Forex Futures Trading: How To Start

Spot Forex offers a more accessible and flexible way to trade currencies with lower initial capital, suitable for retail traders looking for direct market access and high liquidity. Currency Futures provide a more structured and regulated trading environment with standardized contracts, which can be beneficial for traders looking for transparency in costs and legal protection.

-

Forex futures are standardized, exchange-traded contracts

-

Typically, futures trading requires higher minimum deposits than spot Forex

-

Forex market daily volumes exceed $6 trillion, futures are less but still liquid

-

Advanced analytical tools like market depth are used in futures trading

Navigating the complexities of the Forex market can be daunting, especially when considering the myriad of instruments available to traders. Forex futures are one such instrument that offers the dual benefits of hedging against currency risk and speculating on currency movements.

The problem many face is understanding how these instruments work and how to utilize them effectively in their trading strategies. This article will elucidate the concept of Forex futures, differentiate them from spot Forex trading, and demonstrate their application within the Forex market.

-

Can you trade futures on Forex?

Yes, you can trade futures on Forex through standardized contracts on exchanges such as the Chicago Mercantile Exchange (CME).

-

What is an example of a FX future?

An example of an FX future is the 'Euro FX Future' traded on the CME under the ticker symbol '6E,' which represents the euro against the U.S. dollar.

-

Is futures more profitable than Forex?

That depends on the trader's strategy, skill level, and market conditions. Neither market inherently offers more profit potential as both involve high risk and the possibility for significant returns.

-

What are Forex Futures Margins?

Forex futures margins are deposits required by the exchange to open and maintain a futures position, set as a percentage of the contract value, and are meant to cover potential losses.

How do Forex futures work?

Forex futures are a derivative instrument that derives their value from an underlying currency pair. They are standardized contracts traded on regulated exchanges like the Chicago Mercantile Exchange (CME). Each contract stipulates the purchase or sale of a currency pair at a set price and a predetermined future date, hence the term “futures”.

Unlike the spot Forex market, where trades are settled instantly or within a short time frame, Forex futures have specific expiration dates ranging from one month to several months into the future.

Spot Forex vs Forex Futures

The image provided shows a trading platform with two distinct chart types. This visual representation is key for traders who utilize technical analysis to forecast future price movements. The left chart displays the price movement in a traditional candlestick pattern, while the right one, with its histogram, reveals the Market Profile - a tool that gives insight into trading activity at various price levels over a specified time period.

For practical purposes, let’s compare how Forex pairs and their corresponding futures are referenced:

An example of a Forex futures ticker on a trading platform like TradingView would be 'CME:6E' for the EUR/USD futures contract. To load this in TradingView, a user can simply type '6E' into the search bar, select the appropriate futures contract from the list, and proceed with their analysis or trading.

Note: the currency futures price is calculated as an inverse quote to the dollar, i.e. JPY/USD for ticker 6J, CAD/USD for ticker 6C, etc.

In essence, when trading Forex futures, you're speculating on the direction of the currency pair. If you expect the EUR/USD pair to rise by the contract's expiration date, you would buy a 6E contract. If the EUR appreciates against the USD, the contract will be worth more, and you could potentially profit from this increase.

However, if the EUR depreciates, the contract would lose value correspondingly, and the trader could incur a loss. This makes understanding the market's dynamics and the contract specifics essential for effective trading and risk management.

Best Forex Brokers for Futures Trading in 2025

What are the differences between futures and standard Forex trading?

Asset Type

In standard Forex trading, often referred to as spot Forex, you're directly trading actual currency pairs. This involves exchanging one currency for another at the current market price, which is constantly fluctuating due to various economic factors. The immediacy of spot Forex means that transactions are settled “on the spot”, usually within a short period following the trade, typically two business days.

In contrast, when trading currency futures, such as the 6E contract on the Chicago Mercantile Exchange (CME), you're entering into a contract. This contract is an agreement to exchange a specific amount of one currency for another at a predetermined future date and at a pre-agreed price when the contract was initiated. Unlike spot trades, futures contracts have set expiration dates.

Exchanges

Spot Forex operates in a decentralized over-the-counter (OTC) market. This vast network consists of banks, brokers, and financial institutions globally, with no centralized exchange overseeing transactions. The OTC nature of Forex results in a wide range of prices at any given time, as there is no single price for a currency pair at any moment.

Currency futures are traded on centralized exchanges. A prominent example is the CME, where contracts like the Euro Futures (6E) are standardized and provide a regulated environment for trading. These exchanges facilitate transparency and uniformity in contract specifications.

