What is the Best Leverage for a Small Forex Account?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Plus500 - Best Forex broker for 2025 (United States)

If you’re trading with a small account, you may want to use leverage to amplify your profits by up to 1000 times. However, using leverage or margin means you incur as much risk as profit opportunity. On a smaller account using high leverage, a small decrease in a currency pair’s price could lead to a loss of all your capital. Therefore, for smaller accounts, we recommend only using leverage up to 1:10 or 1:20.

Using leverage in Forex trading is essentially using capital borrowed from brokers to control positions magnitudes larger than the funding you put into a trade, up to 1000 times larger. As your position is amplified, you gain the opportunity to see much higher profits than you would without leverage. However, the amount you could lose is also multiplied by just as much as the profit potential. This makes using leverage incredibly risky, particularly for beginners, and those with smaller Forex accounts.

In this article, we’ll be looking at what margin and leverage are, and explaining how much leverage Forex traders with small accounts should use.

How much margin should I use in Forex?

To trade without extreme risk, TU experts recommend beginner traders use only a fraction of their account balance for each trade. Experienced traders suggest risking no more than 1-3% of your trading capital on any single trade. So, if you had a $5,000 account, for example, risking 1% would mean you should only use $50 of margin on each trade.

Therefore, it’s recommended to use lower margin levels or leverage as a beginner with a small account. Stick to leverage of 1:10 or 1:20 with a small account, as you don’t want to see your funds wiped out after just a few trades gone wrong.

Best Forex brokers

| RoboForex | Exness | VT Markets | |

|---|---|---|---|

|

Min. deposit, $ |

10 | 10 | 100 |

|

Max. leverage |

1:2000 | 1:2000 | 1:500 |

|

Demo account |

Yes | Yes | Yes |

|

Cent account |

Yes | Yes | Yes |

|

Micro account |

Yes | No | No |

|

Open an account |

Open an account Your capital is at risk. |

Open an account Your capital is at risk.

|

Open an account Your capital is at risk. |

How does margin trading work?

If you’re unfamiliar with the concept of margin in Forex, it refers to the amount of funds required to be “set aside” to open and maintain a trading position. Margin is like a good-faith deposit that you make to a broker so that you can open and maintain your positions using their capital. Margin and leverage essentially refer to the same process, so you may see both terms used interchangeably when dealing with brokers.

If you wanted to trade a standard lot worth 100,000 units of the base currency, it would usually require a margin percentage of 1% to 2%. So, that means if you opened a standard lot position worth $100,000, you’d have to cover the 1% margin of $1000. Think of it like a security deposit. If the price of your currency pair declines, your losses are covered using your margin.

Here's a table summarizing the margin requirements and corresponding leverage in Forex trading:

| Margin Requirement (%) | Leverage |

|---|---|

| 0.25% | 1:400 |

| 0.50% | 1:200 |

| 1.00% | 1:100 |

| 2.00% | 1:50 |

| 5.00% | 1:20 |

| 10.00% | 1:10 |

| Higher | Lower Leverage (Less than 1:10) |

Calculating margin is quite simple. Let’s say we wanted to purchase one standard lot of EUR/USD, with a leverage or margin ratio of 1:100 (1%), at the current price of 1.06488. We can use this formula:

Margin = (Trade Size / Leverage or Margin) * Current Price Margin = (100,000 / 100) * 1.06488 = $1,064.88

So, to buy one standard lot of EUR/USD, you’d need $1,064.88 of margin to control 100,000 units of the currency pair.

Now you may be wondering if using 1:100 margin is appropriate, particularly if you’re a beginner. Well, it largely depends on how much funding you have in your account, your risk tolerance, and your trading strategy.

