Creating an Excel Trading Journal – Step-by-Step Guide

To create a free trading journal in excel, follow these steps:

Step 1 – Set up your spreadsheet

Step 2 – Enter your trading data

Step 3 – Calculate profit / loss using excel formula

Step 4 – Calculate net profit by deducting other charges paid

Step 5 – Determine strategy and trade result

A trading journal serves as a valuable tool for traders. It helps them organize and analyze their trading activities, and allows them to record and track crucial data such as stock purchases, sales, trade dates, entry and exit points, quantities, and prices. This data can then be used to generate insightful visualizations, monitor trading performance, and identify patterns over time. In addition, Excel's calculation capabilities can aid in determining profits, losses, and overall portfolio performance almost instantaneously while also facilitating the creation of graphs and charts that can help traders visualize trends and make informed decisions. In this article, the experts at TU have discussed the step-by-step process using which anyone can create their own free trading journal.

Do you want to start trading Forex? Open an account on Roboforex!Download free excel trading journal template

Click here to download the trading journal template prepared by TU analysts.Importance of maintaining a trading journal

A trading journal serves as a comprehensive record of trading decisions, strategies, and outcomes. Documenting the rationale behind each trade provides traders with insights into thought processes, helps them learn from both achievements and errors, and enables them to adapt their strategies accordingly. The journal nurtures self-discipline via consistent analysis and reflection, identifying behavioral patterns, emotional triggers, and biases influencing decisions. Looking back at your journal regularly keeps the learning process going, which helps in improving your decision-making skills and trading performance.

