What Are The Different Types Of Forex Trading Charts?

Price chart is a type of graphical display of price. Basic price charts for most trading platforms - line chart, bars, candles. Additional charts: Renko, Heiken Ashi, tick charts.

Charts are one of the most important tools for forex traders. They provide information about past price movements and can be used to predict future trends. There are several different types of charts, each with its own advantages and disadvantages.

Basic types of charts

The most common types of charts for forex trading are:

-

Line charts

-

Bar charts

-

Candlestick charts

-

Tick charts

-

Renko charts

-

Heikin-Ashi charts

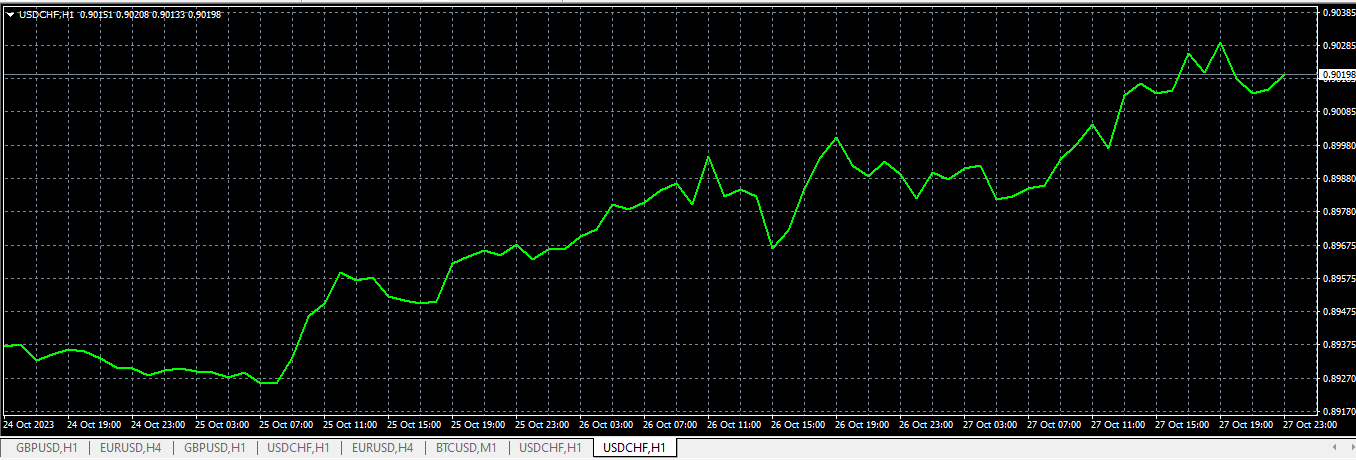

Line charts

Line charts are the simplest form of price representation. They are a line connecting the opening, closing, high, and low prices for each time period. Line charts are easy to use and can be useful for traders who want a general overview of price movements.

Line charts

👍 Advantages:

• Ease of use. Line charts are the simplest type of chart to understand and use. This is because they consist of a single line that connects the opening, closing, high, and low prices for each time period

• Overall view. Line charts provide an overall view of price movement. This can be helpful for beginner traders who are just starting to learn about the market

• Suitable for various trading strategies. Line charts can be used for various trading strategies, including technical analysis, fundamental analysis, and news-based trading. This makes them a versatile tool for traders of all levels of experience

👎 Disadvantages

• Does not show price extremes. Line charts do not show the opening, closing, high, and low prices for each time period. This can make it difficult to identify trends and patterns. For example, if the price reaches a new high, but the line chart does not reflect this, the trader may miss important information

• Can be susceptible to noise. Line charts can be susceptible to noise caused by small price fluctuations. This can make it difficult to identify real trends. For example, if the price makes small fluctuations up and down, it may give the impression that the trend is changing when it is not

Line charts are a valuable tool for traders who want to get an overall view of price movement and use various trading strategies. However, they may not be as detailed as other types of charts and can be susceptible to noise.

