Forex Trading For Beginners

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Traders Union’s Forex trading crash course designed just for beginners by the experts. Our goal is to help you get a grip on the basics of the Forex market quickly and with minimal effort. We've made sure that the course is straightforward and easy to follow, so you won't feel overwhelmed.

The Forex market is the largest financial marketplace in the world, with a massive daily trading volume of over $7 trillion. It’s open 24 hours a day, five days a week, allowing traders to buy and sell currencies in pairs like EUR/USD or GBP/JPY to profit from changes in exchange rates. To start trading Forex, you’ll need a trustworthy broker, practice with a demo account, and a solid trading plan.

With a little focus and determination, you’ll be ready to enter into the world of Forex trading and investing in no time. Let's get started on your journey to becoming a confident trader!

Basics about Forex

What are Forex rates?

Forex rates represent the value of one currency in terms of another. These rates determine how much of one currency you can exchange for another and are crucial for international trade, travel, and investments.

In the Forex market, currencies are traded in pairs. Each pair has a base currency and a quote currency. The base currency is the first currency listed, while the quote currency is the second. The exchange rate tells you how much of the quote currency you need to purchase one unit of the base currency.

For example, in the currency pair EUR/USD (Euro/US Dollar):

EUR is the base currency.

USD is the quote currency.

If the exchange rate is 1.20, it means 1 Euro is equal to 1.20 US Dollars.

Types of Forex rates

Spot rate. The current exchange rate at which a currency pair can be bought or sold.

Forward rate. A predetermined rate for a currency pair for a future date, agreed upon today.

Cross rate. The exchange rate between two currencies, neither of which is the official currency of the country in which the rate is quoted.

Factors influencing Forex rates

Economic indicators. Data such as GDP, employment rates, inflation, and manufacturing output can impact currency values.

Interest rates. Central banks’ interest rate decisions can influence the strength of a currency. Higher interest rates offer better returns on investments in that currency, making it more attractive.

Political stability. Countries with stable governments and economies are more attractive to foreign investors, boosting the value of their currencies.

Market sentiment. Traders' perceptions and reactions to news, events, and economic reports can cause fluctuations in exchange rates.

Trade balances. A country with a high export rate relative to imports will generally see an appreciation in its currency due to higher demand for its goods and services.

Understanding Forex rate quotes

Forex rates are typically quoted to four decimal places, with the exception of currency pairs involving the Japanese yen, which are quoted to two decimal places. The smallest price movement in Forex trading is called a "pip" (percentage in point).

For most currency pairs:

One pip = 0.0001

For yen pairs:

One pip = 0.01

Bid and ask prices

In Forex trading, each currency pair has a bid price and an ask price:

Bid price. The price at which the market (or your broker) will buy the base currency in exchange for the quote currency.

Offer (Ask) price. The price at which the market (or your broker) will sell the base currency in exchange for the quote currency.

The difference between the bid and ask price is known as the "spread."

How to start trading in the Forex market

Education. Before you start trading, you must understand the basics of the Forex market. Many online resources, courses, and tutorials can help you learn about trading strategies, market analysis, and risk management.

Choose a broker. Look for a broker that is regulated by a recognized financial authority, offers competitive spreads, and provides excellent customer service.

Open an account. After choosing a broker, you need to open a trading account. Brokers typically offer different types of accounts depending on your trading experience and investment amount.

Fund your account Deposit funds into your trading account using a preferred payment method. Most brokers accept bank transfers, credit/debit cards, and online payment systems.

Start trading. Begin trading by placing buy or sell orders based on your market analysis. Start with small trades to gain experience and gradually increase your trading volume as you become more confident.

Demo account

A demo account in the Forex market is a type of trading account provided by brokers that allows you to practice trading with virtual money. It replicates real market conditions and provides a risk-free environment to learn and test trading strategies without using actual funds. Demo accounts are particularly beneficial for beginners who are new to Forex trading and want to gain experience before committing real money.

Benefits of using a demo account:

Risk-free trading. Since you are trading with virtual money, there is no financial risk involved. This allows you to make mistakes and learn from them without any monetary consequences.