Contracts Specifications and the Tick

The “tick” is the minimum price increment at which a contract can move. In spot Forex, the tick size is commonly known as a “pip” and is typically equal to 0.0001 for most currency pairs.

For currency futures, each contract has a standardized tick size that varies depending on the specific contract. For example, the tick value for the CME Euro Futures (6E) is $12.50 per 0.0001 move in price. Futures contracts have a set contract size, expiration date, and other specifications.

Trading Costs

Trading costs in spot Forex can vary significantly. They typically include the spread, which is the difference between the ask and bid prices, and in some cases, there might be commissions depending on the brokerage's pricing structure. There are no exchange or clearing fees in spot Forex.

In currency futures trading, costs are more transparent. They typically involve exchange fees, clearing fees, and broker commissions. The spread still exists, but it is complemented by per-contract fees which are clearly defined.

Spot Forex trading often employs leverage, allowing traders to open larger positions than their deposited capital would ordinarily permit. Margins are required by brokers to cover potential losses and can vary in size. There are no overnight fees because each trade is settled within two business days.

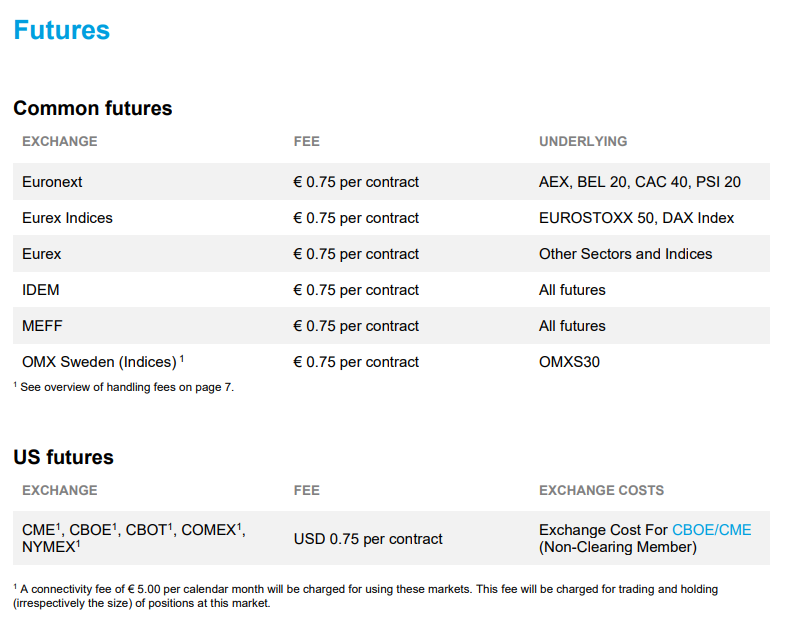

Сurrency futures trading conditions offered by Degiro broker

In the case of currency futures, margin requirements are set by the exchange and are generally higher compared to spot Forex due to the larger size of the contracts. There are also overnight fees, known as “maintenance margin”, and these can vary depending on the broker and the specific futures contract.

The screenshot above shows the currency futures trading conditions offered by Degiro broker. Read more in the review: DEGIRO Review 2025: Pros, Cons and Key Features.

Minimum Deposit to Start

Spot Forex: The barrier to entry is often low, with many brokers offering the option to start trading with minimal initial deposits. It's not uncommon to find accounts that can be opened with as little as $50 or even less. This accessibility makes spot Forex attractive to retail traders who wish to start with a smaller capital outlay.

Currency Futures: Due to the larger size of contracts and the margin requirements, currency futures typically necessitate a higher minimum deposit. The required starting capital can vary widely, influenced by the broker's policies and the specific futures contract being traded.