Creating a trading journal in 5 easy steps

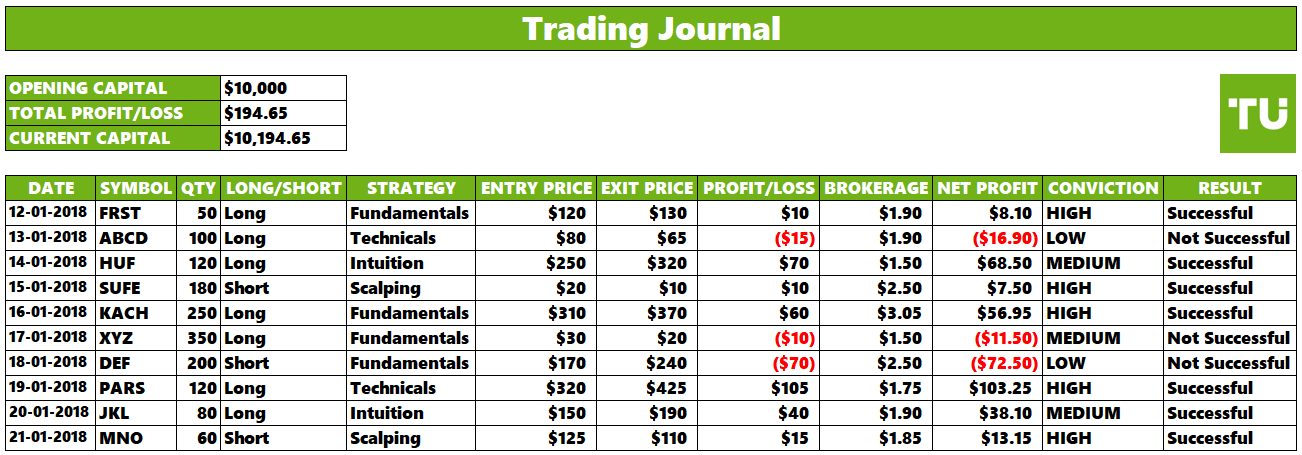

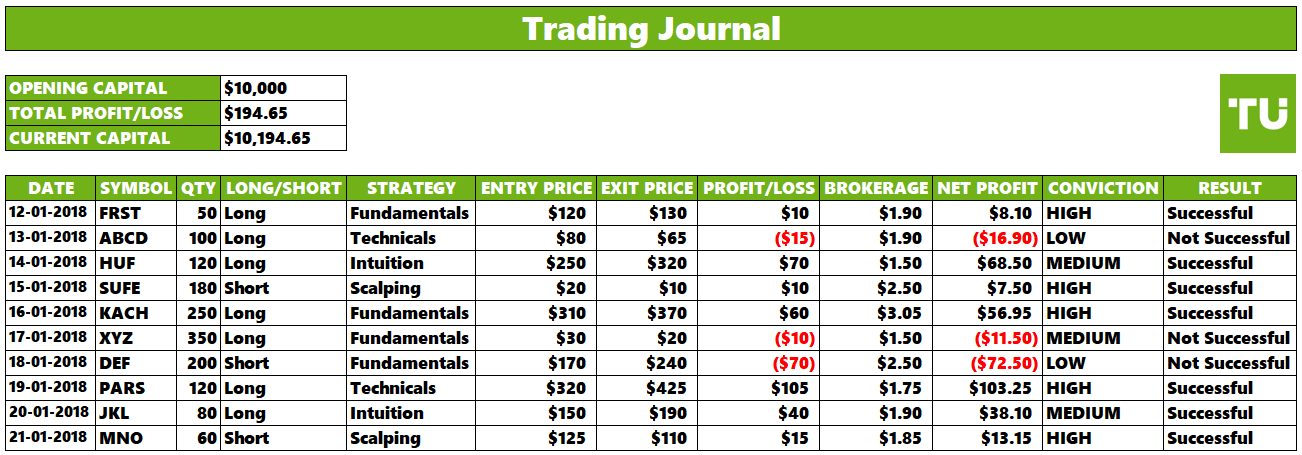

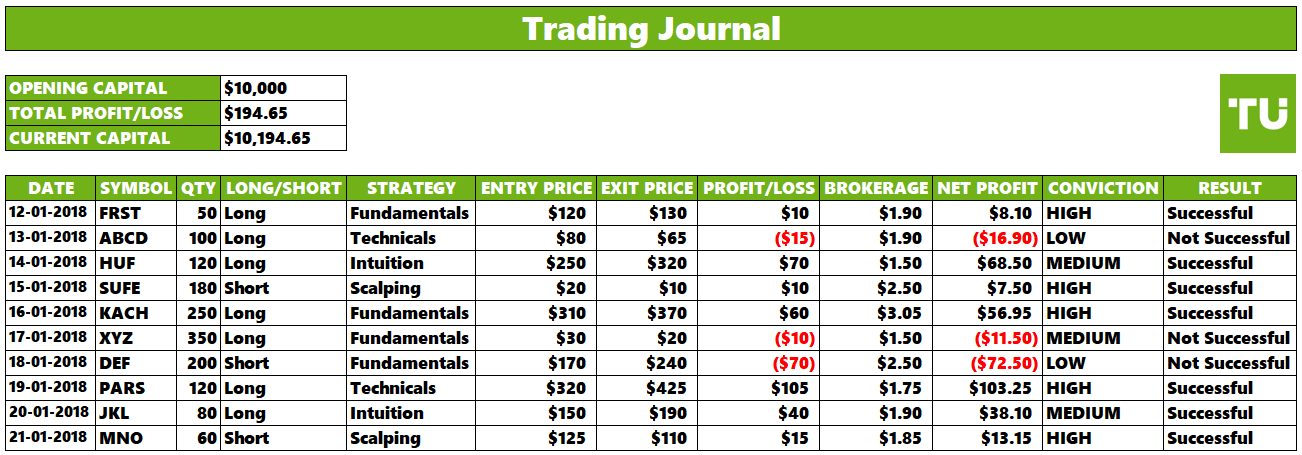

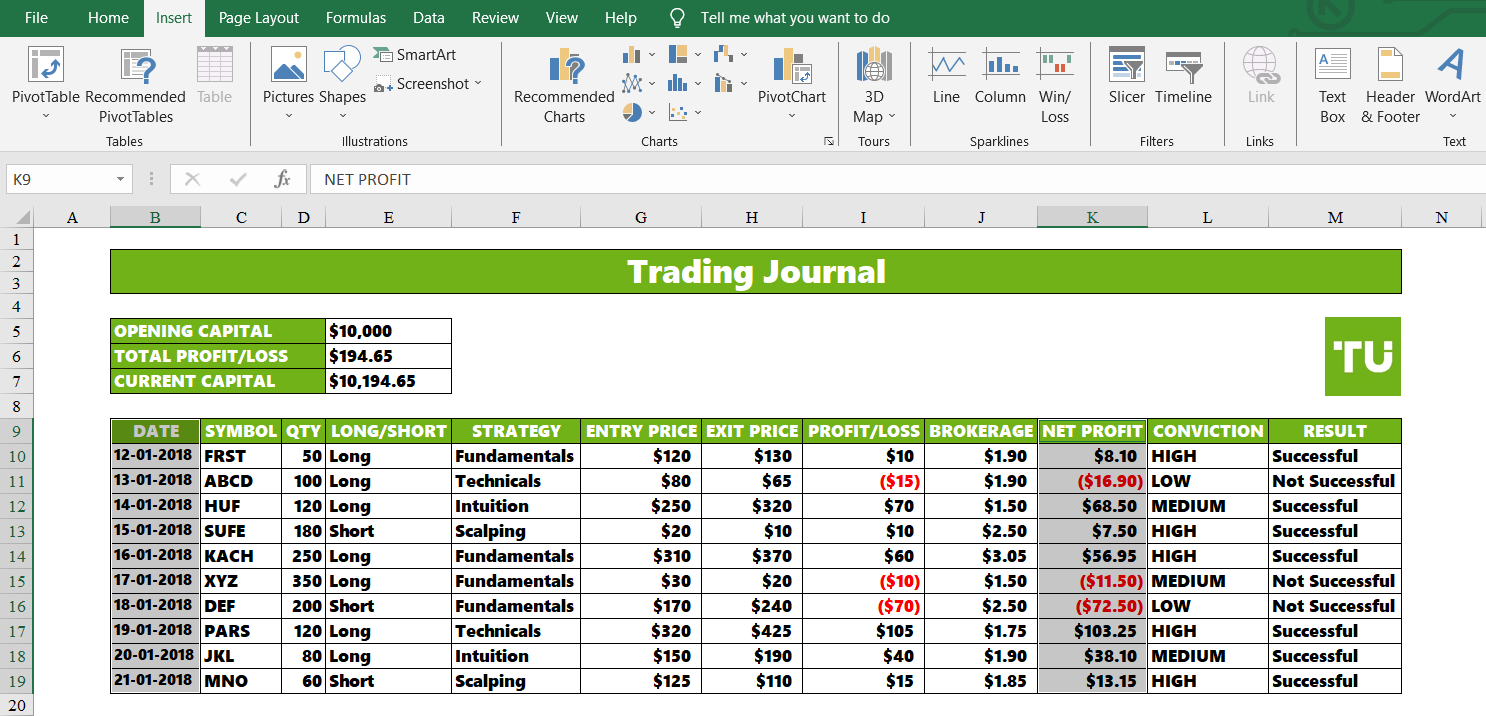

Excel trading journal – Final result

Creating an excel trading journal is easy, if done with the help of a step-by-step guide. You can follow these steps to get started.

Step 1 – Set up your spreadsheet

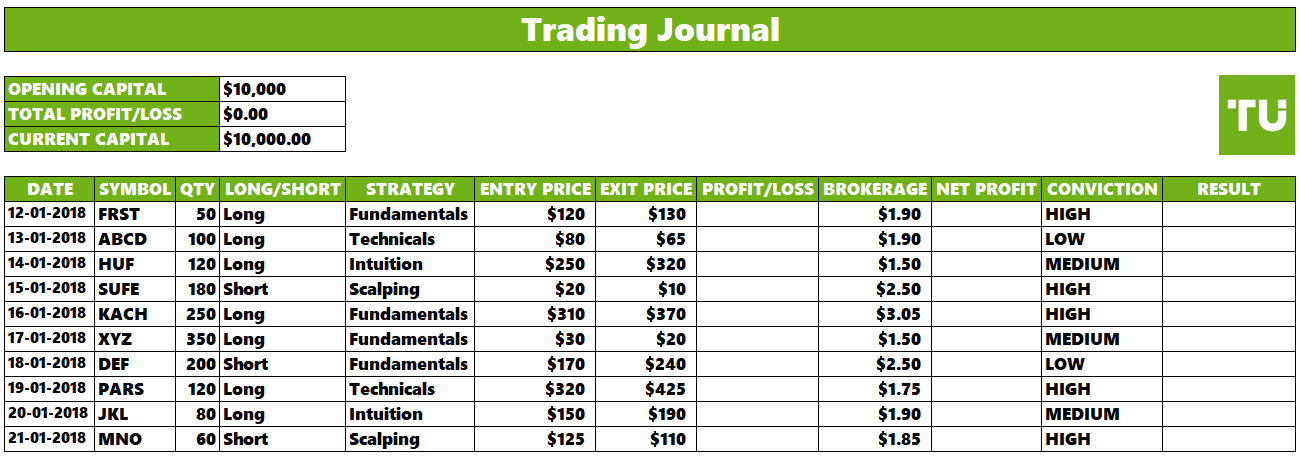

Step 1 – Setting up a spreadsheet

Setting up your trading journal in a spreadsheet provides a structured format for recording and analyzing your trades. Each column captures specific data points that contribute to understanding your trading performance. Key input parameters include trade date, quantity, strategy used, entry price, exit price, brokerage paid, and the level conviction for that trade.

