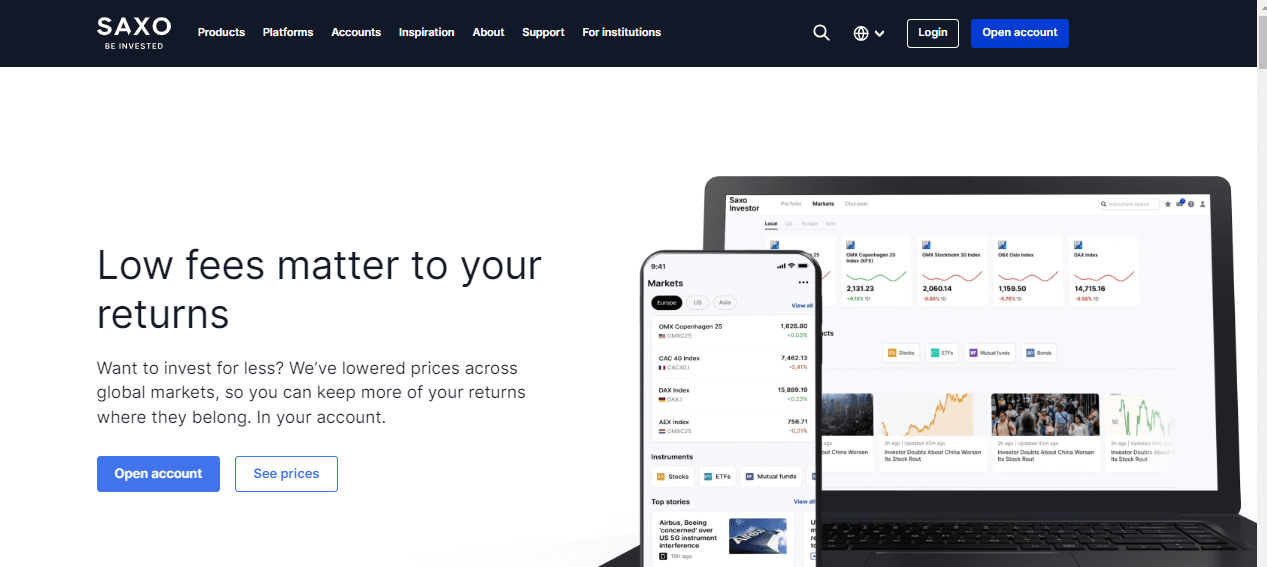

Saxo Bank provides access to global stock exchanges through functional platforms

The company has developed three powerful platforms for trading, market analysis, and efficient portfolio management. SaxoTraderGO is suitable for a wide range of traders, including novice traders. SaxoTraderPRO is a specialized platform with a complicated but functional interface for professional trading. SaxoInvestor is only available in Denmark, Australia, France, Poland, Belgium, Singapore, Hong Kong, the Netherlands, and the Middle East and North Africa regions.

Saxo Bank clients get access to trading 23,000+ stocks on 50 global exchanges, 250+ futures contracts, and 3,200+ options on different assets, including currencies and stocks. Also, the broker provides for investment in over 7,000 ETFs traded on 30 international exchanges, government bonds, corporate bonds of 26 countries, and over 17,000 mutual funds.

Useful services offered by Saxo Bank:

-

Podcasts headlined by financial market experts. These are broadcast several times a week and are available on Spotify, Apple Podcasts, Stitcher, and PodBean.

-

Market news. The broker’s website covers events connected with stocks, Forex, options, and cryptocurrencies. Also, macroeconomic indicators are published there.

-

Demo mode. All in-house platforms allow traders to open a virtual account and trade without depositing real funds within a limited time.

-

Quarterly forecast. Before the start of the next quarter, Saxo Bank strategists and department heads compile recommendations and forecasts on financial markets.

Advantages:

Investment-free funds held in the account bring additional income;

Saxo Bank doesn’t charge deposit or withdrawal fees;

It is possible to transfer securities from an account opened with another broker;

Investments are protected by the state compensation schemes of Denmark and the UK;

Mobile versions of trading platforms and API-based user interfaces are available.

Saxo Bank provides access to a wide range of financial assets and investment products. This allows its clients to diversify their portfolios and work on different sites using one trading platform.

Guide on how traders can start earning profits

Potential clients can open accounts with Saxo Bank that correspond to their experience and investment strategy.