Forex Futures Margin Requirements

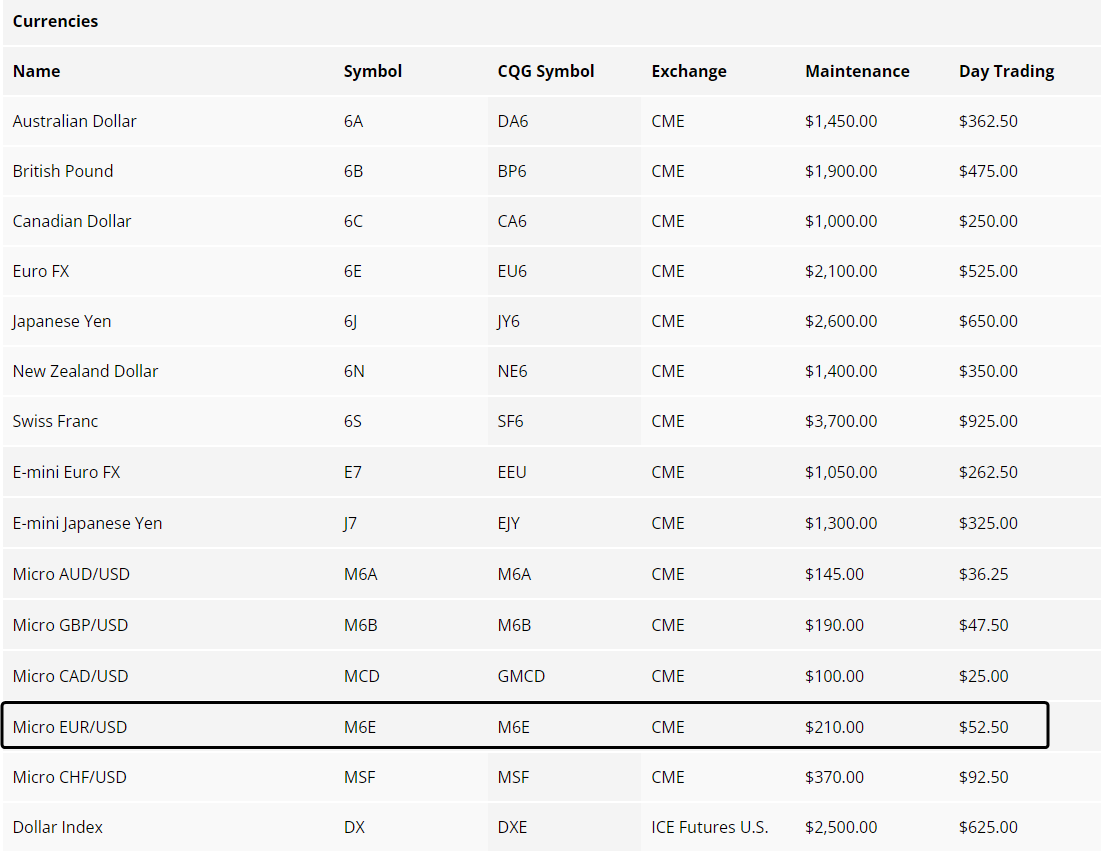

The screenshot above shows the currency futures trading conditions offered by AMP Futures broker. As you can see, to trade a micro-contract intraday, you need 52 dollars. But in reality, the amount should be higher to account for trading risks.

It is important for traders to check these requirements before initiating trading in currency futures.

Volumes

Spot Forex: The Forex market boasts exceptionally high trading volumes, recognized as the largest financial market globally. With daily volumes surpassing $6 trillion, liquidity is rarely a concern, particularly for the major currency pairs, which are traded around the clock by a global clientele.

Currency Futures: While the volumes for currency futures are generally lower than those found in the spot Forex market, they still offer sufficient liquidity, especially in major futures contracts such as the Euro Futures (6E). This liquidity is most robust during the market's peak trading hours, which usually coincide with the business hours of their underlying spot markets.

Types of Uses

Currency futures serve multiple purposes in financial markets. Hedging is a common use, where businesses and investors lock in a currency price to mitigate the risk of adverse currency movements affecting their operations or investments.

Speculation is another significant use, with traders seeking to profit from changes in currency prices based on their market predictions. The structured nature of futures contracts makes them well-suited for these strategies.