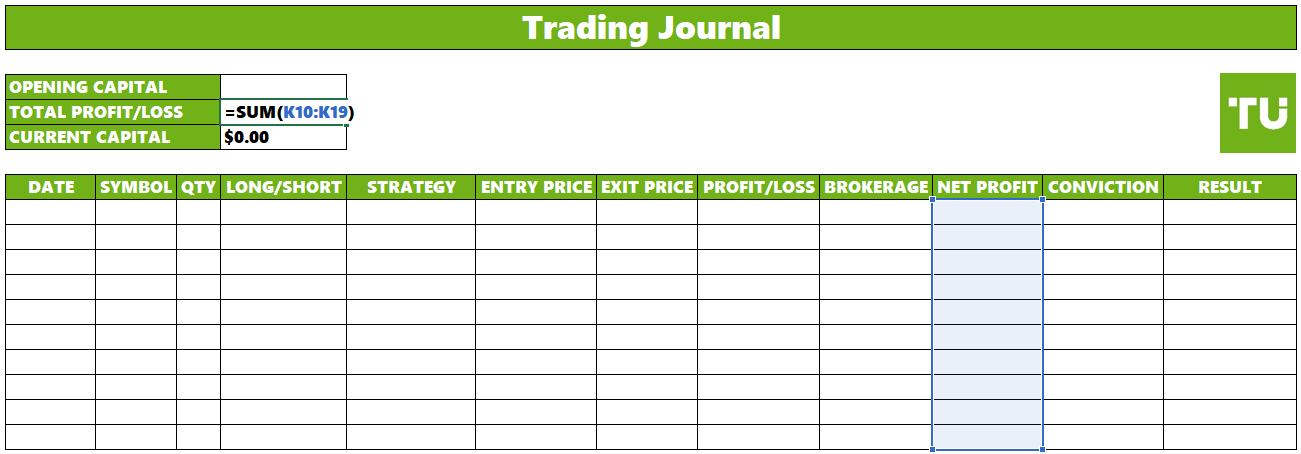

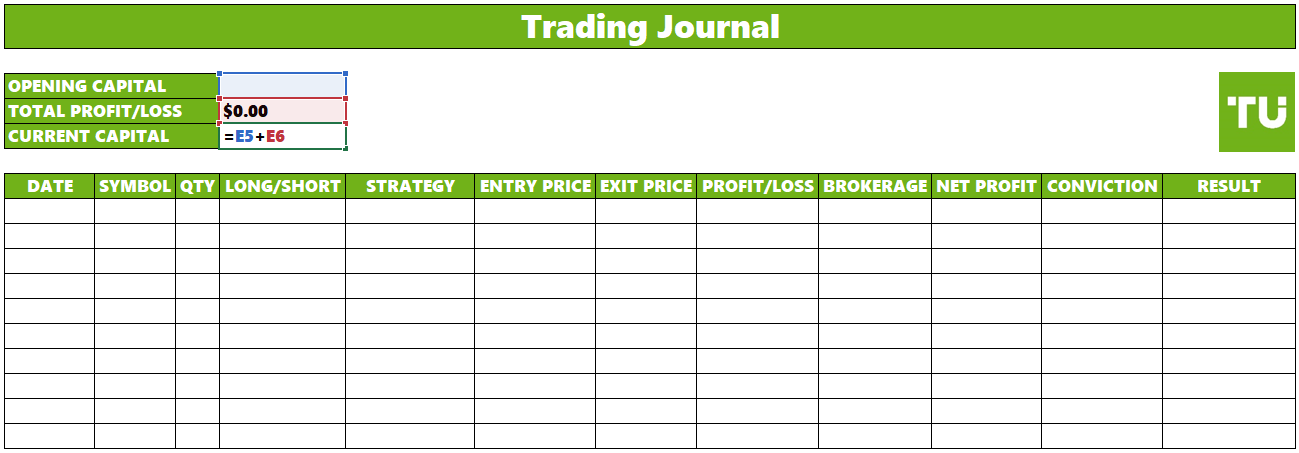

Additionally, you may also create total profit / loss and current capital tabs using the following formula inputs

Formula input for total profit / loss tab

Formula input for current capital tab

Step 2 – Enter your trading data

Step 2 – Entering your trading data

Enter the details of each trade in the respective columns. These details include the date of the trade, the trading symbol (stock or asset), quantity of units traded, whether it's a long or short position, the strategy used for the trade, the entry price, and the exit price. You may add additional parameters relevant to your specific strategy.

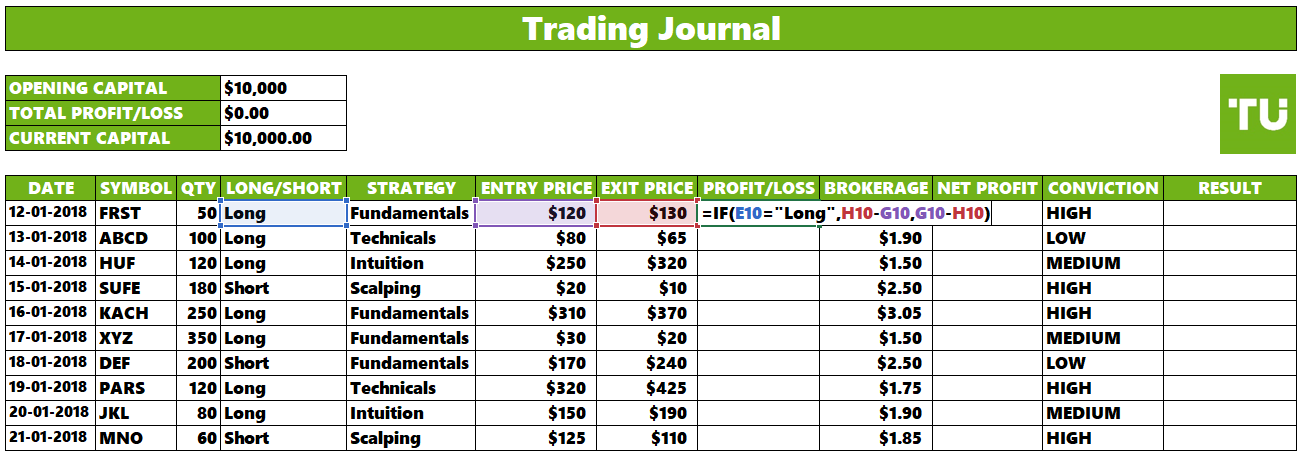

Step 3 – Calculate profit/loss

Step 3 – Calculating profit / loss

Use conditional formulas to calculate the profit or loss for each trade based on whether it was a long or short position. This enables you to see the financial outcome of each trade, which is crucial for evaluating the effectiveness of your trading strategies. Input the formula =IF(D11="Long", G11-F11, F11-G11) in the first cell of the profit/loss column and drag it downwards to fill it for the entire table.