Learning platform. A demo account provides an excellent platform for beginners to understand how the Forex market works, including how to read charts, use trading tools, and place orders.

Testing strategies. Even experienced traders use demo accounts to test new trading strategies or refine existing ones. It helps in understanding the effectiveness of a strategy under real market conditions.

Familiarization with trading platforms. It allows you to get accustomed to the broker’s trading platform, understanding its features, tools, and functionalities. This familiarity is crucial when you switch to a live account.

Emotional management. Trading on a demo account helps in managing emotions like fear and greed, which are significant aspects of trading psychology. It allows you to develop discipline and a systematic approach to trading.

Tips for using a demo account effectively:

Treat it like a real account. Approach your demo trading with the same seriousness and discipline as you would a live account. This helps in building good trading habits.

Set realistic goals. Set realistic trading goals and work towards achieving them. This helps in understanding what to expect when you start trading with real money.

Experiment with strategies. Use the demo account to experiment with different trading strategies and find what works best for you. Test various approaches, time frames, and instruments.

Track your performance. Keep a trading journal to track your trades, strategies used, and the outcomes. Analyze your performance regularly to identify strengths and areas for improvement.

Learn risk management. Practice risk management techniques such as setting stop-loss and take-profit levels. This is crucial for protecting your capital when you move to a live account.

How does a trading platform work?

