How Do You Trade CFD Effectively?

CFDs are popular financial derivatives that allow you to profit with leverage in the equity, index, currency, and cryptocurrency markets. Among the proven strategies used for this purpose are:

-

Fake breakout of the psychological level

-

False trend reversal

-

Dead cat bounce

Contracts for Difference (CFDs) are a popular form of derivative trading that allows traders to speculate on the rising or falling prices of fast-moving global financial markets, such as currencies, stocks, indices, commodities, and even cryptocurrencies.

Essentially, CFDs enable traders to place orders on whether the price of an underlying asset will increase or decrease without actually owning the asset. This mechanism offers flexibility but also comes with a high level of risk due to market volatility.

A well-thought-out strategy for trading CFDs not only provides a framework for making trading decisions but also helps manage risks. Whether a trader is new to CFDs or an experienced trader looking to refine their approach, understanding and implementing solid trading strategies is fundamental to achieving success in this dynamic market.

-

What is the best strategy for CFD trading?

The best strategy for CFD trading is subjective and should align with your risk tolerance, market knowledge, and financial goals. Generally, a mix of technical and fundamental analysis is recommended for informed decision-making.

-

How Does CFD Work?

A CFD, or Contract for Difference, is a financial contract that allows traders to speculate on the rising or falling prices of fast-moving global financial markets without owning the underlying asset. For a detailed explanation, read our article on CFD Trading: What Is It And How Does It Work?

-

Is CFD good for trading?

CFDs are popular among traders for their ability to leverage and access multiple markets, but they also come with high risk and can result in significant losses.

-

Do CFD traders make money?

Yes, some CFD traders make money through careful strategy, risk management, and market analysis, but there's also a high risk of losing money due to leverage and market volatility.

How to trade CFD

Before diving into CFD trading, the first step is to open an account with a reliable broker. You can read our article on 5 Best CFD Brokers (2024) - Top Trading Platforms to find the best platforms for CFDs.

Once you have your broker account set up, the next crucial element is selecting and applying an appropriate trading strategy.

What are the types of CFD trading strategies?

By the information used for analysis:

-

Fundamental: This strategy involves analyzing economic, social, and political factors that may affect the price of an asset. It's about understanding the bigger picture and how these factors interplay to influence market trends

-

Technical: This approach relies on patterns, charts, and various technical indicators to forecast future market movements. It's based on the premise that historical price actions and market statistics can indicate future trends

-

Behavioral strategies: These strategies consider human psychology and market sentiment. Traders using this approach analyze investor behavior and make decisions based on how they believe other market participants will act

By position holding time:

-

Short-term strategies: Ideal for traders who prefer quick, small gains over a brief period. These strategies (such as intraday strategies and scalping) involve making fast decisions and require constant market monitoring

-

Long-term strategies: Suited for traders who are willing to hold positions for a longer period, expecting substantial gains over time. This approach requires patience and a deep understanding of long-term market trends

In relation to the current trend:

-

Trend reversal strategies: These strategies focus on identifying points where the current trend is likely to reverse, allowing traders to anticipate and capitalize on market shifts

-

Counter trend strategies: Opposite to trend trading, this strategy involves betting against the current trend, predicting that the trend will reverse

-

Trend continuation strategies: This involves identifying and following an established trend, with the belief that the trend will continue

-

Range or flat market strategies: These strategies are used when the market is not showing a clear trend and is moving within a certain range

Selecting the right strategy depends on various factors, including market conditions, trader's experience, risk tolerance, and investment goals. Before you start CFD trading, understanding these different strategies is paramount. Before you risk real money using any of the strategies, make sure with a demo account that the odds are in your favour.

Five successful CFD trading strategies

Some strategies are sometimes simply better than others, and below you can find a list 5 CFD trading strategies that have historically proven successful if done right:

-

Fake freakout of the psychological level: This strategy capitalizes on the market's reaction to significant psychological price levels, which often see a false breakout before the true market direction is established

-

Breakout of consolidation pattern: Here, traders focus on identifying and acting upon breakouts from consolidation phases in the market, which often signal the start of a new trend

-

Parallel channel: This involves trading within a parallel channel, buying at the lower trend line (support) and selling at the upper trend line (resistance), effectively capitalizing on the market's range-bound movements

-

False trend reversal: This strategy is based on identifying and responding to false signals of a trend reversal, allowing traders to take advantage of continued trends or swift counter-movements

-

Dead cat bounce: Predominantly used in bearish markets, this strategy involves recognizing a temporary recovery in a declining market, which is usually followed by a continuation of the downward trend

Fake breakout of the psychological level

The "Fake Breakout of the Psychological Level" strategy involves identifying significant price levels that are widely monitored by traders, such as round numbers or historical highs and lows. These levels often hold psychological importance and can influence trading behavior.