Let's consider two scenarios:

If the trade was a "Long" position

The formula checks whether the value in cell D11 (which indicates "Long" or "Short") is equal to "Long". If the condition is met (meaning the trade was a long position), the formula calculates the profit by subtracting the entry price (F11) from the exit price (G11). This is because in a long trade, you aim to buy low and sell high to make a profit.

If the trade was a "Short" position

If the condition in cell D11 is not met (meaning the trade was not a long position, so it must be a short position), the formula calculates the profit by subtracting the exit price (G11) from the entry price (F11). In a short trade, you aim to sell high and buy back low to make a profit.

The formula thus accommodates both scenarios, providing the appropriate calculation based on the trade type.

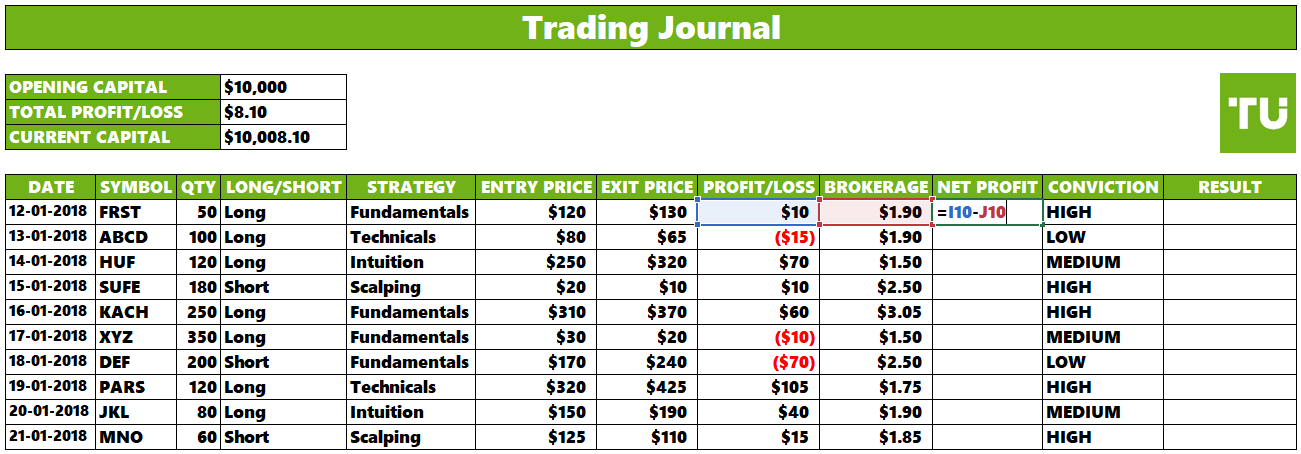

Step 4 – Calculate net profit

Step 4 – Calculating net profit / loss

Calculate the net profit for each trade by subtracting the brokerage fees from the calculated profit/loss. For the provided excel template, using the formula “= H11 – I11” and filling it downwards provides you with a clear picture of the net profit earned from each trade after accounting for brokerage fees. This information enables you to understand and manage your trading costs effectively, and also to accurately assess the financial impact of your trading activities.