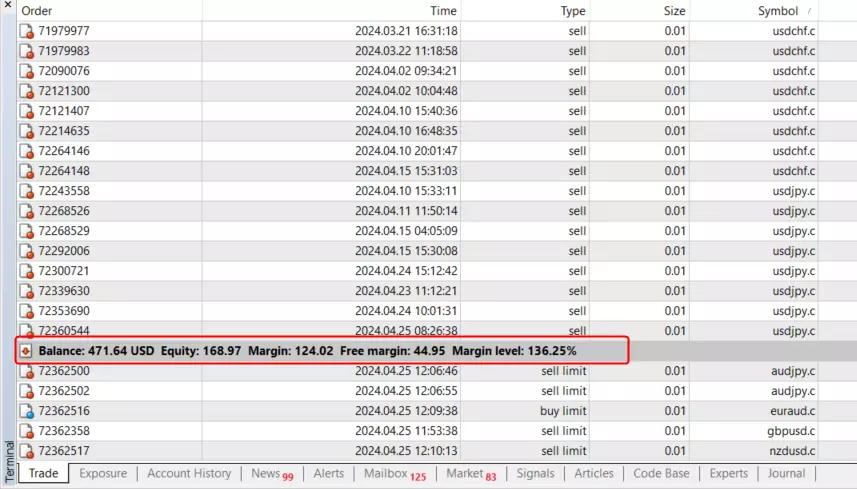

Margin Level (%) = (Equity / Margin Used) ×100. Margin levels between 100% and 200% mean high risk

Margin Level (%) = (Equity / Margin Used) ×100. Margin levels between 100% and 200% mean high riskWhat margin should I use for different accounts?

Is 1:500 leverage good for small accounts?

A 1:500 leverage would allow you to control a position worth $500,000 with only $1,000 in your trading account. While the idea of controlling such a large position and potentially seeing huge profits is enticing, such high leverage poses a considerable risk, as a small adverse price movement can lead to significant losses or even account liquidation. If you’re a beginner, with a small account, we don’t recommend using such high leverage.

What is the best leverage for a mini account?

For a mini account with smaller capital, you should use lower leverage to manage risk effectively. Leverage ratios of around 1:10 to 1:30 are commonly recommended for mini accounts. That means using 10 times to 30 times the capital you have available.

So opening a trade with $10 using 1:30 leverage means you could control a position worth $300. If the currency pair’s price increased by 3%, you’d see a 90% profit. However, just a 3% dip in price would deplete nearly all of your invested capital.

What is the best leverage for $10 account?

With an account size of $10, which is a common minimum deposit for Forex brokers, you’ll want to be quite conservative due to your limited capital. We’d recommend sticking to a lower leverage such as 1:10, as significant price movements could lead to significant losses. However, due to most brokers’ policies on minimum position sizes, your opportunities will be rather limited. Some brokers allow you to buy nano lots (0.001 lot, 100 units of the base currency).

A movement of one pip in a currency pair with a USD base currency, is equal to $0.01. So let’s say you bought one nano lot, worth 100 units of the base currency, for $1, with a leverage of 1:10. Your position would be worth $10. A 10% price increase would increase your position’s value by 100%, or $1. However, a 10% decrease would incur a complete loss, -100%.

Is 1:1000 leverage good for a small account?

Chances are, if you’re starting off with a small account, you’re a beginner. And if you’re a beginner, it is not advisable to use leverage of 1:1000. Any price movement would be amplified by 1000 times. That means once you enter the trade, even a price decrease of just 0.1% would wipe out all of your margin. On the plus side, a 0.1% increase would net you 100% profit, doubling your investment. But again, you’d need to have at least some trading experience to be confident that the trade will go your way. Stick to lower amounts of leverage to begin with.

How to start trading with a small account?

If you’re beginning your Forex trading journey with a small account, there are several measures you can take to get the ball rolling. Growing a small account into a profitable one requires careful planning and stringent risk management to protect your capital, so follow these simple steps:

Use a Micro Account: Micro accounts allow you to trade with smaller amounts of capital, typically starting from as low as $10. This enables you to gain real trading experience with minimal risk.