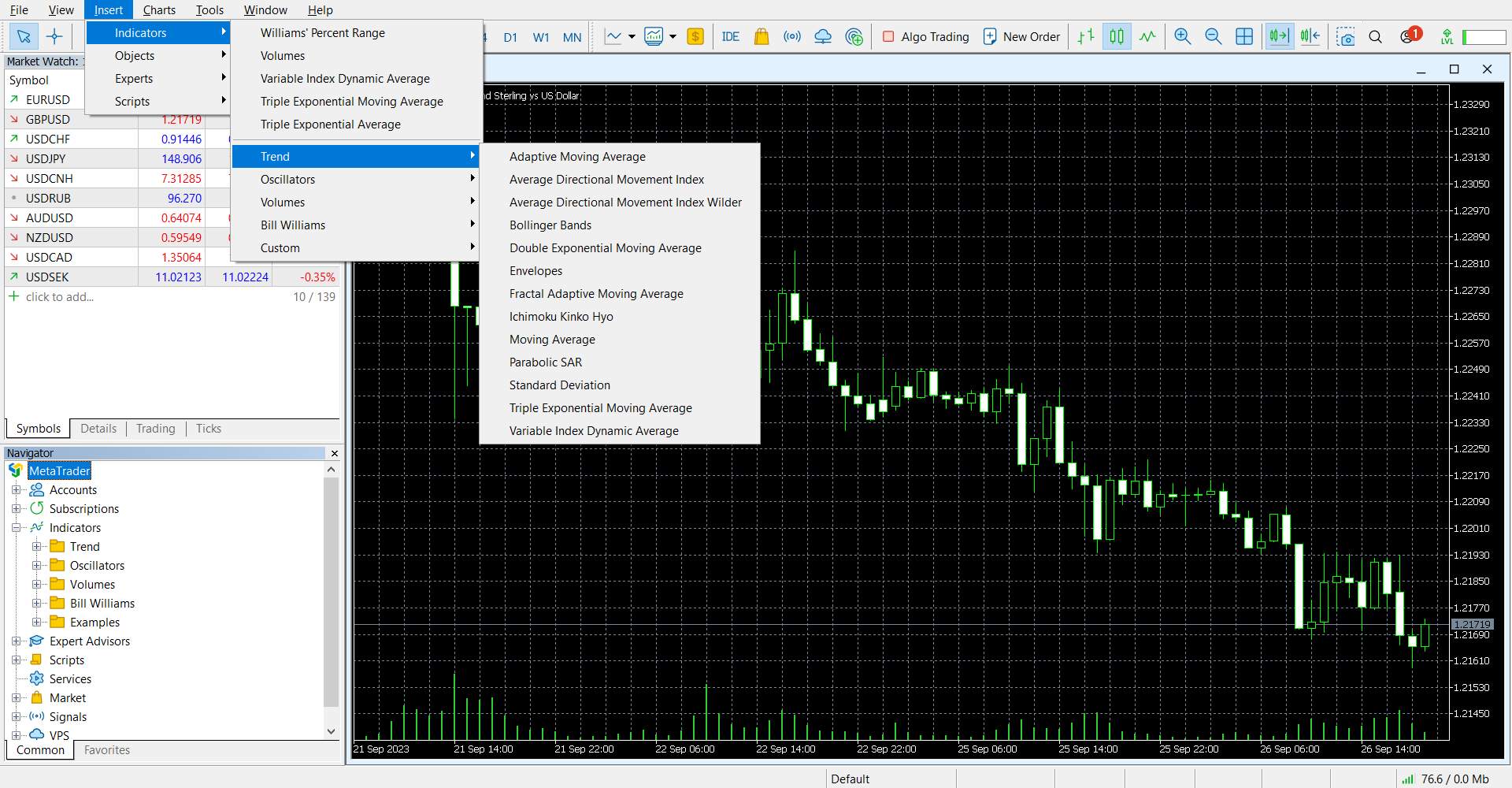

To understand this part, let us take the example of MT4, a popular trading platform:

Chart window. The currency chart is displayed in the central part of a platform. The number of charts of currency pairs depends on the number of pairs, which a trader utilizes.

Chart types. There are three chart types in the MT4 terminal: bars, Japanese candlesticks, and lines. Chart types are switched using the buttons in the toolbar.

Timeframe. An important property of the chart is its timeframe, or in another way, a time period for which a candlestick (bar) shows an instrument price. There are the following timeframes: 1, 5, 10, 15, 30 minutes, 1 hour, 4 hours, 1 day, 1 week, and 1 month.

Market overview window. Here you can find information on the purchase and sale prices of currency instruments at the moment: Bid is the selling price, Ask is the purchase price. By right-clicking on a line with any currency pair, you can open a menu with the following tasks:

A new order opens a window that allows you to make a trading transaction (purchase, sell);

A chart window displays a chart of a tool;

A tick-by-tick chart displays a chart in "Market Overview", showing each price change (in seconds).

Navigator window. Here you can see a list of available accounts ("Accounts") that you have ever connected to. To start working with another account, you need to double-click on it with the mouse. In addition, this window contains a list of all indicators, advisors and scripts installed in a trading platform.

Trading terminal window.

Trading. This tab contains all the information on trading activity on the account: opened positions and orders as well as the current state of the account (current balance, free funds, etc.);

Account history. Displaying information on completed trading operations, cash flow on the account (input, output);

Mailbox. A list of emails from the server of your dealing center is stored here;

Experts. Logs of advisors or scripts;

Log. In this tab you can view the logs of all actions for the current session.

How to trade on the trading platform

Login. Enter your account details to log in to the trading platform.

Set up. Customize the platform layout to suit your preferences. Most platforms allow you to arrange charts, indicators, and other tools.

Market analysis. Use technical and fundamental analysis to identify trading opportunities. This involves analyzing price charts, economic news, and other data.

Place orders. Choose the currency pair you want to trade and place an order. You can place a market order (executed immediately at the current price) or a pending order (executed when the price reaches a specific level).

Manage trades. Monitor your open trades and adjust them as necessary. Set stop-loss and take-profit levels to manage your risk and secure profits.

Close trades. Close your trades when you have reached your profit target or want to limit losses.