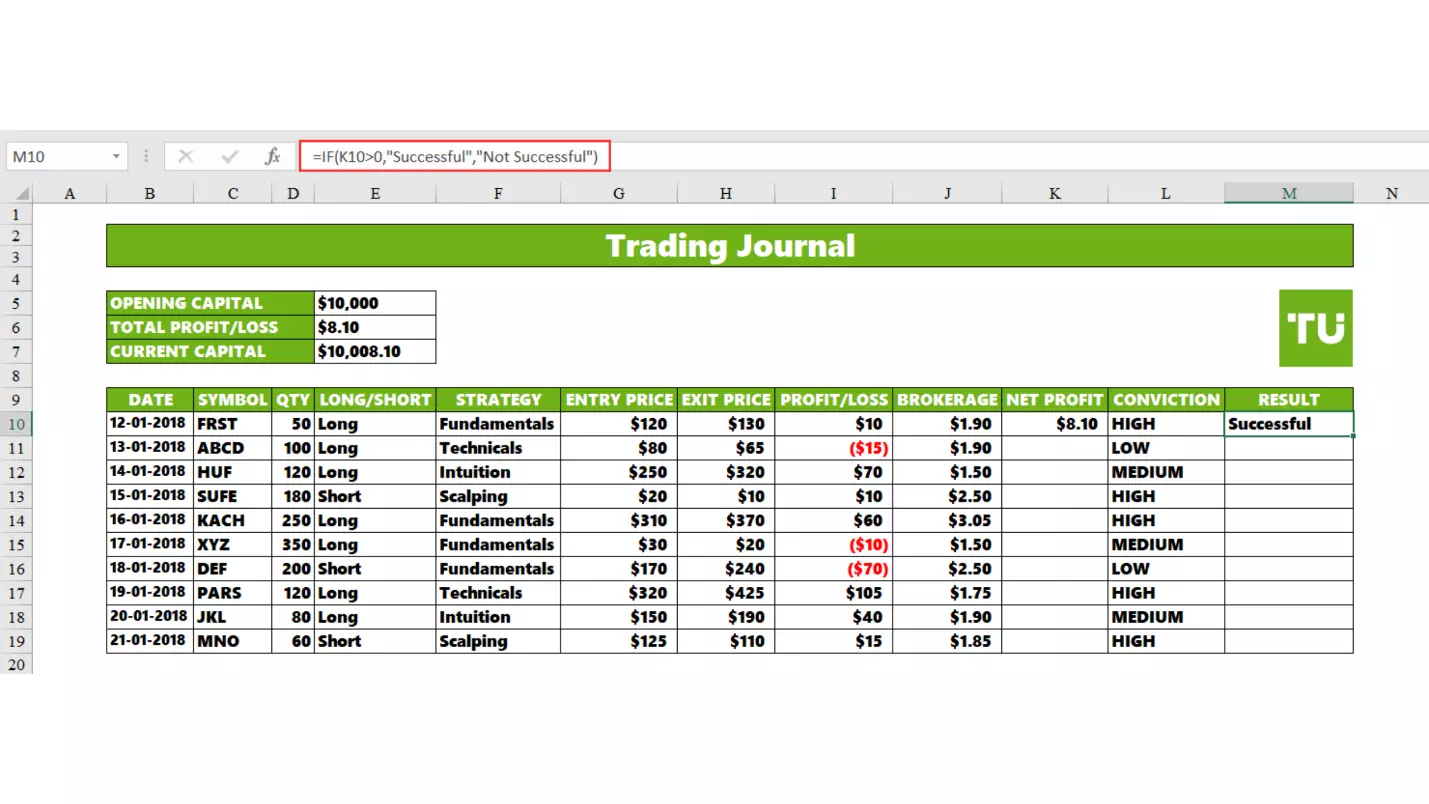

Step 5 – Determine Strategy and Trade Result

Step 5 – Determining strategy and trade result

Determine the result for the trade and analyze it based on strategy you used to initiate the trade whether it was fundamental, technical, scalping or intuitive. The definition of success is subjective for each trader. In the provided template, if the trade resulted in a positive net profit, it is said to be successful. This can be asserted in the form of formula as “IF(K10>0,”Successful”,”Not Successful”). Fill the formula in the designated cell and fill it downwards.

With this, you have successfully created an excel trading journal within 5 steps. The final result will look something like this:

Excel trading journal – Final result

How to analyse trading journal results?

Now that your trading journal is populated with data, you can begin analyzing your trading performance. Here's how the data can be useful:

Identify patterns

By sorting and filtering the data, you can identify patterns in your successful and unsuccessful trades. For instance, you might notice that trades based on certain strategies tend to be more profitable than others.

Track progress

You can see how your trading performance evolves over time. This insight helps you gauge whether you are improving as a trader or if there are persistent issues you need to address.

Spot mistakes

Reviewing unsuccessful trades can help you pinpoint mistakes in your decision-making process. This knowledge can lead to better-informed future trades.

Refine strategies

If you notice that certain strategies consistently result in losses, you can adjust or refine those strategies. Similarly, you can reinforce strategies that have consistently yielded positive results.

How to filter trades based on strategy in trading journal?

To filter trades based on strategy, follow these simple steps:

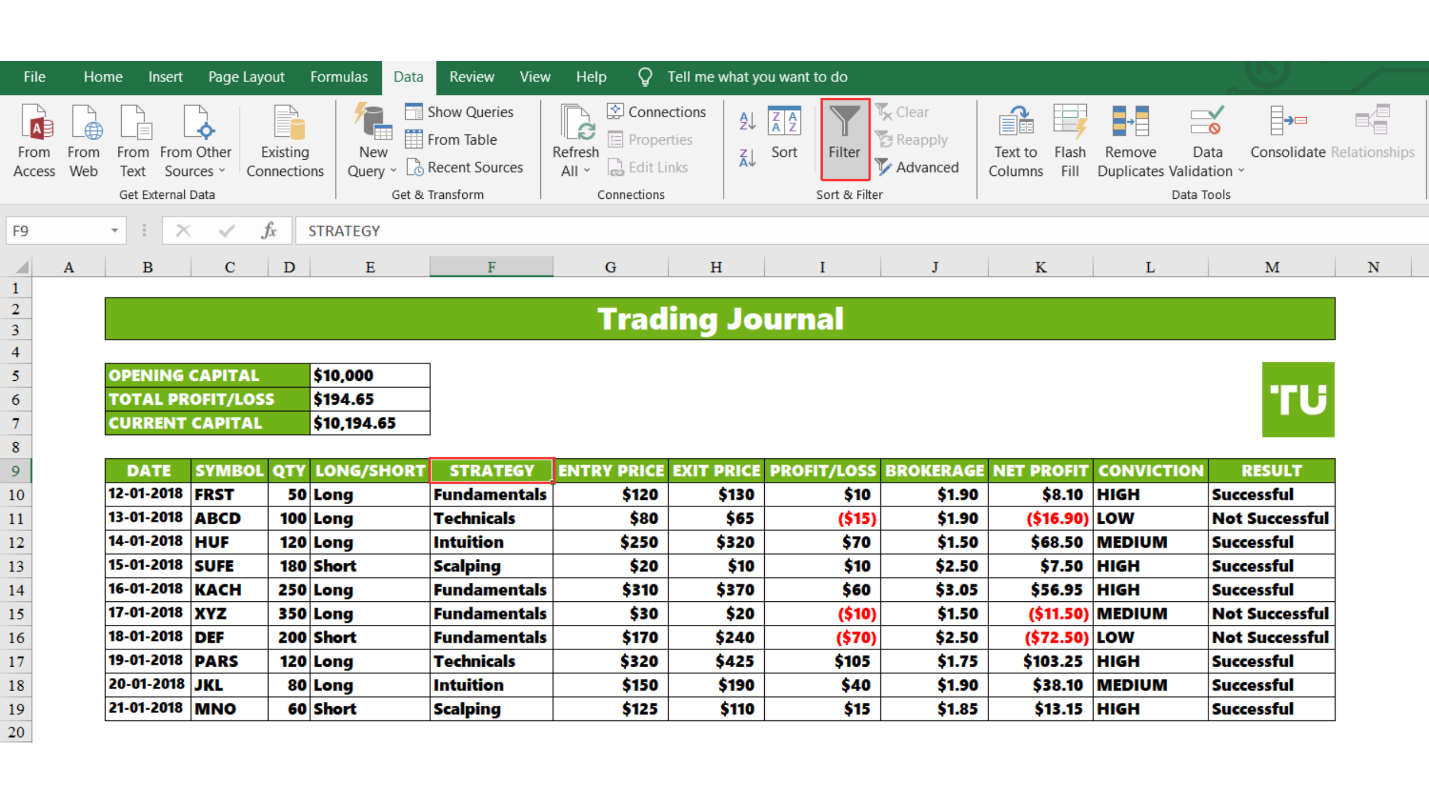

Step 1 – Apply excel filter

Applying excel filter

Select the “Strategy” header cell. Then, click on “Data” followed by “Filter”. This will apply a filter to the strategy tab.