Types of Analytical Tools

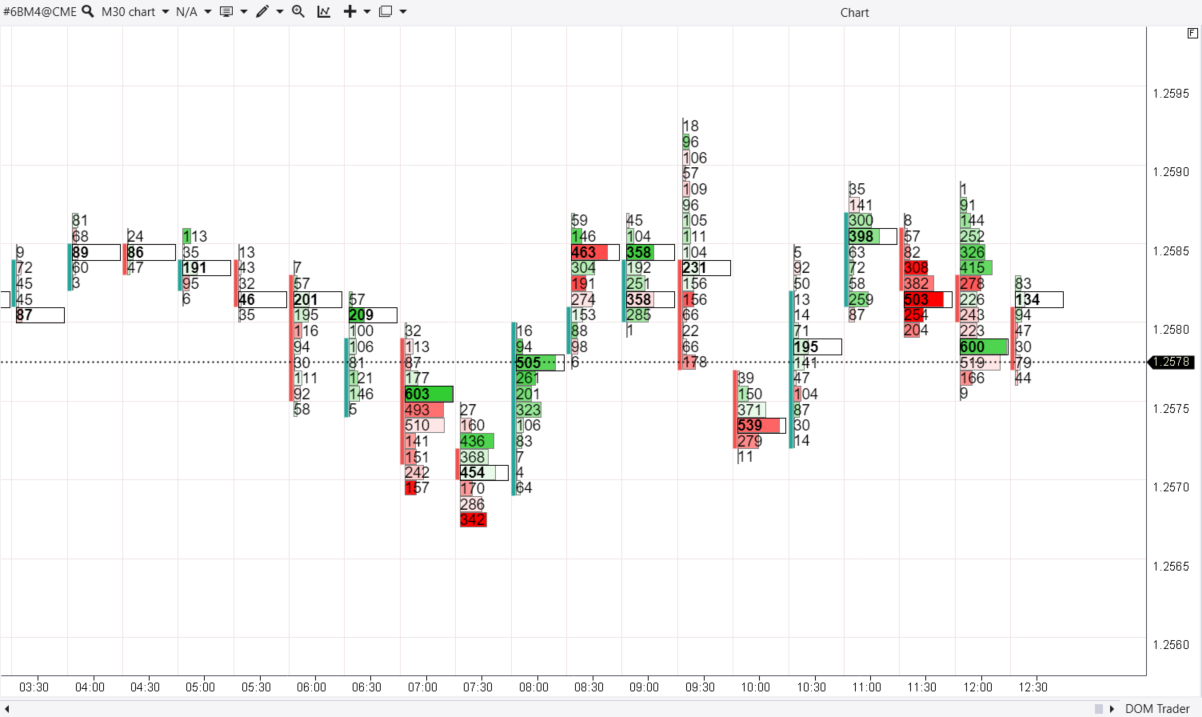

The use of advanced analytical tools is essential in the futures market. The image pertains to this particular aspect, likely depicting a type of market depth or order book analysis, commonly used by futures traders.

These tools often include:

-

Delta indicators: Measure the net difference between buying and selling volume at each price level, providing insight into market direction

-

Footprint charts: Offer a visual representation of trading data by price and volume for each time interval, highlighting where orders are being executed in real-time

-

Market depth: Shows the quantity of buy and sell orders at different price levels, typically in real-time, providing a glimpse into potential support and resistance levels

Footprint from British Pound Futures

How to start trading futures:

Here is a basic step-by-step instruction on how to start trading currency futures contracts:

-

Education: Acquire a solid understanding of futures markets, including contract specifications and leverage

-

Assess Goals and Risks: Clearly define your financial goals and establish your risk tolerance

-

Develop a Strategy: Formulate a trading strategy with precise entry and exit points, and risk management protocols

-

Open a Brokerage Account: Select a reputable broker that caters to futures trading and fund your account to meet initial margin requirements. You can easily use Traders Union's Find my Broker tool to choose a broker based on dozens of parameters

-

Trade Responsibly: Implement your strategy with discipline, manage risks effectively, and keep emotions in check to maintain a clear decision-making process

Expert Opinion

“Trading Forex futures is not just about predicting market movements, it's about strategic risk management. Always align your trades with your overall financial plan and never risk more than you can afford to lose. Utilize stop-loss orders to protect your capital, and be as disciplined with exiting trades as you are with entering them. As in chess, to win, you must think several moves ahead."

Summary

Forex futures provide traders with the means to hedge against currency fluctuations and speculate on future prices. Unlike spot Forex, these contracts are standardized and traded on centralized exchanges, requiring higher initial deposits and offering transparent pricing structures.

To trade Forex futures effectively, one should undergo thorough education, establish clear goals and risk parameters, develop a disciplined trading strategy, and engage with a reputable brokerage. Responsible trading with robust risk management is key to success.

Glossary for novice traders

-

1

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

-

2

Leverage

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

-

3

Futures contract

A futures contract is a standardized financial agreement between two parties to buy or sell an underlying asset, such as a commodity, currency, or financial instrument, at a predetermined price on a specified future date. Futures contracts are commonly used in financial markets to hedge against price fluctuations, speculate on future price movements, or gain exposure to various assets.

-

4

Spot Forex trading

Spot Forex trading is the simultaneous buying and selling of currency pairs in the foreign exchange market with immediate settlement and delivery, based on the current exchange rate.

-

5

Index

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).