Forex trading analysis

Technical analysis:

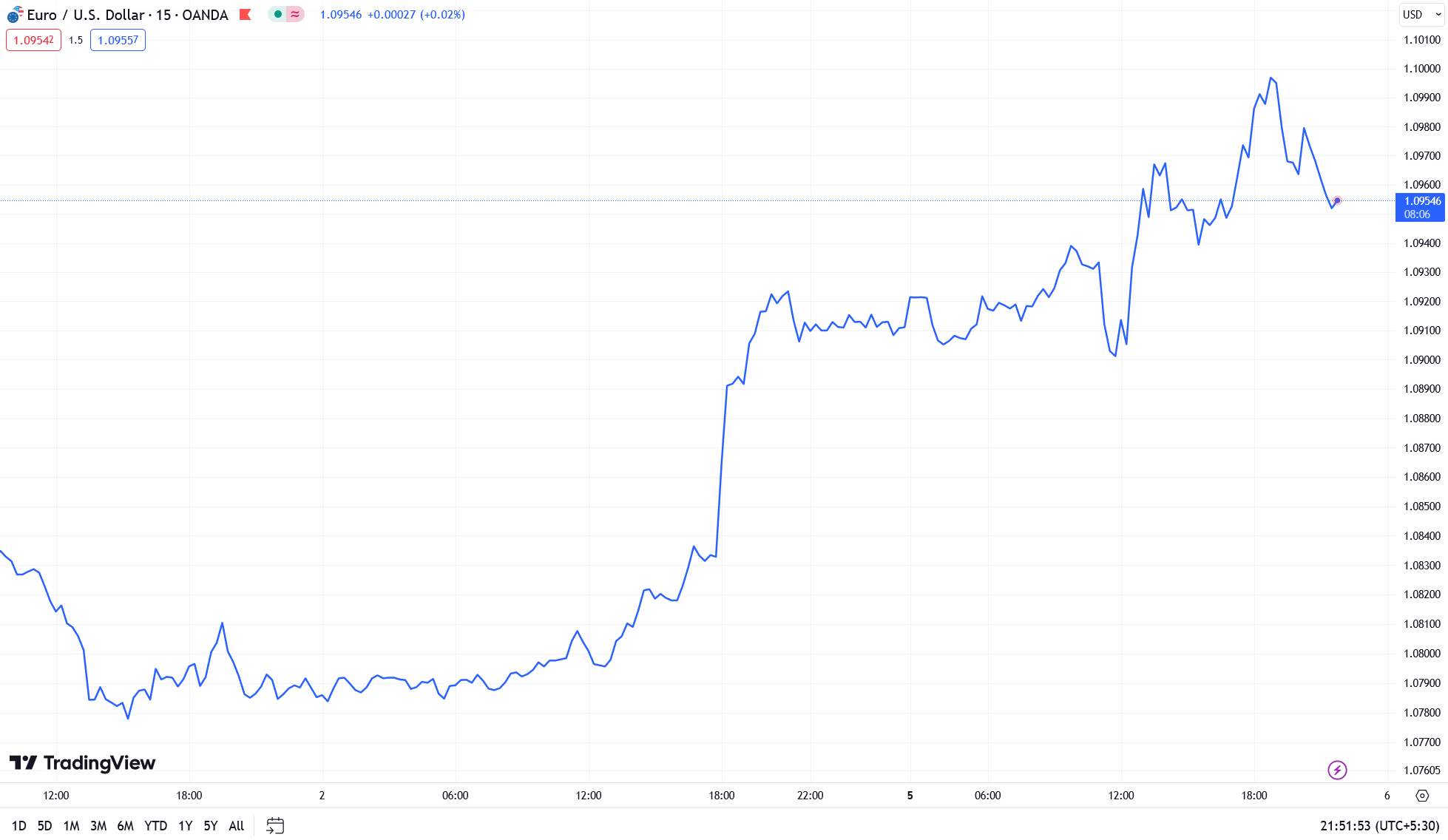

Charts. Use price charts to analyze historical price movements. Common chart types include line charts, bar charts, and candlestick charts.

Indicators. Technical indicators, such as moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence), help identify trends and potential entry/exit points.

Patterns. Learn how to identify chart patterns, like head and shoulders, double tops/bottoms, and triangles, which can signal potential market movements.

Fundamental analysis:

Economic indicators. Monitor key economic indicators, such as GDP, employment data, and inflation rates, which can impact currency values.

News. Stay updated with global news and events that can influence the Forex market, such as political developments, central bank decisions, and economic reports.