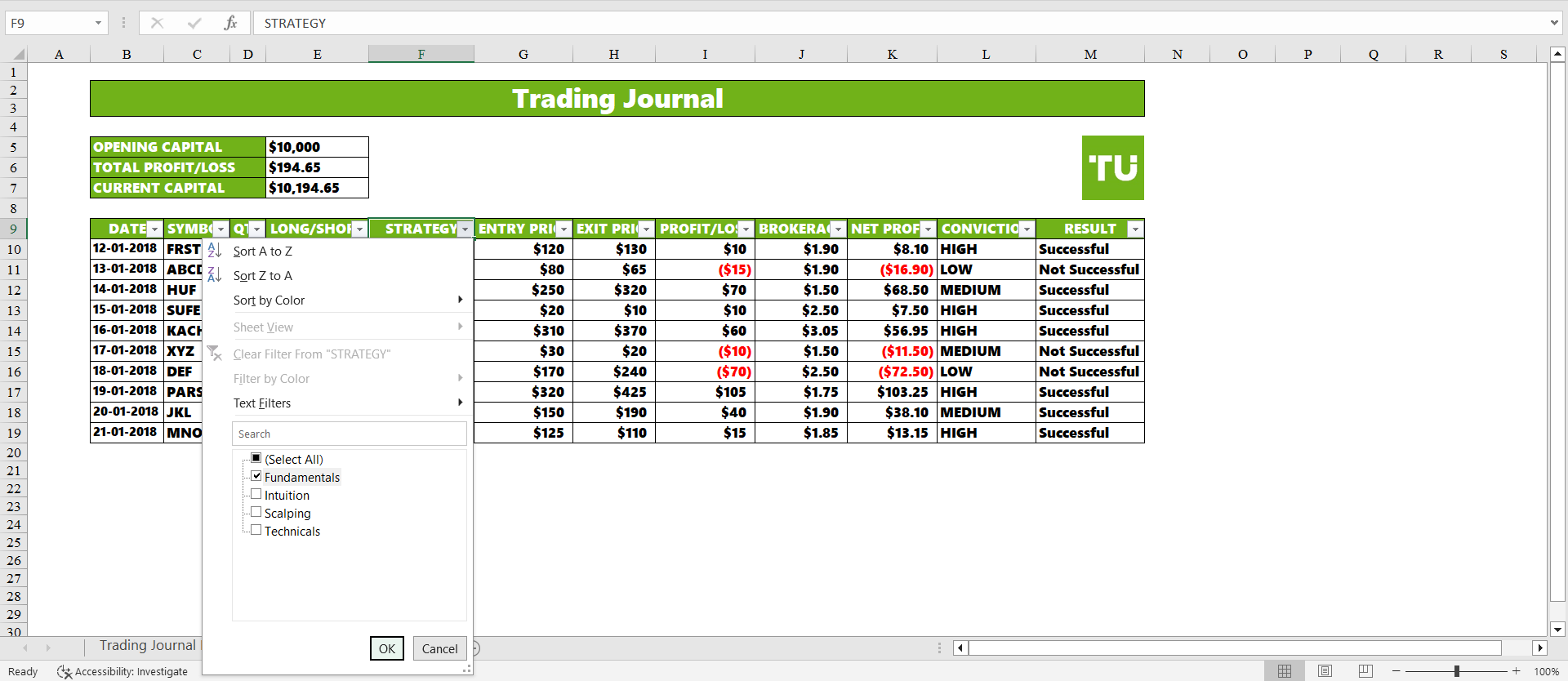

Step 2 – Select the strategy to be filtered

Applying excel filter

After you apply the filter, click on the arrow in the “Strategy” cell to open the filter dropdown menu. Then, deselect all strategies and select the specific strategy you want to filter.

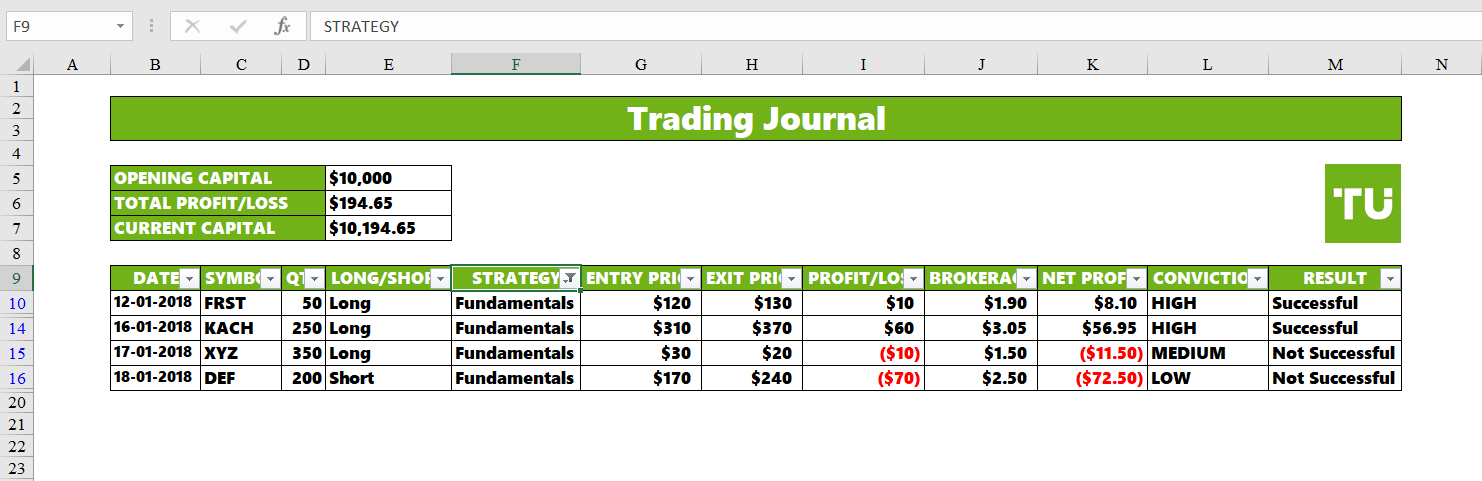

Step 3 – Analyse the specific strategy results

Applying excel filter

Done, you can now analyse any of your strategies in isolation. Note that calculating the total profit/loss from a specific strategy requires one additional step of applying the SUM formula to the specific “Net Profit” cells of the strategy.

Recording trading strategy for each trade – Why is it important?

It's important to record which trading strategy was used for each trade for several reasons, including:

Performance evaluation

By noting the strategy used for each trade, you can later assess which strategies are most successful for you. Excel allows you to create summary statistics and charts, making it easy to compare the performance of different strategies over time.

Strategy-specific metrics

You can track strategy-specific metrics like win rate, average profit, and average loss. Excel's calculation capabilities allow you to automatically compute these metrics, providing insights into the effectiveness of each strategy.

Adaptation and optimization

As you accumulate data in your Excel trading journal, you can identify trends in the performance of specific strategies. This information can guide you in adapting and optimizing your trading approach. For instance, if you notice that a particular strategy consistently yields losses, you may decide to replace it.