Bar charts

Bar charts are more detailed than line charts. They are vertical bars that show the opening, closing, high, and low prices for each time period. Bar charts can be useful for traders who want to identify trends and patterns.

Bar charts

👍 Advantages:

• More detailed information than a line chart. Bar charts show the opening, closing, high, and low prices for each time period, which allows traders to better understand price movement

• Easy to identify trends and patterns. Bar charts can be used to identify trends and patterns, such as uptrends and downtrends, triangles, flags, and others

• Suitable for various trading strategies. Bar charts can be used for various trading strategies, including technical analysis, fundamental analysis, and news-based trading

👎 Disadvantages:

• Can be difficult for beginner traders. Bar charts can be more complex to understand than line charts

• Can be susceptible to noise. Bar charts can be susceptible to noise caused by small price fluctuations

Bar charts are a valuable tool for traders who want to get more detailed information about price movement and identify trends and patterns. However, they can be more complex to understand than line charts and can be susceptible to noise.

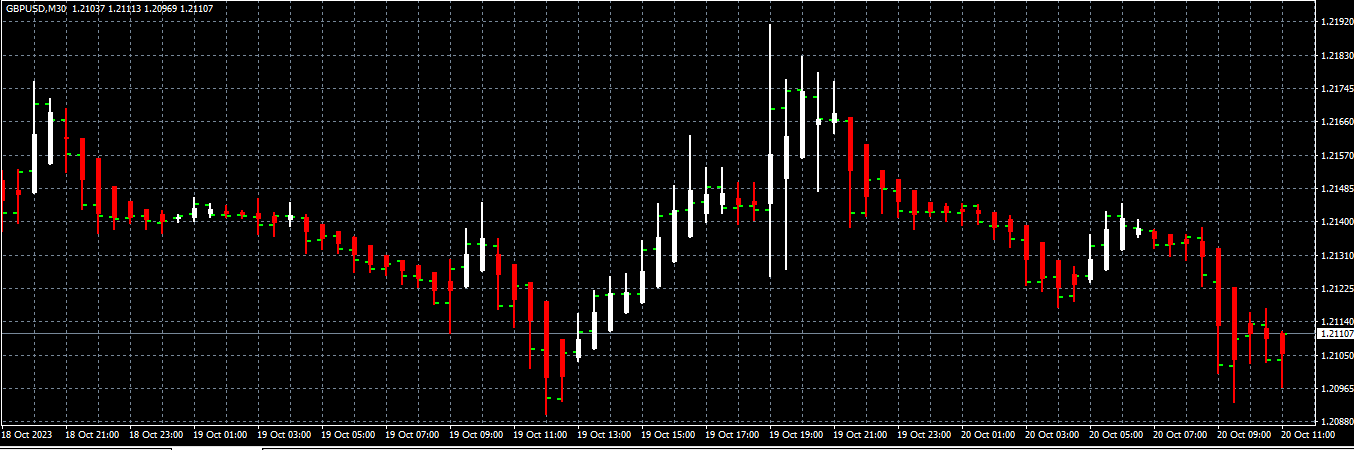

Candlestick charts

Candlestick charts are the most popular type of chart for Forex trading. They are four-point figures that show the opening, closing, high, and low prices for each time period. Candlestick charts can be useful for traders who want to identify trends, patterns, and volatility.

Candlestick charts

👍 Advantages of candlestick charts over bar charts:

• More visual information. Candlestick charts use color and size to show the difference between the opening and closing prices. This can be helpful for traders who want to quickly understand the direction of price movement

• Easier trend and pattern identification. Candlestick charts can be easier to identify trends and patterns than bar charts. This is because candles provide more information about price movement. For example, candles with long lower shadows can indicate a trend reversal, and candles with long upper shadows can indicate a trend continuation

• More reliable noise filtering. Candlestick charts take into account all price information, including the opening, closing, high, and low prices. This can help traders filter out noise caused by small price fluctuations

👎 Disadvantages of candlestick charts over bar charts:

• Can be more difficult to understand. Candlestick charts can be more difficult to understand than bar charts. This is because they provide more information and can be more visually cluttered. For example, beginner traders may not understand the meaning of different types of candles

• Can be susceptible to noise. Candlestick charts can be susceptible to noise caused by small price fluctuations. This can make it difficult to identify trends and patterns. For example, a candle with a small body can indicate no trend

Ultimately, the choice between candlestick and bar charts is a matter of personal preference and trading strategy. Candlestick charts can be more useful for traders who want to get more detailed information about price movement and identify trends and patterns. Bar charts can be simpler to understand and less susceptible to noise, which can be helpful for beginner traders.

Tick charts

Tick charts are the most detailed type of chart. They are a separate bar for each price tick. Tick charts can be useful for traders who want to identify microtrends and volatility.

Needed to calculate trading volumes when generating data from technical indicators. They are practically not used in real trading.

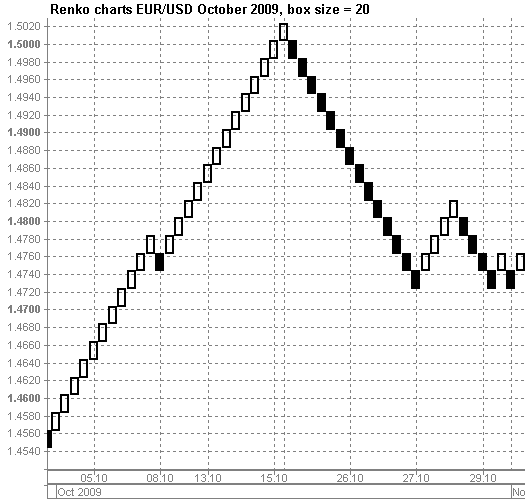

Renko charts

Renko charts are a variation of candlestick charts. They are based on four points: open, close, average price, and average price for the period. Renko charts can be useful for traders who want to identify trends and patterns without the noise caused by volatile price.

Renko charts

👍 Advantages:

• Noise removal. Renko charts ignore time and focus on significant price movements, effectively filtering out market noise

• Visual simplicity. Renko blocks resemble bricks, with color and position indicating price direction, making them visually straightforward to interpret

• Clear signals. By filtering out minor price fluctuations, Renko charts often generate clearer buy and sell signals

• Time-independence. Renko charts are not time-dependent, which can be beneficial when analyzing assets with price fluctuations at different times of the day

👎 Disadvantages:

• Time ignored. While an advantage, it can also be a drawback, as it overlooks the importance of time, which can be significant in financial markets

• Higher processor requirements. Renko charts may demand more computer resources to create and display, especially on lower time frames

• Reduced data. Renko charts truncate data, potentially omitting crucial information and trading opportunities

• Limited availability. Not all trading platforms support Renko charts, limiting the availability of the tool

• Artificial nature. Renko charts may be less precise during high market volatility because they add new blocks only after the price exceeds a defined value

In summary, Renko charts can be useful to traders, particularly for trend analysis and noise reduction. However, like any analytical method, understanding their pros and cons is essential. It's best to use them in combination with other tools and strategies to make well-informed trading decisions.

Heikin-Ashi charts

Heikin-Ashi charts are another variation of candlestick charts. They are based on the average price for the period. Heikin-Ashi charts can be useful for traders who want to identify trends and patterns.

Heikin-Ashi charts

👍 Advantages:

• Simplicity. Heiken Ashi charts are very simple to understand. They are based on the average values of the opening, closing, high, and low prices for a time period. This means that traders do not need to understand complex concepts such as technical indicators or fundamental analysis

• Effectiveness. Heiken Ashi charts can be very effective for identifying trends and patterns. This is because they filter out noise caused by small price fluctuations. This can make them more reliable for making trading decisions

• Versatility. Heiken Ashi charts can be used for a variety of trading strategies. This makes them a versatile tool for traders of all experience levels

👎 Disadvantages:

• Do not display all information. Heiken Ashi charts do not display all information about price movement, such as opening, closing, high, and low prices. This can make it difficult to identify certain patterns, such as double bottom or head and shoulders

• Can be delayed. Heiken Ashi charts can be delayed, meaning they may not reflect the current state of the market. This is because Heiken Ashi candles are formed after the price has reached a certain level. This can make them less effective for making trading decisions

Ultimately, the choice between Heiken Ashi charts and other types of charts is a matter of personal preference and trading strategy. Heiken Ashi charts are a good choice for beginner traders and traders who want to use simple tools to identify trends and patterns. However, they may not be as effective for traders who want to use more complex trading strategies or track all information about price movement.

Choosing a chart type

The choice of chart type depends on the trader's personal preferences and trading strategy. Some traders prefer line charts for their simplicity. Others prefer bar charts or candlestick charts for their detail. Still others prefer tick, renko, or Heikin-Ashi charts for their ability to filter noise.

Factors to consider when choosing a chart type:

-

Experience level. Line charts are a good choice for beginner traders as they are simple to understand. Bar charts and candlestick charts can be more complex, but they offer more information that can be useful for experienced traders

-

Trading strategy. Some trading strategies are better suited for certain chart types. For example, candlestick charts are often used for trading based on technical indicators such as support and resistance levels

-

Asset type. Some asset types are better displayed on certain chart types. For example, line charts may be more useful for trading stocks, while bar charts or candlestick charts may be more useful for trading currencies

Additional tips for choosing a chart type:

-

Start with line charts. This is a good way to understand the basics of price movement

-

Try bar charts or candlestick charts when you are ready for more detailed market analysis

-

Experiment with different settings and parameters for each chart type. You can change the time frame, scale, and other parameters to customize the chart to fit your needs

-

Read books and articles about different types of charts. This will help you better understand their advantages and disadvantages

There is no right or wrong answer to the question of which chart type is best for you. The best way to choose a chart type is to try different types and see which one you like the best.

How to read charts

Once you have chosen a chart type, you need to learn how to read it. This can be done by reviewing historical data and identifying trends, patterns, and volatility. There are many resources that can help you learn how to read charts, including books, websites, and trading platforms. You might be interested in learning more about How To Read Stock Charts For Beginners.

Practice

The best way to learn how to read charts is to practice. The more you look at charts, the better you will be able to understand them. Start by reviewing historical data for the currency pair you want to trade. Then try to identify trends, patterns, and volatility. As you become more experienced, you will be able to use this knowledge to make trading decisions.

Conclusion

Charts are an important tool for Forex trading. They provide information about past price movements and can be used to predict future trends. There are several different types of charts, each with its own advantages and disadvantages. The choice of chart type depends on the trader's personal preferences and trading strategy.

FAQs

What are the most important forex charts?

The most important forex charts are the daily and weekly candlestick charts. They provide the most complete picture of price action over time, which can be used to identify trends, potential reversals, and support and resistance levels.

What are the different types of charts in MT4?

The different types of charts in MT4 are:

-

Line chart

-

Bar chart

-

Candlestick chart

-

Heikin-Ashi chart

-

Renko chart

-

Point and Figure chart

The most popular chart type used by forex traders is the candlestick chart.

What are the different types of forex charts?

The most common types of forex charts are:

-

Line chart

-

Bar chart

-

Candlestick chart

Candlestick charts are the most popular type of forex chart because they provide the most information about price action.

Which price chart is best for beginners?

Line chart is the best for beginners because it is simple to understand, focuses on the closing price, and is useful for identifying long-term trends.

Glossary for novice traders

-

1

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

2

Volatility

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

-

3

Forex Trading

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly.

-

4

Fundamental Analysis

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.

-

5

Index

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Team that worked on the article

Alex Smith is a professional day trader for a proprietary trading firm within the foreign exchange (forex) and crypto markets. His area of expertise is day trading and swing trading within the 15min-4hr time frames for both the London and NY open.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).