Sentiment. Gauge market sentiment by analyzing investor behavior and market psychology. This can help predict potential market moves.

Choose your Forex broker

Your first Forex broker often becomes your long-term trading partner, so choose carefully. Here’s what to consider:

Experience. Look for brokers with at least 5 years in the market. This indicates stability and expertise.

Reputation. Check the company’s image and read reviews from other traders, especially on Forex forums.

Regulation. Ensure the broker is regulated by reputable authorities.

Insurance. Confirm they have professional liability insurance.

Support. Good technical support is crucial. Prioritize brokers offering 24/7 assistance.

Trading conditions. Evaluate their trading terms and money withdrawal processes.

We have analyzed several brokers for you to help you get started on your trading journey. And here are their basic conditions:

| Plus500 | Pepperstone | OANDA | FOREX.com | Interactive Brokers | |

|---|---|---|---|---|---|

|

Demo account |

Yes | Yes | Yes | Yes | Yes |

|

Min. deposit, $ |

100 | No | No | 100 | No |

|

Max. leverage |

1:300 | 1:500 | 1:200 | 1:50 | 1:30 |

|

Min Spread EUR/USD, pips |

0,5 | 0,5 | 0,1 | 0,7 | 0,2 |

|

Max Spread EUR/USD, pips |

0,9 | 1,5 | 0,5 | 1,2 | 0,8 |

|

Regulation |

FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | SEC, FINRA, SIPC, FCA, NSE, BSE, SEBI, SEHK, HKFE, IIROC, ASIC, CFTC, NFA |

|

Open account |

Open an account Your capital is at risk. |

Open an account Your capital is at risk.

|

Open an account Your capital is at risk. |

Study review | Open an account Your capital is at risk. |

Focus on one currency pair, that is not too volatile and has smaller costs

A unique strategy for beginners in Forex trading is to focus on just one currency pair, preferably one that's not too volatile and has smaller transaction costs. This method lets you get a good grasp of how a particular pair behaves in different situations, like during big news events or political changes.

During the initial days of your journey, keep a detailed journal of your trades, noting down what went wrong and what worked well. This practice helps you learn better and sets a strong base for taking on more complex trades later.

Another important tip is to add sentiment analysis to your trading toolkit. While most people stick to charts or economic reports, understanding how the market feels can give you an edge. Keep an eye on social media, news websites, and economic discussions to sense the market's mood. This can help you spot changes that aren't immediately obvious on a chart. By recognizing emotions like fear and greed, you can make smarter choices that match what's happening in the market, instead of being caught off guard by sudden changes.

Summary

This Forex crash course is structured to help beginners grasp the basics of Forex trading quickly and effectively. This course covers essential topics such as understanding key market terms, selecting an appropriate broker, and using various analysis tools. With clear and concise material, it aims to build confidence and foundational skills. Guided by experienced professionals, the course ensures that beginners are well-prepared to start their trading journey with practical knowledge and insights.

FAQs

How do I start learning Forex trading?

You can start learning Forex by reading beginner-friendly books and taking online courses. Open a demo account to practice trading without risk. Stay updated with financial news and connect with other traders for tips.

Can I learn Forex in 3 months?

Yes, you can grasp Forex basics in three months if you study regularly and practice trading. Staying committed and actively trading will help you learn faster.

Are there any Forex passive income options?

A trader can invest funds with minimal risk in PAMM / LAMM accounts, which are managed by professional market players. There are other features, such as trust management and Copy Trading services.

Is Forex trading a safe investment?

Since trading is carried out according to the margin type, there is always a risk, and initially, it is quite high. However, the risk can be managed with a prudent trading strategy.

Related Articles

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

The informal term "Forex Gods" refers to highly successful and renowned forex traders such as George Soros, Bruce Kovner, and Paul Tudor Jones, who have demonstrated exceptional skills and profitability in the forex markets.

Scalping in trading is a strategy where traders aim to make quick, small profits by executing numerous short-term trades within seconds or minutes, capitalizing on minor price fluctuations.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.