Account types:

This account type is intended for legal entities. It also has three levels. Requirements for deposits and number of points don’t differ for Platinum and VIP, however, the minimum deposit for the Classic level is €100,000.

A variant of the Professional account is the Portfolio-based margin account with a unique margin calculation model.

Saxo Bank offers a wide range of account types, which is an important advantage.

Investment Education Online

Educational materials and useful content for novice traders are provided in the Inspiration block on the broker’s website. Staff strategists and professional investors write and compile these materials. Access to some tools is available only upon opening an account with Saxo Bank.

One of the activities of Saxo Bank is Saxo Investing Sessions. This is a series of training webinars for novice investors that provide them with professional knowledge to become successful on the stock market.

Security (Protection for Investors)

Saxo Bank is a Danish bank that is licensed by the Danish Financial Supervisory Authority under number 1149. However, Saxo Bank has long become international and turned into a financial holding company with representative offices in Europe, Asia, and Australia. Currently, its representative offices are regulated by FCA, ASIC, FINMA, and SFC.

Investments are protected by the Danish Guarantee Fund, which provides coverage up to €100,000 per client. This fund guarantees compensation of investments if the bank fails to fulfill its obligations to its clients due to financial difficulties or bankruptcy. This ensures additional deposit protection increasing trust and stability of the financial system.

In the UK, Saxo Bank participates in the Financial Services Compensation Scheme (FSCS). It is similar to the Danish Guarantee Fund and pays up to £85,000 per client in case of the broker’s insolvency.

👍 Advantages

- Investors can withdraw assets and funds if the broker goes bankrupt

- Regulators constantly monitor Saxo Bank’s activities and process its clients' complaints

- The company is obliged to maintain sufficient capital to fulfill its obligations to its clients

👎 Disadvantages

- In some countries, regulators forbid bonuses and partnership programs

- Traders can’t withdraw their profits by different methods, including electronic systems and cryptocurrencies

- The broker processes client complaints according to approved protocols, which may delay the process

Withdrawal Options and Fees

-

Clients can withdraw funds to their personal bank accounts. Direct transfer to a bank card isn’t available.

-

It is impossible to withdraw money before the due date.

-

If traders request amounts that exceed the required margin on all open positions, the broker refuses the withdrawal request.

-

If withdrawal requests are submitted by 14:00 (CET), they are processed the next business day. If requests are submitted after 14:00, they are confirmed within 2 days.

-

Saxo Bank doesn’t charge withdrawal fees. Traders pay transaction fees charged by banks.

Customer Support

Saxo Bank offers 24/5 support. The communication language depends on the office where clients work.

👍 Advantages

- Numerous representative offices in many countries

- Live chat is available on trading platforms

👎 Disadvantages

- Traders can’t contact support via messengers

- Saturday and Sunday are days off

Technical support can be contacted via the following communication channels:

-

Telephone numbers provided on the website;

-

Email of the servicing office;

-

Live chat on the trading platform.

VIP clients can use the services of a personal account manager.

Contacts

| Registration address | Philip Heymans Alle 15, 2900 Hellerup, Denmark |

| Regulation |

DFSA, FCA, ASIC, FINMA, and SFC |

| Official site | https://www.home.saxo/ |

| Contacts |

Email:

reception@saxobank.com,

saxobankdanmark@saxobank.com,

Phone: +45 3977 4000, +45 3977 6559 |

Review of the Personal Cabinet of Saxo Bank

To log into your Saxo Bank’s user account, use your ID and password. To receive those, create a user account on the broker’s website:

Click the “Open account” button to launch the registration process.

Next, enter your personal data as stated in your passport and email in the on-screen form. Also, the list of documents necessary to open the account is provided there.

Disclaimer:

Your capital is at risk. The risk of loss in online trading of stocks, options, futures, currencies, foreign equities, and fixed Income can be substantial.

Read also about other stock brokers:

See related articles in our country selection:

Articles that may help you

FAQs

Do reviews by traders influence the Saxo Bank rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Saxo Bank you need to go to the broker's profile.

How to leave a review about Saxo Bank on the Traders Union website?

To leave a review about Saxo Bank, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Saxo Bank on a non-Traders Union client?

Anyone can leave feedback about Saxo Bank on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Via eOption's secure website.