A fake breakout occurs when the price briefly breaches these levels, triggering a response from the market, before reversing direction and returning within its previous range.

Setup to sell at false breakdown of important psychological resistance

In the provided chart example, the EUR/USD currency pair appears to make a decisive move above a round number resistance level, suggesting a breakout. However, this breakout is not sustained, and the price quickly falls back below this level, indicating a false breakout.

This creates an opportunity for traders to enter positions contrary to the breakout direction, anticipating the reversal.

Here are the steps to trade a fake breakout:

-

Identify a significant psychological level (e.g., round numbers, hundredths for currencies)

-

Wait for the price to break through the level

-

Confirm that the breakout is not supported by high volume or other confirming indicators

-

Enter a trade in the opposite direction of the breakout after the price moves back through the psychological level

-

Set stop-loss orders just beyond the level that the price initially broke through to manage risk

The table below outlines the pros and cons of this CFD trading strategy:

| Pros | Cons |

|---|---|

High potential for profit if the market's reversal is correctly identified |

False breakouts can be challenging to distinguish from true breakouts in real-time, requiring experience and sometimes additional confirmation |

The psychology of the mass of traders does not change in different markets |

Waiting for a breakdown of a psychological level can take a long time |

Psychological levels are fairly easy to spot and understand, and can be frequently found across various markets |

There is a risk of stop-loss orders being hit if the initial breakout is part of a larger market move or if the market volatility is high |

Understanding the market context and sentiment is vital when trading fake breakouts, as not all psychological levels will produce a tradable reversal. Combine this strategy with solid risk management to mitigate the chances of significant losses.

Breakout of consolidation pattern

This strategy identifies when the price of an asset moves out of a consolidation phase, which is characterized by the price trading within a range-bound area or pattern, such as a rectangle or a triangle. This strategy is based on the idea that when the price finally breaks out of this pattern, it can indicate the beginning of a new trend.

Start of an uptrend after a period of consolidation (accumulation)

In the provided example of the Gold Spot versus the U.S. Dollar (XAU/USD), the market is depicted as moving within a narrowing range, forming what appears to be a triangular consolidation pattern. The strategy comes into play when the price breaks out above the upper trendline of this triangle, indicating potential for a new upward trend.

To trade a breakout of a consolidation pattern:

-

Recognize a clear consolidation pattern in the price chart

-

Determine the support and resistance levels that define the consolidation range

-

Watch for a price candle that closes outside of this range, which could signal a breakout

-

Enter a trade in the direction of the breakout with volume confirmation for additional validation

-

Set a stop-loss just inside the pattern to protect against false breakouts

-

Take profit targets can be estimated based on the height of the pattern projected from the point of breakout

| Pros | Cons |

|---|---|

Breakouts from consolidation often lead to strong and sustained trends, providing significant profit potential |

False breakouts are a common pitfall; the price may revert back into the consolidation pattern Requires strict risk management to avoid losses from these false breakouts |

This strategy is straightforward to implement, as consolidation patterns are easy to spot and breakouts are clear entry signals |

Timing is critical in trading breakouts from consolidation patterns. It's also beneficial to look for additional confirmation signals, such as increased volume during the breakout, to improve the likelihood of a successful trade |

Parallel channel

The Parallel channel strategy involves trading within the confines of three parallel lines, which represent the support and resistance levels of a price channel. The market moves within this channel, providing clear boundaries for trading. Traders look to buy near the lower trendline, where the market finds support, and sell near the upper trendline (or median line), where the market meets resistance.

Example of how to trade on the parallel channel strategy

The EUR/USD daily chart displays a rising parallel channel with the price oscillating between the upper and lower bounds of the channel.

Until February, EUR/USD traded in the upper half of the channel. Then the channel widened downwards and the price found support near the new lower boundary. Traders could switch to the lower timeframes to find a favorable entry point for a long position in the expectation that bullish sentiment would recover.

Here are the steps for trading CFDs on the parallel channel strategy:

-

Identify a channel by connecting the highs and lows

-

Confirm the channel by ensuring the price touches each line at least twice

-

Enter a long (buy) position when the price approaches the lower trendline and shows signs of bouncing upwards

-

Enter a short (sell) position when the price reaches the upper trendline and starts to decline

-

Place a stop-loss just outside the channel to protect against breakout failures

-

Set profit targets based on the width of the channel or prior price swings within the channel

| Pros | Cons |

|---|---|

Provides clear entry and exit points, making it a straightforward strategy to follow |

Channels can break, and unexpected breakouts can lead to rapid losses if not properly managed |

It is applicable in different market conditions, whether trending or range-bound |

Requires frequent monitoring to respond quickly to price touches at the channel's boundaries |

The parallel channel can offer multiple trading opportunities as the price moves between support and resistance |

Traders may need to adjust the channel as new price information becomes available, which can be subjective |

Can be combined with other indicators for enhanced decision-making, such as volume or momentum oscillators |

Identifying true channels versus random fluctuations can be challenging, especially for novice traders |

False trend reversal

This strategy involves identifying and trading on price movements that falsely signal a reversal of the prevailing trend. This can happen when the price makes a new high or low that is not supported by fundamental or other technical indicators, suggesting that the trend will continue rather than reverse.