Utilize a Demo Account: Before risking your real capital, you could practice trading strategies and familiarize yourself with the trading platform by using a demo account. Demo accounts simulate real market conditions without the financial risk that the real market brings, making them ideal for beginners.

Focus on Risk Management: With a small account, it's crucial to prioritize risk management. If your broker allows micro or nano lots, don’t risk more than 1-2% of your account balance on a single trade, and use stop-loss orders to limit potential losses.

Start with Low Leverage: Avoid using high leverage. Instead, opt for lower leverage ratios to minimize risk exposure, sticking to the 1:10 to 1:20 range. Once your trades start going well and you’re seeing profits, if you’re confident in your trading strategy, consider using higher leverage.

Diversify Your Portfolio: Diversification is key! Avoid putting all your capital into one trade or asset. Diversifying your portfolio across different currency pairs or asset classes can help spread risk and reduce the impact of adverse market movements.

We at Traders Union regularly conduct research and provide detailed guides for traders of all backgrounds.

Expert Opinion

Choosing the wrong amount of margin leverage in most cases does not mean that performance will change. If you have traded profitably with a leverage of 1:10, you will most likely trade profitably with a leverage of 1:25 (except for psychological and other nuances that can affect your decision making). I recommend not to get carried away with excessively high leverage in order to reduce risks. It is not for nothing that regulated brokers limit the size of leverage for those who are just starting to trade Forex.

Conclusion

Overall, leverage can be a useful way to amplify your profits, allowing you to open positions worth up to hundreds of times more than your margin. Using leverage gives traders with smaller accounts the opportunity to level the playing field and see the kinds of profit levels seen by wealthier traders. However, due to the massive risks involved with using leverage, we recommend beginner traders stick to lower leverage, such as 1:10 or 1:20. Using high leverage can see your capital wiped out rapidly, so stick to smaller leverage until you have more experience.

FAQs

What is leverage in trading with an example?

Think of using leverage essentially as ‘borrowing’ money (capital) from your broker to open positions larger than the capital you have to hand. For example, if you used $10 to enter a trade with 1:100 leverage, your position would be worth $1000. That means if the asset’s price increased by 1%, you’d see a 100% profit. However, if the price declined by 1%, you’d lose 100% of your trade.

Which leverage is good for Forex?

A ‘good’ amount of leverage for Forex depends on various personal factors, including your risk tolerance, trading strategy, and experience level. Generally, if you’re a conservative trader you may opt for lower leverage ratios, such as 1:10 or 1:20, to minimize risk, whereas if you tend to trend more aggressively, you might use higher leverage ratios, such as 1:100 or 1:200.

What’s the Best Leverage for Beginners?

If you’re a beginner to Forex trading, lower leverage is generally recommended so you can manage risk more effectively. Leverage ratios of 1:10 or 1:20 are more suitable as they allow you to control larger positions while minimizing the potential for significant losses.

What does 20% leverage mean?

Leverage is not usually displayed as a percentage, so 20% leverage might mean 20x or 1:20 leverage, meaning that when you enter a trade you’ll control a position worth 20 times the capital you invest. So, if you used $100 to open a position, with 20x leverage your position would be worth $2000. 20% margin, means that you must put forward 20% of the total size of the trade, as collateral. So if you opened a $1000 position with 20% leverage, you’d pay $200. This might also be described as using 5x leverage or 1:5.

Related Articles

Team that worked on the article

Jason Law is a freelance writer and journalist and a Traders Union website contributor. While his main areas of expertise are currently finance and investing, he’s also a generalist writer covering news, current events, and travel.

Jason’s experience includes being an editor for South24 News and writing for the Vietnam Times newspaper. He is also an avid investor and an active stock and cryptocurrency trader with several years of experience.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

A Forex trading scam refers to any fraudulent or deceptive activity in the foreign exchange (Forex) market, where individuals or entities engage in unethical practices to defraud traders or investors.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.