Risk management

Excel can help you calculate risk-adjusted returns for each strategy by factoring in metrics like the Sharpe ratio or drawdown analysis. This can assist in understanding the risk associated with each strategy and whether it justifies the potential returns.

Decision-making

When entering new trades, having a record of past trades and their associated strategies in your Excel journal can help inform your decision-making process. You can review which strategies have been most successful in current market conditions.

In summary, recording the strategy used for each trade in your trading journal helps you systematically evaluate and improve your trading performance. It enables data-driven decision-making, strategy optimization, and better risk management, ultimately contributing to your success as a trader.

Creating graphs in trading journal

Creating graphs or charts in Excel based on your trading journal data can provide visual insights into your trading performance. Here are the steps you can follow to insert graphs based on your trading data.

Step 1 - Select data

Creating graphs

Open your Excel spreadsheet containing the trading journal data. Highlight the columns you want to use for your graph. In your case, you might want to choose "DATE" and "NET PROFIT" or any other combination of columns that suits your analysis.

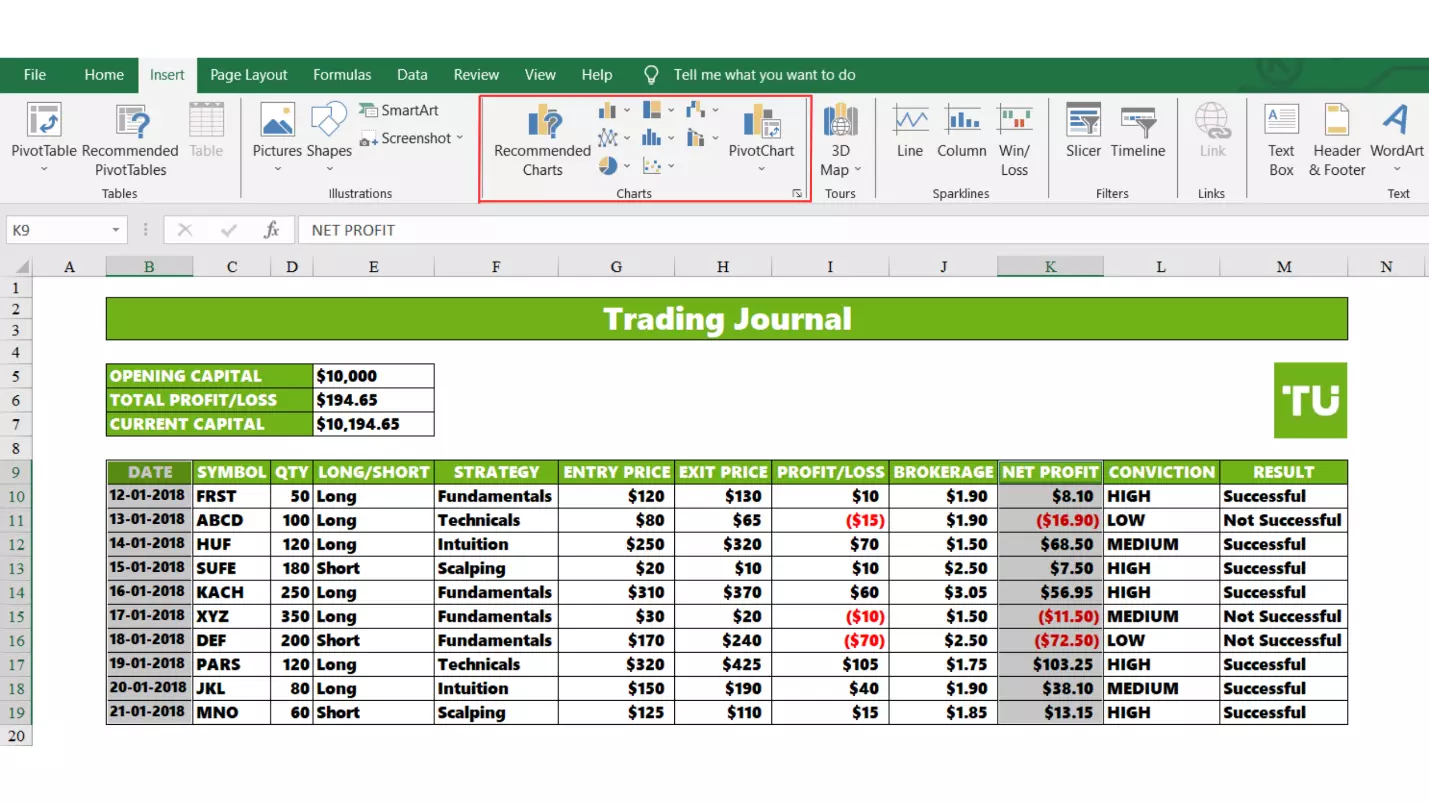

Step 2 – Insert a chart

Creating graphs

With your data selected, go to the "Insert" tab in Excel. In the Charts group, choose the type of chart that suits your analysis. For financial data like trading profits, a line chart or a bar chart can be useful. You might also consider creating a combination chart with multiple series if you want to display more than one type of data.