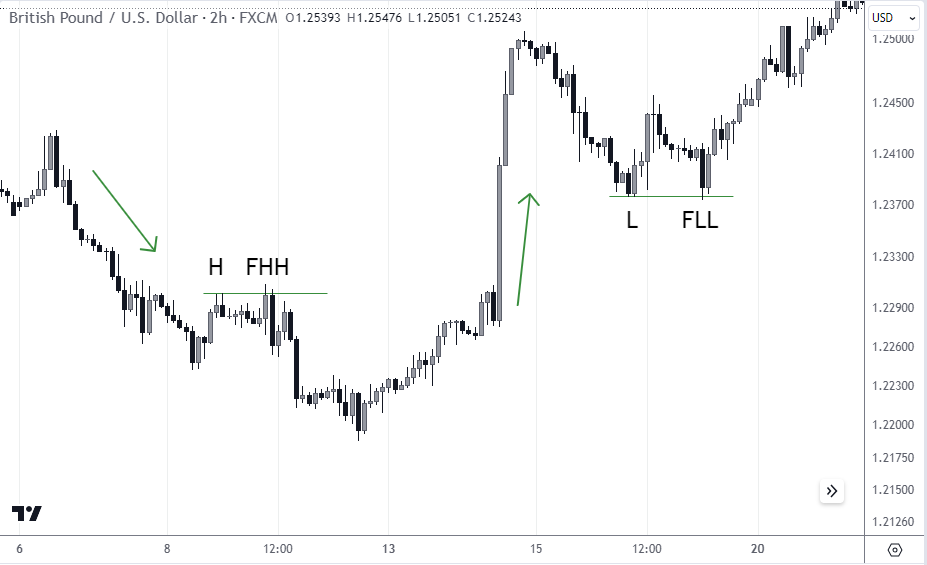

Example of setups for selling and buying

In the provided GBP/USD chart, two scenarios are highlighted: one where a "Fake Higher High (FHH)" is formed during a downward trend, and another where a "Fake Lower Low (FLL)" occurs within an upward trend. In both cases, the price moves past the previous high or low, implying a potential reversal, but then swiftly returns to the direction of the main trend.

To trade a false trend reversal:

-

Identify a strong prevailing trend

-

Look for a new high or low that goes against the trend (FHH in a downtrend or FLL in an uptrend)

-

Confirm the falseness of the breakout. Usually, the price in such cases goes not far beyond the previous high/low and quickly returns. As if having the purpose of activating stop-losses

-

Enter a trade in the direction of the main trend after the price reverses from the new high or low

-

Place a stop-loss just beyond the new extreme to protect against a genuine reversal

-

Set profit targets based on the strength and duration of the prevailing trend

| Pros | Cons |

|---|---|

Can provide high-profit opportunities as these false reversals often lead to strong trend continuation |

Requires accurate identification of false reversals, which can be difficult without significant experience |

The strategy offers clear entry and exit points once the false reversal is confirmed |

Risk of actual trend reversal if the move is not false, which can quickly turn a position into a loss |

It capitalizes on the market's overreaction and the subsequent correction, which can be common in volatile markets |

Traders need to wait for confirmation of the false reversal, which may result in missing the initial move of the trend continuation |

Dead cat bounce

The Dead Cat Bounce strategy refers to a short-lived recovery in the price of an asset that is in a prolonged decline, followed by a continuation of the downtrend. It is called a "dead cat bounce" because, just like a dead cat that might bounce if dropped from a height, the price jump is typically followed by a fall. Traders use this strategy to identify the temporary recovery as a selling opportunity before the downtrend resumes.

Examples of dead cat bounces

The image shows the NASDAQ 100 index on a 4-hour chart where a sharp decline is followed by a modest, brief rally, illustrating a potential 'dead cat bounce.' The price fails to sustain the rally and continues its downward trajectory. This pattern is suggestive of a bearish market sentiment that is not reversed by the short-term recovery.

