How To Trade EUR/USD | Basic Styles And Strategies

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

How to trade EUR/USD:

- Strategies: scalping, intraday trading, swing trading

- Options: spot trading, futures, CFDs, options

- Best time: during the overlap of the European and U.S. sessions, from 8:00 AM to 12:00 PM EST

Trading the EUR/USD pair is one of the most popular choices among traders due to its high liquidity and low spreads. In this article, we will explore various trading styles such as scalping, intraday trading, and swing trading, as well as effective strategies including pullback and breakout trading. Understanding the features and choosing the right approach will help you successfully trade this currency pair.

How to trade the EUR/USD pair

EUR/USD is the most liquid and popular trading asset of the currency market - it has more than one third of the whole volume of operations. Besides the spot market, highly liquid derivative financial instruments with regard to EUR/USD - futures, options, CFD - are in active circulation on the market (see EUR USD chart on-line).

The EUR/USD currency pair shows how many US dollars are needed to purchase one euro. EUR/USD is the most traded currency pair in the world due to its high liquidity and the availability of a large amount of information for analysis. Trading this pair attracts both new and experienced traders due to the significant volume of trades and the influence of macroeconomic factors, such as decisions of the European Central Bank (ECB) and the US Federal Reserve (Fed).

Trading styles for the EUR/USD pair

Trading the EUR/USD pair can be carried out in different styles, each of which has its own characteristics and is suitable for different types of traders.

Scalping involves making many quick trades over a short period of time. Scalpers seek to make small profits from small price fluctuations. This style requires high concentration and quick decision making, as positions can be opened and closed in a matter of minutes. Scalping is suitable for traders who can devote a lot of time to trading and are prepared to endure high stress loads.

Intraday trading involves opening and closing a position within one trading day. They use longer-term charts to determine the general direction of the market and shorter-term charts to find entry and exit points. Day trading requires a good understanding of market conditions and the ability to react quickly to changes.

Swing trading involves holding positions open for days or weeks in an attempt to profit from larger market swings. This style of trading is suitable for those who cannot constantly monitor the market, as it requires less time to monitor positions. Swing trading requires patience and the ability to analyze long-term trends.

There are other strategies such as the use of technical indicators (RSI, MACD), news trading, which is based on economic data and news, and the overbought/oversold strategy, where traders look for extreme market conditions to enter trades. The choice of strategy depends on your trading style and preferences.

Developing your own strategy takes time and practice, but the right approach will allow you to better understand the market and make informed trading decisions.

Available options for trading EUR/USD

Here are the available options for trading EUR/USD:

| Option | Description | Pros | Cons |

|---|---|---|---|

Involves buying and selling the EUR/USD currency pair for immediate delivery. |

|

| |

Are standardized agreements to buy or sell EUR/USD at a predetermined price on a specific future date. |

|

| |

Give the right, but not the obligation, to buy or sell EUR/USD at a fixed price before a specific date. |

|

| |

Allow traders to speculate on the price movements of EUR/USD without owning the underlying asset. |

|

|

Best time to trade the EUR/USD pair

The most volatile trading sessions for the EUR/USD pair are the New York and London sessions. The highest activity occurs when these two sessions overlap, from 1:00 PM to 5:00 PMGMT. During this period, the market sees the most participants, leading to higher trading volumes and tighter spreads. Notably, this is also when significant economic data releases from the US and Europe occur, such as employment reports, GDP data, and central bank decisions.

The New York session, which runs from 12:00 PM to 8:00 PM GMT, is particularly volatile. This time is ideal for traders looking for significant and rapid price movements. Conversely, periods of low liquidity, such as the late New York session transitioning into the Asian session, should be avoided. During these times, the market is less active, spreads widen, and sharp price spikes may occur due to low trading volumes.