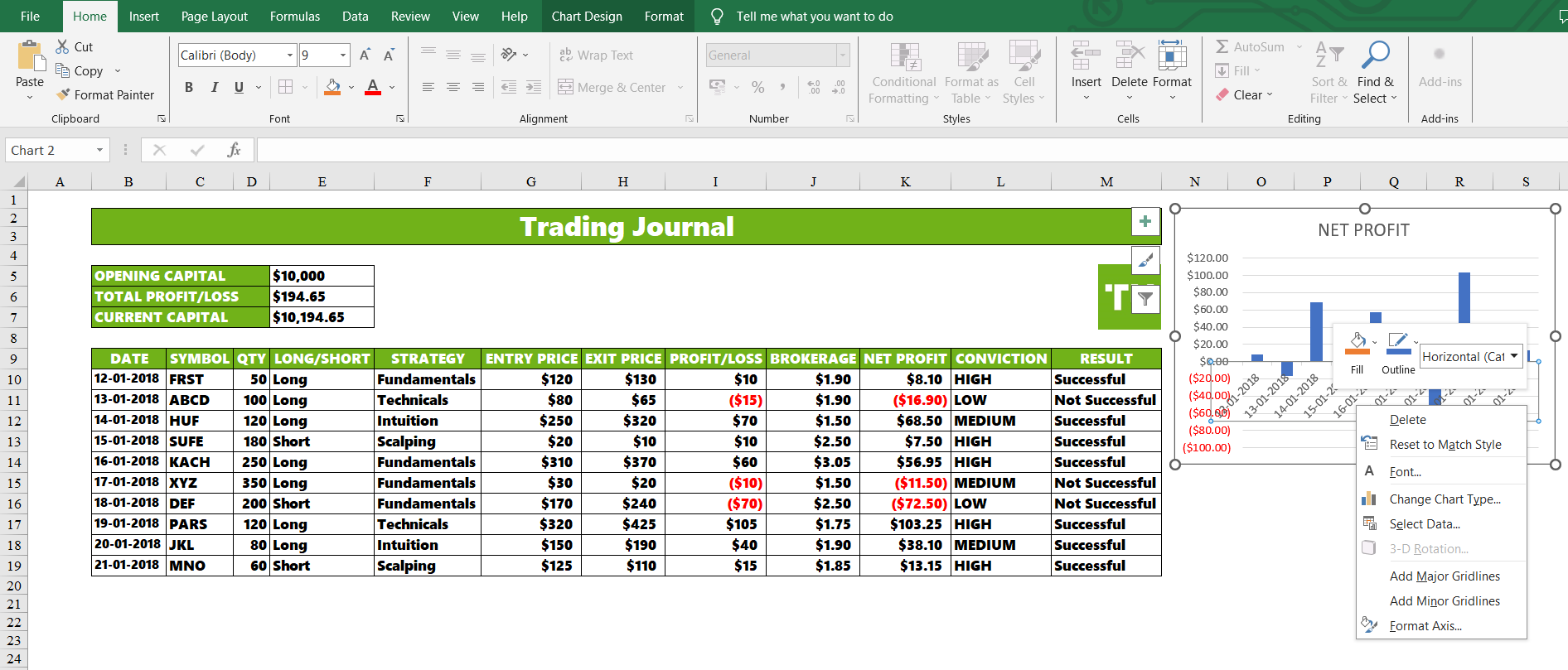

Step 3 – Customize the chart

Creating graphs

Once you have inserted your chart, Excel will create a default chart using your selected data. You can customize the chart by right-clicking on various chart elements (axes, data points, legends, etc.) and selecting format options to change colors, labels, and more. Add a title, axis labels, and a legend to make your chart more informative.

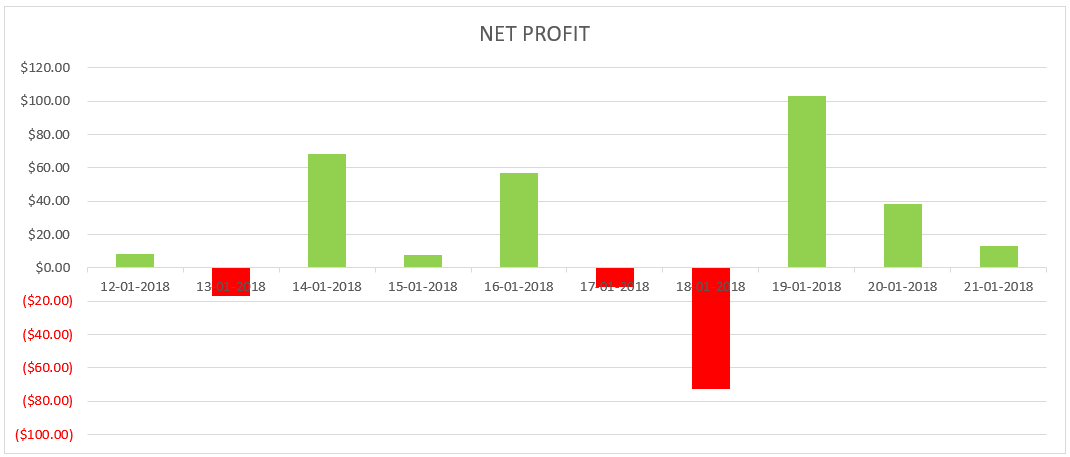

Step 4 – Interpret the chart

Creating graphs

Your chart will visually represent your trading data. For instance, if you choose "Date" and "Net Profit," the x-axis will show dates, and the y-axis will display your net profit over time. Look for trends, patterns, or any insights that the chart reveals. Are there periods of consistent profitability or losses? Did specific strategies perform better during certain times? Answering these questions will help you interpret your performance better.

Step 5 – Save and update the chart

Save your chart within the Excel document. To keep the chart updated with new trading data, simply add new rows of data to your trading journal as you make new trades. The chart will automatically reflect these changes.

Advantages of maintaining a trading journal

According to experts, maintaining a trading journal has the following advantages:

Unbiased evaluation

A trading journal offers an unbiased record of trades, allowing you to objectively assess your decisions and results.

Learning from errors

By analyzing unsuccessful trades, you gain insights from mistakes and prevent their recurrence.

Leveraging strengths

Trading journals help you to identify your strengths and capitalize on them, focusing on strategies that consistently yield profits.

Adapting and progressing

Regular journal reviews aid in adjusting to changing markets and refining strategies over time.

Understanding emotions

Recording conviction and emotions during trades provides insights into psychological influences on decisions.

Measuring growth

Using trading journals, you can track your trading journey, acknowledging achievements and utilizing setbacks as valuable learning experiences.

Informed choices

Trading journals enable you to rely on historical trade data, rather than memory, for making well-informed decisions.

Maintaining discipline

A trading journal fosters accountability and discipline in your trading approach. Consistency and thoughtful use of a trading journal yield substantial insights into trading patterns and contribute to becoming a more accomplished and prosperous trader.

Best Forex brokers 2024

FAQ

How do I create a trade journal in Excel?

To create a trade journal in Excel, follow these 5 simple steps

Step 1 – Set up your spreadsheet

Step 2 – Enter your trading data

Step 3 – Calculate profit / loss using excel formula

Step 4 – Calculate net profit by deducting other charges paid

Step 5 – Determine strategy and trade result

Can Excel be used for trading?

Yes, Excel has varied uses for trading. It can be used to maintain a trading journal, visualize trading data, analysing trading performance, and other important tasks.

How do you structure a trading journal?

For a basic trading journal, key input parameters include trade date, quantity, strategy used, entry price, exit price, brokerage paid, and the level of conviction for that trade. Based on these inputs, several key outputs can be calculated, including gross profit, net profit, and trade success, among others.

Does TradingView have a trading journal?

Yes, TradingView has a trading journal tool where traders can upload their trading data in the (.CSV) format.

Glossary for novice traders

-

1

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

2

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

3

Yield

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

-

4

Scalping

Scalping in trading is a strategy where traders aim to make quick, small profits by executing numerous short-term trades within seconds or minutes, capitalizing on minor price fluctuations.

-

5

Risk Management

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).