Steps to trade a dead cat bounce:

-

Identify a strong downtrend in an asset's price

-

Look for a temporary rise in the price, which does not break the established downtrend pattern

-

Confirm that the bounce is likely to be temporary using technical indicators, like low volume during the recovery or resistance levels holding strong. Ideally, the top of each subsequent bounce is below the previous one

-

Enter a short position during the bounce, anticipating the continuation of the downtrend

-

Place a stop-loss slightly above the peak of the bounce to protect against the possibility that the recovery is not temporary

-

Set profit targets based on previous support levels or other technical analysis tools

| Pros | Cons |

|---|---|

Provides an opportunity to take advantage of the prevailing downtrend without requiring a long-term commitment |

Difficult to distinguish from a genuine market reversal without significant experience and analysis |

The strategy has clear entry points as the price starts to fall again after the bounce |

The potential for losses if the market sentiment changes and the asset's price starts to rise significantly |

It is particularly useful in bear markets or during market corrections, where temporary recoveries are common |

Timing the market is crucial, and getting it wrong can mean missing out on the bounce or entering too late |

Best CFD Brokers

1. RoboForex - best overall for beginner traders and experienced investors (12,000+ assets)

In 2009, RoboForex Ltd. was established. RoboForex has been offering trading services on a global basis ever since it entered the market for Forex brokers. The broker specializes in trading automation solutions such as the CopyFx auto trading platform, as well as the bot builder. RoboForex supports both 12,000+ CFDs, as well as direct trading in US shares with extra low fees from 0.09 cent per share.

The account type selected on the interface at RoboForex will determine the spreads. For EUR USD, the spreads' is ranging from 0.03 to 1.4 pips for different account types. RoboForex provides 0% fee on all deposits and withdrawals.

RoboForex is generally governed by Belize's Financial Services Commission. At RoboForex, there is a civil liability insurance program in place that offers industry-leading defense against errors, fraud, omissions, negligence, and other risks that might result in losses for clients.

2. Pocket Option - best for a copy trading service (signals from MQL5.Community)

Pocketoption was launched in 2017. The broker gives its clients access to trade currency pairs, commodities, stocks, cryptocurrencies, and indices. To operate in the financial markets, the company has developed its own unique trading platform. In addition, Pocket Option clients can trade in MT5. The broker’s service is available in more than 95 countries and regions globally. Pocketoption’s top priority is the high quality of customer service, constant improvement of trading technologies, and financial innovations.

The company's clients get access to many bonus offers, and participate in a profitable affiliate program. Thanks to unique rewards, traders can increase their profile level and purchase resources in Pocket Option's own Market store to increase their profitability while trading.

Leverage is a tool that is offered by numerous brokers to traders. With leverage, traders can open larger positions, allowing them more exposure to the market in which they are trading despite their small initial deposit, and PocketOption offers a maximum leverage of 1:100 on its MT5 Forex account.

The company behind the Pocket Option website that provides brokerage services is PO Trade (SV) Ltd, which is registered in Saint Vincent and the Grenadines, considered to be a Caribbean offshore tax haven. The company says on its website that it is regulated by the International Financial Market Relations Regulation Center (IFMRRC), which is not an official regulatory authority

CFD trading strategies to avoid

Knowing what strategies to avoid is just as important as choosing which ones to employ. In CFD trading, certain strategies might seem straightforward but are often misleading and risky:

-

Crossover of moving averages: Can produce false signals due to its lagging nature

-

Crossover of zero line by MACD: Prone to giving misleading signals in volatile markets

-

Overreliance on technical indicators: No single indicator should dictate your trading decisions

-

Ignoring economic releases: Economic events can drastically affect the markets, and not accounting for them can be costly

-

Chasing performance: Entering trades after a big market move can result in losses if the trend reverses

-

Martingale strategies: Doubling down on losses can lead to significant financial damage, especially with leveraged trades

-

Impulsive news trading: Quick reactions to news without understanding its full impact can lead to poor trading decisions

It's vital to have a balanced trading plan that combines technical analysis with an understanding of market fundamentals and risk management.

CFD trading tips

Successful CFD trading hinges not just on the strategies you choose but also on how well you execute them with discipline and awareness:

-

Personalize your strategy: Understand and adapt strategies to fit your risk profile and investment goals instead of copying others

-

Do thorough research: Dive deep into the strategies to grasp their underlying principles

-

Utilize volume analysis: Volume can validate price movements and signals

-

Back-test strategies: Use historical data and a demo account to test strategies before going live

-

Risk management: Only invest what you can afford to lose and manage risk through proper stop-loss orders

-

Professional advice: Consult with experts, especially when you're uncertain about your trading decisions

Summary

In CFD trading, success comes from a combination of well-researched strategies, risk management, and an understanding of market psychology.

While there's no one-size-fits-all approach, the backbone of profitable trading lies in customizing strategies to individual risk tolerance, back-testing before implementation, and maintaining discipline.

Always remember, in the quest for profits, preserving capital with sound risk management should remain a trader's number one priority.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).