We have selected several reliable brokers for trading on the Forex market. These companies provide access to quality trading tools and resources, such as educational materials, customer support, and market analysis platforms.

| Plus500 | Pepperstone | OANDA | FOREX.com | Interactive Brokers | |

|---|---|---|---|---|---|

|

Opportunity to trade the EUR/USD pair |

Yes | Yes | Yes | Yes | Yes |

|

Currency pairs, number |

60 | 90 | 68 | 80 | 100 |

|

Demo |

Yes | Yes | Yes | Yes | Yes |

|

Min. deposit, $ |

100 | No | No | 100 | No |

|

Min Spread EUR/USD, pips |

0,5 | 0,5 | 0,1 | 0,7 | 0,2 |

|

ECN Spread EUR/USD, avg, pips |

No | 0,1 | 0,15 | 0,2 | 0,2 |

|

Open account |

Open an account Your capital is at risk. |

Open an account Your capital is at risk.

|

Open an account Your capital is at risk. |

Study review | Open an account Your capital is at risk. |

Fundamental analysis of EUR/USD

The Euro is the main financial opponent of the U.S. dollar, and together with it makes up the majority of the world currency in circulation. The EUR/USD pair is a reliable indicator of market conditions for most trading assets, and at the same time traders need to be prepared for unexpected factors that can cause sharp and unpredictable market movements.

Examples of unusual reactions of EUR/USD to fundamental events:

European Debt Crisis: During 2010-2012, news about debt problems in Greece and other Eurozone countries caused sharp and unpredictable EUR/USD movements despite various measures taken by the ECB and governments.

Japanese intervention:

Swiss Flash-crash:

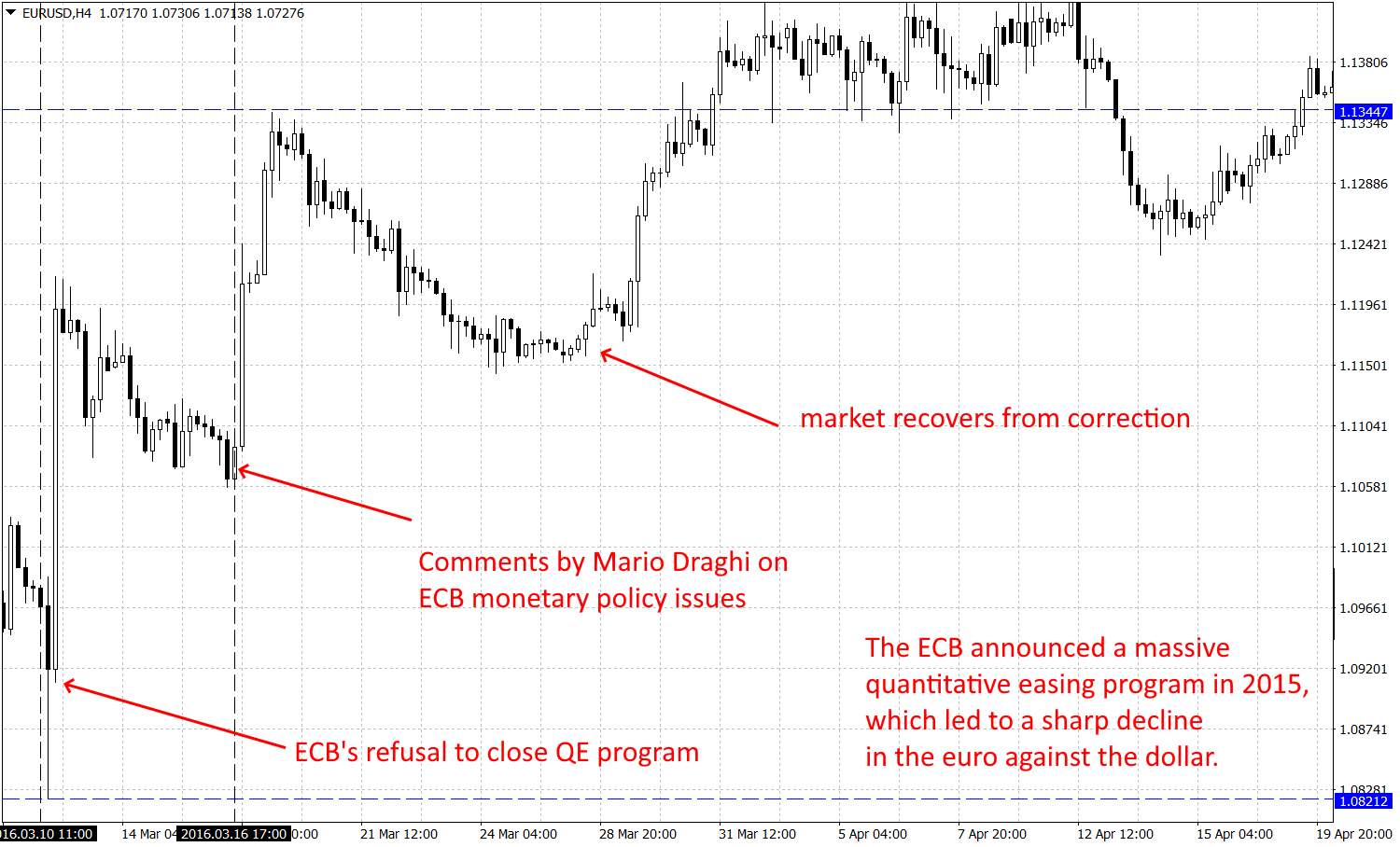

Draghi and QE:

Italian Referendum: In 2016, a referendum on constitutional reform led to the resignation of the Prime Minister and panic over political stability in the Eurozone.

Coronavirus: In March 2020, amid a pandemic, demand for USD/USD liquidity surged.

US Shutdown: In October 2013, the US government was temporarily shut down due to lack of budget.

A large amount of information and actual statistics on the EUR USD exchange rate serves as a basis for multifactor analysis and allows you to make a full-fledged forecast of the EUR USD exchange rate. In periods of political instability forex EUR USD rate decreases, as the U.S. dollar is considered as a protective asset at such times.

Forex forecast EUR USD should take into account:

main economic indicators of the Eurozone and the US (discount rate, GDP, inflation, unemployment rate, CPI, PMI, etc.);

assessment of the dynamics of the European stock markets, as well as the main assets of oil and gold.

statements by ECB and Fed officials and non-monetary policy developments;

assessment of global political developments, especially in the Eurozone and the US.

Understanding these factors and being able to quickly adapt to changing market conditions are key skills for successful trading of this currency pair.

Expert opinion

My extensive trading experience allows me to say that the exchange rate between the euro and the dollar primarily depends on factors such as political instability, economic reforms and global crises. For example, if the ECB reduces the key rate, this weakens the euro exchange rate against the US dollar.

I recommend that traders develop and stick to a clear trading plan that includes risk management rules and loss limits. Personal observation shows that discipline and consistency in decision making significantly increases the chances of success in the long run.

To improve your skills, take part in seminars, read analytical reports and communicate with other traders. Constantly updating your knowledge and sharing experiences will help you better understand market trends and make more informed decisions . When trading the EUR/USD pair, it is important to stay up to date with the latest news and use it to your advantage.

Conclusion

Trading the EUR/USD pair provides traders with unique opportunities due to its high liquidity and tight spreads. Understanding the main trading styles such as scalping, day trading and swing trading, and choosing the right trading style, helps traders make the most of market conditions. Analyzing the most volatile trading sessions and avoiding periods of low liquidity is also key to successful trading.

To successfully trade the EUR/USD currency pair, you need to be able to quickly adapt to changing market conditions and be prepared to quickly respond to economic and political events. With the right approach and careful analysis, trading the EUR/USD pair can be a profitable activity for both beginners and experienced traders.

FAQs

What affects the quotes of the EUR/USD currency pair

The main influence on the quotes of the EUR/USD pair is exerted by changes in the monetary policy of the European Central Bank (ECB) and the US Federal Reserve System (FRS). Interest rate decisions, quantitative easing programs and other economic measures often cause sharp price movements

What are the features of the EUR/USD currency pair

Traders must be aware of current events and be prepared to respond quickly to changes in market conditions. For example, news about the dynamics of trade wars between the US and China or unexpected statements from key politicians can significantly affect the pair’s exchange rate

How to choose the best trading style for the EUR/USD pair?

The trading style you choose depends on your time and comfort level. Scalping is suitable for intensive trading with short trades. Day trading requires analysis throughout the day and is suitable for those who can devote more time. Swing trading is suitable for long-term positions and requires less time to monitor the market.

What strategies can you use when trading the EUR/USD pair?

To trade the EUR/USD pair, you can use pullback and breakout strategies. Trading on pullbacks allows you to enter a trend at a better price, while trading on breakouts involves entering the market when key levels are overcome. Technical indicators and fundamental analysis are also useful.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Swing trading is a trading strategy that involves holding positions in financial assets, such as stocks or forex, for several days to weeks, aiming to profit from short- to medium-term price swings or "swings" in the market. Swing traders typically use technical and fundamental analysis to identify potential entry and exit points.